This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Ethereum crashed to 10 cents in December 2018, and the whole world exploded, leading some to label Ethereum’s Ether a fake coin.

Less than three years later, in 2021, despite wintering a pandemic, ETH has skyrocketed through various all-time highs in less than twelve months, trading from just $745 in January 2021 to an all-time high of 4,800 in November. Sometimes confused with “Etherium price prediction” or “Etherum price prediction”.

Will Ethereum reach $10,000?

That’s left to be determined.

ETH’s impressive 500% appreciation in such a short period has got crypto experts and crypto enthusiasts wetting themselves with various price predictions.

Aside from ETH’s creatively designed use cases, past ICOs, and tokenomics, Ethereum’s massive jump in 2021 can be mainly attributed to Ethereum’s network’s various technological innovations, new partnerships, and versatility in supporting tens of dApps on its platform.

Table of Contents

ETH Price Statistics

ETH Price Technical and Fundamental Price Predication For 2023, 2024 and 2025.

From a technical point of view, there are quite a few different ways ETH might play out in the coming years. The current bearish movement might not be able to fall below the 38.2 weekly fib level of $3600-$3800, which already has started acting as support since the end of October. It was retested last week, with another retest on its way after some short daily buys.

Most likely, if the support doesn’t hold, it might be able to break below the $3500 to test the $3000/$2800 support level, which confluences with the 61.8 fib level on the month, and since December, will almost be getting rounded up. It will be a strategic time for the bulls to get in again to initiate the first bull leg. Unless the worst happens, that is when we can see ETH falling headlong back again to the $1700 support that has already been tested three times, which is very unlikely.

Ethereum has been displaying a negative trend since the second half along with the rest of the cryptocurrencies caught in a bear market. Following the long-anticipated Ethereum 2.0 upgrade to the blockchain, the price of ETH lost 10% and continued its sideways trading pattern.

Ethereum’s market cap is over $194 billion, and its 24-hour trading volume is $25.5 billion.

Currently, the general emotion in the market is fear, and ETH is trading at around $1,300. Although the market is currently in a bear trend, support at the $900 level could be crucial for the next few weeks. According to some supporters, the selling pressure is not as high right now, which could cause the price to decline further.

If the price of Ethereum goes below $900, it could drop to $500 within the next couple of months. This is because the technical factors are not in favor of a reversal at the moment.

In a recent Forbes article, a committee of crypto experts including Sagi Bakshi and Lex Sokolin predict that ETH could rise as high as $19,842 by 2025. Ethereum (ETH) price is set to enter the final and most volatile week of the year, it could be the most widely transacted cryptocurrency due to its expanding utility in the marketplace.

These experts cite an array of upgrades to the network in 2021 that will reduce the currently high cost of transactions and drastically increase utility. One expert on the panel, Sarah Bergstrand, estimated ETH could reach $100,000 by 2025.

The biggest upgrade being eyed by investors is EIP-1559, which will overhaul the transaction fee system used by Ethereum. So, instead of sending fees to miners who complete tasks on the network, users will be able to send the fee to the network itself, which will destroy the fee, reducing overall supply and subsequently increasing the currency’s value.

Notably, institutions are increasing their Ethereum holdings to be filled into the growth of next-generation internet (Web3) applications currently being developed on the Ethereum blockchain. With the progressive growth in the adoption and utilization of NFTs and decentralized finance (DeFI) applications, they could support Ethereum to gain price in the future.

The cryptocurrency market, in general, got a boost from rising gas prices on October 29. Gas, also known as Ether, is the computational resource that the Ethereum network needs to facilitate transactions. Because of this movement, Delphi analysts suspect Ethereum gas looks like it is about to make a run higher, which could boost nearly all decentralized finance (DeFi) tokens.

Conclusively, ETH is the only coin showing the healthiest rivalry against BTC, and it is at an early phase of its life span. Therefore, now might be a good time to start buying up ETHER; with your discretion of course.

ETH 2020 Price Analysis

Q1 and Q2 2021

ETH price analysis shows that the coin was trading sideways at the end of 2020, with its price fluctuating between $550 and $750.

After a strong resistance hold at $631 and $679 between Nov.24 – Dec.20, 2020, ETH finally broke impulsively out of this resistance and established strong support at the marked demand zone, consolidated for 3 days to mark the end of 2020.

ETH opened 2021 at $727.

The 1-month consolidation was in the form of a rising wedge, a continuation pattern of a trend.

Mind you; ETH has been bullish all through 2020. It had to take a short nap before starting 2021 Q1.

BTCs graph mirrored this trend at this period.

Since it has been proven over time by fundamental analysts that financial interest in Ether tends to follow in the wake of Bitcoin rallies because it is the second-largest cryptocurrency, this quickly draws the attention of the novice investor.

So, having found demand strength at the marked 1H OB support, ETH sponsored the price rally to $1348 as the first ATH for 2021.

Upon hitting this ATH, and after some hours of lower timeframe range, ETH signifies preparation for a significant move, which may be either bullish or bearish.

The latter proved to be the case as ETH dipped below $1000, a fib retracement deep into the premium levels of 61.8 and 71.4.

Conveniently, one could have thought; it will further move downwards to the January demand zone considering the bearish market trend.

However, it established a bullish trend by making an HL and HH after the dump. Although the bullish trend didn’t appear impulsive, an indicator that the bears were beginning to initiate their move, the bulls were not ready to give up.

A more precise confirmation of the struggle is the 1-week consolidation towards the end of January, which was like an accumulation if thoroughly investigated on LTFs.

Since accumulation in TA indicates preparation for a bullish move, ETH found its way up to $1700.

In the real sense, there was a consolidation in January and February.

Moreso, the consolidation’s aftermath was the same for both months.

You might say the fundamental factor attributed to this pump is the launch of Ethereum futures trading on February 8, indicating that traders will be able to speculate on what Ether will be worth at a given date in the future for the first time – a hallmark of any mature financial asset.

Q2 and Q3 2021

After hitting $1700, it retraced to the marked demand zone after mitigating the liquidity to initiate the ascending channel trend of HHs and LLs.

The next significant high after $1700 was the $1838 price point. After this, there was a 6-day consolidation, also indicating the coming of a major move.

For the consolidation to last as long as six days, it shows that the sellers fought the buyers hard, but the buyers endured all that they could to drive the price higher to $2040.

The next thing that happened to ETH after hitting $2040 was a shock to some analysts who didn’t see it coming. The first remarkable dump of the year occurred immediately, with the price falling from $2040 to $1290, about a $750 drop.

When it broke the previously created ascending channel, it retraced back to the imaginary trendline giving out another opportunity to those who were still skeptical about the sell to get in the flow that would later dip down to $1290.

PS: ETH hit this low on February’s last two days. March launched with a bullish move that started with an expanding triangle pattern rallying up to make another ATH bouncing off $4375, which consequently led to another remarkable dump for the year on May 12; a price fall to around $1727 creating three-time tested strong support, which eventually held to continue the upside move till Aug.1, with the price at $2700, thus marking the end of the first half of the year.

Q3 and Q4 2021

August, after a short retracement, continued with the ascending channel pattern, after the price consolidated, bouncing off $2911 and $3361, then breaking out to the up-side all the way back to $4000, a confluence with the premium fib level of 86.1 on September 1, which marked the beginning of Q3; the last quarter of the year.

As it played out with the previous significant highs, ETH experienced another remarkable fall to the downside, at 38.2 fib level. It gained support that held and sponsored the last bullish move for the year’s final quarter. This upside move broke the previous ATH price by around $4372 to achieve the new and latest ATH price above $4700 on November 10, 2021.

The reason for the move wasn’t clear so let’s blame cryptocurrencies’ old-buddy — volatility.

With moves up to 20% higher or lower. Mikkel Morch said: “Importantly, the uptick doesn’t seem to be leverage-driven but rather results from the increased demand on the spot market where there’s currently very little sell-side liquidity.”

As usual, the ATH experience consolidated at a resistance level of $4770-$4870, which ultimately held, resulting in an impulsive sell down to $4000. Since then, ETH has not made any lower low.

In fact, the 4H/1H bullish BOS might be signifying a continuation of the bullish move, which may eventually break through the $4700 ATH all through $5000.

So far, ETH has maintained its bullish structure weekly and daily since the beginning of the year.

In 2021 Q2, ETH has been making a retracement move, which it usually does at the end of a notable period.

Without considering technical analysis yet, the current retracement may be indicating that buyers are stepping out to relax for the year after making enough waves in the market to gather momentum to start another bullish journey. This is because, technically, considering the buying volume and the RSI trading above 69 for the past weeks, it doesn’t look like the buyers were forcefully pushed out of the market or that they are finally out of play.

Fundamentally, Ethereum news has also been driven by the application of smart contracts in DeFi and NFTs.

According to a report by Chainalysis in September, it was found that central, northern, and western Europe has the world’s biggest cryptocurrency economy – and the majority of large institutional-sized transfers in the region went to DeFi platforms in the past 12 months.

As a result, most of those large institutional transfers were made in Ether and wrapped Ethereum (wETH), an ERC-20 token commonly used in DeFi protocols.

At the same time, trading activity in the NFT space spiked in the third quarter of this year and continued its bullish momentum in October. Decentralized applications registered more than two million daily unique active wallets for the first time during October, which was up by 21% compared with the previous month, and 626% year on year from October 2020, according to DappRadar. The NFT space saw $4.2bn in trading volume in October alone, increasing 2% compared with September, with Ethereum accounting for 82.11% of the total volume.

With NFTs on the Ethereum blockchain traded using the ether coin, any increase in activity drives up demand for the cryptocurrency, supporting higher prices.

A report said; “The floor market cap for the top 100 Ethereum NFT collections and NBA Top shot was measured at $16.72bn, an 18% increase from the figure recorded in September.”

While adopting alternative blockchains like Solana and Polygon is growing, Ethereum remains the leader in DeFi in terms of total locked value (TVL). According to the report:

“Ethereum held $120bn in TVL, almost 55% of the industry’s metric. Even though the supply in DeFi Dapps has increased in recent months, and despite all the negative effects of high gas fees, Ethereum is still a network rich in DeFi activity.”

Understanding Decentrality

Decentrality is not impossible to achieve. The term ‘bitcoin technology’ comes into play from Satoshi cleverly combining three different technology protocols.

- Decentrality

- Calligraphy

- Digital currencies

You, too, can set up your personalized decentralized network. You only need:

- To understand how bitcoin’s decentralization works

- To write codes that mimic the network

- Extensive computer network to run the code.

It is time, money, and energy demanded to satisfy the above conditions.

Here is where Ethereum comes in. It understood how Bitcoin decentralization works.

Ethereum operates the Solidity programming language, and it creates the logic (smart Contract) on which DApps are borne.

Unlike bitcoin, which only supports Defi on its blockchain, Ethereum focused on other uses of Bitcoin technology and thus widened its perspectives, market, and versatility.

ETH is the worldwide running DApps infrastructure where you can specify the type of DApps you’d like to run. Some examples of DApps that run on the Ethereum blockchain include Tether etc.

What is Ethereum?

Ethereum is a network that consists of groups of computers (nodes) connected and sharing information (communication) in a decentralized network.

Ethereum’s native coin is Ether, and it is used to pay Ethereum’s network fees and gas for transactions amidst other use cases.

PS: Do not confuse ETH (Ether) with ETC.

ETH Tokenomics

ETH tokenomics is a little different from the token distribution you might be used to.

Firstly, it has no specific total number; its economy is designed to prevent excessive concentration and potential loss of the coin and, therefore, create a permanent linear growth model.

In 2015 during Ether’s first ICO, Ethereum sold between 70 and 73 million Ethers.

At the moment, there are about 118 to 120 million circulating Ethers. Contrary to what people think, Ether’s maximum supply is not unlimited. It is determined by the annual number of coins sold and lost.

The amount of coin lost is then minted in the next session. Through this, equilibrium is achieved, and Ether keeps its value up.

Ether significant uses are:

- Transfer of value: transfer of Ether from one wallet to another.

- Trigger or activation of Smart Contract.

- As Gas

Transfer of value (Ether) from one wallet to another and Gas fee is easily understandable.

Gas

Gas fees are the cost per transaction on the Ethereum network. To avoid spamming, ETH blockchain validators will only take you seriously if you pay a certain amount to have your transaction processed faster. The higher you pay, the faster your transaction gets processed.

It’s like a legal system of bribery.

Smart Contract

Smart contracts are if then coded logic executed on the Ethereum network.

You might have heard your programming geek friend refer to Bitcoin as a Turin-incomplete network and Ethereum as a Turin-complete network.

What it simply means is that bitcoin can only handle a single task at a time. That is, the platform by itself has to reset again before handling subsequent tasks.

The bitcoin network is only designed to send and receive value (Cryptocurrencies).

Ethereum network took that further with its blockchain technology’s Solidity programming language.

Solidity is used to write smart contracts that are the logic that runs DApps.

If a particular logic is satisfied, then a specific action is taken.

Smart contracts are:

- Self-executing

- Letter Strict

- Immutable

Smart Contract deals with all of the aspects of the Contract

- Enforcement

- Management

- Performance

- Payment

Ethereum was designed to create a very complex Contract, but the downside is maintaining its security.

To make sure the Contract does ONLY what the coder/author wants it to do, every possible way in which a contract can be executed must be perfectly addressed.

Ethereum opined that code is the law; a contract is an ultimate authority because of its immutability.

Although, some crypto experts argue about Smart contract’s letter-strict characteristics as its one major flaw. A truly smart contract should be flexible enough to adapt its execution to specific contexts.

Transfer of Value

Users can transfer Ether from various wallets through digital wallets equipped with public and private keys.

There are two types of Ethereum accounts.

(Externally Owned Account) EOA: Has a public and private key to control the account they can:

- Send and receive Ether

- Create and trigger smart Contract

Contract Account: Lacks private keys but are coded with pre-defined rules/triggers for accessing it. Every smart contract on the Ethereum network has a contract account.

The rules, logic, or accessing contract accounts are hard-coded into their building.

Contract accounts can:

- Receive Ether.

- Send Ether (when triggered)

- Trigger new contracts.

Ether Transactions:

EOA interacts with other EOA to transfer value.

Types of nodes/clients/wallets on the Ethereum network

There are three major types of nodes on the Ethereum network.

- Full nodes

- Light nodes

- Hardware wallets

Full nodes contain all the information of the Ethereum blockchain from its inception until the present moment. Its features include:

- Full blockchain copy

- Memory intensive

- No 3rd party reliance

- Usually harder to operate.

Full nodes are integral parts of the Ethereum network that helps execute smart contracts in a decentralized manner.

Some platforms (in the form of developed software) that allow you access to Ethereum’s entire network are:

- Geth; for developers

- Mist;

- Parity

All full nodes are smart contract wallets; they can deploy smart Contracts to the Ethereum Wallet.

Light nodes:

Wallets require a third party to get the information about the blockchains.

They do not contain the entire ETH blockchain. They can transfer value between (EOS), and they cannot trigger or deploy smart Contracts.

Light nodes are usually accessed on mobile phones etc.

Hardware wallet: Hardware wallets are not contracted wallets; they do not support smart contracts but are relatively the most secure. They can only send and receive ERC-20 and Ether.

How to buy Ethereum on eToro

Ethereum has quickly become one of the most famous cryptocurrencies to ever exist. Even though the price of numerous cryptos dropped in 2019, Ether only became more valuable. Therefore, everyone understood that these coins are almost impossible to predict.

Considering the previously mentioned aspects, buying crypto as relevant as Ethereum might be the ideal option for you. Numerous traders, investors, and even famous people have chosen it to see if it’s the cryptocurrency to reach their goals, so why shouldn’t you?

Even though many people buy Ethereum, you need a trustworthy platform if you want to do so. Therefore, eToro might be the perfect site to trust, and this guide offers everything you should know about using it to buy Ether.

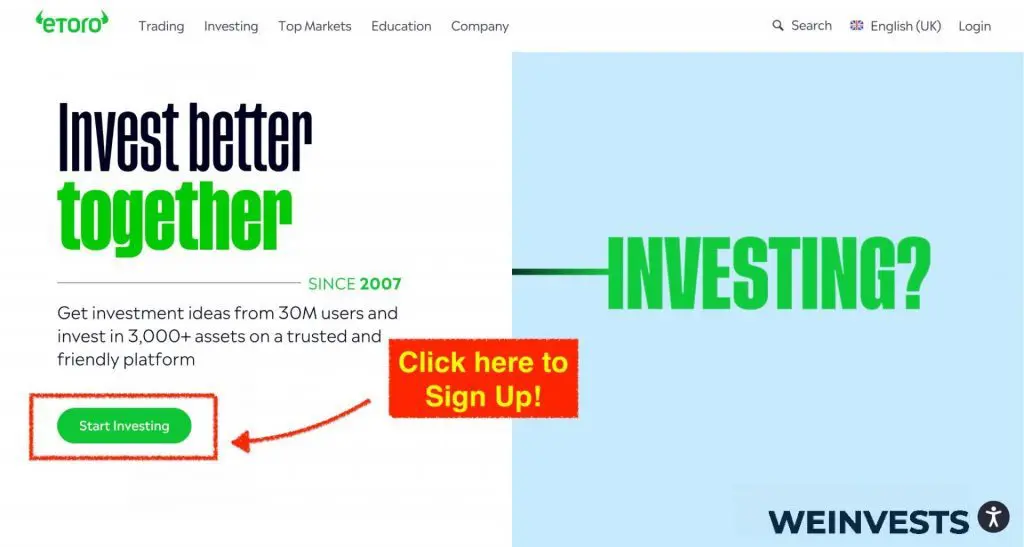

Step 1: Open an Account

If you decide that you want to use eToro to buy Ethereum, you have to open an account first. Go to the eToro’s site.

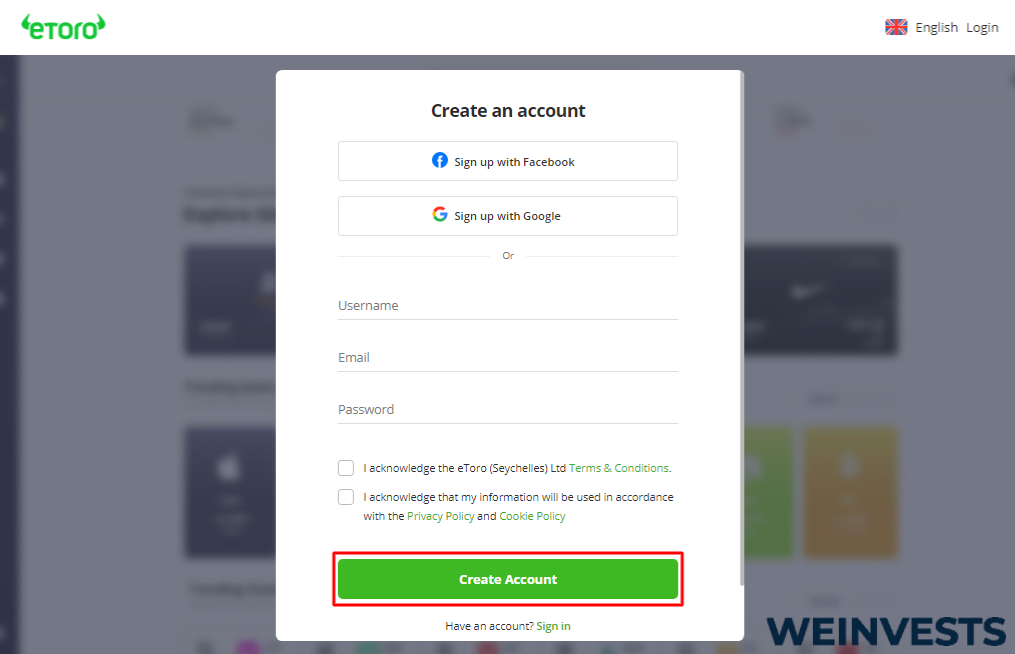

Filling out the necessary information for you to set up your account. You will need to provide personal details, but nothing out of the ordinary compared to what you must input when you’re opening any other type of account.

Once you do this, reread everything you wrote and make sure you correct any errors in case you missed anything. After guaranteeing that all the information is correct, proceed to the next step.

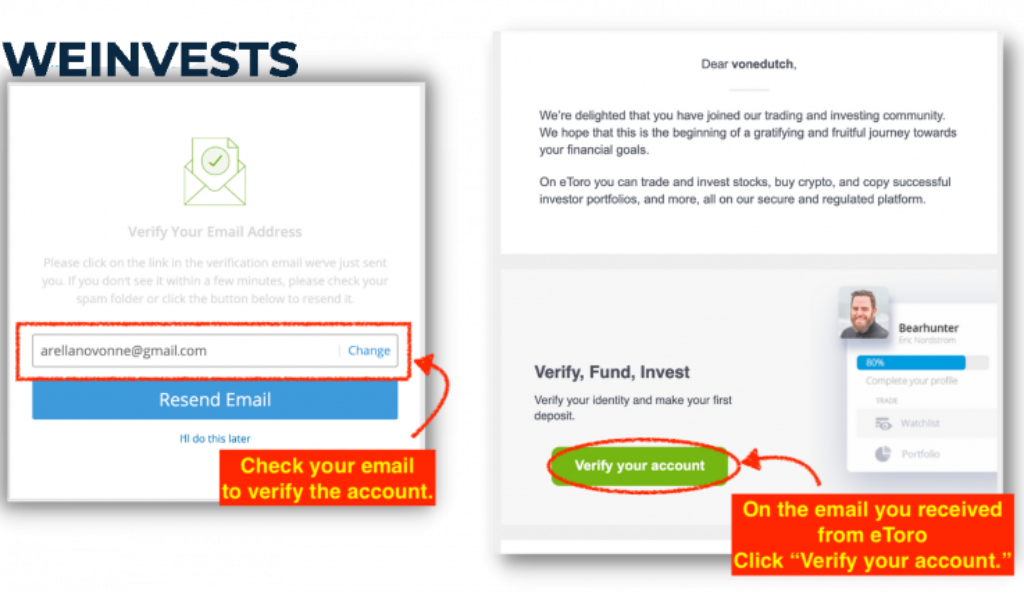

Step 2: Upload ID

You probably care about safety, especially considering that you’re investing your assets when you buy cryptos. Therefore, guaranteeing that eToro provides you with sturdy security measurements is probably a relief.

Since eToro considers security as something immensely essential, you must verify your identity when you open an account. Otherwise, you can’t proceed or buy any cryptos.

To verify your profile, you must upload proof of residence, so you’ll need a utility bill. You also have to add a valid ID picture to prove your identity.

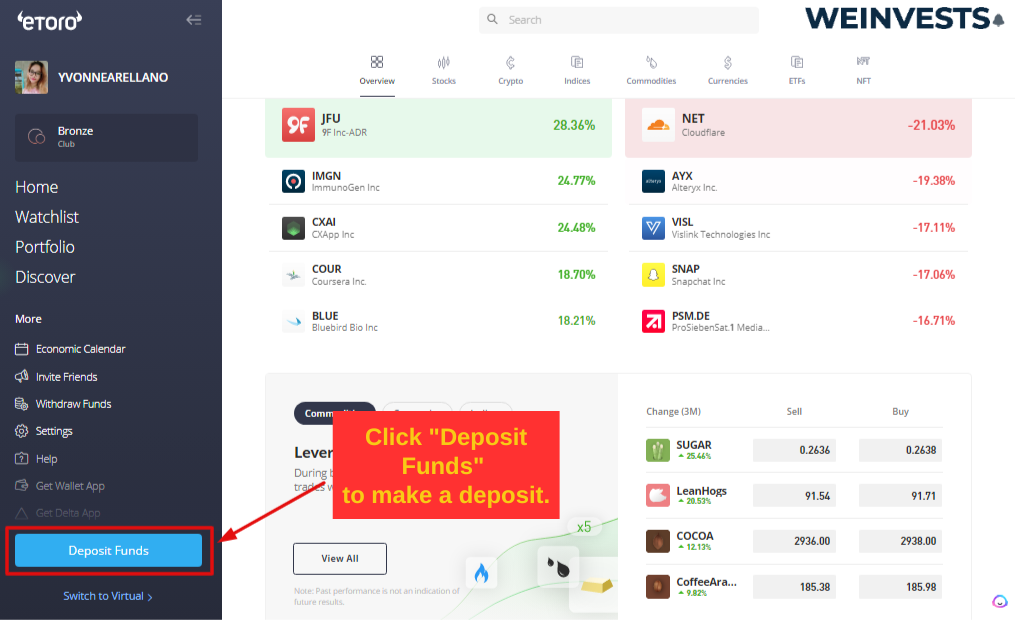

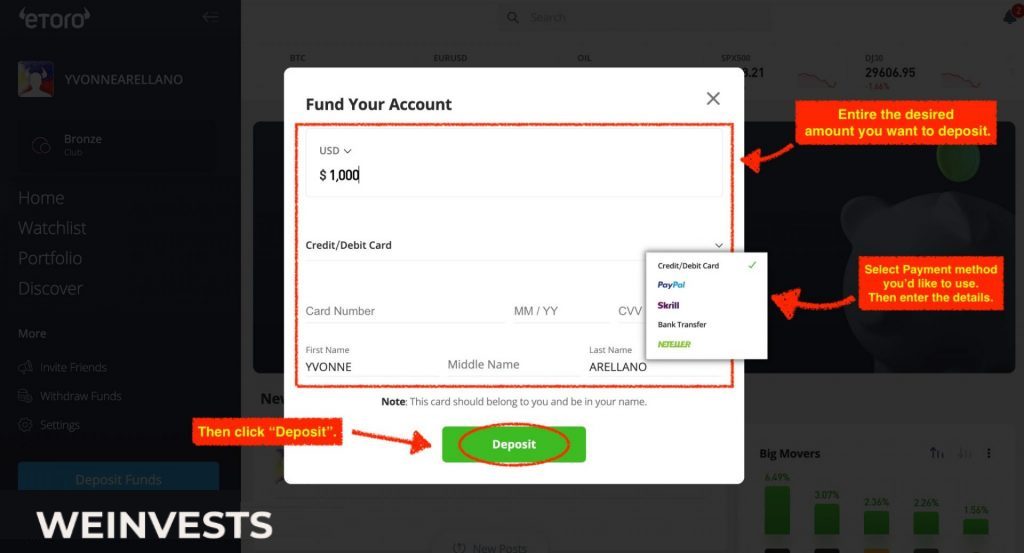

Step 3: Make a Deposit

Numerous traders and investors ask the same question: is it safe to trust trading platforms? The truth is that it depends on the platform. However, you can’t go wrong with eToro. It’s one of the most secure sites you can use.

When you want to make a deposit, all you need to do is log into your account, look for the ‘Deposit’ button, and pick the amount of money you want to invest, the currency, and the payment method. After this, you can proceed to the next stage of the process

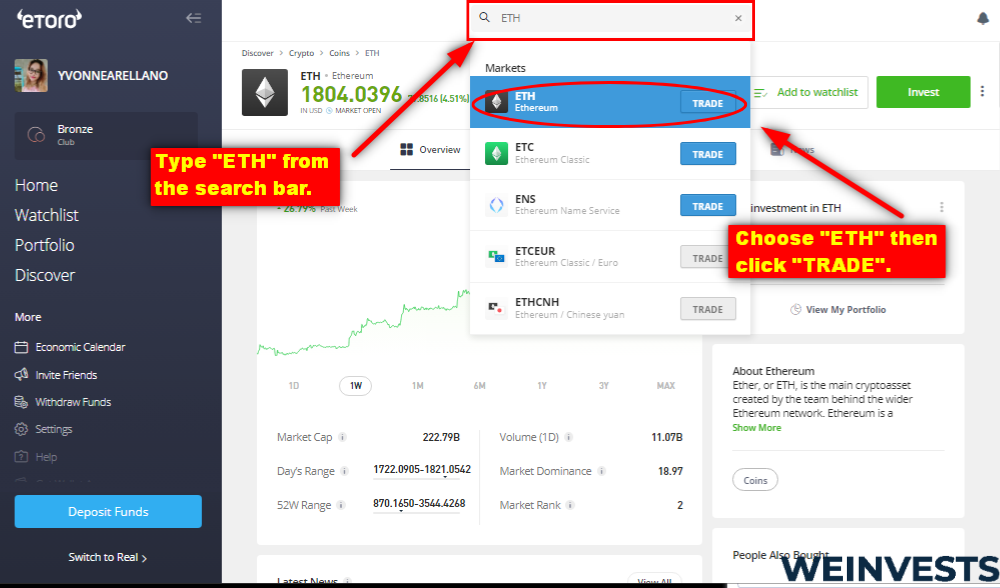

Step 4: Search for Ethereum

You can search for Ethereum on the eToro platform once you fund your account. By now, you should be almost ready to make your first purchase.

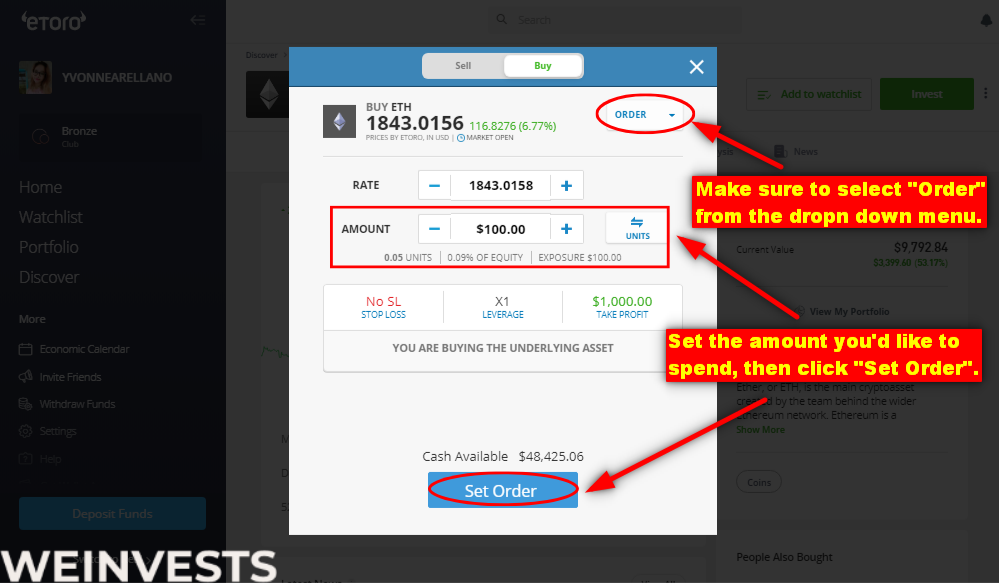

Step 5: Buy Ethereum

The last step in this guide is to buy Ethereum. Predicting how cryptos will react in the future is almost impossible. However, since Ether has grown immensely over the past years, some traders believe that it can only become even more relevant!

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More