This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

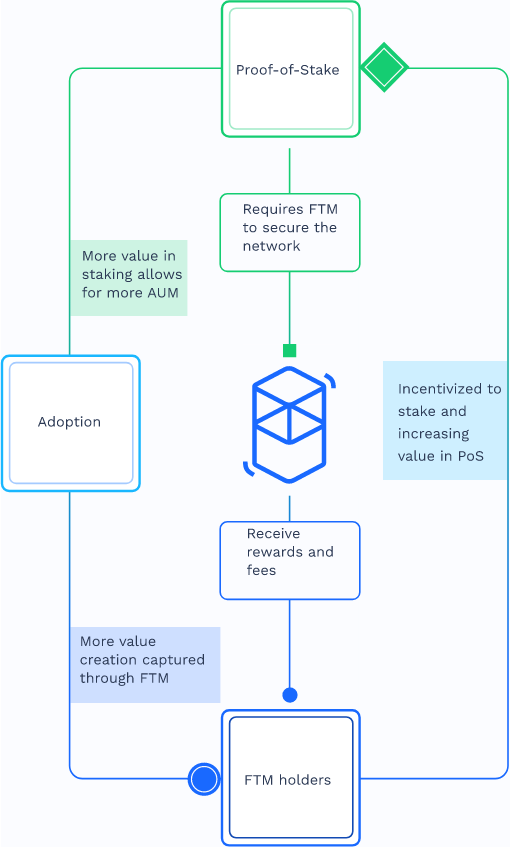

Staking Fantom is possible because staked FTM aids in securing the Fantom network while bolstering the Fantom ecosystem. In exchange for securing the system, stakers earn FTM tokens as a reward.

This layer 1 blockchain alternative to ETH allows holders to earn passively with crypto holdings. Fantom’s elevated network is a smart contract framework that is freely available. It is flexible and EVM-compatible, which means you can use Fantom to develop and execute Ethereum decentralised applications (DApps). Apart from handling digital assets and Decentralized applications, its framework offers support for its decentralised financing (DeFi).

- Fantom offers a fluid staking model that gives investors flexibility in the lockup period; the lockup period ranges from 0 to 365 days.

- Fantom is EVM-compatible (Ethereum Virtual Machine), so it fully supports the Ethereum blockchain and its code.

- Fantom utilises decentralised on-chain governance, so investors steer the network’s development. Voters/investors can show their degree of support for proposals.

- The Fantom network is incredibly scalable, leading to near-instant transactions that cost little, especially in relation to other dApps.

- Although it has been dubbed an “Ethereum killer,” Fantom still faces stiff competition in the form of Ethereum and other alternatives.

- Being a DeFi project, Fantom may experience regulation or crackdown in the future because of a lack of adequate customer protection.

- Founded in 2018, Fantom is relatively new in the crypto market and experiences frequent price changes.

- The Internet of Things (IoT) is still in its initial phases, so use cases for Fantom may be delayed or minimal.

Table of Contents

What is Fantom Staking?

Fantom staking is the process of securing the Fantom ecosystem by delegating FTM tokens to a validator or by running a validator node. Before July 2020, FTM stakers had no choice but to lock up their tokens for a long or short period in order to earn rewards. But the investors voted on a new staking model that affords stakers maximum flexibility. Now, stakers can decide not to lock up their tokens, or they can lock them up for a period dependent on the maximum lockup period their validator chooses.

Fantom uses a proof-of-stake consensus mechanism that has been adapted to its network, and it is called Lachesis. Lachesis is designed to provide high-speed transactions, which are possible because of the independent validation of transactions by the Lachesis protocol without consensus from the rest of the blockchain.

Unlike traditional proof-of-stake systems where validators determine the validity of transactions within the blockchain, Fantom Opera is leaderless. This means that even though stakers can delegate their FTM tokens to trusted validators, the validators do not determine which blocks are valid.

Fantom is based on the directed acyclic graph (DAG), which creates faster and more energy-efficient transactions by avoiding the traditional method of validating transactions sequentially. Instead, DAG uses past event blocks, which are yet to be confirmed, to add even more event blocks.

How to Stake Fantom (FTM)?

Staking Fantom (FTM) using Simple Earn on Binance is a straightforward process. By staking FTM, you can earn passive income while supporting the Fantom network. Here’s a step-by-step guide on how to do this:

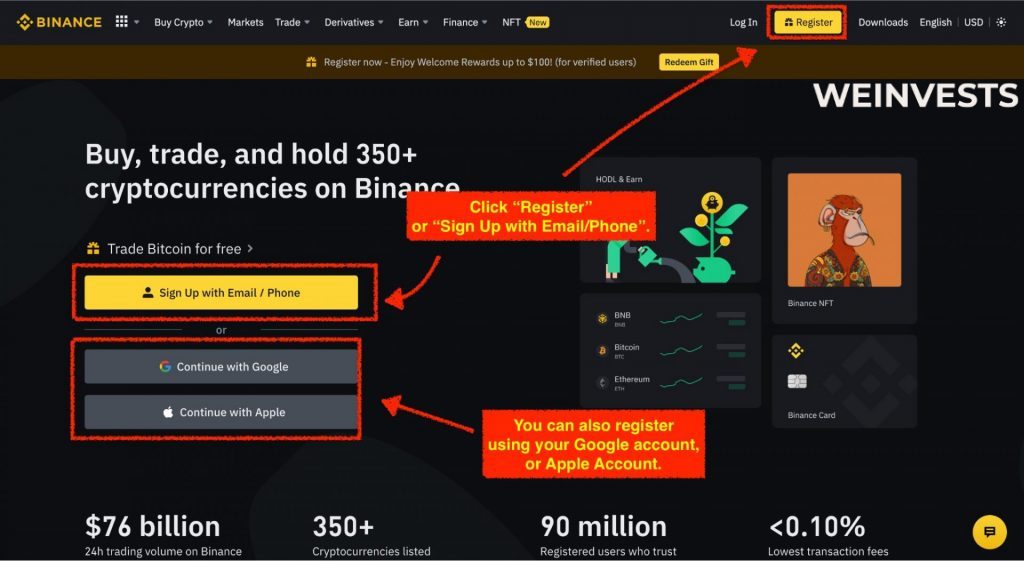

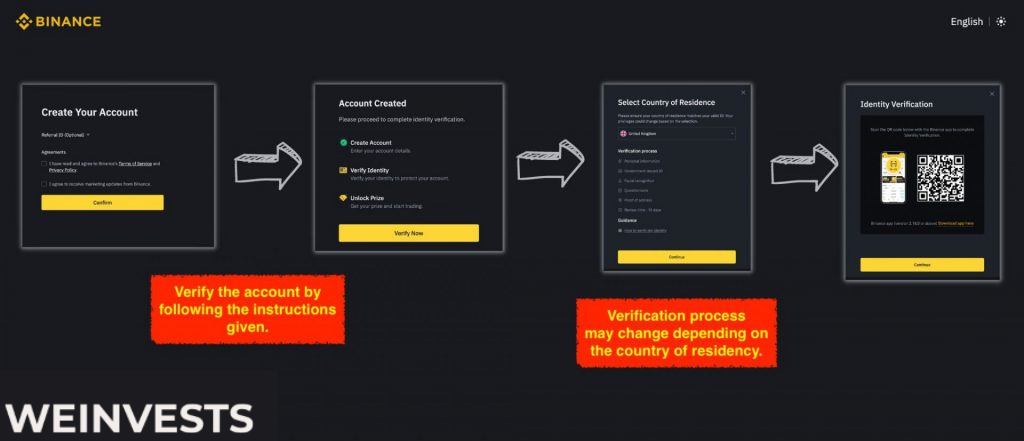

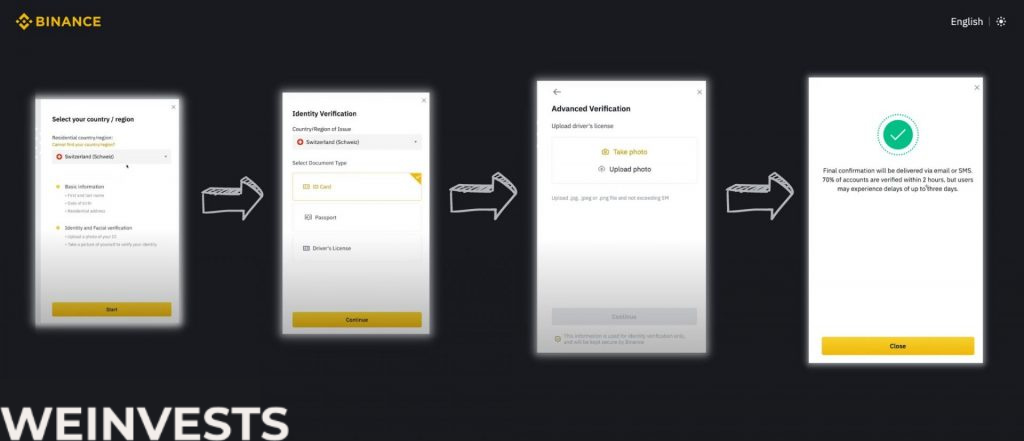

Step 1: Sign Up and Verify your Account

If you don’t have a Binance account yet, go to www.binance.com and sign up for a new account. Complete the registration process, which includes email verification and setting up two-factor authentication (2FA) for added security.

Then go through the verification steps to provide Binance with proof of identity.

Step 2: Fund your Account

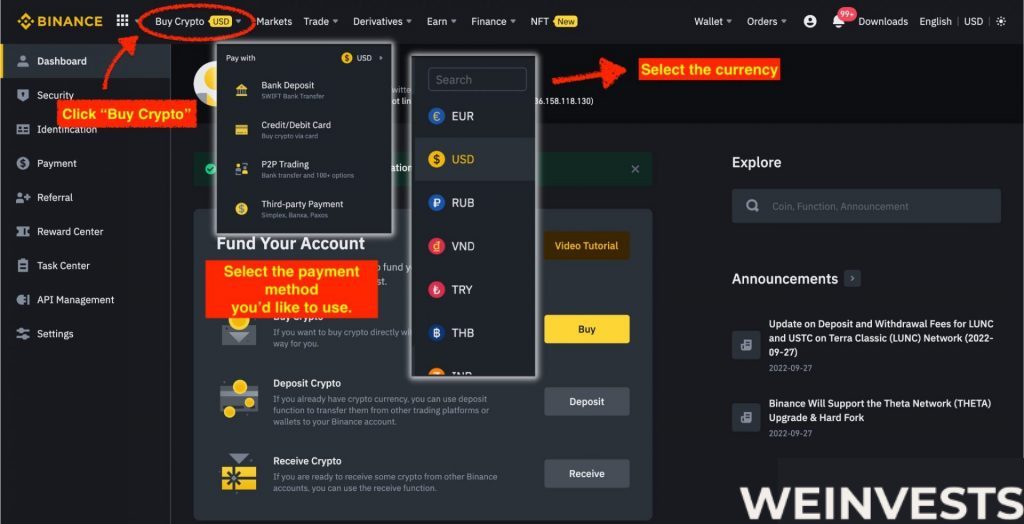

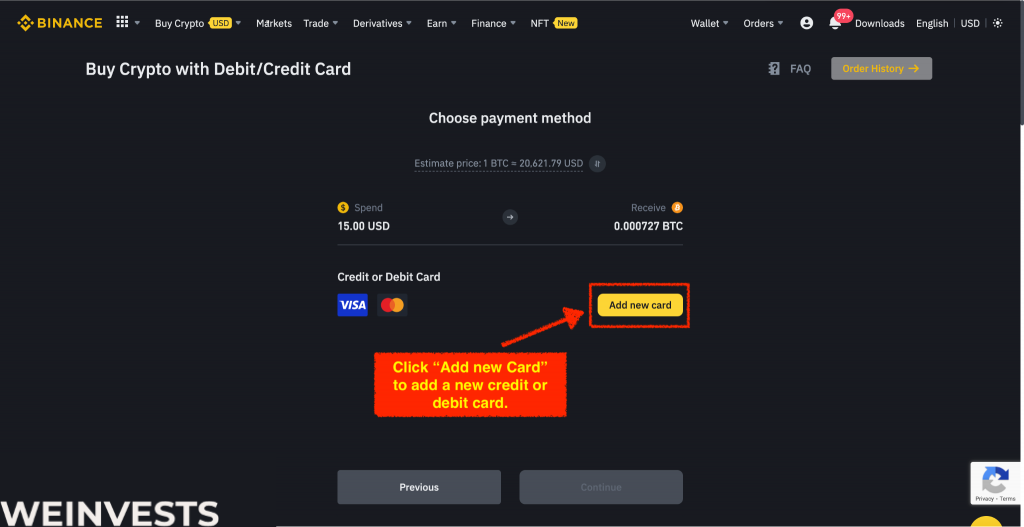

If you already own FTM, transfer it to your Binance account by depositing it into your FTM wallet. If you don’t have any FTM yet, you can buy it on Binance using your preferred payment method. To buy FTM, navigate to “Buy Crypto” and select your desired payment method. Then search for FTM and complete the purchase.

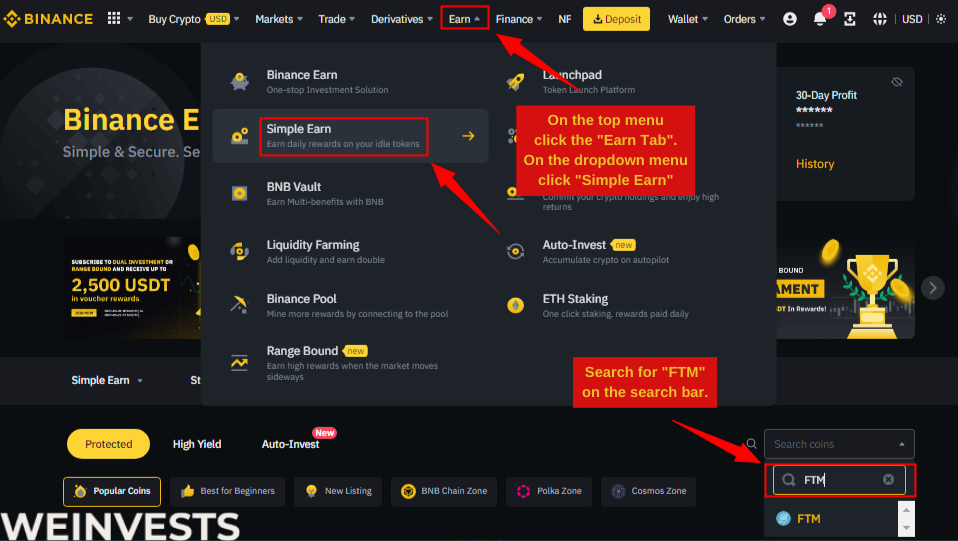

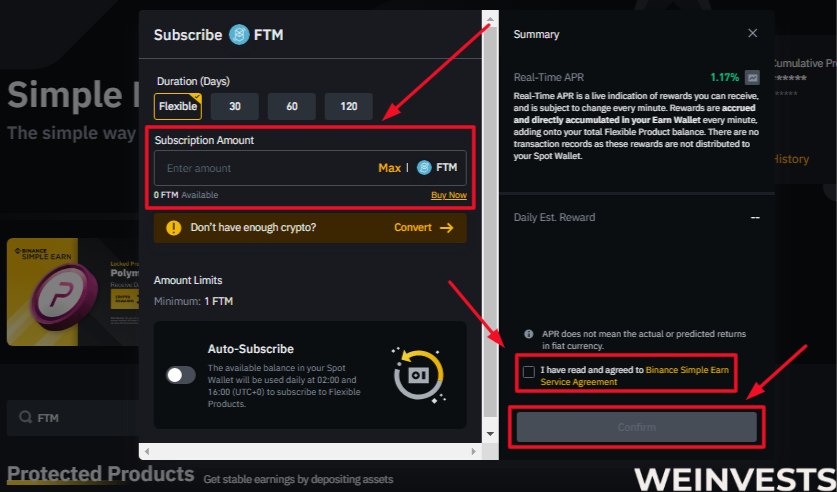

After your FTM deposit has arrived or your purchase is complete, go to the “Earn” section in the top menu and click on “Binance Earn.” Once you’re on the Binance Earn page, find the “Simple Earn” section.

In the Simple Earn section, scroll through the list of available staking options or use the search bar to find Fantom (FTM). Click on FTM when you find it.

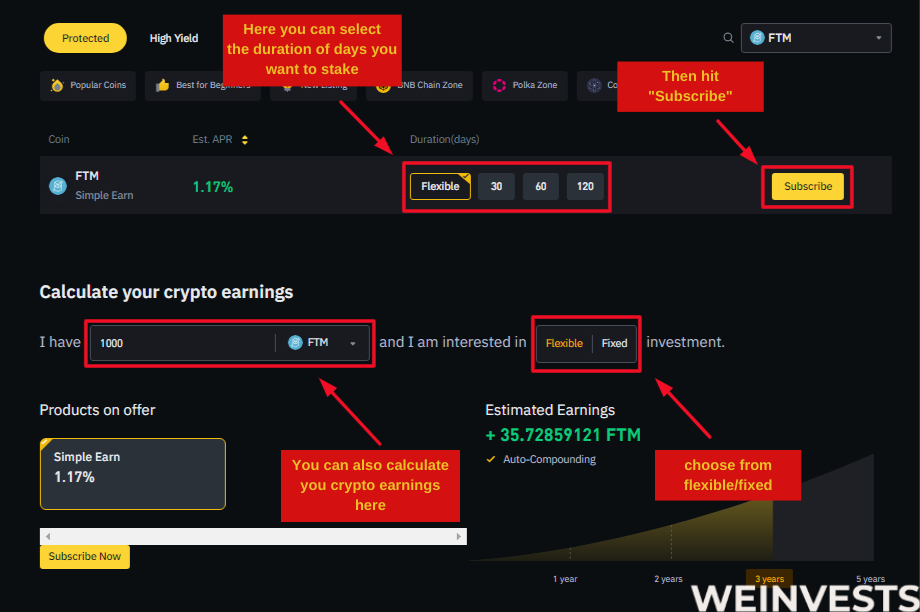

Step 4: Analyze the Staking Parameters and Stake

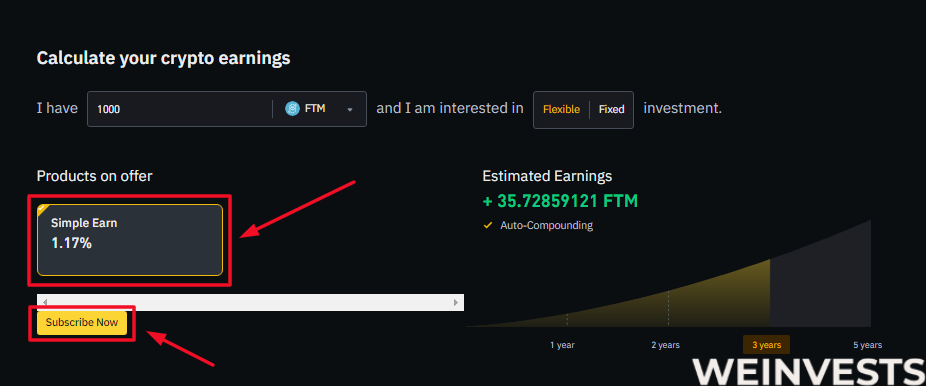

Here, you can analyze Fantom (FTM) using the ‘Calculate your crypto earnings’ feature. You can input the amount you want to invest and see the projected earnings for 1 year, 2 years, 3 years, or 5 years. Simply click on the desired number of years to invest in ‘FTM’.

If you want to earn rewards with your FTM on Binance.com, you can go to the “Products on Offer” section under “Earn” and choose between two options: “Simple Earn” and “Flexible DeFi Staking”.

“Simple Earn” lets you deposit your FTM in flexible or locked products and earn daily rewards. You can subscribe or redeem at any time, so you can maintain your assets’ flexibility and liquidity. The rewards are sourced from Binance’s own funds and are based on market conditions.

Fantom Staking Tax

Taxation of cryptocurrencies is still a relatively shaky aspect of finance and taxation in many countries, including the UK. Generally, the UK’s stance on taxing crypto places the onus on investors to determine how much tax they are to pay. Her Majesty’s Revenue and Customs (HMRC) formulated the crypto assets manual to guide crypto investors, tax-related bodies, and individuals on crypto taxation.

If you stake FTM and plan to sell or unstake after it appreciates, you may be liable to pay capital gains tax. But the UK exempts people from paying capital gains tax unless their yearly gains surpass 12,300 Great British pounds. On the other hand, you will pay income tax on FTM received via the following means: as a salary, mining, airdrop, or confirmation rewards.

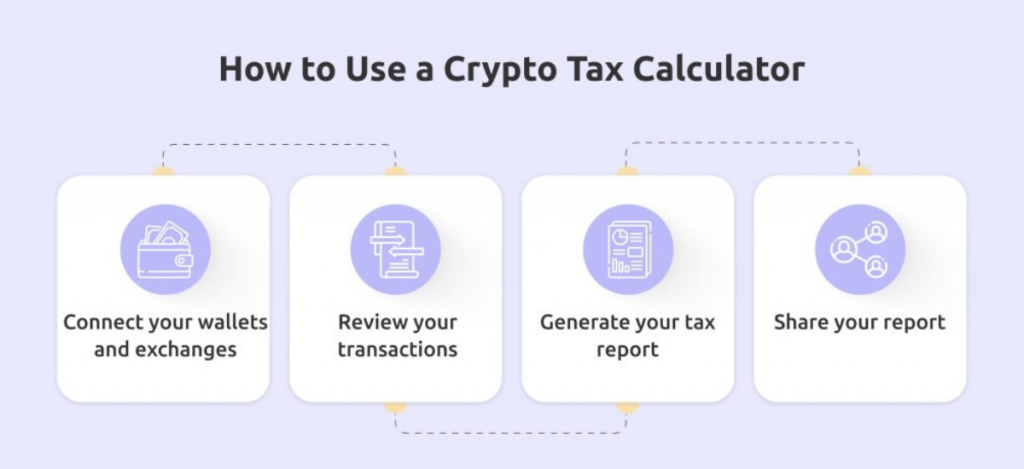

As Fantom rises in popularity, more services dedicated to its native token, FTM, arise. For example, several crypto tax calculators are adapted for Fantom, among other cryptocurrencies. Earlier this year, ZenLedger, the premium web app for crypto tax reporting, launched support for Fantom. By inputting your wallet address into ZenLedger, you can get all the relevant transaction data from the Fantom blockchain. ZenLedger supports many types of transactions on Fantom, including, but not limited to, staking, liquidity pool, and swap/trade.

CryptoTaxCalculator is another platform that aids in calculating the amount of tax payable on FTM. This platform has developed an integration with Fantom that recognises, categorises, and reports all taxable transactions.

Why do people like Staking FTM?

There are many reasons behind investors’ decision to stake Fantom, one of which is its decentralised nature. Aside from the fact that Fantom is a DeFi that lets users lend, borrow, and trade cryptocurrencies, including FTM, it also utilises decentralised governance, which puts decision-making power in the hands of investors. For example, in July 2020, FTM holders voted for the fluid staking model, which allows stakers to lock up their tokens for a minimum period of 14 to 365 days, or they can choose not to lock up their tokens.

Another reason people like staking Fantom is that it focuses on three critical aspects of blockchain technology: scalability, security, and decentralisation. Scalability has to do with the practicality of its applications in real-life situations, so transaction speed and cost of transactions influence scalability.

Conclusion

Fantom was one of the first blockchains to have a proof-of-stake system working hand-in-hand with on-chain governance. The technologies that grease the wheel that keep Fantom running allow it to scale and process transactions in seconds while charging users a few cents.

Fantom increases its network security by eliminating the need for leaders while maintaining a consensus algorithm where the network as a whole validates transactions. In an Asynchronous Byzantine Fault Tolerance (aBFT) protocol, which is what Fantom operates, nodes need not exchange finalised blocks; they can reach consensus independently.

Staking FTM is a great way to earn yields and make profits from your FTM tokens, while contributing to the blockchain’s economy. But you should also remember that there are risks involved in staking Fantom, especially during a bear market. By staking and locking up your coins, your funds may become illiquid.

FTM Staking FAQ’s

Can You Stake FTM on Ledger?

Yes, you can stake FTM on Ledger. Like other FTM transactions, staking FTM through a hardware wallet like Ledger is a smart contract interaction. Staking is a crucial part of the Fantom ecosystem, so you can stake FTM from the Fantom fWallet, created as a Progressive Web App (PWA), and sign it with the Fantom FTM Ledger Nano S application. To do this, you have to set up your Ledger Nano S with Fantom and use the “Stake” menu option in your account.

Can I Stake other Tokens on Fantom?

Fantom provides a flexible ecosystem that makes it possible to stake several DeFi tokens, from which you can earn passive income. You need to connect your MetaMask, KuCoin, or Binance wallet (or any other compatible wallet) to the Fantom Opera Network. In such situations, Fantom acts as a centralised exchange (CEX), such as Coinbase or Binance, where you can trade non-natives cryptocurrencies.

You can stake tokens such as BOO and BEETS on Fantom, even though they are the native tokens of decentralised exchanges (DEX). BOO is the native token of Spookyswap, the biggest DEX on Fantom, and you can bond the token with FTM to yield farm and for maximum liquidity. BEETS is the native token that governs BeethovenX, a community-driven decentralised exchange, a DeFi powerhouse, and an automated market maker (AMM). BeethovenX lives on the Fantom Opera chain, and its native token, BEETS, yields an APR of 31%.

Can I Unstake My FTM Tokens during the Lockup Period?

Yes, you can unstake your tokens during the lockup period because they are still in your wallet, and you are the only one with access to them. But remember that you will lose some of your rewards if you unstake before the set duration expires. It is also essential that you not forget that it takes seven days to unstake your tokens, after which you will receive your rewards.

The reason for the seven days between unstaking and receipt of staking rewards (generally known as “unbonding”) is to create stability in the Fantom network, and it prevents potential attackers from withdrawing their stake before the effects of their attack reflect on the network and market.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More