This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Investing in bonds is not just for retirees. If you want to hedge your portfolio, allocating a portion of it to long-term corporate bonds is a good idea.

Fortunately, you don’t have to manually select bonds for investment. ETFs like Vanguard Long-Term Corporate Bond ETF will do this for you at a low cost.

But given the fact that Vanguard is not the only player when it comes to bond ETFs, it makes sense to wonder how well this one competes with its peers. After all, there are close competitors like the SPDR Portfolio Long Term Corporate Bond ETF and the iShares 10+ Year Investment Grade Corporate Bond ETF. What makes Vanguard’s ETF different?

In this article, we will answer this by giving you an overview of the ETF, how it performed over time, and what risks are associated with investing in it; a brief comparison with its competitors will be included too. We’ll go over its cost, its returns through various periods, its distribution yield, how you can invest in it, and more. After you read this article, you will know enough to make a sound investment decision.

Just remember that this article is informational in nature and cannot replace financial advice from a professional.

Let’s get started…

Table of Contents

ETF Fundamentals

Vanguard Long-Term Corporate Bond ETF was created in 2009, is managed by Vanguard, and is listed on Nasdaq under the ticker symbol “VCLT”.

It currently has about $5.4 billion in assets under management, its most recently reported portfolio turnover rate was 31%, and it charges an expense ratio of 0.04%. Its competitors, SPDR® Portfolio Long Term Corporate Bond ETF (ticker: SPLB) and iShares 10+ Year Investment Grade Corporate Bond ETF (ticker: IGLB) charge the same expense ratio.

Now, when it comes to income, VCLT has a 30-day SEC yield of 5.42% while SPLB and IGLB have 5.44% and 5.49%, respectively.

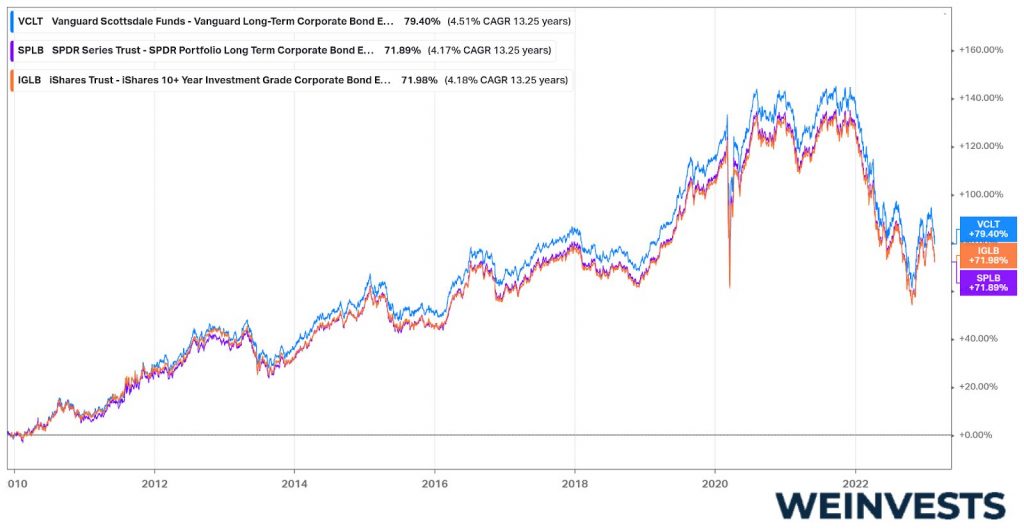

So far, these funds seem more or less identical when it comes to the fees and yields. It’s the same story with their total price returns since their inception (they were all issued in the same year):

VCLT outperformed both of its competitors, but not by a great margin. Let us now take a look at the fund’s returns during different periods in order to gain a better understanding of its overall performance.

Since its inception, its market price grew by 5.1% per year on average. The index VCLT tracks had its price increased by 5.09%.

In the last decade, the ETF had an annualized return of 3.19% on average, while the benchmark’s price increased by 3.16%. It’s worth noting that SPLB (which tracks the same index) returned 3.06% during the same period.

Now, in the last 5 years, it returned 0.8% annually. The index increased by 0.85% and SPLB returned 0.59%.

Last, in the past 3 years, VCLT’s price decreased by 4.9% per year on average and the index decreased by 4.84%. SPLB’s price fell by 5.02% per year.

Investment Strategy

VCLT is a passive ETF and attempts to replicate the performance of the Bloomberg U.S. 10+ Year Corporate Bond Index.

The index selects corporate bonds that are USD-denominated, fixed-rate, and investment-grade (which means they must be rated at least ‘BBB’ by either Standard and Poor’s or Moody’s).

VCLT aims to invest at least 80% of its assets under management in the bonds the index includes. It also has a dollar-weighted average maturity that is consistent with that of the index (the index’s dollar-weighted average maturity was 23.1 years as of August 31, 2022, while the ETF’s was 22.9 years).

Currently, the ETF holds about 2,690 corporate bonds while the index includes 2,811.

It’s also worth knowing how exposed the ETF is to various bonds based on investment grades, industries, and individual companies.

First of all, VCLT has 49.5% of its portfolio in BBB corporate bonds, 39.1% in A bonds, and 8.9% in AA ones.

Second, its exposure in industries is as follows: Financials (44.3%), Technology (8.6%), and Health Care (8%).

Last, the ETF has allocated 0.47% to corporate bonds issued by Anheuser-Busch, 0.29% to bonds of AT&T Inc., and 0.29% to bonds issued by Boeing Co.

How to Buy in Vanguard Long-Term Corporate (VCLT)?

As a reputable online broker, eToro offers a wide range of investment options for both beginner and professional traders. In this mini-guide, we will walk you through the process of opening an account on eToro and investing in Vanguard Long-Term Corporate.

Step 1: Open an Account

To get started, you’ll first need to create an account on eToro. Visit their homepage and click on the “Join Now” or “Sign Up” button. This will take you to the registration page where you’ll need to fill out your personal information, such as your name, email address, username, and password. Once you’ve completed this step, you’ll receive a confirmation email. Follow the instructions in the email to verify your account.

Step 2: Upload ID

As part of eToro’s account verification process, you’ll need to upload a proof of identity. This can be a government-issued ID or passport. Make sure the document is clear and all relevant information is visible. eToro will review your submitted documents and verify your account.

Step 3: Make a Deposit

Before you can invest in Vanguard Long-Term Corporate, you’ll need to fund your eToro account. Log in to your eToro account and click on the “Deposit Funds” button. You’ll be prompted to choose your preferred deposit method, such as credit/debit card, PayPal, or bank transfer. Follow the on-screen instructions to complete the deposit process.

Step 4: Search for VCLT

Once your account is funded, you can start searching for Vanguard Long-Term Corporate. Log in to your eToro account and use the search bar at the top of the platform to search for “Vanguard Long-Term Corporate.” The search results will display the relevant stock for you to invest in.

Step 5: Trade VCLT

After locating Vanguard Long-Term Corporate, click on the stock to view its details. On the stock’s page, you’ll find the “Trade” button. Click on it to open the trading window. In this window, you can set the amount you’d like to invest, any stop loss or take profit orders, and your desired leverage (if applicable). Once you’ve set your preferences, click on the “Open Trade” button to complete the transaction. Congratulations! You’ve now invested in Vanguard Long-Term Corporate Stocks on eToro.

All investments carry risks and even a well-diversified ETF is no exception. Before you invest VCLT, it’s good to understand the most significant and specific risks related to this ETF.

It’s also important that you have a rule of thumb regarding allocation so you can start thinking about how much you should invest in it. We will address both below…

This risk is about the possibility that bond prices will decrease due to rising interest rates. Long-term bond prices are more sensitive to changes in interest rates, so VCLT will be at higher risk than other ETFs, generally speaking.

Credit risk here is the chance one of the companies that have issued the bonds VCLT holds will delay payment of interest or principal. It’s also the possibility that the creditworthiness of an issuing company will make the price of a bond decline due to negative sentiment regarding the company’s ability to pay on time or continue being solvent.

Liquidity risk refers to the danger VCLT will not be able to trade bonds at desirable prices due to inadequate trading volume.

This is the chance that the fund’s distributions will decrease due to declining interest rates. For VCLT, this risk is not very pronounced because the bonds it buys are long-term.

Index sampling risk is common for all passive ETFs and it’s the chance that the securities that an ETF buys will not, in the aggregate, provide returns that will match those of the index.

Now, when it comes to an optimal allocation, begin by thinking of your risk tolerance and your income needs. The more you allocate to VCLT as opposed to equity ETFs, the lower your portfolio’s volatility will be. And the more you invest in a bond ETF, the better your overall portfolio’s yield is going to be if your other allocations focus more on growth.

If you intend to make frequent withdrawals from your investment fund, allocating a large portion of your money to bonds to decrease volatility would make sense. The same applies if you require a larger income than growth.

As a rule of thumb, according to Federated Hermes, a portfolio allocated to stocks and bonds by 40% each (20% cash) is conservative. The more you weigh your portfolio to stocks from here, the more aggressive it becomes.

This cannot be an exact science, of course. You will need to tweak your allocations as you go on according to your risk tolerance and your income needs. For the best possible structure, you may want to consult a financial advisor.

Conclusion

Vanguard Long-Term Corporate Bond ETF stands out as a well-established bond fund. Its expense ratio is in line with its competitors, while its track record is long and its performance close to that of its index.

As you saw above, two of its closest competitors have performed worse in the long term by a small margin. But this margin can widen as the years go by if this trend continues.

The returns are definitely insignificant compared to what equity ETFs can provide, but the higher they are, the larger your cushion against capital erosion will be.

This may be considered a conservative investment, but you’d do well to talk to a financial advisor before you buy it. This article is for informational purposes only and doesn’t intend to provide you with financial advice.

FAQs

Are bond ETFs a good long-term investment?

Bond ETFs are a good investment for the long run if you need to diversify your portfolio, produce more income, or both.

What is the problem with bond ETFs?

The most obvious problem with bond ETFs is their performance which is generally worse than that of equity ETFs.

Are corporate bond ETFs safe?

Corporate bond ETFs are generally safe to invest in because they often hold a very high number of bonds to decrease credit risk. They are riskier than U.S. Treasury bond ETFs and safer than equity ETFs.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More