This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Companies in the energy sector are at a crossroads since the pressure to move toward renewable energy increases. Climate change is a major concern for governments globally since the severe environmental impact is sending shockwaves throughout various vulnerable countries. It is also making investors focus more on green energy stocks.

Governments will increase the incentives to energy companies looking to enhance their renewable energy production. These companies can have an advantage over firms that still use oil and gas.

It can help you enjoy exceptional returns on your investment in the coming years. It is best to start researching companies like Chevron Corporation to understand their prospects and future growth plans. Chevron Corporation is the oldest company in the gasoline, natural gas, and energy industry. The company was founded in 1879 as Pacific Coast Oil Co. As per the Sherman Antitrust Act, the government divided Pacific Coast Oil Co into various companies, leading to the formation of Chevron Corporation. The company has many brands operating under it, including:

- Calso (From 1946 to 55)

- Caltex

- Chevron

- Gulf (From1985 to 2010)

- Havoline

- Techron

- Texaco

While the company had primarily focused on oil and gas, it is now turning its attention towards alternative energy. We can expect the company to increase its focus on renewable sources. Here are the company’s financials:

Table of Contents

Chevron Corporation (CVX) Statistical Overview

Chevron Corporation (CVX) Stock Forecast 2023

In 2023, Chevron stock had a great year. If analysts’ predictions for the industry come true in 2023, the company’s earnings could be lower. However, this does not rule out the possibility of CVX stock continuing to reward investors. Because regardless of the oil market conditions in 2023, Chevron will continue to be, at worst, a superb dividend investment.

Chevron’s share price is predicted to be steady in 2023, and while energy prices are unlikely to rise substantially above present levels, they should also not fall significantly.

The company also revealed its capital investment estimates for 2023. The oil company’s capital budget is increasing by 25%. This is a significant increase given that the oil industry has been keeping a tight control on investment spending.

Chevron’s budget will have no impact on its capacity to return capital to shareholders. It closed the quarter with a fortress-like balance sheet, with net debt under 5% and considerably below its target range of 20% to 25%. As a result, even if oil prices fall in 2023, it will be able to raise spending while increasing dividends and buying back stock.

Chevron is a great oil company stock to own for 2023 and beyond because of its strong financial position, expansion in traditional and low-carbon energy, and shareholder rewards.

As per the expert at CNN, the average price prediction for the Chevron Corporation’s share is around $192. It shows an increase of around 11.41% from its current stock value, which is at $172.33. The analysts expect the price to go as high as $215 and can go as low as $161 in the next 12 months.

Chevron Corporation (CVX) Stock 2022

Chevron Corporation’s share price had a staggering growth in 2022. The company’s share price had continued its upward trajectory and hit an all-time high value in 2022, making it one of the hottest stocks as oil prices soared throughout the globe.

Chevron Corporation’s share price opened at $125 on the first day of trading in 2023. The share price saw slight drops, but it continued to go upwards. It reached an all-time high value of $172 by the fourth week of May 2023. Chevron would go ahead to break its all-time high once more, as it crossed the $180 mark in November.

The two main factors for the increase in oil prices in 2023 are:

- Increase in global demand as economies continue to recover from pandemic’s impact

- The Russia-Ukraine war caused the oil supply to go down

These events contributed to the increase in oil prices. Thus, it is prompting investors to buy stocks of companies in the energy and oil sector. Since Chevron Corporation is the largest oil producer in the US, it has become the top pick for many investors.

As per the expert at CNN, the average price prediction for the Chevron Corporation’s share is around $183. It shows an increase of around 6% from its current stock value, which is at $172. The analysts expect the price to go as high as $213 and can go as low as $147 in the next 12 months.

Chevron Corporation (CVX) Stock 2021

As many countries lifted the restrictions and the global oil consumption restored to the pre-pandemic levels, Chevron Corporation’s share price increased rapidly. The demand for oil worldwide started to increase as people resumed working from offices. Investors saw it as an opportunity to get their hands on the stock of Chevron Corporation.

The company’s stock price closed at $91 at the start of the year. It enjoyed a bull run throughout the year, closing at $117 by the last week of December 2021. While the company did challenges like supply chain disruptions, it managed to post exceptional numbers. It lured investors to put money into the company and enjoy amazing returns years later.

In addition, the rise in oil prices also became a contributing factor in the increase of the company’s share price. The company’s share continued to experience the same growth in 2023.

Chevron Corporation (CVX) Stock 2020

2020 was a challenging year for many sectors since the world had to deal with the impact of the global pandemic. Some sectors had a more devastating effect than others, such as aviation and oil companies. Chevron Corporation faced a major drop in its stock value when the Covid-19 pandemic hit.

The company’s share price dropped to $59 by the third week of March from $116 at the start of the year. However, it did recover gradually and reached $90 by the end of 2020. Besides the Covid-19 pandemic, the company had to deal with another setback of a reduction in oil prices.

As people stayed indoors, global oil consumption and prices were in free fall. Oil prices had dipped down below zero, and producers had to pay people to buy oil as they ran out of storage capacity. As a result, it had a huge impact on Chevron Corporation’s revenues.

Furthermore, the company’s future revenue forecast also didn’t look promising as there was still a lot of uncertainty. Many investors were not sure what the future would look like for the oil and energy sector in the wake of the pandemic and refrained from investing in it.

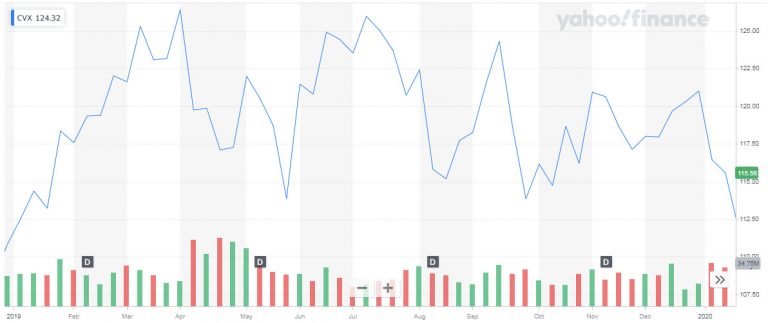

Chevron Corporation (CVX) Stock 2019

2019 was a volatile year for Chevron Corporation as the share price continued to go up and down. The stock opened at $112 on the first day of trading in 2019 and increased to $126 by the 1st of April. However, the company’s share price fell below the $115 mark by the last week of May 2019.

Nevertheless, Chevron Corporation saw an increase of $6 by the last day of trading in 2019, closing at $121. The primary reason for the company’s share price to see a downward trajectory was due to its decline in revenue.

Chevron Corporation’s earnings declined by more than 25% compared to the last years. In addition, the company also experienced a decrease in its refinery output. Nevertheless, the rising oil prices and the company’s plans gave investors confidence that the stock price would increase.

Chevron Corporation (CVX) Stock 2018

Chevron Corporation’s share price saw some ups and downs throughout 2018. It remained volatile throughout the year and saw a decline in its value by 15% at the end of 2018. Chevron Corporation’s share price closed at $127 on the first day of trading and reached the $138 mark within a few days.

However, Chevron Corporation’s stock value saw a fall from there on with slights ups and downs, closing at around $104 by the end of December 2018. While the company did manage to perform well in the last two quarters of 2018, investors were not too keen to invest in it.

In addition, external factors also became the leading factor in the share price fall in 2018. Political instability and a trade war with China were the reasons investors were cautious about investing in Chevron Corporation.

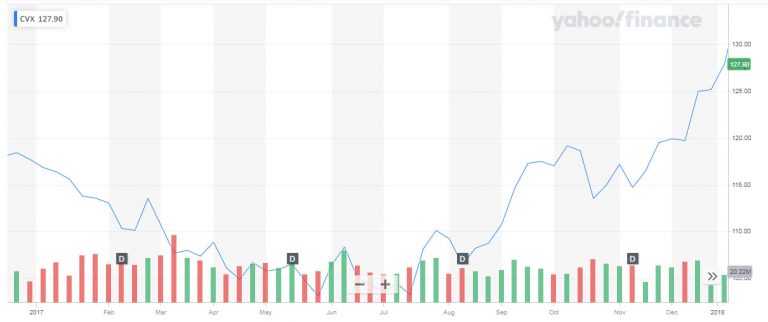

Chevron Corporation (CVX) Stock 2017

Investors of Chevron Corporation had a good 2017 overall as the company’s stock price increased till the end. The share price opened trading at $118 on the first day of trading in 2017. Though it did fall to $103 by July 2016, it started to increase and closed at $125 by the last week of 2017.

The primary reason for this increase is due to the company’s exceptional performance in Q2. Chevron Corporation managed to beat the analysts’ expectations for its revenues and profits. It grabbed the attention of investors who believed that the company could increase its earnings in the coming quarters.

Chevron Corporation (CVX) Stock 2016

Before 2016, the entire oil industry had suffered from the devastating impact of the oil price crash. The oil prices plunged to a significant low, and it caused the share prices of big names to plummet. Chevron Corporation also had to deal with the impact of falling oil prices. The company stock lost a significant value a couple of years before 2016.

However, the tide started to turn in 2016, and Chevron Corporation’s share price increased throughout the year. The company’s stock opened at $83 in the first month of 2016 and reached $117 by the last week of December. The two reasons for this growth are:

- Recovery of oil prices in 2016

- Increase in Chevron’s cash margins for oil

The company also started its Gorgon Project that year. As a result, the company’s share price increased in 2016

Conclusion

Chevron Corporation is currently witnessing an increase in its share price. The company’s stock is at an all-time high due to the rising oil prices.

Therefore, investors must watch out for all the latest developments in the energy sector. You might never know which change can impact the company’s share price.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More