Pros

- Wide range of investment offerings

- They accept clients from the US

- Regulated by top regulatory bodies in the industry

- Dedicated resources to education and research

- Offers adequate protection for client accounts in specific regions

Cons

- No account protection and guaranteed stop losses for clients in America

- No back-testing integration or copy trading on IG platform

- High share-CFD fees

| 💻 Trading Platforms | IG Trading Platform, MetaTrader 4, ProRealTime, and L2 Dealer platforms with access to various markets and instruments |

| 📞 Customer Service | 24/5 support via phone, email, or online chat; help center with FAQs |

| 🎁 Promotions/Bonuses | No promotions or bonuses currently available |

| 🛡 Regulation | Regulated by FCA in the UK; also regulated by ASIC in Australia, BaFin in Germany, FINMA in Switzerland, MAS in Singapore, FSCA in South Africa, DFSA in Dubai, and JFSA in Japan |

| 💵 Deposit/Withdrawal Methods | Various payment methods; minimum deposit $250; no withdrawal fee |

| 📊 Spreads/Commissions | Variable spreads depending on the instrument and market conditions; commissions from 0% (forex) to 0.1% (shares) |

| 🔒 Security | Segregated funds; SSL encryption; firewalls; anti-virus software |

| 📚 Education/Resources | Webinars, videos, articles, etc.; economic calendar, market news, market analysis, etc. |

| 📱 Mobile Trading | iOS and Android app with all IG Trading Platform features and functions |

| ⚡ Execution Speed | Fast and reliable execution with low latency and minimal slippage; various order types |

| 🔧 Trading Tools/Indicators | Moving averages, Bollinger bands, Fibonacci retracement, etc.; custom indicators and alerts |

| 🌍 Country/Region Availability | Over 200 countries and regions |

| 💰 Account Minimum | $250 for live account; free demo account with $10,000 virtual funds |

| ⚖ Leverage/Margin Requirements | Up to 30:1 leverage on forex and CFDs |

| 📈 Asset Selection/Market Access | Over 17,000 instruments across forex, indices, shares, commodities, cryptocurrencies, options, ETFs, etc. |

Stocks are among the best long-term investments people use to build wealth. Thanks to advancements in technology like smartphones and faster internet, buying stocks online has never been easier.

To show how resilient and profitable the stock market is, the S&P 500 index shows that the market’s long-term average return is 10 percent. However, in the last 10 years decade, the S&P 500’s annualized performance was 14.5 percent. This makes the stock market a more attractive option for seasoned and prospective investors alike.

For those looking to explore this investment option, we’ve compiled an in-depth review of IG Group – an online broker that makes investing in stocks as seamless as possible.

Table of Contents

- Pros

- Cons

- About IG Group

- Types of accounts offered

- Range of Investment Opportunities

- Base currencies

- Payment method

- Fees & commission

- Leverage

- Platforms & tools

- Account opening

- Deposit and withdrawal experience:

- Customer service & support

- Education & learning resources

- Research & analysis

- Regulatory compliance & security

- Conclusion

About IG Group

IG Group (also known as IG) is a subsidiary of IG Group Holdings PLC, a publicly traded conglomerate that was founded by Stuart Wheeler in 1974. According to him, he wanted the company to be “the world’s first spread betting firm that empowers informed, decisive, adventurous people to access opportunities in financial markets.”

And from the look of things, the company has lived up to the billing with its amazing service offerings.

Types of accounts offered

IG offers five different types of accounts: the IG International Account, IG International Demo, IG Domestic Account, IG Corporate Account, and IG Domestic Demo Account.

Most traders often choose an IG Trading account if it’s their first time signing up with IG. For most clients, they can access the regular features the broker provides with this account type.

Only traders that need specialised features consider going for an alternate account.

Here are some reasons:

- They need guaranteed stop-loss for all their trades

- Stock trading

- Swap-free trading

- Higher leverage

- Options trading

Range of Investment Opportunities

IG offers a wide range of opportunities like;

Investors can trade thousands of ETFs and global shares. In addition, they can trade commission-free on US shares, while UK shares will cost them a £3 commission. Also, they have to pay a meagre 0.5 percent for FX conversion.

IG builds, manages, and monitors a diversified portfolio personalized to the user’s risk profile and goals.

IG’s ISA wrapper is extremely tax-efficient, which allows clients to maximise their returns. Clients who invest about £20,000 don’t have to pay income or capital gains tax on their returns.

Base currencies

IG has several base currencies available to its clients to ease their payment needs. They are; US Dollar ($), GB Pound (£), Australian Dollar (AU$), EURO (€), Singaporean Dollar SGD (S$), and Hong Kong Dollar (HK$).

To avoid being charged conversion fees, users are urged to deposit funds into their brokerage account in the base currency of the account. Otherwise, the user will be charged conversion fee(s).

Payment method

IG has several payment and withdrawal methods. Users can deposit or withdraw funds with a debit or credit card, bank transfer, or HK FPS. Let’s explore the options they have;

This is the fastest way a user can fund their account via a debit or credit, as successful payments are immediately deposited.

Users can also use the FPS method to fund their accounts at no cost. However, it takes 1 business day to clear. Keep in mind that this option is available only to Hong Kong bank accounts.

Bank transfers often take about 3 days to clear as it all depends on the bank in question. They can upload proof of payment on the app if they want to trade straight away.

Apart from the above listed conventional payment methods, users can fund and withdraw on their IG account with Wise.

Fees & commission

Internationally, IG’s fees are quite competitive when compared to other players in the industry.

When a client trades CFDs, they pay a commission charge, and it’s included on both sides of the market spread. Also, there’s a commission for each share-CFD trade. Additionally, IG users in the UK pay for guaranteed stop-loss orders when the order is activated. There are other third-party charges that are expressly stated website.

On IG’s US platforms, the minimum spread for the majors starts at 0.8 pips, while the advertised average spread is between 0.9 (USD/JPY, EUR/USD) to 5.4 (GBP/CAD). Clients also have to pay swap fees on positions held through the night (tom-next rates are used).

Also, there’s an inactivity fee of $12 per month if the client doesn’t trade in 24 months. There’s also a $15 charge for wire withdrawals, and the platform offers a detailed breakdown of forex trading costs. The global minimum account deposit is 250 units i.e. $250, and traders that meet specific volumes are eligible for rebates.

Leverage

In actual fact, a significant number of leveraged trading use derivative products. This means the user trades an instrument that derives its value from an underlying asset’s price instead of than owning the asset in question.

In addition, IG has several leveraged products available like options, some ETFs, and futures. Remember that each product works differently as they all have the prospects of increasing profit and loss.

Even though leveraged trading is as risky as it gets, IG comes equipped with risk-management tools to help reduce potential losses. An example is stop – losses which is a popular method of reducing leverage risks. When investors attach a stop-loss to their position, they can restrict losses when prices move against them.

There are various other tools available for users to help manage risks including limit take-profit orders and price alerts.

Platforms & tools

IG offers native mobile apps for both Android and iOS. The best part is that the app also works seamlessly on tablets too. Although the layout may take some getting used to, it’s quite user-friendly, with great user experience on mobile devices. Some basic features it comes with include price alerts, customized watch lists, and technical charting.

Also, IG offers API interfaces and can be used on other platforms, like the web-based version, which is easy to navigate and customizable. The trading platform is streamlined, stable, and easily accessed from any browser.

The web-based version of IG comes with risk management tools like price alerts and stop losses. Although the mobile apps may not have all the bells and whistles of the web-based version, they offer Touch ID and facial recognition for security.

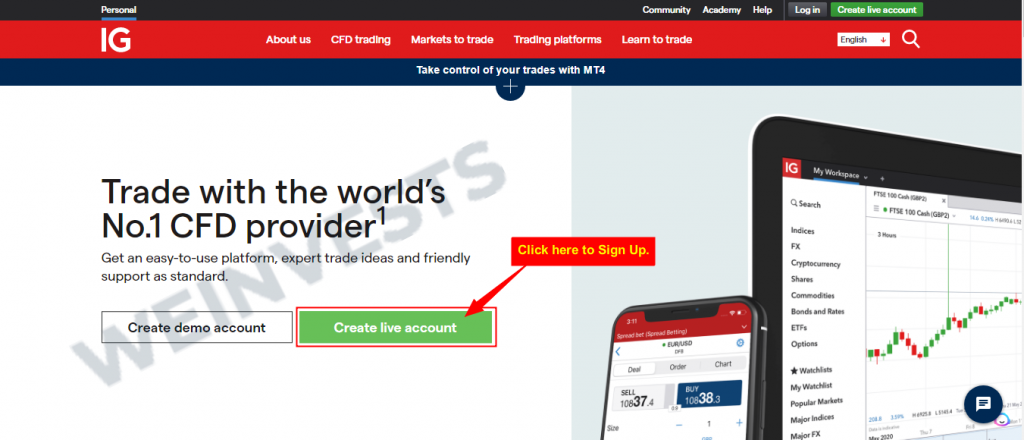

Account opening

As luck would have it, almost everyone can open an IG account. There are a few exceptions and these are the citizens of unstable political or economic or backgrounds. To be on the safe side, users should ensure they are allowed to open an IG account in their jurisdiction.

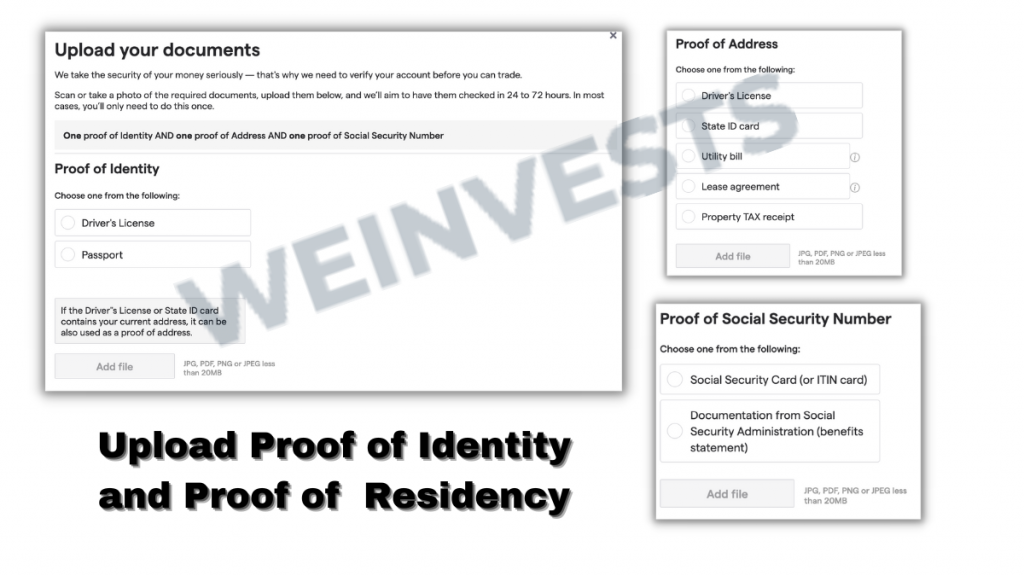

Opening an IG account is relatively easy, but users must provide documents like proof of residency and identity. IG accepts the following documents;

- Proof of identity: International passport, government-issued ID, or driver’s license

- Proof of residency: Utility bill or bank statement

IG doesn’t require a minimum deposit, making it the ideal broker for people who want to trade or invest with small funds. Note that bank transfers on the platform have no minimum amount, but transactions with PayPal or credit/debit must be a minimum of $300.

Deposit and withdrawal experience:

There are a plethora of deposit and withdrawal options on IG users can explore. The process is easy and seamless. All the user has to do is log in to their IG account, navigate to ‘add funds’ and choose one of the following deposit options; credit or debit card, Hong Kong FPS, Wise, or bank transfer.

For card payments, the minimum deposit amount is $300, while there is no minimum limit for bank transfers. On the other hand, the max deposit is $99,999 for each debit card transaction and $50,000 per credit card transaction.

On the other hand, withdrawals are a little more complicated than depositing funds. Users can withdraw funds via bank transfer after meeting all AML regulations. Also, they can withdraw as a refund to a card account.

Withdrawal times vary as card withdrawals take between 2 – 5 working days, while bank transfers take between 1 – 3 working days.

Customer service & support

IG offers extensive customer service options which are available to all customers. Both potential and active clients can reach them on their toll-free line. They can also talk to a customer rep via live chat on their web and mobile apps.

Other options like social media, email and a detailed FAQ are also at the customer’s disposal. If these don’t suffice, a customer complaint procedure for grievance resolution is available.

Online customer support is also available in various languages, which appeals to a more extensive client base. IG also has satellite offices that support licensed operations in multiple regions.

Education & learning resources

When it comes to learning and educational resources, IG stands ahead of the pack. The reputed online broker has an extensive trader’s library, run by an equally impressive IG Academy. With this, beginners can get started quickly, while expert traders will discover advanced trading strategies in their knowledge base.

They also have several online webinars, and the IG Academy course was created for investors of different pedigrees. In addition, clients can use the search function and the platform’s glossary to get more info.

Research & analysis

IG is committed to offering its clients informative and timely research with the tools they’ve deployed for research and analysis. In addition, they have text, audio, and video resources for their teeming user base.

A lot of people may not know that IG runs DailyFX – a news portal that covers indices, commodities, and forex in the financial market. They offer detailed news, in-depth research, an educational portal, and a community of seasoned analysts.

They discuss various topics from fundamental analysis to intermediate technical and everything in between. They also offer real-time news while covering major currency pairs in-house. They also run several live webinars to help build trading skills. They highlight key events that could impact the industry and identify news drivers.

IG is also equipped with a trading strategies section that shows lots of technical data like short-term buy and sell signals, pivot points, and analyst picks.

Regulatory compliance & security

IG is regulated in all jurisdictions where they offer spread betting, CFD, stockbroking products, and foreign exchange. Every company on IG is overseen by the appropriate regulatory bodies, as each jurisdiction has specific requirements.

In addition, the group also works within legislative and regulatory frameworks that pertain to their technology use, internet usage and provision of internet services.

For example, IG LLC in the US is registered with the CFTC and is an NFA member. In addition, both IG Index Ltd and IG Markets are regulated and authorized by the United Kingdom FCA.

IG goes the extra mile to ensure that clients’ funds don’t mix with corporate funds in line with the FCA rules. This way, the client’s assets are protected should the company become insolvent. Also, clients have extra asset protection of up to £85,000 through FSCS (the Financial Services Compensation Scheme).

Conclusion

The platform has competitive spreads, various trading instruments, and up-to-date news, research, and educational sections. They also have the required credibility thanks to their NFA, CFTC, and FCA regulations. In general, the platform has proven to be reputable and competent, with a large user base spread across several countries worldwide.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More