Over the long term, stocks have consistently been a good asset class for investors to have exposure to. Stocks do not always rise, but stock returns are generally high enough to justify their risk.

It’s important that investors have an understanding of how stock trading works before diving into the markets. As famous stock investor Warren Buffet has advised, never make an investment you don’t understand.

In this article, we will outline the very basics of stock trading and stock investing. While this will not serve as a complete guide, it should give investors a starting point for further research.

Table of Contents

Understanding the Basics of Stock Market Investing

Stocks are ownership shares of an underlying business. The company’s profits flow to the stockholders, as owners of the business. Stocks differ from privately-held business ownership because anyone can buy shares of stock on an exchange.

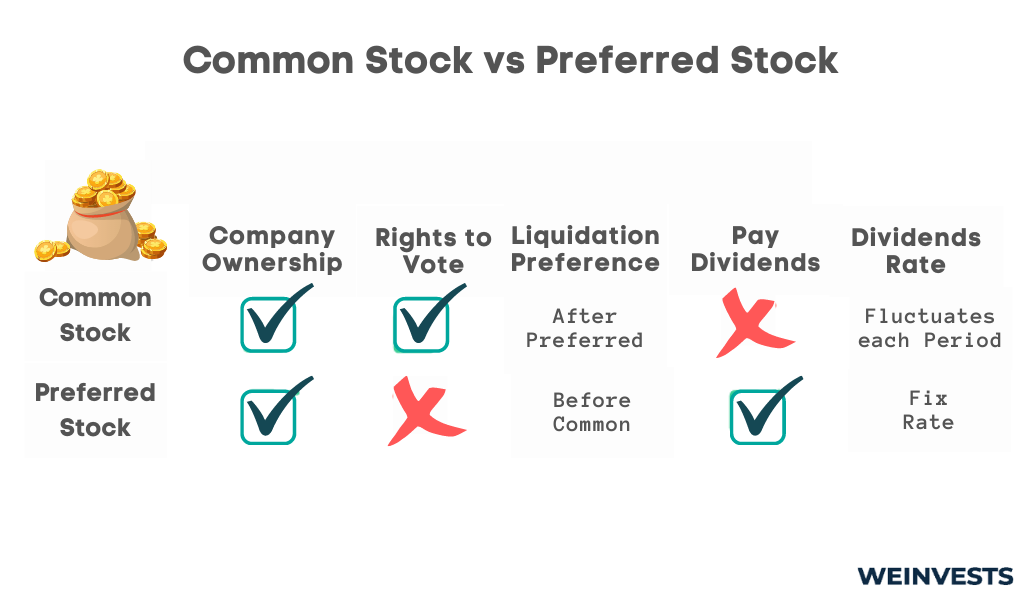

There are two main types of stock. Common stock shares are the standard form of stock. When people refer to a company’s stock, they are generally referring to common stock.

Businesses pay dividends to common stock shares, but only after the firm pays all other expenses. Additionally, common stockholders are last in line in the event of bankruptcy.

Preferred stock is a type of stock that has hybrid qualities of both debt and equity. While it is technically a share of stock, most investors treat preferred shares as similar to debt. Preferred stock ranks just ahead of common stock in the event of bankruptcy.

The vast majority of stock traded on an exchange is common stock. Most individual investors have no need to invest in preferred shares, but specific situations may differ.

The stock market as a whole refers to the collection of exchanges through which investors trade shares. The market brings together buyers and sellers, all of whom aim to profit from the change in value of stock prices.

Companies have an incentive to issue stock on the market because it allows them to raise money to finance new investment projects. In this way, the aim of the market is to ensure capital flows to valuable projects, and away from bad ones.

Understanding and Choosing the Right Stock Broker

To participate in the stock market, investors need to trade through a broker.

A broker connects with the stock exchange to trade shares on behalf of investors. Without brokers, individual investors would have to set up complicated data connections with exchanges directly. To avoid this, brokers let investors trade through an online interface or app.

Picking the right broker can be challenging because of the multitude of great options. Investors should consider what aspects of a broker are most important to them. Some online brokers prioritize ease of use, while others cater to professional traders. No one size fits all solution exists.

Some of the most popular online brokers for retail traders include Robinhood, eToro, and TD Ameritrade. Each of these three options is popular because they combine powerful trading options with a strong user experience. In addition, each offers no commission fees for standard stock trading, making them great choices for cost-conscious traders.

How to Open a Brokerage Account

Before opening a brokerage account, you should first consider what type of account you need.

For most investors and traders, an individual brokerage account will be suitable to start. While these types of accounts are taxable, they have relatively few deposit or withdrawal limitations when compared with non-taxable retirement accounts.

If you are not confident about which type of account to choose, you should discuss your options with a financial or tax advisor.

Once you’ve chosen a broker and an account type, you should navigate to the main sign-up page. From here, you will have to provide your name, address, and possibly additional identifying information. In some cases, brokers will require government ID to comply with anti-money laundering regulations.

After providing this information, you should be able to link your bank to fund your account. Some brokers also allow you to transfer funds via credit card or check. After making an initial deposit, you should be almost ready to make your first investment!

Researching Potential Investment Opportunities

Before executing trades, though, investors should familiarize themselves with the basics of stock research.

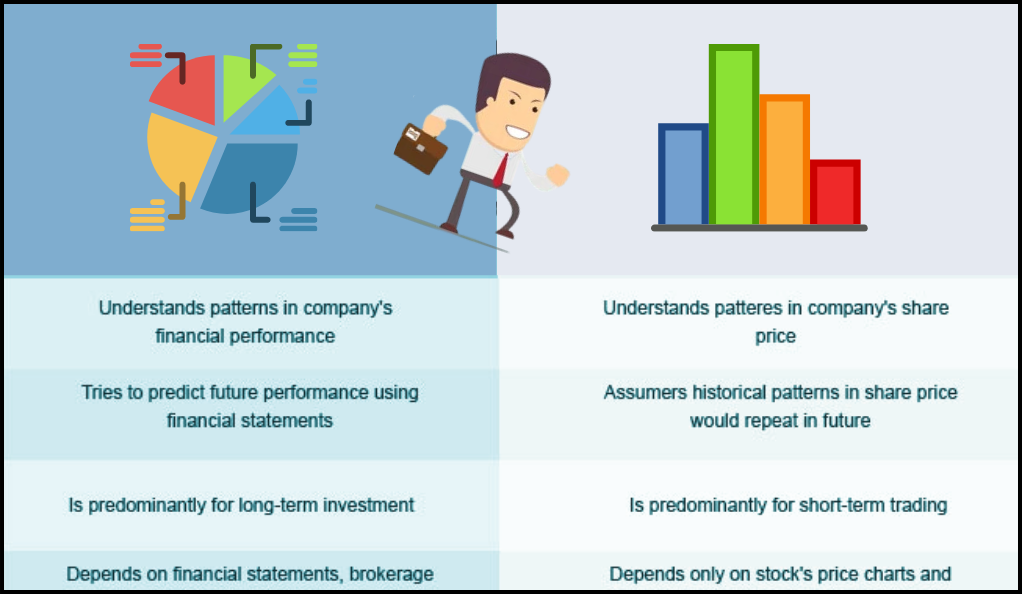

While every trader and investor has a unique style, stock analysis primarily falls into two categories. Fundamental analysis is the art of understanding the business underlying a stock to determine if shares are appropriately valued. Technical analysis is the study of charts and statistics to predict future stock price movements.

Fundamental analysts focus on financial statements to build investment models. The main thing they look for are stocks whose market value differs from their fundamental value. By going long or short on such stocks, fundamentalists hope to profit from this discrepancy.

Technical analysts, meanwhile, identify specific patterns and trends on price charts. In doing so, technicians aim to find elements of reversion or momentum in stock prices.

Finally, it is imperative that investors have an understanding of market trends and macroeconomic indicators.

Identifying market trends can help traders differentiate between real opportunities and unwarranted hype. In addition, trend following can be an attractive strategy for technical traders.

The impact of inflation over the past several years also underscores the importance of paying attention to the broader economy. Indicators like GDP and unemployment can help investors understand the current business environment, and thereby make better decisions.

How to Evaluate a Stock

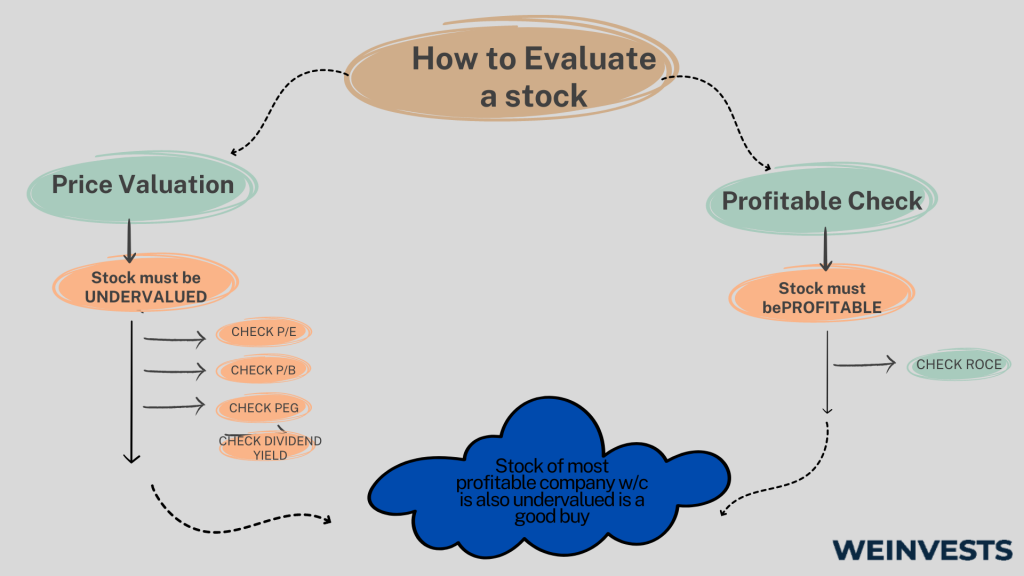

Fully evaluating a stock can be complicated, but there are important basic principles.

Fundamental analysis makes great use of ratios to understand how business performance relates to stock value. The price-to-earnings ratio, for instance, is a commonly used metric for quickly determining if a stock is appropriately priced.

Higher amounts indicate that investors are paying a lot per dollar of actual earnings. One reason that investors may pay more for specific stocks is due to a high-quality management team, which is another key factor analysts look at.

Stock charts can be difficult to discern without technical training, but a basic glance at a stock chart can grant some useful information. If a stock is climbing but fails to exceed a certain price, it is possible that the stock has hit a resistance level. This could be an indication the rally will not continue. A similar approach could indicate a reversal for a falling stock price.

Making Your First Stock Purchase

Now that we have a sound understanding of the basics of stock research and analysis, we can move on to placing a real stock purchase.

First, you need to decide which stock you want to purchase. The wide universe of potential options can make this difficult to narrow down, but consider which industries you know the most about or which business you believe will continue to grow. Once you have a stock in mind, make sure you know the ticker, which is how brokers identify stocks uniquely.

Next, you’ll have to decide how many shares to buy. For a first order, it makes sense to start small and learn the process. Traders can place orders either as a market order or a limit order. Market orders execute at the current market price, while limit purchases execute only when the stock is below the set limiting price. If you value immediacy over price certainty, you’ll probably prefer market orders.

Finally, make sure you understand the fees you’re paying. Luckily, most brokers offer commission-free stock trades these days, but you should check to make sure.

With this information, you should be set to make your first stock purchase and begin trading for real!

FAQ

Is stock investing safe?

Making stock investments can be risky since stocks can fall by a large amount. However, investors can mitigate their risks through careful research, disciplined trading, and ample diversification.

Are stocks FDIC insured?

No, stocks are not FDIC insured. Unlike your bank account, stocks can lose a great amount of value, especially during volatile market periods.

Is stock investing profitable?

Stock investing can be profitable, but it is not easy. Successful trading requires many hours of dedicated work. The market is very competitive, with traders all searching for the best opportunity, so careful research and analysis are required to keep up.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More