This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The iShares iBoxx High Yield Corporate Bond ETF (HYG) is an exchange-traded fund that only has bonds as its holdings and seeks to track the investment results of an index composed of USD-denominated high-yield corporate bonds. It essentially is an investment vehicle quite similarly structured to mutual funds, which represents an equally diversified, still a lower-cost alternative. The benchmark index, which HYG aims to track is the Markit iBoxx USD Liquid High Yield Index.

Table of Contents

Characteristics, Performance Analysis, and Expectations

Characteristics

HYG is a liquid fixed-income asset class, providing its investors the opportunity of purchasing its shares quite like trading a regular stock. The key features of HYG are characteristic of many other bond ETFs – it is essentially a basket of many bonds issued by various enterprises, offering a diversified investment opportunity. Its key differences from the higher-grade bond ETFs like iShares Core U.S. Aggregate Bond ETF (AGG) or iShares iBoxx Investment Grade Corporate Bond ETF (LQD) are:

- The holdings have lower ratings, hence are perceived to bear a relatively higher level of risk.

- It offers a comparatively higher dividend yield, given the above point.

- Finally, the number of the fund’s holdings currently totaling around 1,200 is a much smaller range than in other above-mentioned ETFs.

Apart from that, it has a less attractive expense ratio compared to AGG and LQD, which however is still much lower than the management costs related to equal high-yield mutual funds.

Like any other iShares fund, HYG was launched back in April 2007 and is managed by BlackRock. It offers a portfolio of non-investment grade bonds, so its holdings are perceived to be less creditworthy than investment grade bonds held by other ETFs like AGG, LQD and some others.

This ETF currently has the below structure:

- Nearly 55% of its assets are in BB-rated bonds,

- Around 33% are in B rated.

- The rest are invested in lower-rated bonds.

As of now, the volume of the net assets of HYG amounts to USD 18.5 billion, which includes all of its bond holdings, cash, and other reserves. This makes it a medium-sized fund within the ETF universe.

At the same time, HYG offers an annual dividend yield of 4.72% as of date, paid out monthly.

Generally, ETFs are traded like usual company stocks, based on their per-share price at a given moment, which is called net asset value (NAV) for exchange-traded funds. The fund’s NAV is calculated based on the difference between the ETF’s total assets and liabilities, which is defined as the fund’s total net assets (TNA). Then the amount of TNA is divided by the total number of outstanding shares to arrive at the actual NAV at the opening or closing of the market. Thus below are some key numbers for the fund:

- The TNA amount makes USD 18.5 billion as of now.

- It is distributed through 1,200+ corporate bond holdings.

- The number of outstanding shares is 243.0 million units.

- HYG’s closing share price was USD 76.16 per piece at the closing of the last trading day

- Its weighted average maturity is currently calculated to be 5.07 years.

The distribution of the fund’s holdings through various industries is concentrated in the following five areas which make up over 74% of its total holdings:

- Consumer cyclical

- Consumer non-cyclical

- Capital goods

- Energy

- Communications sectors

Performance Analysis

The beginning of the year 2023 looks promising for HYG with a +4.11% year-to-date (YTD) rise in its share price. Indeed, it’s driven by the overall market rebound following the previous year-end drop and is based on some positive expectations like a slow-down in the inflation rates in the U.S. and across the world.

In fact, the main benchmark indexes have been moving in the same direction so far, positioning themselves within a range of 1.8-3.2%, thus HYG’s results look much better compared to the average performance in the market.

If we try to compare the 15+ year performance of the iShares iBoxx High Yield Corporate Bond ETF since inception with the rest of the market and other bond ETFs in particular, then we will realize that HYG had a quite volatile ride since the beginning.

It has seen major ups and downs, especially during the global financial crisis of 2007-2009, during the Covid pandemic, as well as last year among huge inflationary and related interest rate hike pressures.

Expectations

Based on HYG’s historical performance and its key features, our forecast for the rest of 2023 is that it may continue its volatile performance. This is primarily due to recession expectations and uncertainty of the pace of global economic recovery, so investors should rather stay cautious entering higher risk instruments, which are typically also more sensitive to adverse economic news.

In case if after conducting your own research, you may decide to invest in HYG, then you would need to check whether your country appears on BlackRock’s white list. This can be done on their website. Provided a positive result, your next step could be opening a direct brokerage account for trading BlackRock’s products, also purchase of iShares iBoxx High Yield Corporate Bond ETF’s shares among others.

Nevertheless, if your country isn’t on the eligibility list, then you still have two other options. Firstly, if you already use another brokerage account, like any of the known online platforms – eToro, Interactive Brokers, Trading 212, or else to name a few, then you should simply try to type and search for the “HYG” as a ticker symbol. If you however don’t have any access to mentioned brokerage platforms, then the last option remaining would be to approach your banking institution with a question, of whether it would be possible to acquire shares of this ETF through their services.

If you’re looking to invest in iShares iBoxx High Yield Corporate Bond ETF, eToro is an excellent choice. In this mini-guide, we will walk you through the steps to open an account on eToro and invest in iShares iBoxx High Yield Corporate Bond ETF.

Step 1: Open an Account

To begin, navigate to eToro’s homepage (https://www.etoro.com/) and click on the “Sign Up” or “Join Now” button. You will be directed to the registration page, where you’ll need to provide your personal details, such as your name, email address, username, and password. Additionally, you may be asked to complete a short questionnaire to assess your trading experience and knowledge. Once you have submitted your information, you will receive a confirmation email to activate your account.

Step 2: Upload ID

To verify your identity, you will need to upload a proof of identity document. This could be a government-issued ID card, passport, or driver’s license. Navigate to the “Upload Documents” section of your eToro account, and follow the instructions provided. Make sure the document you upload is clear and readable, with all relevant information visible. After submitting your document, eToro will review and verify your identity, usually within a few business days.

Step 3: Make a Deposit

Before you can start investing, you will need to fund your eToro account. Go to the “Deposit Funds” section of your account and select your preferred payment method. eToro accepts a variety of payment options, including credit/debit cards, PayPal, Skrill, Neteller, and bank transfers. Follow the on-screen instructions to complete the deposit. Keep in mind that there may be a minimum deposit requirement depending on your country and chosen payment method.

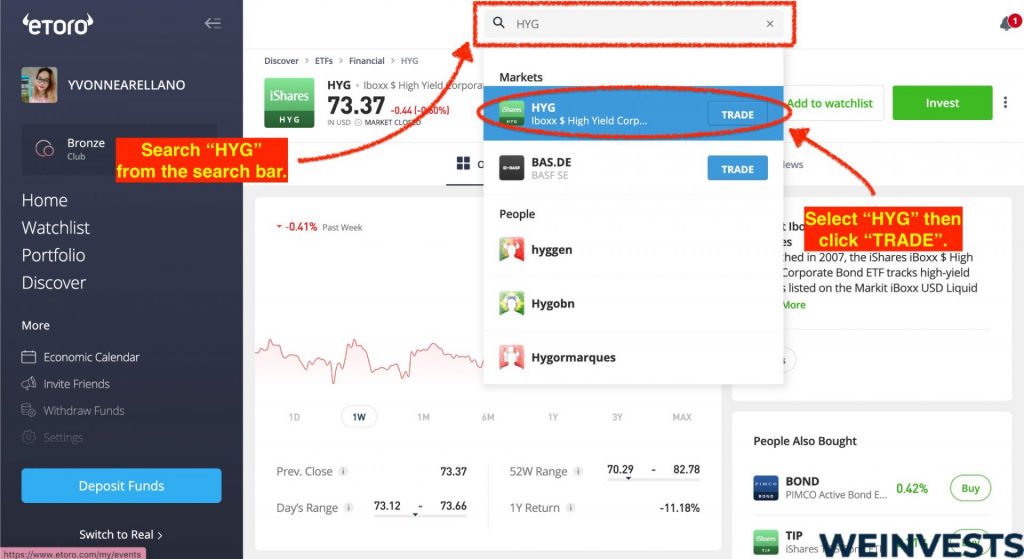

Step 4: Search for HYG

Once your account is funded, you can start searching for the iShares iBoxx High Yield Corporate Bond ETF. To do this, use the search bar at the top of the eToro platform and type in “iShares iBoxx High Yield Corporate Bond ETF” or the ticker symbol “HYG.” The search results will display the ETF, and you can click on it to access its dedicated page.

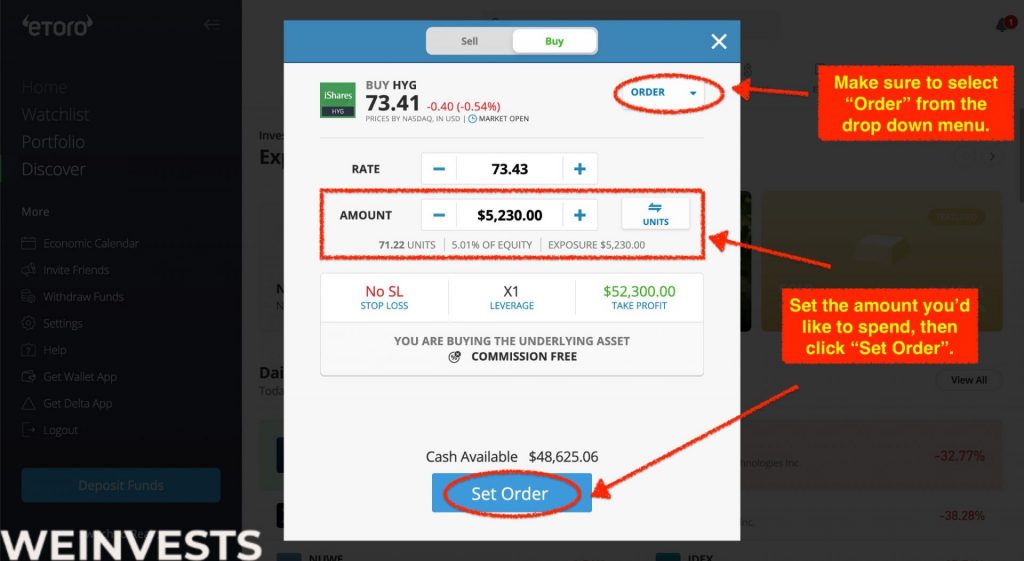

Step 5: Trade HYG

Now that you’ve found the iShares iBoxx High Yield Corporate Bond ETF on eToro, you’re ready to invest. Click on the “Trade” button to open a new order window. Here, you can set the amount you wish to invest, choose whether to apply leverage (if available), and set stop loss and take profit levels as desired. Once you have reviewed your order, click on “Open Trade” to complete the transaction. Your iShares iBoxx High Yield Corporate Bond ETF investment will now be added to your eToro portfolio.

By following these steps, you can easily open an account on eToro and invest in iShares iBoxx High Yield Corporate Bond ETF. Remember to regularly monitor your investments and make adjustments as needed based on market conditions and your personal financial goals.

Risks associated with HYG

Market Risk

The market risk covers many key factors related to the financial markets: level and duration of inflation, interest rate hikes or drops, supply-demand-driven volatility in the share prices, leading global currency rate changes, as well as economic or political turbulences.

Since the iShares iBoxx High Yield Corporate Bond ETF is mainly holding bonds issued by various companies, deterioration of their business results along with any negative news on their capacity of debt-servicing or financial credibility will certainly have an impact on the fund’s health and its share price respectively.

Therefore, before undertaking investment moves towards acquiring shares of HYG, it is strongly recommended to conduct your own research aiming to understand the market and also other risks associated with such investment decisions, as these may reduce the quality of your portfolio, causing potential capital losses.

Credit Risk

In talking about credit risk, we understand the risks associated with probable failures in payment of outstanding obligations by the contractual parties, which in the case of bond ETFs would be the corporations issuing these debt securities. As a fixed-income vehicle like HYG holds only bonds, it is exposed to thousands of counterparties, which may possibly default meeting their financial liabilities in part or even fully, given certain business circumstances.

Moreover, as we are dealing with non-investment grade bonds here, the probability of default of issuing entities may occur ranging from low to moderate. Therefore, it is important to look deeper into the ETF’s holdings to understand how high the credit risk could be in this case, before taking any investment decisions in favour of HYG.

Liquidity Risk

If compared to others, the liquidity risk is quite simple to understand. It appears in form of limitations, like time delays or discounts of the portfolio value that you may face, when trying to trade your shares once you decide to cash out your investment. In the case of iShares iBoxx High Yield Corporate Bond ETF, the liquidity risk is considered to be relatively low provided its credibility, diversification level, as well as large share turnover every trading day.

Valuation Risk

As the name itself tells you, the valuation risk may impact the accurate pricing of a given investment product, causing possible deteriorations and thus misleading the investment decisions of potential investors. However, financial instruments such as equity or bond ETFs (in this case – HYG), typically involve low valuation risks, because those are mainly traded in stock exchanges and hence the share price is defined by the forces of supply and demand.

Nevertheless, you should keep in mind that depending on the ETF’s holdings there are always business-related, political, or macroeconomic circumstances, which may negatively impact HYG’s share prices.

Risk Summary

| Risk | Relatively Low | Average | Relatively High |

| Market Risk | – | – | X |

| Credit Risk | – | – | X |

| Liquidity Risk | – | – | X |

| Valuation Risk | – | – | X |

Conclusion

The iShares iBoxx High Yield Corporate Bond ETF is an exchange-traded fund that tracks the Markit iBoxx USD Liquid High Yield Index as its benchmark. HYG can afford higher dividend payouts compared to other ETFs holding investment-grade bonds, as the issuing companies not having a BBB or higher rating should naturally offer a better return on investment (ROI) to attract investors.

This ETF is established and passively managed by BlackRock, therefore offering a medium-level expense ratio of 0.48%. It is above the cost levels of other comparable bond ETFs, given the higher dividend yields paid by the fund. HYG is one of the most commonly used high-yield bond ETFs, which has broad exposure to a wide range of U.S. high-yield corporate bonds. Potential investors of HYG would be looking for above-industry average and frequent income flows.

It should be emphasized that compared to other bond ETFs like AGG or LQD while offering a better return in form of a higher dividend yield, an investment in HYG shares also involves bigger volatility and higher risks of capital loss. Therefore, you should make sure that it matches your risk appetite as an investor, upon digging deeper into the ETF’s portfolio and its financials.

Frequently Asked Questions

Provided that HYG is composed of non-investment grade U.S. corporate bonds (currently around 1,200 holdings), it is quite diversified, however more costly than existing alternatives with an expense ratio of 0.48%. This ETF is not necessarily the best option to consider, given its higher volatility since inception, if compared to similar bond ETFs. Especially in current times of uncertainty, investors may wish to be more aware of involved risks to avoid possible capital loss in their portfolios.

How does HYG afford to offer higher-than-average dividends?

If we take a look at the holdings of this ETF, we will notice that nearly 88% of those are concentrated in financial instruments rated BB or B. The remaining portion is distributed even further down the rating ladder. The involved issuing corporations have to therefore offer better yields for their bonds to attract investors, which secures a respective income flow for HYG. This is how the fund manages to pay higher dividends for its shares.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More