This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

DASH staking is possible because the Dash network (the Blockchain that facilitates the financial transactions of which DASH is the digital currency) adopts and introduces features such as PrivateSend, InstantSend, Masternodes, and even Decentralised Autonomous Organisations (DAO), which make it an impressive fork of bitcoin. DASH staking is based on a two-layered system with proof-of-stake and proof-of-work algorithms.

Numerous DASH staking pools promise high yields, and this article aims to discover the realistic possibilities of staking Dash, as well as the intricacies of the network. In this article, you will find the most crucial information about DASH staking.

- Dash’s InstantSend allows DASH holders to transfer DASH in, at most, two-and-a-half minutes, give or take a few seconds.

- Dash’s PrivateSend affords users anonymity by sending DASH in a unique sequence that makes it difficult to trace DASH transactions.

- Dash’s double-layered network, i.e. the mining and validating/Masternode layers, ensures the speed and functionality of DASH transactions.

- There is a low entry barrier to staking DASH, especially when compared to mining DASH and other cryptocurrencies and running a Masternode.

- The rewards or yields for staking DASH remain the same, regardless of the number of stakers in a Masternode.

- Just like most cryptocurrencies, DASH is a volatile asset with high market risk, so you run the risk of losing via devalued coins.

- Staking DASH in a node that violates the staking policies of the exchange could lead to the loss of the entire staking pool.

- You may stake DASH for a long period of time, during which you cannot access your coins. And unstaking your assets may take a long period.

Table of Contents

What is Dash Staking?

Dash staking involves pure staking or delegated proof-of-stake, and it is a system whereby DASH holders can hold on for dear life (HODL), after which they may earn profits from their yields. If you choose to stake Dash, you can go about it in either of two ways: you can pool your coins in a staking pool with other stakers or operate a Masternode.

The Dash protocol requires 1,000 DASH to run a Masternode, and in pursuit of this requirement, only nodes with at least 1,000 DASH can validate blocks in the Dash network. You must meet this requirement to function as a node should, and you will get rewards. Stakers with enough technical know-how and resources launch Masternodes which are costly to establish and maintain; to start with, you need a server that operates 24/7 to run a node.

However, there are low-cost and low-entry barrier alternatives for people who want to stake on Dash without hosting or operating a node. These people turn to crypto exchanges which create a staking pool, and the staking pool is then used to launch a Masternode. The crypto service becomes responsible for running the server and keeping the node online and for other necessary maintenance projects. Whatever rewards stakers gain during the staking period are dependent on and proportional to their initial deposited amount.

How to Stake Dash?

You can stake on Dash in either of two ways: through pure staking i.e., proof-of-stake, or delegated proof-of-stake (DPoS). In proof-of-stake, validators stake DASH as capital, and the staked DASH acts as collateral for the validator, who gains responsibility for validating the new blocks propagated over the Dash Blockchain. The validators or owners/holders of Masternodes may, on occasion, create new blocks.

Delegated proof-of-stake is a system that allows Dash users to vote for delegates to validate the next blocks. Users pool their DASH tokens into a staking pool, which is, in this case, a Masternode. The delegate who wins the votes receives the transaction fees from the validated block, and the users who pooled their tokens gain DASH staking rewards.

The validators, owners of the Masternodes, use DASH to validate transactions. In the case of the Dash protocol, 1000 DASH is the minimum amount required to validate transactions.

The staking rewards from validating blocks are shared in equal portions of 45% each by the Masternode operators and the proof-of-work miners, and the remaining 10% is allocated to the Dash Treasury. The Dash Treasury can be allocated to various tasks such as marketing, development, and other important projects. Masternodes vote to determine how the Dash Treasury will be allocated and spent.

Below is a step-by-step guide to staking DASH, with detailed explanations of every step.

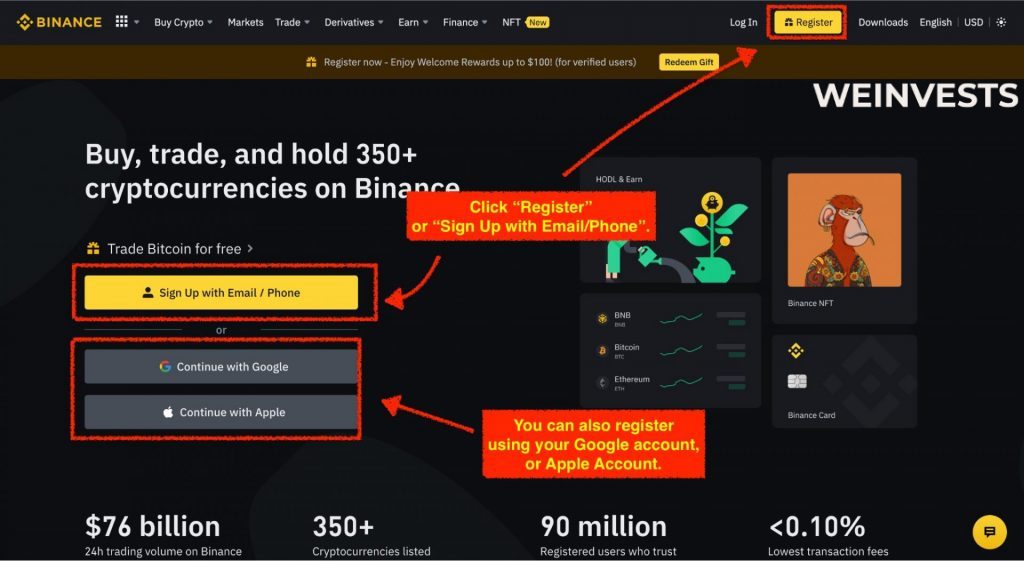

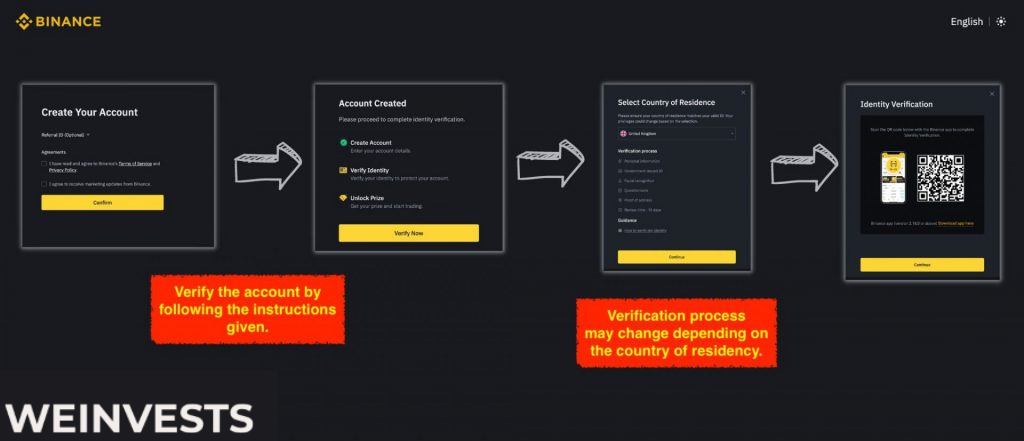

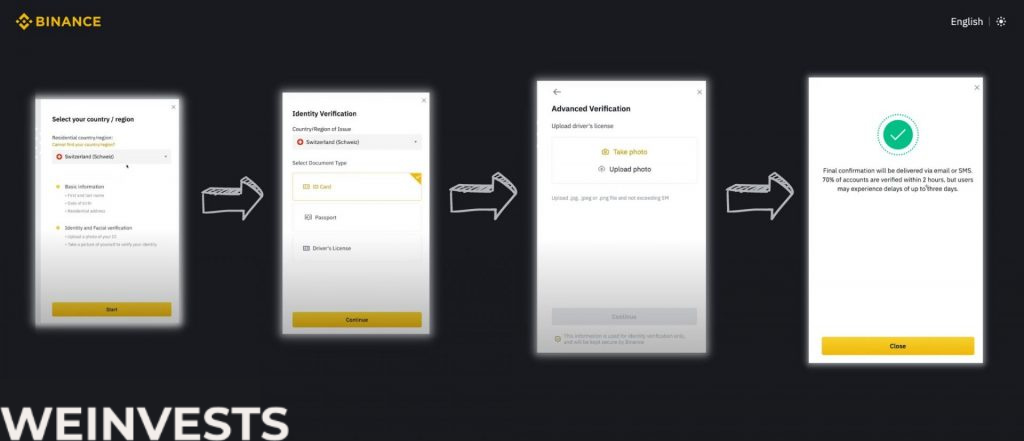

Step 1: Sign Up and Verify your Account

If you want to stake Dash, the first thing you must do is create an account on Binance.

Then go through the verification steps to provide Binance with proof of identity.

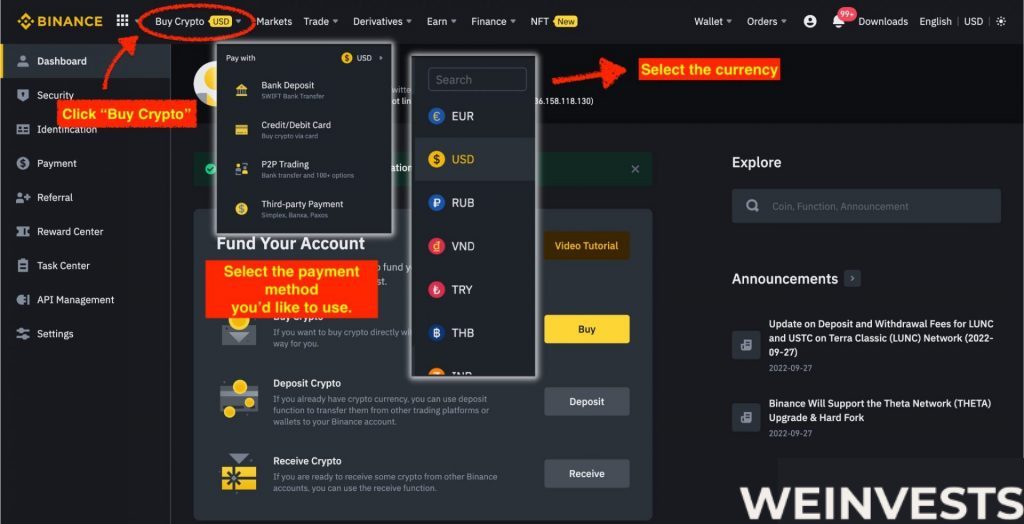

Step 2: Fund your Account

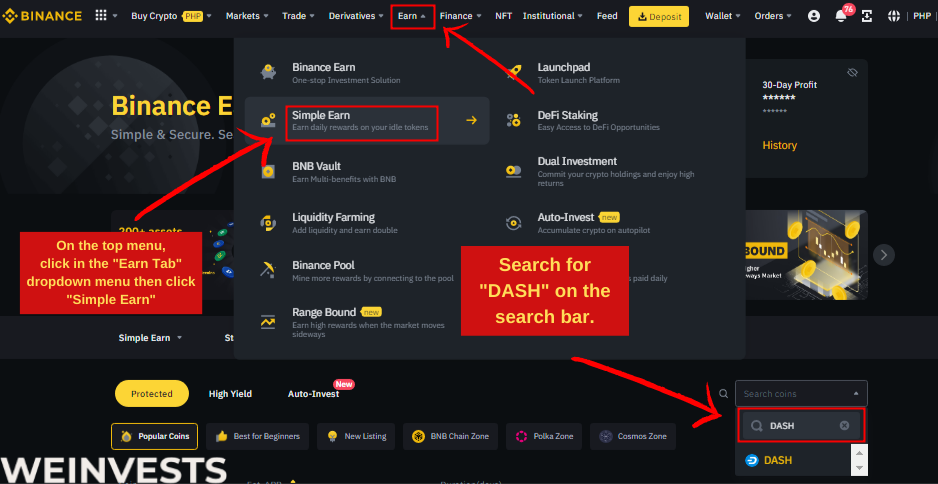

Once your account is set up, log in to Binance and go to the “Earn” section. You can find this by clicking on the “Simple Earn” tab.

Go to the drop-down menu labeled ‘Earn.’ Here, you will have multiple options. Click on ‘Binance Earn’ and then search for ‘DASH’.

Step 4: Analyze the Staking Parameters and Stake

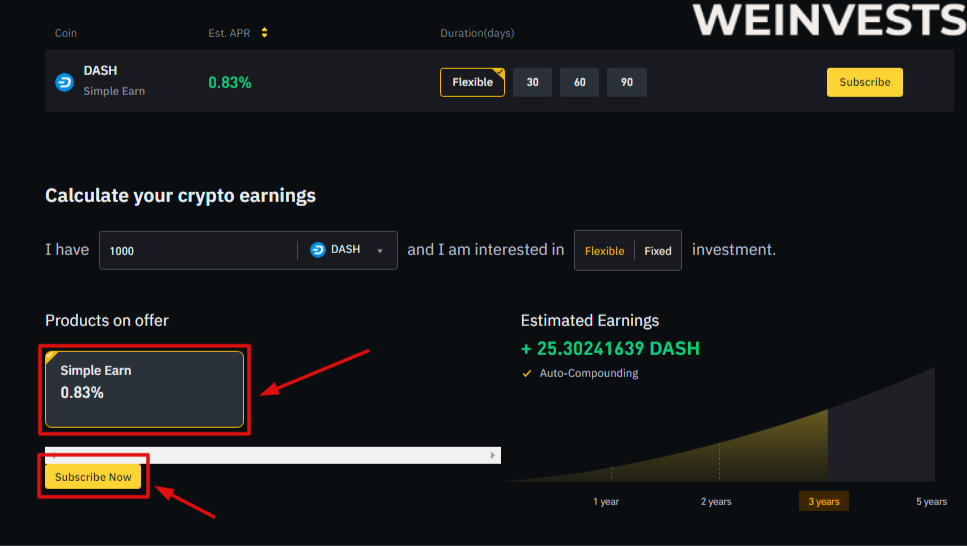

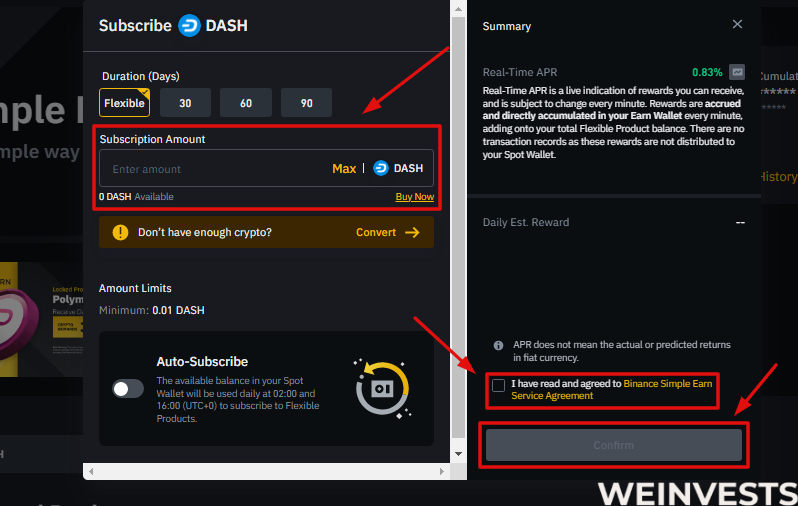

Find the Dash staking product and click on “Subscribe”. This will open up a new page where you can enter the amount of Dash you want to stake.

After analyzing, you can subscribe to the program.

If you want to earn rewards with your Dash (DASH) on Binance.com, you can go to the “Products on Offer” section and then click “Simple Earn”.

“Simple Earn” lets you deposit your DASH in flexible or locked products and earn daily rewards. You can subscribe or redeem at any time, so you can maintain your assets’ flexibility and liquidity. The rewards are sourced from Binance’s own funds and are based on the market conditions.

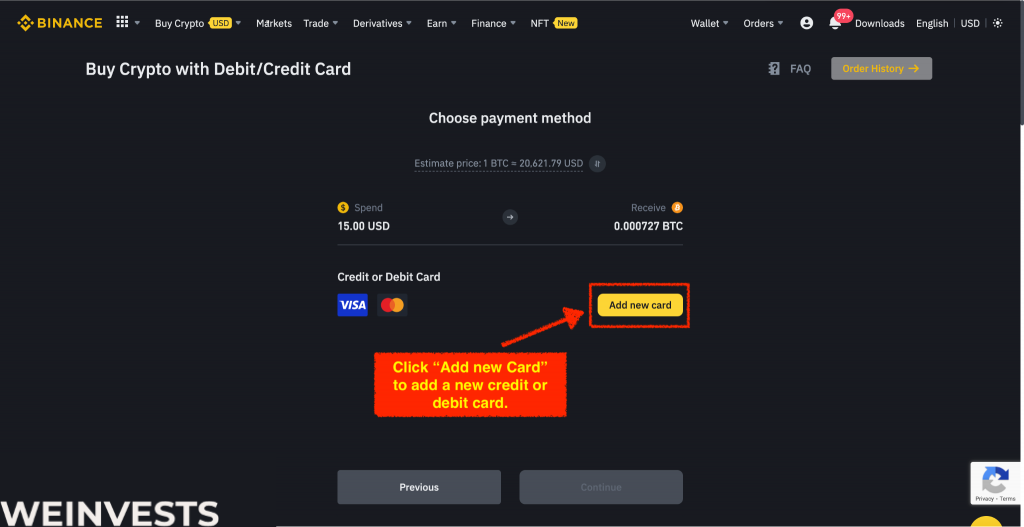

1. Purchase DASH.

The first thing you need to do when staking Dash is to purchase DASH coins. To do this, you have to create an account with an exchange, but if you already have an account with a trusted exchange, simply buy DASH coins via the account.

If, however, you just created an account with a trusted exchange, navigate to the deposit page, where you will send fiat to your account. You can swap fiat for DASH on the exchange.

2. Stake DASH via your chosen exchange.

The next step is to stake DASH, and you can do this by depositing your DASH coins in a staking pool. Most centralised cryptocurrency exchanges offer staking pools with different staking periods. While some exchanges offer flexibility and allow you to withdraw your coins whenever you want, others are strict and permit withdrawal only at the stipulated time.

You should choose the staking period that lines up with your expectations for your stake. Keep in mind that although you can withdraw before the expiration of the lock-up period of some exchanges, you may not receive your interest, if any, before the end of the staking period.

3. Unstake DASH at Your Discretion or at the End of the Staking Period.

After you stake your decided amount of DASH, you have to exercise patience. This next step is a waiting game, so try to hold on until the lock-up period elapses so that you can receive your rewards. If you like, you can restake a sum that is more or less than or equal to your initial stake. You may also restake the yields with your initial stake to gain even more returns at the same percentage. But earnings change regularly, so you may not find a stake with the same yield and staking period.

Dash Staking Tax

The UK has general guidelines on taxing staking, and these guidelines place the onus on crypto investors to figure out how much tax they are to pay. The guidelines are provided in the crypto assets manual, as created by Her Majesty’s Revenue and Customs (HMRC). According to this manual, (dash) stakers must study the terms and conditions of the platforms through which they stake their coins. Careful examination of these terms and conditions will determine and reveal if you must pay additional levies.

Note that, according to this HMRC-provided guideline, if a DASH staking platform has used your coins while holding them, that could be an indication that beneficial ownership of your DASH coins has passed. The situation would, therefore, be regarded as a disposal, thus incurring capital gains tax.

The UK and the US share a similarity in taxing cryptocurrency in that both countries do not consider cryptocurrency assets to be legal tender or currency. Because of this approach to crypto assets, if you are a resident of the UK, your yields from staking DASH would not be regarded as interest. Whatever profit you earn from staking DASH would be subject to income tax.

As long as you hold and stake DASH as a personal investment, the UK taxes any profit you make from your coins. If you receive DASH via confirmation rewards, mining, airdrop, or as your salary from your employer, you will be taxed on the receipt. If you suffer losses while staking and sell your coins at a loss, the loss can be calculated and deducted from your overall capital gain. This reduces your tax liability by reducing your capital gains tax.

In the UK, you may pay capital gains tax, i.e., tax on the appreciated value of an asset when you sell it if your yearly gains surpass the annual tax-free allowance, which is 12,300 great British pounds. Thus, if you stake DASH and gain high enough yields to sell, as a citizen or resident of the UK, you are not to pay capital gains tax unless your profit exceeds 12,300 pounds.

Why do people like Staking Dash?

People like staking DASH for many reasons, one of which is the Dash network. The Dash network emphasizes privacy and scalability, and this has led to the pioneering of innovative features such as Masternodes, long-living Masternode quorums, InstantSend, and many more, some of which have been adopted by other crypto networks.

Also, DASH is getting scarcer every day because it has a limited supply of 18.9 million coins, with around 10 million DASH coins in circulation (this is a relatively conservative supply, especially when compared to coins such as Ethereum, Bitcoin, or Litecoin).

As DASH becomes scarcer and the Dash network grows, it is almost inevitable that the price of DASH soars. Staking DASH, especially for long periods of time, ensures that you have a foot in the race and that you can gain significant yields from your stake. These qualities make the Dash network attractive as a cryptocurrency payment space, and even more to potential stakers.

Conclusion

Dash staking is the process by which investors stake DASH for a certain period while belonging to or operating a Masternode that validates transactions on the blockchain. It is somewhat similar to keeping cash in a bank account and gaining interest on such money.

Dash upholds decentralization, privacy, and efficiency above all, and this has led to its many innovations, which have set it up as a potential competition to bitcoin; although it emerged as a litecoin fork, which was, in turn, a bitcoin fork. Staking DASH offers investors the opportunity to contribute to, and profit from, the Blockchain economy. As a staker, you can participate in decentralized governance via Dash’s DAO by voting on the allocation of the Dash Treasury.

Dash Staking FAQs

Is Dash Proof-of-Stake or Proof-of-Work?

Dash is a double-layered crypto network that is both Proof-of-Stake (PoS) and Proof-of-Work (PoW). The mining layer, which uses the proof-of-work protocol, processes “regular” transactions, and mining rewards are granted to miners at a 45% profit based on computational power. The second layer of the Dash network is the validating or Masternode layer, and this layer uses proof-of-stake. Proof-of-stake provides yields based on the number of coins a user owns. The validating layer sets Dash apart from other crypto networks.

Is Dash Staking Profitable?

Dash staking can be profitable, with returns and interests generally high for verifying block transactions and contributing to the blockchain economy. The rewards you gain from validating blocks are somewhat dependent on the size of the staking pool you are part of. If you are part of a large pool with many people, your rewards may be small because the rewards will be shared between all participants in the pool. However, with Dash staking, you can be sure that your Masternode will receive 45% of mined DASH (as long as the node does not go against the staking policies).

But remember that DASH is a cryptocurrency, so it is volatile, and the tides could easily and swiftly turn.

For how long should I stake DASH?

The duration for which you stake DASH should depend entirely on you and your risk capacity, yield goals, and the level of flexibility you want. It is essential that you consider these factors and much more such as the amount of time you are willing to hodl. If you plan to hold your coins for a short- or mid-term period, look for stake pools that offer high yields for relatively shorter periods, or consider stake pools that offer flexibility and allow participants to withdraw their coins before the expiration of the lockup period.

If you are looking to hold your coins for the long term, and this is usually a period of four years measured in terms of crypto market cycles, find the longest lockup periods with the highest yields and stake your DASH coins.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More