This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Welcome to the world of Ethereum, the second-largest cryptocurrency by market capitalization and a leading player in the digital asset world. Ethereum is not just a cryptocurrency; it’s a platform for creating and deploying decentralized applications (dApps), introducing the concept of self-executing contracts, and revolutionizing sectors like finance and art through DeFi and NFTs.

Table of Contents

Ethereum and Its Role in the Crypto World

Ethereum, often referred to as the world’s programmable blockchain, is more than just a digital currency. It’s a decentralized, open-source platform that enables developers to build and deploy a myriad of applications on its blockchain. Ethereum’s ecosystem is expanding daily, with its influence permeating various sectors, from finance to gaming, real estate, and beyond.

At the heart of Ethereum’s appeal is its ability to eliminate intermediaries and provide a platform for creating decentralized applications (dApps). These dApps run on the Ethereum blockchain, leveraging its decentralized nature to offer services that are transparent, secure, and resistant to censorship. This has led to the emergence of a new wave of applications in finance (DeFi), gaming, supply chain management, and many other sectors, disrupting traditional business models and democratizing access to services.

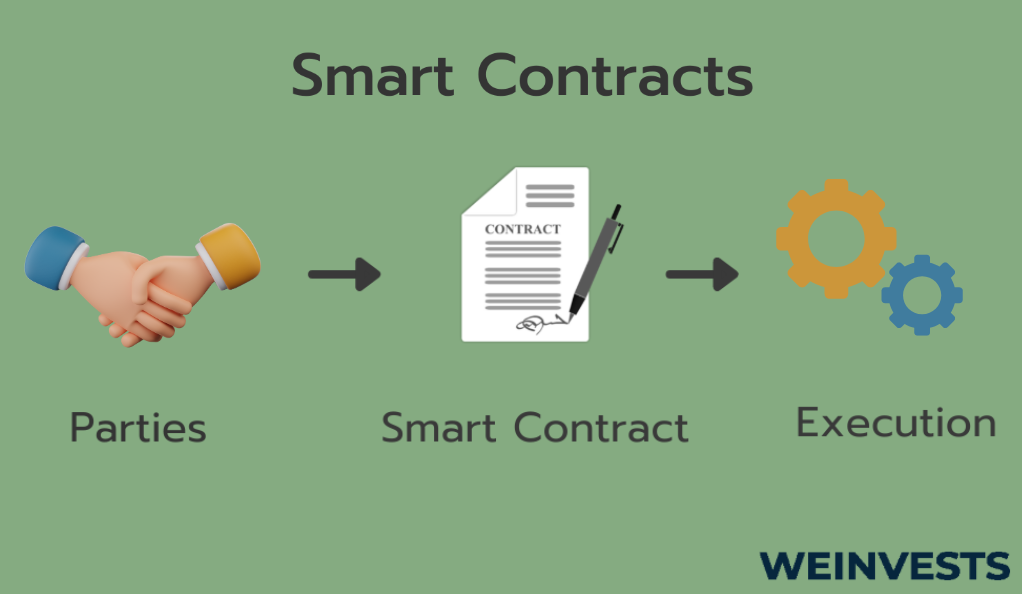

One of the key innovations that Ethereum introduced is smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. They automatically execute transactions when predefined conditions are met, eliminating the need for a trusted third party. Smart contracts have found numerous applications, from simple token exchanges to complex decentralized applications, and are a fundamental part of the Ethereum ecosystem.

Ethereum’s future developments are strongly intertwined with the broader blockchain industry. As an open-source software platform, Ethereum is constantly evolving, with a global community of developers contributing to its codebase. The upcoming Ethereum 2.0 upgrade, also known as Serenity, is a testament to this. It aims to improve the scalability, security, and sustainability of the network, which could further cement Ethereum’s position as the leading platform for decentralized applications.

Moreover, Ethereum’s role in the crypto world extends beyond its own blockchain. It has spawned an entire ecosystem of tokens through its ERC-20 standard, which has become the de facto standard for issuing new tokens in Initial Coin Offerings (ICOs). This has led to a proliferation of tokens and decentralized projects, further contributing to the growth and diversity of the crypto space.

In conclusion, Ethereum’s role in the crypto world is multifaceted. It’s not just a cryptocurrency, but a platform for innovation, a catalyst for decentralization, and a key driver of the blockchain revolution. As the Ethereum ecosystem continues to grow and evolve, its impact on the crypto world and beyond is likely to increase.

Ethereum and ERC Standards

Ethereum’s innovative nature extends beyond its blockchain and smart contracts. One of the platform’s most influential contributions to the crypto world is the introduction of Ethereum Request for Comments (ERC). ERCs are technical documents used by Ethereum developers to define standards for the Ethereum platform. They describe various features, behaviors, and methods that affect how applications and contracts work on the Ethereum platform.

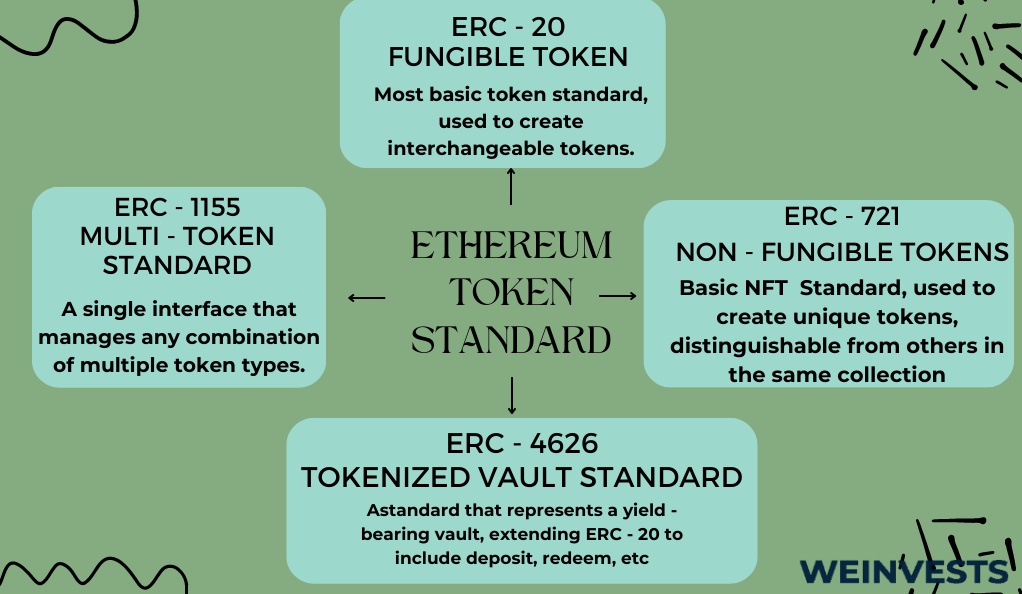

Among the most well-known and widely adopted ERC standards are ERC-20 and ERC-721, which have fundamentally transformed the blockchain landscape.

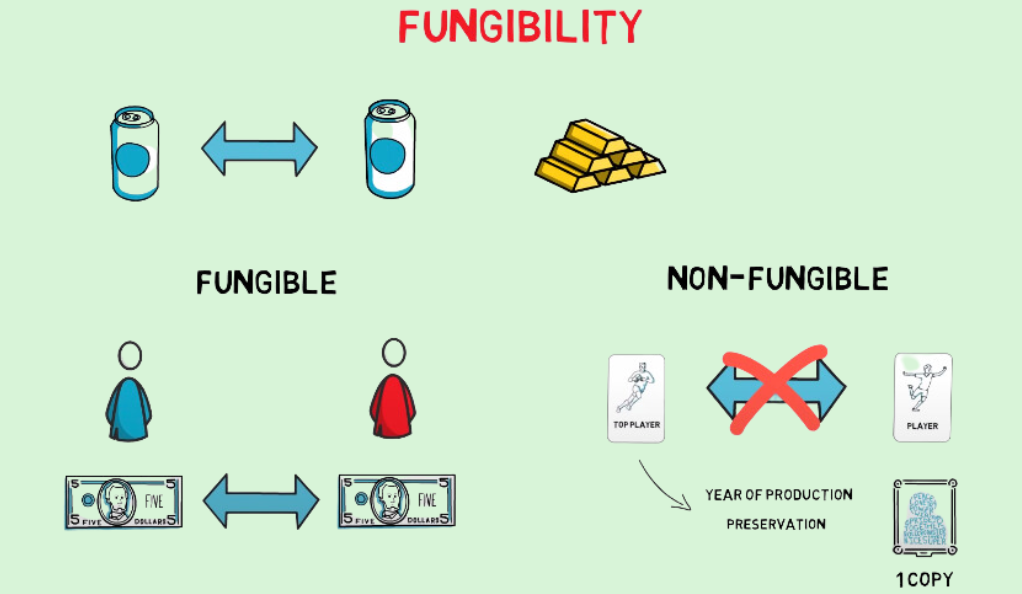

ERC-20 is a standard for fungible tokens, meaning each token is identical to every other token; it’s this standard that has made the ICO (Initial Coin Offering) boom possible. ERC-20 defines a common list of rules that all Ethereum tokens must adhere to, including how tokens are transferred, how transactions are approved, how users can access data about a token, and the total supply of tokens. This standardization has significantly simplified the process of interacting with tokens, as wallets, exchanges, and other service providers can offer support for various tokens without having to implement a unique integration for each one.

On the other hand, ERC-721 is a standard for non-fungible tokens (NFTs), meaning each token is unique and not interchangeable with any other token. This uniqueness has opened up entirely new possibilities for blockchain technology, enabling the tokenization of digital and real-world assets like virtual pets, digital art, and real estate. The rise of NFTs has been one of the most significant trends in the crypto world, with ERC-721 at the heart of it.

Understanding these standards is crucial for anyone looking to delve deeper into the Ethereum ecosystem. They provide a framework for creating tokens that can interact seamlessly with other tokens and applications on the Ethereum network. Moreover, they have paved the way for the rise of Decentralized Finance (DeFi) and the tokenization of a wide range of assets, contributing to the growing diversity and complexity of the crypto space.

However, ERC-20 and ERC-721 are just the tip of the iceberg. There are many other ERC standards, each serving a different purpose and expanding the capabilities of the Ethereum platform. For instance, ERC-223 and ERC-777 aim to improve upon ERC-20 by adding new features and addressing some of its shortcomings. ERC-1155, on the other hand, allows for the creation of both fungible and non-fungible tokens within the same contract.

In conclusion, ERC standards are a fundamental part of Ethereum’s success and a testament to its potential for fostering innovation and driving the evolution of the blockchain industry.

For more detailed information about ERC standards: Proposals (EIPs) on GitHub

How to Buy Ethereum on eToro

Regardless of whether you’ve been in the crypto trading world for a week or three years, there are some cryptos that everyone knows. Ethereum, also known as Ether, is one of them. It’s one of the most relevant coins to exist along with Bitcoin.

In recent years, Ethereum’s value has dramatically increased. Therefore, numerous investors are examining it with attention. You might want to do this if you’re interested in broadening your investment opportunities and changing your trading path.

However, how can you acquire this cryptocurrency if you don’t have a reliable platform that you can trust? It’s almost impossible, which is why eToro might be the solution to your problems. This guide tells you everything you need to know about this site and how to use it to buy Ethereum.

Step 1: Open an Account

Many digital assets lost value in 2019, but that was not the case with Ethereum. Instead, it became much more relevant. Thus, many investors wanted platforms that allowed them to buy this crypto, and this is where eToro comes in.

To get started with eToro, you have to open an account. Go to the site’s homepage and fill out personal information.

A crucial part of this step is to review the information you’re including. Don’t submit your form until you make sure that every detail you added is correct. Once you’re done, you can proceed to the next step.

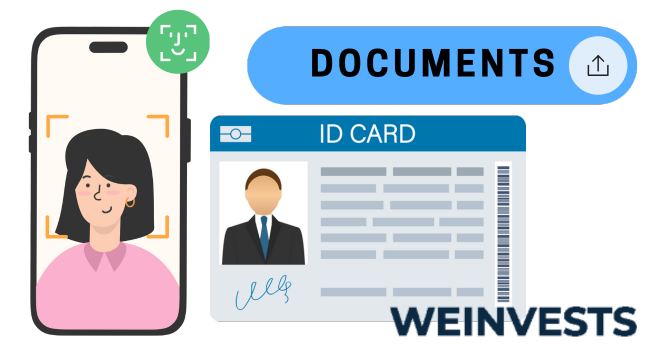

Step 2: Upload ID

If you open an account on a trading platform and you don’t have to verify your identity, you shouldn’t trust it. There are, of course, some legit sites where verification is not needed, but the lack of these security measurements tends to be a red flag.

You don’t have to worry about this with eToro because it takes security very seriously. As a new investor, you have to verify your identity, so you must upload a valid ID picture, for example, a picture of your passport.

When you open your eToro account, you also need to add proof of residence. Consequently, you might need a picture of a utility bill that’s no more than three months old.

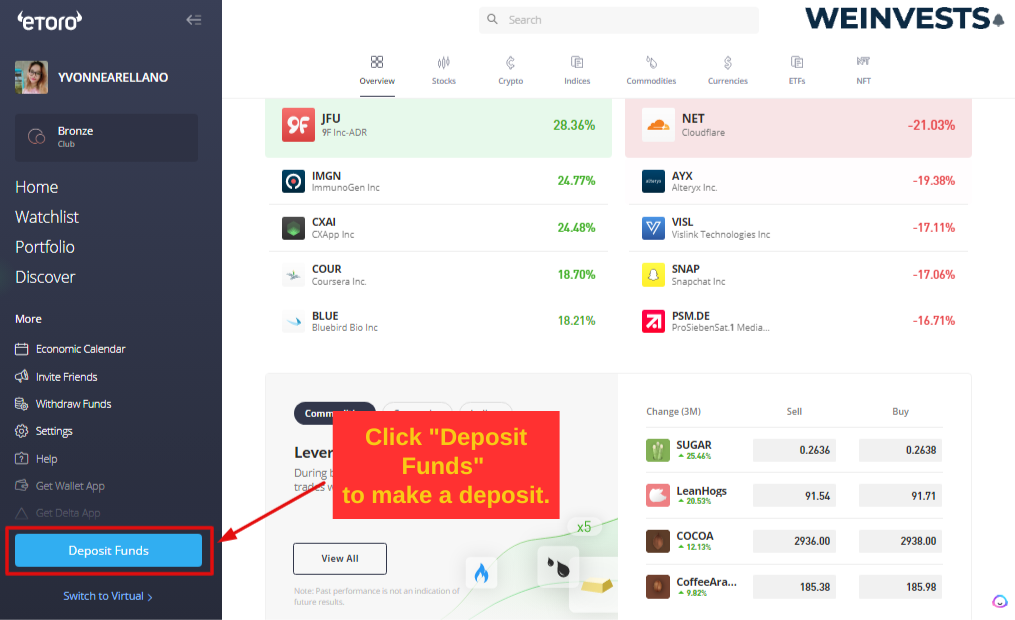

Step 3: Make a Deposit

Your account should be verified by now, so you can make a deposit and fund it.

Log in, go to the ‘Deposit’ tab, and start by choosing how much money you want to invest first. After that, pick the currency you’ll use, and select your payment method.

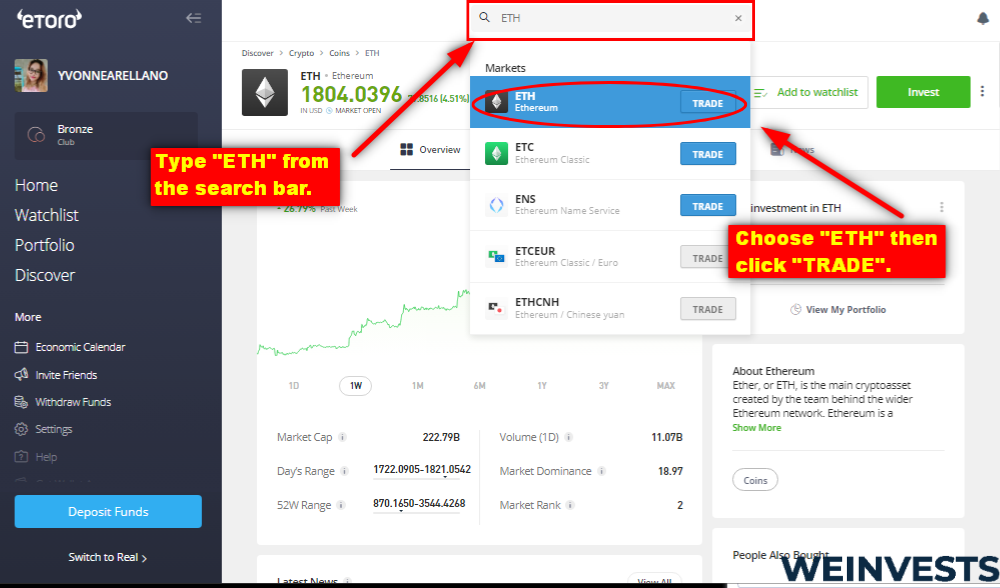

Step 4: Search for ETH

The eToro site offers numerous cryptocurrencies, but its layout is relatively straightforward. Thus, examine its features and locate Ethereum.

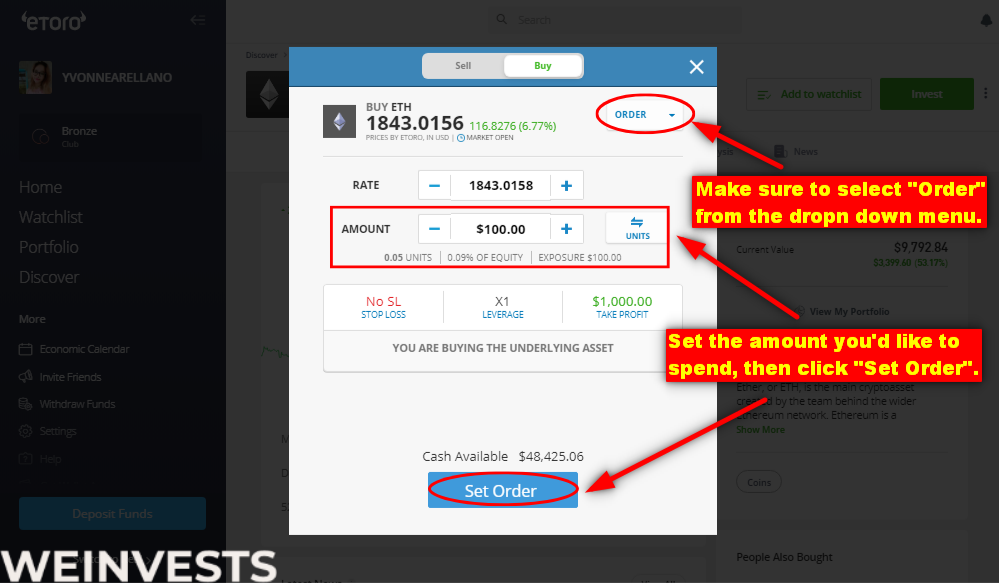

Step 5: Trade ETH

Lastly, you’re all ready to start buying Ethereum. This is one of the most relevant cryptos nowadays, and it might be the ideal coin for you. Since you’re using eToro to purchase it, you can start changing your trading journey by acquiring the amount you need for your goals!

Understanding Ethereum Transaction Fees

When buying Ethereum, it’s essential to be aware of the various fees that may apply to your transactions. These fees can significantly impact the cost of your investment, especially for larger transactions or frequent trading.

Exchange Fees: Most cryptocurrency exchanges charge a fee for buying and selling cryptocurrencies. These fees can vary widely depending on the platform. For instance, eToro charges a spread fee, which is the difference between the buy and sell price of Ethereum. It’s crucial to check the fee structure of your chosen platform before making a transaction.

Deposit and Withdrawal Fees: Some platforms may charge fees for depositing or withdrawing funds. For example, if you’re depositing money into your account via bank transfer or credit card, there might be a fee associated with that. Similarly, when you withdraw Ethereum to an external wallet, the platform may charge a withdrawal fee.

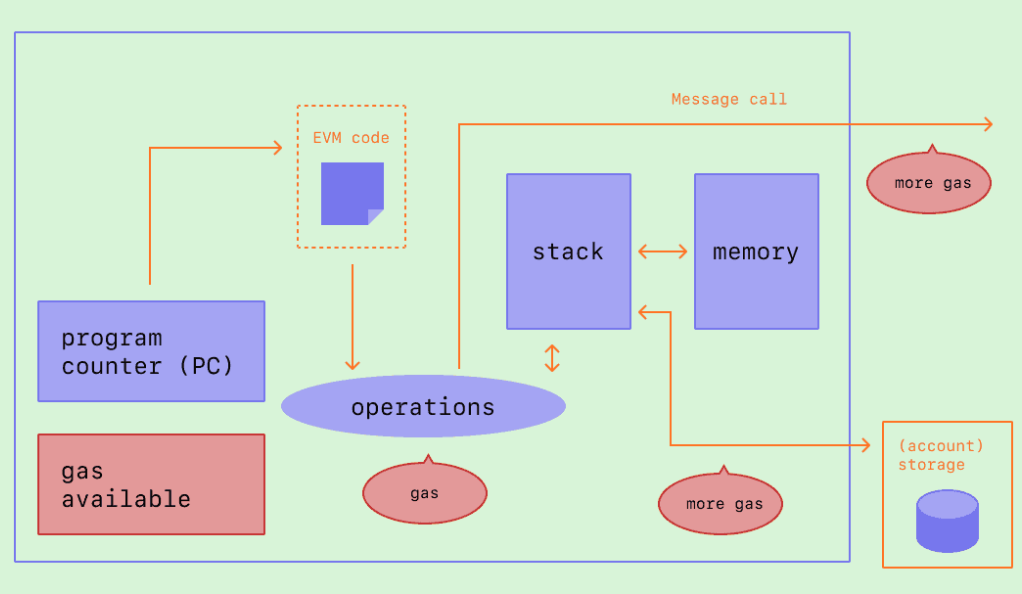

Network or “Gas” Fees: When you send Ethereum or interact with a smart contract on the Ethereum network, you’re required to pay a “gas” fee. This fee compensates miners for processing your transaction and is typically denoted in “gwei” (a smaller unit of Ethereum). Gas fees fluctuate based on network congestion – when the network is busy, gas fees increase, and vice versa.

Smart Contract Interaction Fees: If you’re interacting with smart contracts on the Ethereum network, such as when using a decentralized exchange (DEX) or a DeFi platform, additional gas fees may apply. These fees can sometimes be high, especially during periods of high network congestion.

Storage Fees: If you choose to store your Ethereum in a wallet provided by a third-party platform, they may charge a fee for this service. However, many wallets are free to use, especially software wallets.

It’s important to factor in all these potential costs when buying Ethereum to understand the true cost of your investment. Always check the fee schedule of your chosen platform and wallet provider, and remember that network fees can vary based on network activity.

Ethereum: A Good Long-Term Investment?

Ethereum has consistently held its position as one of the top cryptocurrencies in the market, second only to Bitcoin in terms of market capitalization. This standing, combined with its innovative technology and wide-ranging applications, has led many to consider Ethereum as a potentially good long-term investment.

One of the key reasons for this is Ethereum’s adaptability and its commitment to innovation. The Ethereum network is not static; it’s continually evolving and adapting. The most significant recent development is Ethereum’s transition from a Proof-of-Work (PoW) consensus mechanism to a Proof-of-Stake (PoS) model with the Ethereum 2.0 upgrade. This transition is expected to address many of the current challenges faced by the Ethereum network, including scalability and energy efficiency.

The PoS model, also known as Ethereum 2.0 or “Eth2,” aims to improve the network’s performance and security. Unlike PoW, which requires miners to solve complex mathematical problems to validate transactions and create new blocks, PoS relies on validators who hold and lock up a certain amount of cryptocurrency to propose and validate new blocks. This method is not only more energy-efficient but also reduces the risk of centralization, as it’s not dependent on mining power.

Moreover, Ethereum’s potential for growth extends beyond its technical improvements. Ethereum’s smart contract functionality has given rise to a whole new sector of decentralized applications (dApps) and has been instrumental in the DeFi (Decentralized Finance) boom. DeFi applications aim to recreate traditional financial systems (like loans, insurance, and derivatives) in a decentralized manner, and most of these applications are built on Ethereum. As DeFi continues to grow, so too does the demand for Ethereum.

Additionally, Ethereum’s introduction of NFTs (Non-Fungible Tokens) has opened up new possibilities for digital ownership and created a booming market for digital art and collectibles. As the primary platform for NFTs, Ethereum stands to benefit significantly from this trend.

However, like any investment, investing in Ethereum is not without risks. The cryptocurrency market is known for its volatility, and Ethereum is no exception. The price of Ethereum can fluctuate widely in a very short time, which could lead to significant losses. Furthermore, while Ethereum 2.0 promises many improvements, the upgrade process is complex and not without potential hurdles.

Therefore, while Ethereum has significant potential as a long-term investment, it’s essential to do thorough research and consider your risk tolerance and investment goals before investing. It may also be beneficial to consult with a financial advisor or investment professional.

Alternative Methods: How to Buy Ethereum with Credit Card, Cash App, and More

While buying Ethereum on platforms like eToro is a popular choice, there are several other methods to acquire this cryptocurrency, catering to various needs and preferences.

Credit Card Purchases: Many cryptocurrency exchanges, including Coinbase, Binance, and Bitstamp, allow users to buy Ethereum directly with their credit cards. This method is straightforward and convenient, especially for beginners. However, it’s important to be aware of potential transaction fees and ensure your credit card issuer allows such transactions.

Bank Transfers: Bank transfers are another common method for buying Ethereum. They are typically used for larger transactions due to their lower fees compared to credit cards. SEPA transfers in Europe and ACH transfers in the U.S. are commonly used.

Cash App: Cash App, a mobile payment service developed by Square, allows users to buy and sell Ethereum directly from the app. It’s a convenient option for those who prefer mobile transactions. However, it’s currently available only to U.S. users.

Peer-to-Peer (P2P) Exchanges: P2P exchanges connect buyers and sellers directly, allowing them to negotiate prices and choose from a variety of payment methods, including cash, wire transfers, or even gift cards. Examples of P2P platforms include LocalCryptos and Paxful.

Bitcoin ATMs: While primarily designed for Bitcoin, some cryptocurrency ATMs also support Ethereum purchases. These machines work similarly to regular ATMs but allow you to buy Ethereum directly with cash or a debit card.

Decentralized Exchanges (DEXs): DEXs like Uniswap or SushiSwap allow users to trade Ethereum directly from their wallets, providing increased privacy and control over one’s funds. However, they can be more complex to use and may not be suitable for beginners.

Ethereum and Ethereum 2.0

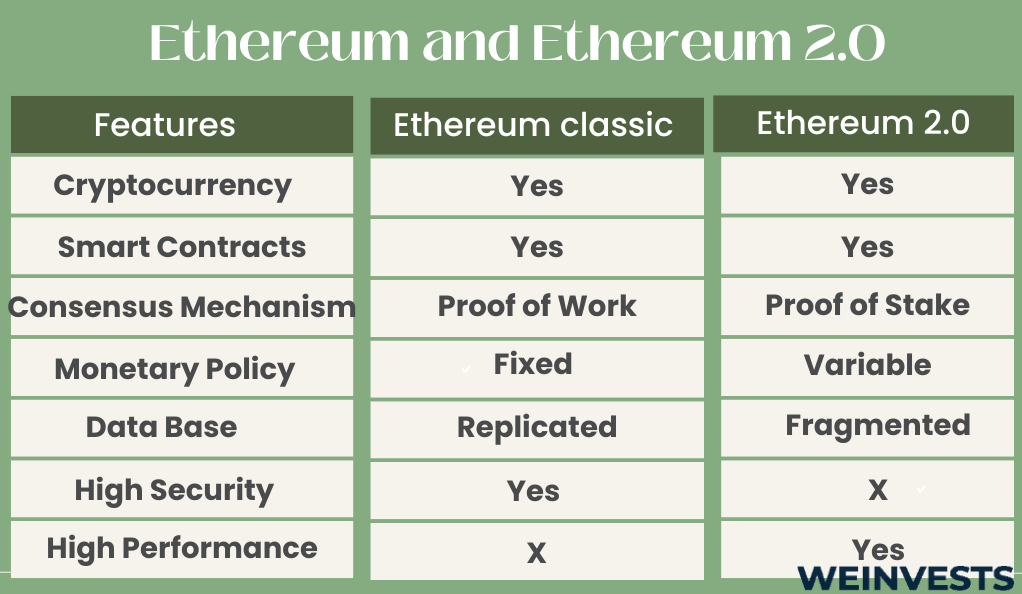

Ethereum, as we know it today, operates on a consensus mechanism known as Proof-of-Work (PoW), where miners solve complex mathematical problems to validate transactions and create new blocks. While this system has proven secure and effective, it has its drawbacks, including high energy consumption and potential scalability issues as the network grows.

Ethereum 2.0, also known as Eth2 or “Serenity,” is an upgrade to the Ethereum blockchain that aims to address these issues. The most significant change in Ethereum 2.0 is the shift from PoW to Proof-of-Stake (PoS). In PoS, validators are chosen to create new blocks based on the number of Ethereum they hold and are willing to “stake” as collateral.

This change is expected to drastically reduce the energy consumption of Ethereum. Additionally, Ethereum 2.0 will introduce shard chains, smaller chains that run in parallel to the main Ethereum chain, significantly improving the network’s speed and capacity.

While Ethereum 2.0 promises many improvements, it’s important to note that it’s still in development, with a multi-phase rollout plan that extends into 2023 and beyond.

In conclusion, while Ethereum 2.0 promises significant improvements over the current Ethereum network, it also introduces new complexities and potential risks. Investors should carefully consider these factors and stay informed about the progress of Ethereum 2.0’s development. As always, it’s crucial to remember that investing in cryptocurrencies involves risk, and one should only invest what they can afford to lose.

Conclusion

Ethereum, as the second-largest cryptocurrency and the pioneer of smart contracts, has solidified its position as a cornerstone of the blockchain world. Its open-source platform has revolutionized the way we perceive and interact with decentralized applications, eliminating intermediaries and fostering innovation. The Ethereum Request for Comments (ERC) standards, including ERC-20 and ERC-721, have been instrumental in the rise of ICOs, DeFi, and NFTs, shaping the landscape of the crypto industry.

With its recent transition from Proof-of-Work to Proof-of-Stake, Ethereum is poised for significant growth and improvements in network performance, making it a potentially good long-term investment. However, investing in Ethereum, like any other cryptocurrency, comes with its own set of risks and fees. These include exchange fees, deposit and withdrawal fees, network or “gas” fees, and potential storage fees.

Moreover, there are various methods to buy Ethereum, including traditional exchanges, credit card purchases, and even peer-to-peer trading. Each method has its own set of advantages and potential drawbacks, and it’s crucial to choose the one that best fits your needs and risk tolerance.

In conclusion, Ethereum offers a world of possibilities for investors and developers alike. Its potential for growth, coupled with its fundamental role in the blockchain ecosystem, makes it a cryptocurrency worth considering for your portfolio. As always, thorough research and careful consideration are key when entering the world of cryptocurrency investing.

What’s the future of Ethereum (ETH)? Read our article to find out:

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More