This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Navigating the world of investments can be daunting for beginners. But, with the right broker, it becomes a much smoother journey. In 2023, several brokers stand out for their user-friendly platforms, educational resources, and robust trading tools.

All these dimensions will allow us to list some of the top brokers that are suitable for beginners. Before we begin, keep in mind that financial trading is an activity that requires both knowledge and experience.

Top Trading Platforms for Beginners in 2023

This article provides a comprehensive list of the best trading platforms for beginners in the market today. Each top-rated option has been thoroughly reviewed and is specifically tailored to those just starting out in their trading journey!

- eToro – Best Overall Trading Platform for Beginners

- Avatrade – Easiest Account Opening Procedure

- Markets.com – Best Broker for Educational Content

- Swissquote – Easiest to Navigate User Interface

1. eToro – Best Overall Trading Platform for Beginners

eToro is a leading social trading platform that allows users to trade and invest in a variety of financial instruments, including cryptocurrencies, stocks, commodities, and more.

eToro is well-known for its social trading feature, which allows users to share their trading decisions, discuss ideas, and talk about strategies on the social News Feed. This feature, known as CopyTrader, enables users to copy the trades of other successful traders, making it easier for beginners to get started with trading.

Users can trade and invest in a diversified portfolio starting at $10. They also have the option to practice risk-free with a virtual portfolio before investing real money.

eToro provides an intuitive platform for options trading. This feature simplifies the process of exploring, learning about, and trading options. Moreover, eToro offers a demo account where users can practice trading and try out strategies without risking real money.

The broker also provides free courses, tutorials, podcasts, and more to help users, whether beginners or experienced traders, be successful on the platform. Finally, eToro’s mobile app, available on Google Play, offers a user-friendly interface for investing with 0% commissions on US stocks and ETFs.

- Users have the opportunity to test their trading strategies with a simulated portfolio of up to $100K

- CFDs make it possible for traders to access the forex market

- Traders can gain insight from and socialize with others through copy trading

- The platform offers both desktop and mobile interfaces with an intuitive design

- Retail traders are limited to a single account type

- US clients may not have access to certain features such as crypto and FX trading

- Only one base currency is available for accounts on the platform

2. Avatrade – Easiest Account Opening Procedure

With its simple account opening process, comprehensive trading options, and an all-in-one solution for Forex, commodities, cryptocurrencies, indices, and stocks trading globally, Avatrade has solidified its position as a leading choice for traders worldwide.

One of the most notable features of Avatrade is its hassle-free account opening procedure. The process is designed with the utmost simplicity in mind, enabling clients to open their accounts in a matter of minutes. This speed and efficiency eliminate any unnecessary delay, allowing traders to dive right into the exciting world of trading without any undue waiting or complex procedures.

Whether you’re a seasoned trader looking for advanced features or a beginner seeking a simple, straightforward experience, Avatrade has you covered. Each account type comes with its unique advantages, ensuring every trader finds a perfect fit for their trading strategy.

Moreover, Avatrade provides access to leading market analysis, allowing its users to stay ahead of the curve. This invaluable tool empowers traders to make well-informed decisions, enhancing their ability to navigate the ever-changing market landscape successfully.

Avatrade’s user-friendly website and trading platform further enhance the trading experience. The platform’s technology is built to streamline the trading process, making it an enjoyable and efficient experience regardless of your trading proficiency.

- Quick and easy account opening process

- Responsive, multilingual customer support

- Multiple trading platforms available

- No fees for deposits and withdrawals

- Limited charting capabilities

- High charges for inactivity

- Withdrawing funds may take longer than with other brokers

4. Markets.com – Best Broker for Educational Content

Markets.com is a globally recognized broker known for its user-friendly trading platform, comprehensive suite of tools, and robust regulatory credentials. It’s regulated by top-tier authorities such as the CySEC and the FSB. This ensures a high level of safety and transparency for its clients.

What truly sets Markets.com apart from other brokerages is its commitment to education. Recognizing that informed traders make better decisions, it offers a wealth of educational materials catering to all skill levels. These resources range from webinars and courses to video tutorials and regular market analysis updates.

Webinars offer live interactive sessions where experts discuss various trading topics, giving beginners an opportunity to learn directly from the pros. The courses are structured and detailed, covering everything from the basics of trading to advanced strategies. Video tutorials provide visual aid, simplifying complex concepts and making them easier to grasp. Regular market analysis updates keep traders abreast of the latest trends and developments in the financial markets.

Another notable feature of Markets.com is its emphasis on risk management. Trading, by nature, involves risks, and understanding how to manage these risks is integral to successful trading. Markets.com provides its clients with effective risk management strategies, enabling them to protect their investments and maximize their profits.

- Simple and fast account setup process ideal for novice traders

- Impressive selection of tools and resources to help users manage their portfolios

- Fast deposit and withdrawal times without extra costs

- Opening an account requires only a few minutes

- Not many options for expert traders looking for specialized accounts

- Conversion fees on certain order types are quite high

- Simplicity of the platform can come at the expense of advanced features

5. Swissquote – Easiest to Navigate User Interface

Swissquote stands out in the crowded online trading landscape with its blend of user-friendliness, a multilingual platform, and a wide array of trading products. The moment you land on their website, you’re welcomed by a clean, intuitive interface that speaks volumes about Swissquote’s commitment to delivering a seamless user experience.

Navigating Swissquote is a breeze whether you’re a novice trader or a seasoned professional. The dashboard layout is clear and straightforward, neatly organizing all the important information at your fingertips. This simplicity extends to the transaction process as well. With just a few clicks, you can execute trades, track your investments, and access detailed market analysis.

What truly sets Swissquote apart is its ability to make investing accessible to everyone. Despite the simplicity of its interface, the depth and quality of its services are never compromised. Swissquote offers comprehensive educational resources, ensuring that users feel confident and informed about their trading decisions.

In essence, Swissquote has successfully married simplicity with sophistication, creating a user-centric platform that demystifies the world of online trading. The result is a trading experience that is as rewarding as it is effortless, a testament to Swissquote’s pursuit of excellence in serving its users.

- Intuitive platform for trading

- Reputation for excellent customer service

- Comprehensive selection of educational resources

- No charges for inactivity

- Trading fees are higher than the industry average

- Not all research tools are complimentary

- No fixed spread accounts available

How we test our brokers

Weinvests.com only works with the most reputable and trustworthy brokers in the industry. In order to determine which broker is best for you, we first conduct extensive research on their offerings, costs, regulatory compliance, and support services. In addition, we evaluate the brokers’ websites to determine how user-friendly, robust, and secure they are.

Next, we look at reviews and feedback from actual users to gauge overall satisfaction. Finally, we rate each broker on our set of criteria for quality to guarantee that only the best services make it into our lists. Our process guarantees that our rankings are both objective and fair.

What is Beginner Trading – A Guide to a Beginners-Friendly Market

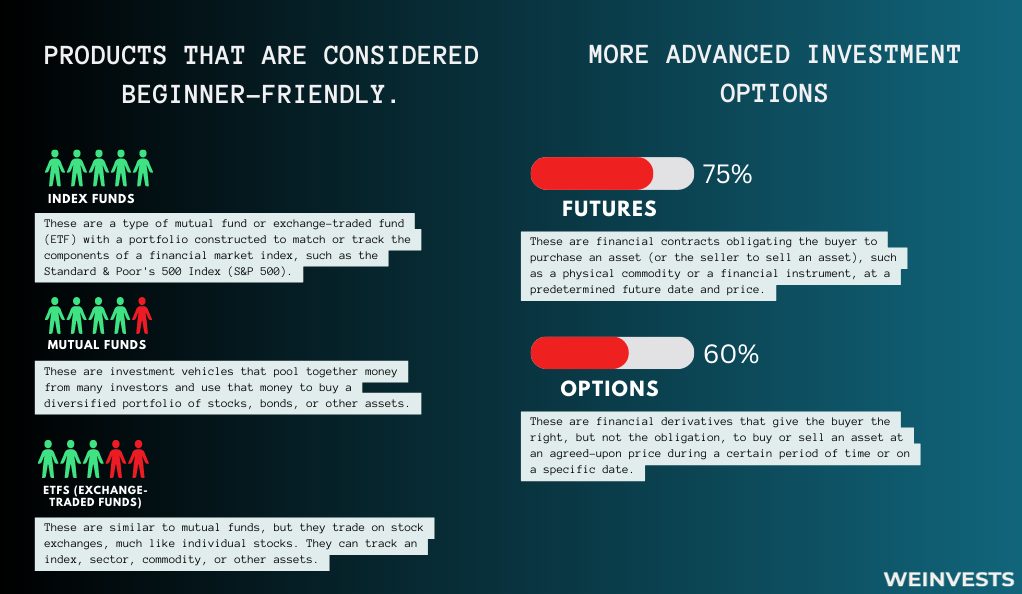

“Beginner-friendly” in trading refers to the elements of the financial market that are accessible and less complex for those who are new to the world of investing. It involves tools, platforms, resources, and types of investments that are easy to understand and navigate.

A beginner-friendly market often has a wide range of educational resources. These may include user-friendly apps and websites, online tutorials, webinars, and even simulation platforms where beginners can practice without risking real money.

In terms of investments, beginner-friendly options are usually those with lower risks and more predictable returns. For instance, index funds and mutual funds are often recommended to beginners because they offer diversification, which can help reduce risk. Exchange-Traded Funds (ETFs) can also be a good start as they’re traded like individual stocks, but they represent a basket of securities, providing a balance between risk and reward.

Moreover, a beginner-friendly trading environment should have transparent fees and charges. It’s crucial for beginners to understand exactly what they’re paying for and not be surprised by hidden costs.

Lastly, customer support is key. A beginner-friendly platform will offer robust customer support to help newcomers navigate the complexities of trading.

Remember, while these elements can make trading more accessible, it’s vital to do your own research and possibly seek advice from a certified financial advisor before making any investment decisions.

How Are Stocks Different from Commodities? A Beginner-Friendly Distinction

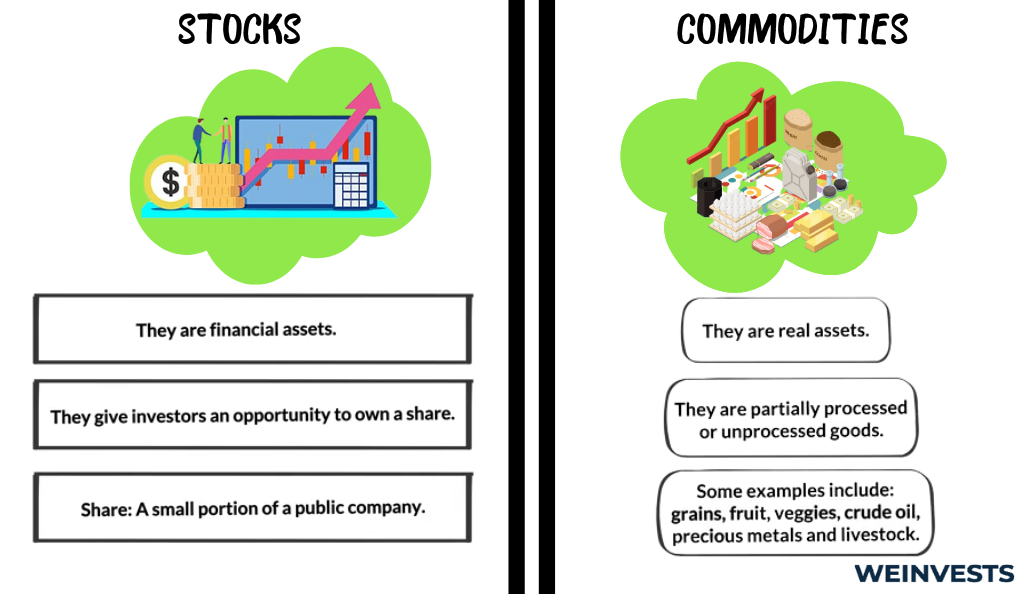

Stocks and commodities are two different types of investment vehicles. Stocks represent ownership in a corporation, allowing the holder a claim on part of the company’s assets and earnings.

They also may provide dividends and voting rights. Commodities, on the other hand, are basic goods that are interchangeable with other goods of the same type. Examples include crude oil, gold, wheat, and natural gas.

The value of commodities is primarily determined by market supply and demand, and they are typically used as input in the production of other goods or services. It’s important to understand these differences before investing.

How Are Crypto Different from CFDs? A Beginner-Friendly Distinction

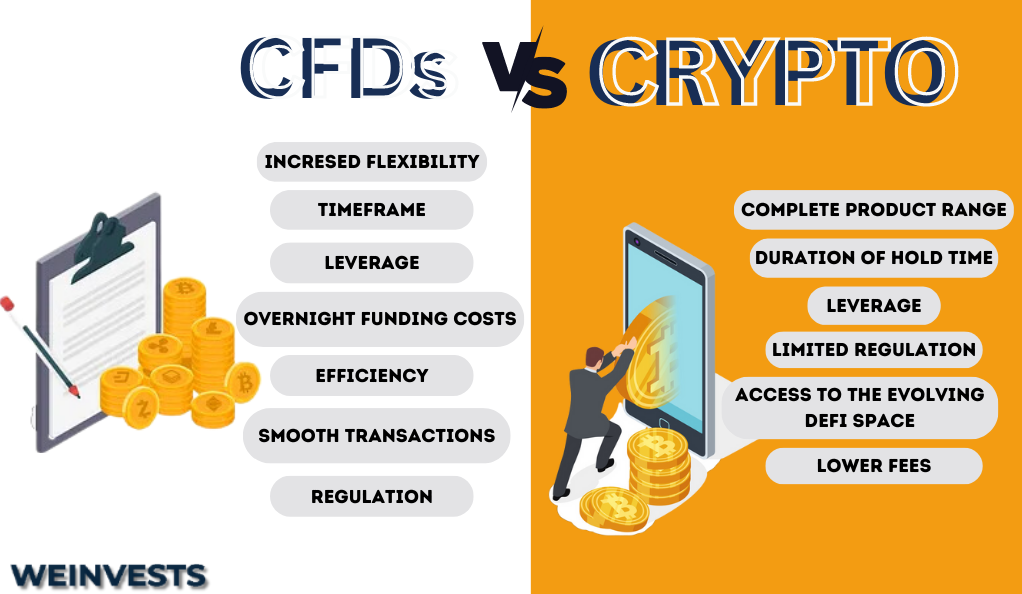

Cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that are powered by blockchain technology. Cryptocurrency transactions are often public and decentralized, meaning they don’t require a central authority to approve the transaction. On the other hand, Contract-for-Difference (CFD) investments are derivative instruments that enable traders to speculate on the price movements of various assets without owning the underlying asset.

You do not need a wallet to own a CFD, and you can enter into or exit an open position at any time without restrictions. Whereas crypto involves actual ownership of the asset, CFDs are more like bets on price movements in the market.

Pros & Cons of Beginner Trading

- Learning opportunities

- Potential for Profit

- Access to Demo Accounts

- Low Initial Investment

- High Risk of Losses

- Volatility of Prices

- Time-consuming Research Required

What beginner-friendly brokers charge the lowest fees?

- Robinhood: No direct trading fees

- eToro: Easy to Use app and low-cost trading

- Fidelity: Low fees and good educational content

- Acorns: Low-cost and no-frills trading

- Webull: Simplified trading with low fees

Trading for Beginners – Summary

A beginner-friendly market provides a range of educational resources and low-risk investments such as index funds, mutual funds, ETFs, and more. For those just starting to trade, it is important to understand the differences between stocks and commodities, as well as cryptocurrencies and CFDs. There are potential profits to gain from trading for beginners, but also the risk of significant losses.

Trading for Beginners FAQ

What is trading?

Trading refers to the buying and selling of financial assets, such as stocks, forex, cryptocurrencies, or commodities, with the goal of making a profit. Traders speculate on the price movements of these assets, aiming to capitalize on market fluctuations. Furthermore, trading involves the use of analytical tools to assess risk and make informed decisions.

How do I get started with trading?

To get started, educate yourself about different financial markets, trading strategies, and risk management. Choose a reputable online broker, open an account, and familiarize yourself with the trading platform. Start with a small investment, practice with demo accounts, and gradually increase your trading skills and capital. Avoid buying on tips or rumors, and always remember to manage your risk. Also, do not forget to diversify your portfolio and take into account taxes when trading.

What are some common trading mistakes to avoid?

Common mistakes include trading without a plan, letting emotions dictate decisions, overtrading, and not practicing proper risk management. Stick to your trading strategy, manage your emotions, avoid impulsive trades, and use tools like stop-loss orders to protect your investments. Finally, stay up to date with market news and financial reports to avoid missing out on potentially profitable opportunities.

How long does it take to become a successful trader?

Becoming a successful trader takes time and practice. The learning curve varies for each individual, but it can take months or even years to develop the necessary skills and experience. Patience, discipline, and continuous learning are vital for long-term success in trading. There is no fixed timeframe; it all depends on the individual’s commitment and dedication.

How can I improve my trading skills?

Continuous learning is key. Stay updated with market news, analysis, and educational resources. Keep a trading journal to track your trades and learn from your successes and failures. Consider joining online trading communities or finding a mentor who can provide guidance and insights. Demo accounts are also a great way to practice trading in real time and refine your strategies.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More