This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

A blockchain network called Tezos (XTZ) was created to deal with some of the problems that other crypto blockchains have encountered, namely protocol upgrades. Tezos intends to become the first self-upgrading blockchain that can smoothly integrate new beneficial improvements and modifications approved on by the users by adopting an “open-to-everyone” validation mechanism.

When trying to change their protocol, some well-known blockchains, including Ethereum, have encountered issues that have necessitated a split like Ethereum Classic. In the end, this caused communal division. Tezos aims to stay away from this. Along with this goal, Tezos provides safe, institutional-grade smart contracts and keeps a close watch on upcoming technological advancements.

The Proof-of-Stake (PoS) mechanism is used by Tezos. The Tezos network’s native token, abbreviated XTZ, is utilised in all blockchain transactions.

- In the system, delegators don’t run the chance of having their assets frozen because a validator violated the protocol.

- When staking using a digital wallet, there is no lockup period, allowing the user to respond swiftly to volatile market movements.

- Individuals have the option to use DeFi apps or financing services to make extra money.

- Stakers participate in the development, administration, and operation of the Tezos blockchain.

- There is the chance that validators won’t provide delegators with their incentives.

- A user may be unable to access their XTZ assets if they lose their wallet passcode and secret phrase.

- To begin staking, certain exchanges demand a bigger XTZ token investment.

Table of Contents

What is Tezos Staking?

The act of staking involves having cryptocurrencies tokens locked up in a smart contract. The blockchain network is then maintained and protected with the aid of those locked up coins. Those who participate in the system are rewarded with fresh tokens under the smart contract.

Staking can be equated to a term deposit in the actual world. An organization can access the money through a term deposit and use them for daily operations. An annual yield would thereafter be paid on the term deposit.

Individuals actively participate in maintaining the Tezos network by staking XTZ. The PoS consensus technique used by Tezos makes the use of XTZ tokens essential for transaction validation. Staking is necessary for the Tezos network to function.

On the XTZ ecosystem, staking is also known as “baking.” Individuals can stake XTZ in one of two methods to gain rewards: as a delegator or as a self-baker (validator).

Anyone who has an XTZ token has the ability to sign up as a self-baker and start collecting return on their tokens. However, a participant must stake more than 8000 XTZ tokens and operate a full-node validator by using approved “baking” programs in order to join the chain as a self-baker. Additionally, the self-baker must make sure it remains current and operational on the network. This method can be costly, time-consuming, and technologically sophisticated when electricity costs are high.

Holders of XTZ tokens may still receive benefits if they become a delegator, but without the bother of managing a node. No minimum quantity of XTZ tokens is necessary. A self-baker can be chosen by delegates to make tokens for them. Following that, delegates receive more tokens in relation to their initial commitment.

How to Stake Tezos

There are two main ways individuals can stake Tezos, there are through a wallet or using an exchange.

Binance Earn is one of the platforms offered by cryptocurrency exchange Binance. It comprises a suite of products to help users bolster their cryptocurrency holdings.

This includes staking Tezos. Below is a step-by-step tutorial on how to stake Tezos on Binance Earn.

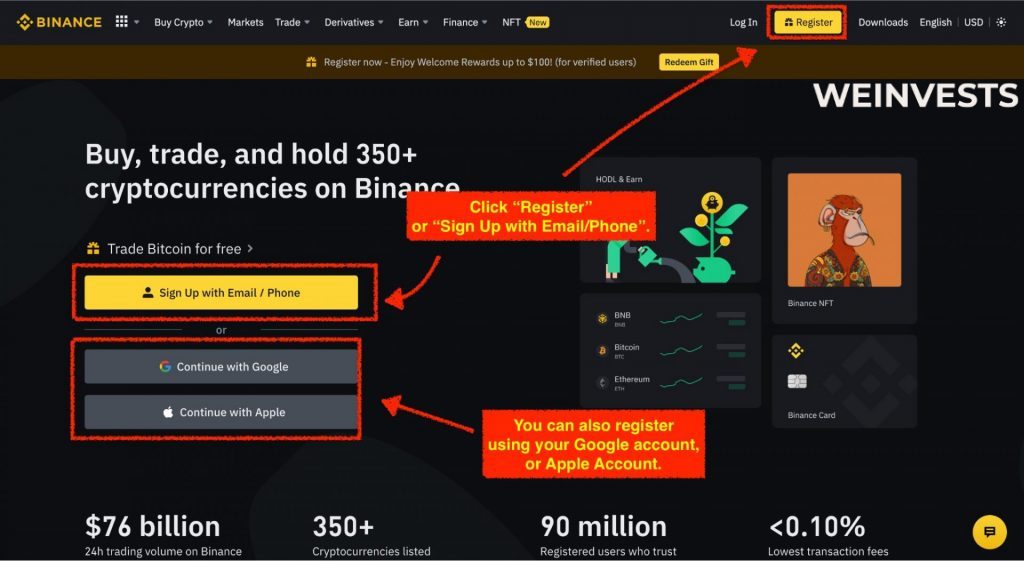

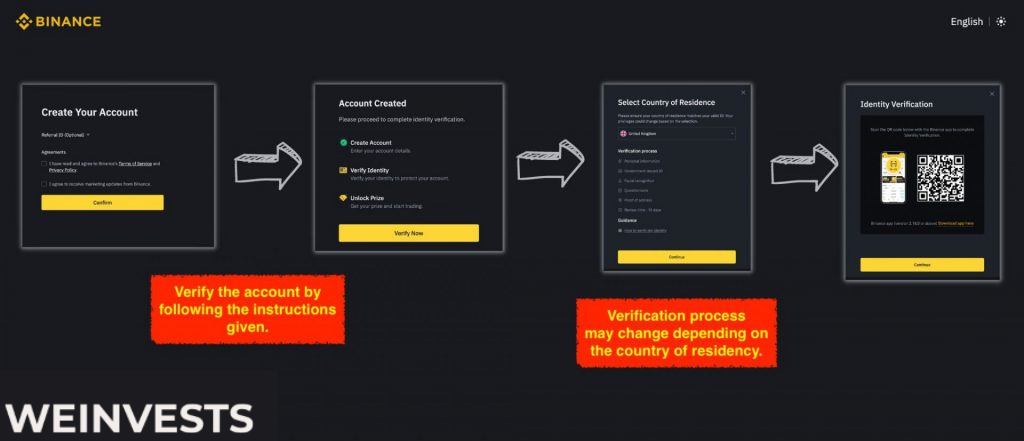

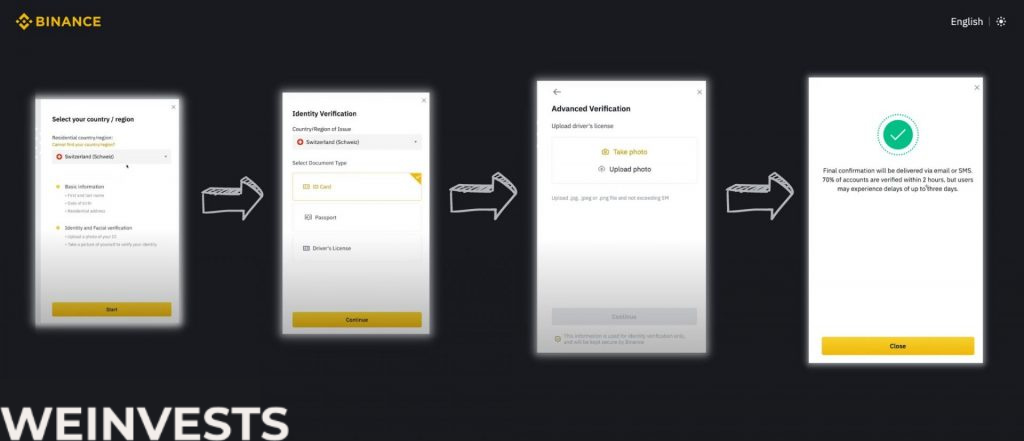

Step 1: Sign Up and Verify your Account

If you want to stake Dash, the first thing you must do is create an account on Binance.

Then go through the verification steps to provide Binance with proof of identity.

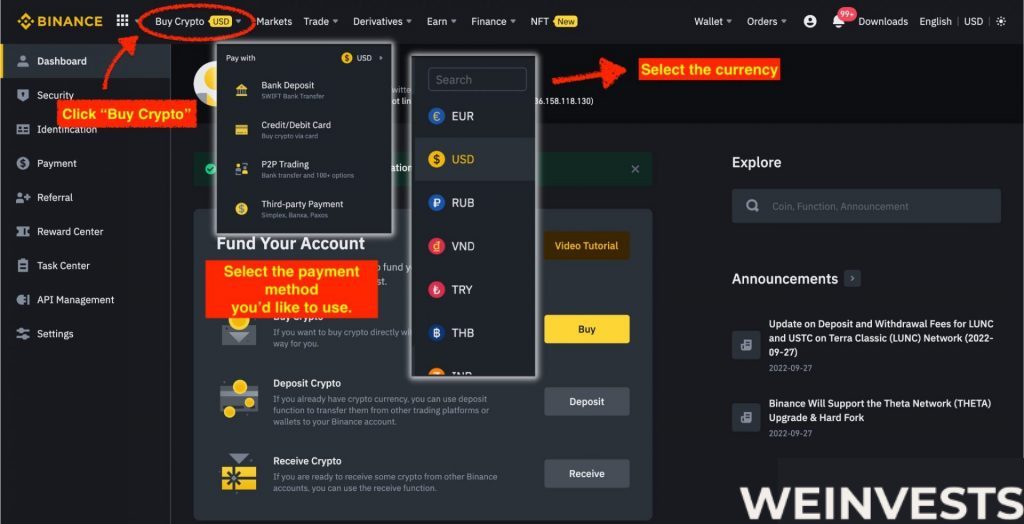

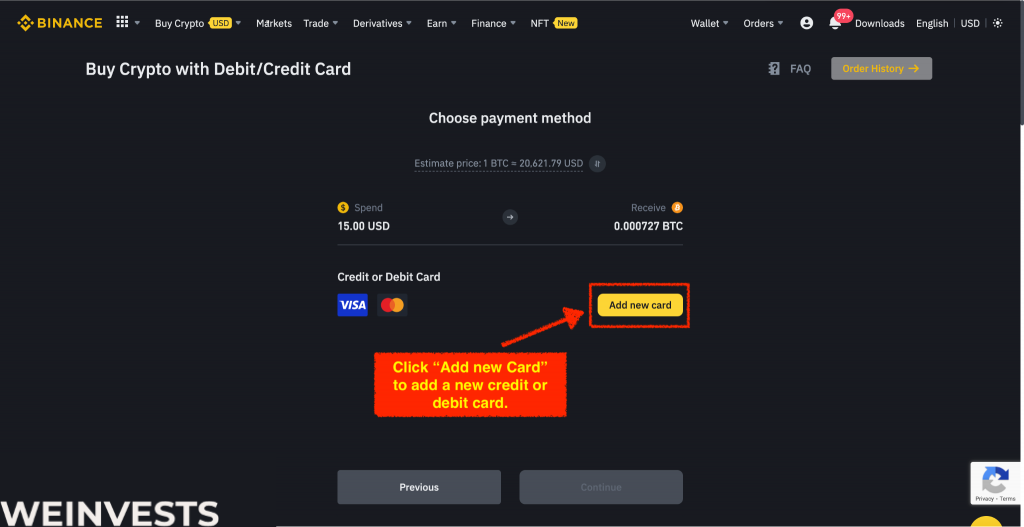

Step 2: Fund your Account

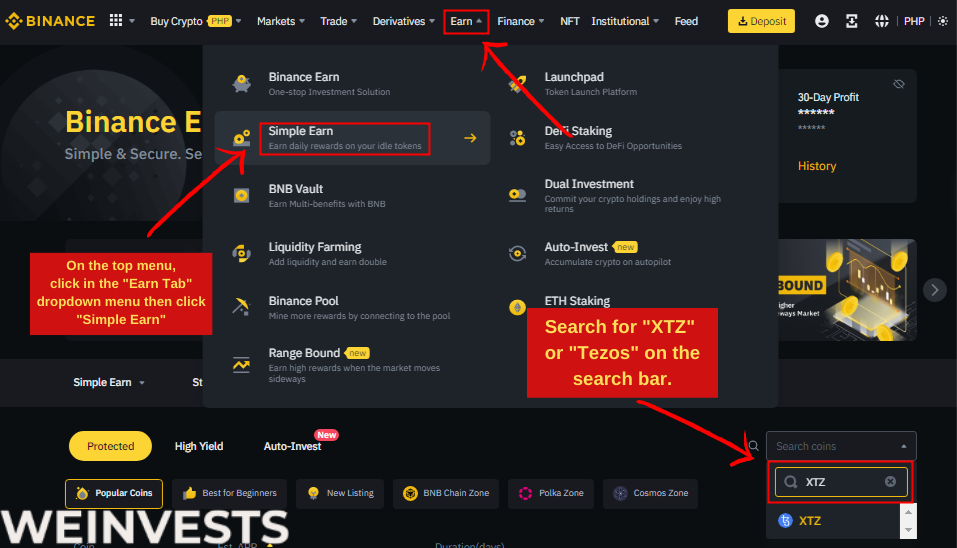

Go to the “Earn” tab on the top navigation bar and select “Simple Earn.”

Scroll down to the section labeled “Staking” and select “Tezos (XTZ).”

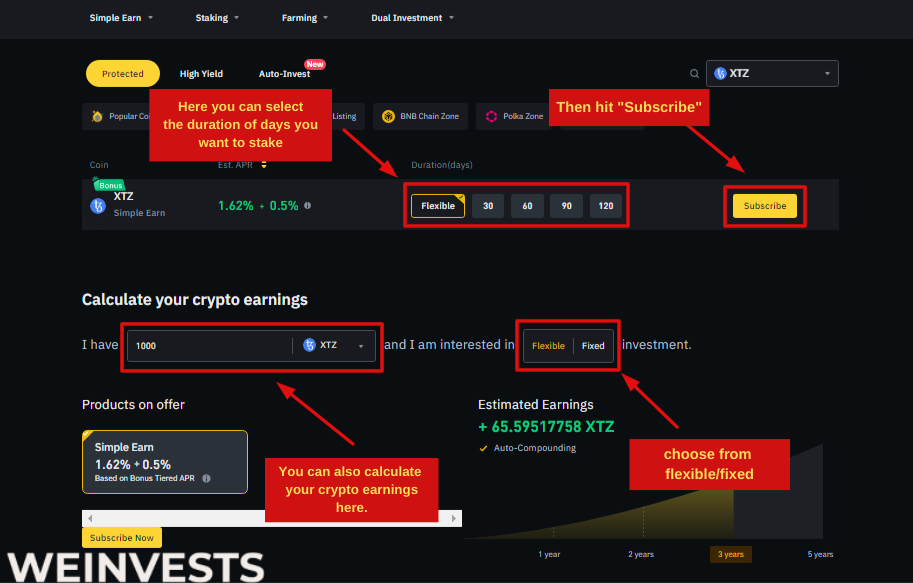

Step 4: Analyze the Staking Parameters and Stake

Here, you can analyze Tezos using the ‘Calculate your crypto earnings’ feature. You can input the amount you want to invest and see the projected earnings for 1 year, 2 years, 3 years, or 5 years. Simply click on the desired number of years to invest in ‘XTZ’.

After analyzing, you can subscribe to the program.

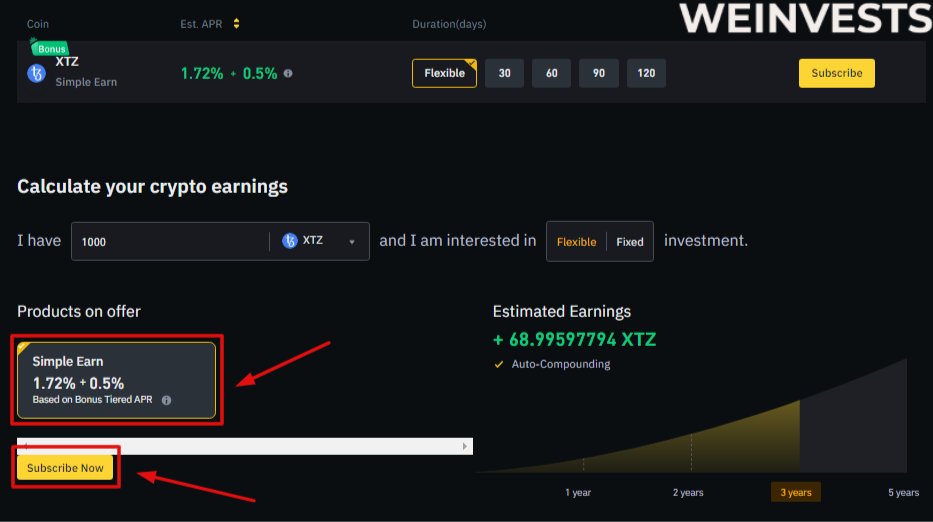

If you want to earn rewards with your Tezos (TXZ) on Binance.com, you can go to the “Products on Offer” section and then click “Simple Earn”.

“Simple Earn” lets you deposit your XTZ in flexible or locked products and earn daily rewards. You can subscribe or redeem at any time, so you can maintain your assets’ flexibility and liquidity. The rewards are sourced from Binance’s own funds and are based on market conditions.

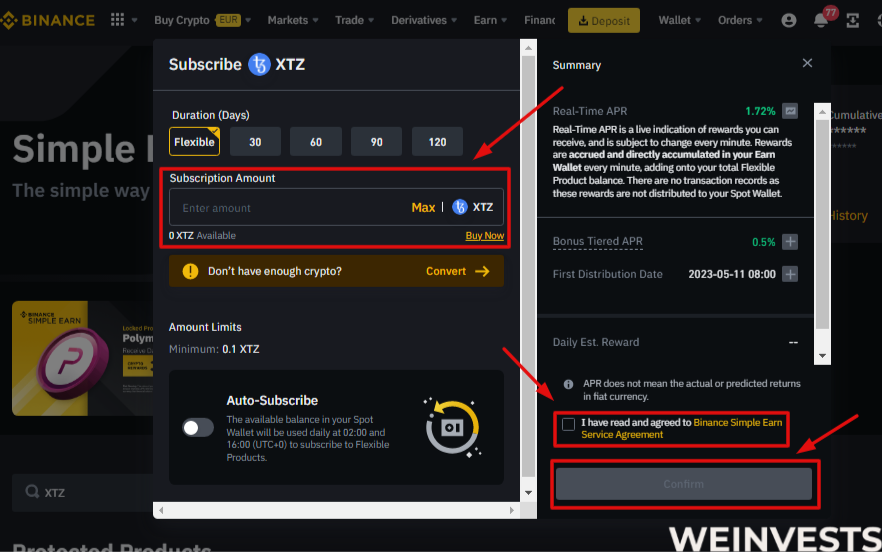

Choose the amount of XTZ you want to stake and click on “Subscribe.”

Confirm the staking amount, agree to the terms and conditions, and click on “Confirm Subscription.”

Staking XTZ using a wallet

Coins belonging to XTZ holders can be staked using a compatible wallet. The methods are straightforward and usually the same from wallet to wallet.

Tezos features software wallets (including iOS and Android ones) like Guarda, hardware wallets such as Ledger, and web wallets such as Atomex.

You choose your validator whenever you bake with such a wallet; therefore, you are in charge of your personal fate (baker). For more experienced users who understand what to search for in a reliable validator, this flexibility could be enticing. When choosing a baker, it’s crucial to take into account information like the total number of pooled tokens, online activity, and commission rates.

While self-bakers operating a full node must stake at least 8000 XTZ tokens, Tezos delegators have no required minimum stake amount.

Staking XTZ using an exchange

Exchanges for cryptocurrencies like Binance, Coinbase, Exodus, and Kraken control a significant share of the overall volume of trading in cryptocurrencies. Both crypto-to-crypto and crypto-to-fiat transactions fall under this category.

Despite initially concentrating on the buying and selling of cryptocurrencies, these platforms have grown in prominence and now include a wide range of capabilities, such as liquidity providing, staking, and lending.

Whenever you stake coins through an exchange, the exchange will serve as the validator (baker) for you, saving you the time and effort of having to find a validator. Additionally, it significantly lowers the chance of a validator malfunctioning. Binance doesn’t impose staking fees, making it a slightly more affordable alternative to utilising a wallet.

If a user wishes to withdraw money from an exchange, the unbonding time is frequently longer. Users are unable to respond to erratic market conditions as a result, which may reduce earnings. Compared to finishing the procedure via a wallet, the entrance point for delegators may potentially be significantly greater.

How to Stake XTZ on Binance

Here is a step to step guide on how to stake XTZ on Binance. After opening up Binance, follow these steps.

Make a deposit

Buy XTZ tokens with USDT, deposit XTZ from another wallet, or swap other cryptocurrencies for XTZ if you do not yet have them in your Binance wallet.

Earn on Binance

Go to the Earn tab on Binance. You can access this by selecting Finance and then Binance Earn from the options list at the top of the window.

Stake

Make use of the search bar, and search for XTZ. After that, find the stake option and select “stake”.

Select lock up term and amount

Enter the quantity of tokens you want to stake after selecting your locking duration (30, 60, or even 90 days). 50 XTZ is the lowest stake size on Binance.

Confirmation

Accept the terms of the staking service contract and finish the transaction. Then, you’ll start receiving extra money from your XTZ tokens.

After heading to your staked orders, just select “Redeem earlier” to remove or trade staked XTZ at whatever time you want. You may accomplish this by selecting Wallet, followed by Earn. You won’t be able to get any profit you earn if you do this.

Tezos Staking Tax

The U.K.’s tax authority, Her Majesty’s Revenue and Customs (HMRC), has amended its guidelines regarding the taxation of gains from borrowing and staking in proof-of-stake systems that are part of decentralised finance (Defi).

The new guideline states that a return from a loan or staking is taxed differently depending on whether it is classified as revenue or capital. However, as the HMRC concedes, determining whether a return is revenue or capital can be challenging.

It is impossible to list all the situations in which a lender or liquidity provider makes a return from their operations and the type of that return since the lending and staking of tokens using decentralised finance (Defi) is a continually developing field. “Instead, a few guiding ideas are presented,” the post stated.

In March 2021, the HMRC released the first set of instructions for the taxation of staking returns. The taxing of staking operations was dependent on whether it qualified as a “taxable trade” based on last year’s guidelines, which used language that was nearly identical to the regulations outlined for taxing crypto mining.

The new guideline, according to a statement from the trade group for digital assets, CryptoUK, dramatically changes how Defi borrowing and staking are classified and treated for tax reasons in the U.K.

The new directive states that depending on a number of variables, such as whether the return’s sum was already known when the contract was reached, whether it is funded periodically or only after the principal has been repaid, and whether the loan’s term is long or short, the yield may be regarded as capital or revenue.

How and why the yield is achieved is also another element: It would be a capital receipt if it was realised through the sale of a capital asset.

Why do people like Staking Tezos?

One excellent technique to get passive Tezos revenue is through staking tokens. It may be thought of as interest on your cryptocurrency investments. Staking certain assets entails agreeing to lock up your tokens for a predetermined amount of time, during which they are not usable. Tezos, on the other hand, is an exception to this. Your Tezos can be used whenever you choose.

By giving resources to the Tezos network (XTZ) or staking your Tezos, you actually support the Tezos blockchain and add to its stability. You obtain Tezos tokens as payment for your assistance.

Conclusion

Comparatively, baking Tezos is a straightforward and relatively risk-free procedure, but there are a number of concerns to be aware of, whether doing so through a wallet or an exchange.

If malicious behaviour is found, staking other cryptocurrencies has the danger of drastically reducing a validator’s holdings. Any delegators who support this may be impacted. However, just the validator’s currency holdings are reduced if they act inappropriately on the Tezos (XTZ) network. Regarding the tokens they invested, delegators experience no loss.

The main threat to staking Tezos is that bakers may not or may incorrectly distribute earned incentives. Delegators should be aware of payment cycles and be aware of the precise timing and amount of their incentives. The Baking Bad interface allows for tracking of rewards.

Users who stake Tezos using a wallet must also be responsible. A user must always have control over both the passcode and seed word while baking through a wallet. A user risks losing all of their deposited XTZ tokens if they forget both.

Also, there is a higher chance of a breach of security while staking XTZ through exchanges. Since exchanges are online infrastructures, they are naturally more vulnerable to attack. If the system is abused, you risk losing XTZ assets.

Tezos Staking FAQs

What wallet should i use for Tezos?

Most people apparently pick Temple as their XTZ wallet of choice. This system, like Kukai, was created for XTZ and it is open source. Using Temple, your XTZs are completely flexible. In addition to storing them, you may assign them to many other users, control Tezos NFTs, and do a lot of other things.

Is Ethereum better than Tezos?

If immutability and decentralisation are crucial. A developer builds on Eth network when they wish to construct an app that cannot be stopped. Tezos, on the other hand, is a superior technology if scalability and quick transaction times are important.

What makes Tezos special?

Tezos uses a method that is energy-efficient. Tezos’ Proof-of-Stake blockchain uses substantially less energy and money to run than Proof-of-Work blockchain systems unlike Bitcoin or Ethereum, which makes it a perfect alternative platform for creating blockchain solutions that are environmentally friendly.

Is Tezos a good investment?

Tezos touts safety as a major attribute, saying it’s a well-liked option for security tokens, a class of coin that serves as a digital asset that represents an item with actual worth. The Tezos blockchain is used by several businesses in this industry, such as Elevated Returns and tZero.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More