This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Before you invest in any ETF, it makes sense to first learn everything you can about it.

Investing in gold ETFs is no different. Though there are fewer things to worry about than is the case with equity ETFs, you nevertheless need to understand what you’re investing in.

Sure, you don’t have to worry about turnover or the index weighting strategy. But you still need to understand the ETF’s tracking error and other things like expenses, vault locations, liquidity, etc.

If somehow SPDR Gold Shares got on your radar, you’re in the right place. In this article, we aim to cover everything that you need to know before you trade this ETF.

More specifically, our goal after you go through this is to help you understand why this ETF is unique, how you can approach investing in it, and the risks involved with trading it.

Let’s get started…

Table of Contents

SPDR Gold Shares is an ETF created by State Street Global Advisors on November 18, 2004. Its goal is to track the price of gold as closely as possible after expenses. It is listed on the NYSE ARCA exchange as the ticker symbol “GLD”.

This offering is for those who want to invest in gold, but don’t want to bear the cost of buying, storing, and insuring physical gold through a gold bullion account. For many investors, such costs will be higher than what this ETF will charge them for holding its shares.

SPDR Gold Shares has an expense ratio of 0.4%.

For comparison, check this list and sort it from highest expense ratio to lowest. Excluding leveraged and inverse ETFs, 8 gold ETFs are cheaper than GLD, while 5 are more expensive.

Now, let’s have a look at this ETF’s returns through various time ranges to gain a complete understanding of its performance.

Since its inception, its market value has appreciated by an average compounding return of 7.62% per year. During the same period, LBMA Gold Price has increased by 8.1% per year on average.

Now, when it comes to the last decade, the fund returned an average of 0.46% per year, while the index changed by 0.9% annually.

Also, in the last 5 years, the ETF had an average return of 6.53% and the index one of 7.03%.

Since multiple ETFs track the price of gold, we need to explain what is special about SPDR Gold Shares.

First of all, this is the very first gold ETF that was traded in the United States and it’s the first that is backed by a physical asset when it comes to ETFs listed in the U.S. This makes for the longest track record possible when it comes to US gold ETFs.

It also naturally has the largest assets under management. As of January 2023, it was managing about $57 billion. Take a look at this list and see for yourself that it’s the biggest gold ETF based on AUM in the US. Another well-established gold ETF, iShares Gold Trust, is the second largest and it doesn’t even come close with AUM of about $28 billion.

If you also sort the list by volume, it’s also the largest based on this factor as well (average volume: ~5.4 million).

Now, when it comes to the custodians of the gold, these are the HSBC Bank Plc and the JPMorgan Chase Bank.

HSBC has a very long history as it was created back in 1865 in Hong Kong and has been operating internationally since then. Today, it serves about 40 million customers, including institutions, across 63 countries and territories.

JPMorgan Chase is an even older bank that was founded in New York City in 1799. It is the largest US banking institution and the world’s largest bank based on market cap (as of 2023).

As for the sponsor, State Street Global Advisors, this institution goes back many decades. It was established in 1978 by State Street Corporation with a focus on offering investment management services to institutional investors.

State Street Global Advisors is also known for another widely traded ETF called SPDR S&P 500 ETF Trust (SPY). This was the first US-traded ETF and has AUM of about $380 billion.

Before you invest in SPDR Gold Shares, make sure that this is the right ETF for you. Although investing in gold through gold ETFs is indeed simple, there are some things that you should consider first.

First of all, consider the reason you want to invest in this ETF. As you may have observed above, the returns of gold can fluctuate wildly across different periods.

Take this period as an example. In the last decade (2012 – 2022), investing in gold would be a good asset to hold to decrease volatility in a diversified portfolio, but a very bad hedge by itself against inflation.

If you don’t intend to use gold ETFs as vehicles to express your macroeconomic thesis (macro trading), then you should know that you cannot expect gold ETFs to do much more than provide you with better diversification.

Now, if you want to trade a gold ETF to diversify, the investment horizon can be anything from a couple of years to decades. It largely depends on your goals.

Gold returns are inversely correlated to those of equities and bonds. This means that in general, when your equity and/or bond allocations decrease in value, the value of your gold allocation increases; and the reverse. A diversified portfolio that includes gold tends to be less volatile than one that doesn’t, all else being equal.

So, it doesn’t matter much how long you intend to hold a gold ETF because successfully delivering low volatility doesn’t depend on your investment horizon. It’s like insurance against your equity and bond investments.

But what you should consider is how much you must allocate to gold.

You can gauge that based on the desired risk/reward profile of your portfolio. The less volatile you want your portfolio to be, the more you should allocate to gold ETFs. You can start with a 5% allocation and increase this based on how much you want gold to impact your portfolio.

If you’re approaching retirement and you are about to start making withdrawals, you should allocate more to gold than if you were a long way till retirement.

But we cannot provide you with a specific range of allocation here because retirement has many parameters for each one. It’s better if you take into account the reasoning we outlined above and have a talk with a financial advisor about the specifics.

In regards to access now, any reputable broker will allow you to trade SPDR Gold Shares. Interactive Brokers, TD Ameritrade, Charles Schwab, and Fidelity are all big names in the industry. You can’t go wrong with either.

How to Buy in SPDR Gold Trust (GLD)

Investing in SPDR Gold Trust (GLD) is an excellent way to gain exposure to the gold market. One of the best options for purchasing GLD is eToro, a highly reputable online broker that offers a wide range of options for both beginner and professional traders. In this mini guide, we will walk you through the process of opening an account on eToro and investing in GLD ETFs.

Step 1: Open your Personal Account

To begin, navigate to the eToro homepage and click on the “Sign Up” button. This will take you to the registration page, where you will need to provide your personal information, including your name, email address, and phone number. Additionally, you will need to create a username and password. Once you have filled in all the required information, click on the “Create Account”

Step 2: Upload ID

After creating your account, eToro will require you to verify your identity. You can do this by uploading a proof of identity document, such as a government-issued ID card or passport. Make sure the image you upload is clear and legible, as this will help expedite the verification process.

Step 3: Make a Deposit

Once your identity has been verified, you will need to fund your account to start trading. To make a deposit, click on the “Deposit Funds” button on the eToro platform. eToro supports various payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal and Skrill. Choose your preferred payment method and follow the on-screen instructions to complete the deposit process.

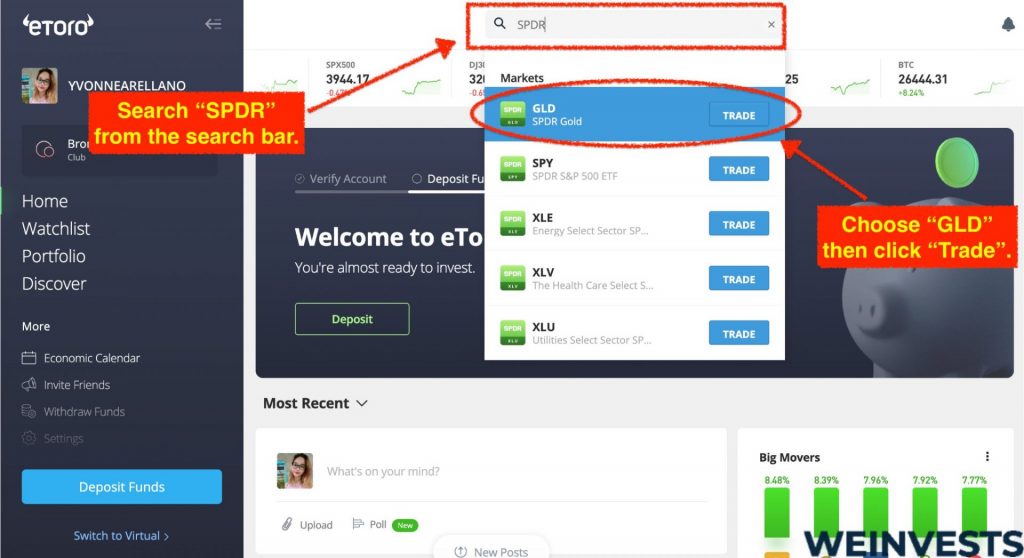

Step 4: Search for GLD

Now that your account is funded, you can search for SPDR Gold Trust (GLD) on the eToro platform. To do this, type “SPDR Gold Trust” or “GLD” in the main search bar located at the top of the screen. Once you have found the GLD, click on it to view more information and access the trading options.

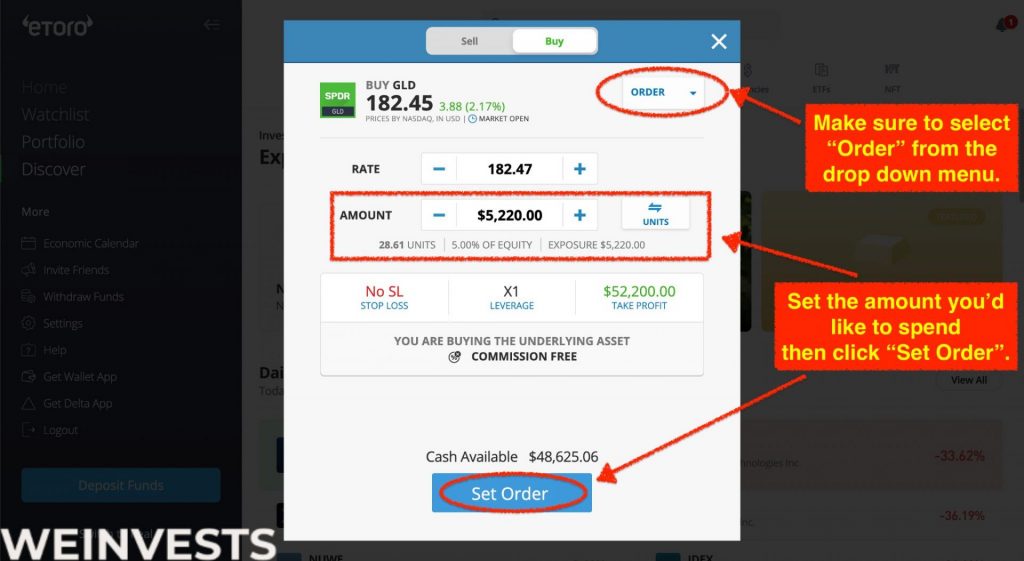

Step 5: Trade SPDR Gold Trust (GLD)

To trade GLD stocks, click on the “Trade” button on the GLD page. This will open a new window where you can input the amount of money you wish to invest in GLD ETFs. You can also choose between a market order (which executes immediately at the current market price) and a limit order (which only executes when the ETF reaches a specified price). Once you have entered your desired investment amount and chosen your order type, click on the “Set Order” button to complete the transaction.

Risks of Investing in gold ETFs

Investing in gold ETFs is risky just like any other investment activity. Before you trade any, consider the risks below…

Market Risk

Market risk is related to the general decrease in the value of gold. Since gold ETFs invest in gold directly, an overall decrease in the price of gold will drive down the price of gold ETFs.

The value of gold is determined, just like securities and other commodities, by supply and demand.

For long-term investors, this risk can have little impact on their portfolios. For speculators, however, market risk is very important.

Liquidity Risk

Liquidity risk is related to the danger of not being able to get out of a position in time. For this reason, it applies more to traders than long-term investors.

Traders that try to speculate on the movement of gold price can use gold ETFs instead of trading directly gold as a way to have more liquidity. However, ETFs with low trading volumes can prevent efficient trading as well to some degree.

If you intend to trade and hold a gold ETF for years, however, this risk will not apply to you.

Conclusion

Gold ETFs like SPDR Gold Shares are a very good way to get exposure to the price of gold.

It’s the first gold ETF ever and was sponsored by the same institution that created the first ETF in the US. That allows for the longest track record when it comes to US gold ETFs.

In any case, before you invest, ensure that you understand all the risks we mentioned above. It is also a great idea to discuss this ETF with a financial advisor first.

FAQ (Frequently Asked Questions)

What is an ETF?

An ETF or Exchange-Traded Fund is a type of security that is listed on a stock exchange that represents ownership in a fund.

An owner of an ETF has ownership of its underlying assets in proportion to the number of shares they own. Such assets can be other securities like stocks and bonds, but also commodities like gold and oil.

What’s the Difference Between ETFs and Mutual Funds?

The most important difference between ETFs and mutual funds is in their structure.

ETFs are securities that are traded like stocks (technically, they are stocks) and therefore there is an active market for them. Mutual funds can only be bought directly from the companies that issued them.

For this reason, ETFs are more liquid than mutual funds and appeal more to active traders.

What’s the Difference Between ETFs and Index Funds?

Though these two terms are incorrectly used interchangeably, ETFs are investment vehicles, while index funds are a type of investment vehicle.

Index funds are called the funds (either ETFs or mutual funds) that attempt to replicate the performance of market indices.

ETFs are famously known for such a passive strategy and that is why they are so often called index funds too. But some ETFs employ an active strategy and wouldn’t be classified as index funds.

How Much Do ETFs Cost?

ETF costs vary based on factors like strategy and the type of underlying assets.

You can expect ETFs that employ active strategies and invest in multiple assets to generally be more expensive than passive ETFs that track indices.

As a rule of thumb, you can often find index ETFs to have an expense ratio of 0.1% to 0.5%, while active ones can be as much as 1%.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More