This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Based on my research, I found that staking Dogecoin is not possible in a traditional way, as Dogecoin uses the proof-of-work (PoW) consensus mechanism, which does not support staking.

However, there are some alternative ways to earn passive income from your Dogecoin holdings, such as:

- Soft staking: This means staking your Dogecoin on a centralized exchange, such as Binance or Kucoin, without having them locked. The exchange will stake your Dogecoin on your behalf and pay you the rewards automatically. However, this comes with the risk of losing your funds if the exchange gets hacked or shuts down.

- Bridging: This means converting your Dogecoin to a wrapped token that represents it on another blockchain, such as Ethereum or Binance Smart Chain. You can then use these wrapped tokens to participate in DeFi protocols that offer staking or yield farming opportunities. However, this comes with the risk of losing your funds if the bridge or the protocol gets hacked or exploited.

- Lending: This means lending your Dogecoin to a platform that offers interest rates for borrowing and lending crypto assets, such as YouHodler or Celsius. You can earn interest on your Dogecoin deposits and withdraw them anytime. However, this comes with the risk of losing your funds if the platform gets hacked or defaults.

Staking is a process of locking up your crypto assets in a wallet or a platform to participate in the network security and governance of a proof-of-stake (PoS) blockchain. By doing so, you can earn rewards in the form of more crypto assets.

If you want to learn how you can still stake Dogecoin, continue reading.

Pros & Cons of Staking Dogecoin

- Generate more Dogecoins with your Dogecoin holdings

- Staking rewards paid out daily

- Help empower the Dogecoin blockchain and general ecosystem

- Easy to get started

- Your Dogecoins are locked up for a certain period of time

- Other cryptocurrencies may provide higher APYs

- The staking pool operator might have malicious intentions or take a large cut of your earnings

- Dogecoin staking pool operators may charge membership fees or impose unstaking fees

Table of Contents

Soft Staking Dogecoin

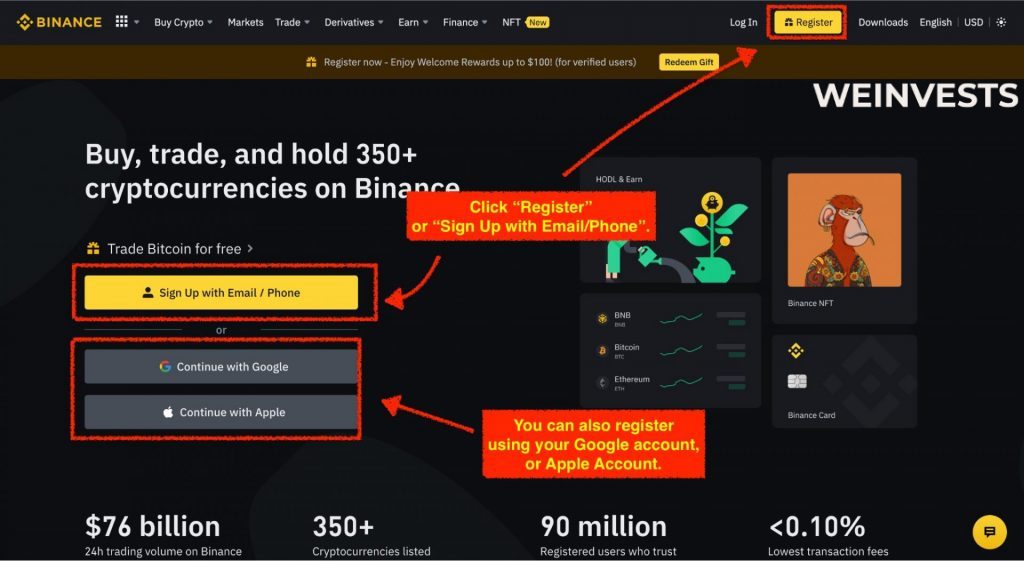

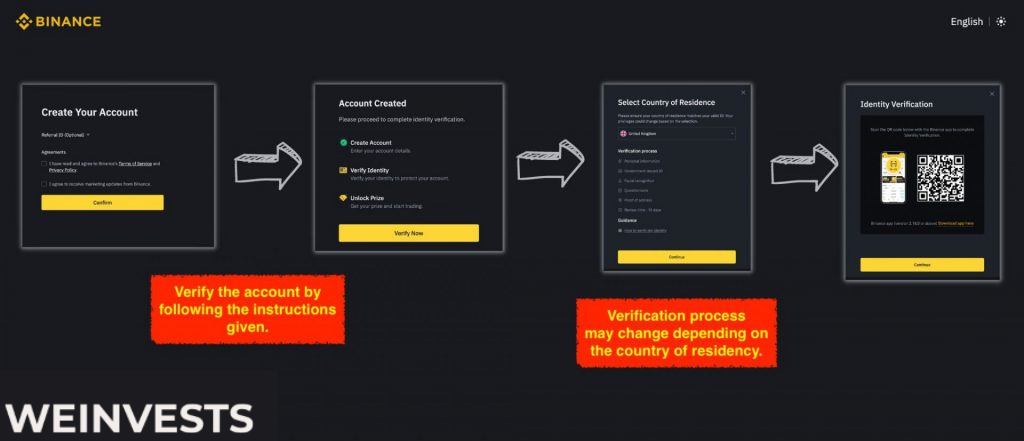

Step 1: Sign Up and Verify your Account

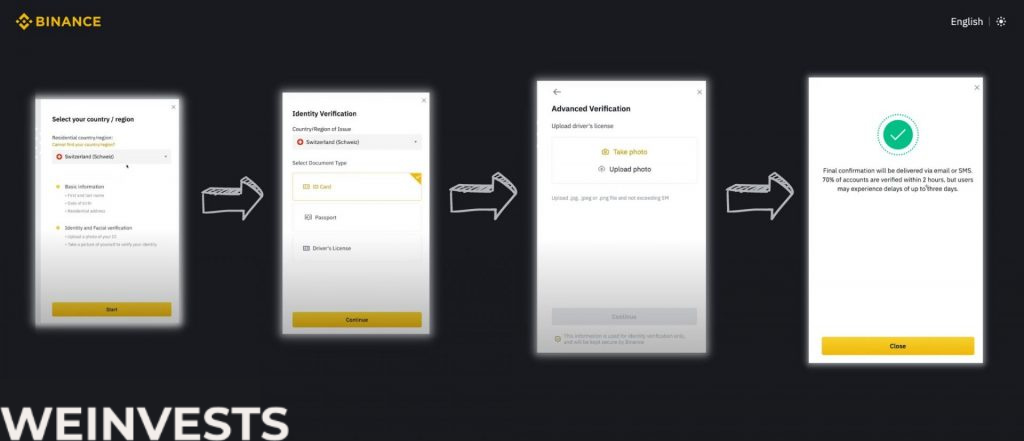

Create an account on Binance and complete the identity verification process. You can use this link to sign up: https://www.binance.com/en/register

Then go through the verification steps to provide Binance with proof of identity.

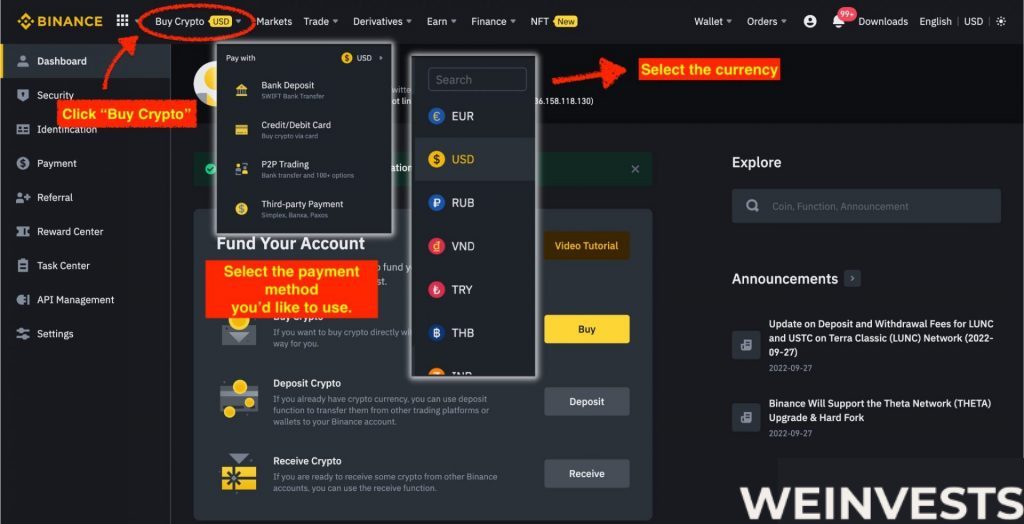

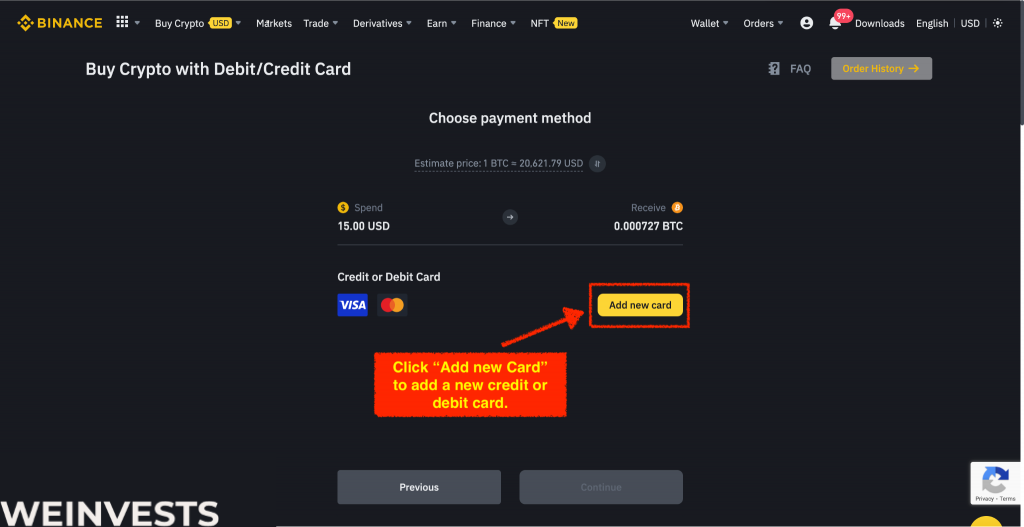

Step 2: Fund your Account

Deposit or buy some Dogecoin on Binance. You can use various methods, such as bank transfer, credit card, or other cryptocurrencies. You can also use this link to buy Dogecoin: https://www.binance.com/en/buy-sell-crypto

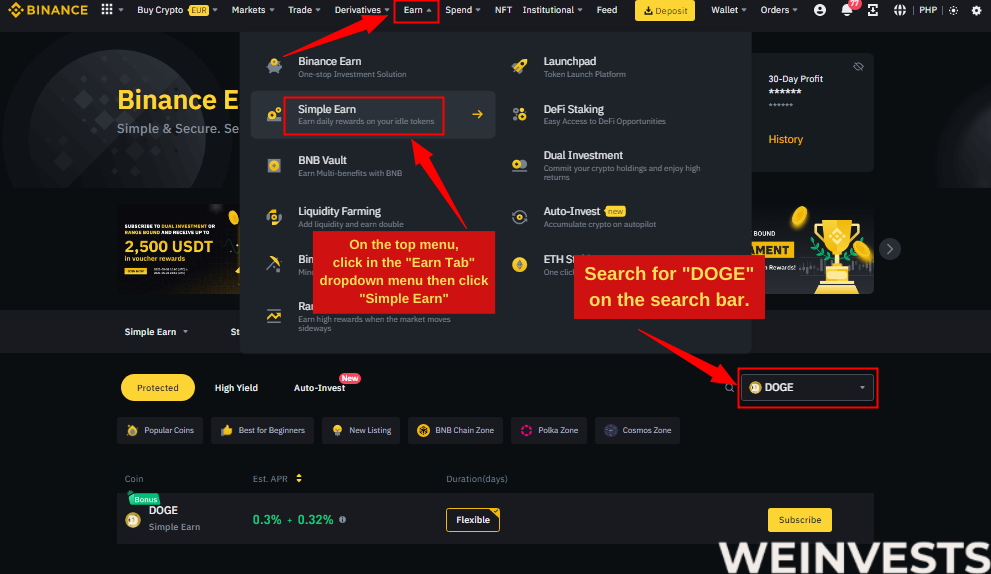

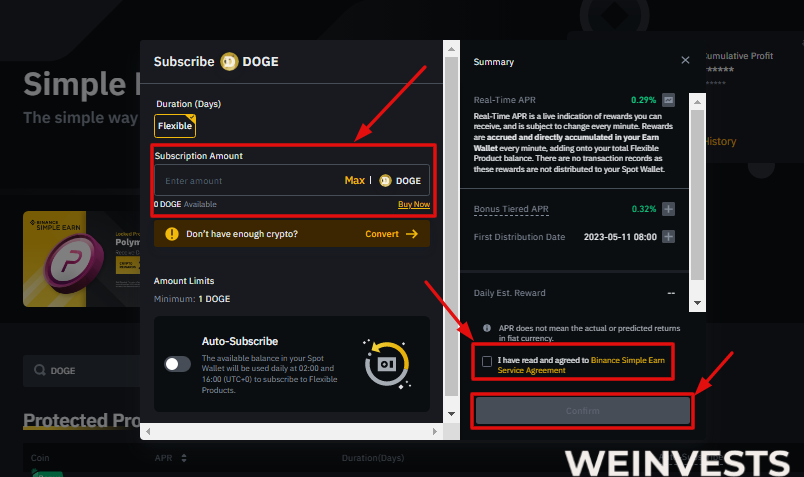

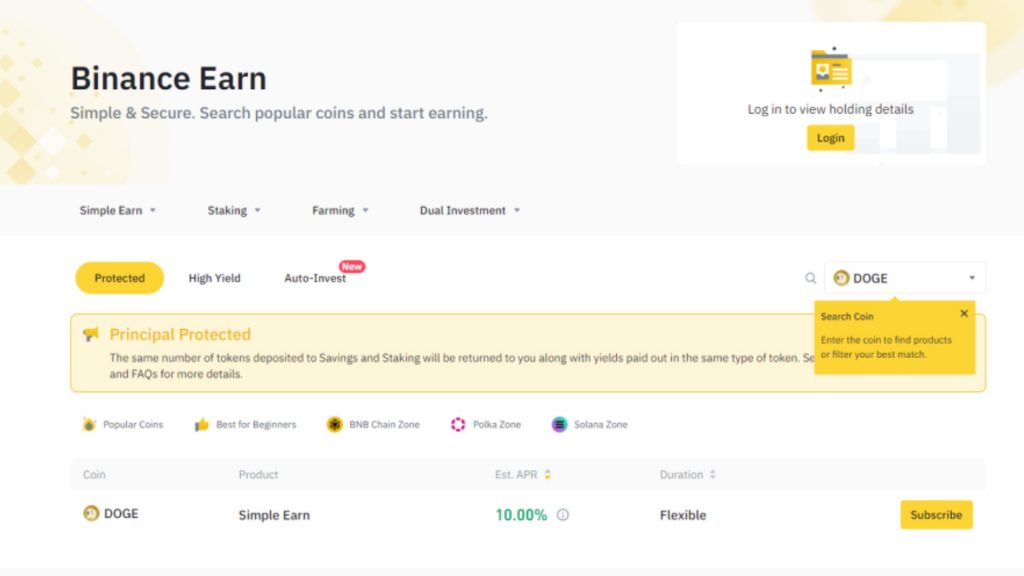

Go to the Binance Earn page and find the Dogecoin product under the Flexible Savings category. You can use this link to go there: https://www.binance.com/en/earn/doge

Go to the drop-down menu labeled ‘Earn.’ Here, you will have multiple options. Click on ‘Binance Earn’ and then search for ‘DOGE’.

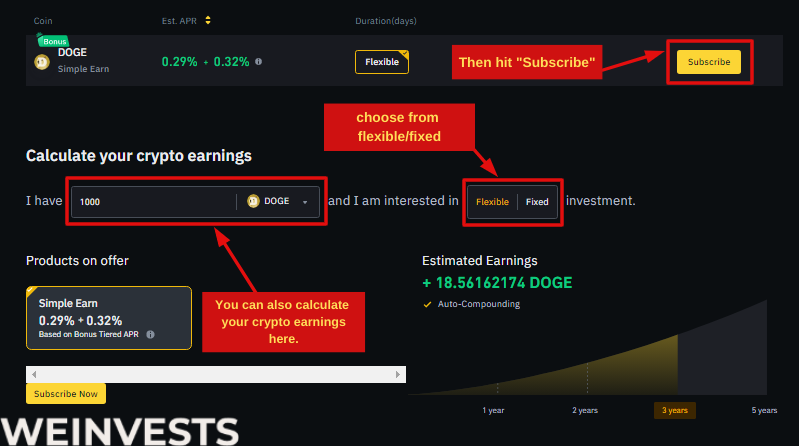

Step 4: Analyze the Staking Parameters and Stake

Click on the Transfer button and enter the amount of Dogecoin you want to stake. You can also choose to auto-transfer your Dogecoin balance to the product every day. Click on Confirm Transfer to complete the process.

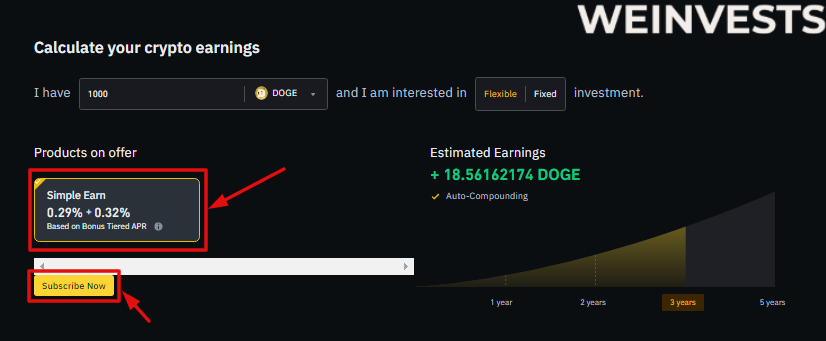

If you want to earn rewards with your DOGE on Binance.com, you can go to the “Products on Offer” section under “Earn” and choose between two options: “Simple Earn” and “Flexible DeFi Staking”.

“Simple Earn” lets you deposit your DOGE in flexible or locked products and earn daily rewards. You can subscribe or redeem at any time, so you can maintain your assets’ flexibility and liquidity. The rewards are sourced from Binance’s own funds and are based on the market conditions.

Congratulations! You have successfully started soft staking Dogecoin on Binance. You can check your earnings on the Binance Earn page or on your wallet page. You can also redeem your Dogecoin anytime without any penalty.

Advantages:

- Simplicity: Easy to set up and manage, with automatic rewards distribution.

- Liquidity: No lock-up period, allowing you to withdraw or trade your Dogecoin at any time.

Disadvantages:

- Centralization: You’re trusting a centralized exchange with your funds, exposing them to potential hacks or exchange shutdowns.

- Lower control: You have limited control over the staking process and the specific pool or validator.

Bridging staking dogecoin

Binance Bridge has been upgraded to version 2.0 and supports a different set of tokens. Dogecoin is not among them, so you cannot use Binance Bridge to swap your Dogecoin for Binance-Pegged Dogecoin (BDOGE) anymore.

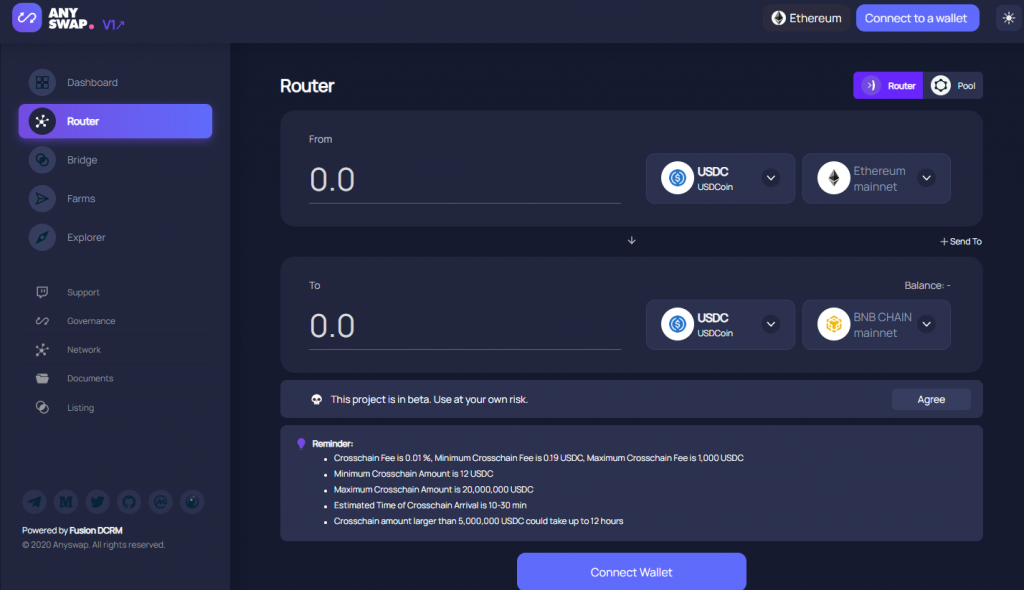

However, you can still use other services or platforms that allow you to bridge your Dogecoin to Binance Smart Chain, such as AnySwap or BurgerSwap. Here are some possible steps to do that:

Step 1: Create an account on Binance and complete the identity verification process. You can use this link to sign up: https://www.binance.com/en/register

Step 2: Deposit or buy some Dogecoin on Binance. You can use various methods, such as bank transfer, credit card, or other cryptocurrencies. You can also use this link to buy Dogecoin: https://www.binance.com/en/buy-sell-crypto

Step 3: Go to the AnySwap or BurgerSwap website and connect your Binance Smart Chain wallet, such as MetaMask or Trust Wallet. You can use these links to go there: https://anyswap.exchange/bridge or https://burgerswap.org/bridge

Step 4: Select Dogecoin as the source token and BDOGE as the destination token. Enter the amount of Dogecoin you want to bridge and click on Swap. You will need to approve the transaction and pay a small fee.

Step 5: You have successfully bridged your Dogecoin to Binance Smart Chain. You can now use your BDOGE tokens to participate in various DeFi protocols that offer staking or yield farming opportunities, such as PancakeSwap, BakerySwap, Venus, etc.

Advantages:

- Diversification: Access to various DeFi protocols and staking opportunities on different blockchains.

- Potential for higher returns: Yield farming or liquidity providing can offer higher returns compared to simple staking.

Disadvantages:

- Complexity: Requires understanding of bridging, wrapped tokens, and DeFi protocols.

- Smart contract risk: Vulnerability to hacks or exploits in the bridge or DeFi protocol.

- Gas fees: Can be expensive, particularly on networks like Ethereum.

Lending Dogecoin

Here are three options for lending Dogecoin.

However, these are not recommendations or endorsements, and you should always do your own research and understand the risks before lending your crypto assets.

Here are three options for lending Dogecoin:

- CoinRabbit: This is a platform that allows you to borrow stablecoins like USDT or USDC using Dogecoin as collateral. You can get an instant loan with no KYC or credit check, and enjoy an unlimited loan term and a fixed interest rate of 16% APR. CoinRabbit claims to have top-tier security and cold wallet storage for your funds.

- Nexo: This is a platform that allows you to earn interest on your Dogecoin deposits and withdraw them anytime. You can also borrow cash or stablecoins using Dogecoin as collateral. You can earn up to 3% APR on your Dogecoin deposits and borrow at rates as low as 6.9% APR. Nexo is licensed and regulated in the EU and has over 2 million users.

- YouHodler: This is a platform that allows you to earn interest on your Dogecoin deposits and withdraw them anytime. You can also borrow cash or stablecoins using Dogecoin as collateral. You can earn up to 3% APR on your Dogecoin deposits and borrow at rates as low as 12% APR. YouHodler is based in Switzerland and Cyprus and has over 1 million users.

Advantages:

- Passive income: Earn interest on your Dogecoin deposits with minimal effort.

- Flexibility: Withdraw your Dogecoin at any time, depending on the platform’s terms.

Disadvantages:

- Counterparty risk: Trusting a third-party platform with your funds, which could be vulnerable to hacks, defaults, or insolvency.

- Lower returns: Lending platforms often offer lower interest rates compared to staking or DeFi protocols.

- Lack of native staking: Lending platforms don’t engage in native staking, which means you’re not directly supporting the security or decentralization of the Dogecoin network.

These are three options for lending Dogecoin, but they are not exhaustive. You should always do your own research and understand the terms and conditions of each platform before lending your crypto assets. You should also diversify your portfolio and not invest more than you can afford to lose.

Lending might be considered the least recommended option for staking Dogecoin due to the combination of counterparty risk, lower returns, and the lack of direct support for the Dogecoin network. While it offers a passive income and flexibility, the other methods, despite their risks and complexities, may provide better returns and a more direct contribution to the underlying blockchain.

What is Dogecoin Staking?

Dogecoin staking basically boils down to putting your Dogecoin holdings to work by locking your Dogecoin up for a certain amount of time and receiving interest in return. Usually, this involves delegating your Dogecoin to a validator node by depositing your tokens into a staking pool. You can compare a Dogecoin staking pool with a high-yield savings account.

The staking pool will use the staked Dogecoins to validate new transactions on the Dogecoin blockchain and thereby making it more secure and reliable. It is possible to stake Dogecoin because Dogecoin is a proof-of-stake token instead of a proof-of-work crypto like Bitcoin.

Dogecoin staking pools often pay out the staking rewards in Dogecoin but can pay out in different cryptocurrencies like USDT, USDC, and other stablecoins as well. In most cases, you will receive your Dogecoin staking rewards daily, weekly, or monthly whilst the principal (your initially delegated Dogecoin) stays within the staking pool.

You can unstake your Dogecoin at any given moment if you’ve joined a flexible Dogecoin staking pool whilst you have to wait for a certain amount of time if you’ve chosen to take part in fixed Dogecoin staking.

Dogecoin Staking Tax

All Dogecoin staking rewards you receive are subject to tax. The value of the received tokens as result of staking is calculated in British Pounds (GBP) and will be taxable as either miscellaneous income or capital gains in the UK.

If you’re trading on your own behalf and not as a company, you can treat it as savings income and claim personal savings allowance to reduce your effective tax rate. It is also possible to apply capital gains tax on your Dogecoin staking rewards instead.

All individuals have an annual tax-free allowance of 12,300 GBP. Any profits above this allowance are subject to 10% tax up to the basic rate tax band and 20% tax on gains made above this basic rate.

How to Pay Tax on my Dogecoin Staking Rewards?

You pay tax on your Dogecoin staking rewards by filling these in in your annual self-assessment tax return. You will need to specify the type of token that you have earned, the date(s) you have received them, the number of tokens you currently own, the value of your total token holdings in GBP, any associated wallet addresses, and records of the costs the staking pool charged you to stake Dogecoin.

Luckily, both eToro and Binance allow you to download a .csv file with detailed information about your Dogecoin staking regards. However, you will still need to fill in the other details required not provided in these .csv files.

Why do People Like Staking Dogecoin?

It is no mystery that many people like Dogecoin in general as it is arguably the meme coin with the largest following globally. By staking a cryptocurrency, users increase the security of its blockchain by verifying new transactions. People like staking Dogecoin not only for the staking rewards this provides them, but also because they want the Dogecoin ecosystem to be as safe and secure as possible.

Dogecoin Staking FAQ’s

What are the current Dogecoin staking rewards?

The current Dogecoin staking rewards vary between 4% and 10% APY, depending on the trading platform and Dogecoin staking pool chosen.

How does Dogecoin staking make me earn more doge?

Dogecoin staking earns you more doge because you will receive staking rewards in the form of additional Dogecoin tokens on top of the principal (the amount of Dogecoin you initially delegated to validator nodes or staking pools).

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More