Understanding the Basics of Stock Trading

While there are many different ways to make money in financial markets, one of the most prominent is stock trading. Stock trading is the art of picking which stocks will go up and which will go down.

Stock traders conduct thorough research to identify attractive investment opportunities. By purchasing or selling certain shares, traders can profit from changes in stock values.

Stocks can be a lucrative investment because each share represents a piece of ownership in a real business. If the business becomes more successful, the owners will receive a greater profit.

By placing large trades and using leverage, traders can make an extraordinary amount of money. As we’ll see, however, high returns come with high risks.

In this article, we’ll outline the basics of stock trading. While trading can be an exciting way to make a living, successful trading requires education, patience, and discipline.

Getting Started with Stock Trading

Assessing your risk tolerance is the first step to start trading stocks.

In finance, higher rewards tend to come with higher risks. The amount of risk you want to take on will be closely tied to your investment goals. For instance, earning a tremendous amount of money from your investments could require high-risk trading. If you’re interested in slowly building a retirement account, however, you might opt for more stable strategies.

Newer traders should also consider which investing style to practice. While each trader’s exact style will be unique, there are several broad categories most traders will fall into.

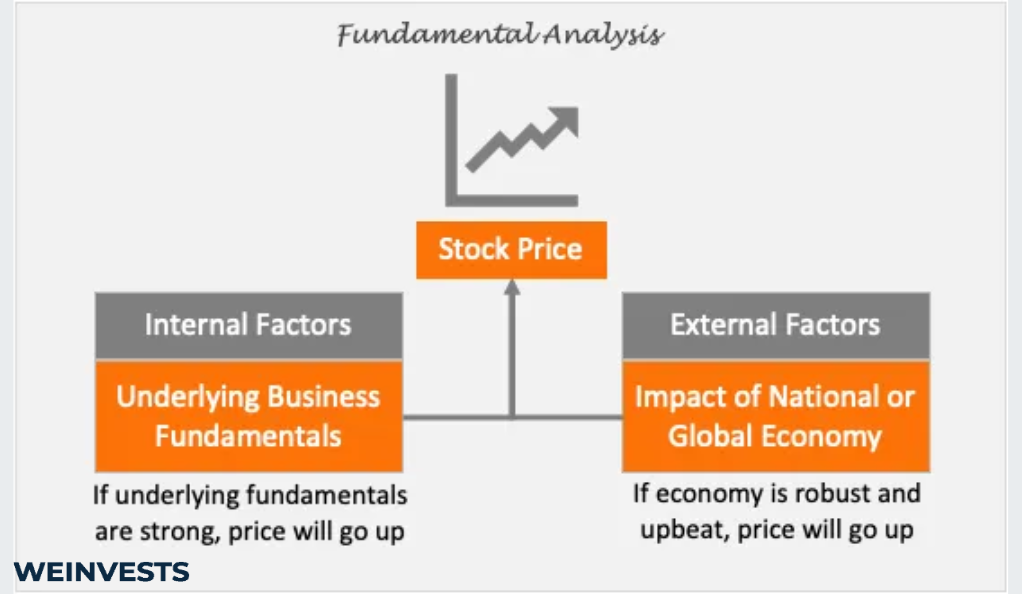

Fundamental analysis is an investing style that depends on understanding each stock’s underlying business. This type of analysis depends on scrutinizing a company’s financial statements and business model.

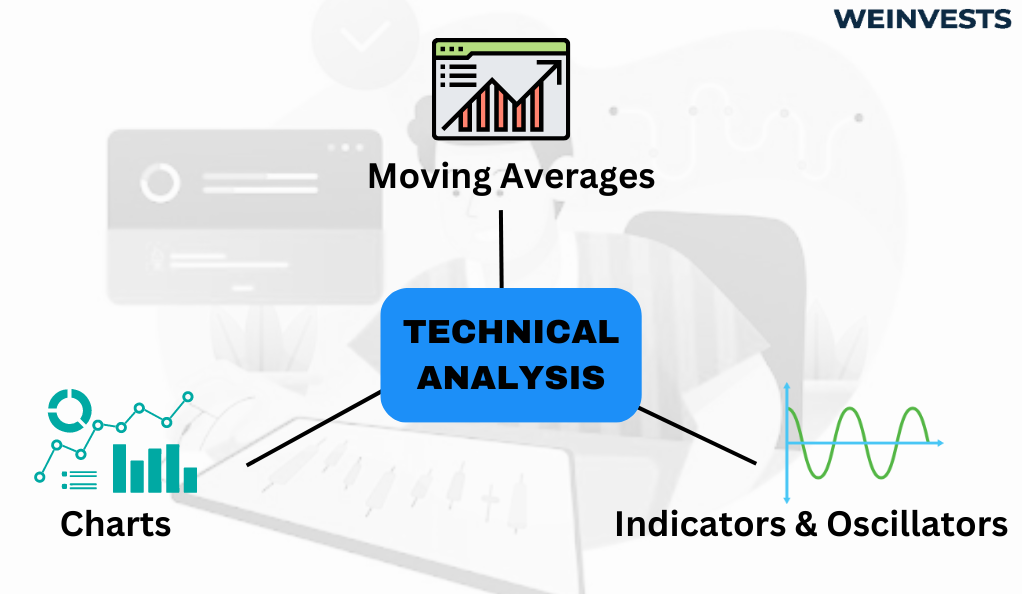

Technical analysis, meanwhile, does not require viewing a stock as a business. Technical analysts primarily focus on identifying chart patterns to discern future stock price movements.

Finally, traders should determine which type of investment account is right for them. An individual brokerage account tends to be a good choice. Other types of accounts are usually focused on retirement, meaning they have restrictions on deposit and withdrawal activity.

Types of Stocks

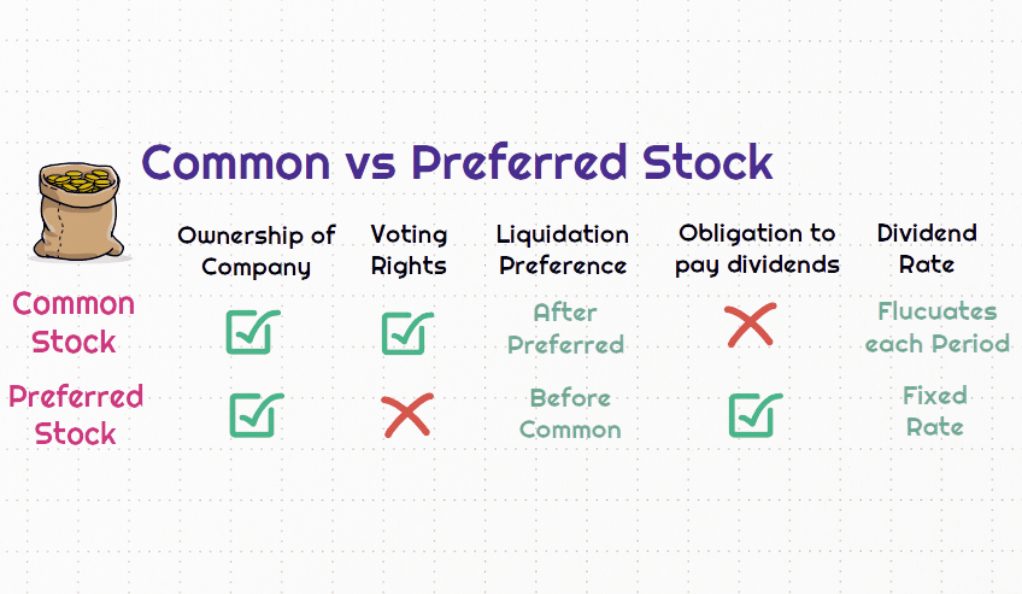

There are two main types of stock. Common stock is the standard type of stock on the market. Most shares that you will trade are common stock shares. These shares do not guarantee a fixed payment but do earn dividends.

The second kind of stock is preferred stock. Preferred stock is a hybrid debt/equity instrument that tends to provide a fixed payment rate. While experienced traders might execute strategies that depend on preferred shares, most new traders will stick to common stock.

Some companies can have complicated legal names, which is why traders often identify companies by their tickers. A ticker is a short string of letters that uniquely identifies a specific company. To trade shares of Tesla, for instance, traders will utilize the ticker TSLA. It’s important to research the correct ticker for each trade you enter to avoid buying or selling the wrong company.

Mechanics of Stock Trading

Now that we have a conceptual understanding of how stock trading works, we can dive into the mechanics of the process.

First, you’ll need to open up a brokerage account. This account will let you execute trades and track your positions. One of the most popular online brokerages is eToro, but there are many good options for retail traders.

Through your account, you’ll be able to place both buy and sell orders. As the names suggest, buy orders instruct your broker to purchase a stock on your behalf, while sell orders tell your broker to sell a stock.

You can place buy and sell orders either as market orders or limit orders. Brokers execute market orders at the current market price. Limit orders, meanwhile, are only executed if the price falls above or below a certain limit.

When you look at a particular stock on your brokerage platform, you will see both bid and ask prices. The bid price is the highest price at which someone is willing to buy the stock. The ask price is the lowest price at which someone is willing to sell the stock. When you place a market buy order, for instance, your execution price will likely be the ask price.

Fundamental Analysis

Fundamental analysis is one of the most important ways traders identify investment opportunities. This type of analysis involves understanding the actual business behind each stock.

One of the most important ways to understand a business is by studying the company’s financial statements. The three major statements are the balance sheet, the income statement, and the cash flow statement.

The balance sheet identifies what a company owns for itself and what it owes other people. The income statement shows how much a company earned over a certain period. The cash flow statement is closely related to the income statement, as it tracks cash movements in and out of a company.

From these statements, traders can calculate ratios that grant insight into a firm’s prospects. Some of the most important financial statement ratios are debt-to-equity, earnings-per-share, and the working capital ratio.

Ultimately, traders use fundamental analysis to determine if a company’s stock price is appropriate. Some traders build complex financial models to do this, but others prefer simple valuation ratios like price-to-earnings or price-to-book.

If a firm’s stock price is lower than its fundamental value, traders may buy the stock, expecting it to eventually rise. If the price is too high, traders could sell the stock short to bet against it.

Technical Analysis

Technical analysis is the second broad area of research that traders focus on. Unlike fundamental analysis, technical analysis does not depend on understanding the business underlying a stock. Instead, technical analysts focus on studying a stock’s price behavior to bet on future movements.

Technicians believe that certain price behavior follows specific patterns and trends. Some patterns are ‘bullish,’ meaning a price increase is likely to follow. Others are ‘bearish,’ which portends a price decline. Common patterns include triangles, pennants, flags, and wedges, all named for the shapes they take when drawn on a chart.

Technical analysis also relies on indicators. Indicators provide important information not simply surmised in a stock chart. For example, some traders might study a stock’s relative strength index to determine how quickly price changes occurred. Others may calculate moving averages to determine how price action has differed from recent trends.

Many traders opt to use specialized tools to support their technical analysis. These tools offer features like automated pattern drawing, trend detection, or indicator calculation. By letting the computer do the grunt work, traders can evaluate more opportunities each day.

Developing a Trading Strategy

To develop a trading strategy, you first need to establish your trading goals. Those looking to trade for a living will be willing to dedicate far more time to research and execution. This opens up more investment opportunities when compared with part-time traders.

After you figure out your goals, you need to establish a trading plan. For instance, if you are a fundamental analyst, you might build a plan that depends on just a few deliberate investments. Since it can take a long time to build a fundamental model, you might have the capacity for just a few positions. Technical analysis, meanwhile, can facilitate much more frequent trading. This is especially true if you use automated tools to support your research.

Risk management will be a key factor in any trading plan. Some traders like to establish maximum position sizes so that one trade will not dominate their portfolio. Others might build complicated correlation models to see which stocks move together. Whatever your risk management method, ensure it is reflective of the underlying analysis method you are using.

Finally, traders should be mindful of adjusting their strategy over time. As market conditions change, it could make sense to swap one plan for another, to yield even better results.

Choosing Stocks to Trade

To select the appropriate stocks to trade, consider which factors are most important to your trading style.

For instance, you might choose only to trade large-cap stocks, since they are less volatile. You might also filter stocks by a specific sector. Once you have built a suitable list of stocks, you can dive into the research process for each one.

Depending on your strategy, this process will differ. Some traders will begin collecting financial statements for each company, while others will work with charts. Having a keen understanding of the macroeconomic situation and trends in various industries will also be helpful during this stage.

As you identify and research your stocks, remember that a diversified portfolio is an effective risk management tool. This does not mean simply having a large list of stocks, but also stocks from different industries. A diversified portfolio makes it less likely that a single stock blowup will significantly impact your performance.

Common Mistakes to Avoid

One of the biggest problems for new traders is emotion-induced overtrading. While it’s easy to write down a disciplined trading strategy on paper, it can be difficult to maintain the strategy when real money is at stake.

Similarly, traders often find themselves chasing exciting tips and fads. While rumors flow freely in finance, they are not a suitable foundation for a successful trading strategy. Whenever a new piece of information comes your way, always think about how it fits into your long-term strategy.

It’s also easy for traders to neglect risk management based on unwarranted confidence. All traders should remember to stay humble when evaluating a new opportunity. A feeling of certainty is an easy way to expose yourself to undue amounts of risk.

Fundamentally, all these common mistakes are about failing to maintain discipline. Traders often battle themselves just as much as the market. It’s vital to have your long-term strategy clear in mind as you trade.

Summary and Key Takeaways

As we discussed in this article, stock trading can be a lucrative way to earn a living, but it is not without risk. Careful research and analysis should be the foundation of any trading strategy. Risk management, however, often makes the difference between successful and unsuccessful traders.

In addition to understanding the conceptual approach behind trading, new traders need to understand how the practice works mechanically. In addition, traders should study the various categories of analysis used in the market.

Since markets are always evolving, traders need to be comfortable with continuous learning. What works one day might fall apart the next. For traders who can stay on top of these changes, though, the rewards can be substantial.

If you’re interested in getting started, the first step to real trading is opening up a brokerage account. Starting with some small, intentional trades can be a great way to learn the ropes.

FAQ

How much money do I need to start stock trading?

Since many brokerage accounts offer fractional shares, new traders can start with under a hundred dollars.

Do I need a brokerage account to trade stocks?

Yes, you will need a brokerage account. Trades must place buy and sell orders through a broker.

How do I choose a reliable online broker?

You should consider popularity, reputation, and ease of use when considering a broker. Some of the most popular choices for new traders include eToro, Robinhood, and TD Ameritrade.

What are the risks involved in stock trading?

There are substantial risks involved in stock trading. The primary risk is that your investments decline in value, which can happen for a multitude of reasons.

How can I minimize risks and protect my investments?

Careful analysis and research, along with a disciplined risk-management framework, is the best way to minimize risk and protect your investments.

How do I select the right stocks to trade?

You should filter stocks by the traits that best fit your framework of analysis. For instance, some people like to trade only large-cop consumer goods stocks.

Is it necessary to use technical analysis in stock trading?

No, it is not necessary, although many traders find technical analysis helpful. Many traders prefer fundamental analysis.

Can I make money by day trading stocks?

It’s possible to make money by day trading stocks by carefully researching investment opportunities, implementing a suitable risk-management framework, and avoiding emotional decision-making.

What are some common mistakes to avoid as a beginner stock trader?

The most common mistake made by beginners is overconfidence in their trades, along with emotional-based overtrading. Traders who have the best results often stick carefully to their strategy and analysis.

Where can I find additional resources to expand my knowledge of stock trading?

We have many other educational guides on this website to help new traders, but you can also find great resources through books, courses, videos, and podcasts.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More