Recently, the idea of investing and trading in the market has become increasingly popular. However, as tempting as it may sound, there are many things beginners don’t know about trading that can affect their profitability in the market.

One of the most important things that aren’t considered before starting to trade are the brokers, even though they’re an essential part of a trading career. Not only do they affect the potential profits you can make by reducing risk and finding better opportunities, but they’re also influential because of their fees and commissions.

In this article, we’ll go over everything there is to know about brokers. We’ll start at the very beginning and step by step we’ll create a complete guide about stock brokers.

Table of Contents

- What are Brokers?

- Types of Stock Brokers

- How Do Brokers Work?

- How to Become a Stockbroker

- Necessary Skills for a Stockbroker

- How Brokers Earn: Commissions, Fees, and Other Charges

- Regulations Governing Brokers

- Considerations When Selecting a Broker

- Evaluating Broker Performance and Reputation

- The Impact of Technology on Stockbroking

- Conclusion

- FAQ

- What is the average salary of a stockbroker?

- Can anyone become a stockbroker? What qualifications are needed?

- How do brokers make money?

- What is the difference between full-service brokers and discount brokers?

- What regulations are brokers subject to?

- Why is a broker necessary for stock trading?

- How has technology impacted the role of brokers?

What are Brokers?

A broker is a financial professional who works as an intermediary between traders and markets. There are many different types of stock brokers, all offering different services and charging different prices. Generally, the “entry level” role of a broker is to facilitate interaction between the two parties, provide complete information, and quick transactions on the exchanges.

However, advanced brokers may also offer portfolio management, risk management, stock recommendations, tax tips and many other services. On the other hand, the more customized the service, the higher the fees and commissions. Some stockbrokers even require a minimum capital to use their services.

Types of Stock Brokers

As we said before, there are many different types of brokers offering different services and charging different prices. The three most common types of brokers are: full-service brokers, online brokers and discount brokers.

Full-Service Brokers

Full-service brokers are licensed specialists who establish a personal relationship with their clients and provide services such as portfolio management, risk assessment, retirement planning, research and estate planning.

This type of broker is used primarily by less financially savvy people who want to invest in the market, or by investors who simply do not have enough time to research and make the investments themselves.

However, full-service brokers charge much higher fees than the other two types of brokers. Therefore, if a trader does not want to benefit from the additional services offered by this type of broker, he should switch to an online or discount broker.

Online Broker

Online brokers are becoming the “hit of the hour” in recent years. Unlike the other two types of brokers, online brokers do not employ physical people or intermediaries. Their service generally consists only of providing an online platform where each trader can execute his or her own orders.

In this case, there is no external advice or research from the broker, but traders can benefit from much lower commissions and, in some cases, even a commission-free service.

Discount Brokers

Finally, discount brokers are considered the happy medium between full-service brokers and online brokers. Just like online brokers, they do not conduct research or fill out tax forms on behalf of their clients.

But just like full-service brokers, clients have a relationship with a physical person who is responsible for executing market orders on the client’s behalf.

For this reason, the commissions charged by a discount broker are typically higher than those charged by an online broker, but still significantly lower than those charged by a full-service broker.

If you’re interested in delving deeper into the role of brokers in stock trading, consider exploring eToro, a reputable online broker renowned for its quality services. With eToro’s platform, you can gain valuable insights into the intricacies of stock trading and enhance your understanding of the broker’s role in facilitating investment opportunities.

How Do Brokers Work?

The main role of stockbrokers is to facilitate the relationship between traders and stock exchanges. In the case of discount and full-service brokers, their role is to act directly in the market on behalf of their clients and thus also to establish a fiduciary relationship with them.

In the case of online brokers, the service offered is much simpler, because although they facilitate the interaction between the parties, the clients are the ones who execute the orders in the market.

However, stockbrokers become an invaluable medium when they are full-service brokers. These licensed professionals conduct a thorough market analysis to determine when and where to enter the market. Then, they enter the market on behalf of their client once they are approved, and finally, they monitor the trade until it is closed.

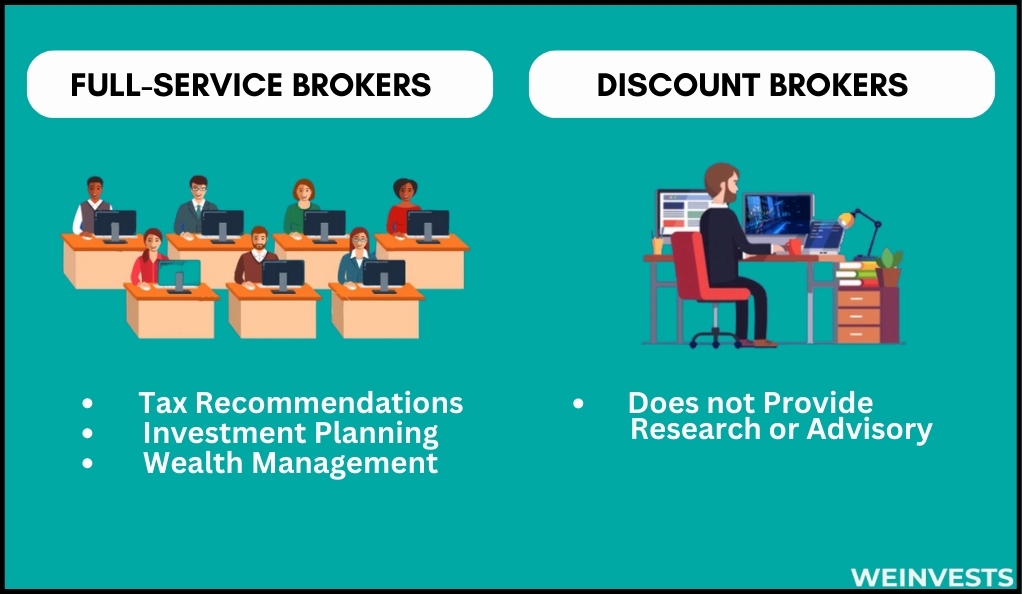

In addition, full-service brokers are able to provide their clients with tax recommendations, investment planning, and wealth management tips, and can therefore charge higher prices.

On the other hand, it is important to know that because full-service brokers establish a fiduciary relationship with their clients, they can also be held personally liable for their clients’ losses.

How to Become a Stockbroker

- Education

To become a stockbroker, you must first earn at least a bachelor’s degree, which is required for almost all entry-level positions. However, in most cases, a major or master’s degree may be a necessary step to show your clients that you have received the necessary training for such a position.

To increase your chances of landing your first job, it is also recommended that you first complete a summer internship at a brokerage firm to gain experience in the field.

- Registration

However, a college degree is not enough to get your first job as a stockbroker because licensing and registration is mandatory in every state.

In the U.S., for example, you must register with the Financial Industry Regulatory Authority (FINRA), a nonprofit organization charged by the U.S. Congress with regulating stockbrokers and brokerage firms in the United States.

- Licensing

After registration, you must pass at least two licensing exams to become a registered securities trader. In the U.S., for example, the first mandatory exam is called Securities Industry Essentials, which provides basic information about the securities industry and the structure of the market itself, with some emphasis also on regulations and regulatory bodies.

The second mandatory qualifying exam is called “Series 7” and requires working with a FINRA-registered firm. This exam is more specific than the first and targets a narrower area of interest chosen by the stockbroker.

Finally, it should be noted that in the U.S., some states also require a third qualification exam called “Series 63,” which focuses on state-specific regulations and laws. This exam is taken with the North American Securities Administrators Association.

Necessary Skills for a Stockbroker

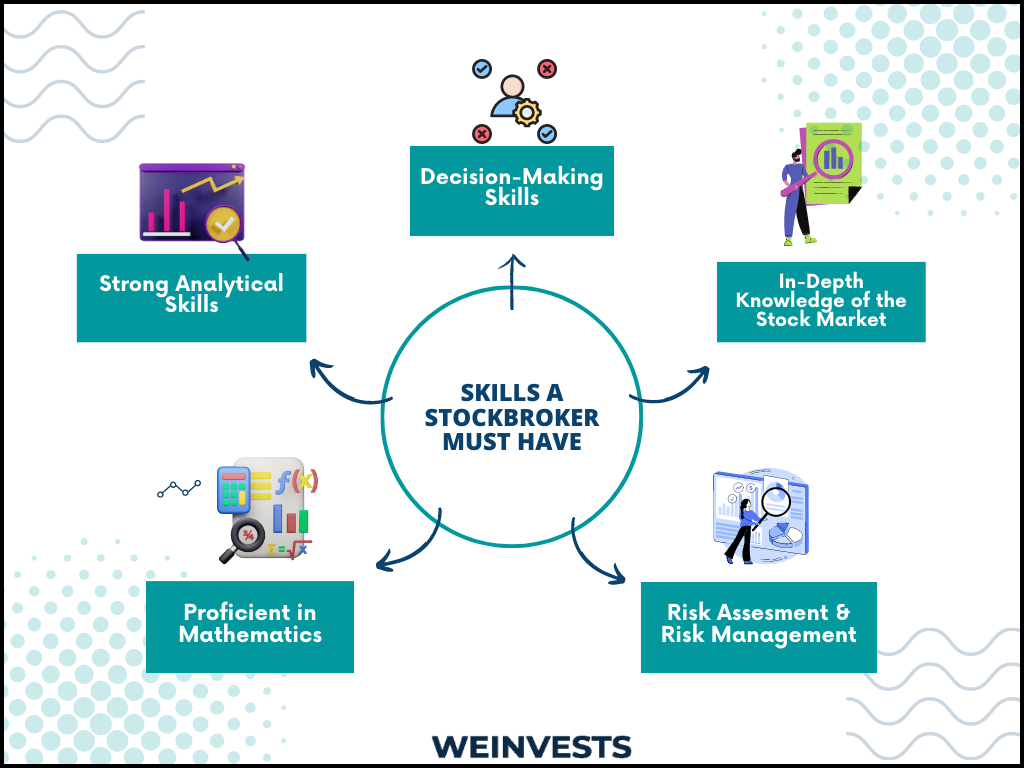

Working as a stockbroker is certainly not easy. The most important skill a stockbroker must have is how to manage his emotions. The market is always changing, and a sudden data release or unexpected change can turn a trade from profitable to unprofitable very quickly.

In such cases, stockbrokers must be able to collect themselves and evaluate the situation from a fundamental standpoint, without paying too much attention to the headlines or other rumors in the market.

In addition, stockbrokers are often promised quarterly, semi-annual or annual bonuses based on their performance, so some of them may be tempted to make riskier trades if they forecast that they could not otherwise reach the target.

Thus, another skill that stockbrokers must possess is risk assessment and risk management. After all, they work for their clients and therefore need to ensure that the riskiness of the investments matches the risk appetite of their clients.

Finally, stockbrokers should also be proficient in mathematics, statistics, and the use of software. For example, since they need to calculate the risk-return profile of a portfolio or the risk of an investment, they should be able to use statistical and mathematical tools to speed up the process and increase accuracy.

How Brokers Earn: Commissions, Fees, and Other Charges

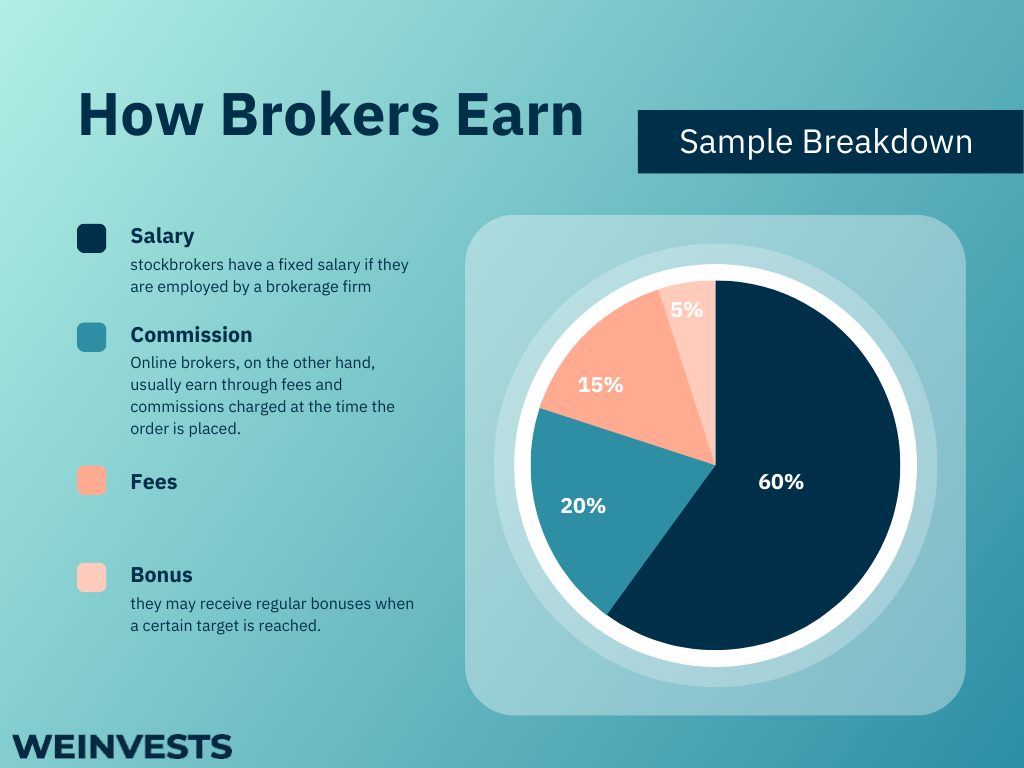

The way stockbrokers make money depends on the services they are currently offering. In some cases, stockbrokers have a fixed salary if they are employed by a brokerage firm, and if provided by the firm, they may receive regular bonuses when a certain target is reached.

Discount brokers, however, usually charge only a fee and a commission for each trade they make on behalf of their clients, without offering (and charging for) any other additional services.

Online brokers, on the other hand, usually earn through fees and commissions charged at the time the order is placed. In this case, however, the fees and commissions are usually fixed and not proportional to the capital invested. In addition, many online broker platforms charge subscription services for access to charting tools, real-time market data or access to desktop software.

Full-service stockbrokers, on the other hand, generally do not have a standardized fee and commission structure, as it depends on the type of client, the amount of assets under management, and the fiduciary relationship between the two. However, stockbrokers typically charge a commission of 1-2% of the assets under management, plus other fixed and/or variable commissions for other additional services such as risk assessment, market research, etc.

In 2021, the average annual salary of a stockbroker was $62,910, but depending on qualifications and client base, salaries can be much higher, with the top 10% recording an average salary of $205,440.

Regulations Governing Brokers

Regulations and regulatory bodies vary from state to state, so it is always important to be informed, especially if the stockbroker intends to expand his business to other countries.

As we mentioned earlier, in the U.S., FINRA is responsible for regulating stockbrokers and brokerage firms. Of FINRA’s extensive regulations, two are important to mention: the Suitability Rule and the Know Your Customer Rule.

Know Your Customer Rule (KYC) (art. 2090)

“Every member shall use reasonable diligence, in regard to the opening and maintenance of every account, to know (and retain) the essential facts concerning every customer and concerning the authority of each person acting on behalf of such customer.”

FINRA, art. 2090

The KYC rule states that stockbrokers have a duty to know the material facts of their clients in order to act accordingly on their behalf. Thus, they should learn how their clients operate in order to adapt their modus operandi to their clients’ style.

Suitability Rule (art. 2111)

“A member or an associated person must have a reasonable basis to believe that a recommended transaction or investment strategy involving a security or securities is suitable for the customer, based on the information obtained through the reasonable diligence of the member or associated person to ascertain the customer’s investment profile. […]”

FINRA, art.2011

The reasonableness rule, on the other hand, includes both a duty of care and a duty of loyalty to customers. Stockbrokers have a duty to analyze trades based not only on their personal preferences, but also on the preferences of their clients.

Considerations When Selecting a Broker

Choosing a broker is not an easy task, but the first step is a common milestone for every trader: what services do you need?

By answering this question, it is possible to first choose between the three different categories of stock brokers. If you do not need help with research and portfolio management, and you do not need a personal broker to execute entry orders, then you should choose an online broker because of the lower fees.

Instead, if you do not need any additional services but think some help navigating the exchanges might be helpful, then a discount broker might be what you are looking for. And if you need all the bells and whistles, then a full-service broker is for you.

On the other hand, it’s much more difficult to narrow down the decision from the general category to a single broker, and there is no standardized decision process. However, it is extremely important to read the fine print and identify any fees, commissions, and extras that you may be charged.

For example, with online brokers, it is not unlikely that clients will be charged spreads, inactivity fees, withdrawal and deposit fees, fees for subscribing to real-time market data, and more. By considering all the fees and commissions, you will be able to determine which broker has the best offer at a competitive price.

If you are looking for a full-service broker instead, it may be more useful to consider facts such as the services available, the broker’s qualifications and training, and finally, the reputation.

Evaluating Broker Performance and Reputation

Evaluating a broker’s performance, reliability and reputation is a critical factor in choosing the right broker. When evaluating a full-service broker, it is important to see that the broker is working in the best interest of its clients, that there are no lawsuits pending against it, and that it has a strong performance record.

If you are considering an online platform, you should also make sure that there are no hidden commissions and that clients can withdraw the money from the platform whenever they want, no strings attached.

The best way to judge a broker’s performance is to look for previous work records or customer reviews. The latter are especially useful for online brokers, as there are numerous platforms like Trustpilot where customers can post their experiences with the broker.

On the other hand, for full-service and discount brokers, it might be more difficult to find the same amount of information. However, the most important factor you should check is whether the stock broker has followed the KYC and suitability rules to determine if they have acted in the best interest of their previous clients.

The Impact of Technology on Stockbroking

Finally, it is important to look at the evolution of stock market trading over the years. Originally, trading and investing on the stock exchange were two activities reserved exclusively for people with much higher than average annual incomes due to very high commission costs.

Nowadays, more and more companies have entered the business of stockbrokerage, increasing competition and lowering prices. For this reason, discount and online brokers have become popular, as they allow traders with smaller accounts to participate in the market.

So, the technological process has helped traders with a smaller account to enter the market and work towards their financial freedom.

Conclusion

Finally, we must emphasize the importance of stockbrokers, who work as intermediaries between traders and stock exchanges, offering other important products and services that allow everyone to become profitable in the markets.

However, the profession of stockbroker is an extremely difficult job, not only because of the required skills, training and licenses, but also because of the burden of duties that he must fulfill.

Therefore, when choosing a broker, you should first decide what type of broker will be most helpful to you (i.e. discount, online or full-service) and then thoroughly examine not only the fees and commissions, but also the reputation and experience of the particular broker.

FAQ

What is the average salary of a stockbroker?

According to the Bureau of Labor Statistics average annual salary of a stockbroker in the US is $62,910, but the top 10% of stock brokers can achieve an annual salary exceeding $200,000.

Can anyone become a stockbroker? What qualifications are needed?

Yes, anyone with the proper education, qualifications and licenses can become a stockbroker. The requirements depend on the state in which the stockbroker wishes to practice, but in the U.S., for example, it is required to have at least a bachelor’s degree, be registered with FINRA, and have passed both the Securities Industry Essentials and Series 7 exams. However, in some cases, passing the Series 63 exam is also mandatory.

How do brokers make money?

This greatly depends on the type of broker we are analyzing. However, generally brokers earn money through commissions and fees, but in some other cases they might have a fixed salary plus performance bonuses.

What is the difference between full-service brokers and discount brokers?

Full-service brokers offer a wide range of services that include not only placing buy and sell orders in the market, but also market research, risk assessment, tax recommendations and more. Discount brokers, on the other hand, typically only provide brokerage services between the client and the market.

This difference is also reflected in the pricing structure of the two services, as a full-service broker usually charges much higher commissions.

What regulations are brokers subject to?

Regulations and laws often are state specific, so each stockbroker should carefully analyze the ones affecting their professional activity.

For example, in the US the main regulation affecting stock brokers is the FINRA regulation, which among its many provisions it has the Know Your Customer Rule and the Suitability Rule.

Why is a broker necessary for stock trading?

A broker works as an intermediary between the traders and the exchanges. Without a broker, it the connection with the exchange would be much slower, making it impossible to trade.

How has technology impacted the role of brokers?

Technological development had a strong impact on the stockbroking industry. While trading was initially reserved for the elite due to the very high commissions charged by full-service brokers, today, with the advent of online and discount brokers, almost anyone can set up an account and start trading with very low commissions.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More