This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Investing in the tech sector can be a little tricky due to the ever-changing market trends and technological developments.

Nevertheless, investors in the past have yielded significant gains on their investment by putting their money in tech companies.

So, if you can identify the right company with the potential to grow in the future, you can greatly increase your ROI. Companies like Taiwan Semiconductor Manufacturing Company offer a great prospect to their investors ahead.

Taiwan Semiconductor Manufacturing Company (TSMC) is a manufacturer of computer hardware and semiconductor contract manufacturing. The company has big names in its clientele, including Apple, AMD, MediaTek, etc. Morris Chang is the company’s founder and started its operations in 1987.

Brief Overview Of TSMC

Taiwan Semiconductor Manufacturing Company (TSMC) Statistical Overview

TSMC Stocks Forecast 2023

The semiconductor market has been witnessing some challenges over the past few years, especially with sourcing raw materials. This issue, and more, has made the industry’s stock market not the best to dabble into as a newbie investor.

With the company’s products being used in different products, a lot of factors are bound to influence the company’s market realities. As of writing, TSMC has a market capitalization of $12.46 trillion, with an EPS (earnings per share) of 5.59.

As the New Year rolls in, TSMC is expected to be priced at $83.79 per share. It is expected that the stock would continue to enjoy the positive dynamics of the Momo shares in the first month of the year, with an expected 8.130% volatility expected. The share price is expected to rise by about $10 to $93.01 in February 2023, while Q1 closes at $92.60. Q2 is expected to close at $76.48, while Q3 sees a slight bump to $77.98.

Without a major shocker, TSMC is expected to close the year at $82.06. Overall, TSMC isn’t predicted to be the go-to money-maker for 2023 in the semiconductors industry.

A Historical Look at Stock Price History of TSMC

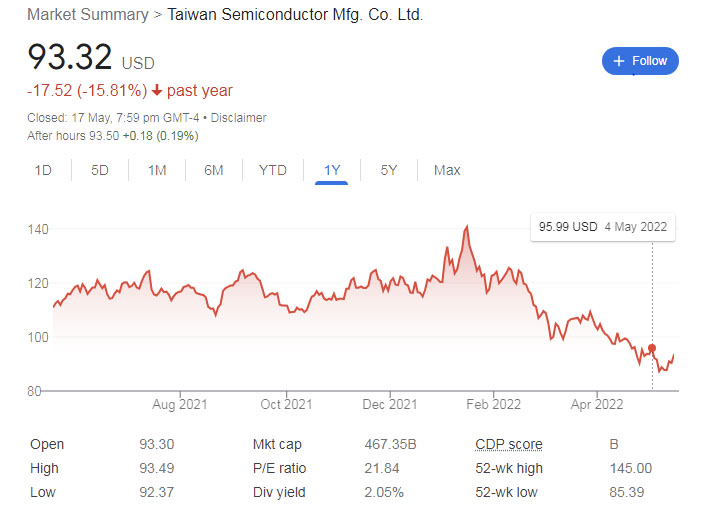

TSMC Stocks 2022

Despite the difficulties of the semiconductor industry, TSMC had some good times in 2022. For instance, upon reporting profit in the third quarter of the year, the company’s shares took an upward leap. However, this good moment couldn’t rewrite the numerous plunges the share price had experienced during the year.

Despite Taiwan Semiconductor Manufacturing Company (TSMC) taking several cautious steps during the year, the company lost about 1/3 of its value in 2022. Some of the major issues were inflation, waning global consumer electronics demand, skyrocketing interest rates, and the newly reported COVID-19 cases in China.

The seemingly tough period can, however, be attributed to the unusual growth most industries experienced in the wake of COVID-19 in 2020, where there was more need for personal computers, data servers, gadgets, etc. Subsequently, as the world went back to normal activities, the demand dropped. Such crash in demand didn’t meet many companies well.

TSMC opened the year at $128.80 per share but maintained an overall downward slope to $80.02 as of press time.

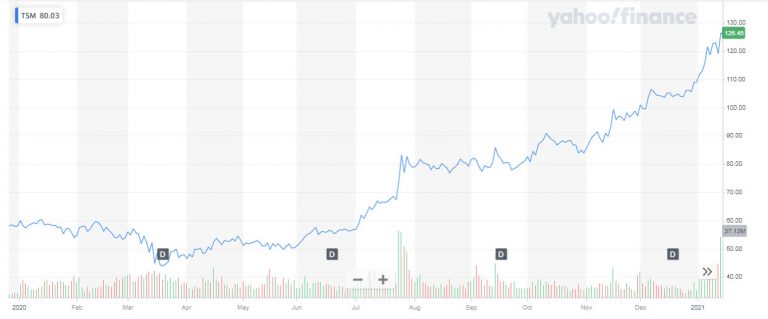

TSMC Stocks 2021

2021 was a fantastic year for TSMC investors since the stock price reached an all-time high of $141 by the mid of February. The major reason for this growth is that it saw a rapid rise in its revenue in the fourth-quarter earnings. TSMC performed much better than most analysts had projected for 2021.

Overall, the company’s revenue saw an increase of 24% to $15.74 billion in that particular year. This revenue figure shows a greater number of $70 million than many analysts predicted for the financial year of 2021. However, that growth did not stay for long, and the stock price came down to $108 in March 2021.

The contributing factor to this decline throughout 2021 is due to a fall in gross and operating margins compared to 2020. TSMC’s EPS growth also took a hit since it went down 15% in 2021 from 50% in 2020 due to the fall in revenue.

The company’s share price did bounce back in the latter part of the year due to a global shortage of computer chips. It also saw a surge in demand for its products as businesses started to reopen and stay-at-home orders were lifted. Overall, 2021 was a turbulent year for TSMC’s share price.

TSMC Stocks 2020

Just like every other company in different industries, the TSMC’s stock price saw a decline due to the pandemic. The company had to deal with lockdown restrictions while ensuring its workers remained safe. However, the company experienced rapid growth throughout 2020.

The major reason is those tech companies benefitted from the pandemic since consumer reliance on technology increased. People were working from home, leading to a rise in the demand for electronic items. Thus TSMC sales revenue increased by more than 30%.

Additionally, the company increased the price of its primary product by 10% to 20%. These are the factors that caused the TSMC price to increase significantly after taking a hit in March 2020.

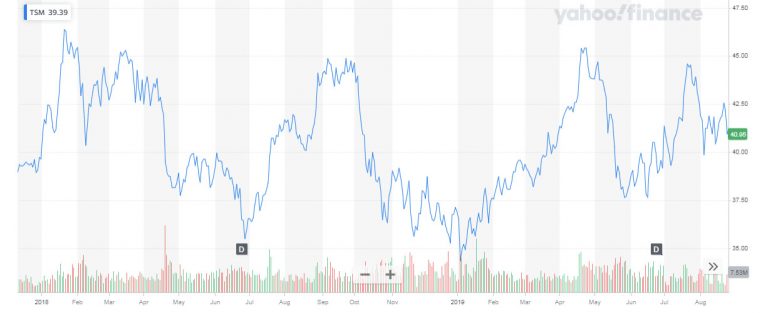

TSMC Stocks 2019

TSMC’s stock price in 2019 saw a massive change as the company introduced newer development and projects. The company was experiencing unprecedented growth that was not even close to its peers. As per their yearly revenue report, TSMC saw a massive increase of around 15% between November and December.

Additionally, the revenue for the fourth quarter crossed the $10 billion mark, capturing the investors’ attention. Moreover, TSMC announced its plans for mass adoption of 5G devices. All in all, these announcements led to an increase in the company’s stock price by more than 40% from the start of the year to the end.

TSMC Stocks 2018

2018 was a year with ups and downs for the TSMC stock price. It continued to go up during the first quarter from $39 to $45 but later plummeted to $37 in the second quarter.

However, many experts predicted a solid comeback in the last two quarters of 2018. As per the expectations, the company’s share price increased from $36 in June to $46 in November 2018. TSMC’s growth was due to its excellent future prospects.

Its aggressive approach toward entering new markets and acquiring new clients for artificial intelligence chips, automotive chips, etc., boosted investor confidence in the company. Thus, they started to put their money into the company, seeking greater returns.

Good planning and excellent execution helped TSMC to sustain its growth in 2019 as well. The company’s share price continued to rise the next year before falling during the pandemic.

TSMC Stocks 2017

TSMC’s share price saw a continuous rise in 2017 due to the high demand for its chips. The increase in demand for Apple phones resulted in an increased demand for TSMC chips. Additionally, the growing usage of high-performance cars further fuelled the rise in TSMC’s share value.

The company’s revenue also saw an increase in the first quarter of 2017 from the previous year. TSMC’s A10 processor used in manufacturing the iPhone was the driving force in the increased revenue for the company.

Another factor for the surge in share price was the investors’ optimism about the future growth of TSMC. Growing usage of IoT means an increase in the demand for TSMC’s chips. Therefore, there were future speculations that the company’s revenue would increase as the demand for computer chips rises.

TSMC Stocks 2016

2016 saw continuous growth for the TSMC share as it jumped to $31.04 in Dec 2016 from $20.90 in Jan 2016. The main reason behind this staggering growth in foreign investments. Many investors from across the world started to invest in the company.

As a result, TSMC stock hit a new high that year and saw an increase of over 50% in its total value. Foreign investors considered TSMC stock as a haven. Also, the company started to produce the 16nm process on a commercial basis.

Consequently, the company’s revenue increased significantly in the 3rd and 4th quarters of 2016. Therefore, it became a top pick for foreign investors, and they started investing in the company throughout the year.

Conclusion

While there is no way to accurately tell whether the TSMC share price will go up and down, it is better to keep an eye on the recent developments. The trends show how the company’s share price increased right before any technological development.

Therefore, investors need to keep a close eye on the news regarding the company. It will help them find the best time to invest in TSMC shares and earn a good return on their investment.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More