This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Tether won’t be going to the moon.

That is as obvious as it gets.

Stablecoins exploding is quite the same as Elon Musk going broke; impossible.

If Stablecoins start going to the moon, they’d need to leave the ‘stable’ prefix on earth pre-launch.

Known as the third-largest cryptocurrency by market cap, the US dollar-based token known as Tether is frequently used by traders and investors to convert other cryptocurrencies to fiat money.

Some investors consider USDT to be a replacement for their earnings due to the high interest and staking rewards offered by various exchanges. However, others are still afraid that a similar crash could happen to the crypto market. In May 2022, the Terra crash wiped out $40 billion from the market.

Can Tether’s trust collateral sustain it through the coming years?

What exactly is the fate of USDT in the coming years in the face of:

- Cryptocurrencies’ volatility?

- Booming Government cryptocurrency regulations?

- And increasing uncertainties of stable coins legitimacy and use cases?

As you can probably guess, Tether price forecast will be more fundamental than technical analysis.

In this article, you’d be learning:

Tether news fundamental analysis

Tether price prediction ( 2023, 2024, and 2025)

Tether charts

Read on to learn more about when to invest and how much your ideal Tether investment will be.

Table of Contents

USDT Price Statistics

USDT Price prediction

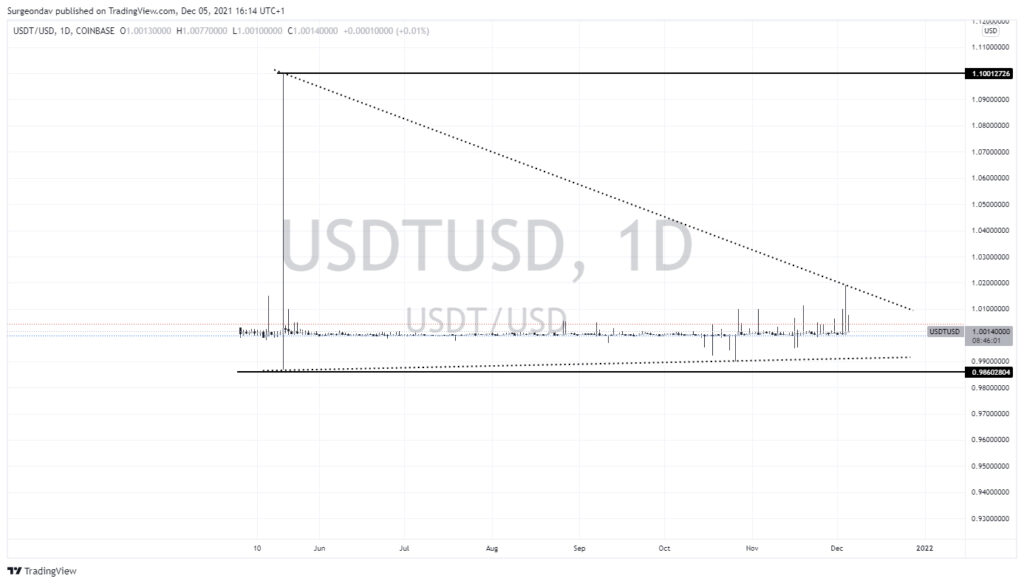

These chart examples prove further using the little technical arsenals possible that against all odds, USDT has been playing stable since its launch days.

And so, the same is expected for the coming years. However, minor fluctuations can happen just like they did with USDT for the past years.

The highest percentage increase and decrease USDT had this year is 10% and 1.3%, respectively. And USDT is currently trading around 1.001 and 1.002, which might be the closing price for 2021, considering the few weeks left for the year to round off.

If USDT repeats its percentage change in price for 2023, it should trade all the way to 1.02 and 1.025, and if it decides to sell below, 0.90/0.95 might be visited.

But fundamentally, cryptocurrency adoption is gaining grounds, which is a pointer to the future validity of USDT’s use-case, therefore, reassuring its stability as a coin.

In conclusion, about 96% of Tether’s minted USDT are purchased directly by Market movers such as Alameda and Cumberland. Such activities are unlikely to have any direct effect on USDT price.

On the other hand, these market movers have Tokens of their own into which they pump some of their profits made off of USDT.

Such actions are likely to have significant to minor effects on the tokens’ prices, indirectly affecting their ripple toward the USDT.

If Tether fails to deliver on its promised external audit, the fate of USDT in the coming years might be shaky; people can dump USDT in a flash and crash USDT’s price.

But, Provided Tether still holds sway on people’s trust, USDT isn’t going anywhere for a couple of years.

Tether’s Price History

A company issued USDT in Hong Kong named Tether, and one of its functions in the cryptocurrency space is to mirror the price of the U.S. Dollar.

USDT primarily launched in July 2014 as Realcoin.

Real Coins’ CEO, Reeve Collins, made this statement in November 2014; “We’re not an altcoin, we’re not our blockchain.

We’re a service, a token that represents dollars. Our specialty at Tether is currencies on the blockchain, so Tether means a digital tie to a real-world asset, and the digital assets that we’re focused on are our currencies.”

USDT Price History; 2019 to 2021

| Date (Month & Year) | Price | Open | High | Low | Vol. |

| Dec 21 | 1.0011 | 1.0008 | 1.0021 | 1.0002 | 2.08B |

| Nov 21 | 1.0009 | 1.0005 | 1.0014 | 0.9992 | 7.13B |

| Oct 21 | 1.0005 | 1.0002 | 1.0009 | 0.9994 | 6.32B |

| Sep 21 | 1.0001 | 1.0003 | 1.0024 | 0.9998 | 6.20B |

| Aug 21 | 1.0003 | 0.9997 | 1.0009 | 0.9995 | 7.38B |

| Jul 21 | 1.0002 | 1.0004 | 1.0015 | 0.9987 | 5.93B |

| Jun 21 | 1.0003 | 1.0002 | 1.0041 | 0.9978 | 8.31B |

| May 21 | 1.0001 | 1.0004 | 1.0057 | 0.9980 | 12.85B |

| Apr 21 | 1.0002 | 1.0003 | 1.0033 | 0.9952 | 8.25B |

| Mar 21 | 1.0002 | 1.0024 | 1.0030 | 0.9984 | 5.96B |

| Feb 21 | 1.0024 | 1.0009 | 1.0039 | 0.9957 | 5.94B |

| Jan 21 | 1.0009 | 1.0004 | 1.0045 | 0.9969 | 6.22B |

| Dec 20 | 1.0005 | 1.0003 | 1.0036 | 0.9954 | 3.24B |

| Nov 20 | 1.0004 | 0.9994 | 1.0036 | 0.9985 | 2.01B |

| Oct 20 | 1.0001 | 1.0015 | 1.0023 | 0.9998 | 974.40M |

| Sep 20 | 1.0009 | 1.0009 | 1.0030 | 1.0002 | 972.90M |

| Aug 20 | 1.0009 | 1.0013 | 1.0031 | 0.9985 | 900.08M |

| Jul 20 | 1.0013 | 1.0003 | 1.0031 | 0.9997 | 559.97M |

| Jun 20 | 1.0003 | 0.9993 | 1.0028 | 0.9983 | 293.31M |

| May 20 | 0.9993 | 1.0007 | 1.0024 | 0.9988 | 363.81M |

| Apr 20 | 1.0007 | 1.0036 | 1.0063 | 0.9986 | 265.95M |

| Mar 20 | 1.0035 | 1.0064 | 1.0667 | 1.0008 | 415.10M |

| Feb 20 | 1.0045 | 0.9999 | 1.0057 | 0.9999 | 234.37M |

| Jan 20 | 0.9999 | 1.0095 | 1.0167 | 0.9959 | 182.16M |

| Dec 19 | 1.0048 | 1.0089 | 1.0198 | 1.0008 | 145.69M |

| Nov 19 | 1.0088 | 1.0034 | 1.0154 | 0.9994 | 171.46M |

| Oct 19 | 1.0034 | 1.0058 | 1.0114 | 1.0015 | 163.92M |

| Sep 19 | 1.0058 | 1.0035 | 1.0182 | 0.9991 | 176.99M |

| Aug 19 | 1.0035 | 1.0015 | 1.0094 | 0.9976 | 178.44M |

| Jul 19 | 1.0015 | 0.9936 | 1.0049 | 0.9936 | 342.81M |

| Jun 19 | 0.9937 | 0.9988 | 1.0062 | 0.9817 | 439.45M |

| May 19 | 0.9988 | 1.0207 | 174.1763 | 0.9906 | 454.30M |

| Apr 19 | 1.0207 | 1.0006 | 1.0420 | 0.9867 | 253.74M |

| Mar 19 | 1.0006 | 0.9954 | 1.0211 | 0.9933 | 56.65M |

| Feb 19 | 0.9954 | 1.0005 | 1.0095 | 0.9856 | 76.52M |

| Jan 19 | 0.9949 | 0.9995 | 1.0265 | 0.9926 | 148.64M |

Tether Price Analysis

That USDT is a stable coin means its price does not significantly fluctuate. As shown in the chart below, USDT launched at $1.00, and since then has been playing around the range of 1.00 and 1.02.

There is not much difference in the cost compared to other cryptocurrencies, with more than 20,000% increases since launch.

Users can use stablecoins to earn interest, lend, and borrow money in decentralized finance applications. Following in the footsteps of USDT and USDC, UST has become one of the most popular stablecoins. It is managed by a group composed of payment firm Circle Internet Financial, Coinbase, and Bitmain.

Before the crash, UST had a market cap of around $18.7 billion, while USDT was valued at over $83 billion. On December 1, 2022, the market cap of USDT has dropped to around $65.3 billion, while that of UST has decreased to around $210 million.

Unlike USDC and USDT, UST is not a collateralized stablecoin. Instead, it uses an algorithm to maintain a constant value. This makes it different from the two.

UST utilizes an on-chain swap function that allows users to exchange UST for $1 of Luna regardless of its price. This objective was to incentivize them to swap UST if its value dropped below $1 and if its price went above $1. The swap resulted in a reduction in the circulating supply and a boost in the stablecoin price.

The growth of UST was mainly due to the Anchor protocol, which rewarded its depositors with 20% interest on deposits. Unfortunately, due to the high interest rate, Terra had to rely on funds from the corporate treasury to fund its operations.

On May 9, 2022, some investors started selling UST in order to force it to depeg. The resulting hyperinflation caused the price of Luna to collapse.

On May 12, the value of UST dropped to $0.7934, and it continued to decline until it reached $0.07601 on May 19. The price of USDT has stabilized, while the Luna Foundation Guard, which bought bitcoin after criticizing the dual-token protocol, had to sell its holdings.

The above charts show USDT paired with fiat and a volatile coin. The USDTUSD line chart on the left-hand side shows dormancy in price movement with no significant increase or decrease in price over the months.

Because the USD paired with USDT is fiat and isn’t volatile, it couldn’t make any substantial movement against USDT, as they are both at equilibrium.

But that wasn’t the case for the second chart depicting USDT paired with a known volatile coin; ETH.

A notable fluctuation in price is seen at play here. Since USDT is a stable kind, it, therefore, didn’t struggle with ETH for volatility but rather gave way for ETH to move freely in whatever form it would.

That isn’t the case with the chart of ETH/BTC as they are both volatile coins, and because of that, there was an evident struggle in the price movement, as analysts call it, liquidity.

What you don’t know about Tether?

Many financial analysts and crypto enthusiasts have unconsciously not been paying attention to Tether (USDT).

A surprising number of crypto traders can’t explain the USDT operating mechanism and use cases.

To this day, some folks still think of Tether as a dignified fiat and not a cryptocurrency.

I recently read one article that referred to USDT as a digital U.S. dollar. What an amusing theory.

So, what then is Tether?

What is Tether?

For a start, Tether is a Cryptocurrency pegged to the U.S. dollar as trust collateral to maintain stability and digitally represent USD value.

Tether claims every USDT Token is backed by real USD in secured vaults and banks.

Since Tether is a stablecoin, it should always have a value of around $1. Therefore, it does not really matter how far we go in the future – whether for a tether price prediction for 2025 or a tether price prediction for 2030, the score should, at least in theory, remain at $1.

A Case Against Tether’s Decentralization

Some experts argue Tether and some Stablecoins aren’t truly decentralized as they derive their value from tangible physical assets secured by centralized authorities.

Tether’s use cases

Tether (USDT) is a cryptocurrency, not a fiat. But compared to other coins, it is a stable currency.

What do I mean by a stable currency?

Cryptocurrencies are generally known for their volatility.

USDT as a stable coin is a refuge for crypto investors and traders. They can safely convert their bitcoins, altcoins such as ETH, ADA, and shitcoins during a period of high volatility in the market.

But USDT’s primary goal is to keep cryptocurrency valuations steady.

Tether designed USDT as a stable wealth storage alternative to the uncertainty in other cryptocurrencies’ investments.

As of Dec 2021, eight blockchains, EOS, Liquid Network, Tron Network, and Omni (among others), currently support Tether. And exchange platforms like Binance, Bitfinex, Coinbase, etc.

According to a statement released by the company on May 16, it had processed over $7 billion worth of USDT redemptions from May 11 to 16. On May 19, it released an assurance report, which showed that its total reserves had increased by 17%. Its total assets had also increased by over $82 billion, which supports its market cap.

According to a report released by accounting firm BDO on August 19, 2022, the total assets of the company had dropped to around $66.4 billion from $82.4 billion. In September, it announced that it had launched a project using the Near Protocol.

FAQs

How can I Buy Tether?

You can buy Tether from

– Any of its supported exchanges like Binance and Coinbase

– Directly from its parent company

– From a friend or any small USDT merchants

How does Tether work?

Tether tokens are built on various blockchains and are pegged at a 1:1 to real-life fiat currencies. That is, 1 USDT token is equivalent to 1 USD. Every Tether minted is backed by a USD reserve. And each Tether returned to the parent company for fiat remittances is destroyed before its fiat equivalent is released. Tether Tokens are also compatible with smart contract protocols of the ETH blockchain and other USDT compatible smart contract supportive blockchains.

Who can use Tether?

Tether allows people, crypto traders, and businesses a decentralized way of using fiat currency USD on blockchains without going through the hefty conversions fee and regulations associated with fiat conversions.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More