Exchange-Traded Funds or ETFs have revolutionized the way you invest your money, along with the wealth management industry in general.

And for good reason. They offer retail investors like you access to assets, strategies, and liquidity, all in one. Before their advent, you could only rely on classic mutual funds or implementing strategies on your own.

ETFs provide all sorts of benefits, such as wide diversification at a very low cost. For this reason, it’s crucial that you understand what they are and how they work.

The good news is that if you know nothing about them, this guide is a great start. After you go through it, you will:

- Understand what types of ETFs exist.

- Know where to buy them from.

- How to select the right ones for you.

Let’s cover the basics first, though…

A Step-by-Step Guide on How to Invest in ETFs

Investing in ETFs (Exchange-Traded Funds) is a great way to diversify your portfolio and gain exposure to different asset classes. ETFs are relatively low-cost, tax-efficient, and can be bought and sold just like stocks. Here is a step-by-step guide on how to invest in ETFs:

1. Open a Brokerage Account: Before you can buy or sell ETFs, you’ll need to open a brokerage account with an online broker. Most brokers offer the ability to trade ETFs, so it’s important to shop around for the best deal that meets your needs. In this phase, consider factors like pricing, commissions, available research tools, and customer service.

2. Decide on Your Investment Strategy: Once you have opened an account, decide on what type of ETFs you want to invest in. Do some research into the different types of funds available and determine which ones fit your investment goals and risk tolerance level. Look for ETFs with low expense ratios, good liquidity, and a track record of consistent returns.

3. Research Your ETFs: Once you have decided on what type of ETFs you want to invest in, research each fund before investing. Read up on the fund’s track record, fees, holdings, performance history, etc., so that you know what you are investing in. Choose your ETFs carefully, just as if you were looking for a stock to buy. For instance, there are several ratios you can look at to determine the financial health and quality of an ETF, such as its P/E ratio, Beta, Sharpe Ratio, and more.

4. Buy the ETFs: When you are ready to make an investment, place an order with your broker using their online trading platform or app. You can buy individual shares or opt for fractional shares if the price per share is too high for your budget. This phase is critical, as there are three aspects to keep in mind when investing in ETFs, namely price, quantity, and timing.

How to Invest in ETFs Using eToro

eToro, a regulated and esteemed broker, gives investors access to various exchange-traded funds (ETFs). As one of the topmost online brokers in the market, eToro has been highly regarded for its selection of services that appeal to both novice and proficient traders alike. This guide will take you through the sequential steps of setting up an account on eToro and investing in ETFs.

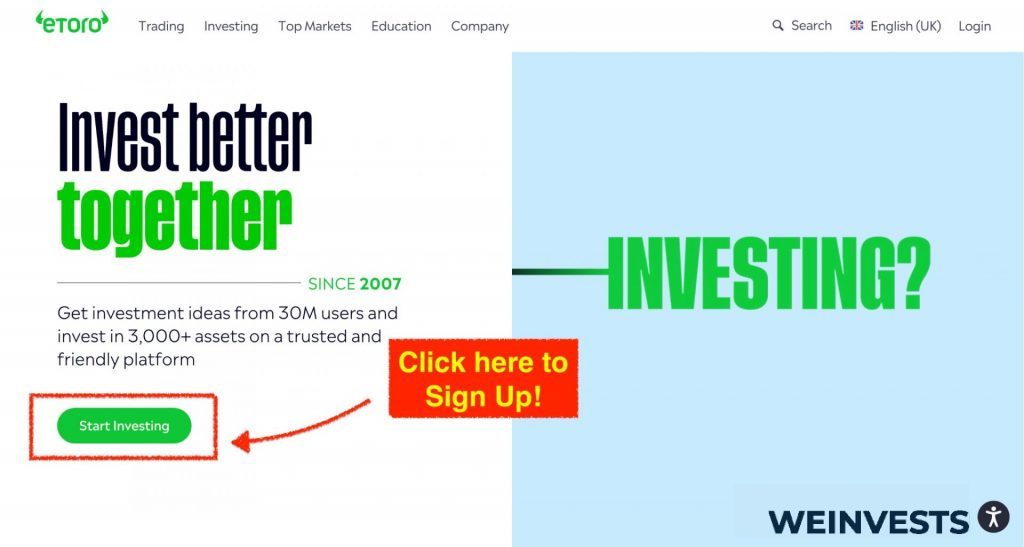

Step 1: Open an Account

To get started investing with eToro, you will need to open an account. To do so, first, visit their homepage at https://www.etoro.com/. On the homepage, click on the “Sign Up” or “Join Now” button to be taken to the registration page. On this page, you will need to provide your name, email address, and phone number and create a password. When all of the necessary information has been filled out, click “Start Investing” and “Create Account” to complete the process. We have included an image of the homepage for your reference.

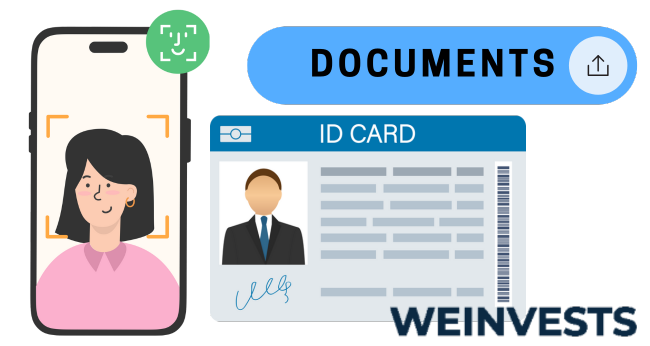

Step 2: Upload ID

In order to ensure your account’s security and meet financial regulations, eToro will require you to verify your identity by uploading a clear picture or a scanned copy of your government-issued ID card or passport. Make sure that all the information on the document is clear and readable so that it can be identified easily. We have provided an image of the upload page for Proof of Identity on our website to guide you.

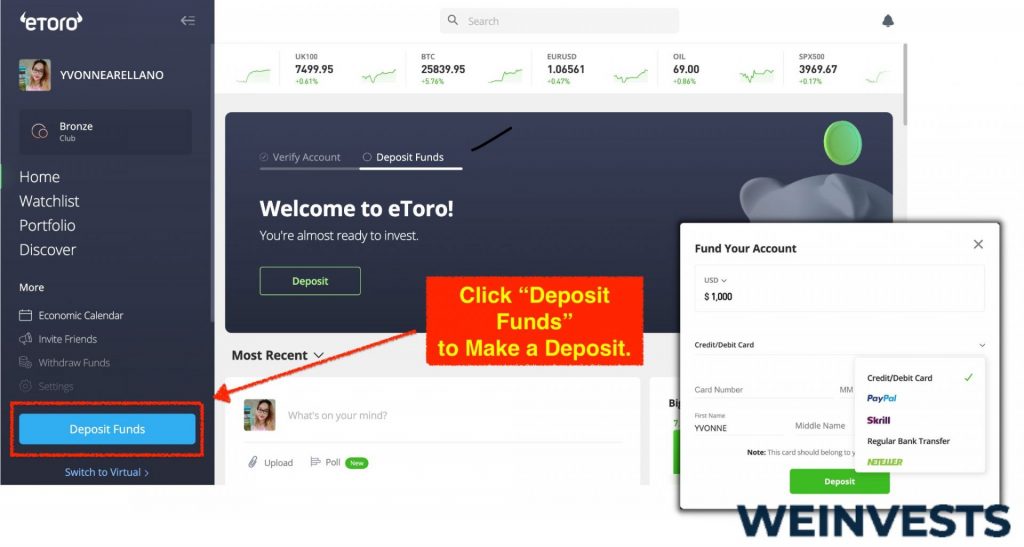

Step 3: Make a Deposit

In order to begin investing in ETFs, you will need to make a deposit into your eToro account. To do this, simply log in and locate the “Deposit Funds” button at the bottom left corner of the platform. You can fund your account through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, or Neteller. Please note that the minimum deposit amount may vary depending on your region and payment method. We have included a screenshot of the eToro platform with an arrow pointing to the “Deposit Funds” button.

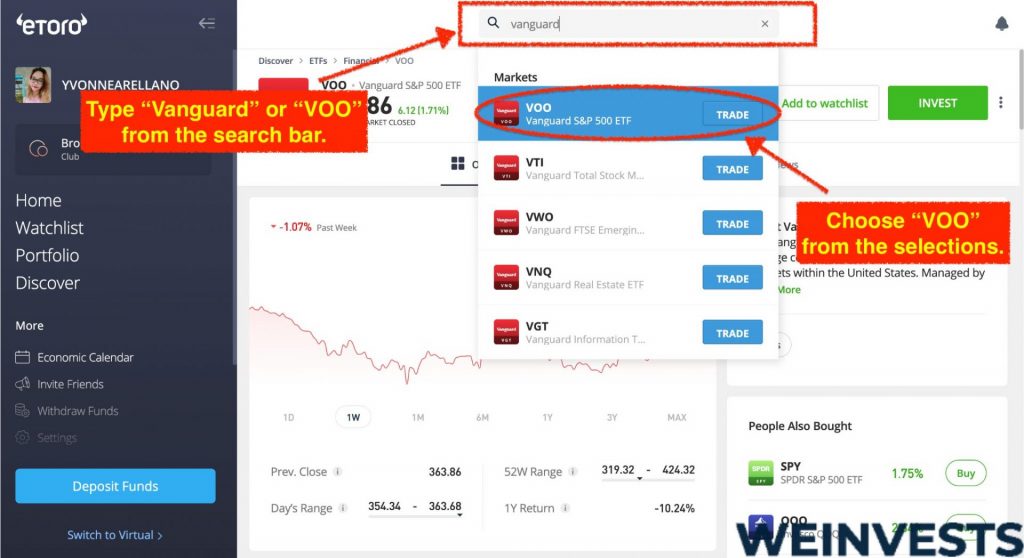

Step 4: Search for an ETF

Using the eToro platform, investors can easily search for exchange-traded funds (ETFs) with the top search bar. To explore the ETF section, users can simply click the category and then scan through a complete list of relevant choices. This comprehensive list provides detailed information about each investment option, allowing investors to make well-informed decisions.

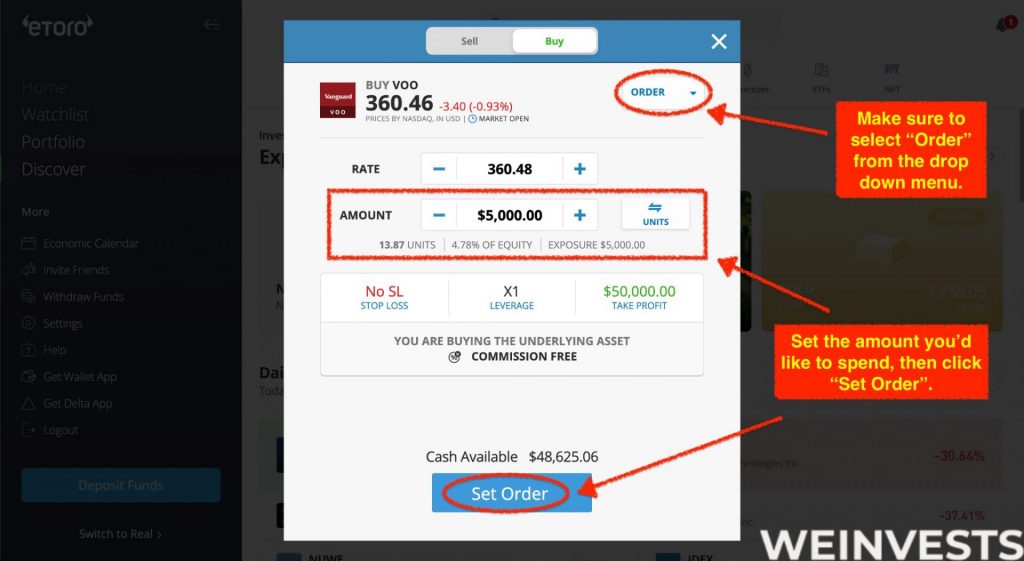

Step 5: Trade ETFs

Investing in ETFs is a simple process. After locating an ETF you’re interested in on the platform, click on the stock to open its trading page. Here you will be able to see all relevant info about the company, such as its current market price, market cap, and recent news. To purchase ETFs, select the “Trade” button, which will open a new window where you can set the amount of funds you’d like to invest and any other order parameters. When you’re ready to proceed with the trade, hit “Open Trade,” and your purchase will be executed.

Remember to monitor your investments regularly and adjust your portfolio as needed to meet your financial goals. Always conduct thorough research and consider consulting a financial advisor for personalized advice.

TOP ETFs to Buy Right Now

Discover the potential of the current market with our selection of top ETFs to consider. From broad-based index funds to sector-specific choices, find investment opportunities that align with your goals and risk appetite.

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is a reliable way for investors to gain access to stocks of companies operating across diverse sectors that have consistently paid dividends.

It tracks the performance of the S&P 500 Dividend Aristocrats Index and does so using a full replication technique.

As of June 2023, the fund has a total market cap of 11.37 billion, with assets totaling 2.76 billion and a dividend yield of 2.57%. Over the past year, this ETF has seen a return of 10.27%, making it one of the top-performing ETFs in today’s market landscape.

Another aspect that makes this ETF attractive is its low expense ratio. This means investors are not paying a hefty expense to obtain the benefits of index-based investing through this ETF.

Vanguard S&P 500 ETF (VOO)

Vanguard S&P 500 ETF (VOO) is an index fund that tracks the S&P 500 index.

The fund has a market cap of 961.69B and total assets of 60.243B, meaning that it’s one of the largest US ETFs in terms of size. It aims to give investors exposure to 500 of the largest public companies in the United States.

The fund has a dividend yield of 1.47% and has seen a 15.87% change over the last year. Investing in VOO gives investors access to a diversified portfolio of large-cap stocks, making it an excellent choice for long-term investors looking for exposure to US equities.

Moreover, Vanguard’s low costs and expert management make VOO an appealing choice for investors looking to minimize fees and maximize returns. The fund proposes an expense ratio below the market average, which helps to further attract capital.

Vanguard High Dividend Yield ETF (VYM)

Vanguard High Dividend Yield ETF (VYM) is one of the largest exchange-traded funds in the United States, with a market cap of 48.31 billion dollars and total assets of 17.168 billion dollars.

The fund seeks to track the performance of the FTSE High Dividend Yield Index by using the full replication technique mentioned above for NOBL.

It invests in stocks of companies operating across diversified sectors and provides investors with exposure to dividend-paying stocks from a variety of market capitalizations, including growth and value stocks. Additionally, it offers an attractive dividend yield of 3.34%.

Unlike the two previous ETFs, VYM charges a bit more than the market average in terms of fees. Strongly dividend-oriented ETFs tend to have this feature, and investors should look out for it before making a decision.

iShares iBoxx Investment Grade Corporate Bond ETF (LQD)

iShares Trust – iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is the largest corporate bond exchange-traded fund (ETF) in the world, with a total market capitalization of $36.83 billion and total assets of $23.70 billion.

The fund invests primarily in U.S. dollar-denominated, investment-grade corporate bonds with at least three years to maturity.

It seeks to track the performance of the Markit iBoxx USD Liquid Investment Grade Index by using a representative sampling technique. In addition, it has an annual dividend yield of 3.87% and a 1-year return of -0.34%.

The most important aspect of this fund is its diversification. LQD offers exposure to a wide range of corporate bonds, which limits the risk of investing in just one bond or sector. The company managing the ETF aims to combine liquidity, low costs, and transparency to provide an attractive investment opportunity.

iShares Gold Trust (IAU)

iShares Gold Trust (IAU) has a current market capitalization of 28.11 billion US dollars. It is managed by iShares Delaware Trust Sponsor LLC and seeks to track the daily performance of gold bullion prices by investing in the commodity markets.

The fund has total assets of 5.75 billion US dollars and does not pay a dividend yield. This choice, which is quite uncommon in the ETF niche, has a clear purpose: it ensures that all the gains can be re-invested in gold, which helps increase the fund’s performance. In the past year, it has seen an increase of 5.38% in its market value.

This ETF provides investors with a low-cost option to gain exposure to the gold market without having to purchase physical gold bars or coins. It also allows for quick and easy trading, enabling investors to gain or divest exposure to gold with a single transaction.

What to Look for When Investing in ETFs?

Fortunately, the due diligence you need to do to pick ETFs is straightforward.

Just use the checklist below and you’ll be good to go…

First, determine what you want to invest. Is it stocks, bonds, or maybe commodities? There are also ETFs that invest in a combination of assets.

Deciding the asset you want to buy is the first step in narrowing down the list.

What kind of strategy do you want the managers to run? We discussed the two ETF types above; active and passive.

If you select an index that you want to track, that will be straightforward.

But you need to be more specific if you decide you want active management. There are all sorts of strategies that aim to beat the market. Some ETFs short (or bet against) stocks. Some others diversify across multiple assets to keep volatility low while trying to beat the market.

Remember that you need to choose a strategy that you can understand well before you invest in an actively-managed ETF.

If you require liquidity in the ETF you buy, you also have to look at trading volume. This shows how many interested buyers and sellers are at any time. All brokers will show you this if you browse ETFs on their platforms.

This is not very important unless you think you will need to sell shares of the ETF frequently for personal needs. If an ETF has a low volume, you may not be able to do this fast enough or at the price you want.

We already talked about the expense ratio above, but as a reminder it’s the annual cost a fund like an ETF charges on your invested capital, expressed as a percentage.

Active ETFs will generally charge a higher expense ratio than passive ones, but there are exceptions.

Expense ratios can range from as low as 0.1% to as high as 1%. The lower the better, of course, but you should also look at the cost in relation to the following two factors…

It goes without saying that when comparing ETFs of the same type that employ a similar strategy, the ones with the higher returns in the past will be the more attractive.

By the same token, new ETFs with no history are less attractive to the ones that have been operating for some time.

Of course, historical returns are not indicative of future ones. But they are often a good indicator of management quality.

Last but not least, you need to look at the turnover ratio of an ETF. This is basically the percentage of the ETF’s underlying assets that are replaced each year.

This is basically the silent fee in the world of mutual funds and ETFs. That’s because of the transaction fees associated with buying and selling assets which will negatively impact performance.

There can also be a more indirect cost related to taxes. If an ETF buys and sells an asset within a year, gains will not qualify for capital gains tax (which in many countries is lower than the income tax rate).

You can generally expect passive ETFs to have relatively low turnover ratios (10% – 30%). But actively managed ETFs can run as high as 100% if they employ a trading strategy.

A high turnover ratio may not necessarily be a bad thing, however. Some actively managed ETFs will run strategies that will require them to buy and sell assets more frequently in an effort to outperform the market.

But as a rule of thumb, the lower the better.

ETFs Explained

An Exchange-Traded Fund (ETF) is pooled money that professional investors manage in the form of a security listed on a stock exchange. In other words, ETFs are stocks that give you access to other assets; these can be stocks, bonds, commodities, etc.

When you buy an ETF, you basically buy equity into a portfolio invested in other assets. If an ETF includes stocks, for example, buying it would make you an indirect owner of all the underlying stocks it holds.

What’s very unique about ETFs is their form. As we mentioned, they’re listed on stock exchanges, so there’s practically no difference between the way you trade them and stocks.

ETFs have shares that are traded back and forth via stock exchanges like Nasdaq and NYSE. When you buy ETF shares, you indirectly buy them from another seller. In the same way, you can sell them in the open market.

Of course, since an ETF is a fund that others manage, there’s a cost associated with holding one. Similar to how you would get charged if you bought a mutual fund, managers will take a small percentage of the amount you have invested every year.

Let us now dive into the types of ETFs and talk about the costs associated with each one so you can get an idea…

Passive ETFs vs. Active ETFs

The types of ETFs are far too many, but there are only two main categories that you need to be aware of. That is because these are where all types come from.

Passive ETFs

Passive ETFs (or Index ETFs) are ETFs that track market indices. Let’s take a moment to explain indices first.

A market index is simply a measure of a market’s performance.

Take the S&P 500 for example. This widely known index measures the total performance of the largest 500 companies in the United States. It’s classified as a broad-market index because the 500 companies it tracks (which change all the time based on specific criteria) are supposed to represent the US economy as a whole.

But there are all sorts of indices. There are indices that track the performance of sectors from Real Estate to Information Technology. But it’s not just markets that indices track. There is also an index that tracks companies that were spin-offed by their parent companies (S&P U.S. Spin-Off Index).

Now, passive ETFs are essentially funds that are set up to mirror the performance of an index. They do that by managing a portfolio that is identical to the holdings the index has at any time.

This, of course, implies that all managers have to do is watch closely for any change in an index’s holdings and act accordingly. For example, say that a hypothetical stock named AAA doesn’t fulfill the criteria of the S&P 500 index anymore and is replaced by one called BBB. The managers of an ETF that tracks the index will have to sell AAA and buy BBB to match their performance with the one the index measures.

It naturally follows that because of costs and a delay in trading the assets included in an index, the index ETF’s performance will deviate from that of the index itself.

TIP: To check how well an ETF matches the performance of the index it tracks, look for its tracking error.

This is essentially the difference between the return of the index and that of the ETF. If, for example, an index returned 10% in a year and the ETF returned 9%, the tracking error is 1%. The lower the better.

Cost of Passive ETFs

As you can imagine, these ETFs are called passive because the strategy the managers employ itself is passive in nature. For this reason, the costs associated with running such a fund are very low. In turn, investing in such ETFs is very cost-effective as well.

A common metric used in the asset management world is the expense ratio. It’s basically the percentage of the assets under management that wealth managers charge their investors each year. If you invest $1,000 in an ETF that charges a 1% expense ratio, your annual expense would be $10, for instance.

But Index ETFs have very low expense ratios. You can expect to pay something ranging from 0.04% to 0.4%. That’s a rule of thumb, of course, and many asset managers will charge even less or more.

But it’s generally uncommon to see passive ETF expense ratios higher than 0.5%. Especially if they track broad-market indices like the Dow Jones or the S&P 500, for which there’s a lot of competition.

Active ETFs

Active ETFs, on the other hand, are all the ETFs that don’t track an index. Most of them employ strategies that aim to beat a market index instead. The essential thing to remember here is that active ETFs are invested according to some proprietary investment strategy.

Such funds could be using trading algorithms or industry insights to find inefficiencies in the market and profit from them.

Take for example the ARK Innovation ETF (ARKK). The ETF buys companies which it forecasts will profit from “disruptive innovation”. The success of this ETF depends on the managers’ ability to identify such investment opportunities.

Another example would be the Fidelity Blue Chip Growth ETF which invests in US large-cap stocks the managers think have been mispriced by the market.

Cost of Active ETFs

Naturally, active ETFs will charge investors more than passive ETFs do. This is to be expected as their work is more complex (research, valuation, and portfolio management).

With active ETFs, you can expect to pay anything from 0.5% to 1% annually. It’s uncommon to see expense ratios above that range here.

But the cost depends on the complexity of running the fund. For instance, the JPMorgan Ultra-Short Income ETF has a 0.18% expense ratio while employing an active strategy. This is actually lower than what other passive index funds charge.

In contrast, the ARK Innovation ETF charges 0.75% on its AUM. But it does attempt to provide investors with a much better return.

For this reason, the conclusion that active ETFs are more expensive than passive ones is based on the fact that passive strategies are generally more cost-effective than active ones. But this is not always the case. That’s why you should remember that there are exceptions.

Dividend ETFs

S&P 500 ETFs

Vanguard ETFs

Bond ETFs

Gold ETFs

Where to Buy ETFs?

Getting access to ETFs is easy. There are chances that your bank will give you access to many of them if you want to go the traditional route.

Of course, if you want to make sure that you get access to a large variety of ETFs to choose from, open a brokerage account.

Brokers like eToro, Fidelity, Interactive Brokers, Charles Schwab, TD Ameritrade, and others allow you to buy ETFs from all over the world.

Make sure that the broker you choose gives access to ETFs before you open an account. But more importantly, confirm that you will get access to the ones you want to buy.

Conclusion

As you can see, Exchange-Traded Funds are not complicated investment vehicles. They are similar to mutual funds in that they allow you to delegate to a professional to manage your money.

The ETF market has grown so much that there are all sorts of ETFs that you can find.

This guide was supposed to give you an overview of the world of ETFs so you can know how to navigate through the various offerings out there a bit easier.

At the same time, it’s also fortunate that you will not have to do it many times. Once you pick the ETFs that fit your investment needs, all you need to do is keep track of their performance.