All investing is not the same. Of course, there are many different types of investments, but there are different time horizons and risk levels for investing too. In fact, time horizons and risk levels are two primary considerations when choosing investments. Whether a long-term or a short-term investment is right for you depends on your investing goals, and what you are planning to do with the money you’re investing.

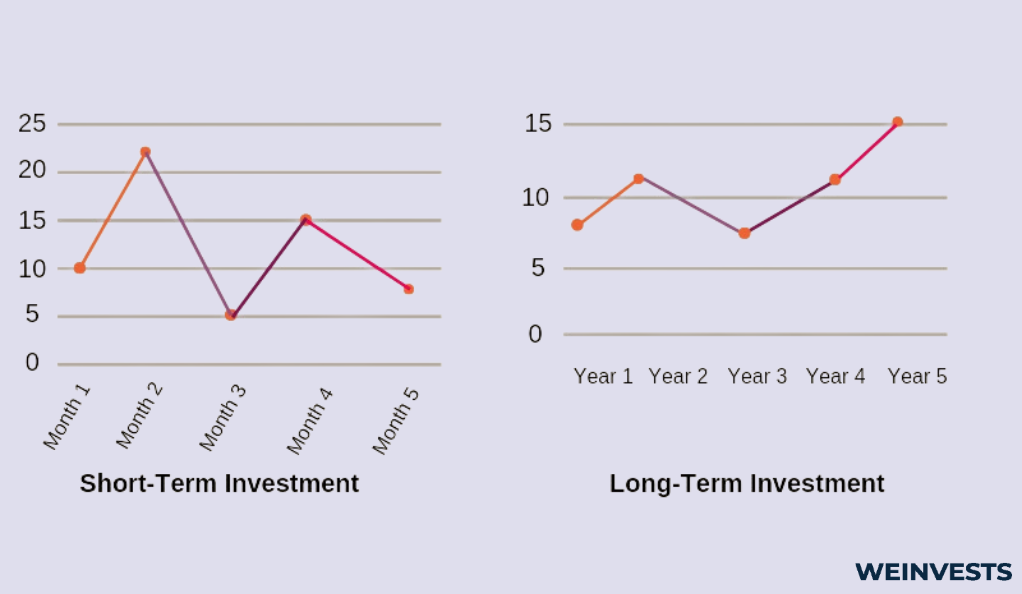

Long-term investments are those held for five years or more, often much more, as is the case of retirement investments which may not be needed for decades. Long-term investments can handle more risk because their longer time horizon gives them time to recover from any possible downturns in the market.

Short-term investments are those held for fewer than five years. Short-term investments need to have a lower risk profile because their short time horizon may not allow them to recover any losses suffered in market downturns before the money is needed.

Making the wrong decision can have dire financial consequences. You could lose the money you were planning to use for a short-term goal or find yourself without enough money to reach a long-term goal, notably funding your retirement.

This article will explain time horizons and risk tolerance, the differences between long and short-term investing, the pros and cons of each, and how to choose the right investments for your financial goals.

Time Horizons

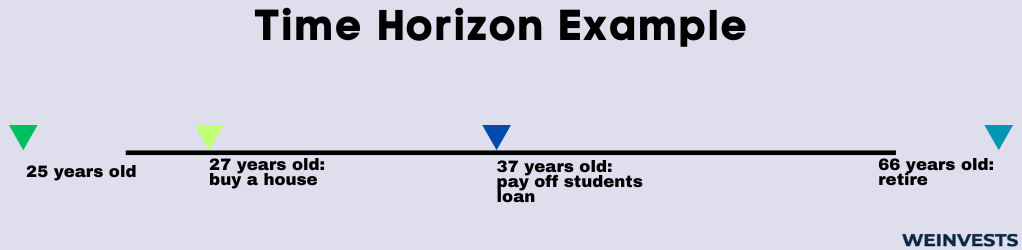

In terms of investing, time horizons refer to how long money will be invested before being withdrawn and used for its intended purpose. Your time horizon helps determine what kind of investment you should make.

Long-term investments are those held for longer than five years and possibly for decades or even after death, in the case of estate planning. Short-term investments are those held for five years or fewer.

Risk Tolerance

Risk tolerance is defined as an investor’s willingness and ability to handle the ups and downs in the financial markets and potential losses in order to pursue higher returns. Risk means how a portfolio is weighted between lower and higher-risk investments and must be assessed before making any investment decisions because it plays a large part in what kind of investments should be made.

There are several factors to consider when it comes to determining risk tolerance:

- Time Horizon: The amount of time before you will need the invested money is the critical factor in determining your level of risk tolerance. The shorter the horizon, the less risk you can afford to take. The longer the horizon, the more risk you can afford to take.

- Knowledge and Experience: The more an investor knows about investing and the longer they’ve been doing it often translates into being more comfortable with a higher level of risk.

- Financial Situation: Those with sizeable emergency funds, a stable income, and overall healthy finances may be more comfortable with taking more risk in their portfolios.

- Temperament: Some people are more or less risk-averse than others. The ability or lack thereof to accept a higher degree of risk for the possibility of a higher return is different for everyone. That said, taking too little or too much risk can mean falling short of reaching investment goals.

Risk Levels

Risk levels in terms of investing are typically broken down into three main categories:

- Conservative: Low-risk or conservative investments include bonds, certificates of deposit (CDs), fixed annuities, and money market funds. Conservative investments offer more stability and a lower risk of losing money, but the trade-off is lower returns over time.

- Moderate: Moderate-risk investments include balance funds, target date funds, and index funds. They offer a balance between stability and return potential.

- Aggressive: These are high-risk investments and include individual stocks, cryptocurrencies, options, initial public offerings (IPOs), and venture capital. Aggressive investments can offer high returns but less stability and a higher chance of losing money.

Long-Term Investing

Long-term investing means holding an asset for at least five years. It is sometimes also called buy-and-hold investing or hands-off investing because investors buy an asset and just leave it alone to grow over a long period of time.

The primary objective of long-term investing is to build wealth in order to reach long-term financial goals. Those goals can include paying the education expenses of children or grandchildren, buying a vacation home, buying rental property, retirement, and estate planning, leaving money or other assets to family and potentially future generations.

Long-term investments include individual stocks, mutual funds, exchange-traded funds (ETFs), real estate, and retirment accounts like 401(k)s and Traditional and Roth IRAs. In fact, retirement accounts typically have penalties for making early withdraws (before age 59 ½.

Market History

The stock market fluctuates. Since 1928 there have been 26 bear markets. Bear markets are defined as those that are down 20% or more from a recent high. And since 1928, there have been almost an equal number, 27, of bull markets. Bull markets are those that are up 20% or more from recent lows.

We have a bear market on average about once every three and a half years, and they last an average of just over nine months.

Long-term investors don’t have to worry too much about these natural ups and downs. Their time horizons are long enough to give their investments, even higher-risk investments, time to recover. And historically, with nearly a century of data to go by, investments have always recovered, with an almost equal number of bear and bull markets for the past nearly one hundred years.

In fact, about 42% of the S&P 500 Index’s best days over the last two decades have occurred in a bear market. Another 34% of the market’s best days happened within the first two months of a bull market, before it was evident that the bear market was over and a bull market had begun.

Pros of Long-Term Investing

- Compounding: Long-term investing puts the power of compounding to work for you, and compounding is the secret ingredient when it comes to growing wealth. As an investment generates returns, those returns can be reinvested and compound further.

- Reduced Transaction Costs: Long-term investors tend to make fewer trades than short-term traders, which results in lower transaction costs and fees which helps preserve more of your investment returns.

- Less Stress: Long-term investments require less monitoring and decision-making, which means investors can ignore dire financial headlines knowing that their investments have plenty of time to bounce back from market downturns.

- Tax Benefits: Long-term capital gains are taxed at a lower rate than short-term gains.

Cons of Long-Term Investing

- Less Liquidity: Long-term investments are less accessible should the money be needed for an emergency. Selling assets at the wrong time can mean losing money, and in some cases, there are penalties for early withdrawal.

- Opportunity Cost: Opportunity cost means while your money is doing X, it can’t do Y. Tying up money in long-term investments means that it’s not available for other uses.

- Higher Risk: Long-term investments are typically higher risk than short-term investments.

Short-Term Investing

Short-term investing means holding an asset for fewer than five years in order to reach a financial goal that is in the relatively near future. Short-term financial goals can include saving for a wedding, a vacation, or a downpayment on a home.

Short-term investments include bonds, certificates of deposit (CDs), fixed annuities, and money market funds. These investments are less impacted by the ups and downs of the stock market and the economic factors that affect the stock market, like recessions, wars, pandemics, and natural disasters.

Based on the information about bear markets above, you can see why short-term investments differ from long-term investments. We have a bear market about once every three and a half years, and they last about nine months. If you had your money in a high-risk investment like individual stocks and you needed it during a bear market, you could lose money.

Now, if your time horizon was somewhat flexible, you could leave the money invested until the market recovered. If you were planning to buy a home, for example, you could wait things out. But if that money was for a wedding, you might have no choice but to scale back your plans or take the loss.

Pros of Short-Term Investing

- Liquidity: Short-term investments can generally be turned into cash quickly without suffering substantial losses. This can be very beneficial in the case of an unexpected expense.

- Less Risk: Compared to long-term investments, short-term investments typically carry less risk.

- Diverse Options: There are a lot of choices when it comes to short-term investing, CDs, Treasury bills, short-term bonds, and money market accounts, to name a few. This allows investors to choose very specific investments based on their goals.

Cons of Short-Term Investing

- Lower Returns: While short-term investments are typically safer than long-term, the trade-off is lower returns.

- Inflation Risk: If the returns on an investment don’t at least keep pace with inflation, the spending power of your money is being eaten away.

- Transaction Costs: Frequently buying and selling short-term investments can lead to a lot of transaction costs and fees, eating into returns.

- Interest Rate Risk: Some short-term investments, like bonds, are impacted by changes in interest rates. If interest rates rise, the value of existing bonds may decrease.

- Limited Compounding: Short-term investments don’t have much time to put the power of compounding to work.

Choosing Short-Term or Long-Term Investing

Most people have both short and long-term goals, so they will have investments for both. These points can help you choose which is suitable for different circumstances.

Long-Term Investments

- The money is not needed for several years, possibly decades.

- You are comfortable with a higher level of risk.

- You are concerned about inflation. Inflation erodes the spending power of money. If an investment doesn’t have returns that can beat the level of inflation, your money becomes worth less over time.

- You have a fairly substantial emergency fund and a stable, reliable income.

Short-Term Investments

- The money will be needed relatively soon.

- You do not have a high tolerance for risk.

Conclusion

Investing is essential to help you reach certain financial goals, but all investing is not the same. It’s important to take into account several factors before choosing an investment, including the goal for the money, your time horizon, and your level of risk tolerance.

Long-term investments are for money that won’t be needed for at least five years and can be for things like college expenses, buying a rental property, or retirement. Long-term investments come with a higher level of risk but can also provide higher returns. Long-term investments can include individual stocks, mutual funds, index funds, ETFs, cryptocurrencies, and venture capital.

Short-term investments are for money that will be needed within five years and can be for things like home renovations, a wedding, or a vacation. While short-term investments are lower risk, they also typically offer lower returns. Short-term investments can include bonds, CDs, and money market accounts.

FAQ

What is the time frame for a long-term investment?

Long-term investments are those held for at least five years and, in some cases, several decades.

What is the time frame for a short-term investment?

Short-term investments are those held for fewer than five years.

What are some examples of long-term investments?

Long-term investments include individual stocks, retirement investment accounts like IRAs and 401(k)s, ETFs, and mutual funds.

What are some examples of short-term investments?

Short-term investments include bonds, CDs, and money market accounts.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More