People who intend to start investing are often confused about the difference between investing and trading. And no doubt why. These two terms have been used interchangeably for a very long time and this doesn’t seem like it’s going to stop any time soon.

And while there is a case to be made about the distinction between the two terms, it’s very reasonable that people will keep using the terms interchangeably when they refer to the practice of buying stocks or other financial securities to make a profit.

However, you often see people who are much more engaged in buying and selling securities to make money either using only “trading” or “investing” to refer to what they do and refraining from using the other term. And that’s exactly the reason why there is some untalked distinction here.

In this article, we will explain what that distinction is and why it exists in the first place. We are also going to

Investing and Trading: The Similarities

In the broad context of buying and selling securities, investing and trading overlap in meaning. If you use money to buy something with the intention to sell it at some point for a higher price than what you bought it at, that activity is called investing.

The reason this activity can also be called trading is simple. You exchange money for something that you intend to sell at some point. That is trading.

There are some exceptions of course. If you buy a café, for instance, it would be absurd to call that activity “trading”. After all, you probably wouldn’t intend to sell it at a much higher price later on. Chances are that you would want to operate it and generate revenue through it. Even if at some point, you sell it for a higher price than you bought it at, it would be absurd to call the activity “trading” or you as a “trader” because of this.

If you do this consistently, however, that’s when it becomes trading.

And that’s why in the world of investing, you will correctly be viewed as a trader if we want to be technical. The prerequisite for defining you as a trader on top of as an investor is the continuous buying and selling in retrospect.

This might be a little confusing but it goes to illustrate why people are justified in using the two terms interchangeably.

And now that we got this out of the way, let’s see why people also use the terms as if they are different from one another. Or more accurately, to emphasize the style they have adopted when it comes to buying and selling securities.

Investing

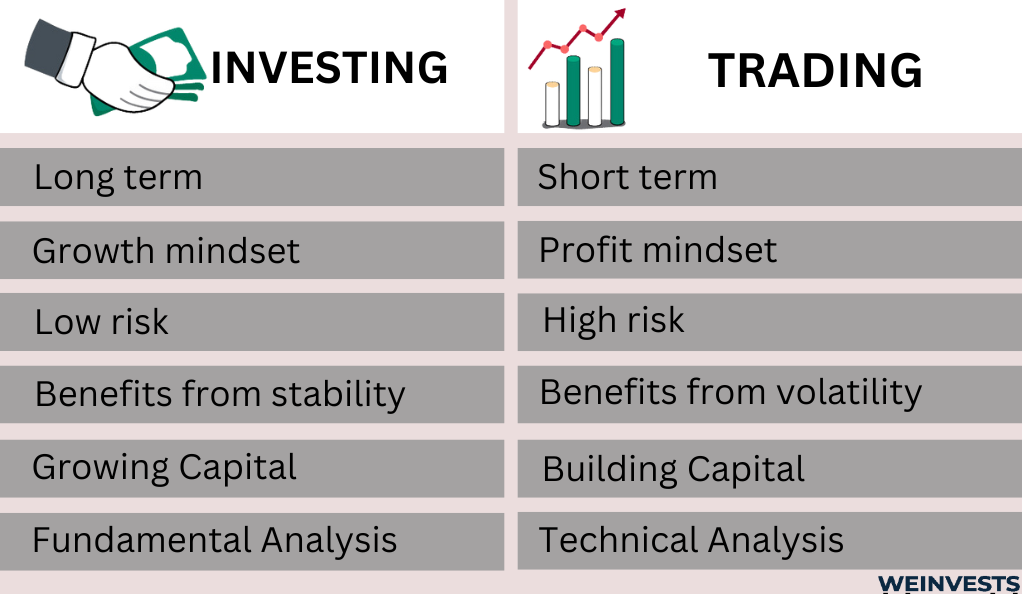

Investing mostly emphasizes a strategy that focuses on building wealth over the long term by purchasing assets with the expectation that their value will appreciate over time. This approach is characterized by a buy-and-hold mentality, where investors aim to ride the wave of the market’s overall growth and capitalize on the power of compound interest. Here are some key features of investing:

- Time Horizon: Investors typically have a long-term perspective, often holding their assets for years or even decades. They seek to benefit from the overall upward trajectory of the market and economic growth.

- Asset Selection: Investors usually diversify their portfolios by spreading their funds across a variety of assets, such as stocks, bonds, real estate, mutual funds, and index funds. Diversification helps reduce risk and protects against the potential downfall of any single asset.

- Risk Tolerance: Investors are generally more risk-averse compared to traders. They prioritize stable, blue-chip assets with proven track records and are willing to withstand market fluctuations in pursuit of long-term gains.

- Involvement: Investing requires less active involvement than trading. Once an investor has done their research and selected their assets, they tend to hold onto them without frequently buying or selling.

- Returns: While the potential returns from investing can be substantial over the long haul, they may not match the gains that are more quickly realized through trading because of the higher liquidity emphasized in the latter.

As you can see, there are various ways that the classification of investing can differ from that of trading.

Advantages of Investing

Here are a couple of pros that come with engaging in investing:

- Passive Approach: Investing is relatively passive compared to trading, allowing individuals to focus on other aspects of their lives without constant market monitoring.

- Compound Growth: Because of the longer time horizon, there often is a tax advantage in investing as many jurisdictions around the world encourage a longer holding period than one year by promising a lower tax rate on any gains at the time of liquidation. The power of compounding can be greater with investing for this reason. And even if that were not the case, by allowing your capital to grow without taxing the gains so frequently you allow compounding to work on a larger capital base.

- Lower Transaction Costs: Investors typically have lower transaction costs since they trade less frequently.

- Diversification: By diversifying across various assets, investors can spread risk and protect their portfolios from extreme volatility.

Disadvantages of Investing

With investing, there are also disadvantages, however. Here are some of them:

- Market Volatility: While investing aims for long-term gains, the market can experience significant volatility, potentially leading to temporary losses. A long time horizon makes much more room for volatility than trading because stop-loss orders are usually not at work; investors must accept the highs and lows no matter how sharp and frequent they are going to be until they liquidate their positions (which can take a while).

- Emotional Discipline: Investors need to stay disciplined and avoid making impulsive decisions based on short-term market fluctuations. That’s true for trading too sometimes, but not always, depending on the trading style.

- Opportunity Cost: Long-term investments may tie up funds for years, potentially missing out on other better opportunities.

Trading

Now, trading is a more active and short-term approach to the financial markets, where individuals buy and sell assets with the aim of making profits from short-term price movements. Traders use various strategies and technical analysis tools to capitalize on market fluctuations, both upward and downward. Here are the main characteristics of trading:

- Time Horizon: Traders typically have a short-term perspective, with positions ranging from minutes to days and sometimes weeks or months. Some traders focus on intraday movements, while others may hold positions for a few weeks.

- Asset Selection: Traders often concentrate on specific assets or markets where they have expertise and can identify short-term trends more effectively.

- Risk Tolerance: Trading can often involve higher risk compared to investing. Traders have strict risk management strategies in place, but they can lose a lot of money much faster than long-term investors do.

- Involvement: Trading requires more day-to-day attention than investing. A lot of traders continuously monitor their positions, market news, and technical indicators to make informed decisions.

- Returns: Trading can yield higher returns in a shorter period, but it also involves higher transaction costs and tax implications due to frequent buying and selling.

Advantages of Trading

- Potential for Quick Gains: Traders can profit from short-term price movements and capitalize on volatility for quick gains.

- Flexibility: Trading offers flexibility in terms of strategy and time commitment. Traders can choose from various approaches, such as day trading, swing trading, or position trading.

- Liquidity: Trading involves a lot of frequent buying and selling. It, therefore, provides much more liquidity than investing.

Disadvantages of Trading

- High Risk: Trading involves higher risk due to the short-term nature of positions and the potential for significant price swings.

- Emotional Pressure: Traders may face emotional pressure during times they expect themselves to take action, leading to hasty decisions and potential losses.

- Transaction Costs: Frequent trading incurs higher transaction costs, impacting overall profitability.

Trading vs Investing: Which Is More Profitable?

The question of whether investing or trading is more profitable depends significantly on the individual’s temperament. Both approaches have the potential to be profitable, but they require distinct mindsets and emotional discipline to navigate the financial markets successfully.

Those with a patient and long-term mindset often fare well in the investing realm. They are willing to hold onto assets through market fluctuations and economic cycles, allowing the power of compounding to work in their favor. They have confidence in their investment choices and believe in the long-term growth of their chosen assets.

When it comes to risk, investors generally are more conservative, preferring stable and established assets over higher-risk speculative options. Their focus is on preserving capital and achieving steady growth over time.

On the other hand, traders need to make quick decisions based on short-term market movements. They must be comfortable with the rapid pace of trading and be able to act swiftly in response to changing market conditions.

Trading can be emotionally challenging, especially during volatile market periods. Successful traders are disciplined and stick to their predefined strategies, avoiding emotional reactions to market fluctuations.

Traders are also known for a higher risk tolerance as they engage in short-term positions. They understand the potential for rapid gains but also acknowledge the possibility of quick losses.

The profitability of investing or trading, therefore, heavily depends on an individual’s ability to align their temperament with the chosen approach. Someone with a patient, long-term outlook and a preference for stability may find investing more suitable. On the other hand, individuals who thrive on the excitement of rapid market movements and have the emotional resilience to handle the associated risks might find trading to be more profitable for them.

It’s essential for individuals to honestly assess their psychological disposition and risk tolerance before deciding which path to pursue. Some people may discover that a combination of both investing and trading aligns better with their temperament. For example, a person may choose to build a diversified long-term investment portfolio while allocating a portion of their funds for short-term trading opportunities.

Conclusion

In conclusion, the difference between investing and trading can be murky for many. And that’s because, in essence, they both relate to the same activity.

But when it comes to practicality, investing and trading are two distinct approaches to the financial markets, each with its own advantages and disadvantages.

Investing focuses on long-term wealth building, while trading seeks to capitalize on short-term market fluctuations. The choice between investing and trading depends on an individual’s financial goals, risk tolerance, time commitment, and expertise. Some may prefer the steady growth and passive nature of investing, while others may embrace the excitement and potential quick gains of trading.

Ultimately, a balanced approach that considers both investing and trading strategies can help individuals achieve their financial objectives while managing risk effectively.

FAQ

What are the advantages of investing?

Investing offers several advantages, including a relatively passive approach that allows individuals to focus on other aspects of life without constant portfolio monitoring. Additionally, the power of compounding can lead to greater growth due to longer holding periods, and transaction costs tend to be lower since investors trade less frequently.

What are the advantages of trading?

Trading provides the potential for quick gains by capitalizing on short-term price movements and market volatility. It offers flexibility in strategy and time commitment, allowing traders to choose from various approaches. Moreover, trading provides higher liquidity due to frequent buying and selling.

Which is more profitable: investing or trading?

The profitability of investing or trading depends on an individual’s temperament and risk tolerance. Long-term investors with a patient mindset may find investing more suitable, as they can benefit from compounding and steady growth. On the other hand, traders who thrive on rapid market movements and can handle higher risks may find trading more profitable.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More