This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

VanEck Gold Miners provides a fair enough solution.

This is an ETF that invests in gold mining companies and gives you diversification without the complication of managing that portfolio.

In this article, we will give you an overview of this ETF, how much it costs, how it performed over time, how to invest in it, and more.

Let’s dive right into it…

Table of Contents

- Overview of VanEck Gold Miners

- Portfolio Construction of VanEck Gold Miners

- The Cost of VanEck Gold Miners

- Performance of VanEck Gold Miners

- What is Special about VanEck Gold Miners?

- How to Buy in VanEck Gold Miners?

- How to Buy in VanEck Vectors Gold Miners ETF (GDX)

- Risks of Investing in Gold Mining ETFs

- Conclusion

- FAQ (Frequently Asked Questions)

Overview of VanEck Gold Miners

VanEck Gold Miners was created by Van Eck Associates in 2006 and listed on NYSE Arca under the ticker symbol “GDX”.

Its goal is to mirror the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), before fees and expenses.

VanEck Gold Miners is essentially a gold mining ETF. Be careful not to confuse gold mining ETFs with gold ETFs. Holding the latter which invests directly in gold bullion gives you direct exposure to the price of gold. Investing in the latter is more complicated.

The companies that are included in the NYSE Arca Gold Miners index and are, therefore, the VanEck Gold Miners’ positions focus on exploring and developing gold mines. Their goal is to produce gold from their mines and trade it to banks, investors, and merchants of gold products.

We will touch again on this subject in order to help you understand if this ETF is for you in a while, though.

Portfolio Construction of VanEck Gold Miners

VanEck Gold Miners currently holds 49 stocks in the gold mining industry. Let us take a look at its 10 biggest positions:

| Company | Ticker | Market Cap | Allocation (%) | |

| 1 | Newmont Corp | NEM US | 1,720,744,788 | 12.61 |

| 2 | Barrick Gold Corp | GOLD US | 1,413,381,258 | 10.36 |

| 3 | Franco-Nevada Corp | FNV US | 1,155,476,810 | 8.47 |

| 4 | Agnico Eagle Mines Ltd | AEM US | 1,036,098,116 | 7.59 |

| 5 | Wheaton Precious Metals Corp | WPM US | 836,285,986 | 6.13 |

| 6 | Newcrest Mining Ltd | NCM AU | 608,671,880 | 4.46 |

| 7 | Northern Star Resources Ltd | NST AU | 568,304,581 | 4.16 |

| 8 | Gold Fields Ltd | GFI US | 538,392,000 | 3.94 |

| 9 | Zijin Mining Group Co Ltd | 2899 HK | 507,202,183 | 3.72 |

| 10 | Anglogold Ashanti Ltd | AU US | 471,380,122 | 3.45 |

The Cost of VanEck Gold Miners

VanEck Gold Miners’ expense ratio is 0.51%.

For some context, check this list and sort it by ER (expense ratio). You will observe that there are 3 gold mining ETFs that are more expensive and 3 others that have a lower expense ratio. So, this ETF’s cost is average.

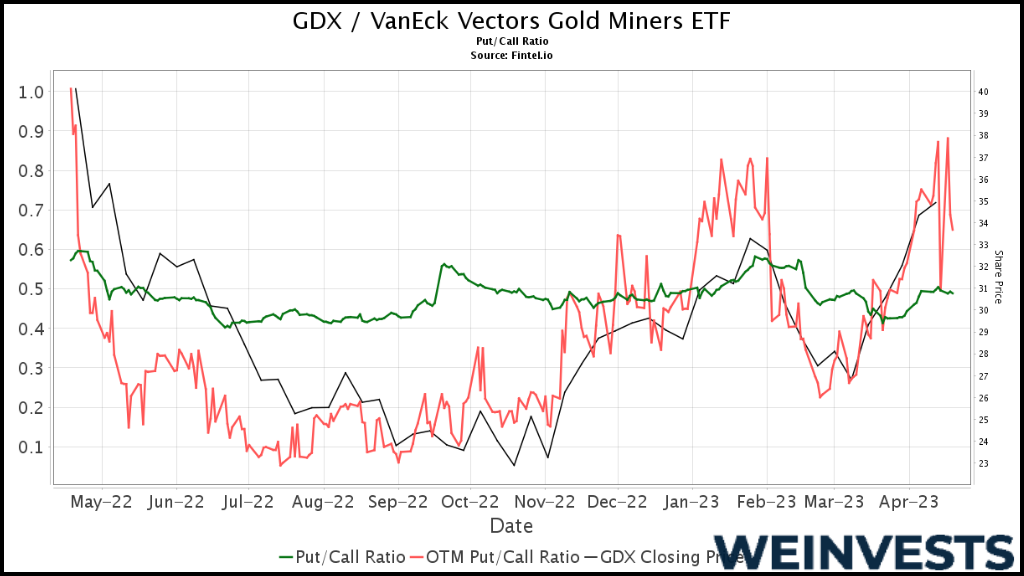

Performance of VanEck Gold Miners

Let’s talk about the ETF’s performance now. For an unbiased overview of its returns, we will examine both its returns since its inception and during different lengths of time up to now.

And we also will do the same for the index it tracks to see how close the ETF managed to replicate its performance.

Since its inception, the fund has realized an average compound rate of return of -1.2% in regards to its market price. The benchmark’s price changed by an average -0.77% annually in the same period.

Now, in the last decade (2012-2022), the ETF returned an average of -3.89% per year, while the index changed by -3.52% per year.

Additionally, in the last 5 years (until 2022), GDX had an average compound growth of 5.33% per year. Within that period the index’s price increased by an average of 5.68% per year.

Last, in the last 3 years (up to 2022), it returned 0.57% per year on average and the index changed by 0.8% per year.

Since this is in some way related to performance, we also need to note here that its turnover ratio has been reported at 15%, as of 12/31/21.

What is Special about VanEck Gold Miners?

Let us, now, discuss a few things that make VanEck Gold Miners different from some of its peers.

First, it’s the biggest gold mining ETF in the US based on assets under management and trading volume (source). Its market cap is currently (January, 2023) about $13.9 billion and its average trading volume is approximately 6.7 million shares.

We should also note that its 5-year returns are lower to just one other gold mining ETF. On this list, you will notice that the rest have performed worse (5 in total). Another interesting fact is that out of all of those ETFs, VanEck Gold Miners is the oldest one.

As for the administrator, VanEck manages $69 billion through its various investment vehicles (mutual funds, ETFs, managed accounts, etc.) and has been in the business since 1955.

How to Buy in VanEck Gold Miners?

If you’re interested in this ETF, you must be able to tell if this is for you before you trade it.

As we briefly mentioned above, investing in a gold mining ETF is different than investing in a gold ETF. You should understand that trading an ETF that invests in gold mining stocks doesn’t give you the same kind of exposure to gold.

Essentially, these companies depend on their efficient operations to turn a profit and their market prices will depend on the same thing as much they will depend on gold’s value. For this reason, they don’t provide the same level of diversification as direct investment in gold does.

In other words, gold miners make money through trading gold for more than it cost to mine for it. When you trade its stock, you speculate more on its ability to keep doing this successfully than you do on the price of gold.

However, the price of gold and that of gold mining stocks are correlated in the long run. It’s just that in the short-term, prices can diverge a lot.

This needs to be clear so you don’t invest in the gold mining, expecting to realize the diversification you would through investing in gold directly. Gold mining ETFs are supposed to give you exposure to the gold mining industry, not the commodity.

Now, if you want such exposure, what you need to consider is how such investment fits into your overall investment approach. This will help you determine your investment horizon.

If you want the diversification that investing in one more industry provides for a smoother journey until retirement or a purchase of something, the holding period is not so crucial.

If, however, you want to speculate on the industry’s performance, timing matters. As you observed above, performance can look very different within various time frames.

Your allocation to such an ETF must also be examined under your needs as an investor. For the most effective diversification, you will need a professional to take a look at your situation and portfolio before you can come up with the best allocation level for you.

How to Buy in VanEck Vectors Gold Miners ETF (GDX)

If you are looking to invest in VanEck Vectors Gold Miners ETF (GDX), eToro is an excellent choice. As one of the top online brokers with a stellar reputation, eToro offers a user-friendly platform with numerous options for both beginner and professional traders. In this mini guide, we will walk you through the process of opening an account on eToro and investing in GDX.

Step 1: Open your Personal Account

To open an account on eToro, visit their website at www.etoro.com and click on the “Join Now” or “Sign Up” button. You will need to provide basic personal information, such as your name, email address, and phone number, and create a password. Once you have completed the registration form, eToro will send you a confirmation email. Click the link in the email to verify your account and complete the registration process.

Step 2: Upload ID

Before you can start trading, eToro requires you to verify your identity. You will need to upload a clear and readable copy of your government-issued ID or passport. This is a crucial step for compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Follow the instructions on the platform to upload your ID or passport, and eToro will review the documents to ensure they meet the requirements.

Step 3: Make a Deposit

To begin trading on eToro, you will need to fund your account. Log in to your eToro account and click on the “Deposit Funds” button. You can choose from various funding methods, including credit/debit cards, bank transfers, and popular e-wallets like PayPal or Skrill. Follow the on-screen instructions to deposit the desired amount into your account. Keep in mind that the minimum deposit amount may vary depending on your region and funding method.

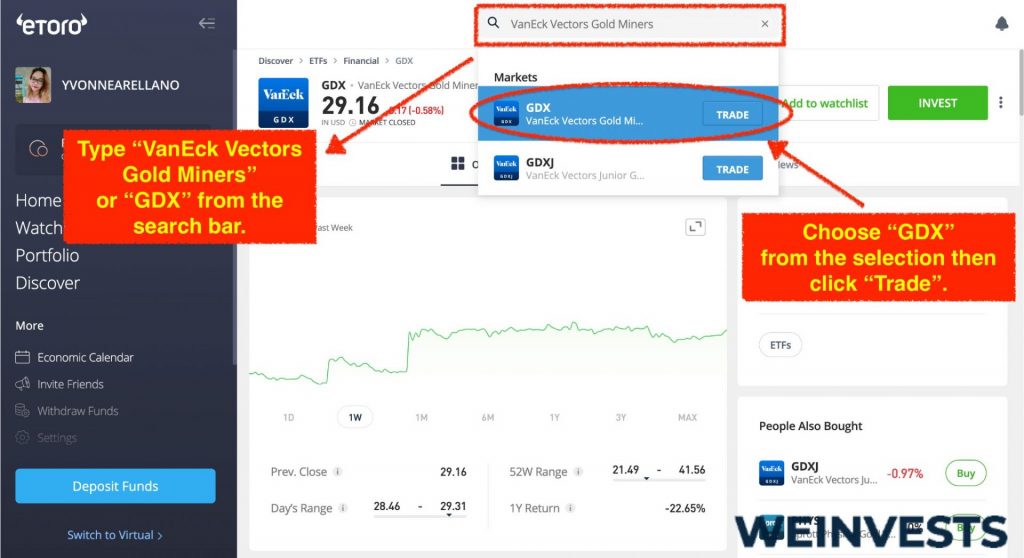

Step 4: Search for VanEck Vectors Gold Miners ETF (GDX)

Now that your account is funded, you can search for VanEck Vectors Gold Miners ETF (GDX) on the eToro platform. Locate the search bar at the top of the screen and type in “GDX” or “VanEck Vectors Gold Miners ETF.” The platform will display the relevant search results, including the GDX ETF. Click on it to access the asset’s page, where you can view its performance, price chart, and other relevant information.

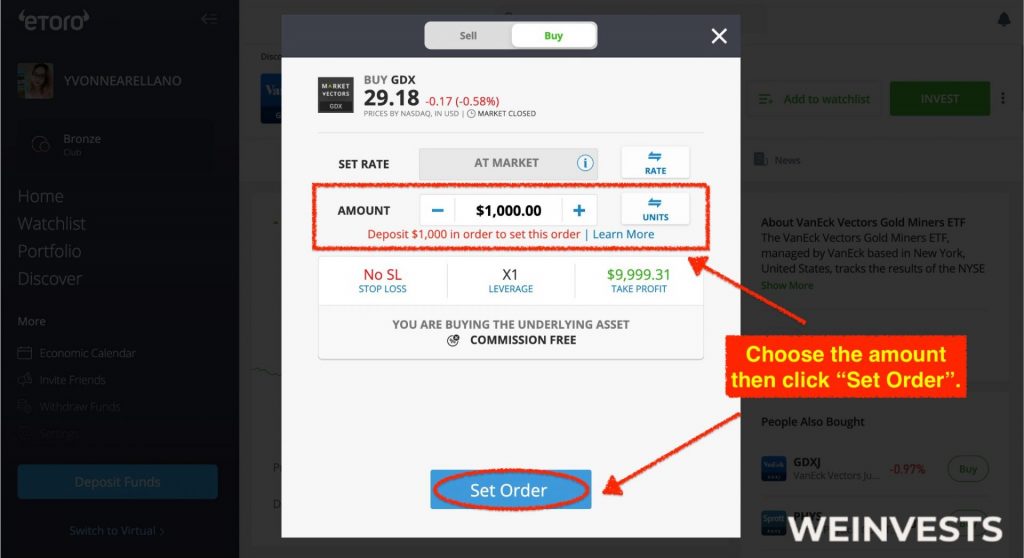

Step 5: Trade VanEck Vectors Gold Miners ETF (GDX)

To trade GDX stocks, click the “Trade” button on the asset’s page. A new window will appear where you can specify the amount you wish to invest, set a stop loss, or apply leverage if desired. Review your order details, and once you are satisfied, click the “Open Trade” button to execute the trade. Your GDX stocks will now be added to your eToro portfolio, and you can monitor their performance and make adjustments as needed.

Risks of Investing in Gold Mining ETFs

Investing in the gold mining industry has risks on its own. Investing in it through an ETF has some additional risks. Below, we sum them all up:

Market Risk

Basically, market risk is related to a general fall in the price of the overall market.

Gold mining ETF prices are affected by their underlying holdings, which are stocks. Therefore, you should be aware that in a market downturn, a gold mining ETF is going to realize a loss as well.

After all, such an ETF invests in equities and its performance is correlated to that of the broader market.

You can manage this risk by means of adequate diversification.

Industry Risk

Industry risk in this instance is the danger of a decrease in the demand for gold. Similar to the market risk, you can decrease the industry risk’s impact through diversification.

Liquidity Risk

Liquidity risk here refers to the danger that an investor won’t be able to liquidate their position in an ETF if its trading volume were to dry up.

This risk is more pronounced in a trading approach than in long-term investing and it can be managed to some degree through the careful examination and monitoring of an ETF’s average volume.

Conclusion

If you want exposure to the gold mining industry, it definitely makes sense to trade an ETF that specializes in investing in it.

And because of its trading volume, this is also an excellent choice for those who want to speculate on the performance of the gold mining industry.

Now, if you intend to invest in it for the long term, you should definitely ask for guidance from a financial advisor. They will be able to help you answer important questions related to allocation strategy and investment horizon.

FAQ (Frequently Asked Questions)

What is an ETF?

ETFs (Exchange-Traded Funds) are stocks issued by fund managers and are listed on stock exchanges.

In essence, an ETF is an investment vehicle that is securitized; that is, it’s an open-ended fund that can be traded in the stock market just like stocks issued by regular companies.

What’s the Difference Between ETFs and Mutual Funds?

In short, the main difference between ETFs and mutual funds will be found in their structures.

ETFs are securitized funds and are traded on stock exchanges, while with mutual funds you can trade them directly from the companies that manage them.

What’s the Difference Between ETFs and Index Funds?

Index funds are simply funds that use an indexing strategy, while ETFs are funds that are traded like stocks.

ETFs generally belong to two categories. Active and passive investing.

Active management is about investing based on a proprietary strategy and often in an effort to beat the market. Passive management is all about mirroring the returns of a market.

ETFs that fall into the latter category belong to the majority and are called index funds.

How Much Do ETFs Cost?

ETF managers will generally charge based on their costs in running the fund which in turn is based on the complexity of the investment approach.

While index ETFs use a passive strategy and can charge as little as a 0.03 expense ratio (depending on what market they invest in), active ETFs can charge as much as 1%, with some exceeding that.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More