- 20+ cryptocurrencies to trade (only 5 in the U.S.)

- Intuitive desktop and mobile interfaces

- Regulated by financial and government bodies

- Community-based trading platform – making it easier for those who want to copy other investors

- Transparent fee structure

- High fees depending on the currency and transaction

- Certain feature restrictions for U.S. residents (i.e. only crypto and FX trading allowed)

| 💻 Trading Platforms | Online platform and mobile app |

| 📞 Customer Service | 24/5 support via online ticketing system or live chat |

| 🎁 Promotions/Bonuses | Refer a friend bonus, trading credits, free stocks, etc. |

| 🛡 Regulation | Multi-regulated by FCA, CySEC, ASIC, and FMA |

| 💵 Deposit/Withdrawal Methods | arious payment methods; minimum deposit $200 ($500 for bank transfer); withdrawal fee $5 |

| 📊 Spreads/Commissions | Variable spreads from 1 pip (forex) or 0.09% (stocks); commissions from 0% (stocks) to 5% (crypto) |

| 🔒 Security | Segregated funds; SSL encryption; firewalls; anti-virus software |

| 📚 Education/Resources | Webinars, videos, podcasts, articles, etc.; economic calendar, market news, market analysis, etc. |

| 📱 Mobile Trading | iOS and Android app with all online platform features and functions |

| ⚡ Execution Speed | Fast and reliable execution with low latency and minimal slippage; various order types and risk management tools |

| 🔧 Trading Tools/Indicators | Moving averages, Bollinger bands, Fibonacci retracement, etc.; custom indicators and ProCharts feature |

| 🌍 Country/Region Availability | Over 140 countries and regions; some restrictions apply (e.g. USA, Canada, Japan, etc.) |

| 💰 Account Minimum | $200 for live account; free demo account with $100,000 virtual funds |

| ⚖ Leverage/Margin Requirements | Flexible leverage options depending on account type, instrument, and jurisdiction; margin calculator available |

| 📈 Asset Selection/Market Access | Over 3,000 assets across forex, stocks, indices, commodities, cryptocurrencies, etc.; CFDs or direct investing (stocks only) |

To see the list of blocked countries click this link: Is eToro blocked in my country?

Table of Contents

- What is eToro?

- Is eToro Safe and is eToro legit?

- What are the benefit of regulations:

- Identifying the Ideal eToro User

- Experiencing Trading with eToro

- Some of the most popular features of eToro:

- Options Trading on eToro

- eToro app

- eToro Fees and Commissions

- Fees Per Asset Class

- Non-trading Fees

- How to Open an Account with eToro

- eToro’s Demo Account: A Comprehensive Overview

- eToro USA review

- eToro Review UK

- eToro Money

- eToro Education

- eToro Forum

- eToro Customer Service

- Conclusion

What is eToro?

eToro is a social trading and investment platform that allows users to buy and sell a variety of assets, including stocks, currencies, commodities, and cryptocurrencies. The platform was founded in 2007 by two brothers, Yoni and Ronen Assia, and has since grown to become one of the largest and most popular online brokers in the world with more than 17 million users in 140 countries.

One of the main features of eToro is its social aspect, which allows users to connect with other traders and investors and share ideas and strategies. This can be especially useful for new traders who are looking to learn from more experienced investors, as well as for more experienced traders who want to share their knowledge with others.

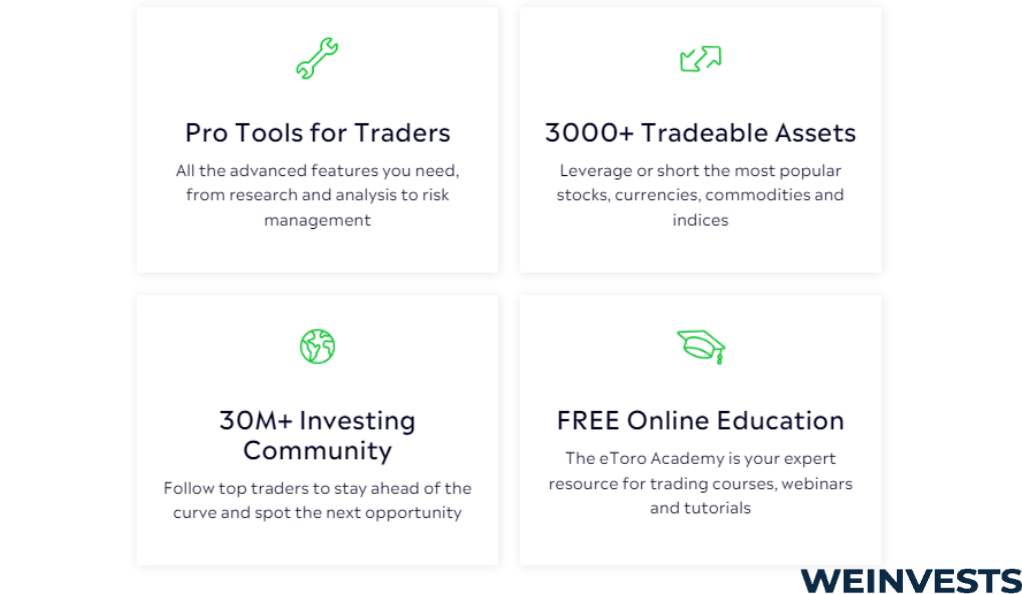

In addition to its social features, eToro offers a range of tools and resources to help traders make informed decisions. These include market analysis and research, educational resources, and a range of trading tools, such as charts and technical indicators.

Another key feature of eToro is its commitment to safety and security. The platform uses robust security measures to protect users’ personal and financial information. It is regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). Recently eToro launched in the United States as well, hence further expanding its user coverage. However, for its US customers, the platform has certain limitations since it just allows crypto and forex trading, unlike European users who can trade many asset classes, including Contracts for Difference (CFDs).

Is eToro Safe and is eToro legit?

Considering the number of online brokers available these days, many may wonder whether eToro is a legit platform to trust your money and portfolio.

In a nutshell, eToro is a legitimate platform for investing in a variety of assets. The company was founded back in 2007 hence it has about 15 years of track record. Since its inception, the company became one of the largest and most popular online brokers with a worldwide presence, a large customer base and more than 1 500 employees globally.

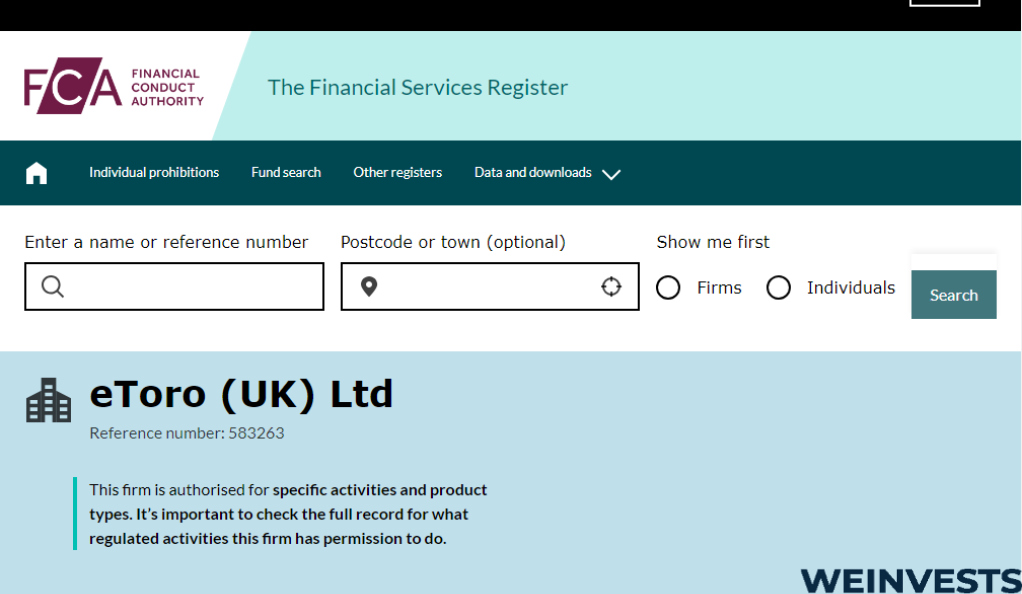

Furthermore, eToro is regulated by FCA and CySEC which oversee the operations of financial firms and ensure that they adhere to strict rules and regulations designed to protect consumers and maintain the integrity of the financial markets.

In addition to its regulatory oversight, eToro is also committed to ensuring the safety and security of its users. The company puts significant focus on security measures to protect users’ personal and financial information with additional authentication or privacy measures recommended to users in order to minimise any possibility of a data breach.

Nevertheless, as with any investment, it is important to do your own research and carefully consider the risks before making any decisions, since you need to identify what platforms and investment products are best suited for your needs. Moreover, it is always advisable to diversify your portfolio and invest only what you can afford to lose.

Is eToro Regulated?

Yes, eToro is regulated by many financial authorities around the world. The company is regulated by the FCA in the UK and the CySEC in Cyprus as mentioned before.

In the United States, eToro is registered with the Financial Industry Regulatory Authority (FINRA) as a broker-dealer and is a member of the Securities Investor Protection Corporation (SIPC).

In addition, eToro is also regulated by the Australian Securities and Investments Commission (ASIC) in Australia and the Monetary Authority of Singapore (MAS) in Singapore. Being regulated by these authorities means that the company passed all the requirements to receive a license, which enables eToro to offer its services in several countries around the world.

Although it is important to check whether the brokerage of your choice is regulated or not, it is still fundamental to note that regulation does not necessarily guarantee the safety of your investments.

What are the benefit of regulations:

Regulated brokers, such as eToro, are required to undergo certain audit processes by submitting both financial and non-financial reports to the designated regulatory authorities. This process ensures sound operations and business continuity while at the same time making sure that the customer portfolios and money are safe.

As a regulated broker, the platform is obliged to show its users a risk warning before creating their first trading account to highlight risks associated with investments, capture certain data about the customer for know-your-customer (KYC) purposes as well as ensure that the client has at least some basic understanding about investing by asking certain questions related to trading and risk associated to it.

Leverage involves borrowing money from your broker for investment purposes. Thanks to regulations, there are certain limits in place in terms of how much leverage a person can use in a transaction, which further protects your capital given the high risks associated with leverage investing.

According to CySEC, regulated brokers including eToro, are governed by the law of the Investor Compensation Fund which ensures that investors still receive the entire or part of their capital even in case of a bankruptcy of the brokerage firm.

Regulated brokers often require investors to pass through the ID verification process and provide proof of address during registration. This further strengthens the KYC process and reduces the probability of a money laundering (ALM) procedure.

Identifying the Ideal eToro User

eToro caters to a broad spectrum of investors, from seasoned professionals to those just embarking on their investment journey. While it offers advanced features that seasoned traders can leverage, it shines particularly brightly for novice and intermediate investors.

The platform is designed to be user-friendly, making it an excellent starting point for beginners. It provides a wealth of educational resources, including in-depth market analysis, engaging webinars, and comprehensive trading courses. These resources are designed to enhance investors’ understanding of the markets and hone their trading skills.

Moreover, eToro is a pioneer in the realm of social trading. This feature allows users to follow, interact with, and even replicate the trades of successful investors within the eToro community. This social aspect not only fosters a sense of community but also provides a unique learning opportunity. Beginners can gain insights from experienced traders’ strategies and decision-making processes, potentially improving their own trading acumen and success rate.

Intermediate investors can also benefit from eToro’s diverse offerings. The platform provides access to a wide array of financial instruments, allowing users to diversify their portfolios and explore different markets.

However, it’s crucial to remember that all forms of investing come with inherent risks. Therefore, potential eToro users should thoroughly assess their financial objectives and risk tolerance before engaging with the platform or any investment vehicle. eToro is committed to promoting responsible investing and provides tools and resources to help users make informed decisions.

Experiencing Trading with eToro

Initiating your journey with eToro begins with depositing a fiat currency into your account, although transferring cryptocurrencies is also an option. Once your deposit is reflected in your eToro account, you’re ready to start trading via eToro’s intuitive web or mobile interface.

For those new to the world of stocks or cryptocurrencies, eToro’s CopyTrader feature is a significant advantage. This tool allows you to replicate the trades of seasoned investors, providing a unique learning opportunity and potentially increasing your chances of success.

eToro’s platform is designed to empower its users with a wealth of information and tools. Real-time market quotes, charts, and news updates are readily available, enabling users to make well-informed trading decisions. The platform’s interface is user-friendly and streamlined, making it easy for both beginners and experienced traders to navigate the markets.

In addition to these features, eToro provides a suite of tools to help manage risk and optimize trading strategies. These include stop-loss and take-profit orders, which allow you to set predetermined levels at which your positions will automatically close, protecting your profits and limiting your losses.

For more advanced traders, eToro offers sophisticated risk management tools. Negative balance protection ensures that you can never lose more money than you have in your account, while margin call alerts notify you when your account’s equity falls below a certain level due to market fluctuations.

In essence, eToro’s trading experience is designed to be as informative, intuitive, and secure as possible, catering to a wide range of investor needs and experience levels.

Some of the most popular features of eToro:

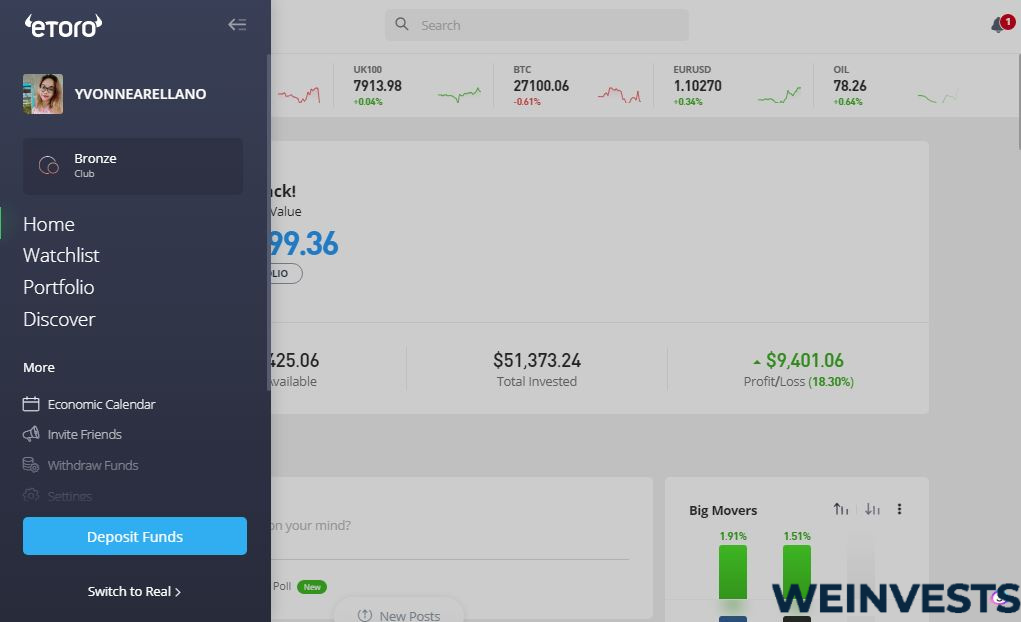

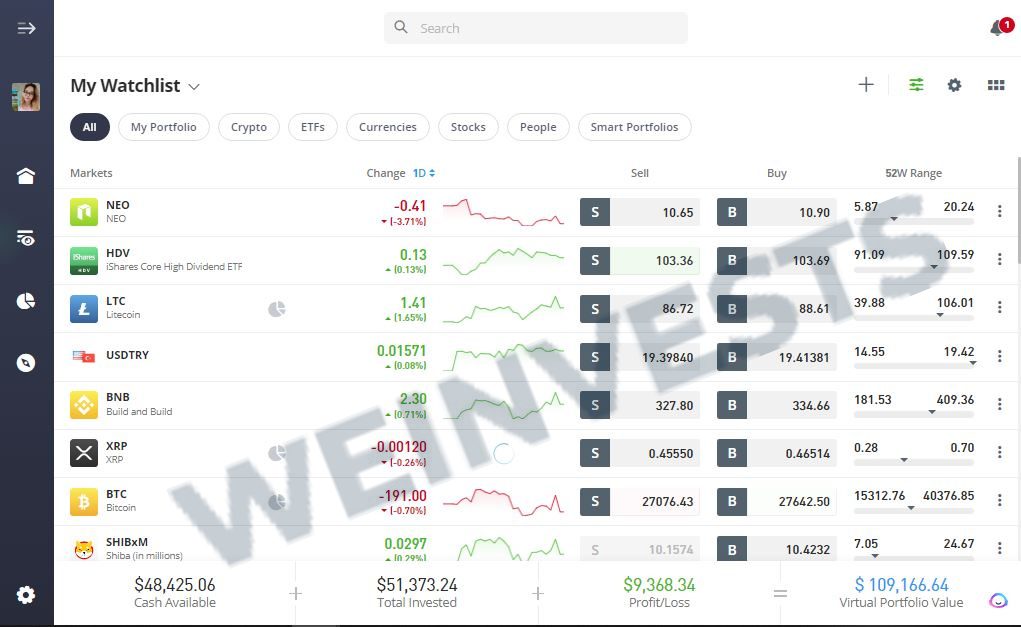

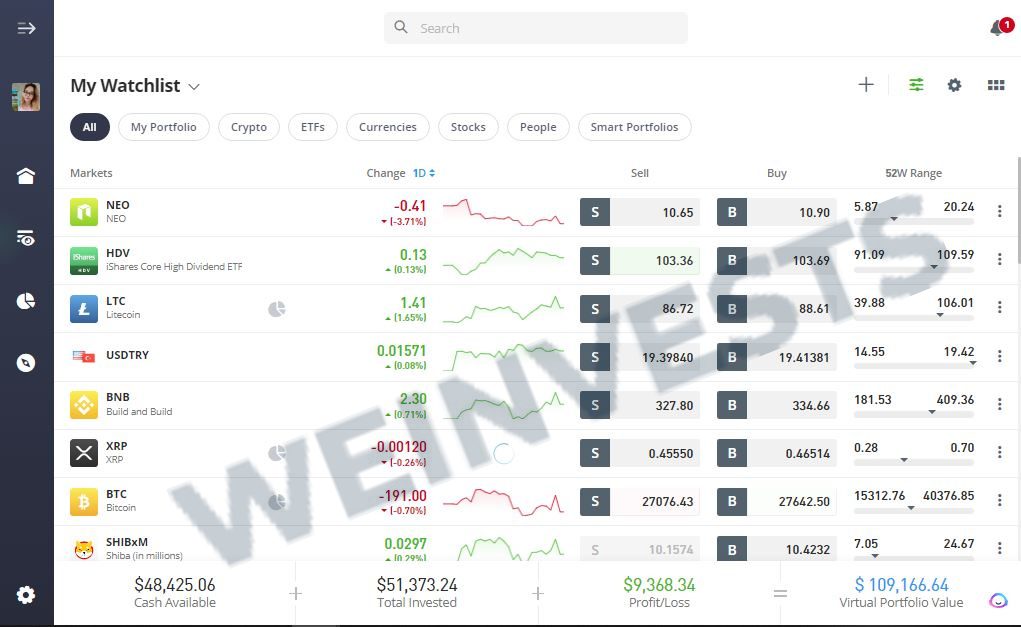

- Navigating the eToro Dashboard

The eToro dashboard serves as the central command center of the platform, offering users a comprehensive overview of their investment activities and access to a variety of features and tools.

Upon accessing the dashboard, users are presented with a snapshot of their portfolio. This includes a summary of their holdings, detailing the specific assets they own, the quantity of each, and the current market value of these investments. This high-level view provides users with a quick and easy way to monitor their investment performance and make informed decisions.

In addition to this portfolio overview, the dashboard also provides quick access to trading actions. Users can effortlessly buy or sell assets directly from their portfolio view. This streamlined process makes it easy to adjust holdings in response to market changes or personal investment strategies.

The dashboard also integrates the user’s watchlist, a personalized list of financial instruments that the user is interested in tracking. From here, users can monitor these instruments’ performance and execute trades when they deem the timing is right.

In essence, the eToro dashboard is designed to provide a seamless and efficient trading experience, putting all the necessary tools and information at the user’s fingertips. Whether you’re a seasoned trader or a beginner, the dashboard’s intuitive design and comprehensive features make managing your investments a breeze.

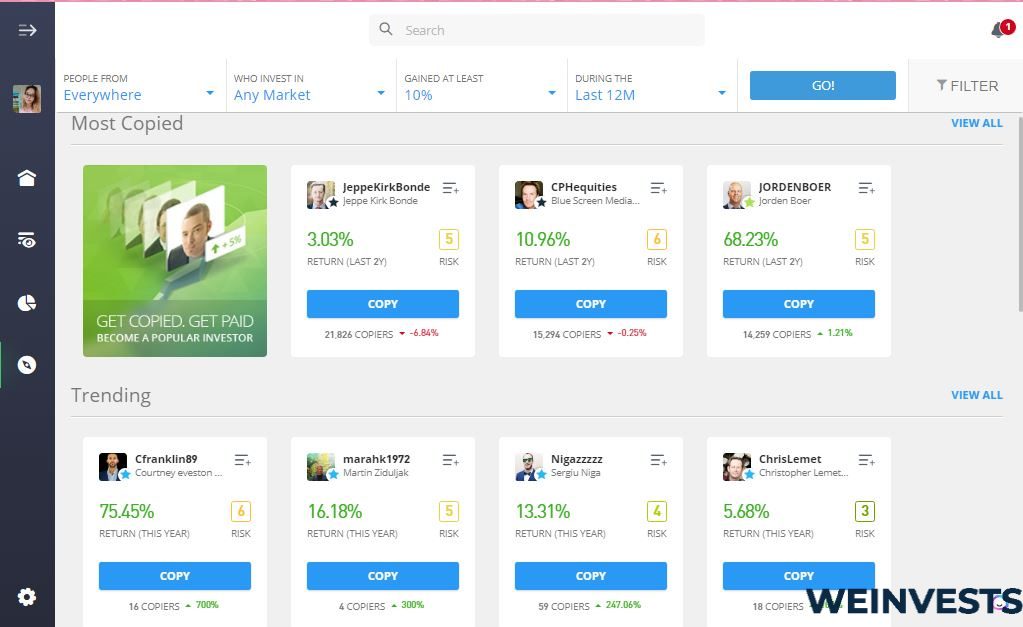

- Detailed Insights into eToro’s CopyTrader and CopyPortfolio

CopyTrader (AKA Copy Trading): eToro’s CopyTrader is an innovative feature designed to simplify the trading process and make investing more accessible to everyone, regardless of their experience level. This tool allows users to mirror the trades of successful traders on the platform, effectively replicating their performance in real-time.

When selecting a trader to copy, users can consider a variety of factors, including the trader’s historical performance, risk score, trading style, and the types of assets they typically invest in. This comprehensive information allows users to make informed decisions about who they choose to follow.

Once a trader is selected, users can set the amount they wish to invest in copying them. The trades are then copied automatically, with the option to stop copying at any time. Users can manage their risk by deciding the percentage of their balance to allocate to each copied trader, and they can copy as many traders as their account balance allows.

CopyPortfolio: eToro’s CopyPortfolio is another feature that takes investing to a new level. It’s essentially a thematic investment product, allowing users to invest in a fully managed portfolio that’s based on a predetermined strategy or a focus on a particular asset class.

Each CopyPortfolio is expertly managed by eToro’s investment team and is rebalanced periodically to ensure optimal performance. The portfolios are comprised of a diverse range of assets, including stocks, commodities, currencies, and even cryptocurrencies, providing a balanced investment approach.

Users can choose from a variety of CopyPortfolios based on their investment goals and risk tolerance. For instance, there are market portfolios that invest in specific sectors, top trader portfolios that copy a selection of top-performing eToro traders, and smart portfolios that use advanced algorithms to generate returns.

Both CopyTrader and CopyPortfolio are designed to provide users with a more passive form of investing, where the hard work of selecting assets and timing trades is handled by experienced traders or eToro’s investment team. This can be a great way for new traders to learn from experienced ones, or for busy individuals to ensure their money is working for them without the need for constant monitoring and decision-making.

- Exploring the eToro Digital Wallet

A digital wallet is a software-based system that securely stores users’ digital assets, such as cryptocurrencies. It allows users to send, receive, and manage their digital currencies. eToro provides its users with a robust digital wallet service, enhancing the overall trading experience.

The eToro digital wallet supports more than 120 cryptocurrencies, including popular ones like Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. This wide range of supported cryptocurrencies provides users with the flexibility to diversify their crypto portfolio on a single platform.

One of the standout features of the eToro digital wallet is its in-app conversion functionality. This feature supports up to 500 different crypto pairs, allowing users to seamlessly convert one cryptocurrency to another without leaving the app. This simplifies the process of managing and diversifying crypto holdings.

The wallet is fully integrated with the eToro trading platform. This means users can easily buy and sell cryptocurrencies directly from their wallet. It also provides a clear view of their crypto balance and transaction history, making it easy to track and manage their investments.

Security is a paramount concern when dealing with digital assets. The eToro digital wallet addresses this by providing an unlosable on-chain private key service. This feature allows for quick recovery of the wallet, ensuring users’ assets are always secure. Furthermore, the eToro platform is fully regulated, providing an additional layer of security and peace of mind for its users.

In essence, the eToro digital wallet is more than just a storage solution for cryptocurrencies. It’s a comprehensive tool that allows users to manage their digital assets efficiently, securely, and conveniently. Whether you’re a seasoned crypto trader or a beginner in the crypto world, the eToro digital wallet is designed to enhance your trading experience.

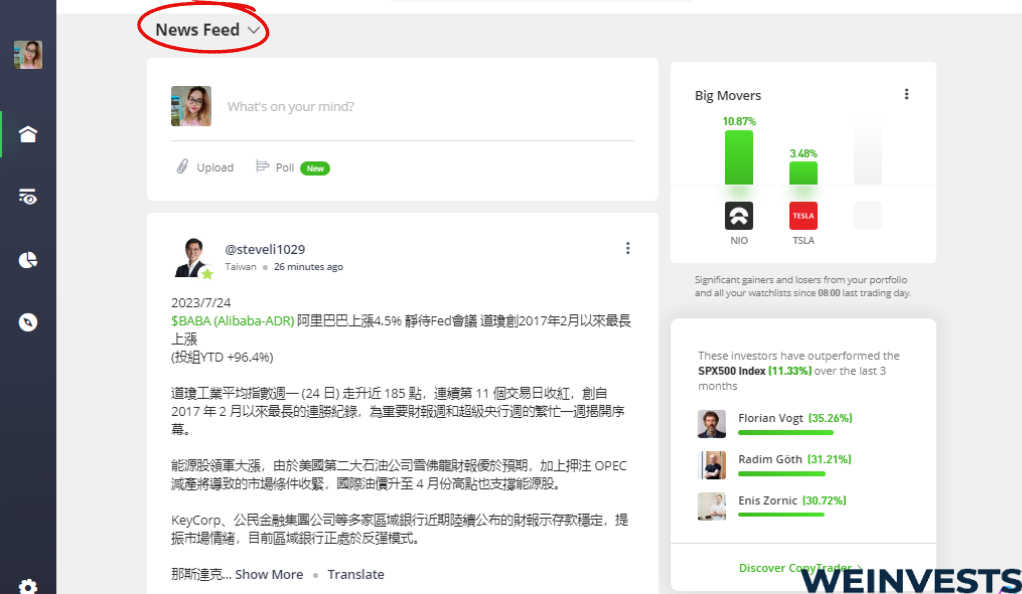

- Staying Updated with eToro’s News Feed

The eToro News Feed is a dynamic feature designed to keep users informed about the latest developments in the financial markets. It provides real-time news updates and in-depth market analysis, ensuring users have access to up-to-date information that can influence their trading decisions.

The News Feed includes a variety of content, from summaries of market trends to detailed analyses of economic indicators. It also provides updates on specific financial instruments or sectors, allowing users to stay informed about areas that directly impact their investments.

One of the unique aspects of the eToro News Feed is its customization feature. Users can tailor their News Feed to receive updates on topics that align with their interests. Whether you’re focused on cryptocurrencies, stocks, commodities, or specific sectors, you can set your News Feed to prioritize this content.

In addition to market news and analysis, the News Feed also includes posts from the investors you are following and related to the instruments and people on your watchlist. This social aspect of the News Feed allows users to engage with the eToro community, comment on posts, share them, and join discussions. This can provide valuable insights and perspectives that go beyond traditional news updates.

In essence, the eToro News Feed is more than just a news update tool. It’s a comprehensive feature that combines real-time market updates, community engagement, and personalized content to provide a unique and valuable resource for eToro users. Whether you’re a seasoned trader or a beginner, the News Feed can help you stay informed and make more informed trading decisions.

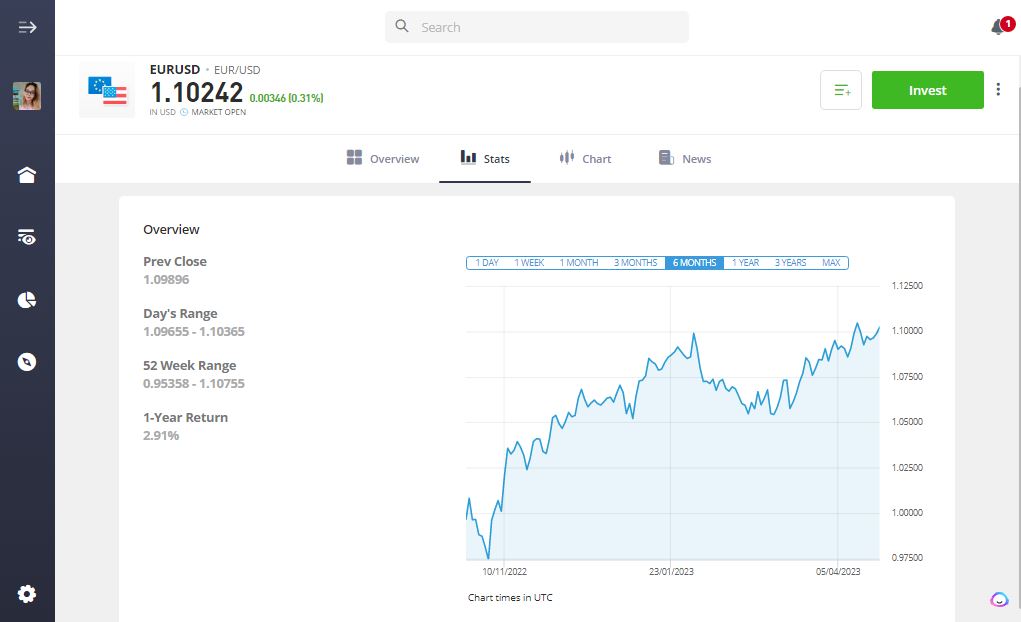

- eToro Charts/Stats:

eToro’s platform offers a robust charting system that provides real-time data and a host of technical indicators, empowering users to conduct in-depth market analysis. The charts are designed to help users identify price trends and potential trading opportunities.

The charting system includes a variety of technical indicators such as moving averages, Bollinger bands, and the relative strength index (RSI). These indicators can provide valuable insights into market trends and price volatility, helping users make informed trading decisions.

Moving averages, for instance, can help identify the overall trend direction, while Bollinger bands can provide insights into price volatility and potential overbought or oversold conditions. The RSI, on the other hand, is a momentum oscillator that can indicate potential price reversals.

Users can customize the charts according to their preferences. This includes adjusting the time frames to view price movements over different periods, such as daily, weekly, or monthly. Users can also choose the type of chart they prefer, such as line, bar, or candlestick charts, each providing a unique way to visualize price data.

In addition to the charting tools, eToro provides a wealth of statistical data to help users understand the performance and fundamentals of different financial instruments. This includes data such as market capitalization, which can give an indication of a company’s size and stability, trading volume, which can provide insights into the liquidity and popularity of a particular asset, and 52-week high and low prices, which can highlight the range of price movements over the past year.

In essence, eToro’s charts and stats offer a comprehensive suite of tools for conducting market analysis. Whether you’re a technical trader who relies on chart patterns and indicators, or a fundamental trader who looks at company and market data, eToro’s platform provides the tools you need to analyze and understand the markets.

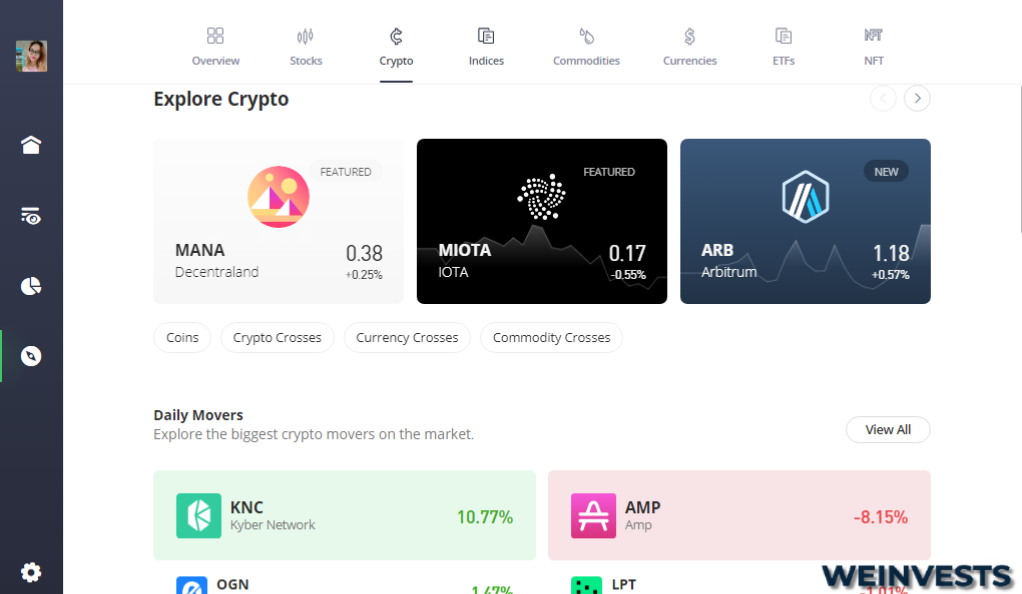

- Cryptocurrencies on eToro

eToro, a multi-asset brokerage and social trading platform based in the U.K, offers a wide range of cryptocurrencies for trading. While it’s not primarily a cryptocurrency platform, eToro has a rich portfolio of coins that users can trade, making it a popular choice for crypto enthusiasts.

eToro provides access to a variety of popular cryptocurrencies such as Bitcoin, Ethereum, Bitcoin Cash, XRP, and many more. Once you acquire your cryptocurrency, you can use the eToro wallet to securely store your coins until you are ready to sell or spend them. The eToro wallet is integrated with the eToro platform, making it easy for users to buy and sell cryptocurrencies, as well as view their balance and transaction history.

One of the unique features of eToro is its social trading capabilities. Users can connect with millions of users worldwide and find top-performing crypto traders to copy with the CopyTrader feature. This feature allows users to replicate the trades of successful traders, potentially increasing their chances of success in the crypto market.

However, it’s important to note that the crypto industry is not supervised by any regulatory body, and prices can fluctuate widely. Therefore, if you trade coins on eToro, you will not be eligible for investor protection. It’s crucial to tread with caution and understand the risks involved in crypto trading.

At eToro, clients can trade more than 35 different coins, 14 crypto crosses (like ETH/BTC), and 63 non-USD currency crosses (like LTC/AUD). eToro offers several methods to trade and own cryptocurrencies: crypto CFDs, spot crypto, crypto exchange (eToroX), and crypto wallet. However, the availability of these methods varies by country.

If you open a non-leveraged long position in any cryptocurrency (meaning you only use your own funds to trade and do not borrow from the broker), you will trade the real asset and not CFDs. This rule applies to all virtual currencies available on eToro.

eToro is one of the pioneers of Bitcoin trading in the brokerage industry. It also provides access to other popular cryptocurrencies like Dogecoin, which was added to its portfolio of products in May 2021, and XRP, a digital currency founded by Ripple Labs in 2012. More recently, eToro added the Shiba Inu coin to its platform, which was launched as an alternative for the popular meme coin, Dogecoin, in 2020.

eToro’s crypto trading fees are relatively high, with a 1% mark-up built into the crypto asset’s price. However, crypto deposits at eToro are free of charge, and there is a $10,000 daily limit for withdrawals for all currencies. Transactions higher than this amount are screened by the broker, and the process takes up to 24 hours on weekdays and up to 72 hours on weekends.

In conclusion, eToro offers a wide range of cryptocurrencies for trading, making it a popular choice for both beginner and experienced crypto traders. However, it’s important to understand the risks involved in crypto trading and to tread with caution.

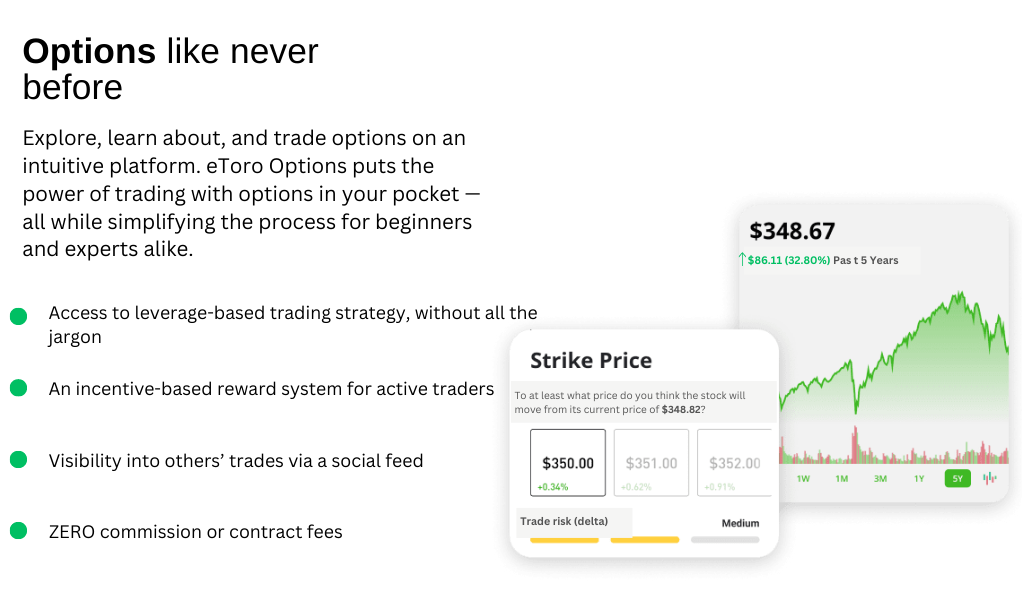

Options Trading on eToro

Experience a new realm of trading possibilities with eToro Options. This innovative platform provides a simplified, curated mobile app, where you can explore and trade options. Whether you are a beginner or an expert, eToro Options delivers an intuitive interface to engage with leverage-based trading strategies, minus the confusing jargon.

Additionally, you can leverage eToro’s incentive-based reward system for active traders and take advantage of zero commission or contract fees. Benefit from the social feed’s visibility into other traders’ actions and learn from their strategies. But the experience doesn’t end there – for a limited time, eToro is offering a $25 bonus when you make your first deposit of $250, giving you more money to trade with until Aug 14th.

Now, let’s dive into the world of options trading on eToro.

What are Options?

Options trading can be likened to reserving a flight hold. Just as the flight hold allows you to lock in a purchase price for later, options give you the right to buy or sell stock at a particular price, regardless of the future price change in the stock market.

The primary terms in options trading are:

- Call: An options contract allowing the buyer to purchase shares at a certain price.

- Put: An options contract enabling the buyer to sell shares at a specific price.

- Spread: A combination of two or more options for the same stock.

With options, you can hedge your investments, protecting against potential losses on stock investments. By using options in a well-planned strategy, you can potentially limit your risk while participating in market movements.

How to Start Trading Options on eToro

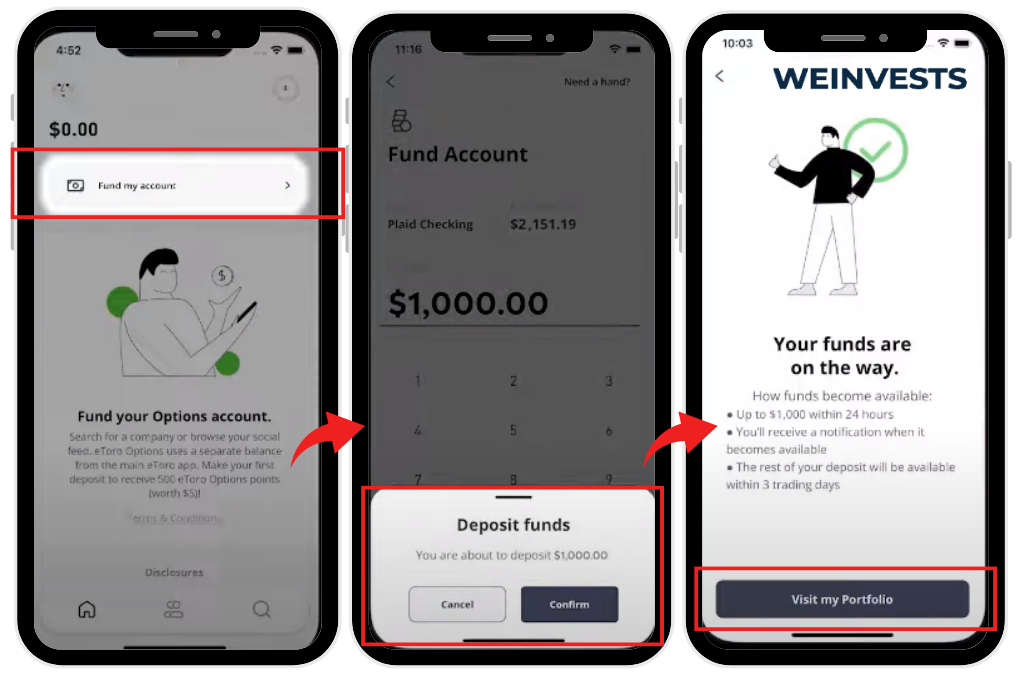

Here is a step-by-step guide to getting started with trading options on eToro.

Step 1: Log in to your account

Before starting, make sure your eToro Options account is registered and verified. If you’re new to options trading, you might need to answer some questions to confirm your fit as an options trader.

Step 2: Fund your account

Once your account is registered and verified, fund your account by clicking the “Fund my account” button, link your bank account, and initiate a transfer. Keep in mind that funds in your eToro account and eToro Options account are separate and need to be funded individually.

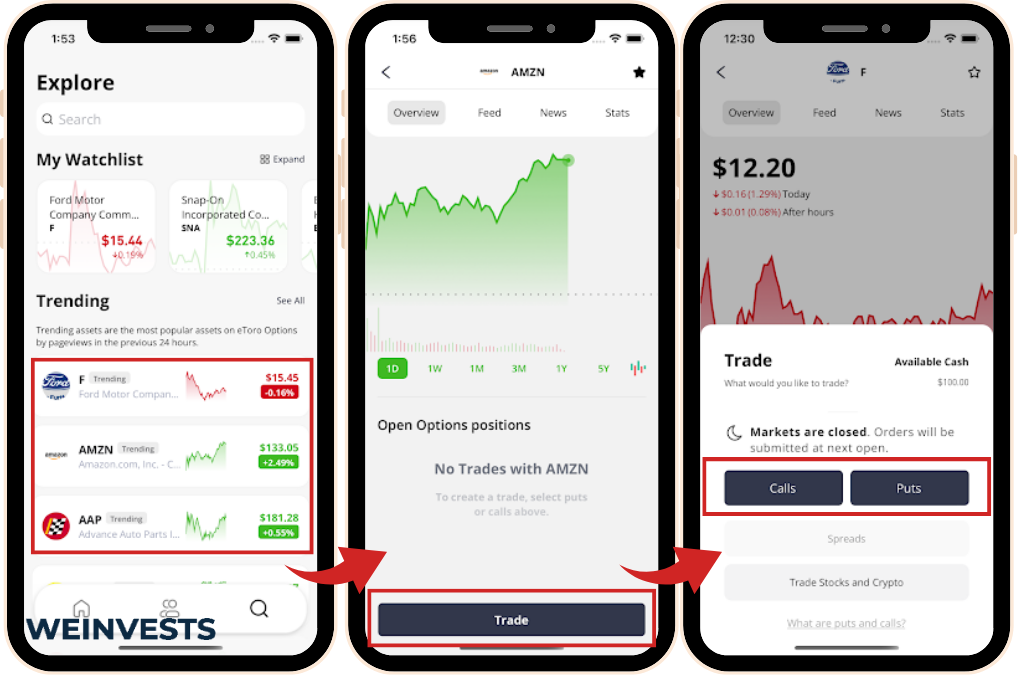

Step 3: Choose your option

Choose an option to trade from your favorite companies that offer stock. You can choose between a put, a call, or a spread. Once you’ve selected, provide the details including the expiry date and the strike price.

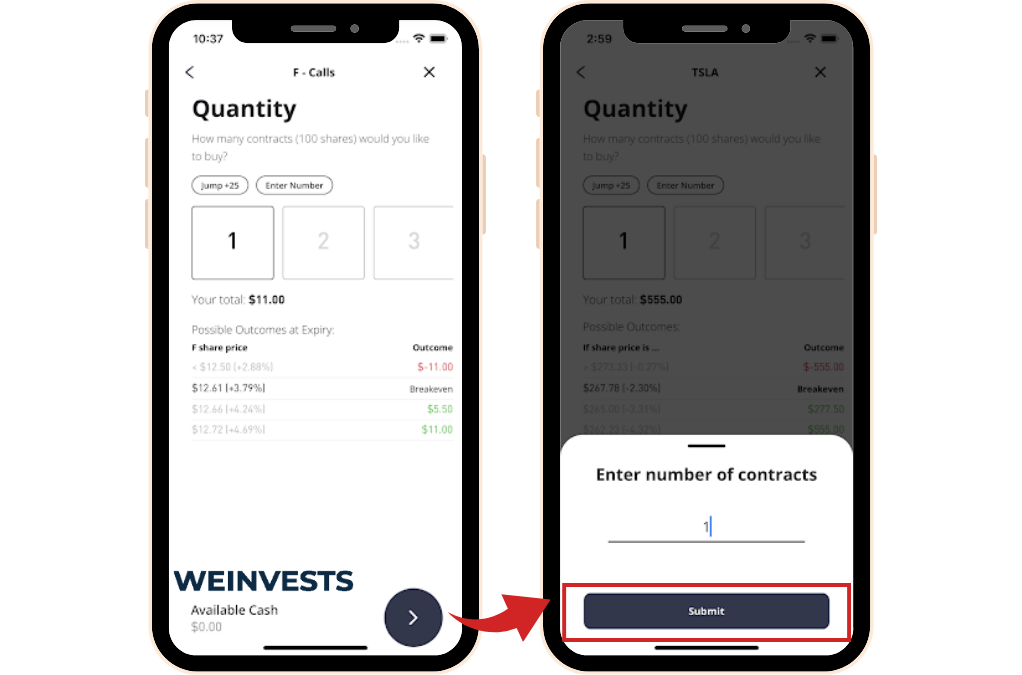

Then, select the number of 100-share contracts you’d like to purchase.

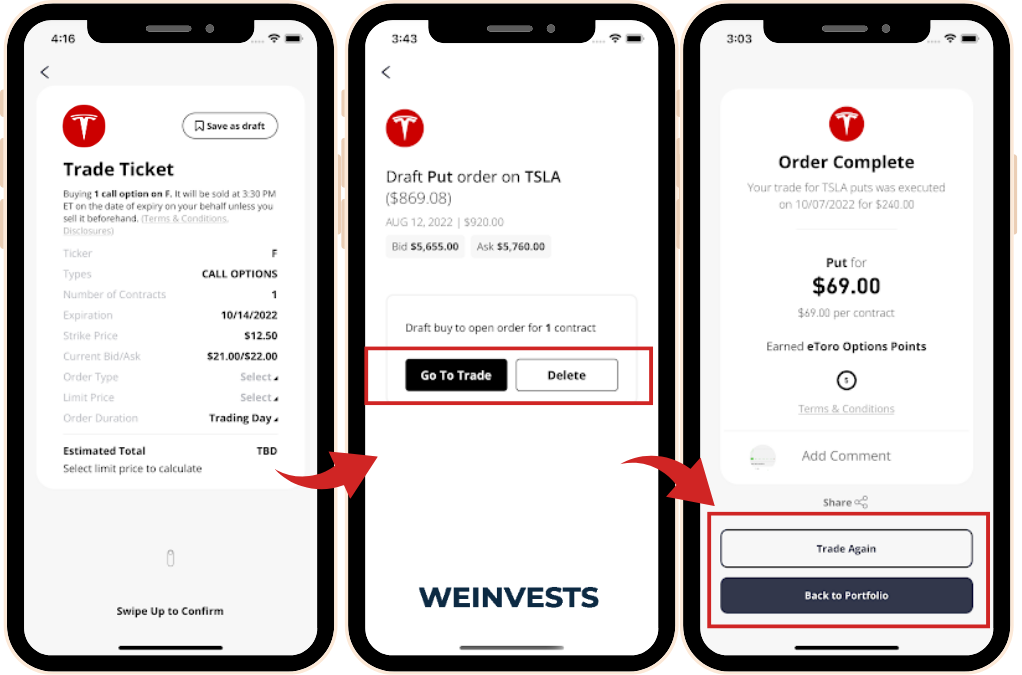

Step 4: Purchase your option

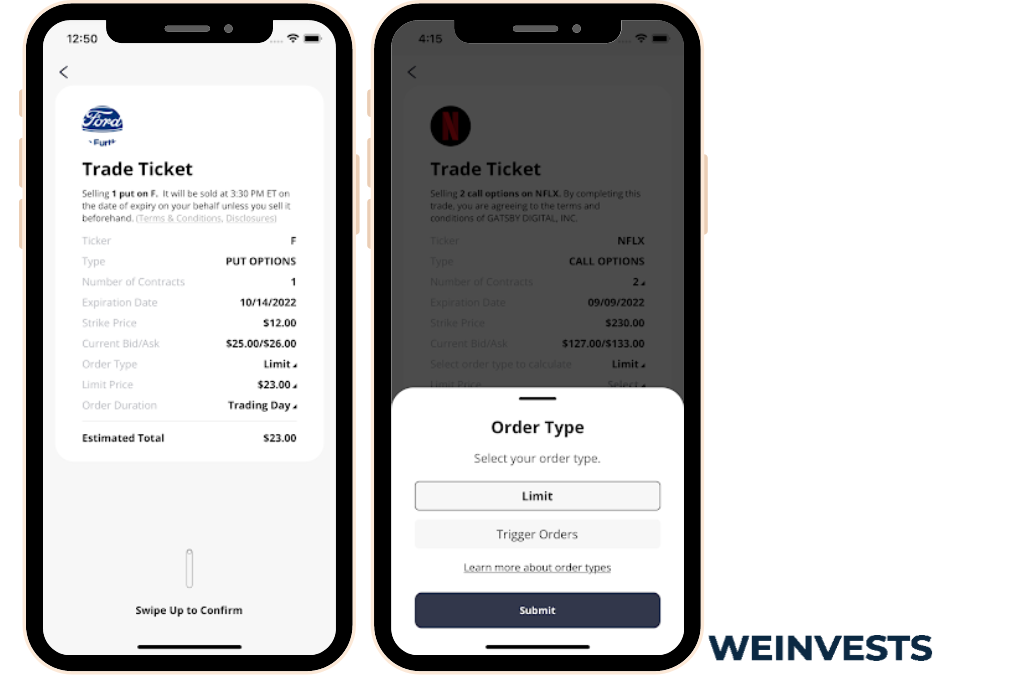

Review all the relevant metrics before purchasing your option. Once you’ve bought your option, you can either wait until the expiry date to see the outcome or sell it to someone else in the market if you don’t wish to wait.

Step 5: Trade your option

If you decide to sell your option, go to your existing ticket, and decide the order type: market, limit, or trigger. If you choose a limit order, set your ask price, a time limit, and wait to see if someone takes up your offer.

Exploring Other Ways to Trade

If you’re hesitant about committing to options, explore the draft trading function to see how options trading works before investing your money. Get inspired by what other users are trading on the eToro Options newsfeed and read their comments to understand their strategies.

Conclusion

Options are a powerful tool to enhance your portfolio management and engage more actively with the market. To start trading options, download the eToro Options app. With the right strategy and understanding, options trading on eToro can offer an additional layer of opportunities for traders of all levels.

Note

The eToro Options app is currently available in the United States only. In the rest of the world, eToro allows you to invest in stocks, currencies, commodities, cryptoassets, ETFs, and indices.

*In rare instances, eToro may be unable to sell expiring positions at 3:30pm EST. In these instances, clients are responsible for losses due to assignment or expiry. No contract fees refer to per-contract fees charged at some major brokerages. Regulatory fees still apply to options trades. For certain services on your brokerage account, eToro may also pass along a processing fee charged by its clearing firm.

eToro app

The eToro app, available on both the App Store for iOS and the Play Store for Android, is a comprehensive trading and investment platform that caters to a wide range of users, from novice investors to seasoned traders. It’s designed with a user-friendly interface that makes navigating the world of trading and investing a breeze.

As a stock app, eToro offers a multitude of features that make trading stocks straightforward and efficient. Users have real-time access to global stock markets, allowing them to buy and sell stocks from major exchanges around the world at their fingertips. The app provides a seamless trading experience with 0% commission on US stocks and ETFs, making it a cost-effective choice for traders.

The eToro app also stands out as a trading platform. It offers one-click trading, which enables users to execute trades quickly and efficiently. The app also includes advanced features such as stop loss and take profit orders, as well as a trailing stop loss function. These features provide traders with greater control over their trades and help manage risk effectively.

In addition to its trading capabilities, the eToro app is a powerful investment tool. It offers a virtual portfolio feature, where each user receives a free $100,000 demo account upon opening an account. This feature allows users to practice their trading strategies without risking real money, making it a great learning tool for beginners.

Furthermore, the eToro app offers the opportunity to invest in cryptocurrencies like bitcoin, ether, and litecoin without deposit fees. This feature, combined with the ability to seamlessly deposit and withdraw to and from your bank account, makes eToro a convenient platform for crypto trading.

The eToro app is not just a place to invest online — it’s also the ideal platform to engage, connect, and share strategies with others. Its award-winning CopyTrader™ technology allows users to replicate top-performing investors’ portfolios automatically. With CopyTrader, when they trade, you trade, making it a unique social trading experience.

The app also provides powerful investing tools to give users an edge in the market. Users can easily view valuable market research, technical analysis, and ProCharts at a glance. They can create and customize their Watchlists and set volatility alerts to catch breaking trends.

The eToro app also introduces the next generation of investing with its innovative Smart Portfolios. These are ready-made, fully allocated portfolios that allow users to diversify their investments and gain exposure to multiple assets with just one click of a button.

In conclusion, the eToro app is a robust and versatile tool that offers a comprehensive suite of features for trading and investing. Its user-friendly design, combined with its advanced trading features and social trading community, make it a top choice for those looking to trade and invest in the financial markets.

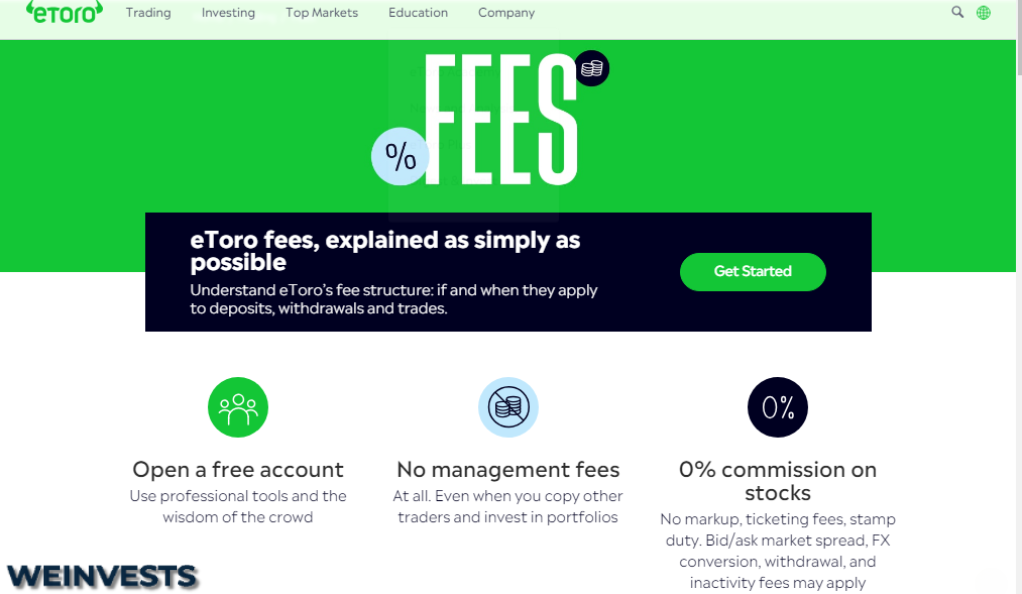

eToro Fees and Commissions

- Withdrawal Fee: eToro charges a flat fee of $5 for each withdrawal, regardless of the payment processors, withdrawal amount, or geographical location. The minimum withdrawal amount is $30.

- Currency Conversion Fee: eToro charges a fee for converting currencies. For example, eToro charged $5 for converting Euros into US Dollars. This fee applies to all traders not using US Dollars.

- Trading Fees: eToro’s trading fees are generally higher compared to most competitors. These fees are most visible in spreads, the difference between the bid and ask price.

- Indirect Costs: eToro has indirect costs such as a controversial withdrawal fee, a currency conversion cost, and an inactivity fee.

- Direct Trading Costs: Direct trading costs have a more significant impact. They consist of spreads, commissions, and swap rates.

- Commissions: Commissions apply on equity, index, and ETF CFDs or direct market access, in other words, not CFD trading. On leveraged positions, buy and sell, eToro charges a 0.09% commission.

- Overnight Fees / Swap Rates: Swap rates are interest payments for leveraged overnight positions on the borrowed capital from the broker to maintain them.

- Inactivity Fee: After twelve months of inactivity, eToro levies a $10 inactivity fee per month until the trader logs into the account, or the balance reaches $0.

Please note that these fees can change and it’s always a good idea to check the latest on the eToro website or contact their customer service for the most accurate information.

Fees Per Asset Class

- Currencies: eToro charges a spread fee for forex trading, which is the difference between the bid and ask price. The spread can vary depending on the currency pair and market conditions. However, it’s not typically expressed in a fixed number of pips. For example, as of 2023, the spread for EUR/USD is 1 pip.

- Commodities: The fees for commodities also depend on the spread, which can vary depending on the specific commodity and market conditions. However, it’s not typically expressed in a fixed number of pips.

- Indexes: The fees for indexes are based on the spread as well, which can vary depending on the specific index and market conditions. Again, it’s not typically expressed in a fixed number of pips.

- CFD Stocks: eToro charges a spread for stock CFDs. For unleveraged buy orders, there are no commissions. However, for leveraged positions, eToro charges a 0.09% commission.

- CFD Crypto Trades: eToro charges a spread for cryptocurrency trades. The spread is expressed as a percentage and can vary depending on the specific cryptocurrency. For example, as of 2023, the spread for Bitcoin is 0.75%.

- Crypto Fees:

- When you buy or sell cryptoassets on eToro, you’re charged a single, straightforward fee of 1%. This fee is included in the price shown when you open or close a position. It’s added to the market price, which is based on the Bid-Ask spread that comes from an internal market maker-like system. This system aggregates order books from external liquidity providers.

- As soon as you open a new position, you will see a “loss” in the position. This is because the displayed Profit & Loss (“P/L”) includes the 1% buy fee you’ve just paid and the 1% sell fee you will pay when closing the position. When you close the position, the selling fee is adjusted to reflect the market price of the cryptoasset at that time.

- For Terra (LUNA), an operational fee of 0.1% is added to eToro’s bid and ask prices, on top of the standard 1% fee. This is due to Terra’s implementation of a 0.2% tax burn mechanism.

- Cryptoassets can be transferred from the eToro platform to the eToro Money crypto wallet. For information about crypto transfer fees and limits, you can refer to the eToro website.

- As for the eToro Money crypto wallet, it charges no fees for sending or receiving transactions, but blockchain fees are applicable. For crypto-to-crypto conversions, eToroX charges a conversion fee of 0.1%. The conversion rates are set according to eToro market rates. The minimum limit for conversions is $20, and the maximum limit is $10,000.

- Transactions for all supported cryptoassets have a permitted maximum of $50,000 per transaction, and an overall daily maximum limit of $200,000. The creation of new wallets for certain cryptoassets like XRP, XLM, and ETH is part of the coin transfer process and is free of wallet creation fees.

- Overnight Fees: eToro charges overnight fees (also known as swap rates) for leveraged positions that are kept open overnight. These fees are based on the amount of leverage used and can vary depending on the specific asset.

Please note that eToro also charges other fees, such as a withdrawal fee of $5 and an inactivity fee of $10 per month after 12 months of inactivity. Additionally, if the currency of your payment processor account differs from the trading account base currency (which is always US Dollars at eToro), eToro charges a currency conversion fee.

It’s important to note that trading costs can have a significant impact on profitability, and they can vary greatly between different brokers and platforms. Therefore, it’s always a good idea to thoroughly research and understand the fee structure of any trading platform before you start trading.

Non-trading Fees

- Account Fees: Opening an account with eToro is free of charge, and there are no management fees.

- Inactivity Fees: If you fail to log into your eToro account for 12 consecutive months, eToro will charge you a monthly fee of $10 on your available balance.

- Deposit Fees: Depositing with eToro is free of charge.

- Withdrawal Fees: eToro charges a $5 fee for any withdrawal you make. You need a minimum of $30 to make a withdrawal.

- CopyTrader and CopyPortfolios Fees: Neither CopyTrader nor CopyPortfolios charge management fees. However, in the case of CopyTrader, you may still have to pay for overnight fees and spreads as applicable.

- Conversion Fees: Deposits and withdrawals are in USD only, meaning that if you make any transaction with another currency, these are going to be subject to conversion fees. These fees usually depend on the platform you make transfers from such as PayPal, Skrill, Neteller, Credit Cards, RapidTransfer, or Local Online Banking so may vary based on the source. If you are a member of the eToro Club and are a part of the Diamond tier, you don’t have to pay any conversion fees. On the other hand, if you are a Platinum or Platinum+ member, you receive a 50% discount for any conversion fees.

- Please note that these fees are subject to change and it’s always a good idea to check the latest information on the eToro website or contact their customer service for the most accurate details.

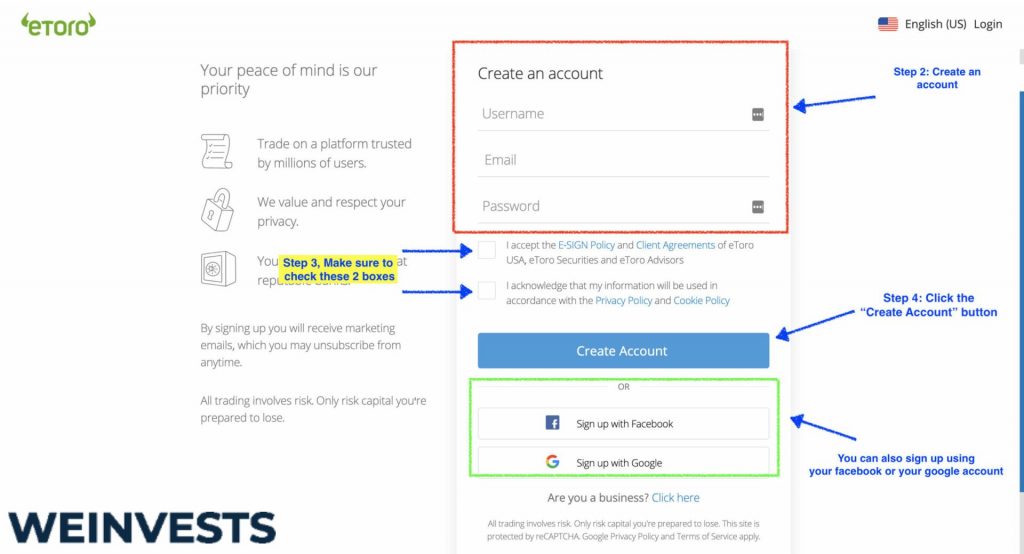

How to Open an Account with eToro

Go to eToro’s website and click on the “Sign Up” button. You will need to enter your personal details, including your name, email address, and password. Once you receive the verification email, verify your email address by following the instructions in the confirmation email that eToro will send.

Complete the registration process by providing additional personal and financial information, as required by eToro’s KYC and AML policies. This may include information such as your date of birth, employment status, and income to name a few. You will also have to provide your ID for verification purposes. Once verified you will be able to trade in all asset classes that are mentioned in this article with certain constraints based on your jurisdiction.

- Step One:

Click on the “Sign Up” button on eToro’s website.

- Step Two:

Fill out the registration form with your personal information. You may also log in via Gmail or Facebook. Make sure to read and check eToro’s Terms & Conditions before creating your account.

- Step Three:

All investors must go through the KYC process as mandated by the European Parliament and Council. The KYC process involves new traders to provide eToro with a Confirmation of Residence and Proof of ID. Additionally, the trader must fill out a questionnaire that includes questions regarding professional status, financial liquidity, investment goals, and more.

If you do everything correctly, you may not take more than 10-15 minutes to complete the process. Currently, eToro offers four different account types, including the following:

- Retail Account

- Professional Account

- Islamic Account

- Demo Account

In most cases, you may go for either the Retail or the Professional account.

Only customers registered under eToro UK and eToro EU can apply to be a Professional Client.

eToro’s Demo Account: A Comprehensive Overview

The eToro demo account, also known as a virtual portfolio, is a powerful tool designed to provide a risk-free environment for users to explore the platform’s features and practice trading strategies without the fear of losing real money. This account is an exact replica of the live trading platform, offering a comprehensive and authentic trading experience.

Upon creating a demo account, users are granted a virtual fund of $100,000. This virtual fund can be used to invest in any asset available on the platform, including stocks, commodities, cryptocurrencies, and more. This allows users to gain hands-on experience in managing a diverse portfolio and understanding the dynamics of different financial markets.

Opening an eToro demo account is a straightforward process. All it requires is an email address and a few minutes of your time. No credit card information is needed. After registering, you will receive a verification email. Once verified, you can switch from the “Real” to the “Virtual” portfolio on the platform.

The eToro demo account provides a comprehensive overview of the platform’s features. The dashboard displays key terms such as:

- Watchlist: A list of assets you’re interested in. eToro automatically creates a watchlist of popular assets for you.

- Portfolio: A list of assets you’ve virtually bought. Here, you can track your profits and losses.

- Copy people: This feature allows you to review and choose traders to copy.

- Available funds: The virtual money that hasn’t been invested yet.

- Total allocated funds: The total amount of the virtual $100,000 you’ve invested on the platform.

- Profit: The amount of virtual money you would make or lose if you sold all assets immediately.

- Virtual Equity: The sum of Available funds, Total allocated funds, and Profit. This represents the amount of virtual money you would have if you sold all assets.

The demo account also allows you to practice making trades. For instance, you can search for a popular company like Apple, click on “Trade,” ensure “Buy” is selected, and then click “Open Trade.” You can then monitor your portfolio to see how your virtual Apple shares perform.

One of the unique features of eToro is its social trading aspect. The demo account allows you to explore this feature by copying the trades of successful traders. This can be a valuable learning tool, especially for beginners.

In addition to the hands-on experience, eToro also offers a wealth of educational resources. The eToro trading academy provides live webinars, an eCourse program, and expert advice from online trading professionals. This allows users to develop their trading skills at their own pace.

The eToro demo account is an excellent choice for both new and intermediate traders. It provides a secure and comprehensive platform for users to learn and refine their trading skills. However, it’s important to remember that while the demo account provides a realistic trading experience, it does not guarantee success in real trading due to the unpredictable nature of financial markets.

Finally, the eToro demo account is not just confined to your desktop. eToro also offers mobile trading options, allowing you to learn and practice trading on the go. This makes the demo account both physically and intellectually accessible, providing a seamless transition from demo to real trading when you’re ready.

eToro USA review

As a US citizen interested in exploring the world of online trading, eToro USA offers a unique platform that caters specifically to your needs. This platform is a subsidiary of the global trading powerhouse, eToro, and is fully compliant with US regulations, providing a secure and reliable environment for your trading activities.

eToro USA is registered as a Money Services Business with the Financial Crimes Enforcement Network (FinCEN), a bureau of the US Department of the Treasury. This registration is a testament to eToro’s commitment to maintaining a transparent and secure trading environment, as it helps in combating potential financial crimes such as money laundering.

Furthermore, eToro USA Securities Inc., which offers stocks and ETFs, is a registered broker-dealer with the Securities and Exchange Commission (SEC). It also holds memberships with the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), further reinforcing its credibility and commitment to protecting investors.

One of the unique aspects of eToro USA is its state-specific operating licenses. In the United States, cryptocurrency brokers are required to obtain separate operating licenses for each state. Currently, eToro USA is licensed to operate in 20 out of the 50 states, which means it can provide its services to residents of these states.

eToro USA offers a wide range of trading options. For those interested in cryptocurrencies, eToro USA provides a selection of 45 cryptocurrencies and a proprietary cryptocurrency wallet. For those more inclined towards traditional assets, eToro USA offers trading in 1,765 stocks and 220 ETFs, primarily US-listed ones. However, it’s worth noting that eToro USA is likely to expand its offerings to include non-US stocks in the future.

Opening an account with eToro USA is a straightforward process. After filling out an online application form with your username, password, and email address, you’ll need to go through a verification process to comply with regulatory Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. This involves submitting a copy of your ID and a proof of residency document. Once these documents are approved, your trading account becomes fully functional.

In terms of funding your account, eToro USA supports deposits and withdrawals through credit/debit cards or bank wires in line with US regulations. The minimum deposit is $50, with a daily maximum of $10,000. Processing times can be up to seven business days, depending on the method used.

In conclusion, as a US citizen, eToro USA offers you a secure and regulated platform to engage in online trading. Whether you’re interested in cryptocurrencies, stocks, or ETFs, eToro USA provides a wide range of options to suit your trading preferences. However, as with any investment, it’s crucial to stay updated with the latest information directly from the eToro website or their customer service to ensure you’re making informed decisions.

eToro Review UK

eToro’s services for UK residents are regulated by the Financial Conduct Authority (FCA), ensuring a high level of security and protection for users. As a UK resident, you can enjoy a wide range of services offered by eToro, including trading and investing in a variety of assets such as stocks, commodities, forex, ETFs, and cryptocurrencies.

However, it’s important to note that due to regulatory changes in the UK, as of January 2021, the FCA has banned the sale of crypto-derivatives and exchange-traded notes (ETNs) that reference certain types of crypto-assets to retail consumers. This means that UK residents can no longer trade cryptocurrency CFDs on eToro. Nevertheless, UK residents can still buy and sell the underlying cryptocurrencies directly on eToro, which is not subject to this regulation.

Moreover, eToro provides a unique social trading platform where UK users can follow and copy the trades of successful investors, which can be a great way for beginners to learn and for experienced traders to diversify their portfolio. The platform also offers a wide range of educational resources, including webinars, video tutorials, and a demo account where users can practice trading with virtual money.

In terms of fees, eToro operates on a spread-basis, which means that the cost of trading is included in the buy and sell prices of the assets. The spread varies depending on the asset, and detailed information can be found on eToro’s website.

Lastly, it’s worth mentioning that eToro takes the security of its users very seriously. The platform uses industry-leading security protocols and also offers additional protection through its membership in the Financial Services Compensation Scheme (FSCS), which can compensate eligible users up to £85,000 in the event of company insolvency.

eToro Money

eToro Money is a unique feature offered by eToro that aims to provide a smarter way for users to manage their money on the platform. It is essentially an e-money account that is managed through a mobile app, providing users with a convenient and efficient way to handle their funds.

One of the key features of eToro Money is the availability of a Visa debit card for Club members in certain regions. This card allows users to easily access and use their funds, making the trading process even more seamless.

eToro Money is provided by two entities depending on the client’s location. For UK clients, the service is provided by eToro Money UK Ltd, while for EU clients, it is provided by eToro Money Malta Ltd. This ensures that the service is regulated and adheres to the financial laws and regulations of the respective regions.

In terms of functionality, eToro Money offers a range of features designed to enhance the user’s trading experience. These include the ability to deposit and withdraw funds, view transaction history, and manage multiple currencies. It also provides real-time notifications on market events and account changes, helping users stay updated on their investments.

However, it’s important to note that the availability and specific features of eToro Money may vary depending on the user’s location and the regulations of their specific region. For more detailed information, users are advised to refer to the Terms and Conditions for eToro Money on the official eToro website.

In conclusion, eToro Money is a valuable tool for any eToro user, offering a convenient and efficient way to manage funds on the platform. Whether you’re a seasoned trader or a beginner, eToro Money can enhance your trading experience by providing easy access to your funds and a range of useful features.

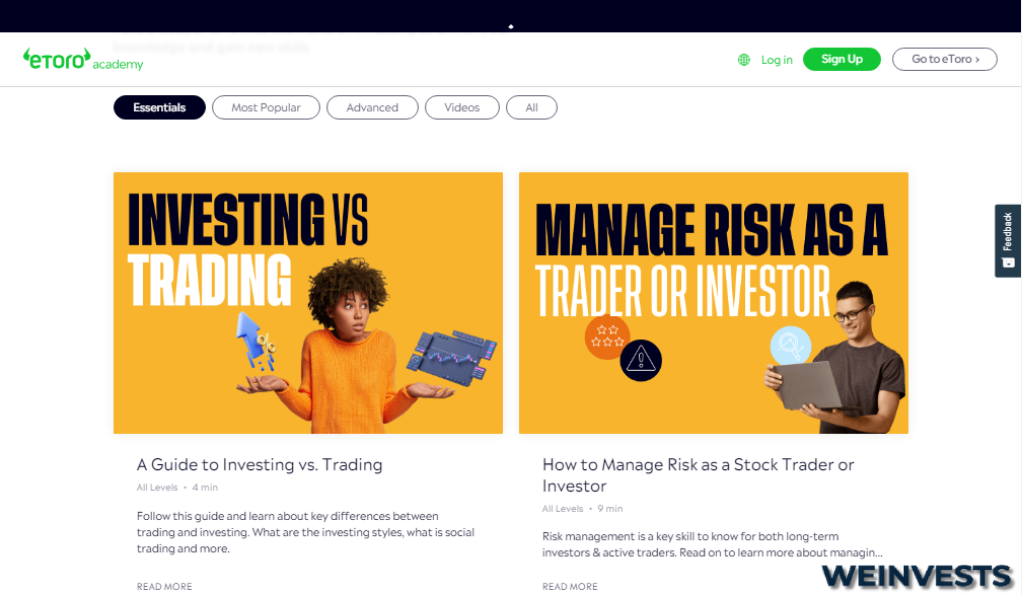

eToro Education

eToro’s educational resources are designed to equip traders with the knowledge and skills they need to navigate the financial markets confidently. These resources are comprehensive and cater to traders of all experience levels, from beginners to seasoned professionals.

- Market Analysis: eToro provides in-depth market analysis and commentary on a wide array of financial instruments and sectors. This analysis is conducted by industry experts and provides valuable insights into market trends, economic indicators, and other factors that can influence market movements. This information can be invaluable for traders looking to make informed decisions about their trades.

- Trading Courses: eToro offers a variety of trading courses that cover a broad spectrum of topics. These include technical analysis, which involves studying price charts and statistical trends to predict future price movements; risk management, which teaches traders how to protect their capital and limit their losses; and trading psychology, which explores the emotional aspects of trading and how they can impact decision-making. These courses are designed to be accessible and easy to understand, making them suitable for traders of all experience levels.

- Webinars: eToro hosts regular webinars that delve into various trading-related topics. These live, interactive sessions are led by experienced traders and industry professionals, and they provide a platform for users to learn about trading strategies, risk management, market analysis, and more. Participants also have the opportunity to ask questions and engage in discussions, making these webinars a highly interactive and engaging learning experience.

- Educational Articles: eToro’s website features a wealth of educational articles that cover a wide range of topics related to trading and the financial markets. These articles provide in-depth information and insights on various aspects of trading, from the basics of how markets work to more advanced topics like complex trading strategies and financial analysis. These articles are a great resource for traders looking to expand their knowledge and understanding of the financial markets.

In addition to these resources, eToro also provides a demo account where users can practice trading with virtual money. This allows users to gain hands-on experience and learn about trading in a risk-free environment. The demo account includes all the features of a real trading account, providing users with a realistic trading experience.

Overall, eToro’s educational resources provide a comprehensive learning platform for traders. Whether you’re a beginner looking to learn the basics or an experienced trader looking to refine your skills and knowledge, eToro’s educational resources can provide the tools and information you need to succeed in the financial markets.

eToro Forum

While eToro does not have a traditional forum, it offers a unique social trading environment that fosters interaction and knowledge sharing among its users. Central to this are two key features: the “Feed” and the “News Feed”.

The Feed in eToro functions much like a social media feed. When you log into your account, you’ll find the Feed on your dashboard. Here’s what you can expect from it:

- Community Interaction: The Feed is where you can see updates and posts from other traders that you follow. This includes their trading activities, market insights, and personal strategies. You can interact with these posts by liking, commenting, or sharing them, fostering a sense of community and open dialogue.

- Personal Sharing: You can also create your own posts on the Feed. Share your trading strategies, market predictions, or thoughts on financial news. This is a great way to engage with the eToro community, get feedback, and even build a following of your own.

- Learning from Others: The Feed is a valuable learning tool. By following experienced traders and engaging with their posts, you can gain insights and learn strategies that can help improve your own trading.

The News Feed, on the other hand, is your go-to source for the latest financial news and market trends.

- Real-Time Updates: The News Feed provides real-time updates on market trends, financial news, and economic events. This can help you stay informed and make timely trading decisions.

- Personalized Content: You can customize the News Feed to show news related to the assets you are interested in or currently trading. This ensures that the content you see is relevant to your trading activities.

- Informed Trading: By keeping you updated with the latest market news, the News Feed helps you make informed trading decisions. It’s a valuable tool for understanding the factors that could impact the value of your investments.

In conclusion, while eToro may not have a traditional forum, its Feed and News Feed features create a dynamic and interactive environment that encourages community interaction, knowledge sharing, and informed trading. Whether you’re a novice trader or a seasoned investor, these features can enhance your trading experience and help you make the most of your eToro journey.

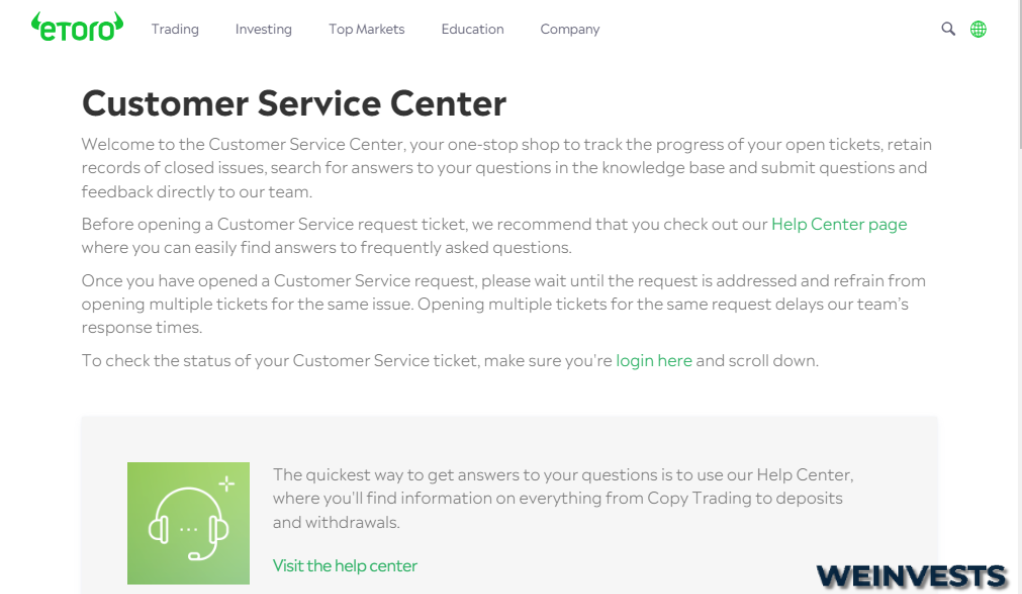

eToro Customer Service

eToro’s commitment to providing a seamless trading experience extends to its customer service. The platform offers a comprehensive support system to ensure that users can navigate the platform with ease and resolve any issues that may arise promptly.

The primary mode of communication with eToro’s customer service is through live chat. This feature allows users to interact with customer support representatives in real-time, ensuring immediate responses to queries or concerns. The live chat feature is particularly useful for urgent matters that require immediate attention.

In addition to live chat, eToro also provides email support. Users can send an email detailing their issue or question to the customer support team. While this method may not provide an immediate response like the live chat, it is a convenient option for non-urgent matters or detailed queries that require comprehensive responses.

eToro’s customer service team is well-trained and knowledgeable about the platform and its features. They can provide assistance on a wide range of issues, from technical difficulties with the platform to questions about trading and investing. Whether you’re a beginner needing help navigating the platform or an experienced trader with a complex query, eToro’s customer service team is equipped to assist.

Moreover, eToro also has a comprehensive Help Center on its website. This resource provides answers to frequently asked questions and information on various topics, including account management, deposit and withdrawal processes, and details about trading and investing on eToro. The Help Center is a valuable resource for users to resolve common issues independently and gain a better understanding of the platform.

It’s important to note that eToro’s customer service is not limited to resolving issues. The team also welcomes feedback and suggestions from users. This feedback is invaluable in helping eToro continually improve its platform and services to better meet the needs of its users.

In conclusion, eToro’s customer service is designed to provide users with a smooth and hassle-free trading experience. With multiple channels of communication and a wealth of resources available, users can be assured that help is readily available whenever they need it.

Conclusion

In wrapping up, eToro stands as a globally recognized and regulated trading and investment platform that caters to a broad spectrum of investors. The platform offers a diverse array of financial instruments, including stocks, commodities, currencies, and cryptocurrencies, and provides a suite of features and tools to assist users in managing their portfolios effectively.

eToro’s platform is not just about providing trading opportunities; it also focuses on educating its users. It offers a plethora of educational resources to help users enhance their knowledge and skills. These resources range from market analysis and commentary to trading courses and webinars, covering a wide array of topics such as technical analysis, risk management, and trading psychology.

One of the standout features of eToro is its social trading capabilities, such as CopyTrader and CopyPortfolio. These features allow users to follow and replicate the trades of more seasoned investors, potentially boosting their chances of success in the markets. This social aspect of trading not only provides a learning opportunity for beginners but also creates a sense of community among traders.

However, users should be aware of the fees associated with the platform. eToro charges various fees, including spread fees for trades, withdrawal fees, and conversion fees for non-USD transactions. While these fees are a standard part of trading, it’s crucial for users to understand them fully to manage their investments effectively.

eToro’s customer service is accessible via live chat and email, providing users with real-time assistance when they encounter issues or have queries. The platform’s help center also contains a wealth of information to address common questions and concerns.

In terms of security, eToro employs robust measures to protect users’ funds and personal information. These include two-factor authentication, state-of-the-art monitoring tools, and the use of offline and online storage for cryptocurrencies. Cash assets are held in FDIC-insured bank accounts, providing an additional layer of protection for users.

For those looking to practice trading without risking real money, eToro offers a demo account. This account is funded with virtual money and mirrors the live trading platform, allowing users to familiarize themselves with the platform’s features and practice trading strategies.

In conclusion, eToro is a comprehensive trading and investment platform that combines a wide range of financial instruments, educational resources, social trading features, and robust security measures. Whether you’re a beginner looking to learn the ropes or a seasoned trader seeking a platform with advanced features, eToro could be a suitable choice. However, as with any investment platform, it’s important to understand the associated fees and risks before diving in.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More