This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The IT industry has been seeing phenomenal growth over the past few decades. Stocks of different IT companies have seen exponential growth in their value. The same is the case for Advanced Micro Devices, which many experts expect to see a surge in its share value.

Walter Jeremiah founded Advanced Micro Devices in 1969 and launched an IPO in less than two years. They started as a second-source manufacturer and focused on giving the best quality. Let’s get an overview of what the company does.

Table of Contents

Overview of Advanced Micro Devices

Advanced Micro Devices is a global manufacturer of semiconductor devices that are a vital component of computer processing. AMD also sells various other components that have a critical role in consumer electronics manufacturing.

Initially, the company started providing second-source chips to Intel. The agreement was signed in 1982 and ended in 1986, after which AMD came up with the Am386 microprocessor. It resulted in a legal war with Intel for the coming years.

However, the verdict in their favor from the US Supreme Court in 1994 came in AMD’s favor. In recent years, the company was split into two different segments. One focuses more on the computer and the graphics part, while the other focuses more on the processors for computers.

Advanced Micro Devices acquired ATI in 2006. The company then launched its spin-off manufacturing operations in the shape of GlobalFoundries Inc. The core products that are driving the growth of AMD share price over the last few years include:

- Zen core architecture (released in 2017)

- Zen+ series (released in 2018)

- Zen 3 series (released in 2020)

- Zen 4 series (released in 2022)

The latest Zen 4 series is coming in with recent development, and many people are waiting for it in 2023. Let’s go over the forecast to understand what to expect from AMD in 2023.

Advanced Micro Devices (AMD): Statistical Overview

AMD Stock Price Prediction 2024

The AMD stock price prediction for 2024 reflects a mix of optimism and cautious analysis from various financial experts and market observers. Key factors influencing these predictions include AMD’s recent advancements in technology, particularly in the AI accelerator market with its MI300 line, and its positioning as a strong competitor to Nvidia in data centers and AI segments. AMD’s innovation in this area, especially with the Instinct MI300X chip, has garnered attention from significant industry players like Meta and Microsoft, indicating a promising market presence.

Furthermore, AMD’s new graphics card lineup, including the Radeon RX 7600 XT, is expected to impact the market positively. This product is anticipated to bridge performance and pricing gaps in its segment, potentially giving AMD an edge over competitors like Nvidia.

Financial forecasts for AMD show varying predictions. Some analysts expect a significant upside in AMD’s stock price, citing factors like revenue growth, EPS increases, and the company’s strategic position in the AI and semiconductor markets. Others adopt a more cautious stance, reflecting the competitive nature of the industry and the challenges AMD faces against established players like Nvidia.

Overall, while predictions vary, there is a general consensus that AMD is well-positioned for growth in 2024, driven by its technological advancements, product launches, and strategic market positioning. The company’s focus on AI and data centers, along with its potential to capitalize on emerging market opportunities, are key factors that could contribute to its stock reaching new highs in 2024.

AMD’s Future Stock Outlook

The perspective on Advanced Micro Devices (AMD) stock takes into account recent market developments and company strategies. Analysts and investors are keeping a close eye on AMD’s performance, particularly in emerging technology sectors.

- Technological Innovation and Market Expansion: AMD’s commitment to innovation, especially in areas like AI and gaming, is a significant factor. The company’s advancements in chip technology and its competition with industry leaders like Nvidia and Intel are pivotal in shaping its future market share and stock value.

- Financial Performance Trends: AMD’s financial results, including revenue growth, profit margins, and market capitalization, will be closely monitored. Any fluctuations in these figures can significantly influence stock value predictions.

- Global Economic Influence: The semiconductor industry is sensitive to global economic trends, including trade policies, supply chain disruptions, and shifts in consumer demand. These factors could play a crucial role in AMD’s stock performance.

- Industry Competition: AMD’s ability to maintain and grow its market position in the face of stiff competition is crucial. Its strategies to outperform or coexist with major competitors will be a key focus for investors.

- Long-term Viability: While short-term gains are important, analysts are also considering AMD’s long-term strategy, including R&D investments, potential mergers or acquisitions, and expansion into new markets.

- Regulatory and Political Climate: Changes in regulations, especially those related to technology and trade, can impact AMD’s operations and, by extension, its stock value.

- Investor Sentiment: The perception of AMD among investors, influenced by both performance metrics and market sentiment, will play a crucial role in shaping its stock price.

Given these factors, while precise predictions are challenging, a balanced view that considers both potential growth and market risks is essential for understanding AMD’s stock outlook.

Historical Analysis of the AMD Stock Price

By doing historical analysis, we can understand the reasons behind the increase in AMD stock price over the years. We can also know about the different reasons that fueled its growth and what lessons we can take from the future. Let’s get right into it.

AMD Stock 2023

The year 2023 holds a great future for the AMD due to its recent developments. Advanced Micro Devices are working on different avenues that can open many opportunities for its growth. Major cloud service providers including Microsoft, Oracle, and Alphabet’s Google have already decided to use AMD’s new processors.

Additionally, server OEMs including Supermicro, Lenovo, and Dell will be producing systems using AMD’s most recent chips.

Due to a rise in the production of game consoles, AMD stock could surge next year. In fiscal 2023, Sony hopes to ship 30 million PlayStation 5 consoles, which are powered by AMD’s semi-custom processors. From its estimate of 18.5 million units in fiscal 2022, it would represent a 64% increase.

Microsoft’s Xbox console shipments are anticipated to increase to 30 million units in 2023, up from the estimated 21 million units this year. This is encouraging for AMD because Microsoft also uses AMD’s chips in its most recent consoles.

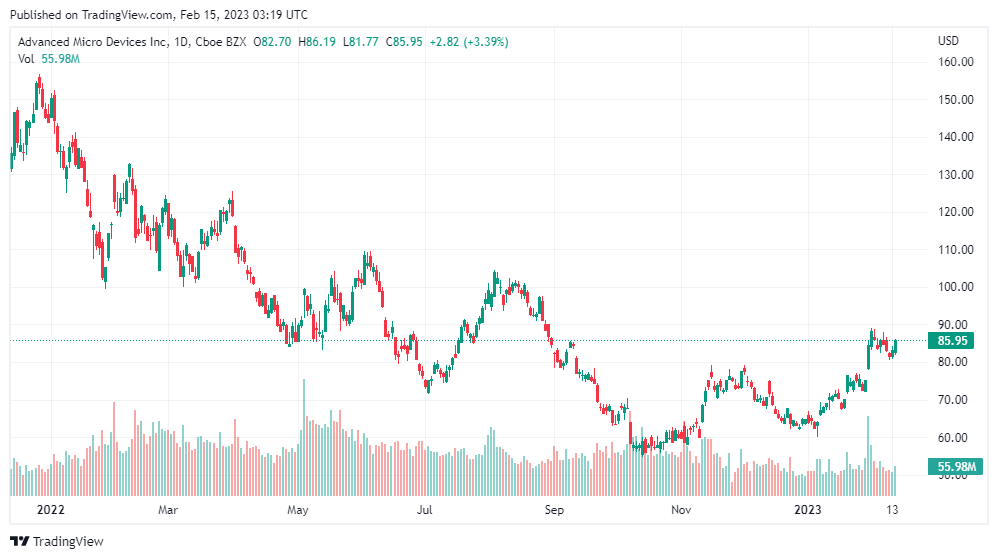

AMD Stock 2022

2022 was not a particularly fruitful year for AMD. The tech giant’s stock value started 2022 above $140, only to plummet to almost half its value by the end of the second quarter. At its most depressed point in December 2022, AMD shares were selling at an astonishingly low price of less than $70.

Despite the turbulence in price in 2022, AMD acquired Pensando, which is a distributed services platform for $1.9bn, allowing Advanced Micro Devices to increase their data center solutions capabilities. Also, the company completed its acquisition of Xilinx in 2022. Both deals offere great prospects for AMD in the nearest future.

AMD Stock 2021

The AMD share price saw ups and downs throughout 2021, but in the end, it was able to increase by 57. Its share price did see an impact of the Covid-19 pandemic. However, it continued to grow after the lockdown was over, indicating the company’s strong policies. Most importantly, it began to finalize the deal of acquiring Xilinx.

They signed the official agreement in 2022 after finalizing the deal in 2020. The main reasons behind the dips throughout 2021 for the AMD share price were:

- Covid-19 pandemic

- Manufacturing facilities shutdown to lockdown

- Global supply chain issues

AMD Stock 2020

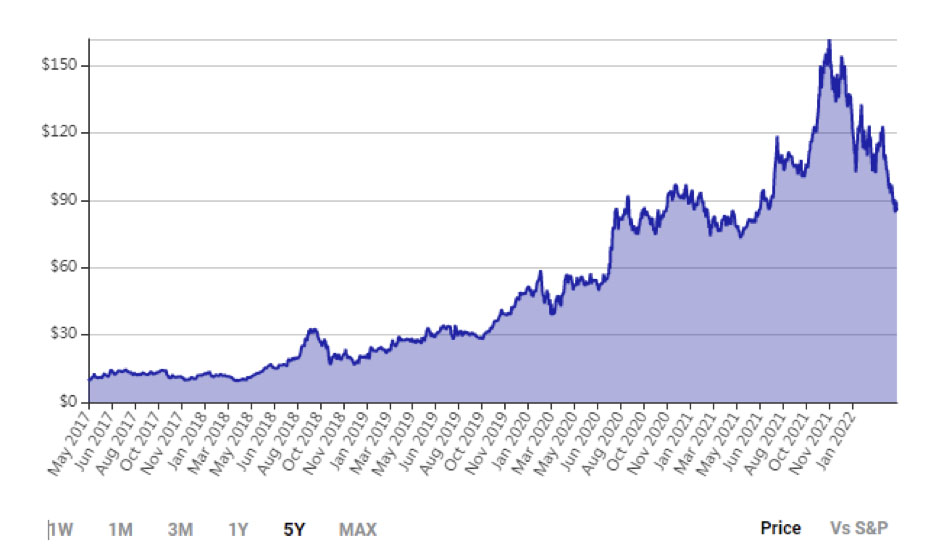

Overall the AMD stock price increased more than 350% in four years. The company stock value was around $59 in February 2020 compared to $35 in 2017. The major reason behind this growth is due to AMD’s steady revenue which gradually increased over the past few years.

The company had total revenue of $5.25 billion in 2017. It further increased to $6.73 billion in 2019. However, AMD surprised everyone with earnings of more than $8.5 billion in 2020. This factor, along with improved liquidity, became the reason behind AMD stock value rise in 2020.

AMD Stock 2019

AMD’s share price growth trajectory remained the same as its predecessor and successor years. The share price increased by 148.4% in 2019 and reached $46 by Christmas 2019. Many factors became the driving force for the increase in the share price.

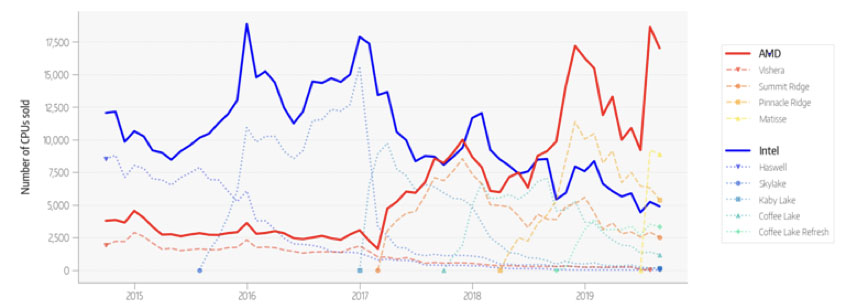

AMD started production with the 7-nanometer chip traces for their processors. On the other hand, its biggest competitor Intel was only beginning with the 10-nanometer production runs. Also, the AMD presented the highest single-quarter revenue in the last 15 years.

It was the trump card that helped AMC’s share price to enjoy growth and an optimal increase in their P/E ratio.

The announcement on 7 August 2019 for the launch of Zen 2 helped boost the share price up. Before the release of Zen 2, the AMD stock price was around $29 in August 2019. However, by the end of the year, it has gone over the $50 mark, showing the impact of the news.

AMD Stock 2018

2018 was a roller coaster ride for the AMD share price since it saw a decline of 25% in its value within two days in September. Yet, the share price increased by 92% by Nov 2018. It was mainly due to the total revenue and operating income, which saw a growth of 4% and 26% in the 3rd quarter.

Furthermore, AMD’s continuous innovation with the CPU tech for computers and data centers also became a growth factor. It helped increase its sales, boosting the share value in 2019 and the years ahead.

Moreover, the price-to-earnings ratio (P/E) and P/E for the 12-month forward were significantly good, around 68.7 and 31.5, respectively.

AMD Stock 2017

The AMD share price was a bit volatile throughout 2017, but in the end, it increased from $11.34 in Dec 2016 to $11.44 by the end of Dec 2017. Advanced Micro Devices saw an increase in their annual revenue by 25%.

There was a brief rise in the share price of AMD to $15.65. It went to the ten-year high due to the rise in demand for the Ryzen chip for desktop computers. However, the stock price soon came back to the $10 and $11 at the end of the year due to its profitability.

Despite the revenue gains, the stock saw a massive drop in its share price, which was the worse in the last ten years. The main reason behind the stock price drop was the disconnection between the investors and the technological advancements by AMD.

AMD Stock 2016

The AMD stock price saw a rapid surge in 2016 due to various reasons, such as strong Polaris GPU Sales, expansion into different server markets, etc. At the start of the year, the stock price of AMD was around $2.70 to $2.80. However, by the end of 2016, that price went up to $11.34.

The AMD stock price used to be in the bracket of $2 to $5 before 2016. But, it became one of the best-performing stocks in 2016, and its value saw an increase of 300%.

AMD had to take several measures, such as raising $293 million in licensing, to boost its financials. However, the turning point and the reason for the phenomenal growth in the share price were due to the launch of Polaris’ mainstream graphics cards.

AMD Stock Price: Tide Is Changing for Good

According to Raymond James, AMD stock can increase as much as 80% by the end of 2022. The Q1 earnings of AMD highlight that the chip manufacturing company has had significant growth. In fact, AMD is set to deliver more advanced products in the market. This is bound to garner more earnings and revenue for AMD and will have a positive impact on its stock in the market.

On the downside, the chipmaker’s stock did go down by 4% in the first two months of 2022. But now AMD wants to make a turnaround in the stock and earn more revenue in Q2 of 2022. In February 2022, AMD saw a jump in AMD stock due to a positive response from tech reviewers and the success of its new chips.

However, the company had a dwindling stock price throughout march. But after the rollout of new chip products in the market, AMD is ready to make the most out of the current momentum and hopes to take control of the chip manufacturing market.

Like other companies, AMD has started to understand the struggle and effort it takes to recover stock prices. But unlike other chip manufacturers, AMD hasn’t had a significant downfall. In fact, the future growth potential of AMD stock looks more promising than ever.

The company expects to increase its revenue by 45% and gain over $5 billion of growth in a different set of businesses. As the competitive drive between Intel and AMD grows fiercer, all eyes are fixed on AMD to surpass market expectations and further increase its stock price.

Conclusion

As we look ahead into 2024, AMD continues to demonstrate its resilience and innovation in the highly competitive semiconductor industry. The company’s strategic moves, particularly in AI and advanced chip technology, have positioned it as a formidable player against giants like Nvidia and Intel. AMD’s latest financials and market performance indicate a company that’s not just keeping pace, but setting trends, especially with its MI300 line and the Radeon RX 7600 XT graphics card.

While the future of the stock market is inherently unpredictable, AMD’s consistent focus on R&D, coupled with its adaptability to market demands, paints a promising picture. Investors should, however, remain aware of the various external factors that could impact the industry, including global economic trends and regulatory changes.

In summary, AMD appears well-equipped to navigate the challenges and opportunities of 2024 and beyond. While careful consideration and regular monitoring of market dynamics are advised, AMD’s current trajectory suggests a potential for continued growth and market significance.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More