This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Bitcoin, the pioneering cryptocurrency, has significantly impacted the financial landscape since its creation by the enigmatic Satoshi Nakamoto.

Today, it’s not just about understanding Bitcoin investment process, but also about familiarizing yourself with the various platforms and methods available, such as buying Bitcoin on eToro, with a credit card, or even anonymously. This in-depth guide will help you navigate these processes.

Table of Contents

Choosing the Right Platform to Buy Bitcoin

The first step to buying Bitcoin is selecting a reliable cryptocurrency trading platform. These platforms, also known as exchanges or brokerages, offer different options for buying Bitcoin.

Factors to consider when choosing a platform include security measures, transaction fees, user interface, customer service, and the availability of other cryptocurrencies.

How To Buy Bitcoin on eToro?

There are various ways to buy Bitcoin, one of which is to purchase directly from another individual online. However, if you want the easiest and safest method, then we suggest opening an account with an online cryptocurrency broker that allows the purchase and sale of Bitcoin on its platform.

Out of the many cryptocurrency brokers out there, such as Coinbase, Crypto.com, etc. On eToro you are guaranteed that your funds are safe and well protected due to its state-of-the-art security system. A dedicated panel of experts is also available to assist you should you face challenges buying Bitcoin on this platform.

Purchasing Bitcoin requires a simple step-by-step process which we shall walk you through below.

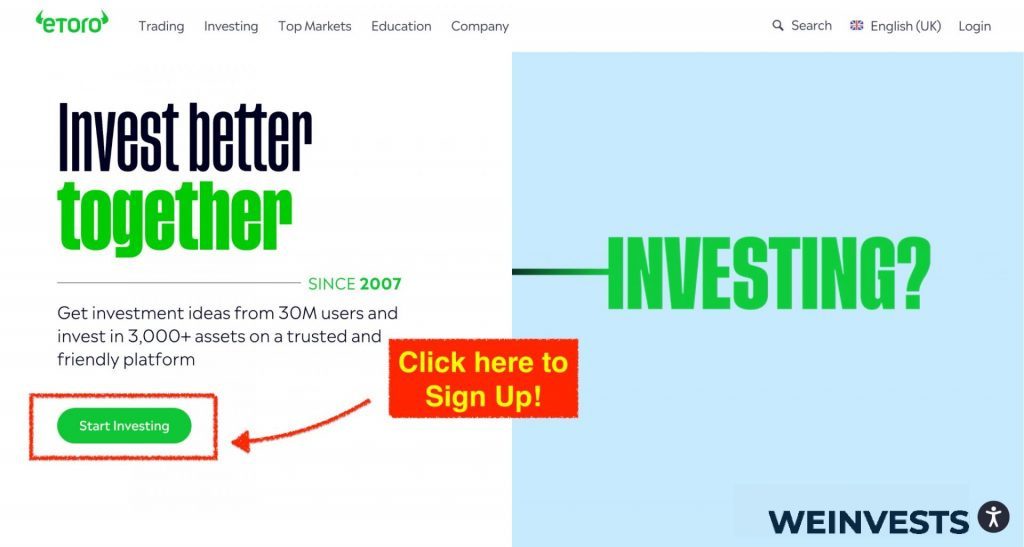

Step 1: Open an Account

Nothing can be easier than opening an eToro account online. The process is made simple enough for beginner traders to understand. Here is how to do it:

Go to etoro website, you will be required to enter all your personal details on the electronic form provided. This is just basic information required by all brokers when opening an account.

It will require you to fill in only the basic information, which only takes a couple of minutes.

You should check out eToro’s terms, conditions, and policies before proceeding to the next step. Additionally, rereading your information to make sure it doesn’t have any errors is also a good idea.

There is a section of terms and conditions for you to review and agree to.

Once complete click “Create Account”.

Check Your E-mail and verify your new account, Click on “Verify your account”.

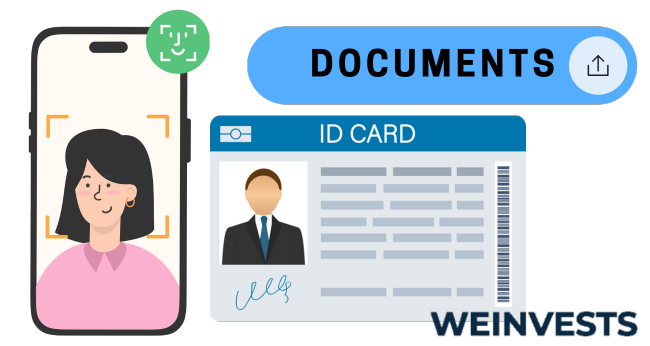

Step 2: Upload ID

The eToro platform is governed by the same rules and regulations to which other legitimate brokers must submit. One such regulation concerns the “Know Your Client” regulations which state that a broker needs to know the identity of all their registered users.

- Utility bill

- Driver’s license or a valid passport

- Bank account statement

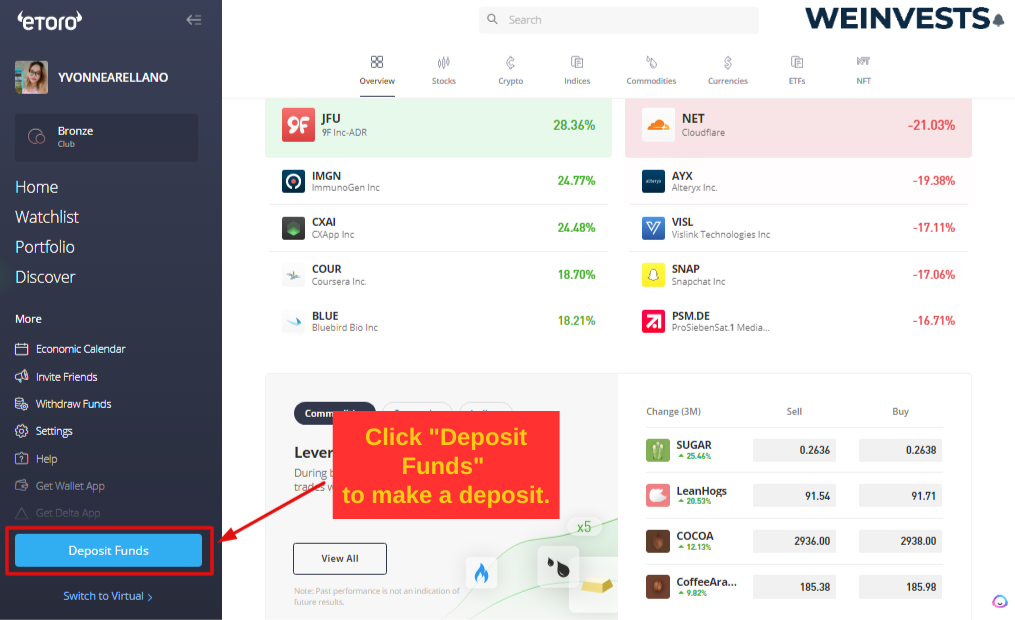

Step 3: Make a Deposit

Depositing funds into your eToro account can be done with no payment of fees required. There are many deposit methods to consider, but we recommend using eToro Money for the best deals. Just follow these steps to complete your deposit:

- Log onto your active eToro account

- Click on “deposit”

- State your amount and desired currency

- Choose the deposit method you want and confirm

- Money will be transferred to your wallet

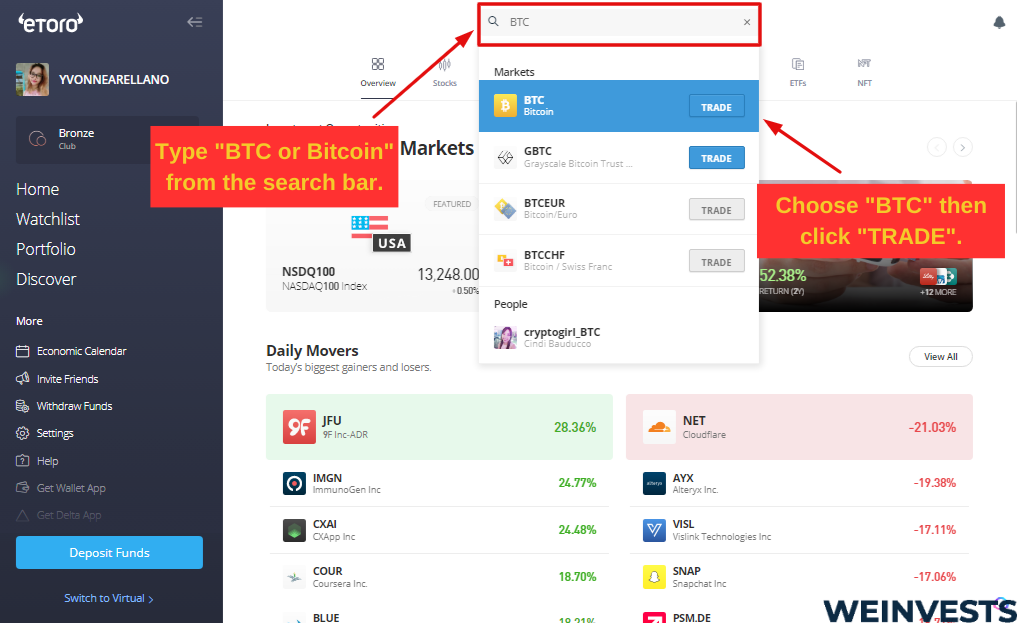

Step 4: Search for BTC

Once your eToro account has been financed, simply search for Bitcoin on the cryptocurrency markets page. Here you will find the day’s rates for buying and selling Bitcoin and other cryptocurrencies that are supported by eToro. The rates are constantly fluctuating so timing is everything to get the best value for money.

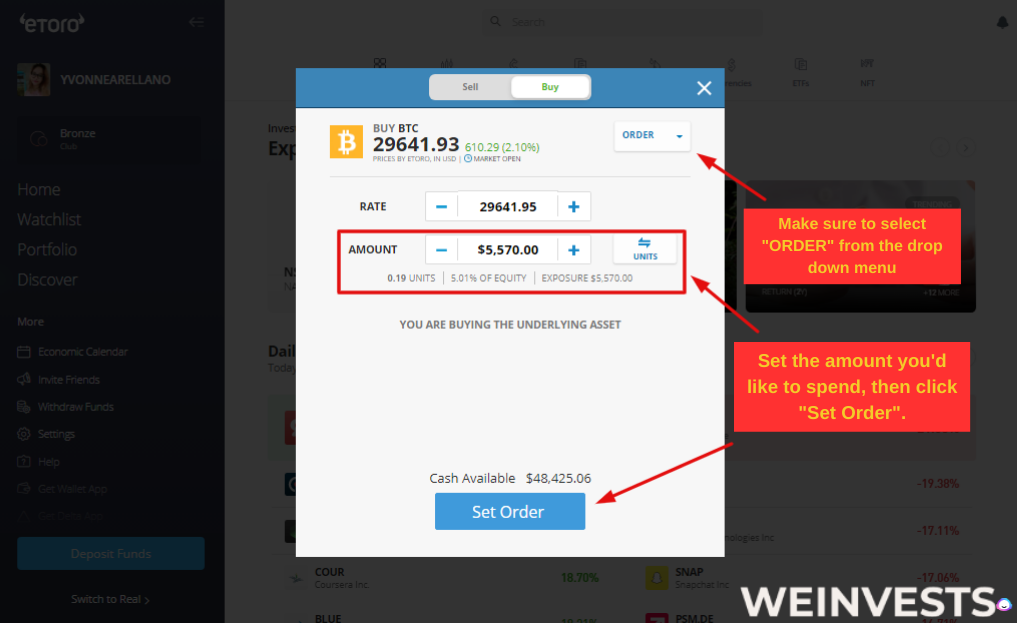

Step 5: Buy BTC

When you are ready to purchase Bitcoin, you can choose to buy the full coin or buy it fractionally. For example, you can purchase 0.2 Bitcoin for $200, if the full Bitcoin price is $1,000. How much you choose to buy depends on your funds and your future trading intentions.

Buying Bitcoin in the UK

The process of buying Bitcoin in the UK has become increasingly straightforward with the rise of cryptocurrency exchanges and platforms that cater specifically to UK residents. To start, you’ll need to create an account on a cryptocurrency exchange that operates in the UK. Some popular choices include eToro, Coinbase, and Binance.

In the UK, the Financial Conduct Authority (FCA) is the regulatory body that oversees cryptocurrency-related operations. While Bitcoin itself is not regulated, the FCA regulates firms that provide cryptocurrency services. This means that exchanges operating in the UK must comply with the FCA’s rules and regulations, providing a level of protection for consumers.

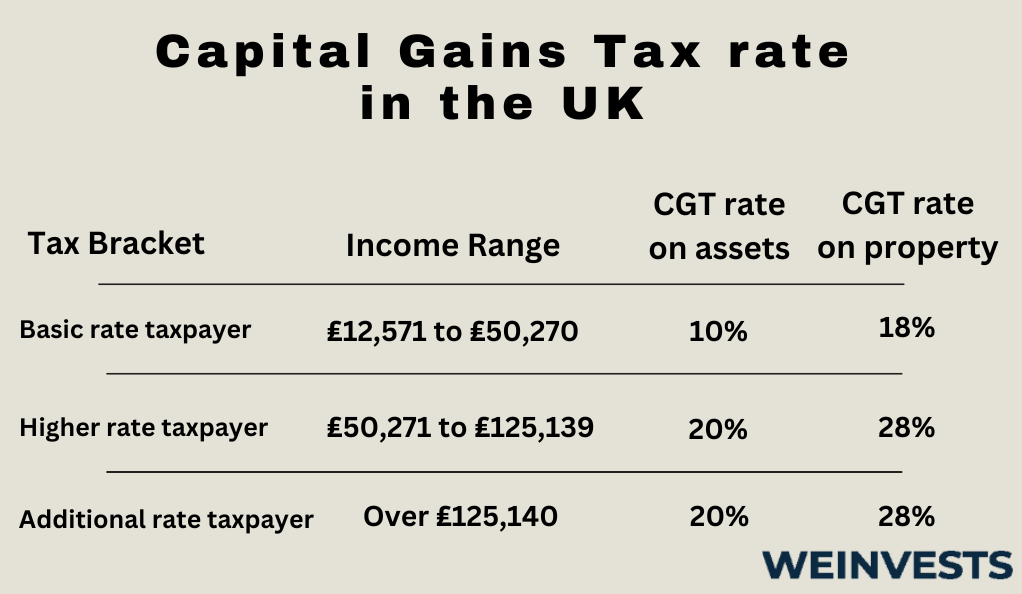

When it comes to taxation, the UK treats Bitcoin as a foreign currency. Profits from buying and selling Bitcoin are subject to capital gains tax, which is currently set at a maximum rate of 20% for most individuals. If you’re trading Bitcoin regularly, you may also be subject to income tax. However, tax regulations can be complex and vary depending on individual circumstances, so it’s advisable to consult with a tax professional.

In the UK, the government and the Financial Conduct Authority (FCA) have issued guidance on the tax implications and regulatory framework for cryptoassets like Bitcoin. You can find more information on the UK Government’s advice on cryptoassets and the FCA’s guidance on cryptoassets.

Buying Bitcoin in the USA

In the USA, buying Bitcoin is a relatively simple process thanks to a wide range of available platforms. Some of the most popular platforms include Coinbase, eToro, and Kraken.

To buy Bitcoin, you first need to create an account on your chosen platform. You’ll need to provide some personal information and go through a verification process to comply with KYC (Know Your Customer) regulations.

In the USA, the regulatory landscape for Bitcoin is more fragmented due to the involvement of both federal and state authorities. At the federal level, the Securities and Exchange Commission (SEC) oversees securities, while the Commodity Futures Trading Commission (CFTC) considers Bitcoin as a commodity.

Cryptocurrency exchanges in the USA must register with the Financial Crimes Enforcement Network (FinCEN) and comply with a range of regulatory requirements, including Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures.

For more detailed information on the legal aspects of using Bitcoin, you can refer to the FinCEN’s regulations on virtual currencies.

For tax purposes, the Internal Revenue Service (IRS) treats Bitcoin as property, meaning that profits from selling Bitcoin are subject to capital gains tax. The rate varies depending on your income and how long you’ve held the Bitcoin, with a maximum rate of 20% for long-term investments. If you’re paid in Bitcoin, this is treated as income and is subject to income tax. As with the UK, it’s recommended to consult with a tax professional to understand your obligations fully.

In the USA, the Internal Revenue Service (IRS) and the U.S. Securities and Exchange Commission (SEC) provide guidelines on the taxation and regulation of virtual currencies like Bitcoin. You can learn more from the IRS’s guidance on virtual currencies and the SEC’s information on digital asset securities.

Alternative Methods: How to Buy Bitcoin with Credit Card, Cash App, and More

There are numerous ways to buy Bitcoin, each with its own set of steps and requirements. Here are a few alternatives:

- Credit Card: Many platforms allow you to buy Bitcoin directly with a credit card. This method is convenient but often comes with higher fees.

- Cash App: This mobile app allows users to buy and sell Bitcoin directly from their phone. It’s a simple and convenient option, especially for beginners.

- PayPal: Some platforms accept PayPal as a payment method for Bitcoin purchases. However, not all countries support this feature. PayPal Cryptocurrency FAQs.

- Anonymously: If privacy is a concern, there are ways to buy Bitcoin anonymously, either through certain online platforms or Bitcoin ATMs. However, these methods may be subject to higher fees and lower purchase limits.

Storing Your Bitcoin Safely

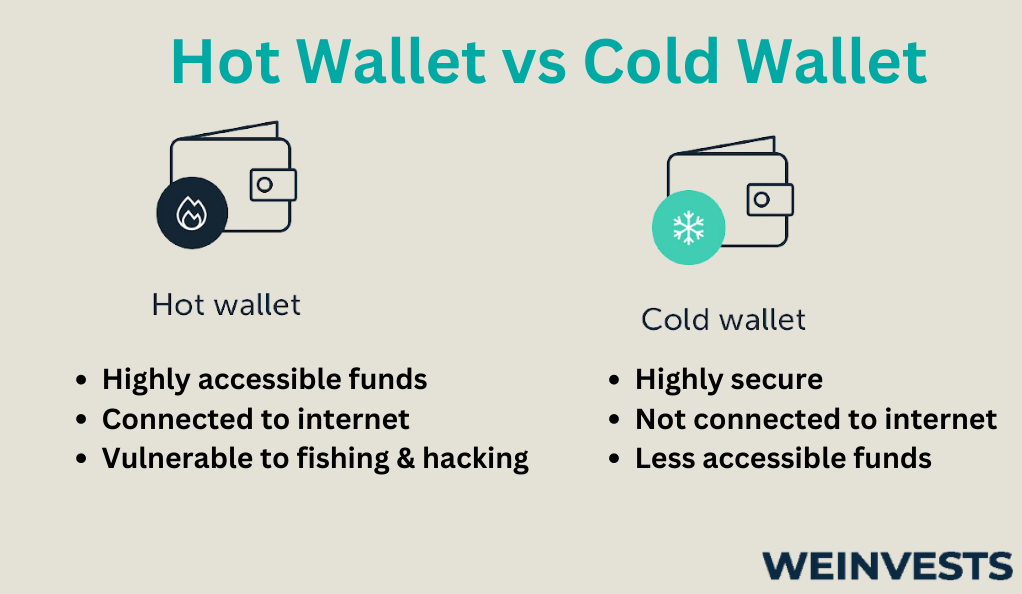

Once you’ve purchased Bitcoin, the next crucial step is to ensure its safe storage. The digital realm of cryptocurrencies brings with it the risk of online theft and fraud, making secure storage paramount. Bitcoin wallets, which come in various forms, are designed to safeguard your digital assets. Understanding the difference between ‘hot’ and ‘cold’ wallets, and knowing when to use each, is key to maintaining the security of your Bitcoin.

Hot Wallets: Online Storage for Quick Access

Hot wallets are digital wallets that are connected to the internet. They are called ‘hot’ because of their online connectivity, much like a live server. These wallets provide quick and easy access to your Bitcoin, making them suitable for everyday transactions and trading.

Hot wallets come in various forms, including online platforms, mobile apps, and desktop software. Each type offers a different balance of convenience and security. For instance, a mobile wallet on your smartphone allows you to make transactions anywhere, much like a physical wallet. Desktop wallets, on the other hand, offer more control and security features, but are limited to the specific computer on which they’re installed.

However, the online nature of hot wallets makes them vulnerable to potential security risks, including hacking, phishing attacks, and malware. Therefore, they are best used for storing small amounts of Bitcoin or for transactions that you want to execute quickly.

Cold Wallets: Offline Storage for Enhanced Security

Cold wallets, in contrast, are not connected to the internet. They store your Bitcoin offline, providing an additional layer of security against online threats. This makes them the safer option for storing larger amounts of Bitcoin or for long-term investment.

Cold wallets can be hardware devices or paper wallets. Hardware wallets are physical devices, much like a USB stick, that securely store your private keys offline. They are immune to computer viruses and are considered one of the safest options for storing Bitcoin.

Paper wallets, on the other hand, involve printing out your private and public keys on a piece of paper. These keys are generated offline, and the paper wallet can be stored in a safe location. While this method is secure from online threats, it does carry the risk of physical loss or damage.

Balancing Convenience and Security

In conclusion, the choice between hot and cold wallets depends on your specific needs and the amount of Bitcoin you intend to store. If you’re an active trader making frequent transactions, a hot wallet offers the convenience you need. However, if you’re a long-term investor storing large amounts of Bitcoin, a cold wallet provides the enhanced security necessary to protect your investment.

Remember, no matter which type of wallet you choose, it’s essential to implement additional security measures. These can include using strong, unique passwords; enabling two-factor authentication; and regularly updating your wallet software.

Conclusion

The rise of Bitcoin and other cryptocurrencies presents exciting investment opportunities. Whether you’re learning how to acquiring Bitcoin in the USA, Canada, Australia, or anywhere else, this guide serves as a comprehensive starting point. Remember, the safety of your funds is paramount, so consider investing in a secure wallet to protect your assets.

What’s the future of Bitcoin (BTC)? Read our article to find out:

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More