This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Gold ETFs offer the liquidity of stocks and exposure to the price of gold at a low cost. A valuable combination that no other investment vehicle can provide.

One of the most prominent gold ETFs is the iShares Gold Trust (IAU). This is the best example of a highly liquid ETF that handles a gigantic amount of money and doesn’t charge you a lot for parking your money in it.

In this article, we will give you an overview of this ETF, explain what exactly makes it special, help you decide how to approach trading it, and outline the risks involved with investing in it.

Let’s get started…

Table of Contents

The iShares Gold Trust ETF is managed by BlackRock and was created back in 2005. As a gold ETF, it aims to replicate the price of gold by tracking the LBMA Gold Price index. This ETF is listed and traded on NYSE Arca under its ticker symbol “IAU”.

We should note that the performance it seeks to replicate is the one before any expenses and liabilities are accounted for.

The sponsor of iShares Gold Trust is iShares Delaware Trust Sponsor LLC, while the trustee is the Bank of New York Mellon and the custodian the JPMorgan Chase Bank N.A., London branch.

The ETF’s shares are issued and redeemed in blocks of 50,000. Each block of shares, which is also called a basket, is traded for gold bullion.

The iShares Gold Trust wasn’t always tracking the LBMA Gold Price index. It only started using its benchmark in 2015. Before that, in the 2010-2015 period, it tracked the London Gold Fix index. Before 2010, the fund was using the Gold Futures Spot Month

Settlement Price as its benchmark.

This ETF has an expense ratio of 0.25%.

For a comparison, take a look at this list and sort it from highest expense ratio to lowest. You will observe that with leveraged and inverse ETFs excluded, 6 gold ETFs are more expensive than IAU and 5 are cheaper.

As for this ETF’s performance, let us examine its returns during different periods.

Since its inception, the fund’s market price increased by an average compounding 8.11% per year. The referenced benchmarks witnessed an average annual 8.39% increase.

Looking at the last 10 years (2013-2023), the ETF returned an average of 0.61% on an annual compounding basis. The relative benchmarks changed by an average increase of 0.86% per year.

Examining the performance of the last 5 years reveals a 6.69% average return per year. As for the benchmarks, their prices increased by an average of 6.93% per year in the same period.

Last, in the last 3 years the fund had an average 6.05% return per year, while the referenced benchmarks’ prices changed by 5.97% per year.

Out of the many gold ETFs, why would an investor choose iShares Gold Trust? There are some strong points in favor of this ETF, so let’s take a look.

First of all, this is the second biggest US gold ETF based on total assets and trading volume. Its assets under management as of January 2023 were ~$27.9 billion and its average volume was observed at about 4.8 million on 2/2/2023.

If you want to see it for yourself, check this list and sort it based on total assets and average volume. It’s noteworthy that the third largest US gold shares, SPDR Gold MiniShares Trust, doesn’t even come close in regards to its AUS (~$5.8 billion).

We also need to mention the fact that for a prominent ETF with such a long track record as iShares Gold Trust, its expense ratio is relatively low at 0.25%. The cheaper gold ETFs in the US which are listed on the etfdb.com page provided above are younger than iShares Gold Trust.

Speaking of prominence, another important fact is that the sponsor of the fund, iShares, has experience in managing ETFs for more than 20 years. Today, its estimated number of investors is 120 million and it manages $2.5 trillion around the globe.

Additionally, this is the same sponsor of another widely known ETF: iShares Core S&P 500, which tracks the S&P 500 index. The net assets of the fund were about $307 billion as of January 2023.

It’s also good to know that the trustee of the fund is the Bank of New York Mellon, a bank with $46.7 trillion in assets under custody and one considered systematically important by the FSB. Naturally, it’s the largest securities services company and custodian bank in the world.

As for the fund’s custodian, JPMorgan Chase, this is a bank operating for as long as 2 centuries and it’s the largest banking institution in the world as measured by market capitalization (January 2023).

Investing in a gold ETF like iShares Gold Trust should be approached like investing directly in gold if you intend to hold for years.

With that being said, the reason you want to invest in this ETF should be taken into account. If you’re looking for a hedge against inflation, gold may or may not do the trick.

There are plenty of periods that we can cherry-pick to observe the price of gold increasing more than inflation. However, in the last 10 years (2012-2022), gold’s performance was weak and couldn’t catch up with inflation. Who says your gold returns won’t lag inflation for a very long time, deeming your investment unsuccessful?

On the other hand, if you treat your gold ETF allocation as a way to decrease portfolio volatility, you can’t go wrong with the time frame you hold such an ETF in your portfolio.

Gold returns are inversely correlated with those of equities and bonds, providing a way to effectively hedge against equity and bond downtrends. That means that the price of gold increases when the prices of equity and bond decrease; and the reverse.

Let’s assume that you want exposure to gold as a way to diversify your portfolio and decrease volatility. Now, how much of your fund should you allocate to it?

No one can know where the market is heading with certainty, so it’s not a good idea to base your allocation based on how bullish or bearish you are. Your best bet would be to look at what you know for sure.

And this is your needs. You can determine your allocation based on how strong of a hedge you require.

If you can’t stand volatility during market turmoil or you are very close to retirement (and withdrawals will start soon), you may want to allocate more to gold than you would otherwise. Consider starting with a minimum allocation of 5% and increasing based on your desired hedge up to 20% (or as much as 30% if you want relatively stable returns from a widely diversified portfolio).

With that being said, it’s best to talk with a financial advisor as well to ensure that your gold allocation fits your overall portfolio construction. Even a large allocation to gold may not be effective if the rest of your allocations do not reflect a well-diversified portfolio.

One of the best online brokers available, eToro offers a user-friendly experience for both beginner and professional traders. With its solid reputation and wide range of trading options, eToro is the perfect choice for those looking to invest in IAU. In this mini-guide, we’ll walk you through the process of opening an account on eToro and investing in iShares Gold Trust (IAU).

Step 1: Open your Personal Account

To get started with eToro, you first need to open an account. Head over to eToro’s homepage and click on the “Join Now” or “Sign Up” button. This will redirect you to the registration page, where you’ll be asked to provide your email address, create a username and password, and accept eToro’s terms and conditions. After filling out the necessary information, click “Create Account” to complete the process. You’ll also receive an email to verify your account.

Step 2: Upload ID

Once you’ve created your account, eToro will require you to verify your identity. This is a necessary step to comply with financial regulations and ensure a safe and secure trading environment. To do this, you’ll need to upload proof of identity, such as a valid ID or passport. Navigate to the verification section in your eToro account and follow the instructions to upload your chosen document.

Step 3: Make a Deposit

After verifying your identity, it’s time to fund your account. eToro offers a variety of deposit methods, including credit/debit cards, bank transfers, and e-wallets like PayPal, Skrill, and Neteller. Locate the “Deposit Funds” button on the eToro platform and choose your preferred method. Follow the prompts to complete the deposit, keeping in mind that eToro has a minimum deposit requirement, which varies depending on your region and chosen deposit method.

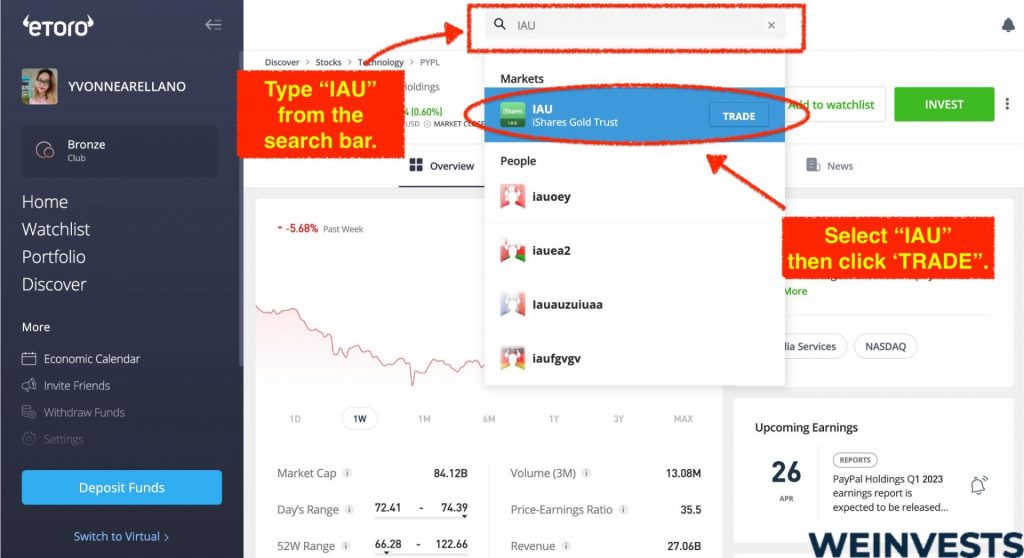

Now that your account is funded, you’re ready to search for iShares Gold Trust (IAU) on the eToro platform. Locate the search bar at the top of the screen and type in “IAU” or “iShares Gold Trust” to find the stock. Alternatively, you can browse the “Discover” section (https://www.etoro.com/discover) to explore various investment options, including IAU.

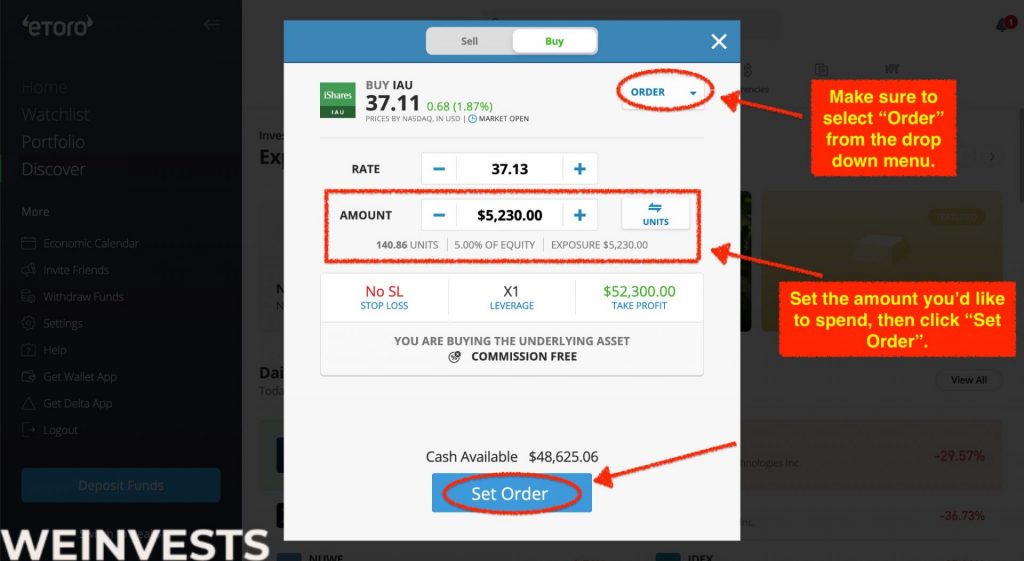

Once you’ve found iShares Gold Trust (IAU) on eToro, click on the stock to open its dedicated page. Here, you’ll find detailed information about the stock, including price charts, news, and analysis. To trade IAU shares, click the “Trade” button to open a new order window. Choose the amount you’d like to invest, and set any stop loss or take profit levels as desired. Finally, click “SET ORDER” to complete the transaction, and congratulations – you’ve successfully invested in iShares Gold Trust (IAU) ETFs on eToro!

Risks of Investing in Gold ETFs

You should know that investing in gold ETFs carries risk just like other securities and types of funds. We outline them below…

Market risk is basically the danger of a decrease in the price of gold which will naturally impact a gold ETF’s performance. Gold is not much different from other assets and securities in that its price will be determined by supply and demand.

If you intend to speculate on the price of gold or you expect gold as a good standalone hedge against inflation, market risk will be very relevant. Not so much if you don’t care about short-term fluctuations and hold for years though.

Liquidity risk is related to the possibility of not being able to get out of a position soon enough. As you would expect, this only applies to traders of gold ETFs.

Gold ETFs are a great vehicle for traders who want to speculate on the price of gold. Trading volume is, therefore, very important. If it were to dry up at some point, effectively buying and selling at the right time would be detrimental to performance.

Conclusion

All in all, iShares Gold Trust is a very good choice for anyone looking to get exposure to gold.

Its long track record coupled with a low expense ratio makes this ETF one of the best options out there. Additionally, the sponsor is well-established and backed by BlackRock, the world’s largest asset manager.

But as with any investment vehicle, the way you approach investing in it matters in order to see your expectations met. Talk about this ETF with a financial advisor, so he can effectively direct you in terms of allocation.

FAQ (Frequently Asked Questions)

What is an ETF?

An Exchange-Traded Fund (ETF for short) is a marketable security of a fund that is listed on a stock exchange.

Buying such a fund’s shares gives you indirect ownership of whatever assets it invests in. ETFs can invest in various assets and securities like stocks, bonds, gold, oil, etc.

What’s the Difference Between ETFs and Mutual Funds?

The main difference is their structures.ETFs are traded like stocks on exchanges, while mutual fund transactions happen directly with their sponsors.

Therefore, another related difference is the much higher liquidity of an ETF as opposed to a mutual fund, in general.

What’s the Difference Between ETFs and Index Funds?

An index fund is a fund that employs a passive strategy through an attempt to replicate the returns of an index. An ETF is a type of fund listed on a stock exchange.

ETFs can be index funds and in most cases they are. But some ETFs employ an active strategy instead, so the two terms should not be used interchangeably.

How Much Do ETFs Cost?

The cost of ETFs can vary depending on the strategy and the assets they invest in.

For instance, actively managed ETFs are more expensive to own than those that track indices. In general, you can expect passive ETFs to charge a 0.1-0.5% expense ratio and active ones to charge as much as 1%.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More