This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

REIT ETFs are specialized in investing in REIT stocks; that is, stocks that are issued by real estate managing companies that are required to distribute at least 90% of their profits to shareholders.

A well diversified portfolio usually includes holdings that are related to the real estate sector. ETFs that invest in REITs are very convenient since you won’t have to worry about buying and selling individual REIT stocks by yourself to rebalance your portfolio or to accurately track an index.

But out of the many REIT ETFs out there, which one should you choose? While we can’t make any recommendations because everyone’s financial situation is different, we will help you understand what you should look for when picking REIT ETFs.

At the same time, we will outline 3 of the biggest REIT ETFs for you to consider, the risks associated with investing in them, and how you can go about buying any of them.

Let’s dive in…

Table of Contents

What are REIT ETFs?

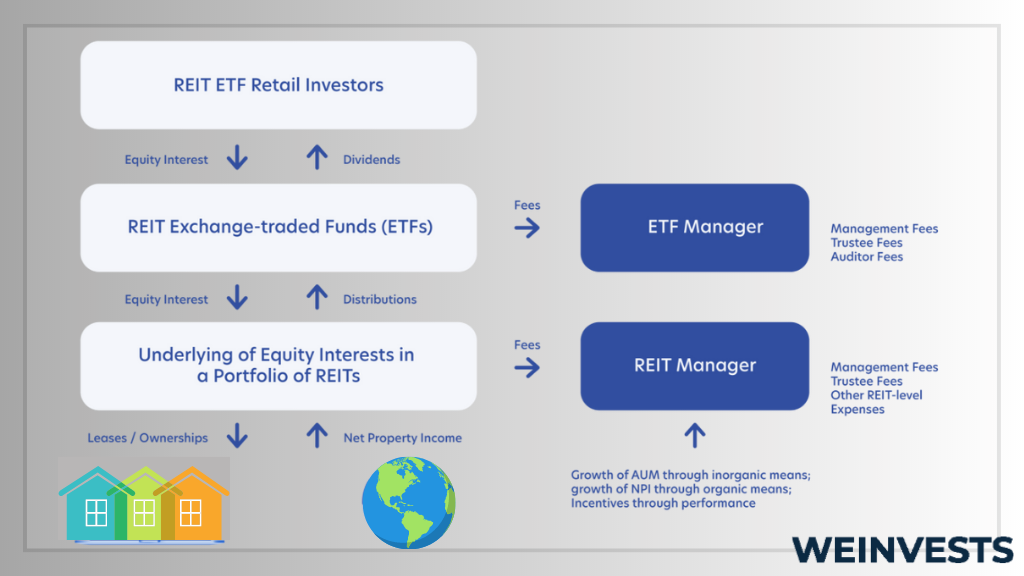

REIT ETFs are Exchange-Traded Funds that mainly invest in REITs (Real Estate Investment Trusts). When you invest in a REIT ETF, you indirectly buy real estate managing companies that qualify as REITs (meaning that they distribute at least 90% of their profits to shareholders).

Such ETFs can hold a few dozen REIT stocks to more than 100 at any time.

Here are a few advantages that investing in REIT ETFs provides:

- Exposure to the real estate sector without having to managing a portfolio

- Superior liquidity to that of holding physical real estate

- Stable dividend income

- Improved diversification level of a portfolio

Factors to Consider when Selecting a REIT ETF

Let us, now, outline the most important factors you should examine when it comes to selecting REIT ETFs:

The dividend yield is the hypothetical dividend return on your investment if you bought at the current price of the ETF and the future distributions of the fund are like the past ones in the last 12 months. This is an important metric to look at when choosing a REIT ETF if you’re interested in some income as the higher the yield is, the better your chance at realizing a high dividend return on your investment.

You should also look at how well diversified the REIT ETF is. The number of its holdings and how much it allocated to each of them will help you identify a risk that may be not prevalent in another REIT ETF. For instance, an ETF may be allocating a significant portion of the portfolio to a few companies that their dividends are at risk of getting cut. Finding these stocks and then looking at their dividend histories to see how stable the growth of their dividend distributions have been is a good idea for gauging the risk.

The expense ratio is the annual fees that ETFs charge and is expressed as a percentage of their assets under management. For instance, an ETF charging a 0.1% expense ratio that you invested $10,000 in would mean a $10 fee per year for you. The higher the expense ratio, the worse your returns are going to be. For this reason, it’s preferable to find the ETF with the best expense ratio.

The fees should always be viewed alongside the performance of the ETF. Some ETFs may have very low fees but their track record can be very short to derive any predictable trend out of its performance.

Top 3 REIT ETFs

Let us now take a look at the top REIT ETFs based on the size of the assets under management…

Vanguard Real Estate ETF (VNQ)

Vanguard issued this ETF back in 2004 and listed it on NYSE Arca under the ticker “NVQ”. It holds about $36.8 billion in assets under management and, for this reason, is the biggest REIT ETF out there.

It charges an expense ratio of 0.12% and tracks the MSCI US Investable Market Real Estate 25/50 Index. Unlike other REIT ETFs, VNQ also invests a small portion of its assets in companies that manage real estate, but aren’t classified as REITs.

The distribution yield of VNQ is 3.76% based on its current market price and its distributions in the last 12 months. As of 01/31/2023, its turnover rate was reported as 7.4%.

Now, its track record is also long enough to examine its performance through various time frames for getting the best idea.

Since the fund’s inception up to 2022, its market price has increased by an annualized 7.98% on average. During the same period the index it tracked has increased by 8%.

In the past 10 years, the ETF has grown by 7.08% per year on average while the benchmark’s price has increased by 7.19%.

And in the last 5 years, the fund’s price increased by an average of 6.64% annually. The index’s price increased by 6.77%.

Schwab US REIT ETF (SCHH)

The Schwab US REIT ETF was issued by Charles Schwab in 2011 and is listed on NYSE ARCA under the ticker symbol “SCHH”. Its assets under management as of 02/23/2023 were about $5.8 billion.

It tracks the Dow Jones Equity All REIT Capped Index and charges an expense ratio of 0.07%. Its trailing twelve-month dividend yield is 2.46%.

As for its performance, in the last 10 years the ETF has returned 5.66% per year on average. Because the issuer changed the ETF’s index from the Dow Jones U.S. Select REIT Index to the Dow Jones Equity All REIT Capped Index in 2020, it reports the performance of a “REIT Spliced Index”, which was an average 5.74% change per year.

In the last 5 years, the fund’s price increased by an average of 3.96% per year, while the benchmarks increased by 4.01% annually.

86% of retail CFD accounts lose money.

Real Estate Select Sector SPDR (XLRE)

The Real Estate Select Sector SPDR Fund was created in 2015 by State Street. It has about $4.9 billion in assets under management and charges a 0.10% expense ratio.

As suggested by its name, like Vanguard’s VNQ, this ETF also invests in real estate companies that don’t classify as REITs. It tracks the S&P Real Estate Select Sector.

Its TTM dividend yield is 3.58% based on its current price, as of 2/25/2023.

Now, since this ETF hasn’t been active as long as the others, we will examine its performance during 5-, 3-, and 1-year periods.

In the last 5 years, the fund had its price increased by 8.23% per year on average, while the index it tracks increased by 8.36%.

In the last 3 years, its market price increased by 4.49% per year. The benchmark’s price increased by 4.64% per year.

Last, in the past year, the ETF experienced a loss of 11.33%, while the index decreased by 11.27%.

How to Buy in REIT Stocks

eToro has earned a strong reputation and offers a wide range of options suitable for both beginner and professional traders. In this mini guide, we’ll walk you through the steps to open an account on eToro and start investing in REIT stocks.

Step 1: Open an Account

To begin, you’ll need to create an account on eToro. Visit the eToro homepage at https://www.etoro.com and click on the “Sign Up” button. You’ll be directed to the registration page where you can enter your personal information, such as your name, email address, and password. You’ll also need to agree to the terms and conditions and privacy policy before proceeding. Once completed, eToro will send you a confirmation email. Be sure to verify your email address by clicking the link provided in the message.

Step 2: Upload ID

After successfully registering, you’ll need to upload a proof of identity to verify your account. eToro accepts government-issued identification documents such as a passport or driver’s license. To upload your ID, go to your eToro profile, and navigate to the verification section. Follow the instructions to upload a clear, high-resolution photo or scan of your identification document. Make sure all information is visible and legible. The verification process may take a few days to complete.

Step 3: Make a Deposit

Once your account is verified, you can fund it by making a deposit. eToro offers a variety of deposit methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal, Neteller, or Skrill. To make a deposit, go to your eToro account dashboard and click on the “Deposit Funds” button. Choose your preferred deposit method and follow the instructions to complete the transaction. Keep in mind that there may be minimum deposit requirements depending on your chosen method.

Step 4: Search for the ETF you Want to Invest In

With your account funded, you can now search for REIT stocks on the eToro platform. Navigate to the eToro “Discover”. In the search bar, type “REIT” or the specific REIT stock you’re interested in, such as “VNQ” for Vanguard Real Estate ETF. The search results will display relevant REIT stocks, and you can click on the stock’s name or ticker symbol to view more information about it.

Risks and Considerations

REIT ETFs carry risks when you invest in them just like any other investment vehicle. In this section we will outline some of the most significant risks you should know.

We’ll also explore how much you should allocate to REITs.

Stock market risk is the possibility that stock prices in general will decrease. REITs are stocks and their prices are correlated to those of any other stock. For this reason, a possible decline in stock prices can affect ETFs that hold REITs.

This is the chance that REITs that belong in a specific real estate market like office or retail space leasing, will constitute a large part of a REIT ETF’s portfolio.

Asset concentration risk is the chance of a REIT ETF declining in value because of a few specific names in the REIT industry in which it is largely exposed.

Interest rate risk is the chance that REITs included in a REIT ETF will have to pay higher rates on their loans. This can affect their prices in periods of high interest rates as investors prefer fixed-income securities.

Now, when it comes to allocation, an analysis that is sponsored by Nareit and done by Morningstar Associates suggests an optimal allocation of 4-13%.

This is, however, a rule of thumb. Your specific financial needs may determine a different range. It’s best to consult with a financial advisor before you invest.

Conclusion

REITs can provide great risk-adjusted returns if you give them time. With the right ETF, you can remain exposed to that industry for a very low cost.

This article was mainly supposed to educate you on a couple of things that you should look out for when selecting REIT ETFs.

The section with the top REIT ETFs above should serve as an applied overview of the data you need to examine when you analyze a REIT ETF. It’s not a solicitation to buy any of them.

And if you find one of them interesting, you should do your own due diligence before you make an investment decision. It’s also a good idea to ask the opinion of a financial advisor.

FAQs

Are REIT ETFs a good investment?

REIT ETFs can be a good investment if you require a stable dividend and intend to hold for the long term.

Are REIT ETFs risky?

Just like any investment vehicle, REIT ETFs are subject to various risks. They are generally riskier than bonds, but the risk can be reduced if they are part of a diversified portfolio.

How does a REIT ETF work?

A REIT ETF is simply an Exchange-Traded Fund that invests in Real Estate Investment Trusts. They often track an index that can include a few dozen to more than a hundred REITS at any time. Buying a REIT ETF gives you exposure to its index’s holdings.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More