Meta Platforms Inc. (stock ticker: META), formerly known as Facebook Inc. is a renowned technology company with a significant presence in the social media and tech industries.

With a diverse portfolio of popular platforms like Facebook, Instagram, WhatsApp, and Oculus, Meta has established itself as a global leader in the digital landscape.

In this comprehensive guide, we will provide you with valuable insights and step-by-step instructions on how to buy META and explore alternative investment options.

We will cover essential aspects such as choosing the right brokerage, analyzing the company’s financial performance, understanding market competition, and assessing risks and potential rewards.

How much does it cost to buy How To Buy Meta Stocks?

Decide How Much to Invest In Meta Shares

Before investing in Meta stocks, several factors should be considered:

- Budget: Assess your financial situation and determine how much you can comfortably invest in Meta stocks. Consider your overall investment portfolio and allocate an appropriate portion of these stocks.

- META’s Current Price: Stay updated with Meta’s stock price. This information will help you calculate the number of shares you can afford based on your budget and desired investment amount. At the moment, Meta is trading at USD 252.69 per piece (as of 25.05.2023).

- Investing Strategy: Define your investment strategy and goals. Are you looking for long-term growth or short-term gains? Understanding your strategy will guide your investment decisions and help you stay focused on your objectives.

- Other Investments: Evaluate your existing investments and how Meta stocks fit into your overall portfolio. Diversification is key to managing risk effectively. Consider the potential correlation between Meta stocks and your other investments to achieve a balanced portfolio.

How to Invest In Meta Stocks With eToro

Investing in Meta stocks through eToro offers a seamless and accessible experience for traders. With eToro’s user-friendly platform and comprehensive range of features, you can easily navigate the process and make informed investment decisions. Whether you are a seasoned investor or just starting your investment journey, eToro provides a reliable and convenient platform to engage in investing.

Step 1: Open an Account

To begin investing in Meta stocks, visit the eToro website and sign up by providing your personal information, including your name, email address, and a secure password.

Step 2: Upload ID

After registering, eToro requires you to verify your identity. This involves uploading identification documents such as a valid passport or driver’s license. Once approved, you can proceed with trading.

Step 3: Make a Deposit

eToro provides various funding options, including bank transfers, credit/debit cards, and e-wallets. Choose the method that suits you best and follow the instructions to deposit into your eToro account.

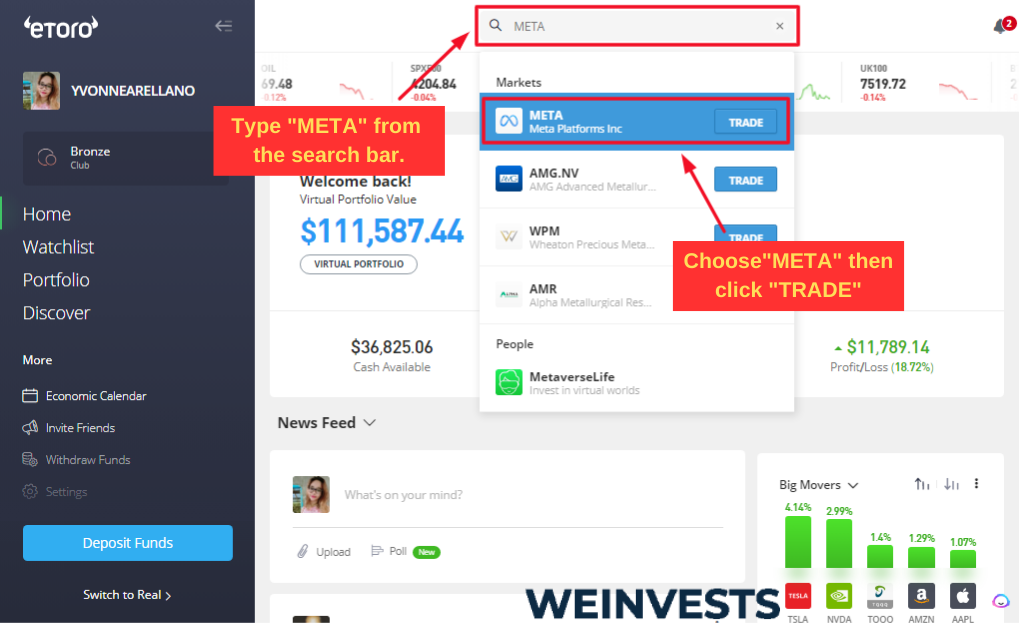

Step 4: Search for Meta

Simply type its stock ticker symbol META or the full company name – Meta Platforms Inc. in the search tab and you will find it. Additionally, you may wish to explore the information available on its stock performance, such as historical data, analyst ratings, and market sentiment, to make better-informed investment decisions.

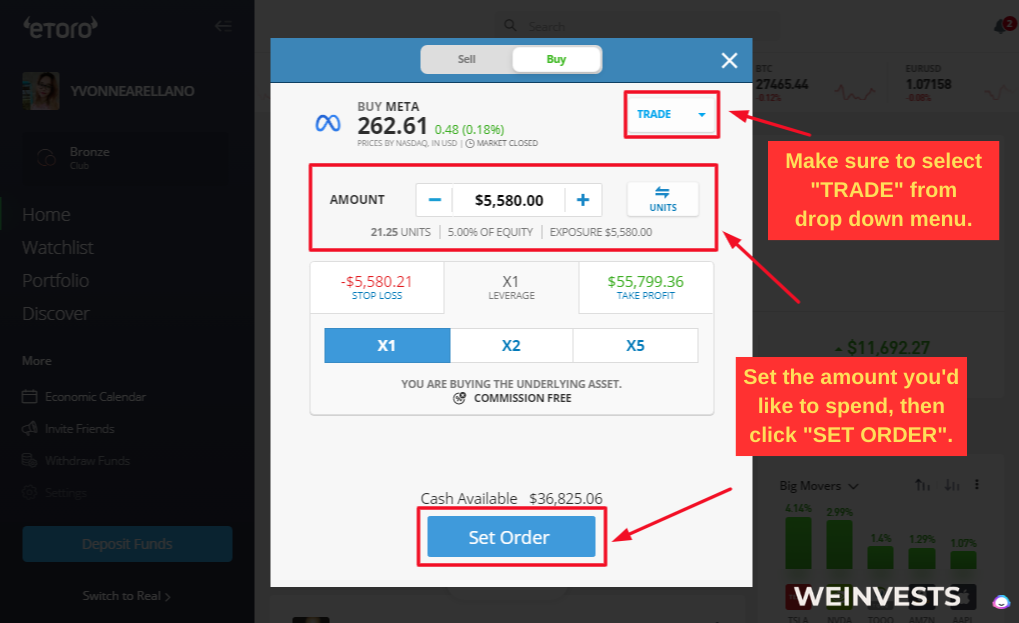

Step 5: Buy/Sell Meta

Specify the number of shares you wish to purchase and review the current market price. eToro offers real-time pricing, ensuring transparency in your transactions. When you are ready, confirm the buy order to execute the trade.

eToro provides a user-friendly interface that allows you to track the performance of your stocks, access relevant news and analysis, and set up price alerts. You can make adjustments to your investment strategy as needed.

Choosing the Right Online Broker To buy Meta Stocks

When choosing a suitable brokerage for purchasing Meta’s shares, there are several key points to consider.

First, you need to decide between an online brokerage or a full-service broker. Online brokerages offer self-directed trading platforms, providing flexibility and control over your investments, while full-service brokers offer personalized advice and assistance but often come with higher fees.

Understanding fees and commissions is also crucial to optimize your investment strategy. Different brokerages may have varying fee structures, including account maintenance fees, trade commissions, and transaction charges. It is essential to carefully review these costs to ensure they align with your trading frequency and investment goals.

Different order types play a significant role in executing trades effectively. Market orders allow you to buy or sell securities at the best available price in the current market. On the other hand, limit orders enable you to set a specific price at which you are willing to buy or sell, ensuring you have more control over the execution price.

Implementing dollar-cost averaging can be a prudent strategy for long-term investors. This approach involves regularly investing a fixed dollar amount in META or other assets at predefined intervals, regardless of the market’s ups and downs.

Financials of Meta Platforms Inc.

Assessing the risks and potential rewards of investing in Meta requires careful consideration of various factors (all data as of 25.05.2023).

- Financial Performance: Analyzing Meta’s revenue and net income is crucial to understand its growth and profitability. Consistent revenue growth and healthy net income indicate a strong financial foundation.

- Earnings per Share (EPS): EPS measures the company’s profitability on a per-share basis. Higher EPS indicates higher profitability and potential returns for shareholders. Unfortunately, Meta has missed its EPS estimates in the previous 2 years.

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares the stock price to the company’s earnings. A high P/E ratio suggests the market has high expectations for future growth, while a low ratio may indicate undervaluation or concerns about future prospects. Meta also has a decent P/E ratio of 30.61%.

- Market Share: Examining Meta’s market share helps assess its competitive position. A growing or dominant market share signifies potential stability and the ability to capture a significant portion of the market. Meta’s market capitalization is considered dominant with around USD 638 billion.

- Risks: Investing in META carries inherent risks, including technological advancements by competitors, regulatory changes, market volatility, and potential litigation.

- Potential Rewards: Investing in Meta’s stocks can provide opportunities for significant returns if the company successfully leverages its technology, expands its user base, enters new markets, and maintains a competitive edge.

When considering investing in META, it’s essential to conduct thorough research, analyze financial metrics, assess risks, and evaluate the company’s potential for growth and profitability. Additionally, seeking professional advice from financial advisors can provide valuable insights tailored to individual investment goals and risk tolerance.

Assessing the company’s competition

As a leading player in augmented reality (AR) and virtual reality (VR), Meta faces challenges from established giants and emerging startups alike. Companies like Apple, Google, and Microsoft are investing heavily in AR/VR technologies, striving to outpace Meta’s innovations.

Startups with unique approaches and niche applications are also vying for a slice of the market. To maintain its edge, Meta must continuously push boundaries, enhance user experiences, and develop ground-breaking hardware and software solutions.

Competition fosters innovation, and Meta thrives in this fast-paced race, constantly refining its products, expanding its developer ecosystem, and exploring new applications beyond gaming and social interactions. As the battle for AR/VR dominance intensifies, consumers eagerly await the next wave of the company’s advancements and the transformative potential they hold.

Alternative Ways of Investing in Meta

Apart from buying individual Meta stocks, there are alternative investment options to consider:

- Investing in Exchange-Traded Funds (ETFs) and Index Funds: These funds consist of a diversified portfolio of stocks, including Meta stocks. By investing in ETFs or index funds, you can gain exposure to Meta along with other companies in a specific market index or industry sector.

- Stock Options and Futures: Advanced investors may explore trading options and futures contracts related to Meta stocks. These derivative instruments provide opportunities to speculate on the price movements of Meta stocks without directly owning them.

- Fractional Shares: If you have a smaller budget, you can consider buying fractional shares of Meta stocks. Fractional shares allow you to invest in a portion of a single share, making it more accessible for investors with limited capital.

Conclusion

The purchase of Meta’s shares can be a rewarding investment opportunity, however, it requires thorough research and due diligence by the investor her/himself. We have covered the essential steps to guide you through the process of buying Meta stocks, including choosing the right brokerage, analyzing the company’s financials, and considering alternative investment options.

Please, bear in mind to always align your investment decisions with your future financial goals, conduct comprehensive research, staying constantly informed about Meta’s news and the general competitive landscape around it. Only then, you may confidently start your investment journey and try to take advantage of Meta’s potential growth and development opportunities.

FAQs

What factors should I consider when acquiring shares of Meta?

It is important to consider factors such as Meta’s financial performance, market competition, industry trends, and potential risks associated with investing in the technology sector.

What are the risks of investing in Meta?

Investing in Meta stocks carries inherent risks, including market volatility, technological advancements by competitors, regulatory changes, and potential litigation.

How can I stay updated on Meta’s stock performance?

You can stay updated on Meta’s stock performance by regularly monitoring financial news, using stock market analysis tools, following reputable investment websites, and utilizing the resources provided by your chosen brokerage platform.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More