Due to the volatile nature of the stock market, understanding what causes sudden price fluctuations in stocks could be a bit of a hassle. Indeed, market cycles and economic conditions may be the first aspects that come to mind. However, market news is a contributing factor that has the potential to drastically affect the prices of stocks and shift investor sentiment.

In a microeconomic point of view, supply and demand plays the most significant role in defining stock prices. As a result, media coverage like breaking news, industry reports, and company earnings, highly influence investors’ decisions.

Understanding the effect of market news on the stock market is a valuable trading strategy. Reacting to the latest announcements or appropriately anticipating the information will help investors reduce risk and find trading opportunities.

Our educational guide will explain how financial news impacts the stock market. By the end, you will learn how to build a solid strategy by analyzing trends that pivot stock prices.

Factors of Market News Driving Stock Prices

Let’s begin by analyzing the significant news factors that drive the movement of stock prices. The first large-scale contributors are economic indicators. They include pieces of data gathered by analyses from governments, companies, and other financial institutions. The most widely followed indicators include the Consumer Price Index (CPI), Gross Domestic Product (GDP), retail prices, and changes in money supply, to name a few.

| Indicator: | Description: |

| Consumer Price Index | Measures inflation and changes in prices |

| Gross Domestic Product | Measures the total value of a country’s goods and services |

| Retail Prices | Tracks changes in consumer prices |

| Money Supply | Measures the amount of money in circulation |

Seasoned investors follow the schedule at which economic indicators are published for the broad public and diversify their investments based on these events. Though numerous other external factors shape stock prices, economic measurements give valuable insights into the potential future state of the economy. And this information is practical, as economic conditions define market trends.

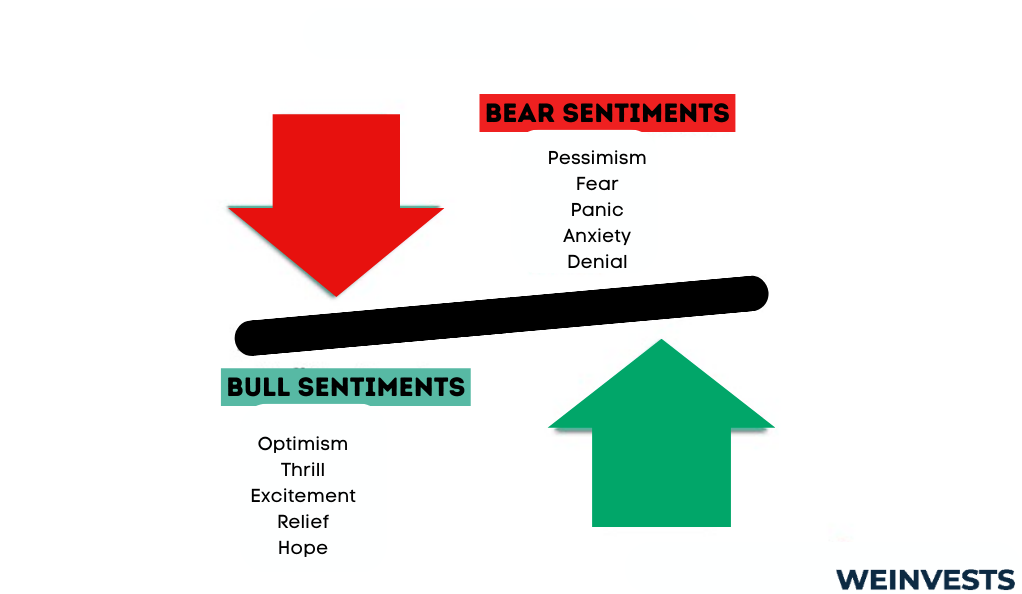

Market cycles are projections of the direction in which financial markets are moving. Bull and bear markets have become widely adopted across various media sources, including news, blogs, and social media. Market trajectory also defines stock prices as during bull markets, stock prices surge in value, while during bear markets, stock prices and demand decrease.

Market trends and economic indicators are easy to follow due to their wide accessibility. Major news channels consistently cover topics regarding the latest CPI reports and the current state of the market.

The Impact of Breaking News on Stock Prices

With the power of the internet, information gets spread quickly, and the wide variety of information sources ensures that all market participants will get notified. We have seen how a single crypto coin like Dogecoin can surge substantially in a day in response to a tweet from Elon Musk. Although not that volatile, stock prices are strongly affected by breaking news, which can cause unexpected short-term price changes.

The reason why the breaking headlines have such a significant impact on the stock market is the fact that they strongly affect investor behaviour. As it is challenging to distinguish the effect of a specific press release post, traders often make investment decisions out of emotion. This uncertainty will result in increased market volatility, led by the overreaction of the market participants.

Furthermore, regulatory bodies, financial institutions, academics, and researchers publish case studies of significant market events and their outcomes. The analyses cover topics like market crises, regulatory changes, and expected market performance in the future. Traders often base their long and short positions on studies of this nature. This may lead to a sudden change in investor sentiment and make substantial changes in the stock market.

Analyzing Earnings Reports and Stock Prices

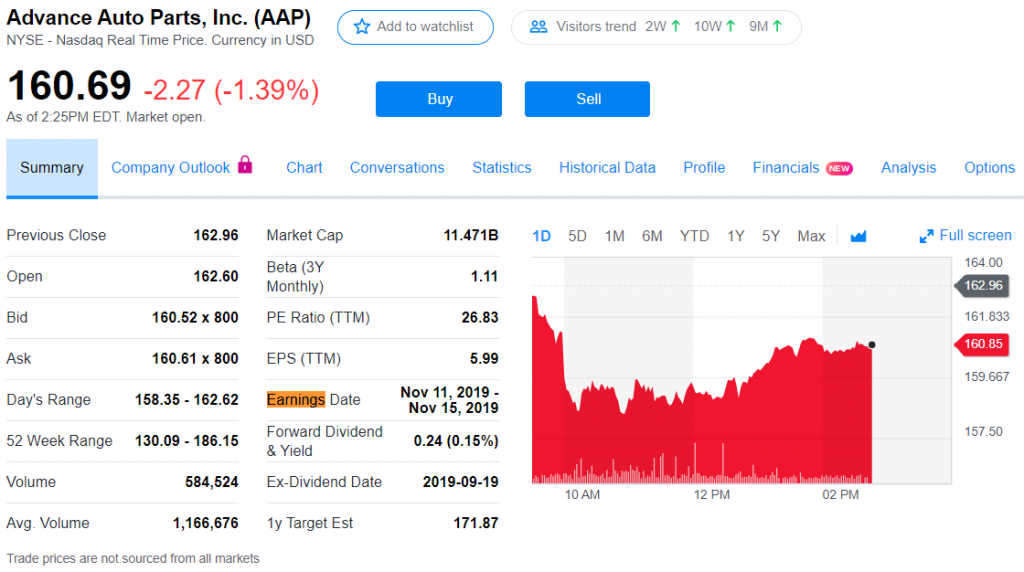

Earnings reports, also known as company financial statements, are documents that give insights into the company’s financial performance. Unlike breaking news, companies share this information every quarter, as they also share the exact days their earnings conference will be held.

There is a strong relationship between earnings reports and stock prices. In these statements, investors find valuable data indicating how well a company executes business and how their share prices may change in the future.

Some key financials shared in the reports include revenue, net income, EPS, profit margin, and operating income. The results are tracked quarterly or year-over-year, helping traders better understand how their investments are performing. The table below will help you gain a better understanding on the key metrics you can find in an earnings report:

| Financial Metric: | Description: |

| Revenue | Total income generated by the company during a specific period |

| Net Income | Company’s total earnings after deducting expenses and taxes |

| EPS | Company’s total earnings after deducting expenses and taxes |

| Profit Margin | Percentage of revenue that becomes profit after deducting expenses |

| Operating Income | Income generated from core business operations |

If the company reports a good outcome for the quarter, the investors respond optimistically, and share prices surge. On the other hand, bad performance over the quarter will lead to a drop in the value of a company’s stock.

Let’s take Microsoft‘s latest report to illustrate the significance of the influence of this type of news on investment decisions. Following the company’s Q1 release for 2023, shares jumped over 4% after announcing surprising growth in revenue and EPS.

The Role of Industry News on Stock Prices

Industry news indirectly affects stock prices and sectors in two ways. Companies are prone to changes caused by industry-related reports. Depending on the industry, many factors, like increased production costs or newly imposed regulations, change a company’s financial results and business operations. The results are visible in the financial earnings reports, and investors notice the impact and react accordingly.

Depending on the report’s significance, the impact may vary across industries. Freightos is a booking and payment processing platform that regularly shares freight market updates & forecasts. In their 2023 market outlook, Freightos shared overall underperforming results in the shipping market, with decreased trade volumes and no change in demand. The effect of the hostile market was reflected in Zim Integrated’s financial results, as the company reported -0.50 EPS as their stock value plunged even further.

Sector rotation is another phenomenon that can be caused by industry news. Investors analyze the outlook of a sector and may change their asset allocation to other industries. Growing sectors will receive more investments as market participants take advantage of growth opportunities. On the other hand, investors will go short on their positions in companies that operate in a poorly performing industry.

Understanding Financial Market News and Stock Prices

As we already mentioned, market prices move within seconds due to the high volatility nature of the asset type. This means that the outcome, whether you profit or lose money on your investment, may be determined in a matter of seconds. To stay up to date with the trends, investors follow various market news sources that help them make informed trading decisions on the spot.

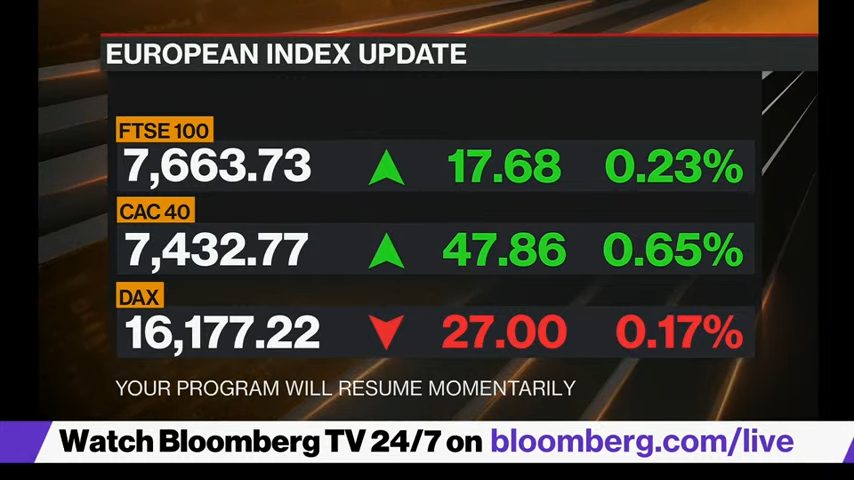

Financial news sources come in different content formats, and choosing the right channel will depend on your trading style. Some of the most popular and reputable global mass media companies include:

- Bloomberg

- CNBC

- The New York Times

- Yahoo Finance

Other channels through which investors can gather information are social media platforms like Twitter, Reddit, YouTube, Telegram groups, or popular podcasts. When creating a strategy for following the latest financial news, consider which sources help you easily digest information. Moreover, beware of the legitimacy of the channels you follow and determine the difference between facts and opinions.

Pricing is another essential factor. Although numerous free online resources exist, paid subscriptions give traders access to premium tools and content. Convenience is the main benefit you will get, so if you want to save time and effort, consider fitting paid news sources into your budget.

Investor Sentiment and Stock Prices

We have already mentioned investor sentiment a couple of times in our guide, as it gives an overview of investor psychology and how it may affect stock prices. Market sentiment tracks the investment behavior of market participants for a specific niche, stock, or industry. Analyzing investors’ beliefs determines whether the market cycle is bullish or bearish and where it may be headed.

Investor sentiment indicators are tracking tools that present trading trends and patterns in a visual format. They are also used to define what positions investors are likely to take. The data is extracted by looking at the investor’s point of view rather than tracking price movements and economic conditions.

The most popular instrument traders use is the Volatility Index (VIX), which tracks the level of fear in the market. Other practical sentiment indicators include:

- Bullish Percent Index (BPI)

- High-Low Index

- The Commitment of Traders Report (COT)

Unlike company financial reports and breaking news, investor sentiment cannot be directly used as a signal for sudden price fluctuations. In other words, they are not timing signals but rather information sources that portray investor behavior. Investor sentiment analysis helps read stock prices when used with other news sources and technical indicators like the MACD.

Market News and the Volatility Index (VIX)

The CBOE Volatility Index, also known as the Fear & Greed Index or simply the VIX, is an index that tracks the volatility of the financial market. It defines how stock prices may change in the following 30 days by monitoring options from the S&P 500 index fund.

Investors use the Volatility Index to make investment decisions based on the levels of volatility, risk, expected price changes, and current and upcoming market cycles. When reading the VIX, it is essential to note that the higher the aggregated measure, the higher the market’s volatility. It is measured on a scale from 1 to 100, and a score above 30 usually indicates an upcoming bear market.

Market news like breaking news, industry news, and earnings reports all indirectly contribute to changes in the VIX index. Investor sentiment changes in response to the news, and market participants decide to go long or short on their positions. This reflects the value of options used as a measure for the VIX.

The CBOE updates the Volatility Index daily, so tracking it can be a solid strategy for understanding the overall volatility level and investor sentiment. Following financial news and monitoring the VIX can help you spot opportunities and control the risk of your investments.

Conclusion

Information spreads fast, and investors can follow the latest financial news and reports to make the most out of their investments. Stock prices respond quickly to news, so having a reliable strategy that effectively spots media trends can help you seize market opportunities. Investors should stay informed and make educated investment decisions with the help of valuable information and news sources. This approach will improve their skills and allow them to build a solid investment portfolio for long-term growth.

FAQ

How quickly do stock prices react to market news?

Information spreads fast in the digital era, and the wide availability of information resources helps investors become more aware of the news that may shape the stock market landscape. With the large TV media and social channels posting regular updates on the financial markets, investor sentiment adapts and makes quick decisions.

Can market news be manipulated to influence stock prices?

Stock market scams are a popular tool used by frauds to manipulate the prices of stocks. Some typical fraudulent schemes include pump-and-dump scams, insider trading, and Ponzi schemes. With the broad reach of investment news and resources, investors should consider the legitimacy of the information with caution.

How can investors stay updated with the latest market news?

Following social media and TV channels, subscribing to newsletters, and following the release of the latest economic indicators will help you stay up to date with financial trends. Large media also have websites where they post daily articles, blogs, and videos, with sections where traders can share their opinions and exchange trading ideas and strategies.

What should investors consider while interpreting market news?

When it comes to interpreting market news accurately, investors should always consider the credibility of the source they follow, as there is a high potential of running into a scam. Furthermore, it is important to differentiate if a news post is written with opinions or facts in mind, as this will help you make informed trading decisions.

Are there any reliable sources for unbiased market news?

Investors should follow market news with attention to detail, as even reputable media channels may include biases and opinions in their posts. Some great examples of respected and trusted sources include Bloomberg, CNBC, The New York Times, and Yahoo Finance.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More