Buying stocks has never been as easy as it is nowadays. Investors looking to purchase company shares can do so by opening a brokerage account and start trading in a matter of seconds.

To accurately execute trades based on your risk tolerance and the market conditions, you should consider incorporating different types of stock market orders in your investment strategy. Utilizing market orders is a strong tool that both beginner and seasoned investors can use to make informed trading decisions.

Investors use different market order types to serve other objectives. The goals may vary depending on factors like tolerable level of risk, market liquidity, volatility, etc.

Numerous factors can cause rapid price fluctuations and swings in the stock market. That is why having a solid market order strategy may bring more control to your investments in stocks and increase your chances of ending with a profit.

In this article, we will examine the different market order types, compare them and give some practical illustrative scenarios. By the end, you will learn the basics and gain insights into implementing market orders in your strategy.

Are you eager to expand your investment skills and knowledge? Let’s not waste time and start with the first essential order type, the market order.

Market Order

Even if you are new to the trading world, you have probably heard the term market order. This is the most basic type of order and is the most popular among investors.

Chances are you have already executed a market order without knowing you have done so. The process revolves around buying or selling stock by completing a trade immediately at the current price determined by the market.

When selling a stock, you execute a sell order. On the other hand, when buying a stock, you are performing a buy order. The two simple types of trades help you instantly trade an asset, within a few clicks in your brokerage app.

Let’s say you have heard that a company is bringing AI innovations, which you believe will lead to the stock price skyrocketing. By placing a market order, you can invest in that company whenever you desire without paying too much attention to the current price.

Although market orders are the fastest and most common type of order, there are a few limitations that you must consider. For example, you never know the price you will pay or get when trading a stock. This is because there may be a price gap between when you press the buy button and when the trade executes. Bear in mind that prices are rapidly fluctuating.

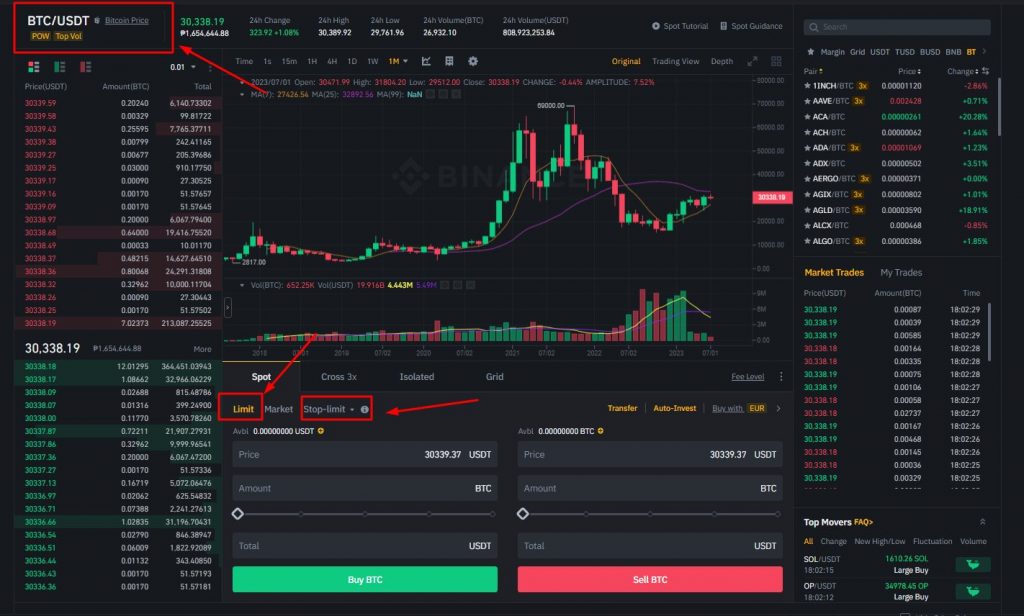

Limit Market Order

The second most common type of stock order is the limit order. In contrast to the market order, this order type imposes more control over the price at which a trade will get executed.

With limit orders, traders set a specific price for the future. The deal will only be completed once the value of the stock reaches the specified price.

There are two types of limit orders; the first is a buy-limit order. You may say you want to buy a stock, but there is a limit on how much you pay. Therefore, the trade will be processed once the stock reaches the specified price or exceeds it.

The idea behind sell-limit-orders is the same: you want to sell a stock but impose a limit on how much you sell it for. Suppose you set your price target at $30. That means you will sell your asset when it reaches the exact price or drops below it.

The purpose of limit orders is to avoid unexpected price fluctuations. Furthermore, they help solidify an investor’s strategy by placing more control over the price they pay for their investments.

However, there is one leading risk traders should be aware of, and that is the chance of missed opportunities. There is a chance the stock never reaches the predetermined price, and thus you may lose on potential profits.

One strategy for effective use is utilizing a limit order for forecasting an anticipated double bottom or a double top. By performing technical analysis and spotting the occurrence of the pattern, traders can place a limit order for the exact price they are willing to trade the asset. This strategy boosts risk management efforts and offers more control over funds.

Stop Market Order

Investors looking for enhanced security when trading or have no time to follow market trends and movements will find stop orders a valuable tool for protection.

This widely used market order type uses a metric known as a stop price, which specifies the exact price you want to buy or sell a stock. The stop order remains fixed and unlocks once the market reaches your pre-defined price target.

Stop orders are generally classified into stop loss and stop limit orders. Let’s take a look at two illustrative scenarios to get a better hang of the two most widely used variations, starting with the stop loss order:

Suppose you don’t want to buy a stock currently as you are unsure of its future price direction. Therefore, you will wait for it to hit a price you believe will benefit you, suppose $20. Place your buy-stop loss order, and once it reaches $20, it will automatically trigger a market order and buy the asset at the best possible price.

The same concept applies to sell-stop loss orders, which become sell-market orders once the stock hits the price target.

Combine a stop-loss and a limit order, and you get a stop-limit order. With this type of order, you are waiting for the price to go up or down, and once it hits your target price, it will trigger a limit order. Therefore, you will buy or sell the asset once the price starts moving in the expected direction.

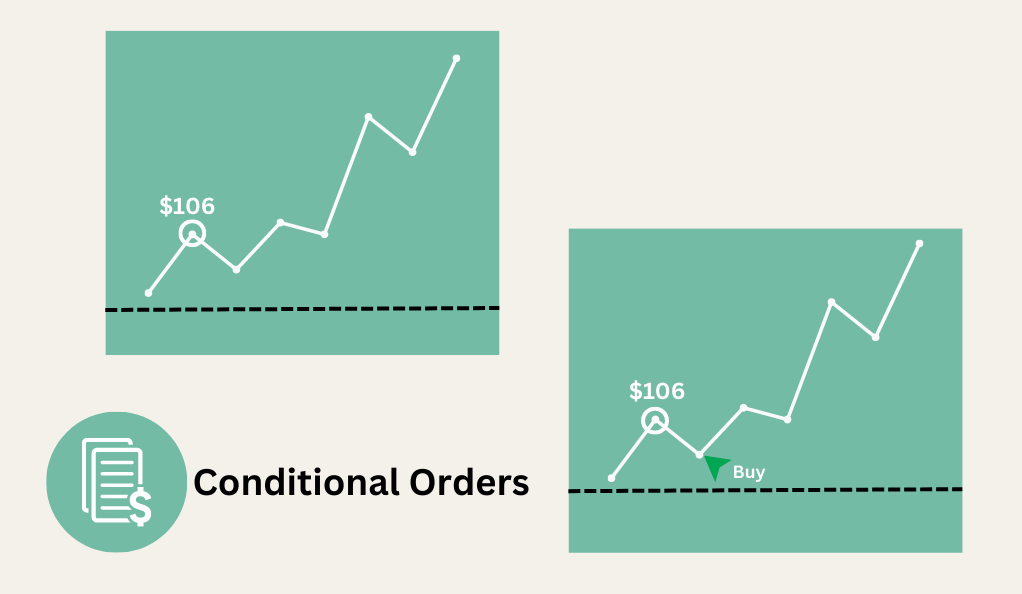

Conditional Orders

Now that we have covered the basics, let’s dive deeper into the more specific but practical market orders, starting with conditional orders. As the name suggests, conditional orders are orders on which you place predetermined conditions.

Due to its high customization capabilities, more advanced traders use the conditional order approach in their strategy.

To make this order type work, traders set specific requirements, for instance, trigger price, order price limit, quantity, time condition, and more. The order will then trigger as a standard market order, but only when the specified conditions are satisfied.

Although there are various conditional orders, some notable types include the fill or kill order and the immediate or cancel order.

The fill or kill is a duration type of order, which executes a trade immediately based on a specific price and a specific number of shares intended for purchase.

The immediate or cancel order is another duration order. Again you set a price target and select your desired number of shares; however, the unfulfilled conditions of the order will be cancelled.

Conditional orders can bring many practical applications to an investor’s trading strategy. For example, the customization aspect of these orders allows for a higher risk management level and the potential to spot valuable breakouts.

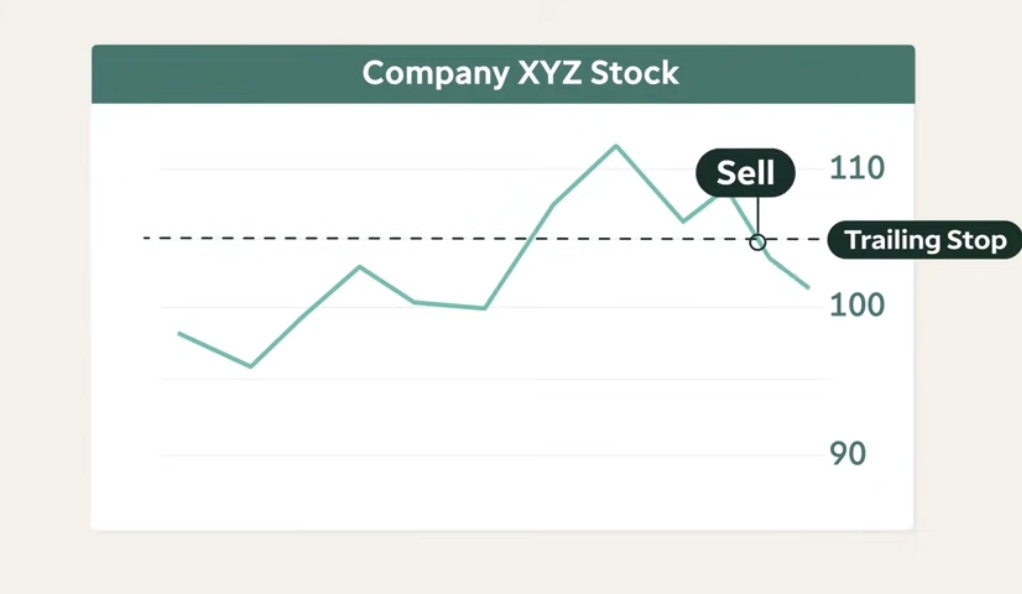

Trailing Stop Order

To understand trailing stops, consider them an enhanced and more flexible version of the traditional stop order. The trailing stop is a stop market order for which investors set a percentage or price amount. Based on the market conditions and buy/sell preferences, they may place the trailing stop order below or above the current stock price. We will quickly put things into perspective by comparing the two order types.

We have already learned that we have a predetermined target stop price with the regular stop-loss order. Once reached, a market order that instantly sells your shares is triggered.

What makes the trailing stop different is that it moves to a point below the current price you are willing to sell. Furthermore, instead of remaining fixed as the stop price in the traditional stop-loss, it will move upwards with the stock price and stay the same if it drops.

Trailing stop orders allows for improved flexibility compared to stop orders and brings automation to your trading strategy. Instead of losing to unexpected market fluctuations, trailing stop orders are dynamic and adjust according to market conditions.

Although automatic trading is appealing, some disadvantages include false trigger signals. What is more, overlying on automated trading may run the risk of missing opportunities. Traders should follow market trends and news and improve their skills to make the most out of their investments.

All-or-None Order

All-or-none (AON) orders are the all-in approach to market orders. With AON orders, traders specify the number of shares they are willing to buy and the exact price they will pay. This method finds practicality in penny stock investment or making a trade that requires a significant capital investment.

To gain a broader understanding, suppose you want to create an order for a penny stock, which looks like this: 5000 shares for exactly $0.10 per share. Your broker will now have the task of looking for a deal that can accomplish these exact requirements.

These order types require a longer time frame to execute, as although shares may be available at your target price, they may need to meet your quantity requirements. In that case, the order will remain active until the end of the trading day, a timeframe specified by you, or will get cancelled if the requirements are not fulfilled.

The primary use case of all-or-none orders is purchasing an exact number of stocks at a specific price. This approach gives you complete control over your investment. On the contrary, if you decide to use a market order, you will instantly place an order; however, you may risk paying a rate different than your desired one.

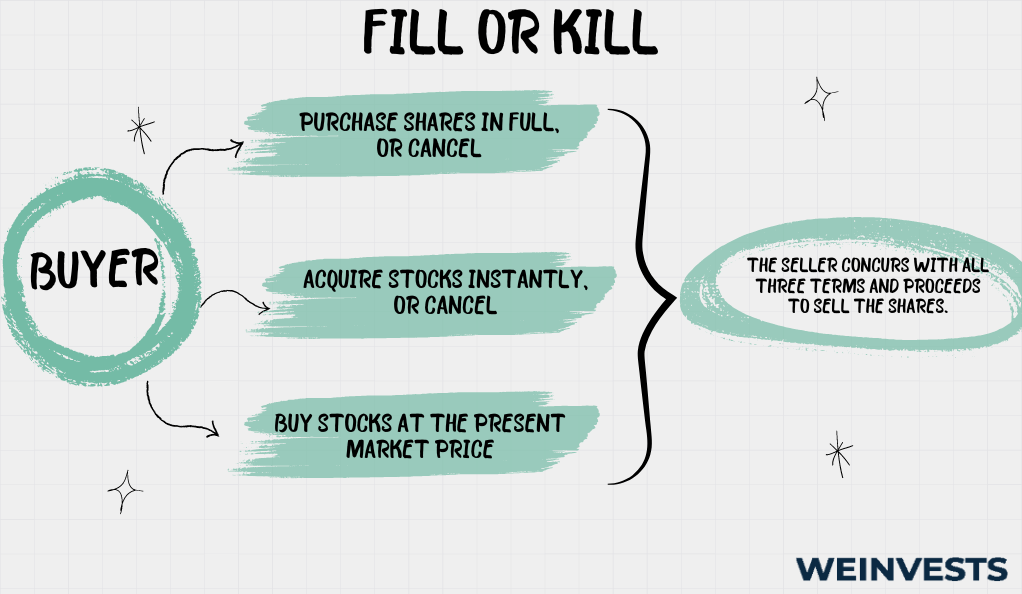

Fill or Kill Order

Fill or kill orders are widely used, so exploring the concept further is worthwhile, especially for investors prioritizing the immediate execution of trades. Like all-or-none orders, you can specify your desired price and number of shares with FOK orders. However, the main difference here is that your position will be automatically cancelled if your broker does not manage to execute the trade immediately.

The main reason behind using fill or kill orders is time efficiency. Day traders and high-frequency traders utilize FOK orders to avoid partial fills and quickly execute trades. Moreover, traders may consider this approach for buying a large quantity of a particular stock at once.

This strategy requires investors to closely monitor the stock market and price movements to benefit from short price fluctuations. Running an order immediately based on specific requirements may be challenging, considering high market volatility, so patience is critical when placing fill or kill orders.

Lack of flexibility and the potential of missing investment opportunities are the main disadvantages of using FOK orders. These orders are rare, especially when the market is highly volatile. If your order gets cancelled and you do not react quickly enough, you may suffer from higher execution costs.

Iceberg Order

The last type of market order in our list, the iceberg order, is one institutional investors will find the most beneficial. Iceberg orders are characterised by the purchase of a large number of stocks through the process of placing several limit orders. An automated system usually executes this whole investment process. This approach aims to minimise the market impact that large trades may cause.

As the name suggests, the main goal of iceberg orders is for institutional investors to keep the anonymity and privacy of their investment strategy. While the tip of the iceberg is initially visible, a series of limit orders remain hidden before they become active.

To see the bigger picture, we will give a real trading example. Suppose a prominent institutional investor places a large sell order, which may cause panic in the market and lead to a massive sell-off. A safer direction would be gradually decreasing prices through several carefully timed limit orders.

Enhanced liquidity is another benefit that iceberg orders propose. As the process of disclosing the investment is gradual, other market participants may notice and drive the price in an upward direction. This may lead to the better execution of the order and reduce the risks of slippage.

Summary Market Order Types

Learning to use different stock order markets is a valuable approach for enhancing your trading strategy and skills. By considering an investor’s risk tolerance, market conditions, and investment goals, market orders create a customizable and regulated environment for calculated decision-making. In the list below you can find a brief summary of the different market order types and their main functionalities:

- Market orders provide instant execution but lack price control

- Limit orders offer price control but may miss potential opportunities

- Stop orders provide security but require predefined stop prices

- Conditional and trailing stop orders offer customization and automation

- All-or-none and iceberg orders fulfill specific requirements

Overall, understanding the different order types is essential, as this allows investors to make informed trading decisions and improve their chances of success in the stock market.

FAQ

What are the most popular market order types?

Three of the most popular market order types include standard market orders, limit orders, and stop orders. These order types give traders all the necessary tools to personalize their investments based on their risk preference, trading strategy, and market conditions. Those looking for more advanced tools can test conditional orders, which offer a more customizable approach to placing orders.

How to choose the market order type that best suits my investment strategy?

Begin by assessing your tolerable risk level, how much time you can dedicate to trading stocks, and what types of stock you want to trade. Based on your answers, make an order type that best suits your trading style and goals

Do I need to be an experienced trader to use market order types?

No, you don’t need extensive trading experience to understand market orders. However, if you are a beginner looking to experiment with different order types, we suggest you seek the assistance of a professional advisor first.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More