This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Since it became one of the largest crypto exchanges, Binance has gained widespread popularity. Its native token, Binance Coin, has been able to secure a place in the top five in terms of market capitalization. Moreover, the exchange has one of the lowest trading fees in the industry.

Binance completed its 17th quarterly BNB burn on October 18th, 2021, where they burnt 1,335,888 BNB tokens worth approximately $639,462,868—bringing the current total BNB to 166,801,148 BNB.

Binance has burnt 30,390,791 (15%) BNB in 17 quarterly burn sessions. (2017-2021).

The Binance team commits to keeping the BNB deflationary by repurchasing and burning specific BNB percentages quarterly until about 50% (100,000,000) of the entire circulating BNB is burnt.

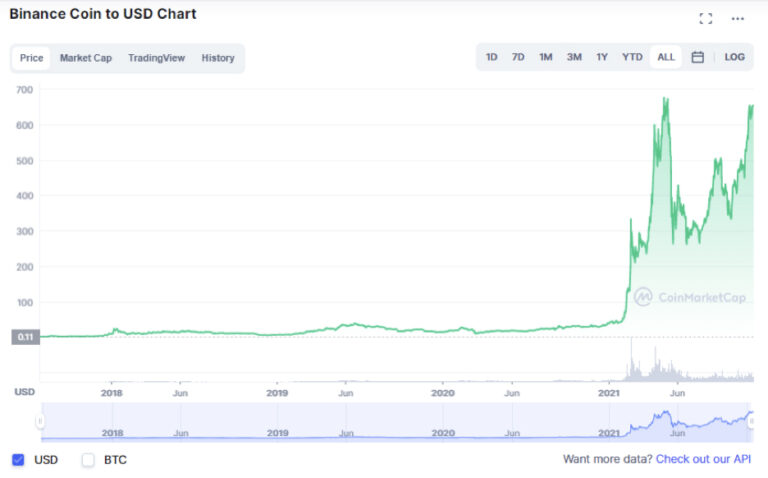

Binance Coin, from its past performance, has gone through incredible appreciation, over 400,000% appreciation in just four years.

As easy as it is to presume to achieve this was a walk in the park for Binance, you might be shocked to learn otherwise in this article.

BNB’s future price prediction, as with most DigitalCoin price predictions, is not set in stone, but the technical analysis in this article should be as close to the actual price as you can hope to be forecasted.

Table of Contents

- BNB Current Overview

- BNB Prediction for 2023

- BNB Prediction for 2024

- BNB Prediction for 2025

- BNB Prediction for 2025 – 2030

- BNB’s Journey to the Moon.

- BNB Coin in 2018

- How did BNB perform in 2019?

- BNB 2021 Analysis

- In January 2021

- BNB in February 2021

- BNB in May-December 2021

- What is BNB?

- BNB Tokenomics Rundown

- BNB’s Tokenomics During its launch (Summer 2017)

- Price Prediction for Binance Coin for 2022

- How to Buy Binance Coins on eToro?

- Conclusion

BNB Current Overview

BNB Prediction for 2023

The Auto-Burn system of BNB allows the bank to reduce its total supply by about 100,000,000 BNB. This mechanism takes into account the price of BNB and the number of blocks that were generated on the BNB Smart Chain.

This provides a great level of predictability and transparency in the BNB ecosystem. With inflation concerns likely to get worse by the start of 2019, we can expect a decent price move.

The price of BNB could rise to around $275.2227 by the end of 2023 if the network upgrades are successful. However, it could also fall to around $246.0648 if the negative sentiments continue. On the other hand, the average price could settle at $260.437.

BNB Prediction for 2024

The potential of the Binance network to attract a wider audience and attract more institutions and big money investors could push the price of BNB up to around $344.0284 by 2024.

If the network gets smaller and fiercer competition persists, the price of BNB could fall to around $271.1397. On the other hand, the regular price could eventually settle at $307.5840.

BNB Prediction for 2025

By 2025, BNB could continue to rise and reach new highs. In addition, Binance could introduce new trading features that could enhance the investors’ experience. These include asset conversion, price protection, and Cross Collateral.

The price of BNB could reach the $447.2369 level eventually. However, if the market gets volatile and crashes, the gains could be wiped out in the next couple of years. On the other hand, the regular price could settle at $386.2573.

BNB Prediction for 2025 – 2030

Our BNB price prediction for 2025 is also based on how the FTX situation has unfolded for Binance. Because of this, many investors are now turning to Binance Coin as a way to get rich off cryptocurrencies. Due to its connection to the exchange, the price of Binance Coin will continue to rise.

Fortune Business Insights noted that the cryptocurrency market is expected to reach a value of over $1.9 trillion by 2028, which would represent a compound annual growth rate (CAGR) of 11.1%. This means that the market will continue to grow.

The anticipated growth of the crypto market is expected to provide exciting and new use cases for BNB. Developers will be more inclined to create applications on the BNB Chain, which will add more utility to the platform. As the number of people using the platform increases, more people will want to use Binance Coin.

In 2025, our prediction for Binance Coin indicates that the token could reach a value of $700. Looking further into the future, our prediction for 2030 indicates that the token will hit the $2,000 mark.

BNB’s Journey to the Moon.

BNB has been on a steady rise since 2019 but, its bullishness gained immense momentum in 2021.

Digital coins are volatile by nature, but the Binance coin seems more volatile than most.

Cryptocurrency asset classes widely use BNB’s wild volatility; this is a significant reason why the coin has been on the top-ranks of Coinmarketcap for a more extended period.

The coin’s high volatility level is due to several factors: Binance Coin plays a crucial role in almost every Binance based operation or transaction, including trading fees and providing discounts on the trading of other coins on the Binance exchange.

BNB had a very significant contribution to the overall rise in the value of Binance since its launch.

Both prices of BNB and Binance have been sharing a close relationship from the start to date. The coin has been active in the market since August 2017, when it was listed for cryptocurrency trading on the Binance exchange. Binance coin played a crucial role in the rise of the value of Binance from just $10 million to $300 million, thus making it one of the fastest-growing exchanges in the cryptocurrency ecosystem.

The price dynamics of Binance Coin can be analyzed through the Crypto Volatility Index (CVIX), which aims to provide a comprehensive view of the market’s overall sentiment. It also intends to implement an algorithm that can demonstrate the market’s sentiment on a positive or negative basis.

The year 2019 for Binance Coin was very positive. Although its price growth slowed down during the second half of the year, it was still able to gain a lot of ground due to the IEO’s success. During the pandemic, the price of Binance Coin went negative due to this phenomenon.

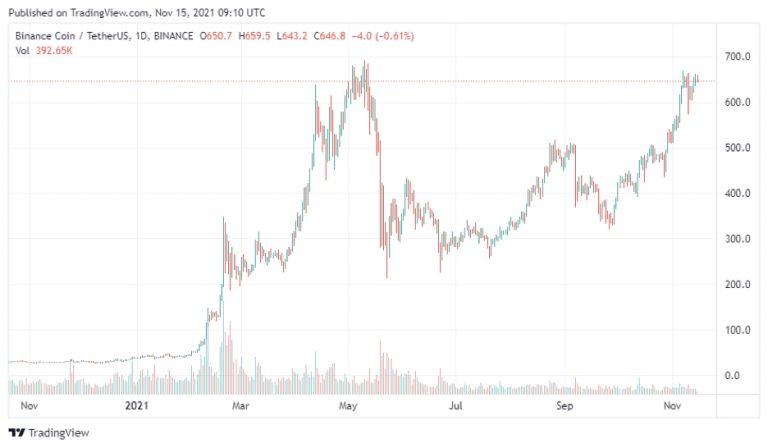

After reaching its ATH, the token experienced a profit booking and failed to cross the $654.32 mark. Following this, a downward trend has developed. In-between price pick-ups have occurred.

BNB Coin in 2018

January to Feb

BNB saw an early rise against USD to $24.46 in the second week of January 2018. Even with the Digital coin falling to $7.34 only a few hours later, it ended January with an average rate of about $11.41, which is 24.5% higher than BNB’s December 2017 average value.

BNB hit another record low of $5.72 in February 2018 but made a slight recovery to an average of $10.46 in the month.

March to August

BNB had minimal success within these six months of 2018, hovering between a medial of $11.01.

September to December

BNB took a dip one can attribute to the bearish sentiments that took over the entire crypto market in late 2018, which affected almost every cryptocurrency at some point.

Once Binance Coin dipped down to $3.63, its value began to spike up rapidly, rising over 10% within 24 hours.

The coin dipped once again after this spike, but it did not reach its previous position of $4.00 once again for quite some time, instead settling somewhere around $3.80-4.00 before beginning to climb up once again for good in 2019

How did BNB perform in 2019?

2019 was an eventful year for the BNB. The Binance platform had a more than average rise in BNB use cases; over one million BNB holders increased 40% from the previous year.

| Dec | 37.33 | 31.49 | 38.62 | 27.02 | 82.43M | 18.51% |

| Nov | 31.5 | 28.42 | 34.71 | 26.27 | 80.46M | 10.47% |

| Oct | 28.51 | 29.27 | 31.98 | 26.37 | 82.14M | -2.58% |

| Sep | 29.27 | 23.15 | 33 | 18.63 | 145.96M | 26.49% |

| Aug | 23.14 | 20.71 | 23.74 | 20.22 | 77.80M | 11.94% |

| Jul | 20.67 | 15.39 | 20.68 | 15.09 | 68.89M | 34.12% |

| Jun | 15.41 | 17.08 | 18.2 | 14.84 | 52.13M | -9.95% |

| May | 17.12 | 16.95 | 18.17 | 14.02 | 84.21M | 0.58% |

| Apr | 17.02 | 12.57 | 18.12 | 11.98 | 117.76M | 35.59% |

| Mar | 12.55 | 19.23 | 21.75 | 6.4 | 136.75M | -34.82% |

| Feb | 19.25 | 18.28 | 27.18 | 17.74 | 80.63M | 5.61% |

| Jan | 18.23 | 13.71 | 18.85 | 12.98 | 51.86M | 32.92% |

BNB 2021 Analysis

The chart above is set to a yearly frame.

2021 has been the craziest year for BNB. BNB has majorly experienced what can only be described as a collection of short-term bullish tendencies, which has resulted in almost immediate bearish corrections reverberations.

In January 2021

BNB was somewhat uneventful in January 2021, it began the year at about $30, and it failed to break $60 before January ended.

BNB in February 2021

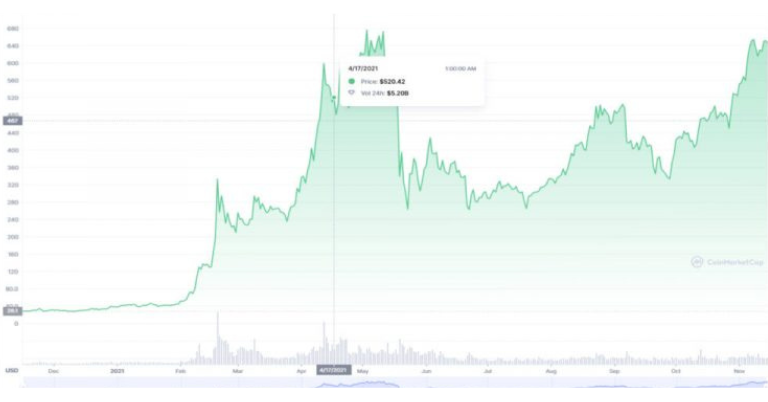

BNB’s 2021 Bullish trend kicked off in February when its value skyrocketed from less than $50 at the beginning of the month to about $348 around February 18th (almost 400% increase).

BNB February’s surge might’ve resulted from the increasing activity of formerly dormant tokens on the Binance network, as Binance has been reporting lately.

The most likely result is what is probably on your mind all along. Perhaps the effect of Binance’s BNB Tokens burning is finally materializing.

Remember, at that time, Binance had just completed its 14th burning session (January 2021).

BNB in May-December 2021

As if February’s surge wasn’t news enough, BNB surged to an all-time high of $690.93 on May 10th, 2021.

From the Graph above (set to a monthly frame) there is a psychological resistance at around $570 and $684. Long-term BNB holders and loss-making investors are biding their time for the cost price close before selling their BNB and exiting.

In 2021, it hit an all-time high of $690 before experiencing a steep decline. This occurred after the coin hit an ATH.

What is BNB?

BNB is the official native coin of the Binance network; it was launched initially as an ERC-20 token on the Ethereum network during Binance’s 2017 summer ICO.

Later on, in 2019, Binance launched its own Tendermint Byzantine-Fault-Tolerant Binance blockchain.

For most digital coins, BNB tokenomics probably trumps most by 10 to` 1.

BNB Tokenomics Rundown

The BNB Token arguably has one of the best tokenomics in history.

BNB Tokenomics is carefully engineered to offer it maximum demand and increasingly diminishing supply.

Aside from this, BNB is probably one of the biggest cap coins out there, and this was achievable by Binance’s mega trading volume and cleverly designed BNB use cases.

For a coin to have a high demand and limited supply, that is, to have a well-grounded economically stable and economically dynamic tokenomics, it must:

- Be clear and have a finite supply

- Have clear specific functions

- Function needs to drive meaningful values to its holders

Let’s examine how the Binance token satisfies all these requirements.

BNB’s Tokenomics During its launch (Summer 2017)

Requirement one; Clear and Finite Supply.

Total Supply: 200,000,000

Circulating Supply: 200,000,000

Functions of the BNB Token

BNB Derives its values from major use cases:

- Pay for Binance fees (Exchange Fees, Withdraw, Listings, etc.)

- Enables you to carry out transactions on the Binance network

- Donate to Charity

- BNB holders have special rights in the Binance Network.

- Make purchases

How do these functions listed above derive meaningful Value for BNB holders?

In September 2020, Binance launched its decentralized exchange (Binance Smart Chain), where BNB is used as a base asset and as gas spent for transactions carried out on the DEX platform.

- Payment discount and enabling transactions (gas fee):

In addition, when you pay for your fees on Binance with BNB, you will receive a specific discount rate:

Discount Rate:

| First Year | Second Year | Third Year | Fourth Year | Fifth Year | |

| Discoumt Rate | 50% | 25% | 12.5% | 6.75% | No discount |

You can also save up to 75% of your trading fee by paying and staking in BNB (up to 11,000 BNB).

- Binance IEO Launchpad; Binance helps you generate the initial capital from presales, then list your token on their website, i.e., exposes it to their audience.

In 2019, Binance implemented a lottery system to introduce randomness, prevent users from losing (fairness) the chances of getting their tokens onto the IEO.

To qualify for winning the lottery ticket, you have to stake at least 100 BNB tokens 20 days before the IEO bidding launch.

The only capital investors can contribute to the IEO is BNB.

The more BNB tokens you have, the more your chances of winning a lottery ticks (from 100 to over 500 BNB tokens win you from one to five BNB tickets.

- You can donate BNB to Binance Charity Wallet; the BCF will disburse the funds in the charity wallet towards different charity projects.

BCF has raised a total of 90,347,592.9 USD from 782 donations.

- You have special perks when you hold a minimum of 500 BNB in the Binance network.

You get the following when you hold at least 500 BNB:

Affiliate reward; holding at least 500BNB gets you at least double multipliers of your downlink’s 20% first deposit as a reward.

Lottery for IEO: Holding 500BNB gets you 5 Binance IEO lottery tickets.

Converting dust to BNB; Binance network’s protocol allows you to convert your dust into BNB.

When you hold 500BNB, you also have the maximum IEO vote count (when voting for the next project to be launched on Binance’s IEO).

- Make Purchases

Some platforms like Crypto.com, Trip.io, BitTorrent, Canva, etc., accept BNB payments.

The points above are already numerous use cases that create immense demand for BNB, thereby appreciating its value.

Price Prediction for Binance Coin for 2022

The Binance Coin was seen to sour higher in 2021 with a price at $37.91 at the start of the year, shooting to an all-time high of $690.93 in May and ending the year at $511.71. This was a whopping 1,268.9% gain. At the start of 2022, the price dropped to $371.31, and it fell further to $361.23 in February.

Its price has remained unpredictable; as seen in March 2022, it rose to $408.48 and dropped to $360.30 in the same month. Binance Coin then started to rise along with other cryptocurrencies to reach $459.81 in April, but it dropped to $422.39.

Long-term predictions indicate that Binance Coin can move $559.36 by the end of 2022. It can go on to surpass its previous high in 2023 to reach $864.61 by the end of it. The long-term algorithms-based forecast indicates by 2025; the Binance Coin would have reached above $1,000 and end at $1,479.37. It certainly is an excellent investment option for anyone wishing to buy the coin, but where can you buy this coin?

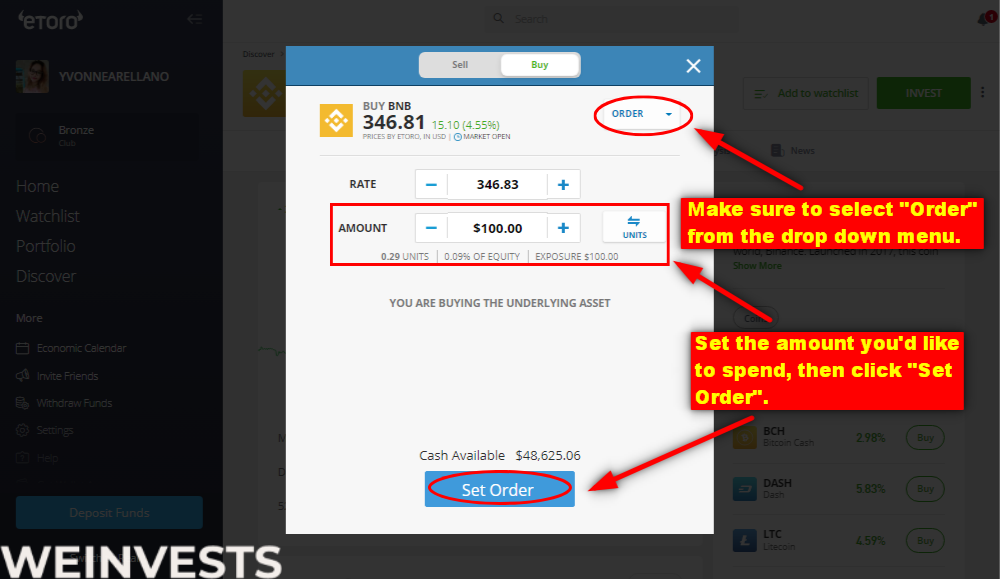

How to Buy Binance Coins on eToro?

Here’s a step-by-step guide to buying the Binance Coin with eToro.

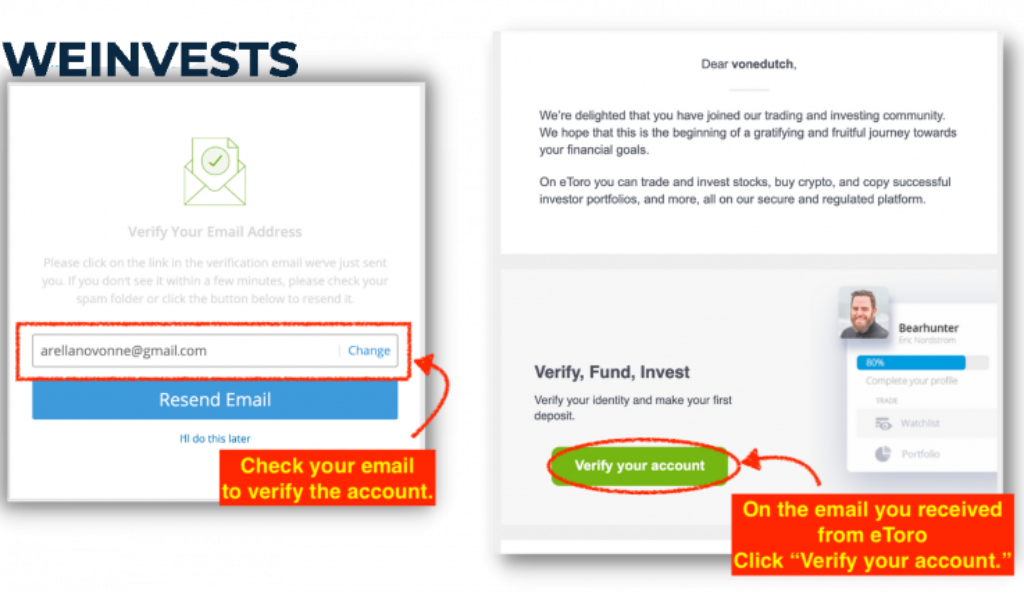

Step 1: Open an Account

Visit the eToro website to sign up and create an account.

Fill in all the required fields, cross-check all data and review the terms and conditions before submitting. Click on the “Create Account” button.

You should check out eToro’s terms, conditions, and policies before proceeding to the next step. Additionally, rereading your information to make sure it doesn’t have any errors is also a good idea.

In addition to that you will need to go to your e-mail account and look for eToro verification e-mail and click “Verify your account”.

Step 2: Upload ID

Investors must go through the KYC process. It is mandated that all eToro accounts are verified by proof of identity. A trader can upload various documents to prove identity and proof of address. To prove your identity, you’ll use a Government ID or Passport. Generally, the document should have a date of birth, a clear photo, and an expiration date. After uploading the document, eToro will verify it. Moreover, you can use a bank statement to prove your address.

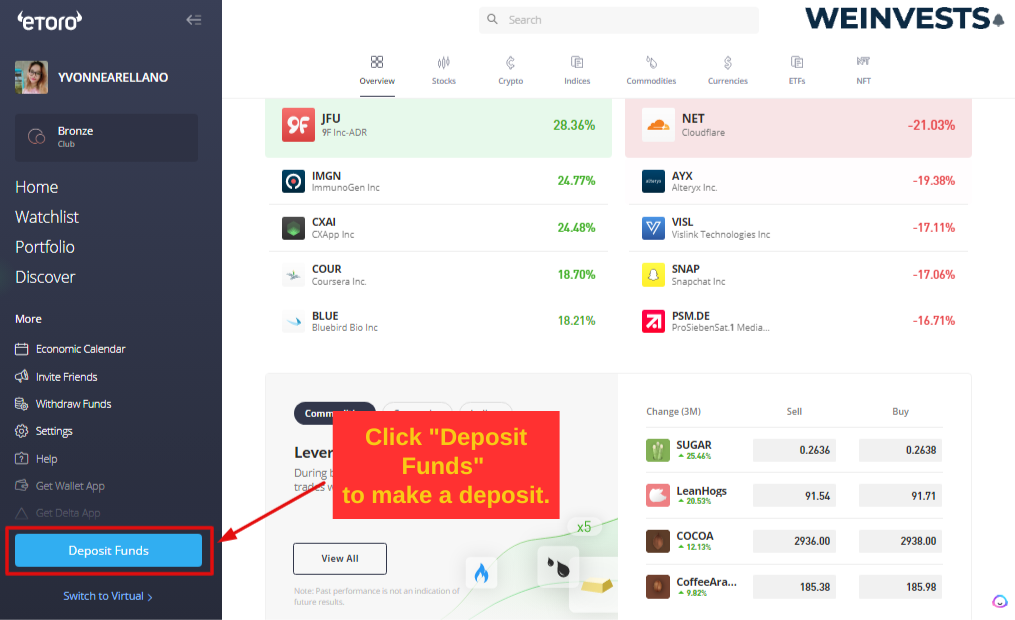

Step 3: Make a Deposit

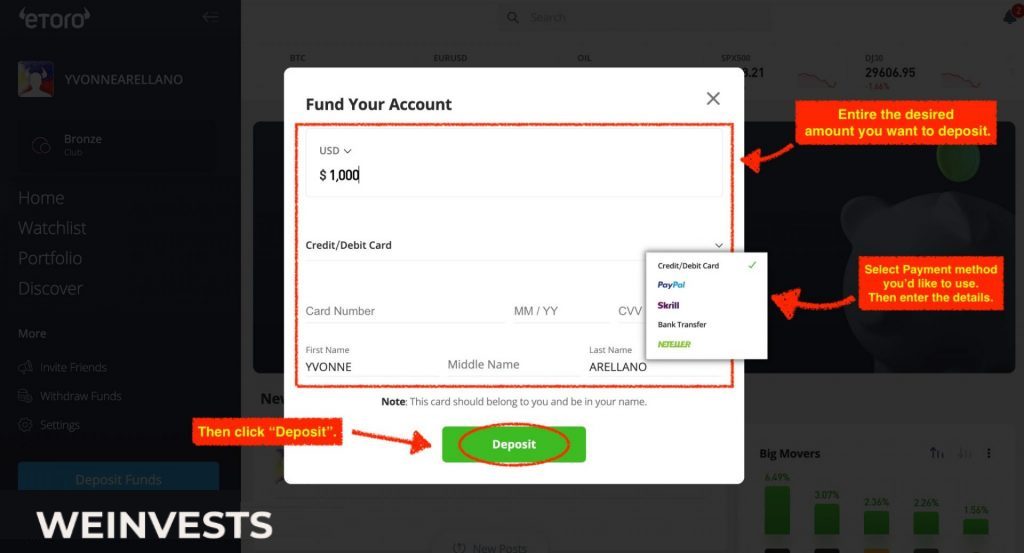

After creating an eToro trading platform account, you must fund it to buy Binance Coin. There are many payment options like PayPal, debit or credit card, bank transfer, and eToro money. Using eToro money allows you to have zero fees in conversions on USD.

After selecting your preferred payment method, you’ll log into your eToro account, click on deposit funds, add the amount and currency, and choose your preferred deposit method.

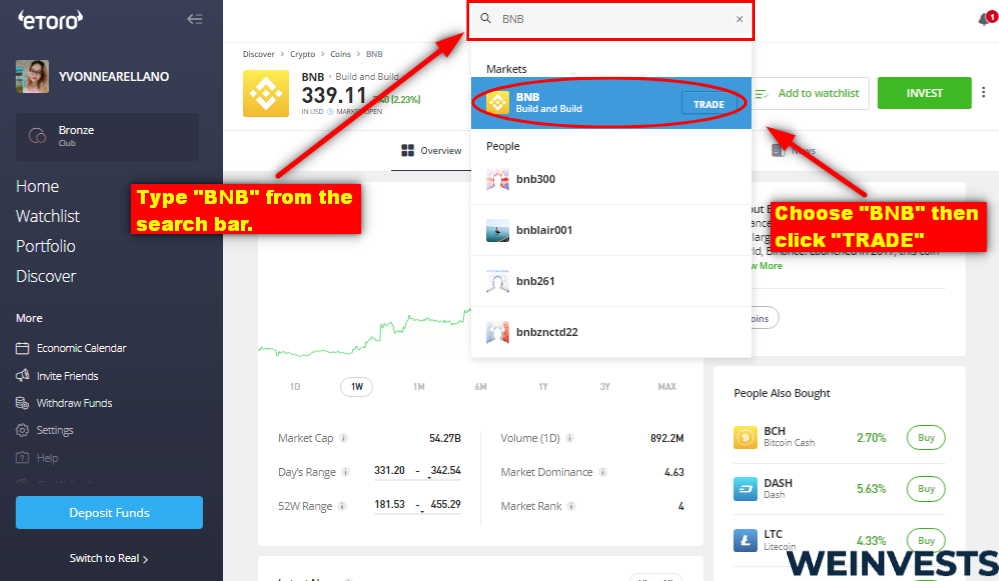

Step 4: Search for Binance Coin

Once you’ve made a deposit, you can visit the eToro marketplace and search for Binance Coin. It’s important to have some basic crypto market information that helps you to know when to buy the coin. Most of the time, you’ll be monitoring the market.

Step 5: Buy Binance Coin

Just like Bitcoin, the Binance Coin can be purchased fractionally. You don’t need to buy a whole Binance Coin to own some. After purchase, it’s imperative to store the coins in a secure wallet where they can be accessible for future use.

Conclusion

The Binance coin has one of the strongest tokenomics out there. Suppose there is any coin designed never to fail, or a coin that can be argued to a considerable extent to be ‘ready for anything I probably wouldn’t have to think much before pointing out the BNB token. Aside from its impressive liquidity, use cases, and ingenious way of reducing its supply.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More