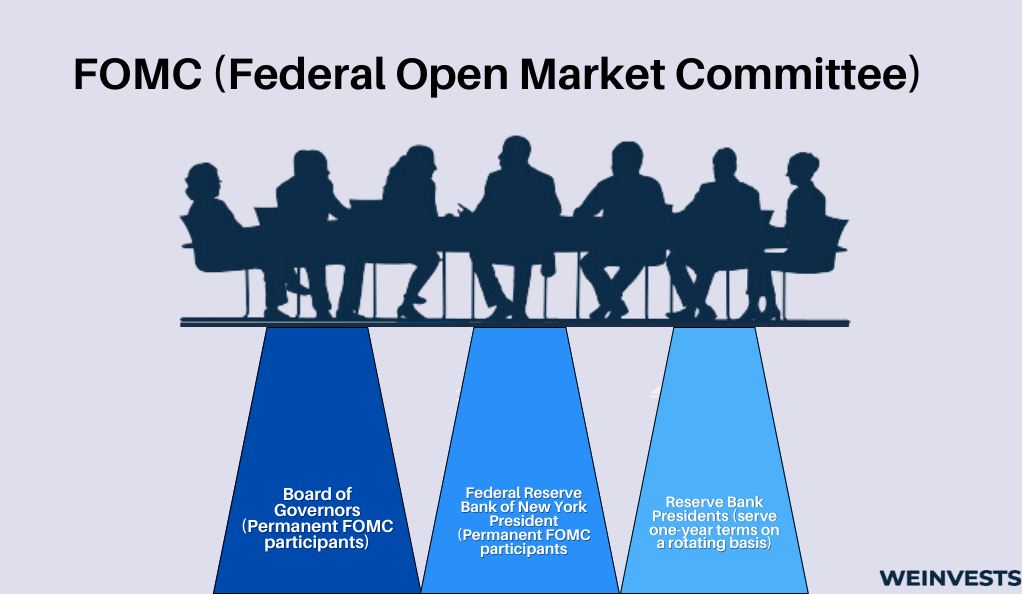

There are many factors that impact the stock market, and interest rates are one of them. In the U.S., fed interest rates are set by the Federal Open Market Committee (FOMC). The FOMC comprises seven governors of the Federal Reserve Board and five Federal Reserve Bank presidents. This body meets eight times each year to set interest rates.

Central banks like the FOMC change their target interest rates in response to economic activity. When the economy is strong, rates are increased, and when it’s sluggish, rates are lowered.

As interest rates rise, consumers and businesses reduce spending. This reduction causes earnings and stock prices to fall. And when interest rates fall, consumers and businesses start spending more, causing earnings and stock prices to rise.

A change in interest rates isn’t immediately felt across the broader economy; it typically takes 12 months to see the impact. But the effects on the stock market happen more quickly.

The more information investors have, the better decisions they can make. Understanding how interest rates affect the stock market will help investors better understand how changes to interest rates can impact their investments.

This article will lay out how interest rates affect the stock market so investors can take the necessary steps to adjust their portfolios in response to changes in interest rates.

What are Interest Rates?

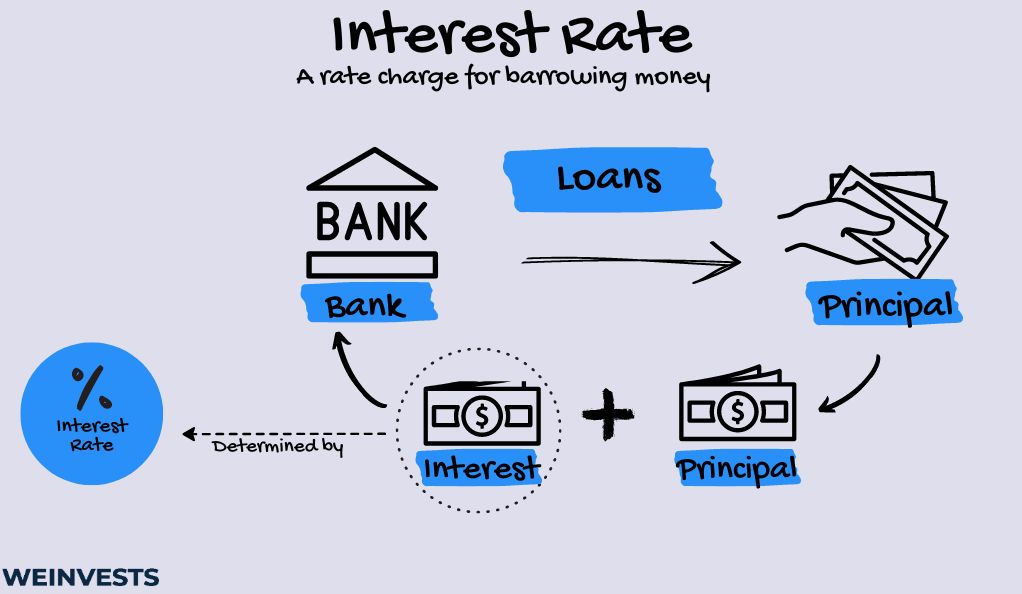

The easiest way to define interest rates is that they are the cost of borrowing money. When you borrow money in the form of a credit card, a mortgage, an auto loan, a student, a business, or a personal loan, the lender charges interest. Typically, the interest rate charged is a percentage of the amount borrowed.

In the U.S., the central bank is the Federal Reserve System. Most other countries have central banks as well that set interest rates.

Central banks use interest rates as a way to help manage economic conditions. The banks raise interest rates to cool rising inflation rates and lower rates to help stimulate the economy, i.e., increase business and consumer spending.

Interest Rates and the Stock Market

Generally, when a central bank increases interest rates, stock prices fall. And when interest rates are lowered, stock prices rise.

The Cost of Doing Business

Higher interest rates mean it costs more for businesses (and consumers) to borrow money. This can see businesses either pay more for borrowing money or shelf plans to borrow money they had planned to use to expand. If companies see slower growth as a result, it can cause the price of their stock to fall. If this happens to enough companies, it can cause a decline in market indices like the S&P 500 and Dow Jones Industrial Average.

When interest rates are increased, it’s seen as a sign that the economy is overheating, which leads to worries about reduced corporate profits and a potential market downturn.

When interest rates are lowered, the cost of doing business typically decreases. Loans are less expensive, so companies may make or resume plans to expand. This can help increase their output and increase revenue. These factors can mean companies’ stock prices increase. If this is the case for enough companies, it can cause an increase in market indices.

Discounted Cash Flow (DCF) Model

The DCF model is typically used to value stocks. DCF calculates the present value of expected future cash flows by discounting them at an appropriate interest rate. When interest rates rise, the discount rate used in the DCF model rises, which reduces the current value of future cash flows. This results in a decrease in the stock’s intrinsic value which can mean a decline in stock prices.

Nervous Investors

Bad news sells, and bad economic news sells particularly well. Everyone is concerned about their finances, of course, and bad financial news travels far and wide. When Wall Street starts to get really nervous, you don’t have to read the Wall Street Journal to know it; the news filters down to more general news outlets and makes big headlines that even casual observers can’t miss.

Poor economic news or even a single event can cause nervous investors to start selling stock. When a large volume of stocks is sold in a short amount of time, it causes the price of stock to fall quickly; this is known as a sell-off. As more shares are for sale than there are willing buyers, the drop in price can accelerate as investors start to get nervous.

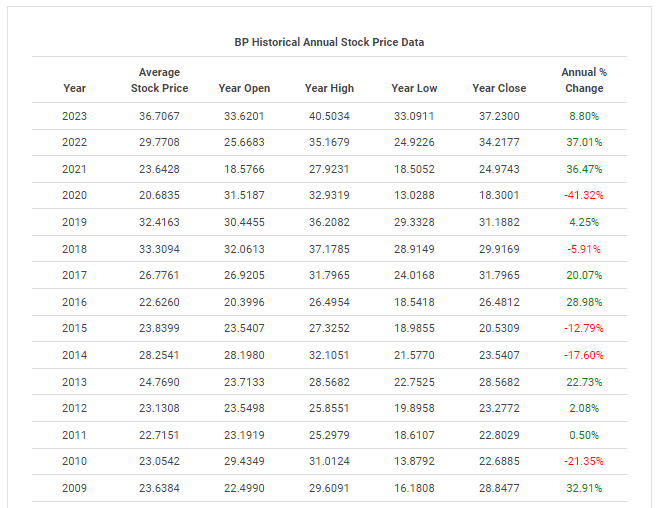

A market sell-off can happen to an entire market at once or a single stock. A good example of this is British Petroleum (BP) in 2010. In April of that year, the Deepwater Horizon oil spill occurred. The Deepwater Horizon was an offshore oil drilling platform that exploded off Louisiana’s coast, spilling between three and five million barrels of oil into the Gulf of Mexico, creating an environmental disaster and costing 11 workers their lives.

BP operated the Deepwater Horizon, and the disaster panicked BP’s investors. In the month after the incident, BP’s shares lost more than 50% of their value as a result of a hundredfold increase in selling volume. By July 2010, BP saw a quarterly loss of $17 billion.

Safer Harbors

When interest rates rise, investors often turn to “safer,” less volatile investments like bonds and Certificates of Deposit (CDs). The increase in the demand for bonds and CDs can also impact stock prices as investors reallocate some of their investing money from stocks to bonds.

Consumer Spending and the Stock Market

Consumer spending is one of the major driving forces in the economy, and the stock market and interest rates significantly impact consumer spending.

Home Buying

The housing market is especially sensitive to interest rates. When interest rates rise, mortgages become more expensive, and the demand for housing decreases, leading to a slowdown in the real estate sector.

Penny Pinching

Higher interest rates can send investors to safer investments and divert funds from stocks. This can cause a decrease in asset prices, including equities and real estate, which can cause a reduction in household wealth. A reduction in household wealth can see consumers tightening their belts when it comes to discretionary spending, impacting businesses and the market.

Interest Rates and Your Investments

There are some sectors that are less impacted by interest rates. Think of things people must have regardless of cost; utilities, some consumer goods like groceries, and health care. That can mean these sectors are less volatile than others.

Sectors more impacted by interest rates include discretionary consumer goods like the automotive industry and industrial products like construction equipment. When interest rates are high, people aren’t buying new vehicles or homes.

Although real estate isn’t wholly negatively impacted by rising interest rates. When interest rates rise, people are less likely to buy a home. That means real estate investors with rental properties can benefit as people stay in rented homes longer, and rising inflation means rent prices increase.

Think Long-Term

Interest rates or anything else that impacts the market can make investors nervous, which can result in emotional decisions. Emotional decisions are often wrong decisions, especially when it comes to investing. But successful investors think long-term. Remember back to the example of the BP stock sell-off as a result of the Deepwater Horizon oil spill. Within a month of the incident, BP’s shares lost more than 50% of their value.

By November 2010, the company began to recover and, by the end of the year, had recovered about half of its losses. The investors who took advantage of the sell-off and bought shares in BP at their lowest saw the share price rise by more than 30% by the end of the year. The low for BP shares in 2010 was $13.88, and the high for 2023 was $40.50. Quite a recovery from such a massive sell-off by panicked investors.

Interest Rates and Debt

On instalment loans like mortgages, auto, personal, business, and student loans, the lender calculates the interest you’d accrue during the term of the loan and adds that to the loan amount. The interest you pay is built into the monthly payment amount. In the case of fixed-rate loans, changes in interest rates don’t impact them. Adjustable rate loans, of course, will be affected.

In the case of credit cards, the issuer charges interest in the form of a finance charge that is added to the balance each month until the balance is paid off unless you pay the balance in full each month, in which case you don’t pay interest. The higher the interest rate, the higher the finance charges. Your credit card APR will change accordingly when the Fed changes interest rates. When you have credit card debt, the higher interest rates make it harder to pay off because more of your payment goes towards the finance charge.

Consider this example:

The finance charge for a $20,000 balance with a 10% APR would be $167 for one month. With a payment of $400, $233 goes toward reducing the balance, and the rest is applied to the interest. If that $20,000 balance had an APR of 20%, the finance charge would be $333. With that same $400 payment, the balance only goes down by $66.

The 10% APR debt will take a little less than five-and-a-half years to pay off, making the $400 monthly payments, while the 20% APR would take a little over nine years to pay off. At 10% APR, the interest paid will be $5,980 by the time the balance is paid off; at 20% APR, the total interest paid will be a whopping $23,360. When interest rates rise, paying down debt becomes more urgent.

Interest Rates and Savings

Banks’ interest rates on savings accounts are loosely correlated to the Fed’s rates. As the Fed raises rates, banks typically pay more interest on high-yield savings accounts and money market accounts, so it can be beneficial to shop around for the best rates.

Conclusion

Interest rates are the cost of borrowing money and are set by Central Banks; in the U.S., the Central Bank is the Federal Open Market Committee (FOMC). Central Banks set interest rates to slow or speed up the economy in response to various economic conditions, which can impact the stock market.

Interest rates can have a broad impact on the economy and the stock market, impacting the price of stocks, investor behavior, and corporate spending and earnings. It’s important for investors to understand how interest rates affect the stock market so they can make informed decisions when it comes to managing their portfolios and other aspects of their personal finances.

In general, rising interest rates will see share prices fall, and falling rates will increase the value of stocks. But there are some sectors that are less impacted by interest rate fluctuations. Investors who have properly diversified their portfolios and can block out noise and stick to their long-term investing plans, can survive and even flourish during times of volatility in the stock market. There are many things investors can’t control, including interest rates, but staying informed can help them make the best decisions for their investments.

FAQ

What are interest rates?

Interest rates are the cost of borrowing money and are set by Central Banks in an effort to slow down or speed up the economy.

Who sets interest rates in the U.S.?

U.S. interest rates are set by the Federal Market Committee (FOMC). This body is made up of seven governors of the Federal Reserve Board and five Federal Reserve Bank presidents. The FOMC meets eight times each year to set interest rates.

How do interest rates affect the stock market?

Typically, if interest rates are increased, stock prices fall, and when rates are lowered, stock prices rise.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More