Cryptocurrencies have gained immense popularity in recent years, revolutionizing the financial landscape. Understanding the growing popularity of cryptocurrencies is essential as they offer decentralized and secure digital transactions. However, with this rise comes the need for caution due to the increasing number of cryptocurrency scams. As the crypto market attracts more participants, it becomes crucial to be aware of potential risks and scams associated with cryptocurrencies. By staying informed and exercising caution, individuals can navigate the cryptocurrency landscape safely and make informed investment decisions.

Table of Contents

- Cryptocurrency Basics

- Common Types of Cryptocurrency Scams

- Recognizing Red Flags

- Secure Practices for Protecting Your Investments

- Tips for Avoiding Scams in Initial Coin Offerings (ICOs)

- Recognizing and Avoiding Phishing Attacks

- Protecting Your Digital Wallets and Exchanges

- Educating Yourself: Staying Informed and Updated

- Dealing with Scams: Reporting and Recovery

- Summary: Protecting Your Investments in the Cryptocurrency Market

- Frequently Asked Questions (FAQs)

- What is a cryptocurrency scam?

- How can I identify a legitimate cryptocurrency project?

- Are all Initial Coin Offerings (ICOs) scams?

- How can I protect my cryptocurrency wallet from hackers?

- What if I fall victim to a cryptocurrency scam?

- Is it possible to recover funds lost to a cryptocurrency scam?

- How can I stay updated on the latest cryptocurrency scams?

Cryptocurrency Basics

Cryptocurrencies have revolutionized the financial world, but understanding their fundamentals is key.

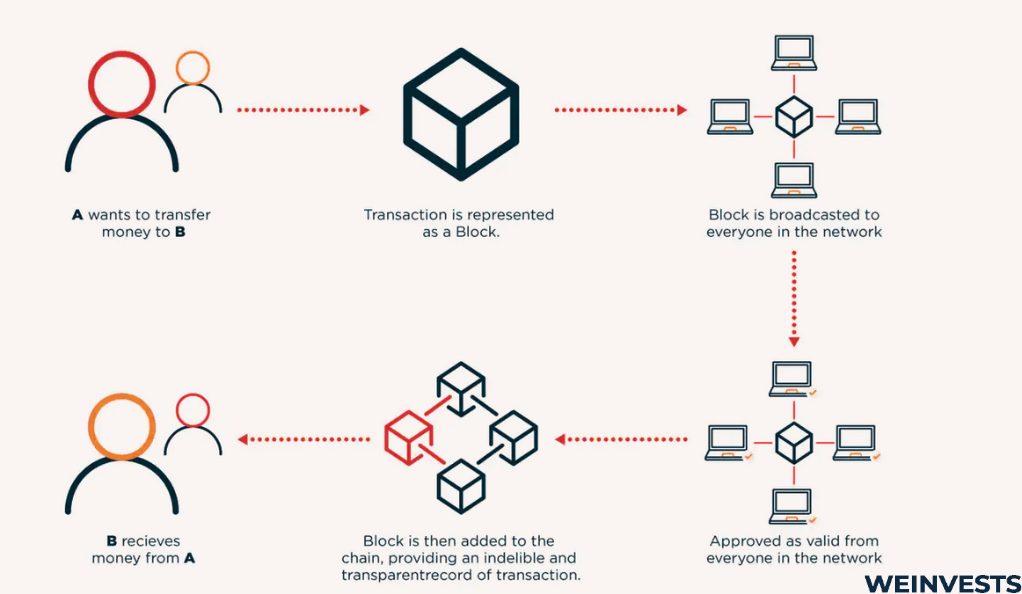

Cryptocurrencies are digital or virtual currencies that use cryptography for secure transactions. They operate on decentralized networks called blockchains, ensuring transparency, security, and immutability.

Key Features of Cryptocurrencies

- Decentralization: Cryptocurrencies are not controlled by any central authority, making them independent of government regulations.

- Security: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units.

- Anonymity: While transactions on the blockchain are transparent, the identities of the parties involved are often pseudonymous.

- Limited Supply: Many cryptocurrencies have a finite supply, preventing inflationary pressures.

- Global Accessibility: Cryptocurrencies enable borderless transactions, allowing anyone with internet access to participate.

Bitcoin (BTC), the first cryptocurrency, remains the most prominent. It functions as a digital store of value and a medium of exchange. Ethereum (ETH) introduced smart contracts, enabling the development of decentralized applications (DApps); other notable cryptocurrencies include Ripple (XRP) for fast cross-border transactions and Litecoin (LTC) for quick and low-cost transfers.

In brief, cryptocurrencies serve various purposes beyond traditional currency: some aim to facilitate decentralized finance (DeFi), provide privacy (Monero/XMR), or enable machine-to-machine transactions (IOTA).

One easy way to avoid crypto scams, is to use eToro, which provides a secure, regulated platform for cryptocurrency trading, safeguarding users from scams. It offers transparency, a user-friendly interface, educational resources, and advanced trading tools, enabling responsible and informed investment decisions in the crypto market.

Common Types of Cryptocurrency Scams

Cryptocurrency scams have become a pressing concern as the digital currency ecosystem grows. So, It is crucial to be aware of the various types of scams that target unsuspecting individuals. Here are some common types of cryptocurrency scams:

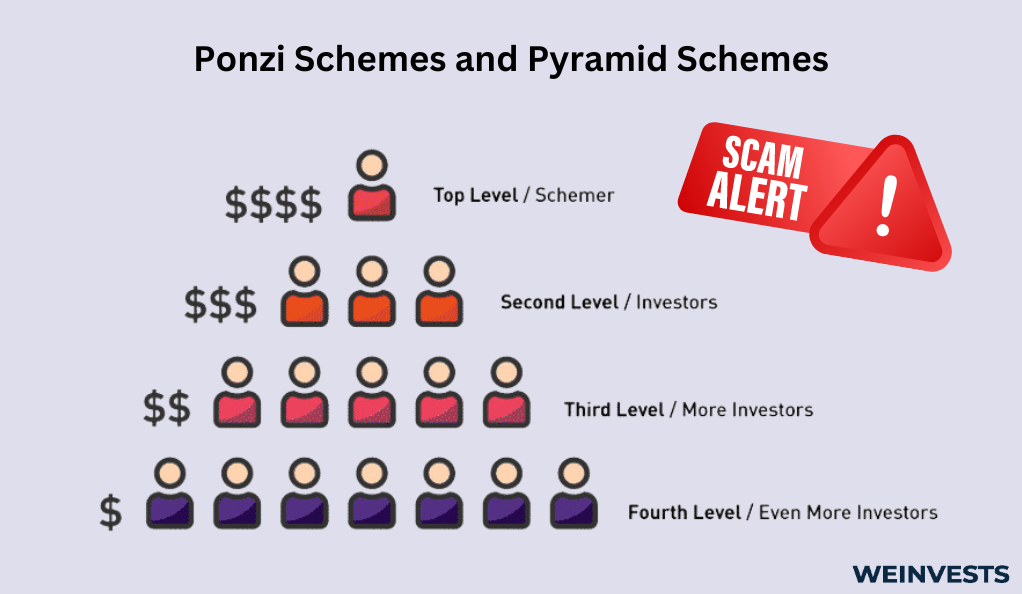

Ponzi Schemes and Pyramid Schemes

Ponzi schemes promise high returns on investment to attract new participants. The funds collected from new investors are used to pay existing investors. Pyramid schemes operate similarly but involve recruiting participants in a hierarchical structure. Eventually, these schemes collapse, leaving most investors with significant losses.

Fake Initial Coin Offerings (ICOs)

Fraudsters create fake ICOs, mimicking legitimate projects, and offer investors the opportunity to purchase tokens at a discounted price. However, once investors send their funds, they receive no tokens in return, resulting in financial losses.

Phishing Attacks and Social Engineering

Phishing attacks involve deceptive tactics, such as fake emails or websites, to trick individuals into revealing their private keys or login credentials. Social engineering techniques exploit human psychology to manipulate victims into sharing sensitive information or granting unauthorized access to their wallets or exchanges.

Cryptojacking and Malware

Cryptojacking involves unauthorized use of individuals’ computing power to mine cryptocurrencies. Malware, including viruses and ransomware, can infect devices and steal private keys or hold them for ransom, compromising the security of cryptocurrency holdings.

Pump and Dump Schemes

In pump and dump schemes, fraudsters artificially inflate the price of a low-volume cryptocurrency through false marketing or spreading rumors. Once the price rises significantly, they sell their holdings, causing a sharp price drop and leaving other investors with losses.

Fake Wallets and Exchanges

Fraudulent wallet apps and exchanges deceive users into depositing their cryptocurrencies. These fake platforms aim to steal users’ funds or private keys, compromising their security and leading to financial loss.

Staying vigilant and practicing due diligence is crucial to avoid falling victim to these scams: it is essential to research projects thoroughly, verify the legitimacy of ICOs, use secure wallets and exchanges, and be cautious of unsolicited communications. By being aware of these common scams, individuals can better protect themselves and their investments in the cryptocurrency market.

Recognizing Red Flags

Identifying potential red flags is crucial when engaging with cryptocurrencies and blockchain projects. Here are some key indicators to watch out for:

Unrealistic Promises and Guaranteed Returns

Beware of projects that make extravagant claims, promising high and guaranteed returns with minimal risk. Such promises are often indicative of fraudulent schemes. Remember, investing in cryptocurrencies carries inherent risks, and legitimate projects do not guarantee profits.

Lack of Regulation and Transparency

Cryptocurrencies operate in a decentralized environment, but reputable projects still adhere to regulatory compliance and transparency. If a project lacks clear information about its team, regulatory compliance, or fails to provide transparent updates on their progress, it raises concerns about their legitimacy and accountability.

Poor Website Design and User Experience

Legitimate projects prioritize a well-designed and user-friendly website to provide essential information and engage with their community. Poorly designed websites, lack of information, or frequent technical glitches could indicate a lack of professionalism or even a scam.

Suspicious Team and Advisors

Research the project’s team members and advisors to ensure their credibility and expertise. Look for verifiable professional profiles and evaluate their track record in the industry. Be cautious if the team lacks transparency or if their identities cannot be verified.

Negative Online Reputation

Conduct thorough research and read reviews from multiple sources to gauge the reputation of the project. Look out for reports of scams, fraud, or suspicious activities associated with the project. Negative feedback from the cryptocurrency community should raise concerns and prompt further investigation.

It is important to note that these red flags are not definitive proof of a scam, but they should alert you to exercise caution and conduct deeper due diligence before investing in or engaging with a project.

Remember, always do your own research, seek reliable sources of information, consult with experienced individuals or professionals in the cryptocurrency space and participate in reputable communities and forums that can provide valuable insights and help identify potential red flags.

Secure Practices for Protecting Your Investments

Protecting your cryptocurrency investments requires implementing robust security measures. So here are some secure practices to safeguard your assets:

Researching Before Investing

Thoroughly research any project before investing your hard-earned money. Evaluate the project’s fundamentals, team credibility, technological innovation, and community support. Verify the project’s whitepaper and examine its roadmap to assess its long-term viability.

Using Reliable Exchanges and Wallets

Choose reputable and well-established cryptocurrency exchanges and wallets. Look for platforms with a proven track record of security and user trust. Research their security features, such as two-factor authentication (2FA), cold storage, and encryption protocols. Avoid using unknown or unregulated platforms with a questionable reputation.

Implementing Strong Security Measures

Strengthen the security of your online accounts by using strong, unique passwords and regularly updating them: enable two-factor authentication (2FA) wherever possible, as it provides an extra layer of security by requiring additional verification during login attempts.

Protecting Personal Information and Private Keys

Exercise caution when sharing personal information online. Be wary of phishing attempts and suspicious emails or links. Never disclose your private keys or sensitive information to anyone, as it can lead to unauthorized access and potential loss of funds.

Employing Cold Storage for Long-Term Holdings

Consider using cold storage solutions, such as hardware wallets or offline storage, for long-term cryptocurrency holdings. Cold storage keeps your private keys offline, significantly reducing the risk of online attacks. It provides an extra layer of protection against hacking attempts and malware.

Regularly Updating Software

Keep your devices, wallets, and software up to date with the latest security patches and updates. Software updates often include security enhancements that protect against new threats and vulnerabilities.

Monitoring Account Activity

Regularly review your account activity and transaction history. Set up alerts for any unusual or suspicious activity. Promptly report and address any unauthorized access or fraudulent transactions.

Remember, maintaining strong security practices is an ongoing effort. Stay informed about the latest security trends and best practices within the cryptocurrency community and be proactive in adapting to new security measures and technologies as they emerge.

By following these secure practices, you can minimize the risk of potential security breaches, protect your investments, and ensure a safer experience in the cryptocurrency ecosystem.

Tips for Avoiding Scams in Initial Coin Offerings (ICOs)

Investing in Initial Coin Offerings (ICOs) can be an exciting opportunity to support innovative projects and potentially earn profits. However, it’s crucial to navigate this space with caution due to the presence of scams and fraudulent activities. Here are some valuable tips to help you avoid scams and make informed decisions when participating in ICOs:

Conduct thorough research

Before investing in an ICO, research the project, team members, and their background. Evaluate the whitepaper, roadmap, and the underlying technology. Look for transparency, credibility, and a solid business model.

Verify team members and advisors

Check the credentials and identities of the project’s team members and advisors. Look for their online presence, past experiences, and contributions to the crypto community. Beware of projects with anonymous or unverified team members.

Assess the project’s legitimacy

Scrutinize the project’s website, social media channels, and community engagement. Look for active and authentic communication. Be cautious if there is a lack of transparency, incomplete information, or exaggerated claims.

Analyze the ICO structure

Examine the ICO’s token distribution, fundraising goals, and the allocation of funds. Ensure that the project has a clear roadmap for development and has a reasonable token distribution plan that aligns with its goals.

Check for regulatory compliance

Verify if the ICO complies with relevant regulations and legal requirements. Lack of compliance could indicate a higher risk of fraud or potential legal issues in the future.

Assess community sentiment

Engage with the crypto community and seek opinions from experienced investors. Participate in reputable forums and social media platforms to gain insights and assess the overall sentiment surrounding the ICO.

Be cautious of red flags

Watch out for warning signs such as unrealistic promises of high returns, pressure to invest quickly, and unsolicited communication promoting an ICO. Be skeptical of projects that lack a tangible product or have limited information available.

Consult with experts

If you are unsure about an ICO, seek advice from professionals or consultants with expertise in the cryptocurrency market. They can provide valuable insights and help you make informed investment decisions.

Remember, due diligence and cautiousness are essential when participating in ICOs. By following these tips and staying informed, you can minimize the risk of falling victim to scams and increase your chances of investing in legitimate and promising projects.

Recognizing and Avoiding Phishing Attacks

Phishing attacks are a common type of online scam aimed at stealing sensitive information, such as usernames, passwords, and financial data. In the context of cryptocurrencies, phishing attacks can lead to the loss of your Altcoin investments if you unknowingly disclose your private keys or login credentials to malicious actors. It is crucial to be aware of the signs of phishing attacks and take necessary precautions to protect yourself. So, here are some key points to recognize and avoid phishing attacks:

Be cautious of suspicious emails

Phishing attacks often start with phishing emails that appear to be from legitimate sources. Look for red flags like spelling errors, generic greetings, or requests for personal information.

Verify website authenticity

Double-check the website address (URL) before entering any sensitive information. Phishers may create fake websites that mimic legitimate cryptocurrency exchanges or wallets. Look for secure connections (https://) and ensure the website address is spelled correctly.

Be wary of unsolicited communication

Avoid clicking on links or downloading attachments from unsolicited emails, social media messages, or online advertisements. Legitimate cryptocurrency services will not ask you for sensitive information through these channels.

Use trusted sources

Only download wallet software or exchange applications from reputable sources. Verify the authenticity of the source before proceeding with any installations.

Enable two-factor authentication (2FA)

Enable 2FA for your cryptocurrency wallets and exchange accounts. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, in addition to your password.

Keep software and devices updated

Regularly update your operating system, web browsers, and security software to protect against known vulnerabilities and exploits.

Educate yourself

Stay informed about the latest phishing techniques and trends. Familiarize yourself with common phishing indicators and learn how to identify and report phishing attempts.

By being vigilant and following these practices, you can significantly reduce the risk of falling victim to phishing attacks and safeguard your Altcoin investments: it is always better to err on the side of caution and verify the authenticity of any communication or website before sharing any sensitive information.

Protecting Your Digital Wallets and Exchanges

Safeguarding your digital wallets and exchanges is essential to protect your Altcoin investments from unauthorized access and potential security breaches. Here are some important measures to consider:

Choose secure wallets and exchanges

Select reputable wallets and exchanges that prioritize security and have a track record of implementing robust security measures. Research their security features, such as encryption, multi-signature authentication, and cold storage options.

Implement two-factor authentication (2FA)

Enable 2FA for your wallets and exchange accounts. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, in addition to your password.

Regularly update and back up your wallets

Keep your wallet software and mobile applications up to date with the latest security patches and features. Regularly back up your wallet data and store the backups securely in multiple locations.

Use hardware wallets

Consider using hardware wallets, which are physical devices that store your private keys offline. These wallets offer an extra layer of security by keeping your keys away from internet-connected devices.

Be cautious of phishing attempts

Be vigilant against phishing attacks and avoid clicking on suspicious links or providing sensitive information to unknown sources. Always double-check website URLs and ensure you are on the legitimate platform.

Avoid public Wi-Fi for transactions

Public Wi-Fi networks are susceptible to attacks, making it risky to perform cryptocurrency transactions. Use secure and private networks, such as your home or mobile data connection, to access your wallets or make transactions.

Use strong passwords and secure login credentials

Create strong, unique passwords for your wallets and exchange accounts. Avoid using easily guessable passwords and consider using a password manager to securely store and manage your login credentials.

Regularly monitor your accounts

Keep a close eye on your wallet and exchange activity. Review your transaction history and account balances to identify any unauthorized or suspicious transactions.

By following these best practices, you can significantly enhance the security of your digital wallets and exchanges, reducing the risk of unauthorized access and potential loss of your Altcoin investments.

Educating Yourself: Staying Informed and Updated

Staying informed and updated about the latest developments in the world of cryptocurrencies is essential for making informed investment decisions. Here are some effective ways to educate yourself:

- Follow trusted news sources and blogs: Stay updated by following reputable news sources and blogs that cover cryptocurrency-related topics. These sources can provide valuable insights, news updates, and analysis on market trends, regulations, and technological advancements.

- Join cryptocurrency communities: Engage with like-minded individuals by joining cryptocurrency communities, such as online forums or social media groups. These communities offer opportunities to discuss and exchange knowledge, share experiences, and learn from experts and experienced traders.

- Participate in online discussions and forums: Contribute to online discussions and forums focused on cryptocurrencies. By actively participating, asking questions, and sharing your insights, you can gain new perspectives, receive feedback, and learn from others’ experiences.

- Attend webinars and conferences: Look out for webinars and conferences that cover cryptocurrency topic, as these events often feature industry experts who provide valuable insights, analysis, and predictions about the market and attending them can broaden your understanding and keep you up to date with the latest trends.

- Follow influential figures and thought leaders: Follow influential figures and thought leaders in the cryptocurrency space on social media platforms, as these individuals often share valuable insights, opinions, and market analysis, providing you with a unique perspective on the industry.

- Lastly, stay updated on regulatory changes: Keep yourself informed about any regulatory changes or legal developments related to cryptocurrencies and understand the impact of these changes on the market and how they may affect your investment decisions.

Remember, the cryptocurrency market is dynamic and constantly evolving: by staying informed, actively participating in discussions, and engaging with the community, you can enhance your knowledge, make well-informed decisions, and adapt to the ever-changing landscape of cryptocurrencies.

Dealing with Scams: Reporting and Recovery

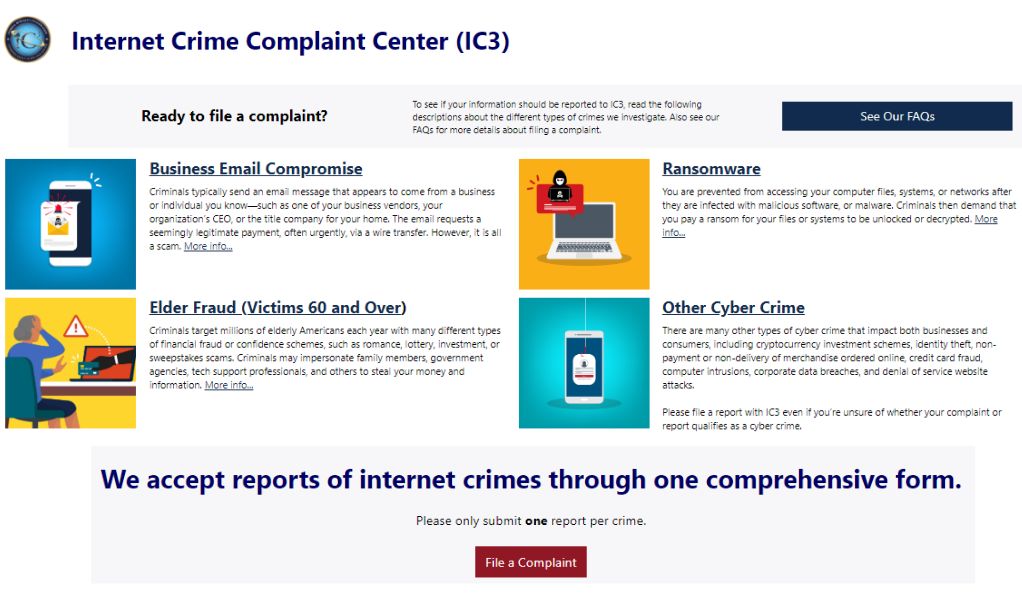

In the unfortunate event of falling victim to a cryptocurrency scam, taking immediate action is crucial. Here are important steps to follow for reporting and recovering from scams:

- Report scams to authorities and platforms: Report the scam to the appropriate authorities, such as local law enforcement or financial regulatory bodies. Additionally, inform the platform or exchange where the scam occurred. Provide them with all relevant details, including transaction records, communication screenshots, and any other evidence that can aid in their investigation.

- Document evidence and contact law enforcement: Gather and document all available evidence related to the scam. This includes transaction records, emails, chat logs, and any other relevant information. Preserve this evidence and provide it to law enforcement when filing a complaint. Contact your local law enforcement agency or cybercrime division and provide them with a comprehensive report of the scam.

- Seek professional help for recovery: Depending on the complexity of the scam and the amount involved, you may need to seek legal or professional assistance for recovery. Consult with a lawyer or a specialized firm experienced in dealing with cryptocurrency scams. They can guide you through the legal process, help recover lost funds if possible, and provide advice on how to mitigate future risks.

Furthermore, It’s important to note that recovering funds lost to scams can be challenging and, in some cases, not possible. Therefore, prevention is the best defense against scams, always exercise caution, verify the legitimacy of any investment opportunity, and conduct thorough research before engaging in transactions.

In conclusion, remember, education and awareness are key in protecting yourself from scam: stay informed about common scam tactics, be skeptical of promises that seem too good to be true, and remain vigilant in safeguarding your personal information and digital assets.

Summary: Protecting Your Investments in the Cryptocurrency Market

In summary, safeguarding your investments in the cryptocurrency market is of utmost importance. Here are the key points and recommendations to keep in mind:

- Educate yourself: Stay informed about the latest trends, news, and security practices in the cryptocurrency market.

- Secure your wallets and exchanges: Choose reputable and secure wallets and exchanges, implement two-factor authentication, regularly update and back up your wallets, and avoid using public Wi-Fi for transactions.

- Recognize and avoid scams: Be cautious of phishing attacks, suspicious websites, and fraudulent investment schemes. Report scams to authorities and seek professional help for recovery if needed.

- Stay informed and updated: Follow trusted news sources, join cryptocurrency communities, and participate in online discussions and forums to stay updated and exchange knowledge with fellow investors.

So, by implementing these measures and staying vigilant, you can protect your investments and navigate the cryptocurrency market with greater confidence.

Frequently Asked Questions (FAQs)

What is a cryptocurrency scam?

A cryptocurrency scam refers to fraudulent activities or schemes that aim to deceive individuals for financial gain using cryptocurrencies; scammers may use various tactics such as fake investments, phishing attacks, or Ponzi schemes.

How can I identify a legitimate cryptocurrency project?

Research is key. So, look for transparent and well-established projects with clear goals, a strong development team, and a solid community presence and assess the project’s whitepaper, roadmap, and partnerships to determine its legitimacy.

Are all Initial Coin Offerings (ICOs) scams?

No, not all ICOs are scams. However, due diligence is essential before participating in any ICO: evaluate the project’s credibility, team, technology, and community support to make an informed decision.

How can I protect my cryptocurrency wallet from hackers?

Protect your wallet by using reputable and secure wallet providers, enabling two-factor authentication, regularly updating your wallet software, and keeping your private keys secure and offline.

What if I fall victim to a cryptocurrency scam?

Report the incident and gather any evidence you have. It’s crucial to act quickly to maximize the chances of recovering your funds.

Is it possible to recover funds lost to a cryptocurrency scam?

Recovery is challenging, but not impossible: in fact engaging legal professionals experienced in cryptocurrency fraud cases may help in tracking down scammers and initiating legal proceedings to recover lost funds.

How can I stay updated on the latest cryptocurrency scams?

Stay informed by following reputable cryptocurrency news sources, joining online communities, participating in forums, and regularly checking official regulatory warnings and updates regarding scams in the cryptocurrency industry.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More