This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Staking crypto is a popular way to earn passive income while holding onto your digital assets. It is possible for cryptocurrencies that operate on PoS (Proof-of-Stake) blockchains and varies in the annual return rates (APR) it provides.

With staking, you can earn cryptocurrency by verifying the accuracy of transactions that take place on a PoS blockchain. This is a relatively simple process, and it can be done directly from a digital wallet or through services offered by exchanges.

Staking can also be used to grow your crypto portfolio by holding onto some assets that you plan on keeping for a long time. It’s more energy-efficient than mining, which is the process used by Bitcoin and other cryptocurrencies.

What is Staking Crypto?

Staking is the process of committing a portion of your crypto to be used by a blockchain network. For instance, by using your assets for the development and the growth of the network, by making transactions more efficient or adding liquidity to the pool of assets.

Staking provides returns similar to the interest accumulated on your savings in a bank. However, keep in mind that this process comes with some risks.

Currently, there are multiple cryptocurrencies that allow users to stake crypto. Ethereum, Tezos, Cardano, and Solana are the most popular. With this process, you can earn a percentage of the total amount of assets that you’ve invested.

The main reason why cryptos are rewarded while being held is that the blockchain is putting it to work. Cryptocurrencies that use the Proof-of-Stake model ensure that all transactions are secure and verified without a third party, such as a bank. If you’re a part of this process, then your asset will become part of the proof-of-stake framework.

How Does Staking Work?

Understanding staking gives you a good idea about the mechanics of Proof-of-Stake blockchains and how they operate. Let’s start at the beginning.

A blockchain is a type of digital ledger that’s decentralized, meaning it doesn’t require a central authority to validate new activity. Instead, it allows users to create and submit blocks, which are then added to an immutable historical record. Those whose blocks are accepted receive a transaction fee.

The process of staking is designed to prevent errors and fraud in the creation and submission of new blocks on the blockchain. It incentivizes users to follow the rules.

The more assets a user stakes, the better their chance of earning a transaction fee. However, if their proposed block is found to contain inaccurate information, they might lose some of their stake.

Proof-of-Stake (PoS) concept

Proof of Stake is a consensus mechanism that aims to reduce fees while increasing the efficiency of the network. One of the main advantages of this system is that it doesn’t require all miners to perform math problems in order to validate transactions. Instead, transactions are handled by individuals who are actively involved in the blockchain.

Similar to mining, staking is a process that allows network participants to add new transactions to the blockchain. They then receive a fee for their participation.

Staking is carried out in various ways depending on the project. In most cases, users stake their tokens to gain a chance to add a new block to the blockchain. These are known as staking tokens, and they act as a guarantee that the transaction they’re involved in is legitimate.

The network chooses a group of people known as “V validators” based on their size and the length of time they’ve been holding it. If a new block is found to contain invalid transactions, the network will burn some of the users’ stake.

Proof of Stake vs Proof of Work

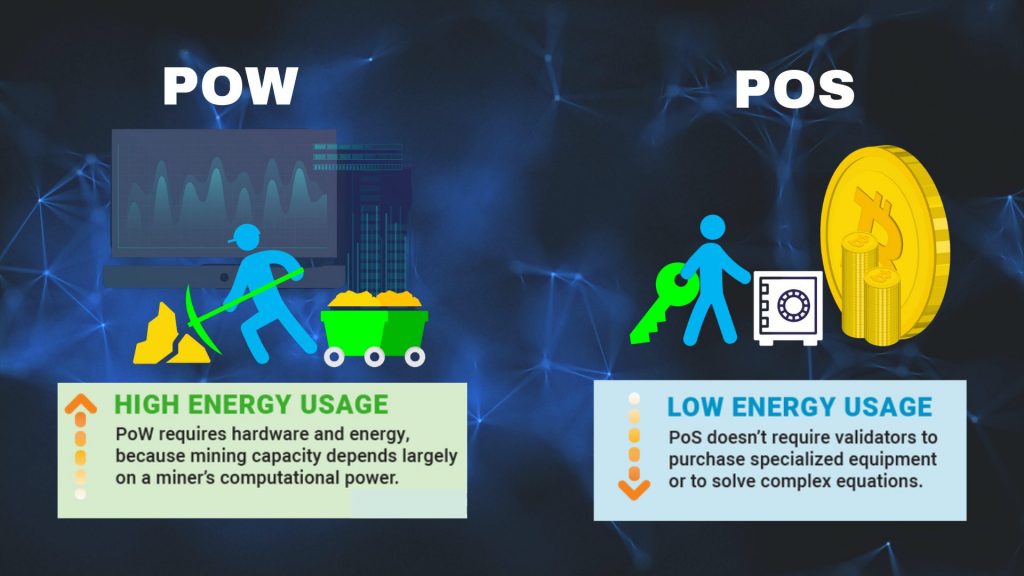

Many cryptocurrencies are currently adopting the Proof-of-Stake model instead of the Proof-of-Work model. This has resulted in a debate about the difference between proof-of-work and proof-of-stake.

One of the most widely used methods of validating transactions in the cryptocurrency world is the Proof-of-Work (PoW). Some of the biggest cryptocurrencies, such as Bitcoin and Ethereum, use this method. However, in the future, Ethereum will be switching to a PoS.

In PoW, there are various miners who compete to solve a certain mathematical problem. Only one of them gets selected to complete the transaction. The energy that other miners use to run their computers will be considered wasted.

Staking Methods

- Traditional Staking (Proof of Stake, Delegated Proof of Stake): This involves holding a cryptocurrency in a wallet and participating in the consensus mechanism of a Proof of Stake (PoS) or Delegated Proof of Stake (DPoS) blockchain. This method directly contributes to the security and operation of the network.

- Soft Staking: This is a form of staking through a centralized exchange, where the exchange stakes your assets on your behalf without locking them up. This method does not directly contribute to the network security, and the user trusts the exchange with their assets.

- Bridging: This involves converting a cryptocurrency to a wrapped token on another blockchain, enabling users to participate in DeFi protocols that offer staking or yield farming opportunities. This method doesn’t involve native staking but rather leveraging other blockchain ecosystems for passive income.

- Lending: This is the process of lending cryptocurrencies to a platform that offers interest rates for borrowing and lending crypto assets. This method doesn’t involve native staking, but users can earn passive income through interest payments.

- Running a Masternode: Some cryptocurrencies operate on a two-tier network architecture, and users can earn rewards by running a masternode that provides additional services to the network. This method contributes to the security and functionality of the network.

- Liquidity Providing: Users can deposit tokens into liquidity pools on decentralized exchanges to facilitate trading and earn a portion of the trading fees. This method contributes to the growth and decentralization of DeFi ecosystems but doesn’t involve native staking.

- Initial Coin Offerings (ICOs): Participating in token sales or launchpad platforms can provide users with early access to new projects and potentially high returns if the projects are successful. This method doesn’t involve staking but rather investing in new tokens or projects.

These options cover the majority of methods for staking cryptocurrencies, but the space is constantly evolving, and new opportunities may arise. It’s essential to stay informed and conduct thorough research before participating in any of these methods, as they carry various risks and complexities.

Platform with Crypto Staking Option (Soft Staking)

Online brokers are increasingly offering the option to stake cryptocurrencies, allowing investors to earn passive income by participating in the proof-of-stake (PoS) consensus mechanism. Two such brokers, eToro and Swissquote, have expanded their staking services to include a limited number of popular cryptocurrencies.

eToro supports staking for Cardano (ADA), Tron (TRX), and Ethereum (ETH)*. ADA and TRX are two promising cryptocurrencies that have gained traction in recent years due to their unique blockchain infrastructure and strong communities. Ethereum, on the other hand, is the second-largest cryptocurrency by market capitalization and is transitioning from a proof-of-work (PoW) to a PoS consensus mechanism. You can learn more about eToro’s staking offerings at https://www.etoro.com/crypto/staking/.

Swissquote, another online broker, currently supports staking for Ethereum (ETH), Polkadot (DOT), Solana (SOL), and Tezos (XTZ). These cryptocurrencies represent a diverse range of blockchain projects, with each one offering distinct features and capabilities. Polkadot aims to connect multiple blockchains, Solana focuses on providing high-speed and low-cost transactions, and Tezos is known for its self-amending blockchain and strong governance model. Find out more about Swissquote’s staking services at https://en.swissquote.com/crypto-assets/staking.

Both eToro and Swissquote provide investors with the opportunity to stake various cryptocurrencies and potentially earn passive income. However, it is essential to research each project and understand the risks involved in staking before committing your funds.

Where do the Crypto Staking Rewards come from?

In a PoS network, the various steps involved in validating a transaction are performed by a computer node. These include validating a new block, writing a transaction into it, and processing the data. The computer that is responsible for validating a new block is referred to as a “validator.” Other nodes that accept stakes from investors are called “stake pool.”

The rewards associated with participating in a stake pool are subject to change due to various factors, such as the number of participants and the volume of transactions. After they have committed their coins to a stake pool, they are able to get the right to add a new transaction to the blockchain. The node that is allowed to perform the validation process depends on the amount of tokens that it has.

When a transaction is successfully completed and approved by the network, the staking rewards are distributed to the chosen node. In return, the node gets a portion of the rewards distributed to the other investors. If a transaction is invalid or the elected node is offline, then they get penalized. This penalty is computed by taking into account the percentage of the staking amount.

What is a staking pool?

Participants with the most amount of tokens are more likely to be selected to perform the validation process in a PoS network. In addition, stake pools allow smaller investors to participate in the process to increase their chances of getting rewards.

There are two types of stake pools: public and private. The former distributes rewards to the operators, while the latter allows delegators to earn additional income by delegating their coins to the public nodes.

Similar to how people get together to carpool in order to reduce their emissions and costs when traveling to the same destination. With a stake pool, crypto investors can increase their chances of getting rewards by setting up their coins in the native network’s staking pool.

Best Staking Crypto

Here’s the list of some cryptocurrencies that support staking:

Is staking crypto safe?

One of the most common factors that investors encounter when it comes to participating in a stake pool is the lockup period, which usually lasts for a certain amount of time. This type of restriction can be a drawback because it prevents them from trading their assets during this period. Before investing in a project, it’s important that investors thoroughly research the requirements and rules for the project they are planning on joining.

When staking cryptocurrencies you still need to take into consideration the volatility of the market. Although a stable payout can be expected from participating in a stake pool, it can also be very risky due to the sudden and severe drops in the price of the asset.

Another factor that investors should consider is the lockup period, which usually lasts for a certain amount of time. This type of restriction can prevent them from selling or unlocking their assets even if the price of the cryptocurrency drops.

Before investing in a project, it’s important that investors thoroughly research the business model and requirements of the project they are planning on joining.

Yield farming vs Staking

Yield farming and crypto staking are two different types of investments. While yield farming offers higher potential profits, it also comes with greater risks.

In yield farming, users buy and sell assets on a decentralized exchange (DEX) in order to provide liquidity to other users. They then earn fees from the transactions that take place on the platform.

Staking is the process of holding cryptocurrency in a blockchain-connected wallet. Users can earn rewards by staking their crypto in a smart contract on the blockchain. This type of investment helps to secure the network and complete transactions.

Although yield farming can be profitable, it’s generally considered risky due to how the value of the assets can change. On the other hand, staking is more predictable since its rewards are usually paid out in the form of coins or fees.

In yield farming, the goal is usually to maximize profits and get the best possible returns. On the other hand, with staking, the goal is to secure the blockchain and make long-term profits.

It’s not uncommon for yield farming to offer returns of up to 50% or 20%. These are depending on the type of platform and token you’re using.

The high returns are typically used to attract liquidity providers. Unfortunately, there are no proof-of-stake chains that can offer more than 15% returns to crypto investors. For instance, Ethereum’s Beacon Chain is currently giving investors 4.5%.

Is Staking Crypto Worth It?

Although crypto staking can be profitable, it’s not for everyone. For instance, if you’re planning on selling or trading your assets, you might not be able to do so due to the time constraints involved. Before you start staking, make sure that you thoroughly understand the terms of the agreement.

Although crypto staking can provide investors with predictable returns, it’s important to remember that it’s an asset that can change quickly. For instance, if the market value of your cryptocurrency drops by 20% during the time you’re holding it, your rewards might not be as lucrative.

Best staking platforms

Choosing a staking platform should be based on its reputation and trustworthiness. It’s also important to consider the fees that you’ll be paying. There are many competing platforms that can help you cut down on the price of making a stake.

Staking is no different from investing in other crypto assets. Before you make a decision, make sure that you thoroughly research the various platforms that you’re considering. Doing so will allow you to make an informed decision.

Binance offers two options for staking: a locked staking option and a DeFi staking option. The latter allows users to stake their assets for a specific number of currencies that are provided by a third-party provider.

Coinbase is another major exchange that allows users to stake their assets. They can do so by moving their funds into a vault. If you’re planning on holding a certain type of coin, this might mean locking it in for a fixed period. Although the fees are high, the platform is secure and intuitive.

Unlike other platforms, Kraken allows users to stake their assets off-chain. This type of staking allows users to simulate the rewards that would be generated by a real on-chain stake. It’s only available to certain customers, and most of its limitations are due to where you are located. Off-chain staking can also be used to stake Bitcoin, as well as various fiat currencies.

With the help of eToro, users can stake their assets for various PoS currencies, such as Ethereum 2, Cardano, and Tron. As with these two, it’s also limited for US users.

Most Popular Crypto Staking:

- Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market cap and the most widely used smart contract platform. Ethereum is transitioning from a Proof-of-Work (PoW) model to a Proof-of-Stake (PoS) model, which will make it more scalable, secure, and energy-efficient. Ethereum staking allows users to earn rewards by locking up their ETH and validating transactions on the network. The minimum amount of ETH required to stake is 32 ETH, but users can also join staking pools or services with lower amounts. The estimated annual reward for staking ETH is around 5-7%.

Official site URL: https://ethereum.org/en/staking/

- Cardano (ADA): Cardano is a third-generation blockchain platform that aims to deliver more advanced features than any protocol previously developed. Cardano uses a Proof-of-Stake (PoS) model called Ouroboros, which is designed to be secure, scalable, and decentralized. Cardano staking allows users to earn rewards by delegating their ADA to stake pools or running their own stake pool. The minimum amount of ADA required to stake is 10 ADA, and the estimated annual reward for staking ADA is around 4-6%.

Official site URL: https://cardano.org/stake-pool-delegation/

- Solana (SOL): Solana is a high-performance blockchain platform that claims to be the fastest in the world, with over 50,000 transactions per second and sub-second finality. Solana uses a Proof-of-Stake (PoS) model with a novel consensus mechanism called Proof-of-History (PoH), which enables greater scalability and security. Solana staking allows users to earn rewards by delegating their SOL to validators or running their own validator node. The minimum amount of SOL required to stake is 0.01 SOL, and the estimated annual reward for staking SOL is around 7-11%.

Official site URL: https://solana.com/staking

- Binance Coin (BNB): Binance Coin is the native token of Binance, the world’s largest cryptocurrency exchange by trading volume. Binance Coin has multiple use cases, such as paying for trading fees, participating in token sales, and accessing various services on the Binance ecosystem. Binance Coin uses a Proof-of-Stake (PoS) model with a consensus mechanism called Delegated Proof-of-Stake (DPoS), which allows users to delegate their BNB to validators or become validators themselves. Binance Coin staking allows users to earn rewards by locking up their BNB on the Binance platform or on the Binance Smart Chain network. The minimum amount of BNB required to stake is 0.1 BNB, and the estimated annual reward for staking BNB is up to 3.1%.

Official site URL: https://www.binance.com/en/staking, https://www.binance.com/en/earn/bnb

- Flow Token (FLOW): Flow Token is the native token of Flow, a blockchain platform that powers various applications in gaming, collectibles, and digital assets. Flow is designed to be fast, scalable, and developer-friendly, and it supports some of the most popular projects in the crypto space, such as NBA Top Shot and CryptoKitties. Flow Token uses a Proof-of-Stake (PoS) model with a consensus mechanism called HotStuff, which enables high throughput and low latency. Flow Token staking allows users to earn rewards by delegating their FLOW to node operators or running their own node on the network. The minimum amount of FLOW required to stake is 250 FLOW for delegators and 135,000 FLOW for node operators, and the estimated annual reward for staking FLOW is around 5%.

Official site URL: https://developers.flow.com/nodes/staking, https://port.onflow.org/

- Tezos (XTZ): Tezos is a blockchain platform that supports smart contracts and decentralized applications. Tezos uses a Proof-of-Stake (PoS) model called Liquid Proof-of-Stake (LPoS), which allows users to delegate their XTZ to bakers or become bakers themselves. Bakers are responsible for creating and validating blocks on the network. The minimum amount of XTZ required to stake is 8,000 XTZ for bakers and 0.01 XTZ for delegators, and the estimated annual reward for staking XTZ is around 5-6%.

Official site URL: https://tezos.com/proof-of-stake/

- Decentral Games ($DG): Decentral Games is a platform that allows users to play casino games in virtual reality using cryptocurrencies. Decentral Games uses a Proof-of-Stake (PoS) model that allows users to stake their $DG tokens and earn rewards from the platform’s revenue. The minimum amount of $DG required to stake is 100 $DG, and the estimated annual reward for staking $DG is around 40-50%.

Official site URL: https://decentral.games/dg/governance

- Akash Network (AKT): Akash Network is a decentralized cloud computing platform that allows users to rent out their unused computing resources or access low-cost cloud services. Akash Network uses a Proof-of-Stake (PoS) model that allows users to stake their AKT tokens and earn rewards from the network fees. The minimum amount of AKT required to stake is 1 AKT, and the estimated annual reward for staking AKT is around 40-50%.

Official site URL: https://akash.network/token

- NOW Token (NOW): NOW Token is the native token of ChangeNOW, a non-custodial cryptocurrency exchange service that allows users to swap between different cryptocurrencies. NOW Token uses a Proof-of-Stake (PoS) model that allows users to stake their NOW tokens and earn rewards from the exchange fees. The minimum amount of NOW required to stake is 10 NOW, and the estimated annual reward for staking NOW is around 25%.

Official site URL: https://changenow.io/tokens

- Vega Protocol (VEGA): Vega Protocol is a decentralized protocol that enables users to create and trade derivatives on any underlying asset. Vega Protocol uses a Proof-of-Stake (PoS) model that allows users to stake their VEGA tokens and earn rewards from the protocol fees. The minimum amount of VEGA required to stake is 1 VEGA, and the estimated annual reward for staking VEGA is around 15-20%.

Official site URL: https://docs.vega.xyz/mainnet/tutorials/staking-tokens

- LTO Network (LTO): LTO Network is a hybrid blockchain platform that enables secure and efficient data exchange and collaboration. LTO Network uses a Proof-of-Stake (PoS) model that allows users to stake their LTO tokens and earn rewards from the network fees. The minimum amount of LTO required to stake is 10,000 LTO, and the estimated annual reward for staking LTO is around 6-7%.

Official site URL: https://docs.ltonetwork.com/tutorials/buying-and-staking-lto

- BitShares (BTS): BitShares is a decentralized platform that offers a range of financial services, such as exchange, banking, and asset creation. BitShares uses a Proof-of-Stake (PoS) model called Delegated Proof-of-Stake (DPoS), which allows users to delegate their BTS tokens to witnesses or become witnesses themselves. Witnesses are responsible for producing and validating blocks on the network. The minimum amount of BTS required to stake is 1 BTS, and the estimated annual reward for staking BTS is around 1-2%.

Official site URL: https://bitshares.org/technology/delegated-proof-of-stake-consensus/

- PIVX (PIVX): PIVX is a privacy-focused cryptocurrency that aims to provide fast and secure transactions with low fees. PIVX uses a Proof-of-Stake (PoS) model that allows users to stake their PIVX tokens and earn rewards from the network inflation. The minimum amount of PIVX required to stake is 1 PIVX, and the estimated annual reward for staking PIVX is around 8-9%.

Official site URL: https://pivx.org/proof-of-stake

- PRIZM (PZM): PRIZM is a cryptocurrency that uses a unique algorithm called Paramining, which allows users to create new coins by holding existing ones. PRIZM uses a Proof-of-Stake (PoS) model that allows users to stake their PZM tokens and earn rewards from the paramining process. The minimum amount of PZM required to stake is 1 PZM, and the estimated annual reward for staking PZM is around 11-12%.

Official site URL: https://prizm.space/en/

- Validity (VAL): Validity is a blockchain platform that enables users to create and manage self-sovereign identities, data, and assets. Validity uses a Proof-of-Stake (PoS) model that allows users to stake their VAL tokens and earn rewards from the network fees. The minimum amount of VAL required to stake is 10 VAL, and the estimated annual reward for staking VAL is around 15-16%.

Official site URL: https://validitytech.com/knowledge-base/category/validity/staking/

Oxen (OXEN): Oxen is a privacy-focused cryptocurrency that powers a decentralized network of secure communication tools, such as messaging apps and VPNs. Oxen uses a Proof-of-Stake (PoS) model that allows users to stake their OXEN tokens and earn rewards from the network fees. The minimum amount of OXEN required to stake is 15,000 OXEN, and the estimated annual reward for staking OXEN is around 12-13%.

Official site URL: https://oxen.io/stake/

- Gridcoin (GRC): Gridcoin is a cryptocurrency that rewards users for contributing their computing power to scientific research projects. Gridcoin uses a Proof-of-Stake (PoS) model that allows users to stake their GRC tokens and earn rewards from the network inflation. The minimum amount of GRC required to stake is 1 GRC, and the estimated annual reward for staking GRC is around 1.5%.

Official site URL: https://gridcoin.us/wiki/staking.html

- Particl (PART): Particl is a decentralized platform that enables users to create and use privacy-focused applications, such as marketplaces and chat apps. Particl uses a Proof-of-Stake (PoS) model that allows users to stake their PART tokens and earn rewards from the network fees. The minimum amount of PART required to stake is 1 PART, and the estimated annual reward for staking PART is around 2-3%.

Official site URL: https://academy.particl.io/en/latest/part-guides/partguides_staking.html

- Electra Protocol (XEP): Electra Protocol is a blockchain platform that aims to provide fast, secure, and scalable transactions with low fees. Electra Protocol uses a Proof-of-Stake (PoS) model that allows users to stake their XEP tokens and earn rewards from the network inflation. The minimum amount of XEP required to stake is 1 XEP, and the estimated annual reward for staking XEP is around 10%.

Official site URL: https://electraprotocol.com/staking/

- Navcoin (NAV): Navcoin is a privacy-focused cryptocurrency that enables users to send and receive transactions anonymously. Navcoin uses a Proof-of-Stake (PoS) model that allows users to stake their NAV tokens and earn rewards from the network inflation. The minimum amount of NAV required to stake is 1 NAV, and the estimated annual reward for staking NAV is around 8%.

Official site URL: https://docs.navcoin.org/coldstaking.html, https://navcoin.org/ecosystem

- BitShares (BTS): BitShares is a decentralized platform that offers a range of financial services, such as exchange, banking, and asset creation. BitShares uses a Proof-of-Stake (PoS) model called Delegated Proof-of-Stake (DPoS), which allows users to delegate their BTS tokens to witnesses or become witnesses themselves. Witnesses are responsible for producing and validating blocks on the network. The minimum amount of BTS required to stake is 1 BTS, and the estimated annual reward for staking BTS is around 1-2%.

These are some more crypto that are PoS (Proof-of-Stake), meaning that you can stake them. There are many more PoS crypto out there, so you may want to do your own research and compare different options before deciding which one to stake.

A great starting point can be found at https://coinmarketcap.com/view/pos/.

Conclusion

Staking is expected to become a significant contributor to the cryptocurrency industry as it uses the Proof of Stake model, which is more eco-friendly than the proof-of-work model.

Anyone can start staking crypto but to start you will need a minimum investment and some technical knowledge. For most people, the easiest way to participate is through an exchange such as eToro or Coinbase. Through this process, you can easily contribute any amount of money without having to purchase or operate costly hardware.

Many experts believe that the PoS model is more practical and profitable than the work model. Due to the increasing number of cryptocurrencies that have adopted the PoS model, it’s important to note that any network that supports it will also serve as your staking platform.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More