This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The Vanguard FTSE Developed Markets ETF (Ticker: VEA) is an exchange-traded fund that seeks to track the investment performance of the FTSE Developed All Cap ex US Index. This index is made up of a diversified group of stocks from large, medium, and small-cap companies located in Canada and the major markets of Europe and the Pacific region. Examples of the biggest stocks included in this particular ETF are:

- Nestle SA

- Samsung Electronics

- Shell plc

- AstraZeneca plc

- Toyota Motor Corp.

- Others

Table of Contents

Characteristics, Performance Analysis, and Expectations

Characteristics

An ETF, or exchange-traded fund, is a type of investment fund traded on stock exchanges, much like stocks. ETFs hold a basket of assets, such as stocks, bonds, commodities, or a combination of these, and are designed to track the performance of a specific index, such as the S&P 500, FTSE 100, or particularly Vanguard FTSE Developed Markets, which tracks Vanguard Index Group.

ETFs allow investors to gain exposure to a diversified portfolio of assets with a single purchase, providing a convenient and cost-effective way to invest in a variety of markets and sectors. For example, VEA has a well-diversified portfolio, including stocks from different industries, such as:

- Automobile

- Medical

- Oil

- Others

An advantage of ETFs is that they are transparent, meaning investors can see the underlying assets that make up the fund daily. This allows investors to understand the fund’s risk and return profile and make more informed investment decisions. Overall, ETFs are an accessible, flexible, and cost-effective investment option that allows investors to gain exposure to a variety of markets and sectors.

Investors who are interested in gaining exposure to this diverse group of stocks can do so through the ETF conveniently and efficiently. The ETF follows a passively managed full-replication approach, which means that it aims to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

The ETF is managed by the Vanguard Index Group, based in Malvern, Pennsylvania, which is a large asset manager that was established in 1975. The group uses advanced portfolio construction techniques and efficient trading strategies to achieve returns that closely track their target benchmarks. They have been managing the Vanguard FTSE Developed Markets ETF since 2007.

A big advantage of investing in ETFs instead of picking stocks individually is the expense of buying and selling stocks each time. The Vanguard FTSE Developed Markets ETF groups lots of big stocks together, making it an existing portfolio. This way it minimizes the effort and the costs of trading those separately, as well as reduces the risk through broad diversification.

As commonly accepted, an advantage of ETFs is mostly their low expense ratio. The ratio for Vanguard FTSE Developed Markets ETF is at 0.05%, which represents the annual cost associated with investing and holding the shares of VEA. In comparison, the average ETF expense ratio in the industry is within 0.2%-0.4%, which makes VEA an attractive option for long, as well as short-term investors. The reason behind this fee being held for the acquisition of VEA shares is for Vanguard to cover its operating expenses.

The dividend yield of the fund is about 2.66% per year as of the end of 2022 (this data does not include adjustments for inflation and taxes).

Performance Analysis

Vanguard FTSE Developed Markets ETF started 2023, with a positive increase, resulting in a YTD (Year To Date) of around +9.5% as of the end of January 2023, which has been a consequence of the general market rebound due to the slowdown of inflation. As most of the stocks in VEA had a significant decrease in share price in fiscal 2022, the ETF also experienced a pull-back of -15.34%, prior to 3 continuous positive years.

Over the long term, VEA has tended to perform in line with the broader market. For example, during the period of the global financial crisis in 2008 and 2009, the ETF’s value decreased along with the broader market. However, it has also seen periods of strong performance, such as in 2017 and 2018 when it saw positive returns.

However, like many other funds, VEA has also been affected by the pandemic of COVID-19, which led to a sharp decline in the equity markets in early 2020. The ETF has recovered some of those losses, but it is still trading below its pre-pandemic levels.

Expectations

It’s worth noting that the performance of the ETF can be affected by a variety of factors, including global economic conditions, political developments, and the performance of individual companies within the fund’s portfolio. Additionally, the ETF’s performance can also be affected by changes in currency exchange rates, as it includes companies from various countries.

However, the reduced pace of the inflationary pressure and hence the expectation of less aggressive monetary policy or rate hikes by the central banks are expected to drive a better performance for the year 2023 assuming no major unexpected events disrupt the market.

How to Buy in VEA?

To invest in the Vanguard FTSE Developed Markets ETF, you will need to open a brokerage account with a firm that offers ETF trading. There are several different brokerage sites/apps, to choose from, on which VEA is tradable. You can also try to invest with online brokerage platforms such as eToro or others. Below is a short guide on how to do so:

- Register an account with eToro.

- Fill in all the required forms with your personal and professional details.

- Share your ID scan to get verification by the platform.

- Transfer funds to your eToro account.

- Search and buy VEA through the platform.

Before investing, it’s important to research the ETF to understand its investment objectives, risks, and fees. This can include reading the ETF’s prospectus, which is available on the Vanguard website. Additionally, you may want to review the ETF’s historical performance and compare it to other similar ETFs.

Once you have a clear understanding of the ETF, you will need to decide how much you want to invest. This will depend on your investment goals, risk tolerance, and overall financial situation.

Once you have decided on the amount to invest, you can place an order to trade shares of the ETF through your brokerage account. You can place a market order, which will execute the trade at the current market price, or a limit order, which will execute the trade at a specific price that you set.

After you have placed your order, you will need to monitor your investment and make sure it is performing as expected. This may include regularly checking the ETF’s price, reading news and analysis about the ETF, or consulting with a financial advisor.

How to Buy in Vanguard FTSE Developed Markets ETF

eToro offers a user-friendly platform that caters to both beginners and professional traders. In this mini-guide, we’ll walk you through the process of opening an account on eToro and investing in Vanguard FTSE Developed Markets ETF.

Step 1: Open an Account

To get started, you’ll need to create an account on eToro. Visit their homepage (https://www.etoro.com/) and click on the “Sign Up” or “Join Now” button. You’ll be directed to the registration page, where you’ll need to provide your name, email address, username, and password. You’ll also need to accept eToro’s terms and conditions and privacy policy. Once you’ve completed the registration form, click “Create Account” to proceed.

For more information, visit: https://www.etoro.com/customer-service/how-to-open-etoro-account/

Step 2: Upload ID

Next, you’ll need to verify your identity by uploading a proof of identification. This can be a government-issued ID card or passport. Simply follow the on-screen instructions to upload a clear, legible copy of your ID. eToro will review your submitted documents and notify you once your account has been verified.

For more information, visit: https://www.etoro.com/customer-service/how-to-open-etoro-account/

Step 3: Make a Deposit

Before you can start investing, you’ll need to fund your eToro account. Log in to your account and click on the “Deposit Funds” button. eToro offers several deposit methods, including credit/debit cards, bank transfers, and e-wallets like PayPal, Neteller, and Skrill. Choose your preferred method and follow the instructions to complete your deposit.

For more information, visit: https://www.etoro.com/customer-service/deposit-faq/

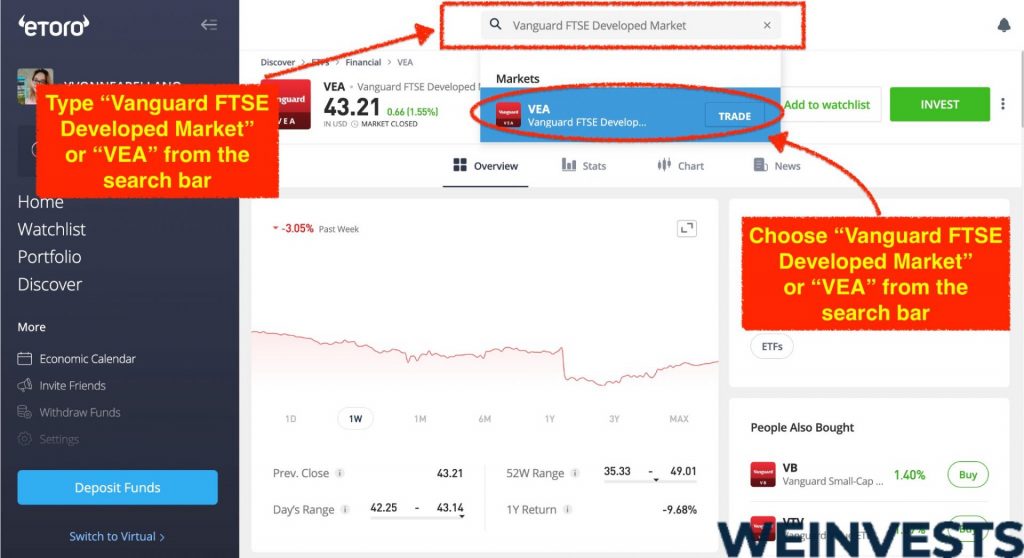

Step 4: Search for VEA

Once your account is funded, you can search for the Vanguard FTSE Developed Markets ETF on eToro’s platform. In the main search bar at the top of the page, type “Vanguard FTSE Developed Markets ETF” or its ticker symbol “VEA” and select the ETF from the search results.

For more information, visit: https://www.etoro.com/discover

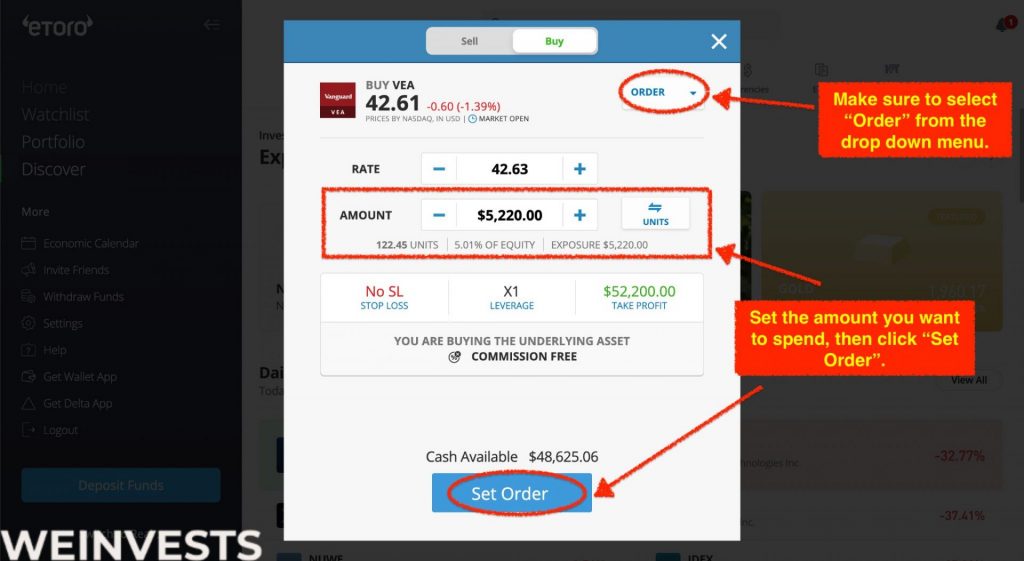

Step 5: Trade VEA

To invest in the Vanguard FTSE Developed Markets ETF, click on the ETF’s name or ticker symbol to open its dedicated page. Here, you’ll find an overview of the ETF, including its performance, fees, and holdings. To buy shares, click the “Trade” button, enter the amount you’d like to invest, and choose your preferred order type (market or limit). Finally, click “Open Trade” to execute your order.

Congratulations! You’ve now successfully opened an account on eToro and invested in the Vanguard FTSE Developed Markets ETF. Keep an eye on your investment and manage your portfolio as needed.

Risks associated with VEA

Market Risk

The market risk, as the name says, represents risks coming from the general market. This means that the share price of the stock, respectively the ETF in this case, is negatively affected by various factors such as a market downturn or changes in stock prices, as well as global economic or political events, which leave a big footprint on the market performance.

Vanguard FTSE Developed Markets ETF is mainly susceptible to changes in share prices of the owned stocks. This means that if a stock included in VEA performs negatively due to poor financial results (for example in 2022 when most of the stocks in VEA underperformed and partly crashed), then it has a direct impact on the ETF’s share price.

As mentioned above, market risk not only comprises stock performances but also events like trade embargos. This indirectly affects the performance of an ETF, as the overall market is influenced. Consequently, it is advised to do extensive research about potential risks before investing.

Credit Risk

Credit risk is the likelihood that a borrower will default on a loan or credit obligation. This can be assessed by analyzing the borrower’s financial history, credit score, and current financial situation. Generally, ETFs aren’t expected to have a high credit risk as this particular risk is more valid for fixed incomes where there is a possibility of one party failing to pay off its debts.

As we already know, Vanguard FTSE Developed Markets ETF is a collection of different stocks. This means that the risk of the ETF being impacted by debt obligation is minimized due to the diversification of stocks. Nevertheless, it is still advised to research the stock holdings of VEA to see if there are holdings that have credit risks due to fixed-income aspects, which could affect the ETF’s performance.

This means that even though the credit risk for VEA is low, it should still be considered before investing, maybe even consulting with a risk manager or financial advisor.

Liquidity Risk

A liquidity risk is a possibility of an investor not being able to cash out his/her investments anymore. In general, big stocks and ETFs like VEA have rather low liquidity risks due to their high trading volume and are less likely to have financial difficulties. Vanguard FTSE Developed Markets ETF has a daily trading volume of USD 12 million and a daily average of USD 15.2 million in the past 65 days. There are ETFs with higher volumes, still, it is relatively high for the financial markets.

Valuation Risk

Valuation risk is the chance of stocks, ETFs, etc. being priced incorrectly. In the case of VEA or other ETFs, the valuation risk is quite low, as they are exchange-traded assets so the price is defined by the market, aka. through supply and demand. This system is not likely to result in inaccurate pricing. Although the valuation risk is relatively small, it is not excluded, as negative events still have an impact on the ETF share price which might diverge from the actual net asset value of the fund.

Risk Summary

| Risk | Relatively Low | Average | Relatively High |

| Market Risk | – | – | X |

| Credit Risk | X | – | – |

| Liquidity Risk | X | – | – |

| Valuation Risk | X | – | – |

Conclusion

The Vanguard FTSE Developed Markets ETF (VEA) is an exchange-traded fund (ETF) that seeks to track the FTSE Developed All Cap ex-US Index, which consists of stocks from large, medium, and small-cap companies located in Canada and major markets in Europe and the Pacific region. The ETF is passively managed, meaning it aims to replicate the target index by investing in the stocks that make up the index, in approximately the same proportion as their weighting in the index.

This ETF is managed by the Vanguard Index Group and has a low expense ratio of 0.05%. In 2023, the ETF had a positive start with a YTD return of around 9.5% due to the market rebound and decrease in inflation. The long-term performance of VEA has been in line with the broader market, but it has also been affected by factors such as global economic conditions and the performance of individual companies in its portfolio. In general, expectations for 2023 are positive based on technical and financial analysis, though unexpected events such as a new pandemic or financial crisis could impact performance.

FAQ’s

How is VEA priced?

ETFs generally are priced based on the value of the underlying assets they hold, and their price fluctuates throughout the trading day in response to market supply and demand.

What are the benefits of investing in ETFs?

Benefits of ETFs include lower cost, diversification, and the ability to trade like a stock.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More