Investing in the stock market can be an exciting and rewarding endeavor, and one company that consistently garners attention from investors is Microsoft Corporation (stock ticker: MSFT).

As a renowned technology giant, Microsoft has demonstrated significant growth and innovation over the years, making it an attractive investment opportunity.

Through this article, we will walk you through the process of buying Microsoft stock, covering crucial aspects such as choosing a reputable broker, analyzing the company’s financials, assessing its competition, and exploring alternative investment options.

Whether you are a seasoned investor or a beginner looking to start your investment journey, this guide will provide you with valuable insights on how to invest in Microsoft stock effectively.

How much does it cost to buy Microsoft stock?

Decide How Much to Invest In Microsoft Shares

First, assess your budget and financial situation. Determine the amount you can comfortably invest in Microsoft stocks without compromising your overall financial stability. Take into account your income, expenses, and existing investment commitments.

Next, stay updated with Microsoft’s current stock price. As of 25.05.2023, Microsoft is trading at USD 325.92 per piece. This information will help you calculate the number of shares you can afford buying, based on your budget and desired investment amount.

Define your investment strategy and goals. The way of trading MSFT depends on if you are looking for long-term growth or short-term gains. Consider your risk tolerance and investment horizon. This will guide your decision on how much to allocate to Microsoft stocks within your investment portfolio.

Evaluate your existing investments and how Microsoft stocks fit into your overall portfolio. Diversification is essential for managing risk effectively. Assess the potential correlation between Microsoft stocks and your other investments to achieve a well-balanced portfolio.

How to Invest In Microsoft Stocks With eToro

Investing in Microsoft shares through eToro offers a convenient and user-friendly experience for traders. With eToro’s intuitive platform and comprehensive features, you can navigate the investment process with ease and make informed decisions.

Step 1: Open an Account

To get started, visit the eToro website and sign up by providing your personal details, including your name, email address, and a secure password.

Step 2: Upload ID

After registering, eToro requires you to verify your identity. This involves uploading identification documents such as a valid passport or driver’s license. Once verified, you can proceed to trade.

Step 3: Make a Deposit

eToro offers various funding options, including bank transfers, credit/debit cards, and e-wallets. Choose the method that suits you best and follow the instructions to deposit funds into your eToro account.

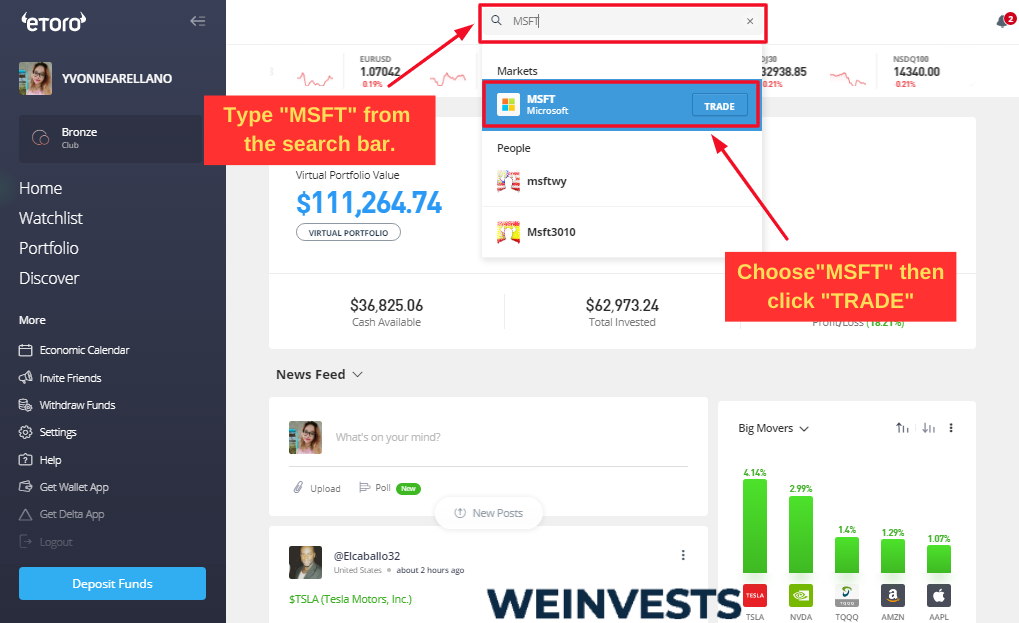

Step 4: Search for MSFT

Using the search function, enter “Microsoft” or the stock symbol “MSFT” to find it. The platform provides additional information such as historical data, analyst ratings, and market sentiment to assist you in making informed investment decisions.

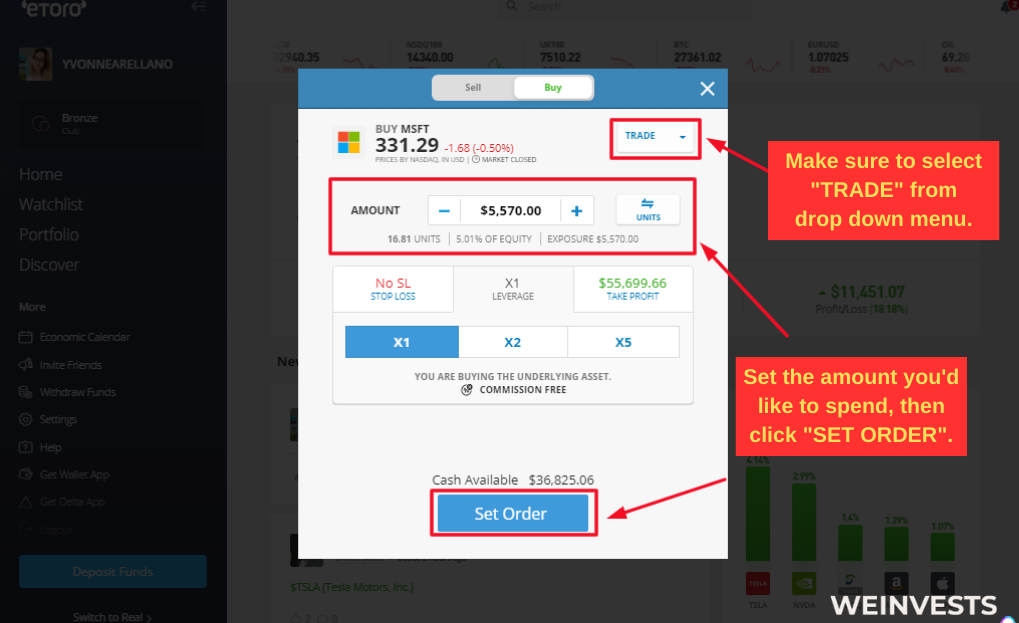

Step 5: Buy/Sell MSFT

Specify the number of Microsoft shares you want to purchase and review the current market price displayed on eToro’s real-time pricing. When you’re ready, confirm the buy order to execute the trade.

eToro’s user-friendly interface allows you to track the performance of your Microsoft stocks, access relevant news and analysis, and set up price alerts. You can make adjustments to your investment strategy as needed, keeping a close eye on market trends and developments.

Choosing the Best Online Broker to Buy Microsoft Shares

Choosing the right brokerage option for purchasing Microsoft shares is a crucial step. Here are some key points to consider:

- Online brokerage vs. full-service broker: Decide whether you prefer a self-directed online brokerage or a full-service broker. Online brokerages offer flexibility and control, while full-service brokers provide personalized advice and assistance.

- Fees and commissions: Understand the fee structure of the broker. Consider account maintenance fees, trade commissions, and transaction charges. Review these costs to ensure they align with your trading frequency and investment goals.

- Order types: Familiarize yourself with different order types. Market orders allow you to buy or sell at the best available price, while limit orders let you set a specific price for buying or selling.

- Dollar-cost averaging: Consider implementing a strategy like dollar-cost averaging. This involves regularly investing a fixed amount in Microsoft or other securities at predefined intervals, regardless of market fluctuations.

MSFT financials

Assessing the risks and potential rewards of investing in Microsoft requires careful consideration of various factors:

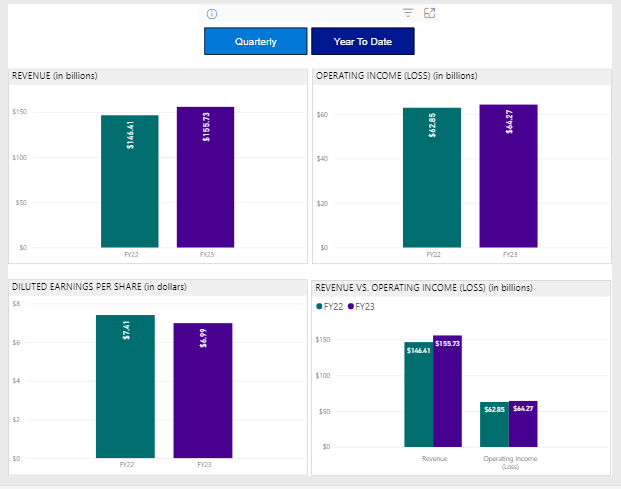

- Financial Performance: Analyze Microsoft’s revenue growth and net income to understand its financial health. MSFT’s revenue growth has been on the rise with 15.56% in average revenue growth since 2018. Net income has also shown positive results with an increase of about 40% on average.

- Earnings per Share (EPS): Consider Microsoft’s EPS, which measures its profitability on a per-share basis. Microsoft has consistently delivered impressive EPS, except in 2022, where MSFT showed a slight miss of 0.67%.

- Price-to-Earnings (P/E) Ratio: Evaluate Microsoft’s P/E ratio, which compares the stock price to the company’s earnings. MSFT’s P/E ratio was at 26.62 in fiscal 2022.

- Market Share: Microsoft holds a significant market share across various technology sectors. The market capitalization is around USD 2.423 trillion.

- Risks: Investing in Microsoft carries certain risks, including intense competition in the technology industry, potential cybersecurity threats, and regulatory challenges.

- Potential Rewards: Microsoft offers the potential for significant rewards, given its strong financial performance, diversified product offerings, and ongoing innovations in emerging technologies such as artificial intelligence and cloud computing.

When considering an investment in Microsoft, conducting thorough research, analyzing financial metrics, and assessing the company’s competitive position are vital. Additionally, consulting with financial advisors can provide tailored insights based on individual investment goals and risk tolerance.

Assessing the company’s competition

Assessing the competition is crucial when evaluating an investment in Microsoft Corporation. While it is a huge technology giant with a strong market position, it faces competition in various sectors.

In the operating systems market, Microsoft competes with Apple’s macOS and various Linux distributions. Each platform offers unique features and user experiences, influencing consumer preferences and market share.

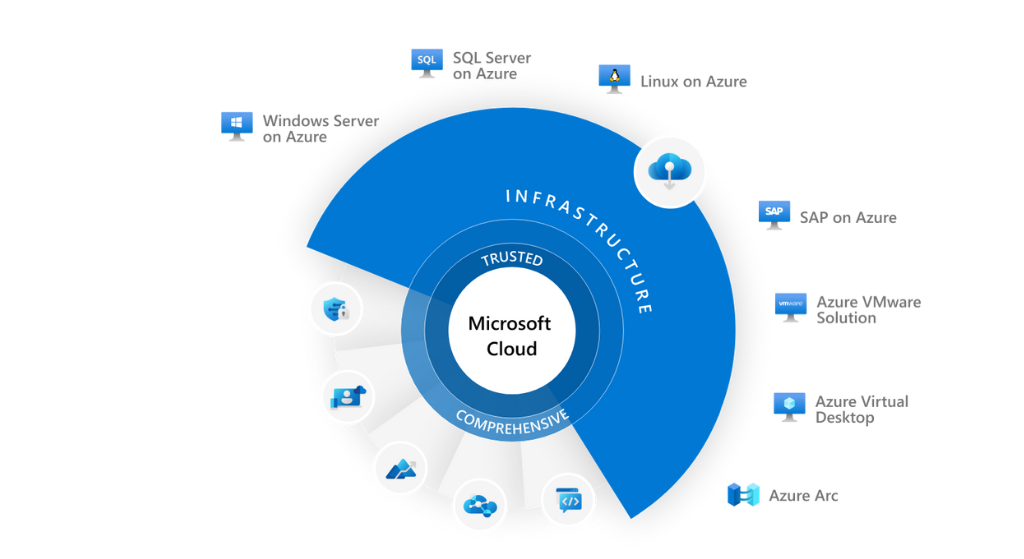

In cloud computing, Microsoft Azure competes with Amazon Web Services (AWS) and Google Cloud Platform. These cloud providers offer similar services, and competition is fierce to capture market share in this rapidly growing industry.

In the productivity software space, Microsoft Office faces competition from Google Workspace and other productivity suites. The choice between these platforms often depends on factors such as collaboration features, ease of use, and compatibility with other applications.

Alternative ways to invest in MSFT

In addition to buying individual Microsoft stocks, there are alternative investment options to consider:

- Investing in Exchange-Traded Funds (ETFs) and Index Funds: ETFs and index funds offer a diversified portfolio of stocks, including Microsoft. By investing in these funds, you can gain exposure to Microsoft along with other companies in a specific market index or industry sector.

- Stock Options and Futures: Advanced investors may explore trading options and futures contracts related to Microsoft stocks. These derivative instruments allow investors to speculate on the price movements of Microsoft stocks without directly owning them. Options and futures can offer leverage and flexibility for those who are experienced in trading these instruments.

- Fractional Shares: If you have a limited budget, you can consider buying fractional shares of Microsoft stocks. Fractional shares allow you to invest in a portion of a single share, making it more affordable and accessible.

Conclusion

Eventually, investing in Microsoft can be done through various avenues, including traditional stock purchasing, ETFs and index funds, trading options and futures, and fractional shares. Each method offers its advantages and considerations, allowing investors to tailor their approach based on their financial goals, risk tolerance, and budget.

However, in each of those cases, it is fundamental to conduct thorough research, assessing the company’s financial performance and the competitive landscape surrounding it, thus staying informed about the industry and market trends.

Additionally, seeking professional guidance from qualified financial advisors may provide valuable insights into optimizing your investment strategy. Ultimately, investing in Microsoft shares presents opportunities for potential growth and long-term returns in the technology sector.

FAQs

Are there any minimum investment requirements to buy MSFT?

This may vary depending on the broker you choose. Some brokers may have a minimum investment amount for individual stocks, including Microsoft.

Is it possible to receive dividends from owning Microsoft shares?

Yes, Microsoft regularly pays dividends to its shareholders. The dividend amount is subject to change and is usually based on the company’s financial performance and board decisions.

What is Microsoft’s stance on sustainability and corporate social responsibility?

Microsoft has made significant commitments to sustainability and corporate social responsibility. It aims to be carbon negative by 2030 and has initiatives in place to promote diversity and inclusion, ethical business practices, as well as philanthropy.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More