Pros

- Commission-free options trades, stock and ETFs.

- Wide array of research providers.

- Excellent customer service.

- Expense-ratio-free index funds.

- Intuitive and easy-to-use mobile app.

- Tradable securities.

Cons

- The broker-assisted trade fee is comparatively high at $32.95.

- No access to commodities, futures, or cryptocurrency trading

- Accounts are limited to the residents of America and the Main Island.

- Compared to competitors, Fidelity’s options fees are higher.

| 💻 Trading Platforms | Active Trader Pro, Fidelity Mobile, and Fidelity.com platforms with access to various markets and instruments |

| 📞 Customer Service | 24/7 support via phone, email, or online chat |

| 🎁 Promotions/Bonuses | Free trades for new accounts with qualifying deposits; cash bonuses for referrals; rewards programs for eligible accounts |

| 🛡 Regulation | Regulated by FINRA and SIPC |

| 💵 Deposit/Withdrawal Methods | Various payment methods; no minimum deposit to open an account; no withdrawal fee |

| 📊 Spreads/Commissions | No commissions on online US-listed stock, ETF, and options trades; low commissions on mutual funds, bonds, and CDs |

| 🔒 Security | Segregated funds; SSL encryption; firewalls; anti-virus software |

| 📚 Education/Resources | Webinars, videos, articles, etc.; research tools, screeners, calculators, etc |

| 📱 Mobile Trading | iOS and Android app with all Fidelity.com features and functions |

| ⚡ Execution Speed | Fast and reliable execution with low latency and minimal slippage; various order types |

| 🔧 Trading Tools/Indicators | Moving averages, Bollinger bands, Fibonacci retracement, etc. |

| 🌍 Country/Region Availability | US residents only |

| 💰 Account Minimum | No minimum deposit to open an account; $2,000 minimum deposit to trade on margin |

| ⚖ Leverage/Margin Requirements | Up to 4:1 intraday and 2:1 overnight leverage on marginable stocks |

| 📈 Asset Selection/Market Access | Over 10,000 instruments across stocks, ETFs, mutual funds, options, futures, forex, bonds, and CDs |

They get top points thanks to their no commissions on ETF trades or stock and a range of no-expense-ratio index funds that’s perfect for all kinds of investors.

Table of Contents

- Pros

- Cons

- About Fidelity Investment

- Types of accounts offered

- Range of Investment Opportunities

- Base currencies

- Payment method

- Fees & commissions

- Platforms & tools

- Account opening

- Deposit/Withdrawal Experience

- Customer service & support

- Education & Learning Resources

- Research & analysis

- Regulatory Compliance & Security

- Conclusion

About Fidelity Investment

The company was established in Boston in 1943 and currently has about 40 million investors. That’s not all, the broker has $9.6 trillion in administration, 3.1 million daily trades, and $3.6 trillion in discretionary assets.

The company’s guiding principle is “Take intelligent risks rather than follow the crowd,” which stands true to this day. They actively invest in systems and they launch new innovations for their online trading platforms.

Let’s see the kind of accounts they offer;

Types of accounts offered

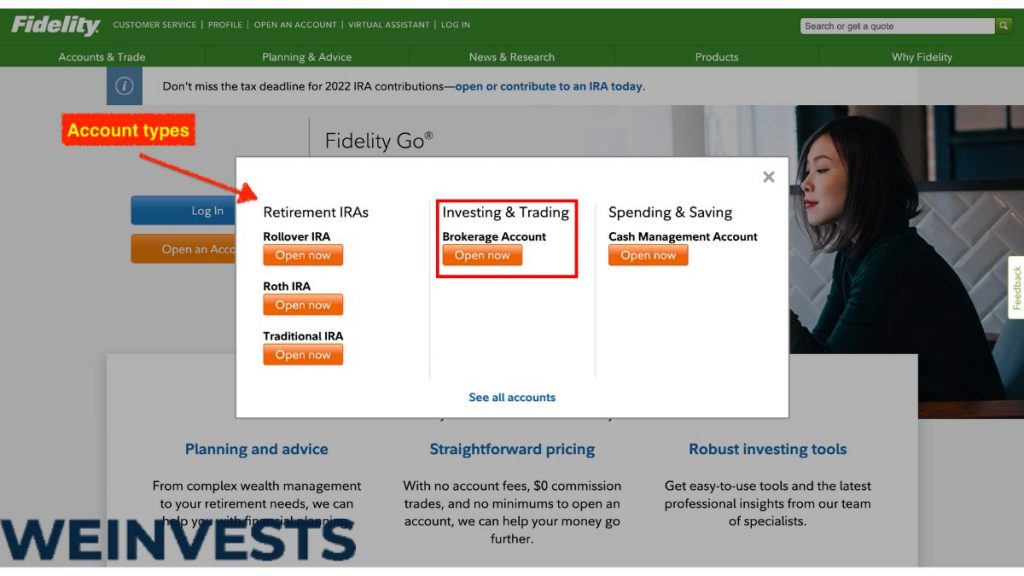

Fidelity offers a wide range of accounts. However, we are after the accounts dedicated to trading and investing.

This is a brokerage account that comes with full features and it has no minimums or account fees. Users can trade exchange-traded funds (ETFs), options online and US stocks for no commissions. To top it up, clients can access several investments like bonds, mutual funds, IPOs, CDs, and more.

This is a low-cost brokerage account that offers investors mutual funds, comprehensive trading, and great cash management features.

This is a brokerage account for investors that want FDIC insurance to cover their cash balances. It’s a perfect alternative to conventional checking.

Range of Investment Opportunities

The range of investment opportunities Fidelity offers is quite impressive. It’s one of the few brokers that leaves users spoilt for choice. Here are some to consider;

Interest on cash

Automatically, fidelity clients are enrolled in cash sweep programs that offer nominal interest rates.

Margin interest

The margin interest rates of this broker are somewhat below average when compared to other brokers. According to Fidelity, the rate is fixed at 12.075 percent for accounts below $25,000.

Payment for order flow (PFOF)

A practice called PFOF (payment for order flow). How is this done? They simply direct equity and options orders to the investors. For equity trades, Fidelity doesn’t accept PFOF but it gets an average of $0.11/options contract.

Base currencies

When it comes to base currencies, Fidelity stands out as it offers a wide selection of base currencies clients can choose from. Currently, there are 16 base currencies and they are;

US Dollar, EURO, Great Britain Pound, Australian Dollar, Canadian dollar, Danish Krone, Hong Kong dollar, Japanese Yen, Mexican Peso, New Zealand dollar, Norwegian krone, Polish zloty, The South African rand, Singapore dollar, Swedish krona and the Swiss franc.

Payment method

Clients can receive and send funds with their Fidelity accounts thanks to a variety of on-the-go services the broker offers. Their payment apps are secure, and they offer users the needed privacy to transfer funds into their accounts. Here are some payment methods Fidelity offers;

- ATM/Debit card services

- Mobile payments: This broker has several e-wallets like Paypal, Venmo, Apple pay cash, Square cash, Google pay, and Samsung pay integrated into its systems.

- Bill Pay.

- Check writing: users can manage and access funds from their Fidelity account with deposit slips, free checks, and they can upload online images of their cleared checks. This is one of the several features grouped with their full-service and free Cash Management Account.

Fees & commissions

Fidelity’s fees and commissions are so good that it’s ranked highly among the Best for Low-Cost category each year. For American. ETFs and stocks, the broker offers commission-free trading with no account fees. In addition, there are no minimum deposits when customers want to open a retail brokerage account.

Here are some of Fidelity’s fees customers should be aware of:

- For starters, this broker does not charge commissions for ETF, online equity, OTCBB trades and options.

- For a 50 options contracts order, the fee is $32.50. However, it costs $65 to open and close 50 options contracts. This means the client pays on each side of the trade.

- Per-contract options fee is fixed at $0.65.

- Funds that aren’t in the no transaction fee program for mutual fund commissions are fixed at $49.95 on the trade. However, the buy/sell doesn’t attract a charge.

- It costs $3.25 for 500 shares plus five contracts covered call.

- For accounts below $25,000, the margin interest is fixed at 12.075 percent. Also, breakpoints of 11.575 percent for accounts with a balance below $50,000. For accounts with a balance below $100,000, it’s 10.625 percent; 10.575 percent for balances below $250,000; 10.325 percent for balances below $500,000; 8.00 percent for balances below $1 million; and 7.75 percent for accounts with more than $1 million.

- There are no charges for inactivity, software, account transfer or closure, domestic wires, exercise/assignment, checks, trade confirmations, or paper statements.

- There are exchange fees for most orders. Typically, they’re less than a penny per contract or share, which the broker passes along to the customer.

- For some mutual fund families, including CGM, Vanguard, Sequoia funds, and Dodge & Cox, are charged $75 on the initial purchase.

- Live broker fee per trade is $32.95.

- International trades incurs different fees, so it’s important to look carefully at the commissions before entering the order.

Platforms & tools

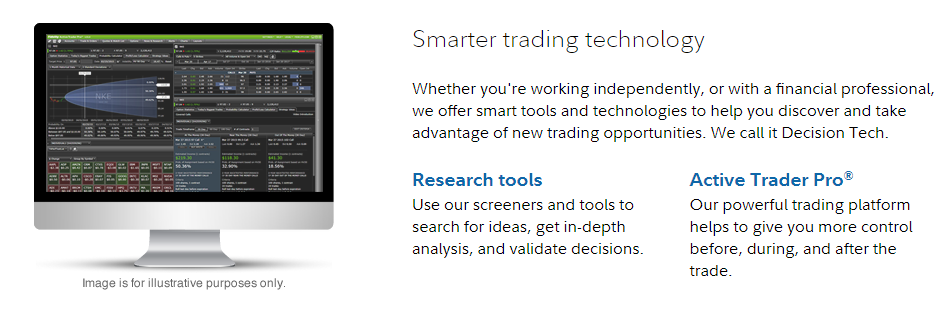

Fidelity offers three platforms and they can be used at the same time. Each platform provides news and stock quotes. However, the web platform doesn’t show this data in real-time.

However, there’s every possibility it will not appeal to active traders and investors. They’d most likely lean towards Active Trader Pro, a downloadable trading platform of Fidelity.

Active Trader Pro has several more features and tools compared to the web platform. The best part is that it’s customizable. Expert traders that want to use tools to analyze options, and advanced features like conditional orders, will always go for Active Trader Pro.

The mobile app is available for iOS, Android, Amazon, and Google devices and has several similarities with Active Trader Pro. However, the mobile app doesn’t support conditional orders or fixed-income trading.

In general, navigation is intuitive across all platforms Fidelity offers. However, the website has several sub-menus that may not be easy for newbie investors to get the hang of. For more tech-savvy users, Fidelity has a watch app where clients can view quote history and in-depth, real-time quotes for options, stocks, mutual funds and ETFs. Also, the watch app provides notifications for price triggers and orders.

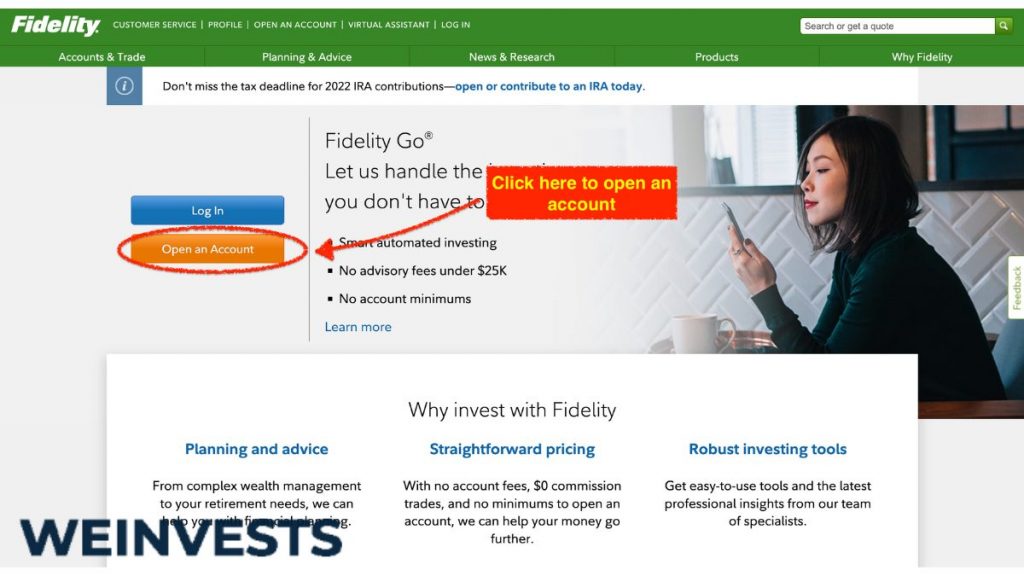

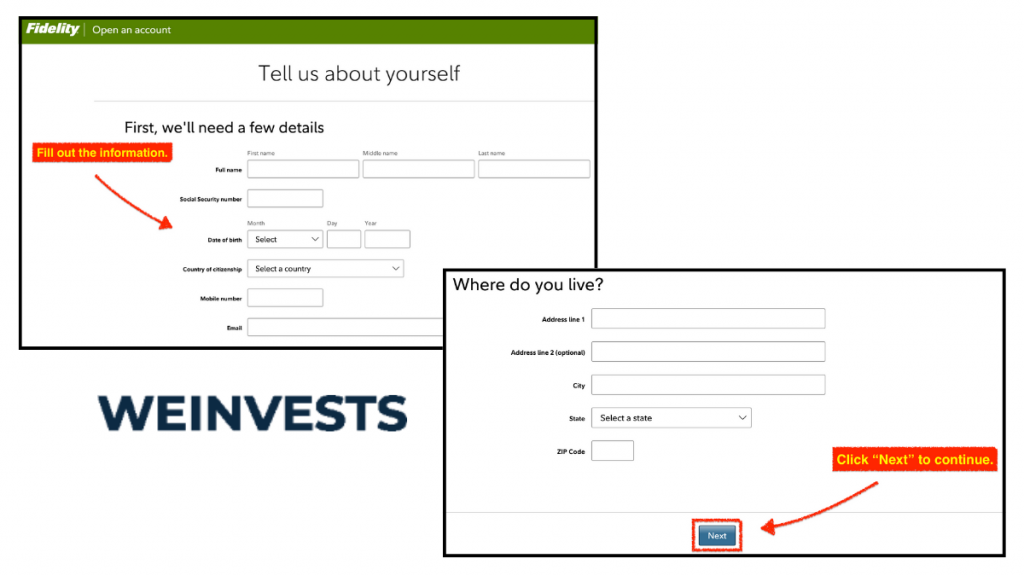

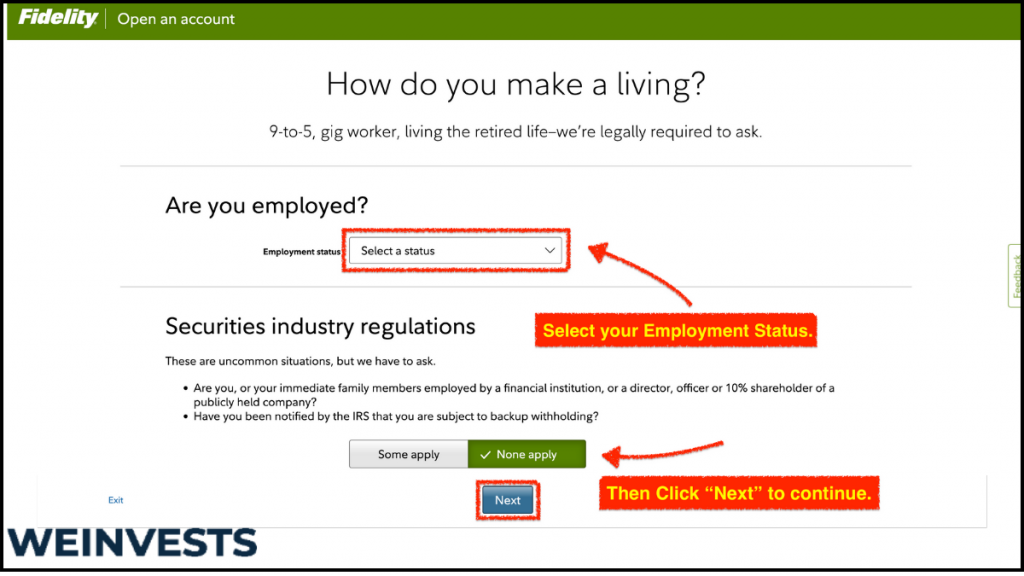

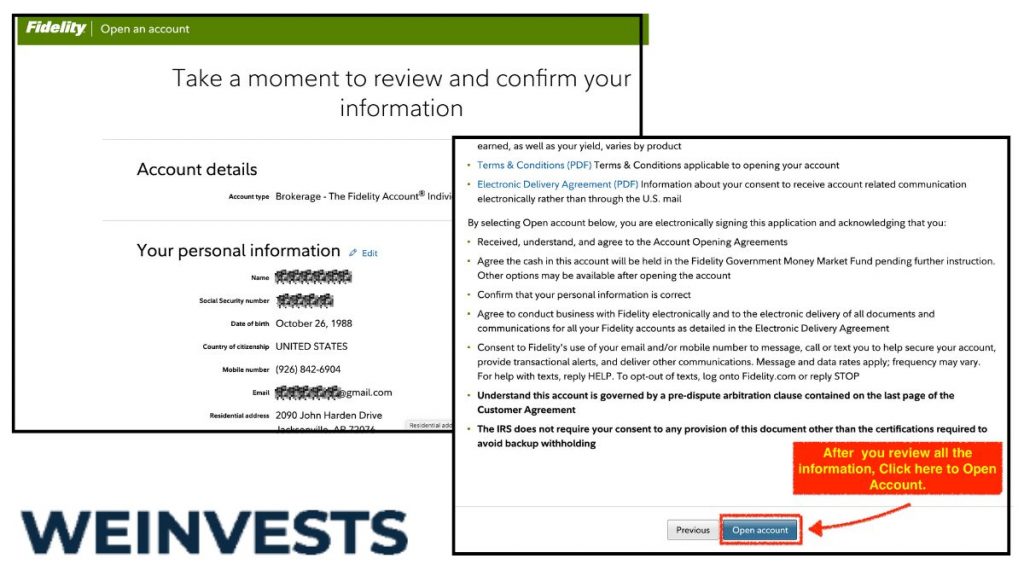

Account opening

Opening a Fidelity account is user friendly, there’s no minimum deposit and users can also choose from a wide selection of account types. Surprisingly, account verification is slow to some extent.

Setting up a Fidelity account is friendly-user if the user follows the standard process i.e. provide the documents most brokers request – mailing address, employment information, Social Security number – before the account is created.

For existing customers, they can easily create a new account, and they can have several account types for various purposes. Clients who want to trade on margin or options need to fill out extra forms and get approval, just like other brokerage accounts.

Deposit/Withdrawal Experience

As stated earlier, Fidelity doesn’t charge deposit fees. In that regard, clients can use wire transfer, check, electronic (ACH), Venmo, or PayPal to deposit funds. However, credit and debit cards aren’t available for deposits.

In addition, Fidelity gives users a feature called Bill Pay as an extra service. This service allows them to make payments and manage bills with their brokerage account, but it comes with a subscription. Bank transfer can take several business days – 2 business days, to be precise – although credit/debit card payment is instant.

For the ACH transfer, it takes 2 business days before the funds land and users can only deposit funds from accounts in their name. There are no withdrawal fees when using USD wire withdrawal or ACH, while it costs 3 percent for non-USD withdrawals.

Customer service & support

Getting in touch with customer representatives they have physical Investor centers that can be found across the United States. Fidelity has;

- A live chat with an agent

- 24/7 phone line

- Users can communicate with a live broker. Note that there’s a surcharge for all trades placed through the broker.

- A Fidelity Virtual Assistant i.e. a chatbot.

- Support email

- Walk-in branches

Education & Learning Resources

Fidelity has tons of education and learning resources made available to users. They can get the required assistance on the fundamentals of personal finance – saving, budgeting, and managing debt. However, users have to note that financial education exceeds advice and planning.

At the learning center of Fidelity, users can attend or view recorded webinars. These resource detail almost all aspects of options, funds and trading, and how to use the tools the broker offers, like Active Trader Pro. There are also brief courses ranked in order of skill level to help them as they advance and gain mastery.

Research & analysis

This online broker provides an extensive list of research and analytic resources for all kinds of investors. Even for non-Fidelity customers, they can check these resources out for free and use them as they wish.

Research: the Fidelity website has a vast amount of useful information for its users. By navigating to the page for a specific stock, a user can get competitor analysis, financial data, reports and news on each stock from a range of 3rd party research companies, including Thomson Reuters, Argus, Zacks, CFRA, and more.

In addition, they’ll get access to SEC filings and several market commentary sources. That’s not all, they’ll get more ETF reports. The best part is that this site has a clean layout that’ll make it easy for users to find what they’re looking for.

Regulatory Compliance & Security

Fidelity has various companies that offer and distribute investments to its clients worldwide. Each company and subsidiary are regulated and authorized by the Financial Conduct Authority (FCA).

This regulatory body requires Fidelity to have the appropriate controls and systems to manage its business. They also have strict rules that mandate Fidelity on how to hold client assets and money.

This broker is also covered by investor protection together with negative balance protection in certain jurisdictions.

Conclusion

In all ramifications, To put this in perspective and to show how good their service offerings are, Fidelity unseated Charles Schwab as the Best Broker for ETFs. Also, Fidelity has outstanding market platforms available to all their users, be it web, mobile devices or PCs.

Lastly, Fidelity doesn’t hesitate to leverage its already strong market position to enhance its stellar product. They do this while continuing to maintain very low administrative costs and fees. They don’t charge a commission or fee on ETF trades or stock. Also, Fidelity offers customers options, mutual funds, OTCBB (penny stocks), currencies, and fixed-income products such as corporate, treasury, municipal bonds, agency, and CDs.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More