This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Vanguard High Dividend Yield ETF (VYM) – as the name says it is an exchange-traded fund (ETF) that is a liquid alternative to mutual funds which allows investors to buy and sell the ownership in the fund on the stock market hence it is considered a more liquid alternative of mutual funds. The attractiveness of this type of fund is that they work as pre-constructed portfolios that investors can directly invest in rather than picking each stock separately hence it reduces the trading-related costs.

The VYM ETF is based on the FTSE High Dividend Yield Index benchmark and is managed passively which means that it tries to track the performance of the index without any attempt to actively outperform the benchmark. As the fund name suggests the ETF is exposed to high-yield dividend-paying stocks meaning that the main focus of the fund is to generate high dividend yield by picking companies globally that pay high dividends. Therefore, it is not a surprise that the fund is exposed to a variety of industries such as healthcare, financials, consumer staples, and industrials to name a few.

Another advantage of most ETFs and for Vanguard High Dividend Yield ETF in particular is its low expense ratio of 0.06% which is the annual cost associated with investing and holding the ownership of the VYM. This fee is used by Vanguard to cover its operating expenses. In contrast, the average ETF expense ratio in the industry is within the range of 0.2%-0.4%, thus the VYM expense ratio is well below the industry average making it an attractive option for investors who are looking for high-dividend passive index portfolios. The dividend yield of the fund is around 2.8% per year (without adjustment for inflation and taxes).

The assets under management – that shows how much money the fund is managing including all the underlying stock and cash in the fund, is approximately USD 40 billion for the VYM as of the end of December making it a relatively large fund in the industry. Based on Morningstar which is a respected data provider, the Vanguard High Dividend Yield ETF is rated with 5 stars making it a highly valuable fund for investors who are interested in capturing dividend income.

Table of Contents

Characteristics, Performance Analysis, and Expectations

ETFs are traded based on the net asset value (NAV) which in simple terms it is usually shown as per-share value making it equal to the stock price so the price or NAV of the fund will be used interchangeably from now on. In simple terms, NAV is calculated as the total asset minus the total liabilities of the fund.

So far the VYM ETF started the year positively generating a +2.5% return year to date (YTD) which is largely driven by the overall market rebound from last year-end drop and the expectation that the inflation is finally slowing down. Compared to the S&P500 YTD return of about +1.9% the Vanguard High Dividend Yield ETF’s performance can be mostly attributed to the market performance.

In general, the dividend ETFs are not meant for capital appreciation or price growth in the short term since the companies that pay dividends are usually well-established large market capitalization value stocks that have relatively stable growth and can pay dividends thanks to their matured business circumstances. On top of that, dividend payments are usually assumed to reduce the stock value to adjust for the fact that the investors receive additional income.

Therefore, if you look at the overall performance of the market index such as the S&P500 vs the Vanguard High Dividend Yield ETF performance since its inception you will see less volatility in the VYM price performance vs the market index. A very good example also was the performance when the VYM lost just -1.7% vs the S&P500 loss of about -20% for the year.

The above-mentioned points are making a solid ground for our prediction for the 2023 performance which is that we should also expect less volatility compared to the overall market. At the moment the markets are highly sensitive to the news on inflation and central bank decisions on rate hikes to fight inflation. But as we saw it was not as impactful on the Vanguard High Dividend Yield ETF performance for partially thanks to the fact that the fund is generating additional income through dividends that are reducing the impact of the price depreciation.

We should expect the inflation to slow down but it is still at high levels which means that more interest rate hikes can be expected in 2023. The performance of the fund will be impacted by this till we get some positive news on the inflation front such as a reduction of it to lower levels – closer to the central banks’ target of around 2%.

One thing to always keep in mind is that the Vanguard High Dividend Yield ETF is not a growth or value stock, again the main focus of the fund is to expose your investment to high dividend-paying stocks so it is more of an income investing rather than looking for capital appreciation. Therefore, you need to consider this carefully and align it with your investment goals.

How to Buy in Vanguard High Dividend Yield ETF?

If you are based in the US you can directly open an account with Vanguard and start investing in their ETFs including the Vanguard High Dividend Yield ETF. Most of the major banks and online brokerages that operate in the US and are meant for US residents have the VYM as an available investment product.

If you are outside the US and depending on your exact location it might be difficult to access some of the ETFs from Vanguard. In general, you should check with your bank as well as the online brokerage platforms that offer some of the Vanguard ETFs such as eToro, Degiero, or Interactive Brokers to name a few.

Before investing in VYM you should check the current allocation of the ETF and understand if that is in line with your investment goals. To provide an example some of the top holdings of the VYM at the moment are shown below as a percentage of total portfolio value:

- Johnson & Johnson – 3.2%,

- Exxon Mobil Corporation – 3.1%,

- JPMorgan Chase & Co. – 2.7%

- Chevron Corporation – 2.4%

- Procter & Gamble Company – 2.4%

It is worth checking the overall allocation of the ETF from not only per single stock name perspective but also allocation to different industries to identify whether the current allocation of the Vanguard High Dividend Yield ETF is appropriate for you. Since the VYM ETF is passively managed in most cases the allocation of the shares is going to closely mimic the allocation of its benchmark index – the FTSE High Dividend Yield Index.

Given the fact that the dividend ETF is not a growth stock that you can anticipate short-term capital gains, it is usually advised to invest with a long-term strategy and mindset in such ETFs. What is usually advised in the market is at least a 5-year holding period with periodic regular investments to benefit from dollar cost averaging.

How to Buy in Vanguard High Dividend Yield ETF (VYM)

Investing in Vanguard High Dividend Yield ETF (VYM) stocks can be a great addition to your investment portfolio. One of the best online brokers for purchasing these stocks is eToro.

With a solid reputation and a range of options suitable for both beginners and professional traders, eToro makes the process of buying VYM stocks simple and convenient. In this mini-guide, we will walk you through the steps to open an account on eToro and start investing in VYM stocks.

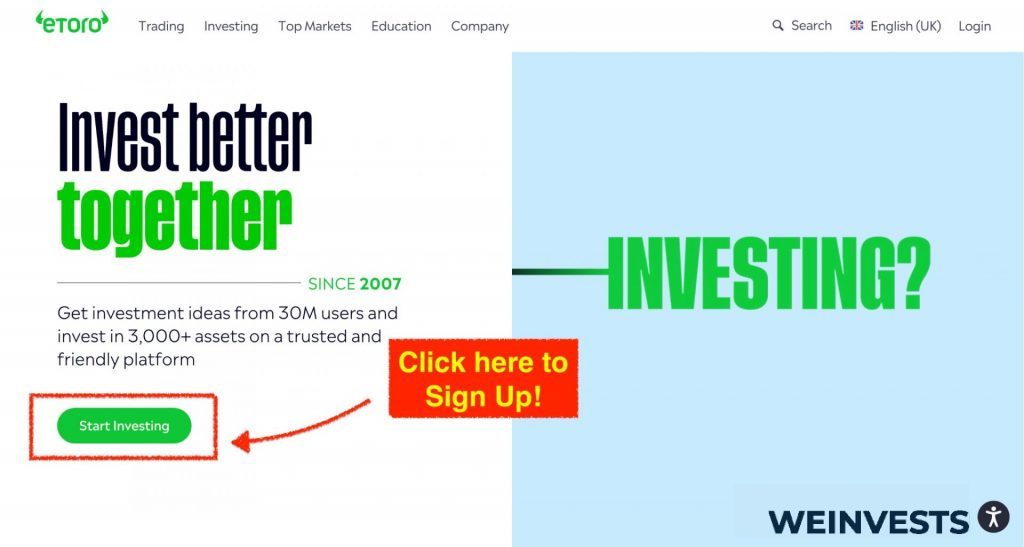

Step 1: Open your Personal Account

To begin, visit the eToro website and click on the “Sign Up” or “Join Now” button on the homepage. You will be directed to a registration page where you can create an account by providing your email address, username, and password.

Alternatively, you can sign up using your Google or Facebook account for a faster registration process. Once you have submitted your information, eToro will send you a confirmation email. Click on the link provided in the email to verify your account.

Step 2: Upload ID

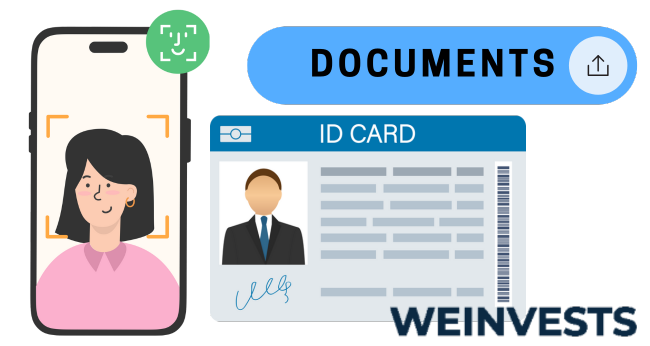

To comply with regulatory requirements, eToro needs to verify your identity. You can do this by uploading a clear, color copy of your government-issued ID or passport. The document must include your full name, date of birth, photograph, and ID number.

Additionally, eToro may request a proof of address, such as a utility bill or bank statement. To upload your ID, log in to your eToro account and follow the on-screen instructions.

Step 3: Make a Deposit

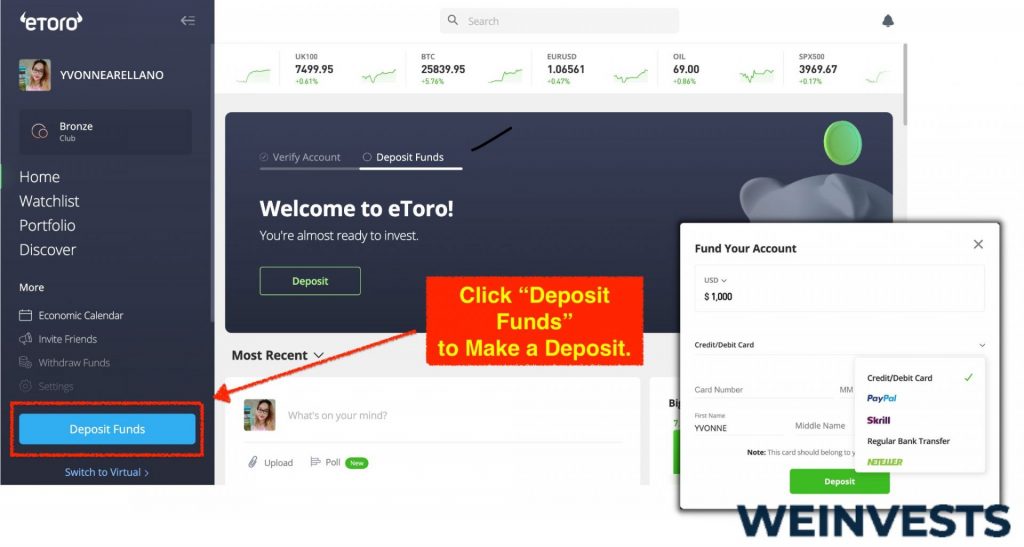

Before you can start investing in VYM stocks, you need to fund your eToro account. Log in to your account and click on the “Deposit Funds” button, which is usually located at the bottom left of the platform.

You can fund your account using various methods, such as credit/debit cards, PayPal, bank transfers, or e-wallets like Neteller and Skrill. The minimum deposit amount varies depending on your region and the method you choose.

Step 4: Search VYM

Now that your account is funded, you can search for Vanguard High Dividend Yield ETF (VYM) on the eToro platform. In the search bar at the top of the page, type “Vanguard High Dividend Yield ETF” or “VYM” and hit Enter. The platform will display the VYM stock in the search results.

Step 5: Buy Vanguard High Dividend Yield ETF (VYM)

To buy VYM stocks, click on the stock in the search results to open its page. On the stock’s page, you’ll see a “Trade” button. Click on it to open the trade window, where you can set the amount you want to invest, any stop loss or take profit limits, and the desired leverage (if applicable). Once you have configured your trade, click on “Open Trade” to execute your order. Congratulations, you have now invested in Vanguard High Dividend Yield ETF (VYM) stocks using eToro!

Risks associated with VYM

Market Risk

The market risk is the overall risk of the market factors affecting the investment negatively such as the overall market downturn causing the value of your investment to drop. Market risk is related to any market factor that can change causing the investment value such as interest rates, stock price, foreign exchange fluctuations as well as economic and geopolitical events that also directly or indirectly affect the financial markets.

Since the Vanguard High Dividend Yield ETF is mainly holding shares of large companies it is affected by the share price changes as well as changes associated with the dividends by those firms. In case one of the companies included in the ETF has negative news the stock price of that firm is going to drop and hence impact the price of the ETF as well. On the other side in case one of the companies in the ETF holdings deciding not to pay dividends, ceteris paribus, because of a bad financial quarter, this event may affect also the overall performance of the fund.

Other factors as mentioned before may indirectly impact the VYM’s performance as well such as the interest rate hikes that cause lower valuation of financial instruments, and changes in the foreign exchange market in which the ETF might have some exposure, to name a few.

Therefore, before any kind of investment in financial instruments, it is recommended to check and understand all the associated market-related risks as well as other risks that can adversely impact your investment value.

Credit Risk

Credit risk is usually associated with the risk of the counterparty failing to pay its obligations. Usually, it is assumed that stock and ETFs have relatively low credit risk and that credit risk is more for fixed-income or derivative investments where there is a risk of the counterparty failing to cover obligations.

In the case of Vanguard High Dividend Yield ETF, you are invested in the stocks but not in single names, rather in multiple stocks of large companies which gives further diversification benefits. Nevertheless, it is important to look at the holdings of the ETF to understand whether there are any small exposures in fixed-income instruments that VYM might use for liquidity or hedging purposes. If such an exposure is available in the ETF then there is also a credit risk aspect that needs to be considered when investing in the fund.

This will also create a credit risk exposure since the person or institution who is the borrower of the securities might not be able to pay the interest.

So even though the credit risk in VYM investment is relatively low as such it creates some credit risk exposure due to the securities lending program at the moment.

Liquidity Risk

In general liquidity risk is the risk of not being able to cash out your investments. Liquidity risk associated with large company stocks or large ETFs is relatively low given the fact that they have high trading volume.

The proof of this is the Vanguard High Dividend Yield ETF’s average daily trading volume of USD 226 million and median daily trading volume of USD 209 million for the past 45 trading days. These are relatively high trading volumes and since the median and average are close to each other it speaks about the fact that there are not many outliers – meaning too small or too large trades. Furthermore, some of the data providers such as FactSet or ETF.com are considering the VYM ETF as a highly liquid investments.

Valuation Risk

Valuation risk is associated with the inaccurate pricing of financial instruments. In the case of ETFs or stocks it is relatively low since these are exchange-traded instruments and the price is largely determined by the market – demand, and supply. Nevertheless, there are still market events that can impact underlying stock prices or ETF pricing itself depending on the underlying holdings. In the case of the VYM, the valuation risk is relatively low.

Conclusion

Vanguard High Dividend Yield ETF is an exchange-traded fund that passively tracks the FTSE High Dividend Yield Index benchmark. It comes with a low expense ratio and is meant for long-term investors who are looking for dividend income rather than capital appreciation. Although there are still market risks and some credit risks involved, the VYM ETF is considered highly liquid and has a relatively low valuation risk. Nevertheless, any investment is associated with a high risk of losing some part or entire investment value, hence you need to consider all risk and reward aspects carefully before making any investment in VYM.

FAQs

What is Vanguard High Dividend Yield ETF?

It is an exchange-traded fund that invests in a basket of stocks of large companies which are paying high dividends.

Why VYM has such a low expense ratio?

Vanguard is known for its ability to offer low-fee funds to its investors, thanks to passive management or index tracking the company is minimizing its costs associated with the operations of the ETF and hence can offer low fees to its investors.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More