If you hold substantial crypto assets, it’s possible to squeeze extra yield from your tokens through the process of staking. Staking involves locking up crypto assets for a specified use in exchange for earning a yield.

While different types of staking exist, one popular version is liquidity staking. This process involves lending tokens to a liquidity pool to facilitate transactions.

As crypto has evolved, so have the possibilities of staking. One exciting new development is the concept of dual staking, which involves locking up two different crypto tokens in the same liquidity pool. While dual staking is not without risk, the process has several benefits over traditional staking.

What Is Dual Staking?

Dual staking is an iteration of the concept of traditional staking, where users can only stake an individual coin.

In the crypto landscape, liquidity providers like automated market makers and decentralized exchanges need a pool of tokens to facilitate transactions for users. They get these tokens from stakers, who lock up their tokens in the pool in exchange for a yield.

In the past, some pools only offered the option to stake a single token at a time. Trying to stake multiple tokens could be a complicated, laborious process.

Dual staking streamlines this process. Since liquidity pools intermediate transactions between two coins, users can stake both coins in the same step. Rather than just providing liquidity to one end of a transaction, dual staking allows users to facilitate both ends.

To further understand the mechanics behind dual staking, let’s take a look at how the process works in practice.

How Dual Staking Works

Let’s use an ETH-DAI liquidity pool as an example to outline how dual staking works.

In a dual-staked ETH-DAI setup, users would deposit both ETH and DAI to the liquidity pool. The pool uses these tokens in the background to facilitate transactions. This process provides value to the crypto market by ensuring sufficient liquidity for trades.

Over time, users would earn staking rewards based on the yield offered by the pool. This yield will vary by the supply and demand of different tokens in the pool, but rewards can be quite high. Users can earn particularly high rewards by staking tokens in undersupplied pools.

Rewards for dual stake pools are split equally between the two coins. This ensures the pool rewards users fairly. Since a transaction requires both ends of a transaction to function, it makes sense to split the rewards for a dual stake pool.

Finally, once they want to trade their tokens again, users can withdraw their staked positions from the liquidity pool. Platforms differ in the way they free up staked coins. Short lockup periods may apply to some pools. With a dual stake pool, though, users earn yield from both tokens upon withdrawal.

Why Dual Staking? The Benefits

While dual staking is an interesting development in crypto, what value does it offer users?

Although every investor has different needs, there are real benefits to dual staking that most users will appreciate. Most importantly, dual staking has the potential to increase investor rewards while reducing risks.

Dual staking can lower the risk associated with impermanent loss through diversification. If users stake just one token and the price falls, they could receive their tokens back at less value than they originally had. While this is still a risk with two staked tokens, it is less likely that both assets will fall at the same time.

In addition, stakers can potentially earn higher rewards with two tokens than with one. In a single staking platform, users might have assets left on the sidelines that are not generating yield. Dual stake pools give users greater flexibility in putting all their assets to work.

Popular Platforms Supporting Dual Staking

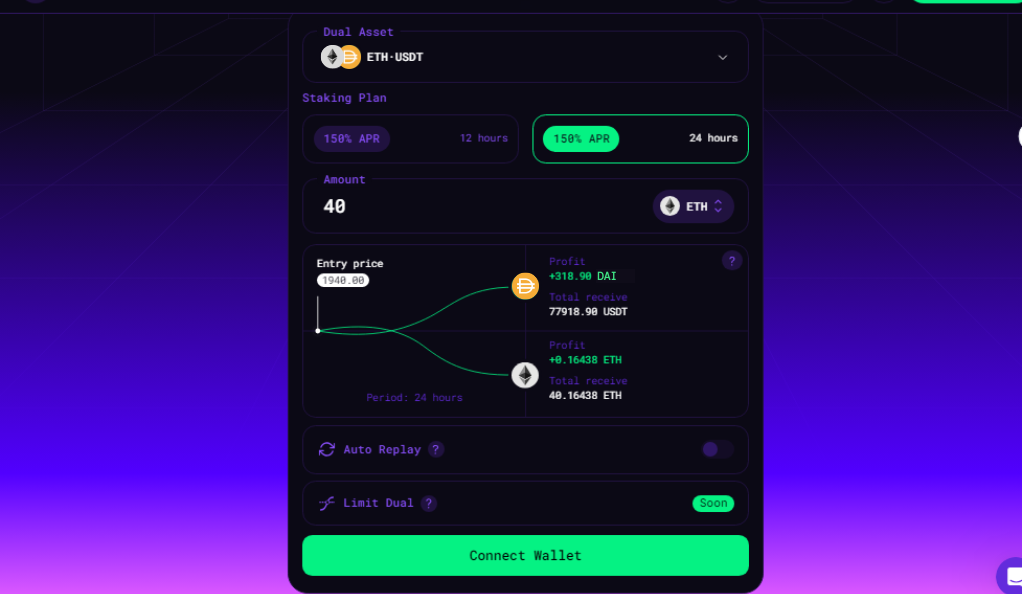

While dual staking is rising in popularity, it is currently just supported by several innovative platforms. One of the most popular is ReHold, which has played an influential role in developing dual staking.

ReHold aims to offer stakers the highest possible rewards with great flexibility. To work towards this goal, they developed dual staking features across a variety of coin pairs.

ReHold, like other dual staking platforms, sits between stakers and liquidity pools. While ReHold is at the forefront of dual staking technology, it is not the only platform offering this form of staking. For instance, both Binance and YouHodler offer their own versions of dual staking strategies.

For a detailed list of the most popular dual staking platforms, readers can review a list of options on stakingcrypto.io. As with all crypto platforms, however, users should do careful research to ensure they can trust the dual staking platform they choose.

Trusting Dual Staking Platforms

Choosing which staking platform to use can be a difficult decision. While factors like ease of use and yield will impact an investor’s choices, their primary concern is likely to be safety and security.

To alleviate this worry, many dual staking platforms operate as decentralized exchanges. This means that smart contracts facilitate all the platforms’ functions with publicly viewable code. In addition, many platforms choose to get security audits to test their contracts for any flaws.

As with all companies, the reputation of the founders should also be a consideration when choosing a dual staking platform. A team with a history of building successful companies is a good sign as to the seriousness of the platform. Due to how common crypto scams are, investors should especially consider this factor.

Finally, popularity with existing users can inform prospective investors whether they can trust a platform. Popular platforms tend to have a history of successful operations.

Benefits of Dual Investment with ReHold

While different platforms exist that offer dual investment strategies, ReHold is one of the premier options. The platform’s innovative approach to dual staking has led to a number of benefits for users.

First, ReHold offers particularly high yields. In some cases, these yields can be up to 300%. According to ReHold, they can offer such high yields due to a focus on providing concentrated liquidity. Concentrated liquidity involves providing liquidity within a specific price range, which can improve staking fees.

Second, ReHold has a highly intuitive interface. This means the ease of use of the platform is quite strong. This could be a particular benefit to newer crypto investors, who may be less familiar with how typical crypto platforms function.

Finally, ReHold has a non-custodial nature, making it easier to trust. ReHold does not take ownership of your crypto coins. Instead, smart contracts route staked investments to existing liquidity pools.

Strategies for Dual Investment

On the surface, dual investment may seem simple. For experienced crypto investors, there are some strategies you can utilize to improve returns.

Due to the way users receive staked tokens, there is an important distinction between entry and exit tickers for similar liquidity pools. For example, an ETH-DAI pool will return tokens in a different manner than a DAI-ETH pool.

The net result of this is that stakers can benefit from certain strategies if they believe the coin prices will change. For instance, if you believe the price of ETH will go up, it makes sense to have DAI be the entry ticker (DAI-ETH pool). If you believe the price of ETH will fall, you would do the inverse pool (ETH-DAI pool).

If you think the market will stay stable, you can still earn staking rewards from either pool. This method is a great beginner strategy to express investment beliefs through dual staking.

For advanced users who are bullish on crypto, it’s possible to use dual staking to either earn a profit or add to their portfolio. With a dual investment strategy, stakers can sell their crypto if the price rises. If it falls, users will simply expand their holdings.

Innovative Features of Dual Staking Platforms

While dual staking is an innovative feature in itself, certain platforms have developed even further improvements for users to take advantage of.

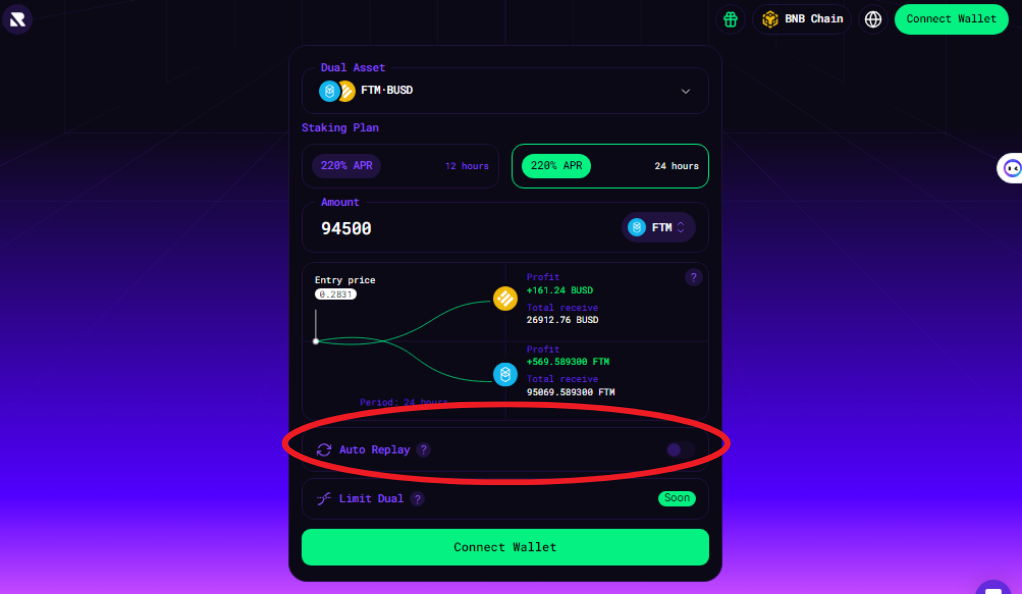

ReHold’s Auto Replay feature is a great way for investors to increase their yields without paying extra fees. Typically, staking new coins will incur a gas fee to execute the transaction. With Auto Replay, however, users can reinvest their tokens automatically, without needing to pay an extra fee.

This feature is similar to an automatic dividend reinvestment program. By compounding staking rewards, users can increase their profits over time. It’s important to note that this strategy works best in a stable, low-volatility market. In times of increased volatility, it’s possible that automatically reinvesting will hurt more than it will help.

For this reason, auto replay may be best suited to advanced users. Still, having the option to use the feature could be a big draw to the ReHold platform.

Earning NFTs through Dual Staking

ReHold also chooses to reward members who signed up early. As a bonus incentive to test out the platform, ReHold is offering access to exclusive NFTs during their Private Launch phase.

If a staker creates at least two dual investments with any trading pair, they will receive an “Early Adopter” NFT. If you invite at least two friends who then each open one dual investment, you will receive a “Gold Early Adopter” NFT.

As ReHold grows, it’s possible that they will continue to expand user access to exclusive NFTs. Additionally, the early adopter batch of NFTs could grow in value as more people use ReHold.

While collecting private NFTs by using ReHold may not be the most important factor influencing an investor’s decision to use the platform, the strategy does emphasize ReHold’s commitment to its user base. It also underscores ReHold’s enthusiasm for the wider crypto community, apart from their focus on improving staking.

Risks and Challenges of Dual Staking

While this article outlined some of the benefits of dual staking, the strategy is not without certain risks. It’s important for investors to understand the challenges inherent in any investment strategy.

First, while dual staking reduces the likelihood of losing money associated with the value of staked coins dropping, it does not eliminate it. Since crypto tokens tend to exhibit a significant degree of correlation, it’s possible that both tokens in a dual pair drop at the same time.

Second, smart contracts can contain hidden bugs. This is especially true with liquidity pools. Certain staked pools have seen their assets drained as hackers exploit security vulnerabilities. While the platforms we discussed today seem to have strong security, the risk is still there.

Finally, investors should be aware that trusting any new platform involves a degree of risk. This risk cannot be eliminated, although thorough research can mitigate it.

Mitigating Risks in Dual Staking

With proper precautions, investors can effectively mitigate many of the risks detailed above.

Stakers should seek dual staking pairs that have little correlation with each other. While historical correlation can only serve as a rough guide to future pair movements, this will minimize the likelihood of both holdings falling together. Choosing a stablecoin as one side of a dual pair can be a good choice.

Next, stakers should search for platforms where auditors vetted the smart contracts in use. For example, Peckshield, a blockchain security consultancy, audited ReHold. This can give users a degree of confidence that the contracts relied upon do not have hidden vulnerabilities.

Although new platforms can be risky, having a reputable team standing behind the platform can alleviate some concerns. To mitigate the risk of relying on a startup, investors should evaluate whether the team has a history of successfully running innovative companies.

The Future of Dual Staking

While the future path of any innovative technology is uncertain, there are reasons to believe that dual staking has a great future ahead of it.

For one thing, crypto investors have consistently shown a preference for diversification. Dual staking’s inherently diverse structure could expand to multiple coins all staked on the same platform.

Closely tied to diversity, dual staking effectively expresses the flexibility of crypto. Just like an investor in traditional finance would not let cash sit around without earning interest, crypto investors should not have to leave valuable assets on the sideline. Allowing more staking options can only benefit investors.

Finally, the high yields of dual staking are an obvious draw. As developers build new smart contracts, yields will rise where liquidity provides the most value. Offering more liquidity to pools through dual staking is one step forward in maximizing the potential rewards for stakers.

Conclusion

Dual staking can lower risks through diversification while simultaneously improving returns through more opportunities for yield. In addition, users can execute both beginner and advanced strategies through dual staking.

With that being said, dual staking could introduce some security risks, and it’s always possible for both staked assets to drop at once. This could be a difficulty for users sensitive to asset value fluctuations.

Ultimately, whether or not to participate in dual staking is an individual decision that must align with an investor’s goals and risk tolerances. Each investor should spend time weighing the pros and cons described in this article.

FAQ

Is ReHold legit?

ReHold appears to be legit. Two fintech executives with a reputable history run the company, and the firm has been covered by a number of media outlets. Finally, ReHold’s smart contracts have passed a security audit.

Is dual staking a good investment?

Whether dual staking is appropriate for you will depend on your personal investment goals. Dual staking can offer higher rewards with better diversification, but it does expose you to the risk of declining asset values.

What is dual staking vs individual staking?

In individual staking, users can stake one crypto token in a liquidity pool to earn a reward. Dual staking allows users better flexibility by offering staking on both ends of a coin pair.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More