This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

In a rapidly evolving automotive landscape, Tesla has emerged not just as an innovator, but as a trendsetter shaping the future of mobility.

The years 2023 and 2024 mark pivotal moments for Tesla, characterized by significant advancements in electric vehicle technology, record-breaking production milestones, and a deepened commitment to sustainable energy solutions.

As Tesla continues to push the boundaries, its stock captures the essence of a company at the forefront of a global transition to cleaner, smarter transportation.

This overview examines Tesla’s recent achievements and its potential impact on the automotive and energy sectors in the upcoming years.

Overview of Tesla

Tesla, a trailblazer in the global automotive landscape, has been redefining the industry since its inception in 2003 by Martin Eberhard and Marc Tarpenning.

Under the leadership of Elon Musk, Tesla has not only launched revolutionary electric vehicles like the Roadster, Model S, Model 3, and Model Y but also spearheaded innovations in sustainable energy.

In recent years, Tesla has achieved significant milestones, including record-breaking vehicle production and deliveries, and advancements in battery technology and autonomous driving.

As we progress through 2023 and into 2024, Tesla continues to push the boundaries of electric mobility, aligning with its vision of a cleaner, more efficient, and technology-driven future.

Tesla Inc: Statistical Overview

Tesla (TSLA) Stock Forecast 2024

Reflecting on Tesla’s 2023 financial performance and its impact on the 2024 stock forecast, the fact that Tesla missed projected revenues is a significant consideration. Despite the impressive milestones achieved in production and technological advancements, this revenue shortfall led to a decline in stock prices following the webcast. This suggests investor sensitivity to financial performance metrics, particularly revenues, which are a key indicator of a company’s market position and growth potential.

Investors and market analysts might perceive the missed revenue targets as a sign of potential challenges in scaling up production or facing market competition. It’s important to consider how Tesla plans to address these challenges in 2024. The company’s ability to adapt to market demands, improve efficiency, and innovate could be pivotal in regaining investor confidence and driving stock growth in the coming year.

Overall, while Tesla’s long-term prospects remain strong, the immediate response to its financial performance highlights the importance of meeting market expectations and the impact of financial results on stock valuation.

- Production and Delivery Milestones: Tesla’s record production and deliveries in 2023 set a strong foundation for 2024. Continued growth in vehicle production and delivery efficiency is expected to positively impact stock value.

- Energy Storage and Renewable Sector: The expansion in Tesla’s energy storage business, with significant battery delivery growth in 2023, indicates potential for increased revenue streams in 2024, contributing positively to stock valuation.

- Financial Resilience: Tesla’s strong financial performance in 2023, especially the $4.4 billion free cash flow, despite high investments, suggests a stable financial base for 2024, which is likely to boost investor confidence.

- Technological Advancements: Progress in Full Self-Driving technology and the launch of new vehicle models like the updated Model 3 could drive stock growth as these innovations appeal to a broader market.

- Manufacturing Innovations: Tesla’s advancements in manufacturing technology, increasing efficiency and production capacity, are expected to reduce costs and improve profit margins, positively impacting stock performance.

- Market Trends and Challenges: Consider global economic conditions, EV market competition, and regulatory changes, as these factors will influence Tesla’s performance and, consequently, its stock.

- Investor Sentiment: Ongoing public and investor perception, driven by Tesla’s strategic decisions and market position, will be crucial in shaping the stock’s trajectory in 2024.

Tesla Stock Price Forecast for Future

Tesla’s journey through 2023, marked by innovation and expansion, has set a strong platform for 2024. The company’s record production and deliveries, combined with its strides in energy storage and electric vehicle technology, underscore its growth potential. However, this optimistic outlook must be tempered with caution due to potential market and economic challenges.

Financially, Tesla demonstrated resilience in 2023, which is likely to continue into 2024, reinforcing investor confidence. The company’s robust free cash flow, despite significant investments, indicates a solid financial foundation that is attractive to investors.

Yet, the landscape in which Tesla operates is rapidly evolving. Global economic conditions, competition in the electric vehicle market, and regulatory shifts are variables that could impact Tesla’s performance. While Tesla’s innovations position it well, these external factors will play a significant role in determining its stock trajectory.

In essence, while Tesla’s stock shows promise for 2024, grounded in its achievements and market position, investors should remain vigilant and informed. Keeping abreast of global trends and Tesla’s strategic moves will be key in navigating the investment landscape.

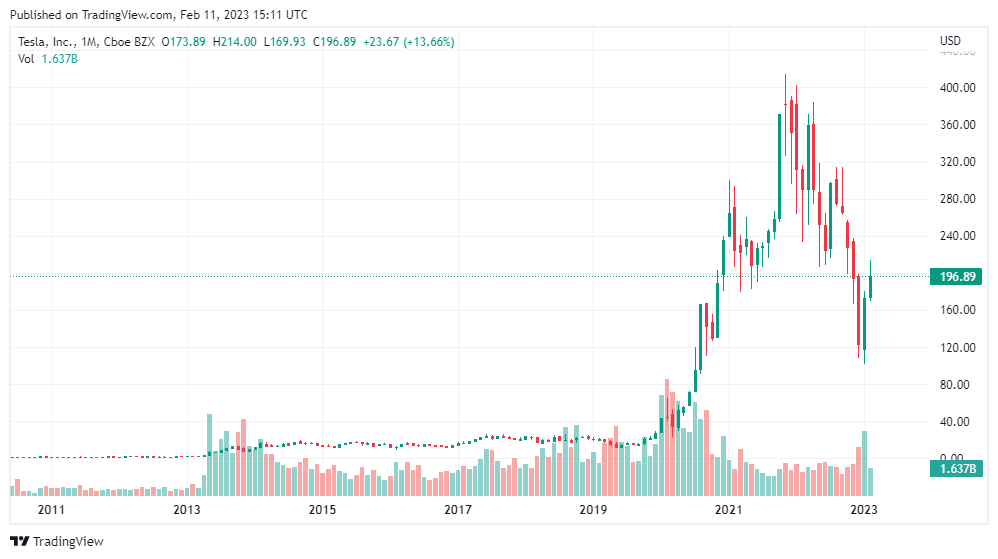

Historical Analysis of the Tesla Stock Price

Historical analysis helps us identify the reason behind the increase in the Tesla share price in the last few years. Let’s go over the growth forecast of the Tesla stock value from 2016 to 2023.

Tesla (TSLA) Stock Forecast 2023

In 2023, Tesla experienced a dynamic financial year. Despite achieving record production and delivery of over 1.8 million vehicles, Tesla encountered challenges, notably missing projected revenue targets.

This shortfall had a notable impact on its stock price. Nevertheless, the company demonstrated financial strength, reporting a substantial free cash flow of $4.4 billion.

This resilience, amidst significant capital expenditures and R&D investments, highlights Tesla’s robust financial foundation and its strategic positioning for future growth and market adaptation.

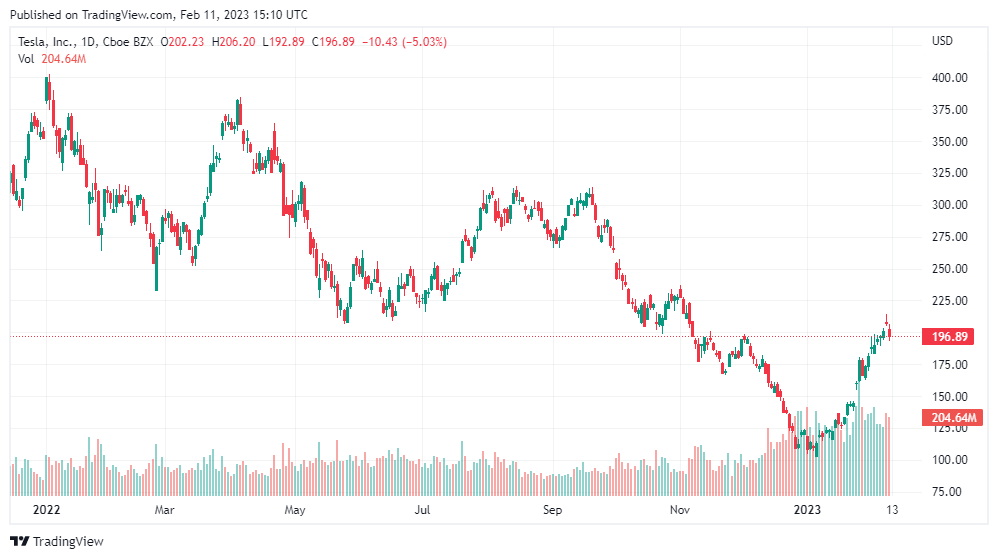

While the price is forecasted to retain the same momentum from 2022 in the first half of 2023, it is expected to pick up in the second half to move above the 200 mark.

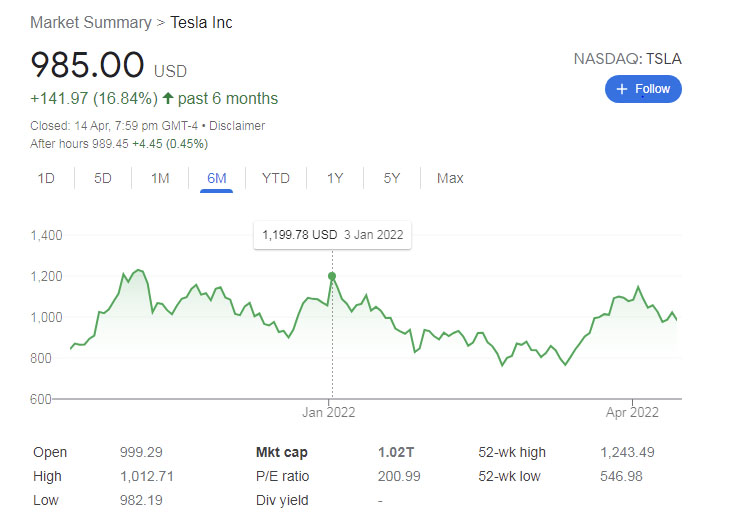

Tesla Stock 2022

Tesla stock price ended on a good note in 2021, closing at $1,082.00 on December 31, 2021. This was largely due to the high number of vehicles sold in the last quarter of 2021. As usual, the price fluctuated but it remained relatively stable till around May when there was a noticeable dip.

On August 4, 2022, during the company’s annual meeting, Tesla’s shareholders approved the 3-for-1 stock split and it was enacted on August 25. The split did not affect the price negatively. On the contrary, the price increased slightly in August but by September, the price began to experience gradual decline.

Among other reasons, the acquisition of Twitter by Tesla’s CEO, Elon Musk, affected the price as investors felt he was preoccupied with running his new company and might not focus the needed attention on Tesla. His selling billions of dollars’ worth of his Tesla holdings to finance the acquisition did not also help with the stock prices.

Tesla Stock 2021

The year 2021 also helped continue its growth trajectory from previous years. With the share price of $699.99 on 31st Dec 2020, the share saw a significant rise by the end of the year. Tesla’s share price closed at $1,082.00 on 31st Dec 2021.

The main reason behind Tesla’s share price growth in 2021 was because of its high production and deliveries throughout Europe. As a result, it continued to see a rapid surge in its share value throughout the year.

Another thing to notice is the delay by the company in the delivery of the Tesla Cybertruck and Tesla Semi. Instead of impacting negatively, it boosted the share price to a higher level. The reason for the delays is that the demand is high and the supply is low.

Investors were ready to cash on this opportunity, and they started putting their money into Tesla’s share prices. Moreover, the reason behind the delay in the delivery of vehicles is due to supply chain issues globally. Once those issues would get sorted out, the delivery of Tesla products can continue in the same way.

Tesla Stock 2020

The year 2020 was disrupted by the pandemic, and many companies suffered significant losses due to the lockdown. However, Tesla share saw immense gains in its share price value. The stock opened at $84.90 on 2nd Jan 2020 and closed at $718.72 on 31st Dec 2020.

Even throughout the peak pandemic months (Mar to Jun), Tesla continued to see a rise in its share value. Many experts termed the growth due to the “Tesla financial complex.”Many technicalities led to these massive capital gains for the investors, such as equity-linked funds and more.

Overall, Tesla enjoyed the year since its share prices soared eight times. Below are some of the reasons we have assessed behind its growth:

- The high number of regulatory credit sales

- Production in the Shanghai facility

- Better and advanced software capabilities and functionalities

- Further technical advancements in battery

- Entry into the Compact SUV market

Tesla Stock 2019

Tesla’s share prices reached an all-time high by the end of 2019. Many reasons led to this growth. For instance, Elon Musk revealed the Model Y to investors with a price range between $39,000 to $60,000. It sparked the interest of many investors that increased the share price.

Most importantly, the company opened its factory in Berlin, making it easy to deliver their cars throughout the European market. As a result, it led to a significant rise in the share price of Tesla by the last quarter of 2019.

Tesla Stock 2018

The Tesla price at the start of 2018 was $62.40, and it closed at $67.84 on Dec 31, 2018. The company’s share price saw a bit of growth, but it remained volatile throughout the year. Tesla delivered 56,000 Model 3 cars to its customers, which helped it regain a better market value by the end of 2018.

The share price of Tesla saw a massive fall on the last Friday of September after the SEC decided to sue Elon Musk for false public statements. The news had a huge impact, and it resulted in the Tesla share price plummeting by 13%.

Tesla Stock 2017

Tesla stock saw a growth of more than 47% by the end of the fourth quarter of 2017. By the end of 2017, Tesla’s share price had reached $62 compared to $45 at the start of the year. Though the Tesla stock price is volatile, the main reason for its rise is due to the Model 3 sedan.

The Model 3 sedan is the most affordable car that customers can get at $35,000. Tesla aimed to change its image from a pricey electric extravagance car manufacturer to a mainstream car marker.

However, the stock continued to go up and down throughout the year since there were concerns regarding Model 3. Many investors were not sure whether it would stand up to its expectations.

Tesla Stock 2016

2016 was a rocky year since Tesla couldn’t stand up to expectations. The stock price opened up at $46.14 on 1st Jan 2016, but it closed at $36.00 on 31st Dec 2016. The most notable reason behind this decline is Tesla’s failure to deliver 4,000 Model X SUVs in the last quarter of 2015.

Investors deemed the stock a bit risky and avoided investing in Tesla. Moreover, there were manufacturing problems with the Tesla cars, which further harmed investor confidence. Overall, 2016 was a year with high volatility for Tesla.

Tesla Energy

How Tesla Energy Ties Together its Stock Levels

The Palo Alto, California-based entity has made significant investments in energy and battery technology. In 2019, Tesla announced that it would acquire Maxwell Technologies, a company that deals in breakthrough storage and energy density technology. This, in turn, had a positive impact on Tesla’s stock in the market. In fact, right from the start, Musk had championed the use of power-efficient batteries and made decisions to pour significant investments into energy.

Back in 2015, Tesla also came into an agreement with Jeff Dahn, a Dalhousie University professor who is an experienced researcher and supporter of energy-efficient batteries. The focus of interest was to produce cost-effective lithium-ion batteries with better energy densities and longer life spans.

And coming back to the present, it has become clear that Tesla’s decision to produce highly energy-efficient batteries was the right move. But the company has more ambitious plans to dive into the energy sector and pave the way for more advanced batteries. These are the stories that continue to increase Tesla’s stock price and lead to more investment opportunities for the company.

Back in 2016, Tesla opened a Gigafactory in Nevada. This dedicated plan covers the large-scale storage of batteries. Within two years, it became the highest battery volume gigafactory plant. At the time, Panasonic would create battery cells and Tesla would assemble these into modules and packs for its attractive line of cars.

Over the years, Tesla has managed to focus more on energy-efficient batteries. Besides, the EV maker understands that large-scale and efficient production of batteries and significant investment in energy would complement its car manufacturing abilities.

Again, this is bound to have a positive impact on its stock levels. When it comes to electric vehicles, Tesla wants to achieve more energy density for its cars. Battery and energy analysts concur that on top of a smaller package, it improves the efficiency of vehicles as well as saves weight.

According to Bloomberg’s research, Tesla’s Model 3 packs around 24% more energy density than, say, the Nissan Leaf model. It means Tesla’s Model 3 offers 90 miles of more range due to its smaller battery and weight. What’s interesting is that Tesla utilizes unique battery chemistry than other automakers in the industry. Battery researchers at Tesla want to maximize efficiency and minimize the potential risk of fire throughout its life span.

Tesla is aware of the tradeoff that involves higher material capacity and a higher degree of density that results in more heat. And that means having a more robust cooling system and proper temperature control management system to maintain the battery life.

Most recently, Tesla’s vehicles have caught fire which had a negative impact on its stock price. But researchers believe that Tesla is committed to investing more in energy-efficient batteries to extend the life cycles of its vehicles.

Ever since traditional auto competitors have started to roll out their line of electric vehicles, Tesla wants to step up the game and make its vehicles bigger and greener. Experts believe that as long as the company sets new high standards, it is bound to maintain and increase its stock levels in the market.

Tesla Energy Stock Forecast 2024

As 2024 dawns, Tesla Energy stands at the forefront of a transformative era in the global energy landscape. After a year of significant achievements and challenges, Tesla Energy’s path in 2024 is shaped by its ambitious vision and strategic initiatives. The year 2022 set a precedent with a remarkable compound annual growth rate (CAGR), overcoming supply chain and regulatory hurdles, a testament to Tesla Energy’s resilience and innovation.

The global energy storage market, having crossed significant thresholds in capacity, presents a fertile ground for Tesla Energy’s growth. The trajectory established in recent years positions Tesla Energy favorably in this expanding market. The division’s strategic goals for 2024 are not just ambitious but also reflective of the evolving energy needs worldwide.

Tesla Energy’s response to global energy dynamics, particularly in the context of fluctuating oil prices and the push for sustainable solutions, will be pivotal. The division’s expansion into new markets and diversification of its product portfolio, including energy storage and battery programs, are expected to drive growth. These initiatives not only promise to strengthen Tesla Energy’s market position but also have the potential to positively influence Tesla’s overall stock performance.

Investment trends and market analyses indicate a substantial influx of capital into Tesla Energy, projecting it as a key player in the global energy transition. However, the journey in 2024 is not without challenges. Tesla Energy will need to navigate a landscape marked by competitive pressures, technological advancements, and regulatory changes.

In conclusion, Tesla Energy’s stock forecast for 2024 is a blend of optimism grounded in the company’s innovative spirit and a realistic assessment of the challenges ahead. With its ambitious targets and strategic expansions, Tesla Energy is poised to play a significant role in shaping the future of sustainable energy, making it a compelling prospect for investors and market watchers alike.

Tesla Energy: Historical Performance and Stock Analysis

By the end of Q4 2021, it became clear that Tesla Energy will supply dedicated Power Packs to SpaceX for on-site expansion of energy sources. In fact, at the Starbase facility, the Megapack unit has commissioned 730MWh BESS or battery energy storage system during Moss Landing.

Consequently, this managed to render a 4GWh figure in energy storage in 2021. As a result, it increased its market share of Tesla by 15% on the S&P Global index. As per Bloomberg, there has been a relatively lower grab of market share by the end of 2021. But when it comes to Tesla Energy, there is strong momentum and a direct impact on its stock levels. In fact, in 2021, Tesla Energy had an increased market share of over 18%.

As of May 16, 2021, S&P 500 closed TSLA at a slightly lower rate. Unlike the momentous rise of Tesla Energy, the stock growth of other Tesla subsidiaries lost significant ground in the Chinese market. The current economic data, however, suggests that increased interest rates are the major reason for the sudden slowdown.

In late April 2021, the economic activities in China started to cool down due to strict COVID-19 lockdowns. This, in turn, had a significant impact on industrial production, employment, and consumption. In the end, it added more fear to the economy and startled investors which significantly decreased the growth of Tesla Energy in Q2 2021.

In Q3 2021, there was high optimism around energy stocks in China. Increased demand managed means recovery for the market. After the receding impact of the pandemic, Tesla Energy started to gain ground in the Chinese market. At the moment, Musk believes that the journey of Tesla Energy has just begun and it would acquire, partner, and evolve for years before it can gain significant market share.

In 2021, the energy index on S&P 500 was as high as in 2014. In fact, Tesla Energy closed at over 2.6% which reflected the strongest performance of the decade. Unlike old days, Tesla investors no longer question the most radical strategies of Tesla Energy to gain market position.

However, there was a mixed signal on whether or not investors should be worried about a sell-off. By the end of Q4 2021, investors realized and recognized that Tesla Energy has become highly sustainable. However, investment strategists profess that it will take a consistent and proactive approach to Tesla to maintain its thrust in the Chinese energy market.

After the long-term goals of Tesla Energy started to out, it saw a gradual increase in its market share. From 2019 to 2020, however, there was strong capitulation in the market that no longer exists for Tesla Energy. In fact, even when TSLA stock fell to 6% in Q3 2021, Tesla Energy stood its ground and played an important role to push the company in a growth-driven direction.

One of the most worrisome issues for investors has been significant hikes in interest rates by Federal Reserve in order to compact the high inflation rate. But there is clear data that hints this decision is bound to backfire and would propel the economy into the rabbit hole of recession. Amidst the conflicting situation in Ukraine and the reemergence of COVID-19 in China, the economic turmoil continues to exacerbate.

After the interest rate hikes in June 2021, traders started to price over 85% of the 50-base points. After that, the word was out that S&P 500 dwindled by 0.39% and ended the session at 4,008 points. Similarly, NASDAQ also declined by 1.20% with 11,662.79 points. On the other hand, the industrial average of the Dow increased by 0.08% with 32,223.42 points.

These figures represent the uptick in investments from investors after the growing sales and growth of Tesla Energy. Although inflation worries will continue to linger, investors understand that consumer sentiment and market perception have become more positive toward Tesla Energy.

According to Bloomberg, Tesla stock had a significant gap throughout 2021. Some market analysts believe that Tesla stock has the biggest divide in the market. In some cases, analyst prices range between $250 and $1,620 per share. Since Tesla’s IPO back in 2010, its shares have increased by 22,000%.

However, the company leadership understands that this feat is not enough to sustain the future growth of Tesla. It needs a subsidiary like Tesla Energy to become more mature and stable in the coming years. The long-term profit margins and production goals of the company hint that Musk would make more radical changes, ann0uncements, and partnerships in line with Tesla Energy.

Some decisions around Tesla Energy pose a high risk for TSLA’s stock. But since 2019, Tesla has had its fair share of challenges. As Tesla continues to scale up its production, it is also weighing more progressive initiatives for Tesla Energy. Musk believes that it is the moral and ethical obligation of the company to make Tesla more energy-driven and render radical changes across the world.

As of now, Tesla Investors believe that the sell-down value of its energy subsidiary is much higher than EVs. When it comes to the energy sector, market dynamics change all the time. And whether it’s battery storage or energy programs, Musk is ambitious enough to take Tesla Energy in a new direction.

You may not be aware of it but even IKEA has decided to be part of the solar energy business with state-of-the-art solar roofs. In the energy space, other players have started to come into play. This, in turn, means Tesla has to make sure that its energy subsidiary continues to retain a strong market position.

In the last few years, the energy sector has become a highly competitive market. With the advent of energy-efficient solutions, there are bound to be many companies competing for a higher market share. But the revolutionary approach of Tesla Energy is one of the main reasons it continues to have a major advantage over others. In fact, Musk has had a long-term vision to move forward with its energy subsidiary.

Conclusion

As 2024 unfolds, Tesla’s journey remains a focal point in the automotive and energy sectors. The past year’s performance, marked by both significant achievements and challenges, particularly in revenue targets, provides a nuanced backdrop for future expectations. Tesla’s commitment to innovation, evidenced by its advancements in electric vehicles and energy storage, positions it strongly for future growth. However, the missed revenue projections in 2023 serve as a reminder of the complexities inherent in the stock market.

Looking ahead, Tesla’s potential in 2024 hinges not only on its internal strategies and technological advancements but also on broader market and economic factors. Investors and enthusiasts alike will be watching closely as Tesla navigates these dynamics, balancing the excitement of innovation with the realities of market performance.

In conclusion, Tesla’s path in 2024 is likely to be as dynamic and eventful as ever, promising new developments and opportunities, tempered by the challenges and uncertainties that define the global market landscape.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More