Introduction to Stock Market Indices

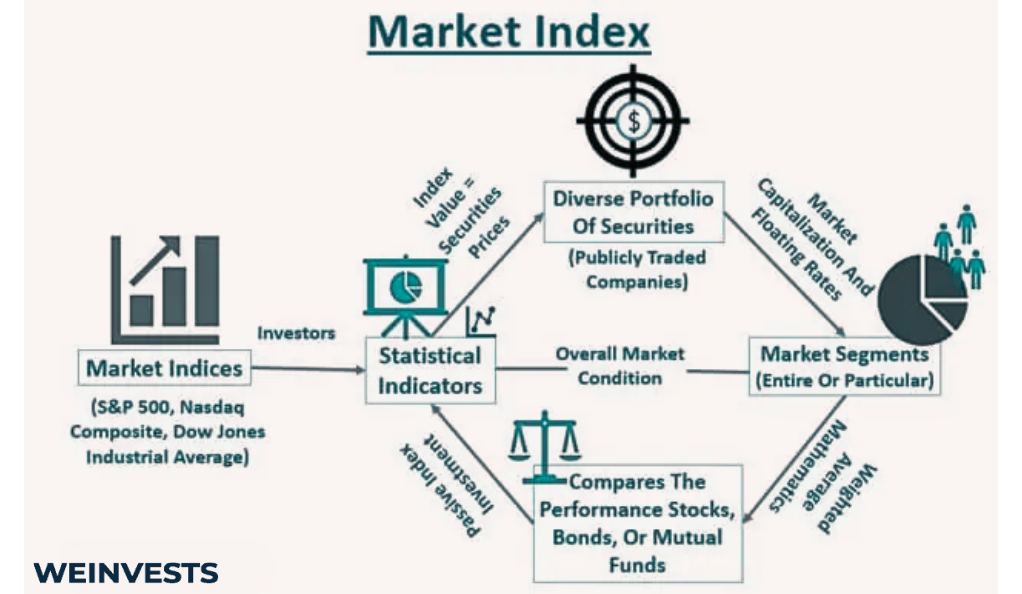

If you want to know how the stock market as a whole is performing, it’s not enough to just check on a couple of individual stocks. Specific stocks may rise, even as the general market falls. What you need is a way to combine the performance of many different stocks into a single measure.

In a nutshell, this is what stock market indices aim to achieve. Each index has a different basket of stocks and calculation methods. Their common aim, however, is to inform investors about how a broad section of the market is performing.

Charles Dow, co-founder of Dow Jones & Company, created the first market indices. The Dow Jones Industrial Average is one of the original indices created by Mr. Dow and remains in use today. While commentators often criticize the Dow for its outdated calculation methods, it helped lay the foundation for the future innovation of market indices.

Key Concepts in Stock Market Indices

In the modern era, there are a wide array of distinct indices. While they all have the aim of aggregating the performance of many different stocks, the conceptual approach of each index differs.

First, indices will differ in what they are trying to represent. Some indices want to reflect the entire stock market, and so track thousands of stocks. Others want to reflect a specific sector, and so only include stocks from that industry.

Since each index aggregates the performance of component stocks, how the index chooses to weigh components is important. Some indices use a price-weighted method, where higher-priced stocks have a greater impact on the index. For instance, the Dow Jones index is a price-weighted index.

Modern indices tend to use a market capitalization-weighted method, where each stock impacts the index in proportion to its total market cap. This method is more popular than price weighting since it does not make sense to punish a massive company for having a nominally low stock price.

Some indices weigh all component stocks equally. These types of indices are slowly growing in popularity, especially as market cap-weighted indices are increasingly dominated by a few large firms.

Indices also have certain inclusion criteria that dictate which stocks will serve as components. Simple indices often hide complexity under the surface.

For instance, investors often view the S&P 500 as representing the top 500 companies listed in the United States. But Tesla needed to achieve certain profitability metrics to earn index inclusion, long after it had become one of the country’s most valuable companies.

Finally, indices differ in how they calculate performance. Some indices focus on price return only. This means they do not factor in dividend payments. Others are total return indices, which reflect performance assuming an investor reinvests dividends back into the index.

Popular Stock Market Indices

Since the creation of the original Dow indices, the concept of indexing has expanded greatly. In this section, we’ll outline some of the most popular modern stock market indices.

Two indices that we discussed previously, the Dow Jones Industrial Average and the S&P 500, are some of the most popular stock market indices in the world. They each aim to track the performance of the American stock market.

The Dow is a price-weighted index of 30 representative companies, while the S&P 500 is a market cap-weighted index of about 500 of the largest companies. Each approach has benefits and drawbacks, but the S&P 500 is commonly seen as being more representative of market performance.

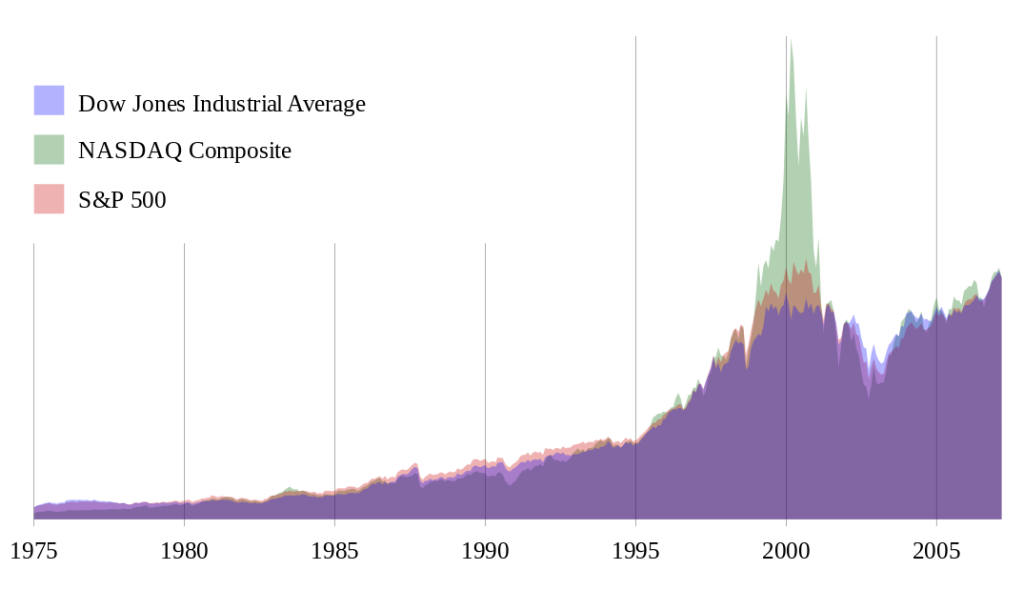

The Nasdaq Composite is a market cap-weighted index that reflects stocks listed on the tech-heavy Nasdaq stock exchange. Overall, these three indices are the most commonly reported measures of American stock market performance.

To track markets in other regions, alternative indices are necessary. The FTSE 100 is a market cap-weighted index that tracks the top 100 companies listed on the London Stock Exchange. It is a standard measure of British market performance.

The DAX, a market cap-weighted index comprising 40 major companies listed on Frankfurt Stock Exchange, reflects German market performance. The DAX is similar to the S&P 500 in its weighting method but has a small number of components like the Dow. The CAC 40 is a near-identical index used to track the French market.

Several popular indices exist to track Asian markets. The SSE Composite Index tracks all the stocks on the Shanghai Stock Exchange using a modified market cap-weight method.

The Hang Seng Index uses a traditional market cap-weighting to track about 70 of the top companies on the Hong Kong Stock Exchange. Finally, the Nikkei 225 is a price-weighted index that tracks 225 representative companies on the Tokyo Stock Exchange.

Emerging markets are developing their own indices, which are growing in popularity. The Ibovespa, which tracks the Brazilian stock market, is one of the most well-known.

Aside from these geographical indices, sector indices exist which reflect the performance of different industries.

Industry indices like the S&P 500 Information Technology Index and the Dow Jones U.S. Financials Index track the technology and the financial sectors, respectively. The S&P 500 Energy Index tracks the energy sector, as the name suggests. Popular index providers offer indices for a whole host of sectors, including in specific countries.

Understanding Stock Market Index Performance

Analyzing index performance can be a bit more complicated than analyzing traditional stock performance. This stems from the different ways indices report returns and the changing composition of indices over time.

Index levels are difficult to evaluate because they do not simply reflect an aggregation of the prices of component stocks. While most indices do require a calculation of the total market capitalization of the underlying stocks, a normalizing factor often adjusts this figure.

The result is that investors cannot simply interpret index levels as representing dollars. Instead, index levels are a unitless figure. This is why an index can never be directly compared with another index.

The difference between total return and price return indices reinforces this fact. To use the S&P 500 as an example, investors could not simply calculate the performance of the traditional index over a certain period to see how their investments would have performed. The S&P 500 is a price return index, which does not account for dividend distributions from component stocks.

To get an accurate picture of performance, investors would have to rely on the less common S&P 500 Total Return index. When they do so, investors should also be mindful to annualize their returns through the appropriate geometric discounting. Simply dividing total performance by the number of years ignores the compounding that takes place throughout the investment process.

It is also difficult to compare two indices with different risk profiles. While the S&P 500 and the Nasdaq Composite may seem similar, the volatile nature of tech companies makes the Nasdaq riskier. To truly compare returns, investors would have to use a risk-adjusted return measure, like the Sharpe ratio.

Finally, while you can generally compare an index to its own previous levels, it’s important to be mindful of changes that may have taken place to the index over time. For instance, it is difficult to truly compare the Dow today with the Dow a century ago. The component stocks are simply too different. Truly understanding index performance requires understanding what additions and deletions have taken place during the specified period.

Factors Influencing Stock Market Indices

Factors that influence stocks will also influence stock market indices. However, since aggregating many different stocks together reduces the influence of individual business risks, indices tend to be primarily affected by macroeconomic considerations.

For instance, general market sentiment can strongly affect index performance. Investor sentiment, dubbed ‘animal spirits’ by economist John Maynard Keynes, can be a dominant factor in how stocks as a whole move. When investors sell off stocks, index levels will fall, reflecting lower prices for component stocks. Since an index decline indicates a general stock sell-off, commentators usually take this as an indicator of poor market confidence.

Economic indicators, as a standard macroeconomic factor, can also play a significant role in index performance. For instance, the Federal Reserve’s rate hiking campaign likely played a large role in the decline of many equity indices in 2022. As inflation has begun to cool, which indicated that rate hikes would ease, broad indices benefited. In general, indices are highly affected by indicators like unemployment, inflation, and GDP, due to the way these indicators inform investors about the business environment.

While individual company earnings are unlikely to greatly impact a broad index, earnings overall certainly do. If corporate earnings generally climb, stock prices as a whole are likely to rise. This will cause aggregate index levels to climb as well. Similarly, if an economic downturn causes earnings to fall, index levels are likely to fall as well. Investor presentations from corporate earnings events can sometimes impact indices as well, particularly for companies whose performance is indicative of overall consumer behavior.

While monetary policy from central banks can certainly impact indices, so too can government regulation. If the government decides to take a softer approach to business regulation, stocks are likely to benefit. Similarly, lowering corporate tax rates could be a boon for stock market indices. Like most factors being discussed, government policies will influence index levels through the way in which they impact stocks as a whole.

Finally, geopolitical events and global market factors will play a role in determining index levels. For instance, the war in Ukraine has had a significant impact on energy and agricultural markets, strongly impacting indices related to those sectors. Similarly, Covid-19 brought markets tumbling down early in the pandemic. Global events are a quintessential example of factors affecting index levels due to the way in which they can impact a broad swathe of stocks simultaneously.

Benefits and Limitations of Stock Market Indices

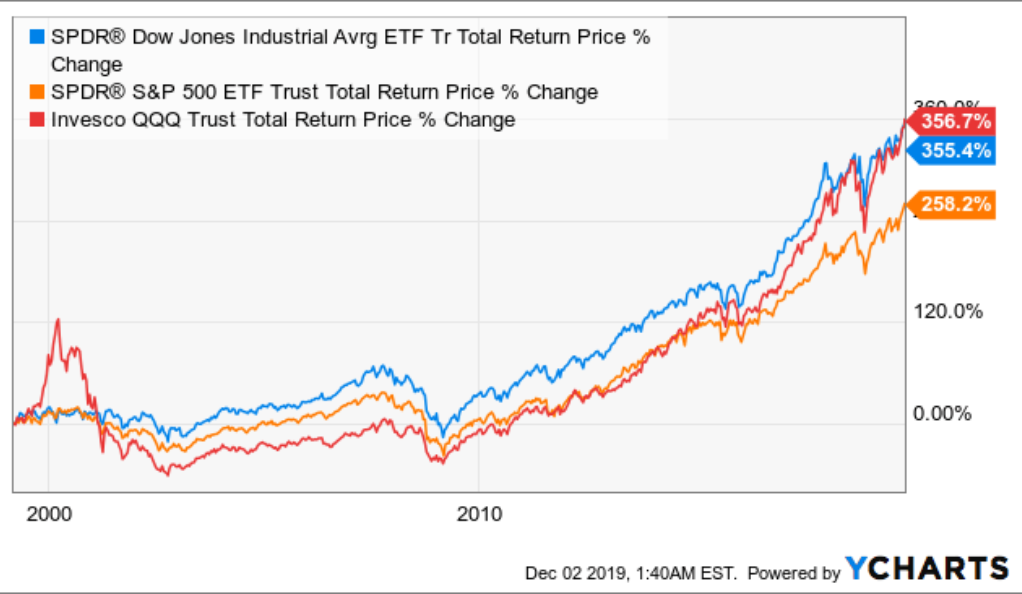

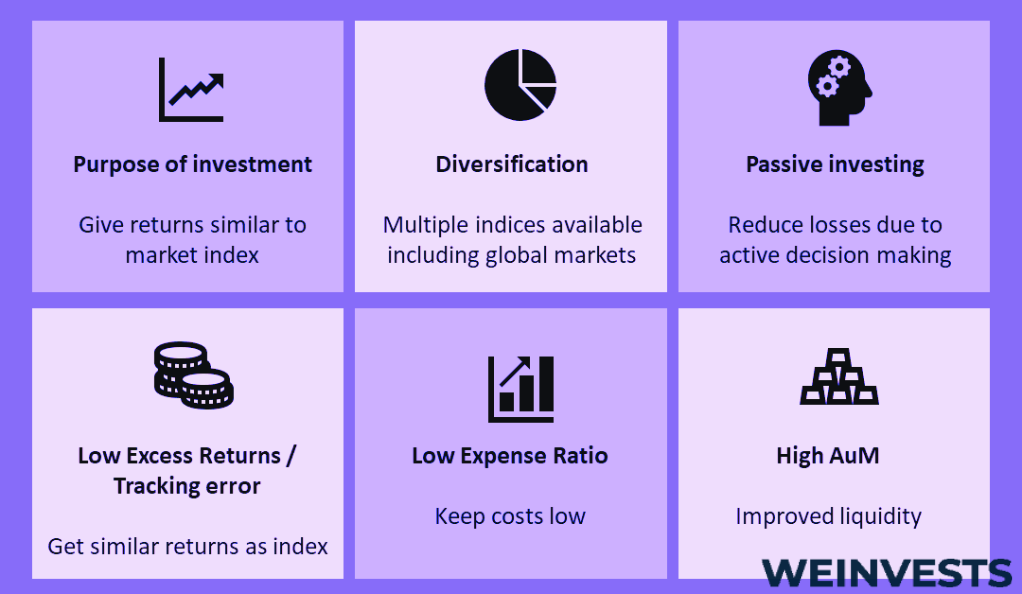

While investors cannot invest in stock market indices directly, they can do so through fund structures that track a benchmark index. For instance, while an investor cannot purchase a share in the S&P 500 Index, they can easily purchase an ETF like SPY that tracks the S&P 500.

Index-based investing has a number of benefits over traditional stock investing. For one thing, index investing has consistently been a high-performing investment strategy over the long term. Ultimately, an investor’s optimal strategy will depend on their risk tolerance and goals, but books like Burt Malkiel’s A Random Walk Down Wall Street provide convincing evidence about the strength of index performance.

Index investing also comes with immediate diversification. By purchasing a share of an index fund, an investor can get exposure to hundreds of underlying stocks. Since diversification is a powerful risk reduction strategy, this is certainly an advantage compared with purchasing a single share of stock.

At the same time, indices are not without some drawbacks. Some investors complain that index investing promotes “diworsification.” This is the process by which allocators add poor investments to a portfolio in the name of increasing diversification. For investors confident about being able to pick out bad investments, index investing may not be the best strategy.

Similarly, index investing comes with the risks inherent in equity investing. While exposure to a wide array of stocks can be beneficial, the stock market is ultimately a risky proposition. Investors that prefer stable investments should steer clear of stock market index investing.

Strategies for Index-Based Investing

For most investors, index-based investing could be a good investment strategy to consider. This section will provide a general overview of the basic factors involved in an index-based strategy.

The vast majority of index funds are passive investment vehicles. This means that the fund itself does not make decisions about which investments to hold and which to dispose of. Instead, the fund merely follows the benchmark index as closely as possible. Passive investing contrasts with active investing, where managers play a role in choosing investments.

Active index investing may seem like an oxymoron, but it denotes a specific strategy in which a manager will supplement an existing benchmark with their own views. This results in a portfolio that closely follows an index, but might tilt towards one specific industry or stock.

For most investors, active indexing likely undermines most of the benefits of passive indexing, but it could be an appropriate strategy for those who want a blend of each style. Investors should be mindful of the higher fees associated with active funds.

When it comes to selecting the index fund to purchase, investors can choose between an array of options. Most index funds are either mutual funds or exchange-traded funds (ETFs). The two structures are quite similar. ETFs, however, have some liquidity benefits when compared to mutual funds, and are also considered more tax efficient.

Since index funds grant immediate access to a broad crosscut of the market, they can be an effective tool to support market timing strategies. Market timing can be difficult to express through individual stocks since investors are exposed to the risks of specific businesses. The market exposure inherent in an index fund could therefore be beneficial to such a timing strategy.

Similarly, index funds can help investors and their advisors structure portfolios with strong asset allocation characteristics. Without index funds, portfolio construction could involve the purchase of dozens of different stocks, tailored for proper exposure to a specific market or sector. With index investing, that process is simplified to the purchase of just one fund.

Finally, investors should consider how dividend reinvestment plans can be effectively utilized with index funds. Reinvested dividends can have a significant impact on long-term performance. Usually, investors with dividends have to consider how to deploy their fresh capital in an effective manner. With a plan set up to reinvest index fund dividends back into the fund, however, this consideration becomes much simpler.

Summary of Stock Market Indices

Since being developed over a century ago, market indices have become increasingly popular in the modern world. Index providers structure benchmarks for many different industries and regions so that investors can accurately tailor their portfolios.

While the structure of each specific index may differ, stock market indices aim to aggregate the performance of a wide basket of stocks in a single measure. While understanding index calculations and figures can be difficult, they provide an effective method of navigating the market as a whole.

Investors considering index investing have a number of choices to make to determine their ideal strategy. In addition to the different fund structures available, investors will have to decide whether to stick with passive strategies or pursue active ones. As with all forms of investing, rewards do not come without risks. While index-based investing can be an excellent strategy for certain investors, stocks should always be considered a risky investment.

FAQ

Are index funds safe?

No investment is a sure thing, least of all stock market index funds. While index funds do offer some risk reduction through diversification, they still produce significant volatility, particularly index funds reflecting risky industries.

Is passive investing better than active?

The benefits of passive investing are well documented, with convincing research showing that lower fees and higher returns are associated with the practice. However, active investing has some benefits, including the inclusion of managerial oversight and the expression of specific investment styles.

Are ETFs or mutual funds better?

ETFs are commonly considered a better investment vehicle when compared to mutual funds. They are more liquid, as they trade on a stock exchange, and provide better tax flexibility. However, some strategies are better executed through mutual fund structures, so not all investors will prefer ETFs over mutual funds.

How do I invest in an index?

While you cannot directly invest in an index, there are a number of index funds through which you can get exposure to the underlying benchmark index. The most common index funds are ETFs or mutual funds. For investors with ample capital, it is possible to recreate an index in a portfolio through direct indexing.

Are index funds expensive?

Ultimately, the cost of any index fund depends on the specifics of the fund structure. Overall, however, index funds are cheaper than other types of funds. This is because index funds are predominantly passive vehicles, meaning investors do not have to pay a manager to make investment decisions.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More