Pros

- Low CFD trading fees

- CFDs are available across a broad range of markets.

- No deposit and withdrawal fees.

- Wide selection of trading platforms

- Availability of account for Islamic Forex trading

Cons

- High Inactivity fees

- Slow Withdrawals

- No 2-step login on all the trading software except MT5

- Research resources can only be found in Trading Central modules

- Broker releases fewer research materials compared to other brokers

| 💻 Trading Platforms | AvaTradeGO, WebTrader, MetaTrader 4, MetaTrader 5, and AvaOptions platforms with access to various markets and instruments |

| 📞 Customer Service | 24/5 support via phone, email, or online chat; help center with FAQs |

| 🎁 Promotions/Bonuses | Welcome bonus, referral bonus, loyalty program, etc. |

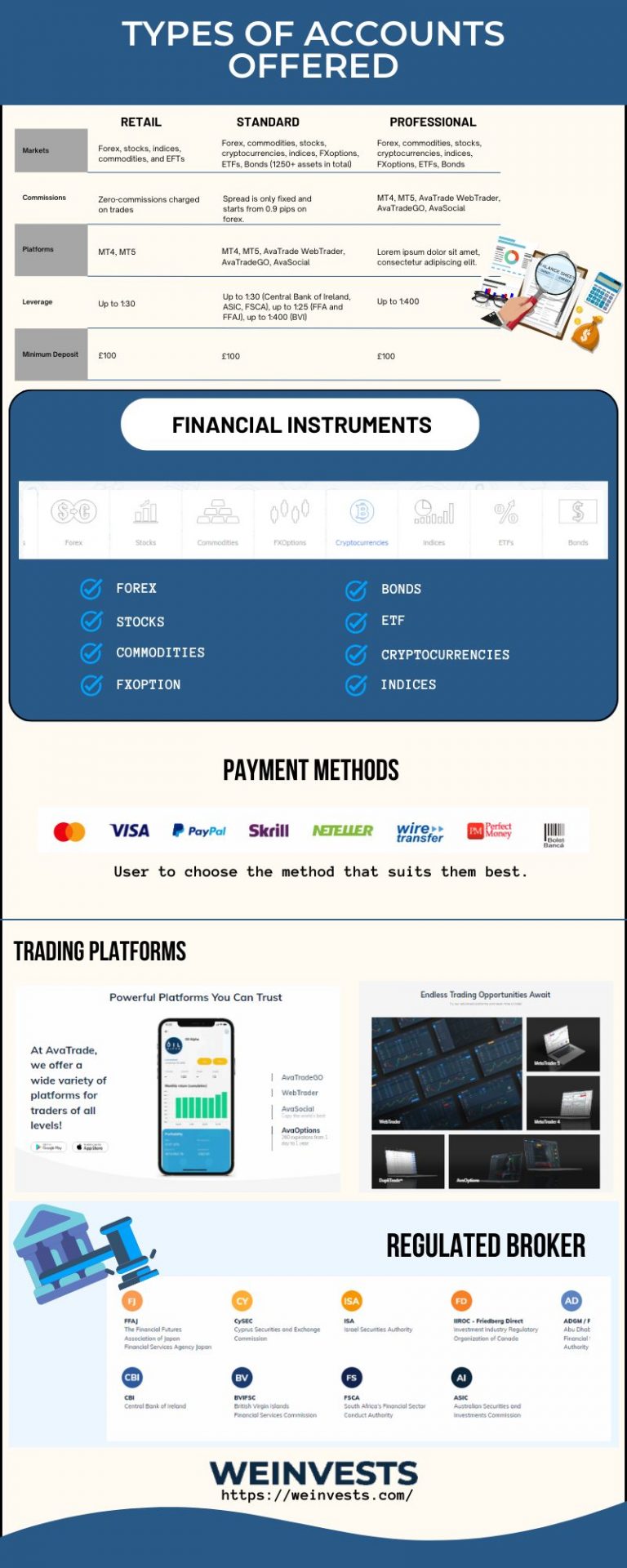

| 🛡 Regulation | Regulated by FCA in the UK; also regulated by ASIC in Australia, CySEC in Cyprus, BVI FSC in British Virgin Islands, FSCA in South Africa, ADGM FSRA in Abu Dhabi, and FSA in Japan |

| 💵 Deposit/Withdrawal Methods | Various payment methods; minimum deposit $100; no withdrawal fee |

| 📊 Spreads/Commissions | Variable spreads depending on the instrument and market conditions; commissions from 0% (forex) to 0.6% (options) |

| 🔒 Security | Segregated funds; SSL encryption; firewalls; anti-virus software |

| 📚 Education/Resources | Webinars, videos, articles, etc.; economic calendar, market news, market analysis, etc. |

| 📱 Mobile Trading | iOS and Android app with all AvaTradeGO platform features and functions |

| ⚡ Execution Speed | Fast and reliable execution with low latency and minimal slippage; various order types |

| 🔧 Trading Tools/Indicators | Moving averages, Bollinger bands, Fibonacci retracement, etc.; custom indicators and alerts |

| 🌍 Country/Region Availability | Over 200 countries and regions |

| 💰 Account Minimum | $100 for live account; free demo account with $100,000 virtual funds |

| ⚖ Leverage/Margin Requirements | Up to 30:1 leverage on forex and CFDs |

| 📈 Asset Selection/Market Access | Over 1,250 instruments across forex, stocks, indices, commodities, cryptocurrencies, options, ETFs, etc. |

AvaTrade isn’t a new name in the industry, as it’s a global brand renowned for offering a wide array of trading platforms for CFD and forex traders.

Table of Contents

About AvaTrade

AvaTrade was founded in 2006 by Negev Shekel Nosatzki and Emanuel Kronitz, two financial experts in online marketing. However, business operations started in 2007 when the company received investment from venture capital firm Clal Finance.

Although the broker has its main headquarters in Dublin, Ireland, it also has satellite offices across 6 continents. AvaTrade has nine regulations from different jurisdictions worldwide, including the European Union, Japan, South Africa, Cyprus, Abu Dhabi, Australia, and the British Virgin Islands.

The broker is fully digital and has a limited product portfolio comprising forex and CFDs only. There are over 250 CFD offers like, e.g. stock indices, currency pairs, bonds, ETFs, individual shares, and commodities such as sugar, coffee, gold, and silver.

Currently, AvaTrade has more than 400,000 registered users executing three million trades per month, The broker provides a wide choice of trading platforms across different device types.

Let’s see the kind of accounts they offer

Types of Accounts Offered

AvaTrade offers various account types to ensure that users have access to a trading environment that fits their financial circumstances, knowledge, and belief. Based on this, the four accounts AvaTrade offer are; a retail account, professional account, Multi Account Manager (MAM), and Corporate account. In addition, each of the accounts above has a demo version and an Islamic variation for Muslim traders.

The retail or standard account caters to individuals who buys and sell securities using their own money on their own account. Although this trader may have some level of trading experience, it isn’t substantial enough to be called professional traders.

Unlike the retail account, the professional account holder can trade their preferred financial asset with higher leverages and lower spreads. On the downside, trading with very high leverage could amplify the trader’s loss if it is unsuccessful. To be eligible for this type of account, an applicant needs to carry out an average of 40 transactions in 12 months. They also must have worked in the financial sector for a year and have a cash saving and financial instrument portfolio worth €500,000 or more.

This account was specially designed to help asset managers manage multiple clients’ accounts from a single place. Not only can the user make group trades for numerous accounts, but they can also assess the position and history of the accounts simultaneously. To explain further, this account is some kind of master account that contains and controls a large, diverse pool of independent accounts.

This account is set up by a legal entity and is meant for institutional and retail business trading. The owners usually trades securities under a formal business entity rather than an individual professional account. As a result, the account holder is allowed to add multiple authorized users to place and manage trades on behalf of the company.

To make their platform all-inclusive for all investors regardless of religion, AvaTrade ensured every one of their four unique accounts has an Islamic variat. This account meets Sharia requirements and is designed for Muslim investors. The Sharia law sees interests as “riba” or exploitative. Hence, in the Islamic accounts, users can keep their positions open for up to 5 days without incurring the rollover fee. However, if the trader holds the position beyond the 5 days, they have to pay the fee.

This is essentially a practice account to help beginner traders improve their trading experience in a risk-free environment. The user gets $100,000 of virtual money to hone their trading strategy for a period of 3 weeks. Besides practice, traders can also use the AvaTrade demo account to evaluate the broker’s trading conditions before committing real funds to the platform.

Range of Financial Instruments Available For Trading

The product portfolio at AvaTrade comprises mainly forex, CFDs, Bonds, shares/stocks, commodities, ETFs, currency pairs, Options, Indices of Foreign Exchange, and cryptocurrencies. In total, the broker provides access to more than 250 financial instruments across a broad range of different asset classes.

For clarity, the number of markets or tools a customer can access depends on the trading platform they are using. For instance, where the MT5 platform listed more than 1,000 assets, the MT4 counterpart only boasts of an average of 250 tradable tools.

Base Currencies

AvaTrade supports up to 7 base currencies, including;

- US Dollar (USD)

- Australian Dollar (AUD)

- Euro (EUR)

- British Pound (GBP)

- Swiss Franc (CHF)

- Japanese Yen (JPY)

- South African Rand (ZAR)

However, not every currency is available to all traders. The number of currencies a trader can access depends on their geographical region. For instance, only British traders may use the GBP as their base deposit currency. Similarly, only people from Australia, Switzerland, and Japan may use the AUD, CHF, JPY options respectively.

In addition, the number of currencies a trader can choose from depends on the payment portal they use. For example, where the bank transfer and credit/debit card channels support more base currencies, people depositing through e-wallet have only 2 currencies (USD, EUR) to choose from.

For traders whose native currency isn’t supported on the platform, AvaTrade will convert these currencies, but the customer will be levied a conversion fee.

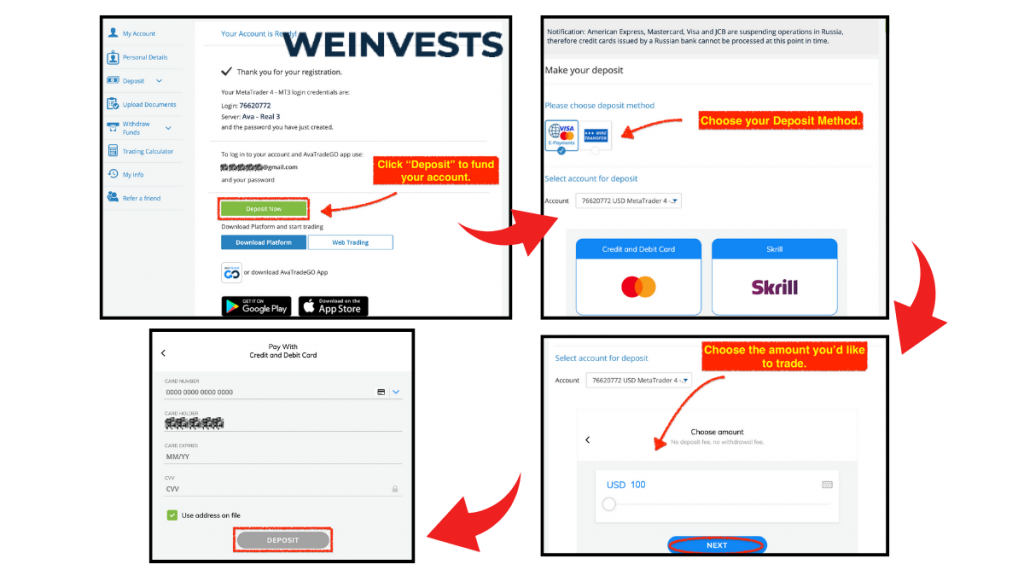

Payment Methods

Avatrade has a myriad of payment options. It is up to the user to choose the method that suits them best. Here are the four channels available:

- Credit card

- Debit card

- Bank transfer

- E-payment (e.g. Skrill, Neteller, PayPal, WebMoney)

Keep in mind that investors from the European Union and Australia cannot deposit funds through e-wallets. However, there are alternative options they can choose from.

Fees, Commission, and Leverage

Users have to understand that the fees and commissions on AvaTrade differ and we’ll try to break them down.

In the FX and CFD niche, all fees are in two classes:

- Trading fees which include everything from commissions and spreads to conversion fees and financing rates

- Non-trading fees which is made up of administrative/inactivity fees, and deposit and withdrawal charges and administrative/inactivity fees.

Trading Fees

The minimum initial deposit to open an account at AvaTrade is $100 or 100 units of any base currency. Clients do not get volume discounts neither do they have guaranteed stop losses. Although the spreads depend on the financial instrument, fees levied on retail accounts are higher than those of professional trading accounts.

To become a professional trader, the user has to meet stringent criteria in terms of their investment capital among other requirements.

Generally, AvaTrade spreads for major forex pairs, which start from 0.9 pips for a retail account is slightly higher than the industry average of 0.47. In contrast, the broker provides some of the most competitive leverage in its niche.

| Instrument | Spread | Leverage |

| EUR/USD: | 0.9 | 400:1 |

| GBP/USD: | 1.5 | 400:1 |

| USD/JPY: | 1 | 400:1 |

| USD/CHF: | 16 | 400:1 |

For CFDs, AvaTrade’s spread starts from 0.01% which is one of the lowest CFD fees in the market. Spreads on AvaTrade can be as low as 0.01% (sometimes lower) of the overall trade position.

Non-Trading Fees

Making deposits and withdrawals is free for all clients. If a user does not trade with their account for three consecutive months, they’ll pay an inactivity or administrative fee for maintaining that account. The fees are $50/€50/£50 for 3 months of inactivity and $100/€100/£100 for 12 straight months of no trading.

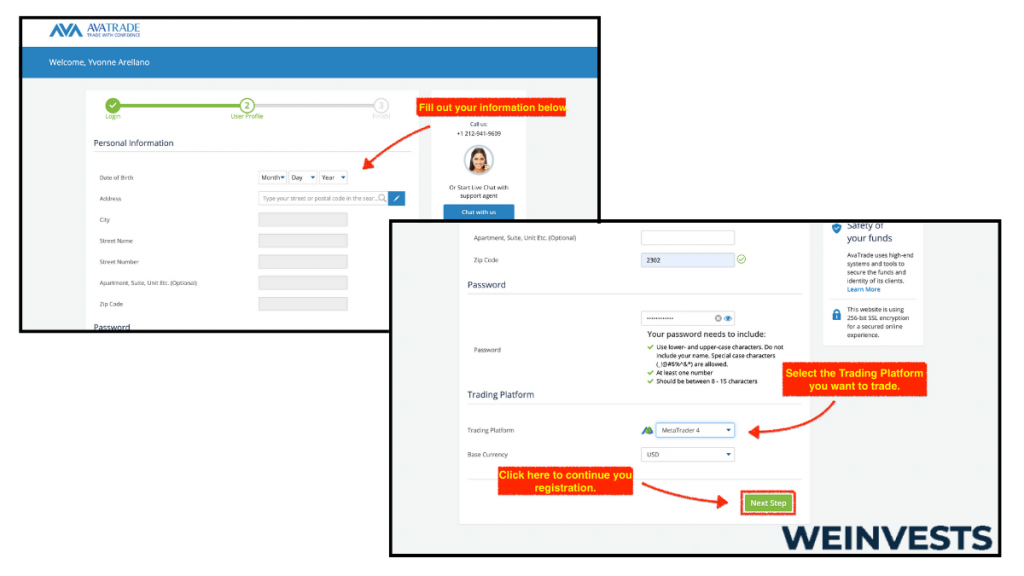

Trading Platforms

AvaTrade has multiple trading platforms for users to choose from. There is the web-based trading platforms, desktop, and mobile trading platforms.

This is for traders that prefer trading from a web browser instead of downloading an app on their mobile or the full software. There are four web options traders can choose to download which are WebTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and AvaOptions. The latter platform is exclusively for trading CFD and FX options.

This software is designed to be downloaded on a personal computer and they include MT4, MT5, and AvaOptions. Like the web-based version, the AvaOptions for desktops can only be used to trade options.

Traders that favour trading straight from their phones will find this option convenient. There are three apps to pick from: AvaTradeGO, (the broker’s own mobile app); AvaOptions, and MT4, a well-known third-party trading platform.

Each platform well-designed, with seamless great UI and UX. The WebTrader, MT4, and MT5 software is available in major languages like English, Chinese, German, Swedish, French, Spanish, Portuguese, Arabic, Russian, Japanese, and Polish. Only AvaOptions is available in the English language.

Besides, the software and app are equipped with a search function to easily bring out information about a specific asset and more for the user to explore.

There are portfolio and fee reports as well as tools for placing basic orders such as market, limit, and stop. Among the trading software, only MT5 has sophisticated capabilities like the “one cancels the other (OCO)” order and a two-step login. The other apps have only one-step login, which doesn’t come with the same level of security.

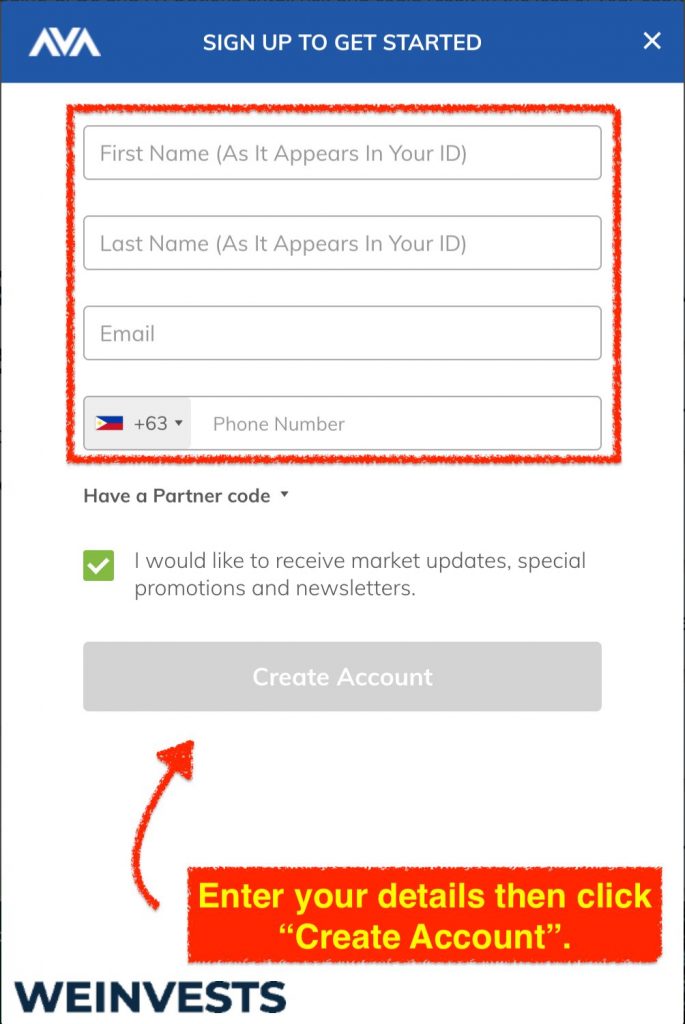

Account Opening

Here are the steps involved;

- Enter your details into the signup form

- Select the platform you want to trade with

- Fund your account using any of the given payment methods

- Choose an asset to buy or sell

- Start Trading

Deposit and Withdrawal Experience

AvaTrade does not charge deposits or withdrawals fees. Funding an account with a credit/debit card is fast as the money reflects instantly. New account holders may have to wait for a business day or a few hours for their deposit to reflect.

This delay is because AvaTrade conducts a security verification all cards used on the platform for the first time. For clients using bank transfer methods, it could take up to 4-5 working days for the payment to go through. User’s depositing money can only do so with a card or bank account that is in their name.

While AvaTrade offers many perks and fair trading conditions to users, a few drawbacks of doing business with this broker is their withdrawal process. Withdrawing money for all clients (new and old, retail and professional) could take as long as 3 business days.

This is mostly attributed to the broker seeking evidence of identification before they release funds. A crucial information for users to remember is that they can only withdraw money via the same channel they use to make payment.

For example, if a trader uses their credit card to deposit $2,000, the first $2,000 they withdraw must also be credited to that card. This law is the same for top brokers and was put in place to curb money laundering. Subsequent withdrawals may then be done through other means like bank account, e-wallets etc.

Customer Service and Support

AvaTrade has an excellent customer service and support system to ensure they meet the inquiries and needs of all customers. The platform provides support in over 14 local languages. A customer can get in touch with the customer service team through email, telephone call, web chat, and WhatsAPP.

To reduce wait time, the platform provides dozens of phone numbers across different regions to cater to users. The only negative with the customer service is that it is 24/5 instead of the 24/7 help available at other online brokers.

Conclusion

AvaTrade stands out for several reasons, but it is renowned for the number of trading platform options it has. In addition, its selection of tradeable markets almost doubled over the years, and with other amazing features.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More