This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Low-cost brokers are often the choice of traders and investors who don’t want to lose much of their capital to brokerage commissions and fees.

Lowering this type of cost is a fundamental part of the trading and investing strategies of users around the world who can today benefit from the competitive fees and commissions of online brokers.

Even if choosing the right broker might seem hard, traders and investors can always filter the available options by looking for brokers that are inexpensive, but also fully regulated and compliant with national and international regulations in matters of financial services, and that don’t give up on quality and intuitiveness.

In this article, we will review the top low-cost brokers currently available.

Top Low-Cost Trading Platforms 2023

This list is just a tease of what we’re going to cover: scroll down to read more detailed information and full reviews for each broker.

- Interactive Brokers – Best for Administration Fees

- eToro – Best for Additional Features

- AvaTrade – Best for Crypto

- Fidelity – Best for Fractional Investing

1. Interactive Brokers – Best for Administration Fees

We chose Interactive Brokers as one of the top low cost trading platform for a few reasons:

- It can be used globally, and despite the fact that its fees and commissions structure often favors the U.S. market, global traders still have significant advantages

- The structure of its fees and commissions is also tiered, allowing traders and investors to pay even less if they’re active

- There are no administration fees – including inactivity fees

Moreover, the broker doesn’t charge any additional fee or commissions and doesn’t use the bid/ask spread method – so traders and investors always know exactly how much they’re going to spend.

No minimum amount is required, and even when commissions and fees are not null, they are extremely low on most products – like less than $0.01.

- No inactivity fees

- No minimum required

- Among the most competitive fees and commissions – also for what concerns margin trading

- Most favorable conditions for the U.S. market

- Some products – like futures – might be less competitive in terms of price if compared to other brokers

- Differences between the Lite (for retailers) and the Pro account might be considerable

2. eToro – Best for Additional Features

eToro focuses on keeping costs low.

The broker offers most of its products for 0% commissions, using the bid/ask spread as a method to get most of its compensation.

For what concerns stocks and ETFs, there are no management fees, but $5 are applied to withdrawals (only Platinum, Platinum+ and Diamond users make an exception) and conversion fees apply if deposits and withdrawals are not in U.S. dollars.

The broker requires a minimum of $10 to open positions.

For what concerns crypto trading, eToro charges 1% of the positions, while CFDs work according to the bid/ask spread method – that’s why traders and investors always see a small loss in their portfolio as soon as they open a new position.

For what concerns other fees and commissions, there are no deposit fees if customers decide to use eToro as a payment method, there are no additional costs to use the copy trading feature, but there is a $10/month inactivity fee (after 12 months of inactivity) and overnight fees.

- No additional fees for the copy trading feature

- Low minimum deposit

- No commissions on most products

- Fees on withdrawals

- Inactivity fee applied

- No overnight fees only for stocks and ETFs

3. AvaTrade – Best for Crypto

Similarly to eToro, AvaTrade uses the bid/ask spread to support its business. An inactivity fee is charged after 3 months of inactivity – and corresponds to $50, €50 or £50. This fee goes up to $100 if the inactivity is prolonged for 12 months.

Accounts might incur in administration fees – unless it is prohibited by law.

On the other hand, fees and commissions for trading the different financial instruments offered by the broker are low or null.

The broker applies 0% commissions on CFD and crypto trading and offers low spreads on forex.

- No commissions on stocks

- No commissions on crypto

- Tight spread

- High inactivity fees

- Possible administration fees

- Minimum deposit of $100

4. Fidelity – Best for Fractional Investing

Fidelity, despite the variety of offers and services it offers, is among the less expensive brokers currently available in the market.

The broker doesn’t charge management commissions, as well as it doesn’t charge any commission for most of the official documentation related to investments and taxes users might need.

Fidelity has no commissions for US stocks, ETF and most options trades – in fact, it is one of the most competitive brokers when it comes to options trading.

Margin fees of the broker start from 9%, which is a highly competitive percentage. It allows fractional investing, doesn’t charge any additional fee or commission to open and close positions, and doesn’t require a minimum deposit amount.

- No management fees

- No hidden costs

- 0% commissions on most products

- 0% commissions often limited to the U.S. market

- Mutual funds might result expensive

- Additional services and discounts might be limited to VIP users

How we test our brokers

We start filtering the available brokers as we suggested at the beginning of this article: Is the broker regulated? Does it have the necessary licenses for the countries where it operates?

These are the first questions we answer to select our list of brokers. The brokers that pass this initial test, are then evaluated to see if they’re in line with what a trader or investor should expect:

- Is the broker transparent enough to provide all the necessary information?

- Are there any hidden costs?

- How does the broker support its business and how these costs affect the budgets of their customers?

- What are the trading and non-trading fees associated with each broker?

All these questions helped us to find the top low-cost brokers available in 2023, and we selected and tested for you those that still offer a wide variety of financial instruments, trading tools and platforms and educational resources.

Why is Low-Cost Trading Important?

Low-cost trading is not only important for the most obvious reason – that is, traders and investors’ capitals shouldn’t be excessively affected by costs that do not contribute to the success of their activities – but also for more “hidden” reasons.

First off, a broker that charges high commissions and fees is not sufficiently inclusive to allow traders and investors to participate in different markets and benefit from the advantages of online brokers.

High costs create entry barriers that can negatively affect the trading volume of the brokers, and further worsen costs if a bid/ask spread method is used to support the business.

Moreover, low costs are a form of risk management tool. Usually, traders and investors with a specific plan know in advance how much they should earn to at least cover costs. If a significant amount of capital is used to pay fees and commissions, the trader might decide to take on more risk to recover losses – and probably incur in even worse, impermanent losses.

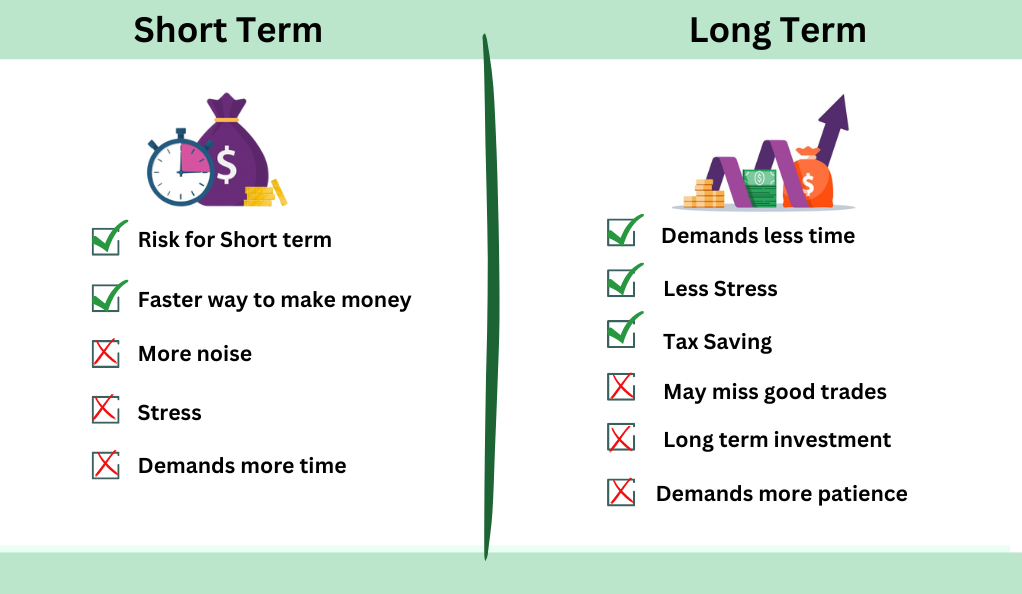

Low Cost Trading for Short-Term Traders vs. Long-Term Investors

The part of capital spent in brokerage fees and commissions has no opportunity to grow. But this affects different types of traders in different ways.

We can maybe categorize the community of brokerage services users into two macro categories: traders and investors.

Traders usually open omr positions, spend more time evaluating entry and exit prices, focus more on technical analysis, plan to hold their positions from short to medium terms.

On the other hand, investors have a longer term vision (they can hold their assets for decades), are more focused on evaluating the intrinsic value of an asset, and spend less time monitoring markets.

For these reasons, different types of costs can affect these two categories differently: a trader might be more interested in trading fees – the opening and closing costs of transactions, margin fees, overnight fees, bid/ask spread, tiered schemes for commissions, and so on.

Investors might be more interested in overnight fees and administration fees – especially if they do not log in very often to their personal dashboards.

Even if different types of users are interested in different types of costs, it’s no doubtful that costs will affect both of them. But it’s also important to choose according to their specific needs – for instance, an investor might find a broker with no administration costs more interesting, even if it has relatively higher bid/ask spreads.

Pros & Cons of Low Cost Trading

- Budgets are not so impacted by fees and commissions

- Traders and investors can avoid unexpected expenses

- It’s particularly convenient to those who want or need to trade frequently

- Not all services might be available for free

- Low cost brokers sometimes can have less analytical tools

- There might be not enough support for institutional investors – and this might affect trading volumes

What Low Cost brokers charge the lowest fees?

To recap what we’ve covered in this article, let’s have a look at the online brokers we listed. All of them are low cost brokers, but in each case there is a characteristic that stands out:

- Interactive Brokers might be the right fit for those traders and investors who look for low, transparent costs and almost no administration fees or commissions.

- eToro offers a set of additional features – like copy trading – without charging additional costs.

- AvaTrade charges no fees on cryptos and derivatives like CFDs, and has tight spreads.

- Fidelity is another low cost broker that doesn’t give up on quality and variety of choice: it doesn’t require minimum amounts and allows fractional investing.

Summary

Low cost brokers play a pivotal role in today’s brokerage markets.

As long as they respect quality standards, are regulated and compliant, and offer different opportunities to traders and investors – also according to their goals and experience – low cost brokers allow liquid markets, inclusivity and relatively lower risks to traders and investors who set comprehensive strategies.

In this article, we covered the top low cost brokers currently available, but it’s always up to you to do your own research and choose according to your trading and investing goals and risk tolerance.

FAQ

What are low-cost brokers and why are they important for traders and investors?

Low-cost online brokers are online platforms that offer financial services, specific to traders and investors, since they allow their users to trade different financial assets and invest according to their goals.

With the surge of online trading, competition among brokers had the positive effect of lowering costs and improving inclusivity. Today, virtually anyone can have access to financial markets. This is why low cost brokers are so important, but there are also other reasons: they play a pivotal role in keeping markets liquid, they allow traders and investors to devote most of their capitals to their trading and investing activities, they can work as risk management tools when traders and investors st specific strategies that duly take costs into account.

How does low-cost trading impact short-term traders versus long-term investors?

Low cost trading can affect traders and investors in different ways. In general, both these categories can take advantage of low cost trading, but they might be more interested in different aspects of the low cost schemes provided by different brokers. While traders, who are usually more active than investors, might be more interested in brokers that keep trading costs low, investors might prefer brokers that focus on lowering overnight and administration fees and commissions.

What should traders consider when choosing a low-cost broker?

There are several elements to take into account when choosing a low cost broker. First off, traders and investors should always make sure to choose a broker that is compliant with national and international regulations related to financial services and activities. Then, they should evaluate the transparency of the broker, to avoid hidden and unexpected costs. Other elements are the availability of enough trading tools and platforms and their intuitiveness, the variety of financial instruments, and the availability of educational resources. In any case, traders and investors should always choose according to their specific needs and goals.

What are the pros and cons of low-cost trading platforms?

Low cost brokers have both advantages and possible drawbacks. Of course, low costs have a positive impact on the budgets of traders and investors, and low trading fees and commissions are particularly beneficial for active traders. On the other hand, low cost brokers might have paid plans and tools to better support their business models, there might be fewer analytical and trading tools and data, and sometimes institutional investors are not supported enough (something that could negatively affect trading volumes).

What’s the top low cost broker currently available?

We chose Interactive Brokers as our top pick overall, since it might fit the needs of both beginners and experienced traders, offers most of its financial instruments for no fees or commissions, and low administration fees.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More