Recently, it is becoming more and more popular to think about cryptocurrencies, making it hard to believe that they did not even exist 15 years ago!

The first cryptocurrency ever created was Bitcoin, developed and launched by an anonymous person named Satoshi Nakamoto in 2009. Since then, thousands of other cryptocurrencies have been introduced every year and the phenomenon has become more popular than ever.

Nowadays, cryptocurrencies are a great way for traders to diversify their portfolios and expand their reach. In this article, you will learn everything you need to know about cryptocurrencies as a stock trader trader to successfully navigate this fascinating world.

Table of Contents

- Understanding Cryptocurrency

- Cryptocurrency Markets vs Stock Markets

- Getting Started with Cryptocurrency Trading

- Understanding Cryptocurrency Trading Strategies

- Risk Management in Cryptocurrency Trading

- Technical Analysis for Cryptocurrency Trading

- Fundamental Analysis for Cryptocurrency Trading

- Tax Considerations for Cryptocurrency Trading

- Preparing for the Future: Trends in Cryptocurrency Trading

- Conclusion

- FAQ

Understanding Cryptocurrency

Cryptocurrencies are decentralized digital currencies that rely on an encryption system to secure transactions. More specifically, cryptocurrencies have the same function as fiat currencies as a store of value, unit of measure, and medium of exchange, but they are “decentralized,” meaning they are not issued by a government or central bank.

Instead, cryptocurrencies are usually issued by developers, and to ensure some validity, all transactions of the coin are registered in the blockchain. The blockchain is a large ledger where information is recorded in encrypted format.

More specifically, transactions are recorded in the blockchain in blocks. You can think of the blockchain as a series of small boxes that are connected to each other. Initially, the information is recorded in the first block. When the block is full, it is locked, encrypted, and connected to the next block where future information will be stored.

This way, blockchain technology ensures that once the block is encrypted, the data is secure and cannot be changed in the future.

Discover new investment possibilities with eToro. Explore the world of digital assets, understand blockchain technology, and experience eToro’s user-friendly interface for seamless cryptocurrency trading. Expand your portfolio and embrace the future of finance with eToro.

Cryptocurrency Markets vs Stock Markets

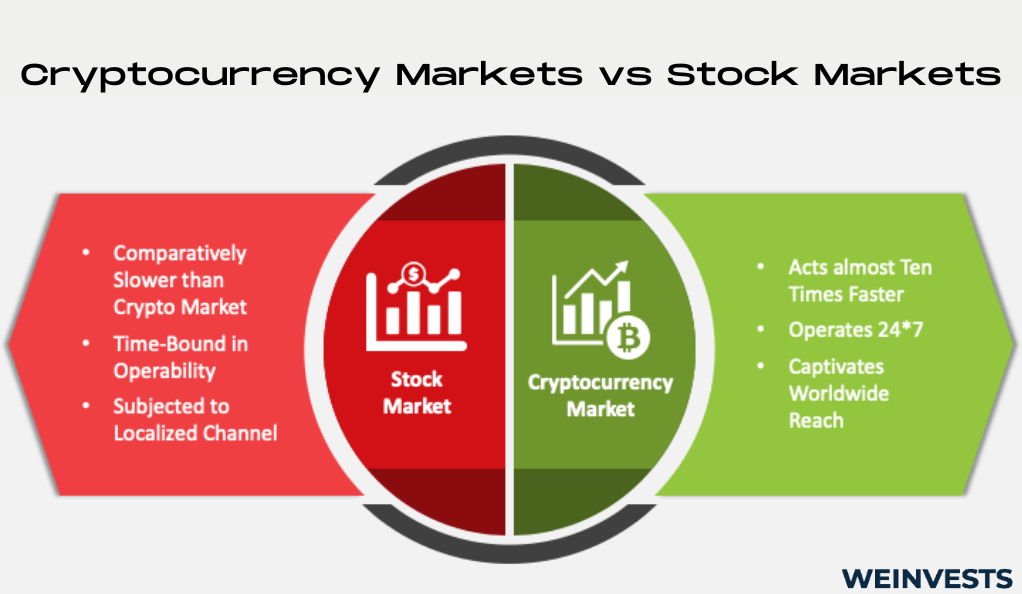

Overtime, the cryptocurrency markets and the stock markets are becoming more and more similar but, to this date, they still have many differences.

The first difference is the fact that cryptocurrency markets are still much less regulated than stock markets, which leads to cheaper and faster transactions and account openings.

Moreover, unlike stock markets that have limited trading hours, it is possible to trade cryptocurrencies around the clock, even during holidays. For this reason, it might be worthwhile for a stock trader to enter cryptocurrency trading, as it increases the number of trading hours and the opportunities to open a position.

A final difference is that the composition of the stock market is very rigid, which means that it is not often that new entrants enter the market or that a company issues new shares. The cryptocurrency market, on the other hand, is much more volatile and fluid. New cryptocurrencies are introduced to the market every day and other opportunities present themselves much more frequently.

Getting Started with Cryptocurrency Trading

Getting started trading cryptocurrencies requires the same steps as opening a stock trading account. The first requirement is to find a good cryptocurrency broker. It is therefore extremely important to read the fine print and do research on the broker’s reputation and reliability.

The second step is to open an account and fund it with fiat money. Usually, this step is much faster than opening a stock trading account and funding it, which can take up to two weeks.

The final step is to find a suitable opportunity and place a buy order for the chosen cryptocurrency. Once the order is executed, the cryptocurrency is deposited in your wallet, where the user’s private keys are stored to protect the cryptocurrencies.

However, it is important that you protect your wallet credentials as there is no way to recover them if they are lost for security reasons.

Understanding Cryptocurrency Trading Strategies

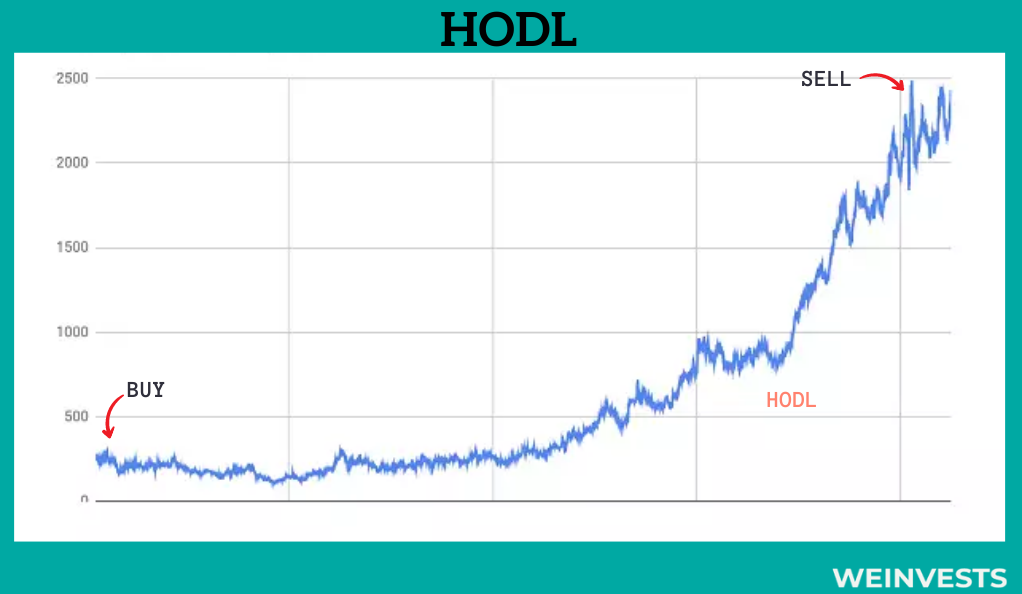

Just like in the stock market, there are two main types of investment strategies in the cryptocurrency markets.

The first is to hold for the long term, which is also known as the HODL strategy. HODL is a misspelling of hold and the acronym stands for “Hold On for Dear Life”. This strategy was coined in 2013 when the bitcoin price was extremely volatile, but some investors believed that in a few years, the price would be much higher than the $950 at that time.

For this reason, the strategy of holding a coin for a long period of time became popular, especially for safer and more stable coins that have a reasonable growth perspective. Besides, this method also brings significant tax benefits, as positions held for more than a year are taxed at a lower rate.

The second, equally popular strategy is day trading. The main advantage of day trading over HODL is the fact that traders can also take advantage of meme coins and other extremely volatile currencies to make additional profits in a short period of time.

Moreover, the rule of pattern day trading does not apply to cryptocurrencies, so stock day traders can gain significant benefits from entering crypto trading.

Risk Management in Cryptocurrency Trading

Despite the many advantages of cryptocurrency trading and its volatility, it can also happen that it is difficult to manage and there is a risk of suffering significant losses.

The first step to limiting the risk is to understand where the volatility comes from. Unlike stocks, where the price is tied (more or less) to intrinsic value and the price tends to rise when the value of the company rises, it is much different for cryptos.

On the other hand, cryptocurrencies have no fundamental value because they do not represent a company’s share of ownership. Since most cryptocurrencies have a maximum amount of tokens they can issue, the price is simply the result of fluctuations in demand due to a fixed supply.

Therefore, the volatility is higher for meme coins or other cryptocurrencies that are backed by a celebrity or other types of advertising.

However, it is still possible to profit from volatility if proper risk management strategies are applied. The most common strategies include setting a stop-loss order, doing thorough research before buying, diversifying the portfolio, and hedging the position in case of a downturn.

Technical Analysis for Cryptocurrency Trading

Just as in stock trading, it is possible to perform technical analysis when trading cryptocurrencies. Technical analysis consists of recognizing chart patterns, candlestick patterns and using indicators.

Chart patterns are the general structures that emerge on the market and allow predicting with some probability the price movements of the coming days. These chart patterns can be identified by looking at a chart and tracing trend lines and support and resistance zones. The most common patterns are double top or double bottom, wedge, channel up, channel down, breakouts and many more.

The second parameter used in technical analysis are candlestick patterns. After determining the chart pattern, candlesticks can be used to predict price reversals and breakouts with greater accuracy. In addition, candlestick shadows can also be used to determine resistance and support zones with greater accuracy. The most common candlestick patterns are engulfing candles, pin bars, tweezers and more.

Finally, the last step of technical analysis is using indicators. These tools can be helpful in determining the strength of a move or the likelihood of a reversal. The most common indicators are the RSI, MACD, MA and EMA, and the force index.

Fundamental Analysis for Cryptocurrency Trading

In addition to technical analysis, it is also possible to perform fundamental analysis before buying a cryptocurrency, although there are some key differences here.

A fundamental analysis for stock trading consists of looking at the numbers generated by the company and then determining if the current price offers a great buying opportunity based on the actual value of the underlying.

When trading cryptocurrencies, fundamental analysis is fundamentally different because there is no underlying asset and therefore there are no profits or losses. It first consists of assessing the value of the cryptocurrency based on the number of tokens, the demand for the cryptocurrency and other parameters that are considered relevant.

Then, when we consider whether a cryptocurrency is a good buying opportunity, we have to take into account the news and updates from regulators, as these markets are not as developed as the stock markets. For this reason, there are often new regulations that can significantly impact the profitability of a trade

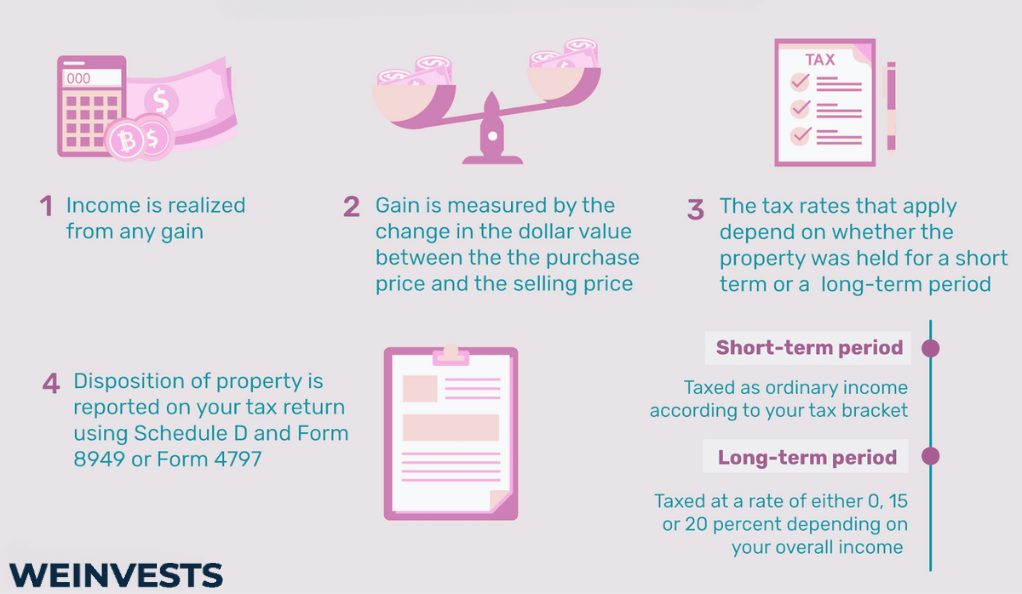

Tax Considerations for Cryptocurrency Trading

According to a 2014 decision by IRS, it was determined that cryptocurrencies should be taxed as capital assets, not currencies. Therefore, just like stocks and bonds, they would be subject to capital gains tax and ordinary income tax.

More specifically, a trader or investor will have to pay taxes once they sell their position and make a surplus over the original investment amount. Depending on the duration of the position, it can then be determined whether the surplus must be subject to a capital gains tax rate or a normal income tax rate.

If a position has been held open for more than 1 year, the relevant tax rate is the capital gains tax rate, whereas the normal income tax rate is applied if the open position has lasted less than this period.

The main difference between the two is the fact that the capital gains tax rate (maximum 20% in the US) is significantly lower than the ordinary income tax rate (usually, 37% in the US). Therefore, when planning to open a position, it must also be taken in consideration the tax benefits of holding it for more than one year.

Preparing for the Future: Trends in Cryptocurrency Trading

Since cryptocurrency markets are a relatively new invention, there are many innovations and technological developments in this area. For example, if in 2009 the only cryptocurrency that existed was Bitcoin, today we know that there are not only thousands of them, but also different types of them, including altcoins, stablecoins, tokens, and meme coins.

Each of these cryptocurrencies has its own advantages and disadvantages when it comes to trading. The only certainty is the fact that new trends will continue to emerge in the coming years as this technology becomes more and more popular.

It is enough to think that NFTs have entered the market in recent years, while Bitcoin and Ethereum have upgraded their structures with the Lightning Network and Shapella upgrade, respectively. These upgrades aim to lower transaction costs and increase both the volume and speed at which traders can exchange these currencies.

For this reason, stock traders should keep a close eye on cryptocurrency markets as they continue to improve and grow in importance, considering that the market capitalization of cryptocurrencies has surpassed $1 trillion.

Conclusion

In conclusion, we must acknowledge the growing importance of cryptocurrencies, which are becoming an integral part of our society. They are not only the result of a strong innovation and technology process, but also the result of the search for an alternative currency that is not regulated by central banks.

Although cryptocurrencies can have some drawbacks when it comes to investing, such as the risks of new regulation or high volatility, they can also be a great investment opportunity for stock traders.

And since it’s relatively easy to get started, you might as well jump on the bandwagon and see what all the hype is about!

FAQ

Is cryptocurrency trading similar to forex trading?

Cryptocurrencies are considered a mixture of stocks and currency pairs. For example, cryptocurrencies are taxed under the same rules that apply to the taxation of stocks. On the other hand, cryptocurrencies are not affected by the patter day trading rule, just like forex pairs.

How can I protect my investments from the volatility of the cryptocurrency market?

The best way to protect against volatility is to be extra cautious when evaluating a potential buying opportunity. Next, set up a stop loss and diversify your investment portfolio to hedge against sector-specific downturns.

What are the best resources for staying updated on cryptocurrency news?

Thanks to the popularity cryptocurrencies have gained recently, you can find plenty of free resources online to keep up with cryptocurrency news. CoinDesk and Cryptonomist, for example, are two of the most popular online newspapers dedicated exclusively to cryptocurrencies.

How do I choose the best cryptocurrency exchange for trading?

Choosing the best cryptocurrency exchange for trading often depends on personal preferences and it is difficult to find a universal solution. However, the best recommendation is to read the fine print about fees and commissions, and then find out about the crypto exchange’s reputation and reliability.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More