Are you looking for ways to earn passive income from your cryptocurrency holdings? Have you heard about yield farming but aren’t quite sure what it is? If so, you’re in the right place. Yield farming has become one of the hottest topics in the cryptocurrency space, and it’s not hard to see why. In just a few simple steps, you can put your crypto assets to work and earn a yield that far exceeds what you might get from a traditional savings account.

A relatively recent development in the decentralized finance (DeFi) world is yield farming. It entails securing cryptocurrency assets in a liquidity pool powered by smart contracts in exchange for benefits in the form of more cryptocurrency tokens. Yield farming aims to increase cryptocurrency investors’ return on investment (ROI) while also supplying liquidity to the DeFi ecosystem.

This article’s goal is to give a thorough introduction to yield farming, including how it operates, possible risks and benefits, and some of the most widely used strategies at the moment. By the time you’re done reading, you are going to know exactly what yield farming is, how to get started with it, and whether it fits with your risk tolerance and investing objectives. So let’s now explore the fascinating world of yield farming!

Table of Contents

How does yield farming work?

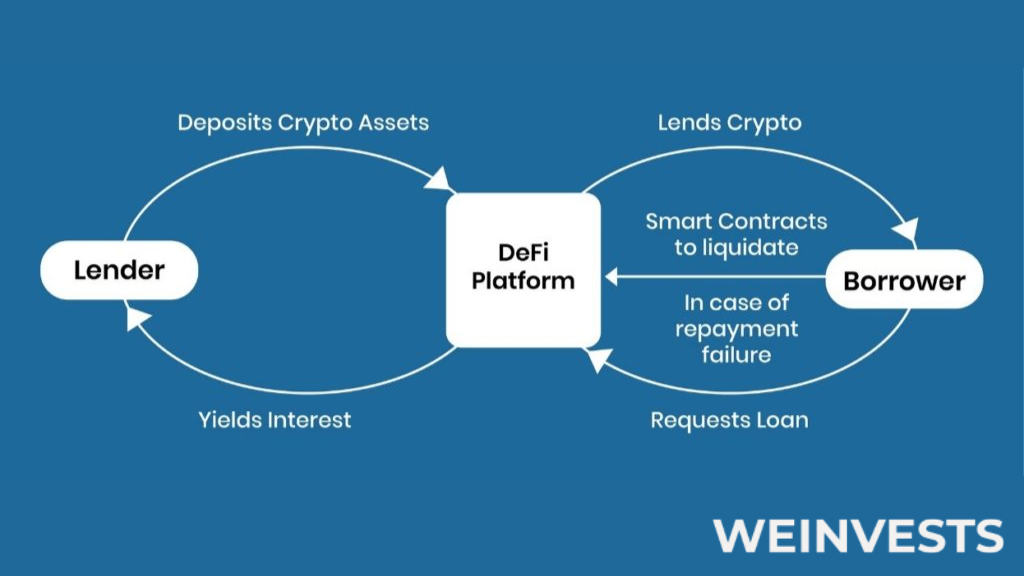

Yield farming is a technique used by cryptocurrency owners to gain more tokens by supplying liquidity to platforms for decentralized finance (DeFi). In order to encourage users to deposit their cryptocurrencies into liquidity pools, which are smart contracts that enable token trading without the need for a centralized exchange, yield farming uses financial incentives. Users are effectively acting as market makers by supplying liquidity to these pools, allowing other users to purchase and sell tokens at reasonable prices.

Yield farmers are rewarded with additional tokens that are delivered through a variety of various strategies in exchange for their liquidity provision. While some platforms use simpler algorithms to determine the most effective reward allocation, others use more complicated algorithms. Some platforms distribute rewards proportionally based on the amount of liquidity provided.

To get started with yield farming, users typically need to deposit their cryptocurrency into a liquidity pool using a compatible wallet or decentralized application (dApp). Once their funds have been added, they will begin earning rewards based on the specific parameters of the platform they are using.

One of the most popular forms of yield farming is known as staking, which involves locking up a specific amount of cryptocurrency for a set time period. During this time, users earn rewards in the form of additional tokens, which can then be sold or reinvested into the liquidity pool to compound their returns.

Another popular form of yield farming is known as liquidity provision, which involves depositing equal amounts of two different tokens into a liquidity fund. By doing so, users earn rewards based on the trading volume, as well as any price fluctuations in the underlying tokens.

What are the risks and rewards of yield farming?

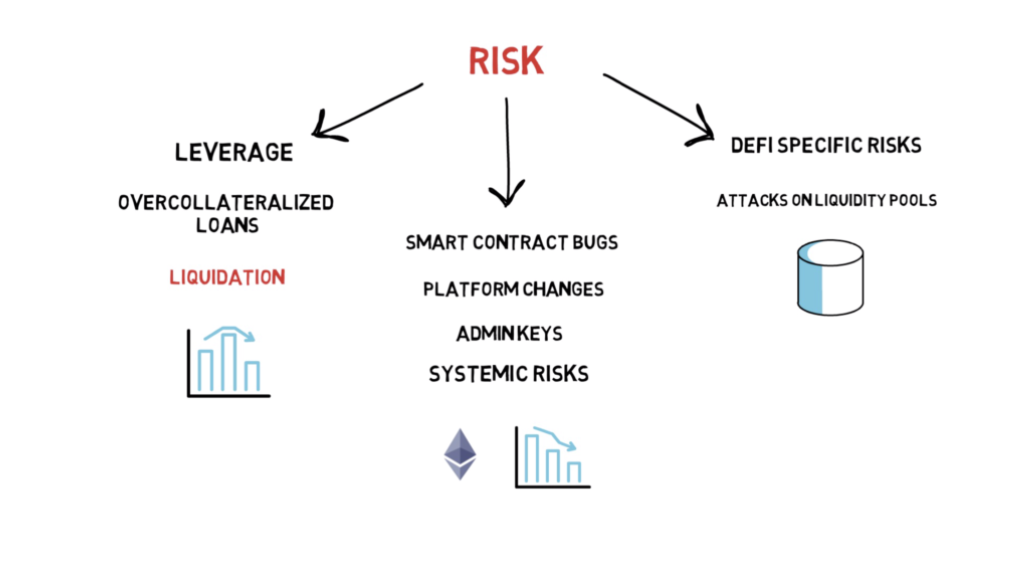

Yield farming can be a potentially lucrative way to earn passive income from cryptocurrency holdings, but it also carries several risks that investors should be aware of. Here are some of the key risks and rewards of yield farming:

Risks:

- Volatility: Cryptocurrencies are notoriously volatile, and the value of rewards earned through yield farming can fluctuate rapidly based on market conditions.

- Impermanent loss: When providing liquidity to a pool, the value of the two tokens being provided can change over time, which can result in a loss of value relative to holding the tokens separately.

- Smart contract vulnerabilities: Yield farming protocols are built on smart contracts, which are subject to coding errors and other vulnerabilities that can result in the loss of funds.

- Platform risk: Not all yield farming platforms are created equal, and some may be more vulnerable to hacks, exploits, or other forms of attacks.

- Gas fees: Yield farming transactions can be expensive due to high gas fees on the Ethereum network and other blockchain networks.

Rewards:

- Passive income: Yield farming can be a way to earn passive income from cryptocurrency holdings, without the need for active trading or management.

- Higher returns: Yield farming can potentially offer higher returns than other forms of passive income, such as savings accounts or traditional investment vehicles.

- Governance rights: Many yield farming platforms offer governance tokens, which give holders the ability to vote on protocol upgrades and other decisions.

- Liquidity provision: Yield farming can contribute to the liquidity of DeFi protocols, making it easier for other users to trade tokens and participate in the ecosystem.

- Growth potential: As the DeFi ecosystem continues to expand and evolve, there may be opportunities for yield farming strategies to adapt and grow alongside it.

Popular yield farming strategies

There is a wide range of strategies and platforms available for those looking to participate. Here are some of the most popular yield farming strategies:

Liquidity provision: This involves providing liquidity to a decentralized exchange (DEX) or other DeFi protocol in exchange for rewards in the form of governance tokens, transaction fees, or other incentives. Users can supply two different tokens to a liquidity pool and earn rewards in return for providing liquidity to that pool.

This involves locking up a certain amount of cryptocurrency tokens to earn rewards, either in the form of additional tokens or as a share of transaction fees. Staking is a common strategy for earning rewards on proof-of-stake (PoS) blockchain networks.

This involves borrowing funds from a DeFi protocol for a very short time to execute a specific trading strategy, often in conjunction with other yield farming strategies such as arbitrage or liquidity provision.

This involves taking advantage of price differences between different exchanges or pools for earning profits. Arbitrage can be a risky strategy, as it requires fast execution and careful attention to market conditions.

This involves participating in the initial distribution of a new DeFi protocol’s governance token or another incentive coin, often through staking or liquidity provision. Users can then sell these tokens on the open market or use them to participate in the governance of the protocol.

While these are some of the most popular yield farming strategies, there are countless variations and combinations of these strategies, and new strategies are emerging all the time. Ultimately, the best yield farming strategy will depend on a variety of factors, including the user’s risk tolerance, investment goals, and level of expertise.

The top yield farming platforms to watch

There are now countless platforms and protocols available for those looking to participate. Here are some of the top-yield farming platforms to watch:

Uniswap is a decentralized exchange (DEX) that allows users to trade tokens and provide liquidity to liquidity pools in exchange for rewards in the form of governance tokens.

SushiSwap is a DEX that was created as a fork of Uniswap and offers similar features such as liquidity provision and governance token rewards. SushiSwap has gained a following due to its innovative yield farming strategies and strong community.

Aave is a lending and borrowing protocol that allows users to earn interest on deposited assets, as well as provide liquidity to various liquidity pools in exchange for rewards in the form of Aave’s governance token.

Curve is a DEX that specializes in stablecoin trading, and offers users the ability to provide liquidity to various stablecoin pools in exchange for rewards in the form of governance tokens.

Compound is a lending and borrowing protocol that allows users to earn interest on deposited assets, as well as provide liquidity to various liquidity pools in exchange for rewards in the form of the Compound’s governance token.

Balancer is a DEX that allows users to create their own custom liquidity pools with varying weights and fee structures. Users can provide liquidity to these pools and earn rewards in the form of Balancer’s governance token.

Yearn.finance is a platform that automates yield farming strategies across various DeFi protocols to maximize returns for users. The platform offers a range of yield farming strategies and has gained a significant following in the DeFi community.

These are just a few of the top-yield farming platforms to watch, and new platforms and protocols are emerging all the time. It’s important for users to carefully evaluate the risks and rewards of each platform, and to stay informed and up to date on the latest developments in the DeFi ecosystem to make informed decisions about yield farming strategies.

Yield farming vs traditional investing

In traditional investing, investors typically buy assets such as stocks, bonds, or real estate intending to generate long-term returns. The value of these assets is influenced by various factors such as economic conditions, company performance, and interest rates.

On the other hand, yield farming involves providing liquidity to DeFi protocols and earning rewards such as governance tokens or transaction fees. The rewards can be significant, with some yield farming strategies offering annual percentage yields (APYs) of over 1,000%. However, yield farming also entails risks such as smart contract vulnerabilities, liquidity issues, and market volatility.

Compared to traditional investing, yield farming offers higher potential returns but also higher risks. Traditional investments are generally more stable and less volatile, making them a safer choice for risk-averse investors. However, traditional investments may not offer the same level of returns as yield farming in the short term.

Ultimately, the decision to invest in yield farming or traditional investments depends on an individual’s risk tolerance, investment goals, and knowledge of the respective markets. It’s important to carefully evaluate the risks and rewards of each option and make an informed decision.

Conclusion

In the DeFi ecosystem, yield farming has quickly emerged as one of the most popular ways for cryptocurrency owners to generate passive income. Users have a wide choice of platforms and techniques to select for their profit maximization strategy, simultaneously contributing to the expansion of the DeFi ecosystem.

However, yield farming also carries a specific set of risks such as weak points in applied smart contracts, liquidity issues, and elevated market volatility. To make wise decisions, users must weigh the benefits and drawbacks of each platform and strategy carefully. They should also keep up-to-date with the constantly evolving DeFi ecosystem.

Overall, yield farming offers a fascinating chance for cryptocurrency owners to support the development of the DeFi ecosystem and generate passive income. New and inventive yield farming platforms and strategies are likely to emerge as the DeFi ecosystem develops and matures, giving users more chances to participate in this quickly expanding market.

FAQ

What is the difference between liquidity mining and yield farming?

Liquidity mining and yield farming refer to slightly different concepts. Liquidity mining involves providing liquidity to a liquidity pool and earning rewards in return, while yield farming involves seeking out the highest yield by moving capital between different liquidity pools and yield-generating protocols.

How do I get started with yield farming?

To get started with yield farming, you will need some cryptocurrency to provide liquidity, choose a yield farming platform, and connect your wallet. From there, deposit your funds and start earning rewards.

What are the risks of yield farming?

The risks of yield farming include smart contract vulnerabilities, liquidity issues, and market volatility. It’s important to do your research, understand the DeFi ecosystem, and only invest what you can afford to lose.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More