This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Options trading is a strategic type of activity for many traders and investors, since it’s often used as a hedge against unexpected market behaviors. Moreover, traders and investors use options as a financial instrument that can be exchanged on different online brokers, but it’s the right broker for your needs that can make the difference in your trading and investing.

In this guide, we will provide you with information on the popular and reliable brokers currently available for options trading.

Top Options Trading Platforms 2023

Here’s a list of the options trading platforms in 2023 — scroll down to see a detailed review for each of them!

- eToro – Best overall

- Avatrade – Best for forex options trading

- Interactive Brokers – Best for trading tools and platforms

- Fidelity – Best for variety of choice

1. Options Trading on eToro – Best overall

Despite the fact that eToro Options is not available in every country, and sometimes available only to traders and investors with an adequate experience, eToro still has features and a variety of tools that can help to enjoy a smoother experience with options trading.

One of the main features is, for sure, the intuitiveness of its platforms – both online and mobile – and the amount of data available to traders and investors, who can benefit from it to make informed choices.

eToro Options charges no fees to US customers – which is quite unusual – and a $0.65 per contract for non-US clients – a price in line with market average. Regulatory fees apply – like the $0.002 fee applied by the FINRA.

An interesting feature of eToro Options is draft trading: users can what would be the outcome of the contract if it were in the market. The available assets are stocks and ETFs options.

Moreover, the copy trading feature is available also when it comes to options trading, giving traders and investors the opportunity to see what professionals are doing with specific assets.

- Copy trading

- Intuitiveness

- Wide variety of choice

- eToro might result more expensive if compared to other online brokers

- Advanced tools are not as many as the basic tools

- eToro Options is not available everywhere

2. Avatrade – Best for forex options trading

Avatrade doesn’t only offer forex options trading at competitive costs, but also focuses on strategies involved in options trading and investing.

Users can choose among 13 strategies that involve puts and calls and combinations – for which costs and spreads are further reduced.

Moreover, the broker offers a strategies guide for users who want to better navigate the available opportunities and create an options strategy that perfectly fits their needs.

The trading platform, which is highly customisable, also shows the level of risk of trades, to allow traders and investors make even more informed choices and assess if the strategy is in line with their plans and budgets.

AvaTrade uses a propietary trading platform to allow users to set up all these strategies and develop their activity as traders – AvaOptions. The platform also includes a demo account and provides real-time data and prices.

- Customisable trading platforms

- Low costs

- High number of strategies

- Guide for traders and investors

- Only forex options available

- Advanced tools and strategies might not fit the needs of beginners

- Minimum deposit required

3. Interactive Brokers – Best for trading tools and platforms

Interactive Brokers is particularly appreciated by traders and investors for the wide choice of trading and analysis tools provided, as well as for the trading platforms it provides.

Interactive Brokers provides four different platforms, which can fit the needs of traders with different levels of experience – along with the API points of the broker.

Moreover, the commissions concerning options are lower or in line with the average commissions applied to options trading – starting from $0.15 per option.

There are more than 30 global markets available for options.

Interactive Brokers is interesting also because of the tools it provides to write options. There are many tools traders can use to further optimize their activity:

- Rollover Options Tool – This tool scans the open positions of the trader and untomatically writes options for uncovered stocks;

- OptionTrader – This platform shows data related to the underlying assets and allows users to manage orders;

- Options Strategy Builder – With this tool, traders can create strategies and combinations and use predefined combinations;

- Options Strategy Lab – This tool allows traders to create combinations according to forecasts based on market data and volatility.

- Several markets available

- Commissions as low as $0.15 per option on U.S. markets

- Wide variety of trading platforms and tools

- Interactive Brokers is not available in all countries

- Lower costs are often linked only to U.S. markets

- Opening a new account could be more complex than on different brokers

4. Fidelity – Best for variety of choice

Fidelity is a broker that gives traders and investors a wide variety of financial instruments for investing and extensive education and trading tools.

The broker offers several types of orders, along with different levels of options that traders and investors choose according to their experience in the field.

Commissions are in line with market average – $0.65 per option. Traders and investors can use one of the trading platforms integrated with the brokers – different versions are available for trading online, on desktop or mobile – and a dedicated tool for options – the Option Trade Builder, which can be used to open orders and set different strategies.

The broker also provides more complex tools and strategies through a paid plan, OptionsPlay, which also takes into account income and income potential.

- Extensive educational tools available

- High number of trading platforms

- Wide variety of instruments and orders

- A dedicated tool for options trading

- Even if Fidelity offers both basic and advanced tools, there are even more opportunities but with paid plans

- Commissions are in line with those offered by other brokers, so it’s not among the less expensive brokers

- Beginners might find it hard to navigate all the available opportunities

How we test our brokers

We factor in many elements to list and rank the online brokers we propose. Elements strictly related with trading and investing activities – like fees, commissions and functionalities – and aspects that can influence the experience of users – like regulatory aspects and intuitiveness and availability of educational tools and trading platforms.

First off, we consider regulated brokers: especially for those that operate at a global scale, it is important to consider their licenses and how they tailor their offers according to the market where they operate – since not all financial instruments can be available everywhere.

Then, the fee and commissions structure: it is important for traders and investors to consider this aspect, since it can particularly affect their budget. Moreover, it is important to be aware of possible hidden costs and the business models used by the different brokers.

Variety of choice – in terms of financial instruments – and intuitiveness of the platforms are other important points: traders and investors often need to decide quickly, but this shouldn’t negatively affect their freedom of choice.

We consider these parameters when we test the different brokers, in order to provide you with reliable information and help you make informed decisions.

What is Options Trading?

In simple terms, options give traders the right, but not the obligation, to buy or sell an asset at a specific price. Options consist of contracts: the contract includes information like the price at which the trader or investor wants to buy or sell the financial instrument, and the expiration date of the contract.

The trader or investor can decide what to do with the asset within that date. So, options are derivative financial instruments: the underlying asset is the asset that can be traded.

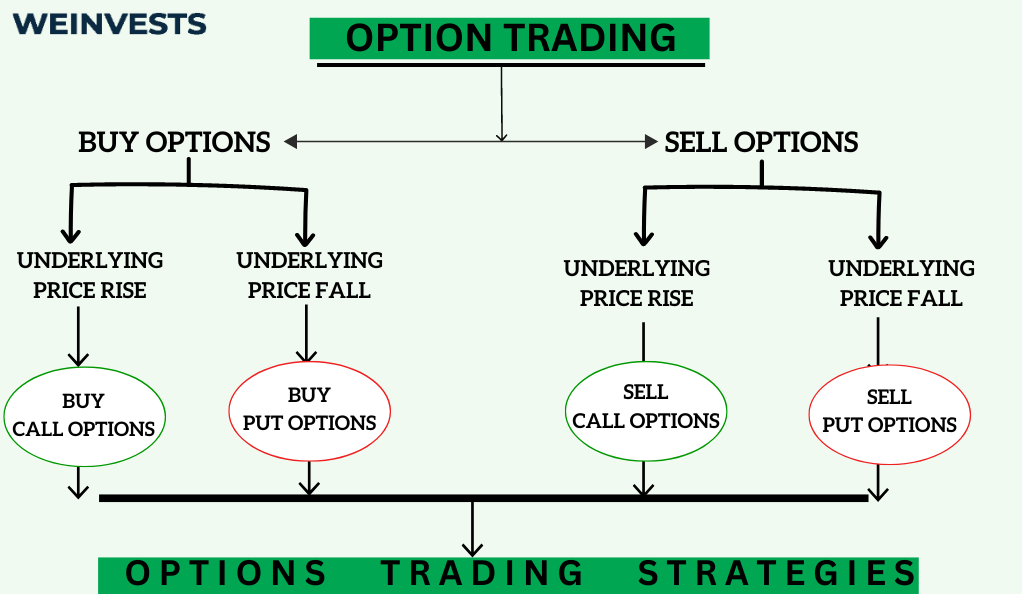

Options can be roughly divided into two types of contracts: calls and puts. Call options give the right to buy the underlying asset at a specific price within the expiration date. On the contrary, puts give them the right to sell.

As we mentioned at the beginning of this article, options are often used as a risk management tool: traders and investors can protect their investments by opening orders that are usually opposite to the ones they opened with other financial instruments, in order to protect their budgets from unexpected market behaviors.

Options are also used as speculative assets by many traders. In any case, they require a good knowledge of trading and investing techniques, as well as risk management strategies, and accurate research.

How are Options different from CFDs?

Both options and CFDs are derivative financial instruments – that is, they base their price on an underlying asset. In both cases, traders and investors get the right to trade the underlying asset, but in quite different ways.

With CFDs, traders and investors can choose to buy or sell, go long or short, and leverage can be a double edged sword – they can improve possible profits, but also increase the level or risk involved in the trade. Traders and investors, when choosing what to do with the CFD, are soon exposed to market risks.

On the other hand, CFDs can be considered less complex financial instruments, which can fit the needs of both beginners and experienced traders and investors.

Options are far more complex. Even if they can be categorized into two main categories, puts and calls, there are several combinations the trader or investor can use, according to the level of complexity they’re able to deal with.

This gives a higher level of flexibility, which is further improved by the fact that the investor is not suddenly exposed to risks, but can choose what to do within the expiration date. Moreover, options can be even sold on secondary markets. Of course, all this requires strategic planning, and a high level of understanding of markets and financial instruments.

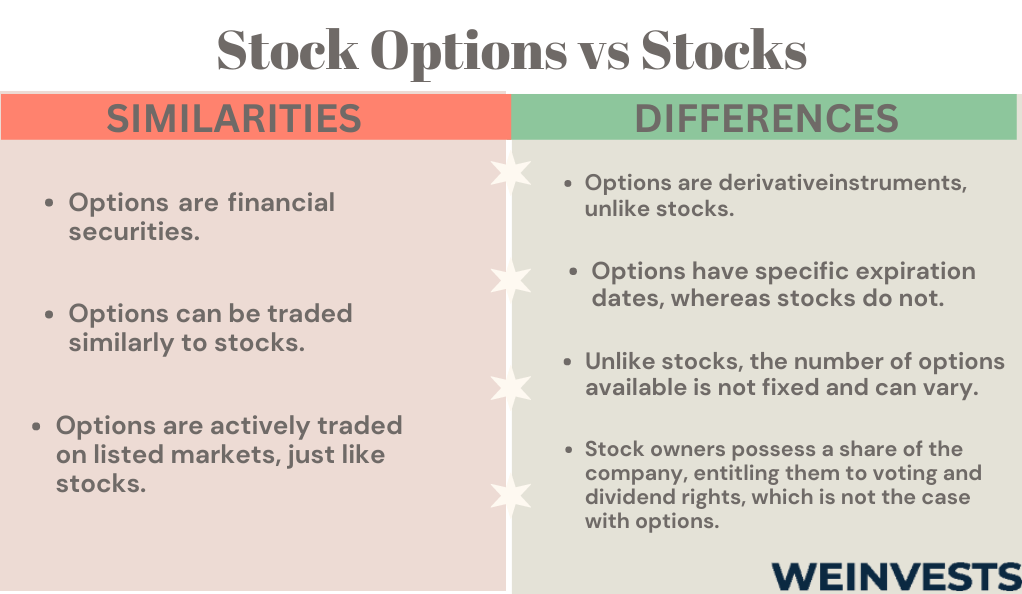

How are Options different from stocks?

Stocks are totally different: they’re not derivative financial instruments, and they can also give decisional rights to the investor, since stocks are issued by companies that are publicly traded.

When directly investing in stocks, the risks are similar to the risks we mentioned for CFDs trading – with the difference that there is no risk associated with leverage.

Stocks can be considered less complex than options, and this is why they’re usually the choice of beginners. On the other hand, they require a different approach: differently from options, which can be considered as speculative assets often working as hedges, stocks might require more long-term vision and a deep understanding of fundamental analysis and general market conditions.

Pros & Cons of Options Trading

- Options are flexible financial instruments

- They give rights, but not obligations

- They can be used as risk management tools

- They are still risky assets

- They might results complex to beginners

- They require comprehensive strategies and advanced planning

What options brokers charge the lowest fees?

Fees and commissions charged by brokers are one of the key elements to take into account before choosing the right platform for options trading.

In fact, they can significantly affect the budget and decision-making of each trader and investor. Let’s see the fees associated with each of the brokers we listed.

1 – eToro – eToro doesn’t charge fees for U.S. customers that use self-directed options. However, regulatory fees may apply. For what concerns U.K. users, they’re charged 0.65$ per contract.

2 – AvaTrade – AvaTrade uses market spread.

3 – Interactive Brokers – Interactive Brokers is one of the less expensive brokers when it comes to options trading, since it charges from 0.15$ per contract.

4 – Fidelity – Fidelity is in line with the average price, since it charges 0.65$ per contract (plus regulatory fees).

Summary

Options differ from other financial instruments mainly because of their flexibility.

As we said, when trading options investors and traders have rights on the contracts, not obligations. They can decide prices and expiration dates, but they can even choose to let the contract expire.

When compared to other financial instruments, for instance CFDs or stocks, traders and investors don’t only need to choose if buying or selling: while other financial instruments expose traders and investors to market risks once the order is executed, options grant higher levels of flexibility and planning, along with inner risk management.

In this sense, options might result quite complex for beginners, since they need to set comprehensive trading or investing strategies before deciding how to deal with options.

FAQ

What are the top brokers for options trading in 2023?

Our picks for the top brokers for options trading in 2023 include eToro, AvaTrade, Interactive Brokers, and Fidelity. Each broker has unique features and can fit the needs of different types of investors and traders. For instance, while eToro is among the most intuitive platforms, brokers like Fidelity focus on giving its customers a wide variety of financial instruments available for trading and investments – among which we can find, of course, options.

How does options trading work?

Options trading involves the trading of contracts, based on an underlying asset, that give traders the right, but not the obligation, to buy or sell that asset within a specific expiration date. Options are widely considered as speculative financial derivatives, but they’re also often used for hedging against unexpected market behaviors – precisely because they give rights and not obligations. They can be divided into two macro categories: call options, similar to buy orders, and put options, similar to sell orders.

How are options different from other financial instruments like CFDs and stocks?

Options, CFDs, and stocks are different types of financial instruments each with its unique characteristics. Options and CFDs are similar in the sense that both are derivatives, but while CFDs expose traders to market risks instantly, options provide more flexibility and room for planning and strategies. Stocks are direct investments in publicly traded companies – they are not derivative instruments. They can be less complex than options but require a deep understanding of fundamental analysis and general market conditions.

What are the advantages and disadvantages of options trading?

Options trading has both pros and cons. Options are extremely flexible, giving traders and investors to use them in different strategies and take advantage of their function of risk management instruments. However, options can be as risky as other financial instruments, especially if not used properly, and they are far more complex than other investment products like stocks or CFDs. Moreover, they imply the creation of comprehensive strategies.

How do you evaluate online brokers for options trading?

We take into account several factors and directly test the platforms listed. Among the key elements to consider we use regulatory compliance, fee and commission structure, variety of financial instruments offered, intuitiveness of the trading tools, and the availability of educational tools. Choosing the right broker is a pivotal part of each trading and investing strategy, and it’s always up to users to finally choose the broker that better fits their goals and needs.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More