Stock screeners play a crucial role in modern investment research, helping traders and investors navigate the vast and dynamic world of financial markets. These powerful tools provide a systematic approach to filtering and analyzing stocks based on specific criteria.

By employing a wide range of parameters such as market capitalization, sector, price-to-earnings ratio, and dividend yield, stock screeners enable users to identify potential investment opportunities and make informed decisions. By swiftly sifting through vast amounts of data, these screeners provide an overview of the market, allowing investors to narrow down their choices and focus on the stocks that align with their investment goals and strategies.

Understanding Stock Screeners

Stock screeners are invaluable tools in the world of investment research, helping traders and investors make informed decisions. There are three primary types of stock screeners: fundamental, technical, and combination. Fundamental screeners evaluate stocks based on fundamental factors such as earnings growth, revenue, debt levels, and valuation metrics. Technical screeners, on the other hand, focus on price and volume patterns, chart indicators, and trends, catering to traders who rely on market momentum and technical analysis. Combination screeners incorporate both fundamental and technical factors to provide a comprehensive analysis, appealing to investors who seek a balanced approach.

The benefits of using stock screeners are manifold. Firstly, they save time and effort by quickly narrowing down a universe of stocks to those that meet specific criteria. Secondly, screeners provide objectivity by eliminating biases and emotions from the decision-making process. Thirdly, they enable investors to uncover hidden opportunities and avoid potential pitfalls by screening for specific parameters tailored to their investment strategy. Lastly, stock screeners help investors stay disciplined and consistent in their investment approach, fostering a systematic and well-informed decision-making process.

Setting Investment Goals

When using a stock screener, it is essential to define your investment objectives, risk tolerance, and investment time horizon. Investment objectives clarify what you aim to achieve, such as capital growth, income generation, or preservation of capital. Risk tolerance assesses your willingness to withstand market volatility and potential losses. Identifying your investment time horizon determines the length of time you plan to hold your investments. By understanding these factors and incorporating them into the stock screener’s parameters, you can tailor your search for stocks that align with your goals. This ensures that the screening process generates results that are suitable for your specific investment needs and preferences.

Selecting a Stock Screener

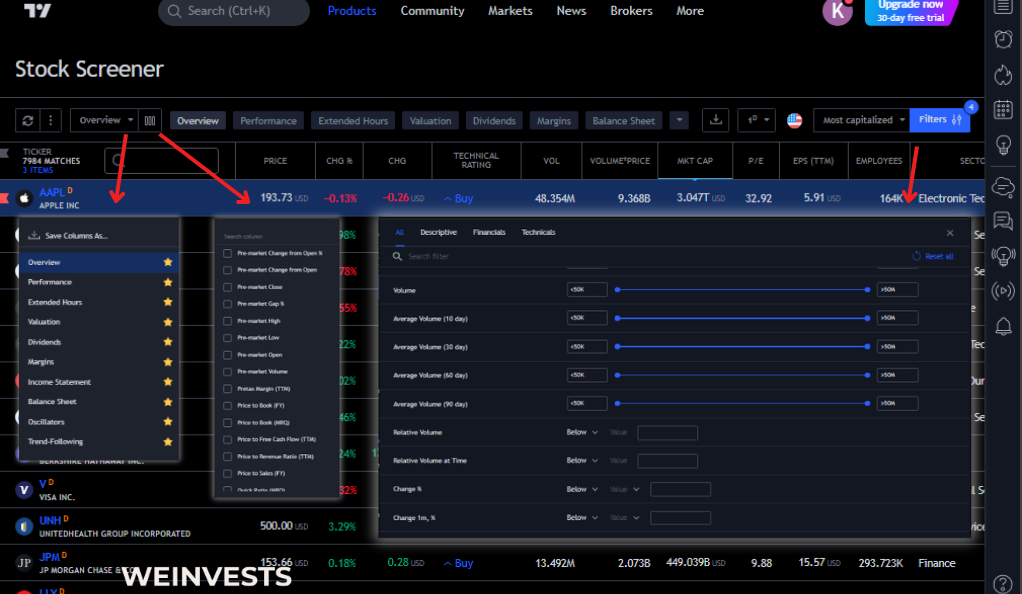

When selecting a stock screener, several factors should be considered to ensure you choose the right platform for your investment research needs. First and foremost, consider the availability and reliability of data. A good stock screener should provide accurate and up-to-date information on stocks, including financial metrics, news, and market data.

Another crucial factor is the range of screening criteria and customization options. Look for a stock screener that offers a wide array of parameters such as valuation ratios, growth metrics, industry-specific filters, and technical indicators. The ability to customize and save screening criteria allows you to fine-tune your search and save time in the future.

When it comes to popular stock screening platforms, several notable options stand out. Finviz is a popular choice known for its extensive screening capabilities, including both fundamental and technical criteria. It provides powerful visualization tools and real-time market data.

Another popular platform is StockFetcher, offering a wide range of pre-defined screens and the ability to create custom screens using their formula language. StockFetcher also provides backtesting functionality to assess the performance of your screens.

For more advanced traders, Trade Ideas is renowned for its sophisticated screening algorithms and real-time scanning capabilities. It offers a wide range of built-in strategies and incorporates artificial intelligence to generate trade ideas.

Criteria Selection

When utilizing a stock screener, several key criteria for stock selection should be considered. Financial ratios and metrics play a crucial role in evaluating a company’s financial health and performance. Some important ones include price-to-earnings ratio (P/E), price-to-sales ratio (P/S), return on equity (ROE), and debt-to-equity ratio (D/E). These ratios provide insights into valuation, profitability, and leverage.

Additionally, setting minimum trading volume and market capitalization thresholds is vital. Trading volume ensures liquidity and ease of buying or selling a stock, while market capitalization reflects the size and stability of a company. Setting appropriate thresholds based on your investment strategy and risk tolerance helps filter out illiquid stocks or those with a smaller market presence.

Fundamental Analysis with Stock Screeners

When using a stock screener, it’s crucial to evaluate financial statements and ratios to analyze company fundamentals and performance indicators effectively. Start by reviewing income statements, balance sheets, and cash flow statements to understand the company’s financial health, revenue, expenses, and cash flow.

Next, analyze key financial ratios such as profitability ratios such as gross profit margin, net profit margin, liquidity ratios including current ratio, quick ratio, and solvency ratios like debt-to-equity ratio, interest coverage ratio. These ratios provide insights into profitability, liquidity, and financial stability.

Additionally, consider performance indicators like earnings growth, revenue growth, return on investment (ROI), and market share. These indicators help gauge the company’s growth potential and competitive position. You can use a stock screener to filter companies based on specific financial ratios and performance metrics that align with your investment goals and risk tolerance.

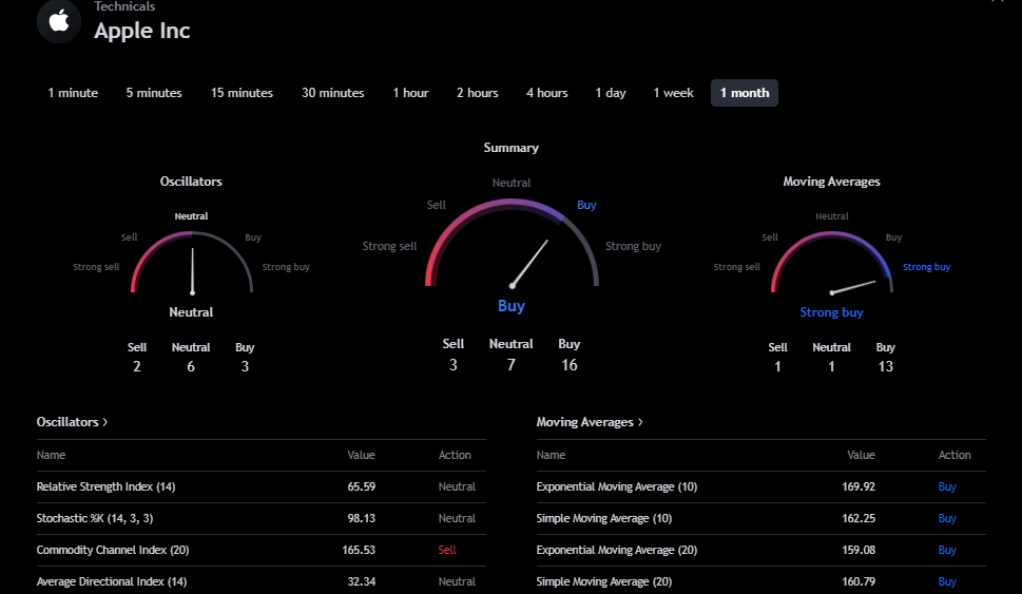

Technical Analysis with Stock Screeners

Understanding chart patterns and technical indicators is crucial when utilizing a stock screener for technical analysis. Chart patterns, such as support and resistance levels, trendlines, and chart formations, provide insights into market sentiment and potential price movements. Technical indicators, such as moving averages, relative strength index (RSI), and MACD, offer quantitative tools to identify trends, momentum, and overbought/oversold conditions.

By using a stock screener, investors can scan for stocks that exhibit specific chart patterns or meet certain technical indicator criteria. This enables them to identify potential entry or exit points and make more informed trading decisions.

Combining technical analysis with a stock screener allows investors to filter through a wide range of stocks, focusing on those that align with their preferred chart patterns or technical indicators. This approach enhances the decision-making process, enabling traders to capitalize on market trends and optimize their trading strategies.

Creating Customized Stock Screeners

Tailoring stock screeners to individual investment strategies involves adding custom filters and parameters to refine the search for stocks that align with specific criteria. Whether focusing on value investing, growth stocks, dividend yield, or other strategies, customizing the stock screener allows investors to narrow down the results to their desired investment opportunities. By adding filters such as specific financial ratios, sector preferences, market capitalization ranges, or minimum trading volume requirements, investors can fine-tune the screening process to their unique investment goals and risk tolerance. This customization enhances the effectiveness of stock screeners by providing tailored results that match individual investment strategies, leading to more informed investment decisions.

Refining and Adjusting Screens

Regularly reviewing and adjusting screening criteria is a crucial aspect of using a stock screener effectively. As market conditions change and investment goals evolve, it’s important to reassess and refine the parameters to ensure they remain aligned with your investment strategy. Additionally, incorporating feedback and learning from past investment experiences allows you to fine-tune the screening process based on real-world outcomes. By analyzing the performance of the stocks identified through the screener, you can identify strengths and weaknesses in your criteria and make necessary adjustments. This iterative process of reviewing, adjusting, and learning enhances the effectiveness of the stock screener and improves the quality of investment decisions over time.

Interpreting Screened Results

Analyzing and interpreting the output from stock screeners is essential for identifying potential investment opportunities and risks. The results generated by a stock screener provide a list of stocks that meet specific criteria, but it’s crucial to dig deeper. Evaluate the fundamental data, financial ratios, and performance metrics of the selected stocks to assess their financial health, growth prospects, and valuation. Consider external factors like industry trends, economic conditions, and competitive landscape. Identify potential risks, such as high debt levels, declining revenues, or industry disruptions. By thoroughly analyzing the output from stock screeners, investors can make well-informed decisions, identifying promising investment opportunities while being aware of potential risks that may impact their investment thesis.

Performing Due Diligence

When using a stock screener, conducting in-depth research on selected stocks is a critical step to validate investment decisions. Beyond the screening criteria, investigating company news, industry trends, and competitors provides a comprehensive understanding of the potential investment.

Start by exploring company news and announcements to stay updated on recent developments, such as product launches, earnings reports, or management changes. This information can shed light on the company’s performance and future prospects.

Next, analyze industry trends and dynamics to assess the growth potential and competitive landscape. Consider factors like market demand, regulatory changes, and technological advancements that may impact the company’s position in the industry.

Furthermore, researching competitors is crucial to understand the company’s relative strengths and weaknesses. Compare financials, market share, and strategic initiatives to gauge competitive advantages and potential risks.

By conducting thorough research beyond the initial screening results, investors can gain valuable insights, validate investment hypotheses, and make more informed decisions. This diligent approach enhances the effectiveness of the stock screener, ensuring that investment choices are backed by a holistic understanding of the selected stocks and their broader market context.

Risk Management Strategies

Implementing risk management techniques is crucial when using a stock screener to identify potential investment opportunities. One effective strategy is setting stop-loss orders and profit targets. A stop-loss order allows investors to define a predetermined price level at which they will sell the stock to limit potential losses. This helps protect capital and manage risk in case the stock price moves unfavorably. On the other hand, profit targets define the desired level of gain at which investors will sell a stock to secure profits. By setting profit targets, investors can ensure they capture gains and avoid holding on to a stock for too long, potentially missing out on potential returns. These risk management techniques provide discipline and structure to the investment process, helping investors maintain a balanced approach and mitigate the impact of market volatility.

When utilizing a stock screener, it is essential to incorporate these risk management techniques into the investment strategy to protect against downside risk and optimize potential returns. Remember, risk management is a critical aspect of successful investing, and combining it with the power of a stock screener can lead to more informed and prudent investment decisions.

Monitoring and Tracking Investments

Establishing a monitoring system for tracked stocks is vital for ongoing portfolio evaluation. Once stocks are selected using a stock screener, it’s important to regularly monitor their performance. This includes tracking key financial metrics, news updates, and market trends that may impact the stocks’ prospects. By setting up alerts and notifications, investors can stay informed about significant developments.

Additionally, utilizing stock screeners for ongoing portfolio evaluation helps identify potential opportunities for rebalancing or adjusting positions based on changing market conditions or shifts in investment goals. A well-designed monitoring system, combined with the power of stock screeners, allows investors to actively manage their portfolios, make informed decisions, and optimize their investment performance.

Performance Evaluation

Assessing the performance of stocks screened through a stock screener and analyzing the impact of investment decisions is crucial for evaluating the effectiveness of the screening process and refining future investment strategies.

To begin, compare the actual performance of the selected stocks against the expected outcomes based on the initial screening criteria. Analyze the returns, profitability, and volatility of the chosen stocks over a defined period. This evaluation helps determine the accuracy of the screening parameters in identifying successful investments.

Furthermore, conduct a post-mortem analysis to identify the factors that influenced the performance. Evaluate company-specific news, industry trends, and broader market conditions to understand the drivers behind the stock’s performance. This analysis provides insights into the impact of investment decisions and helps refine future screening criteria.

Consider the potential risks and shortcomings of the screening process as well. Were there any missed opportunities or stocks that underperformed? Assessing the impact of these factors can help improve the screening methodology and enhance future decision-making.

By regularly reviewing the performance of screened stocks and analyzing the impact of investment decisions, investors can refine their approach, identify areas for improvement, and optimize their portfolio strategy. This iterative process of evaluation and adjustment strengthens the effectiveness of stock screeners, leading to more informed and successful investment outcomes.

Summary and Key Takeaways

Stock screeners play a crucial role in investment research by providing a systematic approach to filter and analyze stocks based on specific criteria. They save time, provide objectivity, and uncover hidden opportunities. When using a stock screener, it is important to establish investment goals, select appropriate criteria, and refine the screening process. Customization, data reliability, and user-friendly interfaces are key factors in choosing a stock screener. Fundamental and technical analysis can be performed using stock screeners, allowing investors to assess financial health, growth prospects, and market trends. Risk management techniques, such as setting stop-loss orders and profit targets, help manage risk and optimize returns.

Ongoing monitoring and performance evaluation of selected stocks are essential for portfolio management and refining investment strategies. Regularly reviewing and adjusting screening criteria based on feedback and past experiences enhances the effectiveness of stock screeners. By utilizing stock screeners effectively, investors can make informed decisions, identify potential opportunities, and optimize their investment performance.

FAQ

What are the best stock screeners available for beginners?

Finviz: Finviz is a widely recommended stock screener for beginners. It offers a user-friendly interface and a variety of screening criteria, including both fundamental and technical parameters. It provides real-time market data, powerful visualization tools, and customizable filters.

Yahoo Finance: Yahoo Finance offers a free stock screener that is easy to navigate and suitable for beginners. It provides access to a wide range of financial data and allows users to set screening criteria based on various fundamental and technical factors. Yahoo Finance also offers additional features like news updates and portfolio tracking.

StockFetcher: StockFetcher is known for its simplicity and intuitive interface, making it beginner-friendly. It offers both predefined and customizable screens, enabling users to filter stocks based on specific criteria. StockFetcher also provides technical analysis tools and the ability to create custom formulas for advanced screening.

TradingView: TradingView is a popular platform that offers a powerful stock screener with a user-friendly interface. It provides real-time data, customizable filters, and the ability to save and share screens. TradingView also offers advanced charting and technical analysis tools.

Zacks Research Wizard: Zacks Research Wizard is a comprehensive stock screener that offers a user-friendly interface and a variety of screening options. It provides access to Zacks’ extensive database and research reports. While it has a subscription fee, it offers a range of features suitable for beginners seeking in-depth analysis.

How often should I review and adjust my screening criteria?

Investors should review and adjust their screening criteria periodically, typically every few months. This allows them to adapt to changing market conditions, align with their investment strategy, and incorporate learnings from their experiences. However, the frequency can vary depending on individual preferences and market dynamics.

Can stock screeners predict future

Stock screeners cannot predict the future. Stock screeners are tools that assist investors in filtering and analyzing stocks based on specific criteria, such as financial ratios or technical indicators. They provide objective data and help identify potential investment opportunities based on historical information. However, they do not have the ability to predict future stock prices or market movements. Investment decisions should be based on a combination of factors, including thorough research, analysis, and consideration of market dynamics. While stock screeners can provide insights and assist in the decision-making process, they do not guarantee future performance or predict future outcomes in the stock market.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More