This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Staking Amp is possible because Amp is used as collateral to transfer value instantly and securely. Amp is a collateral crypto token that can be used universally to aid and expedite fraud-proof and efficient transactions for real-world situations.

Flexa network provides immense value in crypto with its open-sourced protocol, Amp. Amp offers a much-needed solution to a common problem in crypto: high gas fees are often required to complete transactions quickly. Amp powers and backs up the Flexa network’s unique value proposition, which is to process digital payments, especially for merchants, swiftly.

- There are no lockup periods when staking AMP, so you can freely withdraw your staked AMP tokens and reward AMP tokens.

- Staking could increase the value of AMP tokens because of scarcity in the market.

- Staking AMP supports the Flexa network with collateral for securing and processing fast-value transactions.

- You earn a percentage of the current APY every 15 minutes, which compounds as time goes on.

- You could run at a loss when staking lower amounts of AMP because of considerably higher gas fees.

- Staking AMP exposes you to the risk of hackers and losing it all because of typical smart contract risks.

- Keeping track of your staking rewards can be difficult, which can cause issues with tax bodies.

Table of Contents

What is amp Staking?

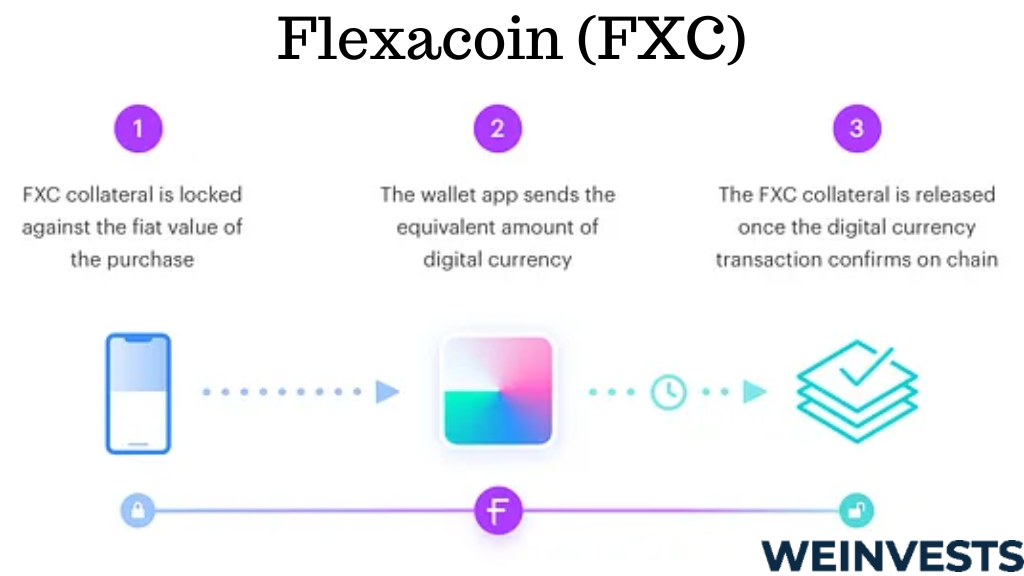

AMP staking is a means by which stakers and AMP holders use their tokens as collateral to validate and guarantee transactions. When you stake AMP, your tokens are locked by a decentralized collateral manager while a transaction is completed. Once the transaction is settled, the collateral tokens are released and used to collateralize another transfer.

Amp operates using a proof-of-stake system where stakers can earn passive income on the staked tokens. When you stake AMP tokens, you entrust them to a validator who validates transactions on the blockchain. In exchange, you receive rewards that are proportional to your investment. By staking your AMP coins, you contribute to the blockchain’s economy and the decentralization and security of the Amp ecosystem.

The Amp network has two innovations to its name, which makes it unique in the crypto ecosystem: collateral token partitions and collateral managers. Collateral token partitions collateralize accounts or transactions with balances that are verifiable on the Ethereum Blockchain. Collateral managers are smart contracts that can lock, release, and redirect staked AMP (in this case, collateral) to support transactions.

It is possible to manage collateral token partitions separately from Amp token contracts, thus making room for different collateral managers to implement rules on separate spaces affiliated with the same digital address. Because of this, you can stake your AMP tokens without transferring them to s smart contract.

How to Stake AMP?

The most common way to stake AMP is to use the Flexa network via the official Flexa Capacity dApp. On the other hand, other projects can use AMP tokens as collateral for any type of value exchange via compatible wallets and DeFi platforms.

Flexa, the company behind the Flexa network, created Amp to ensure and enable fast and secure payments for businesses across the globe. Flexa collaborated with ConsenSys, a platform company with a focus on decentralized web, to develop Amp.

Together, they built the first Amp collateral management contract to be open source. Thus, Flexa can approve, process, and confirm payments quickly by using Amp as collateral while the asset value is yet to be validated. Because of this, Amp can approve transactions almost in real time.

By staking AMP, you provide Flexa network with collateral to process merchant transactions. You get paid with rewards in exchange for such collateral because you and other Amp stakers make the network secure by staking.

Below is a step-by-step guide on staking AMP via the Flexa network, with detailed explanations given for each step:

1. Buy AMP on a Crypto Exchange.

The first step in staking AMP is to buy it on a trusted cryptocurrency exchange such as Coinbase, Gemini, Binance, etc. You can buy AMP tokens with your fiat on any of these exchanges.

2. Transfer Your AMP to a Wallet.

Upon purchase of your AMP tokens, you need to transfer them to a crypto wallet such as Coinbase Wallet, Rainbow, Trust Wallet, Argent, or MetaMask. If you decide to use MetaMask, you have to click on “Add Token” and paste AMP’s contract before your coins can show in your wallet. Or you can navigate to CoinGecko, find AMP, and click on the MetaMask icon. Transfer some ETH into your chosen wallet to pay gas fees when staking or unstaking.

3. Connect Your Chosen Wallet.

Visit the official Flexa Capacity website at app.flexa.network and click on “Connect your wallet’ to connect the wallet you chose. Note that you can use hardware wallets via MetaMask.

Once connected, click on your wallet’s icon, which will be in the top right corner of the screen. When you click on the icon representing your account information, a pop-up tab appears and shows the amount of AMP stored in your wallet.

4. Stake Your AMP Tokens.

In the pop-up tab are the words “AVAILABLE IN WALLET”; below this phrase is the amount of AMP coins in your wallet. Click on the amount of AMP tokens, and you will see a “Stake” button.

Clicking on the button will bring another pop-up tab that shows the applications where you can stake your AMP coins: Gemini, SPEDN, and Lightning. Each application has its annual percentage yield (APY) for staking rewards, so choose the application you want to use and select the amount of AMP you wish to stake. Click on “Continue.”

5. Complete the Staking Process.

The next step is to complete the staking process by paying your gas fee. Upon confirmation of your gas fee, your transaction will begin, and your AMP tokens will be staked. Depending on the limit you set for your gas fee, your wait time for confirmation of the transaction may range anywhere from 5 minutes to 3 hours.

Once your staking has been confirmed, click on your profile to see your AMP shown as “In Capacity” with the current APY. Note that the APY % changes nearly daily. You can also see how many tokens you staked.

AMP Staking Tax

In the UK, the onus is on crypto investors to calculate and figure out how much tax they are to pay on their coins. The UK provides the crypto assets manual, which was created by Her Majesty’s Revenue and Customs (HMRC), as a general guideline on taxation for staking cryptocurrency. As provided by this crypto assets manual, stakers must do due diligence by studying the terms and conditions of the exchanges on which they stake their coins. After careful examination of these terms and conditions, you will know if you should pay tax, how much you are liable to pay, and any other additional levy you owe.

According to the guideline as provided by the HMRC, if an AMP staking platform makes use of your tokens while holding them, that could mean that you have given away or passed on beneficial ownership of your AMP. Thus, the situation would be regarded as a disposal, and you would incur capital gains tax.

However, you may only pay capital gains tax if your yearly gains from a sold asset that appreciated surpass 12,300 Great British pounds. This means that if you stake AMP and plan to unstake and/or sell it after making gains, you are not liable to pay capital gains tax unless your profit surpasses 12,300 pounds.

Because you earn a small percentage of the APY on staked AMP every 15 minutes, taxation on staked Amp can be tricky. You are expected to pay income tax on your stake rewards, and if you receive AMP via airdrop, mining, confirmation rewards, or as a salary or another form of payment, you will be taxed for it. It is imperative that you record your gains at least once every month to avoid possible errors. If you suffer losses while staking and sell your coins at a loss, the loss can be calculated and deducted from your overall capital gain. This loss diminishes your tax liability by reducing your capital gains tax.

Why do people like Staking AMP?

There are various reasons for which people stake AMP, one of which is the yields earned from staking. It has already been established that you consent to use your AMP tokens as collateral when you stake in a particular wallet app. You also receive a portion of the processing fees which the Flexa network earns from processing transactions through your chosen wallet. Thus, if you provide 3% of the total staked Amp for a wallet, you would receive 3% of the total fees generated by the users of that wallet.

Also, by staking AMP, you support the Flexa network and keep it running. With knowledge of how revolutionary Amp is for payments, it’s no wonder many people stake AMP to support the payment network.

Conclusion

AMP is a great cryptocurrency for people looking to make a difference in the crypto ecosystem while benefiting monetarily from staking. Over the years, AMP has gained value as it has become more trusted by investors, and this is only expected to grow in the years to come.

Investing in cryptocurrency is a risky endeavor, and investing in Amp by way of staking is no different. As an AMP staker, you could experience severe fluctuations in its price and the guaranteed APY, so it’s essential to keep that in mind as you invest.

AMP Staking FAQ’s

Can I only Stake AMP from the Flexa Capacity Website?

Yes, you can stake AMP using the Flexa Capacity dApp at https://app.flexa.network/, but there are other methods. You may also stake AMP via supported DeFi platforms and wallets. Although Amp is supported in any non-custodial ERC-20 compatible wallet, some apps allow you to store, trade, or stake AMP directly.

Some supported DeFi platforms by which you can stake AMP tokens are Binance, KuCoin, Gemini, and Coinbase. You can store, send, trade, and stake AMP with these Amp-supported apps and wallets: Krystal, Guarda Wallet, Coinbase Wallet, and MetaMask, to name a few

Does AMP have a Max Supply?

Yes, AMP has a max supply of 99.4 billion tokens. Its max supply can be helpful in controlling the inflation rate of AMP tokens, and this could lead to a long-term appreciation in the price of AMP.

At the moment, there are 42.23 billion AMP coins in circulation. You can use the circulating supply to calculate Amp’s market capitalization; this is done by multiplying the market price of AMP by the number of coins in circulation.

Is Staking AMP the Same as Mining AMP?

Staking AMP is not the same as mining it, although they are both ways to earn from cryptocurrency. Staking requires you to hold AMP in a compatible wallet to support and secure the Flexa network in carrying out transactions and, in the process, you earn rewards. Your rewards are dependent on how many coins you stake, so the more you stake, the more you make. Staking is an excellent way to earn passive income.

Mining differs from staking in that when you mine cryptocurrency, such as AMP, you verify transactions on the AMP blockchain and add them to the blockchain’s ledger. As payment for mining and verifying transactions, miners are rewarded with a percentage of the mined crypto. Mining has a high-entry barrier and requires specialised skills as well as high capital; this is because miners use specialised hardware and lots of electricity.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More