This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Real estate investing is crucial for a well-diversified portfolio.

In the past, the sector has outperformed the broad market in bullish times. It’s also famous for not being very correlated with the stock and bond markets.

With the advent of ETFs, getting exposure to this market has been easier than ever.

Vanguard has issued one that invests in real estate companies in the United States. It’s called Vanguard Real Estate ETF and provides exposure to REITS (Real Estate Investment Trusts), as well as real estate firms.

Besides the improved diversification, such a fund can be of value to the income-seeking investor. REITs, which constitute the majority of the Vanguard Real Estate ETF, must distribute at least 90% of their profits to their shareholders. For this reason, it’s very common to see REITs with high dividend yields.

But Vanguard Real Estate ETF isn’t the only one that tracks the real estate market out there. How do you know this is the right option for you? What about its competitors?

In this article, we want to address all of this ETF’s features, benefits, and risks. This way, you will be able to judge by yourself if this is the right vehicle for you to get exposure to the real estate market.

Let’s dive right into it…

Table of Contents

ETF Fundamentals

Vanguard Real Estate ETF was created in 2004, is managed by Vanguard, and it’s traded on NYSE Arca under the ticker symbol “NVQ”.

It has $36.8 billion under management and charges an expense ratio of 0.12%. When it comes to its fee, it’s a good idea to compare it with what other similar ETFs charge.

But we’ll also mention the inception dates of competitors because the older the fund is, the longer the track record. And the expense ratio should be viewed through the lens of historical performance.

First of all, the second largest real estate ETF, Schwab US REIT ETF (ticker: SCHH), was issued in 2011 and charges 0.07%.

Then we have the Real Estate Select Sector SPDR Fund (XLRE), which was launched in 2015 and charges 0.1%.

Last, the oldest of all these, iShares U.S. Real Estate ETF (IYR), was issued in 2000 and charges 0.39%.

Now, when it comes to the yield of VNQ, its trailing twelve-month distribution yield is 3.62%. Also, its portfolio turnover rate was reported at 7.4% as of 01/31/2023.

As for its performance, we will need to look at the returns during different periods to have a clear idea of that.

Since its inception, the fund’s price has grown by 7.98% per year on average. For comparison, the price of the index it tracks has increased by 8%.

In the last decade, VNQ has realized an annualized return of 7.08% on average. The benchmark’s price has increased by 7.19% per year.

Last, in the past 5 years, the fund’s market price increased by an average compound rate of 6.64% per year, while the index had its price increase by 6.77% in the same period.

Investment Strategy

Now, let’s explain what exactly Vanguard Real Estate ETF does.

This is a passive ETF, which means that it tries to replicate the performance of an index. This is the MSCI US Investable Market Real Estate 25/50 Index. By tracking this index, Vanguard’s ETF aims to provide investors with a high dividend yield and decent long-term capital growth at the same time.

The index is weighted by market capitalization, so the fund’s exposure to the index’s constituents is based on their market caps. More so, the index has criteria for selecting equities based on trading volume and outstanding shares. That way, it can avoid including illiquid stocks.

Currently, VNQ holds 167 stocks. Its largest holdings are Prologis Inc. (7.64% exposure), American Tower Corp. (6.66%), and Equinix Inc. (4.31%).

Speaking of exposure, Specialized REITs constitute 37.1% of the fund, Residential REITs about 13.6%, and Industrial REITs 12.6%

How to Buy in Vanguard Real Estate ETF (VNQ)?

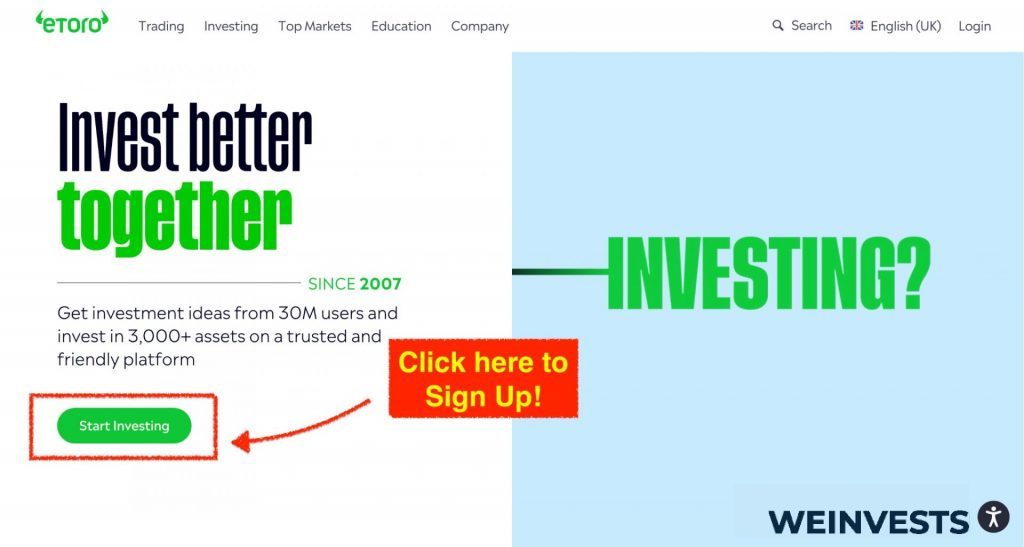

Offering a user-friendly platform, a wide range of investment options, and an excellent reputation. Both beginners and professional traders will find eToro to be a reliable choice. In this mini guide, we’ll walk you through the process of opening an account on eToro and investing in VNQ.

Step 1: Open an Account

To get started, navigate to the eToro homepage and click on the “Sign Up” or “Join Now” button. This will take you to the registration page, where you will need to provide your personal information, including your name, email address, phone number, and password. You can also sign up using your Facebook or Google account for a faster process. After completing the registration form, click on “Create Account.”

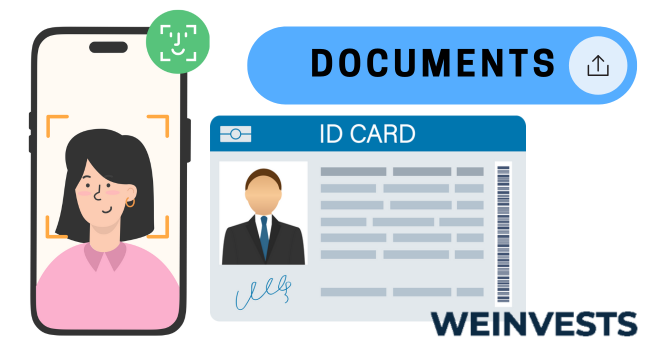

Step 2: Upload ID

Next, you will need to verify your identity by uploading a proof of identity documents, such as a government-issued ID card or passport. This step is essential to comply with regulatory requirements and ensure the security of your account. To do this, navigate to the “Profile” section, then click on “Verify Your Account.” Follow the instructions to upload the required document.

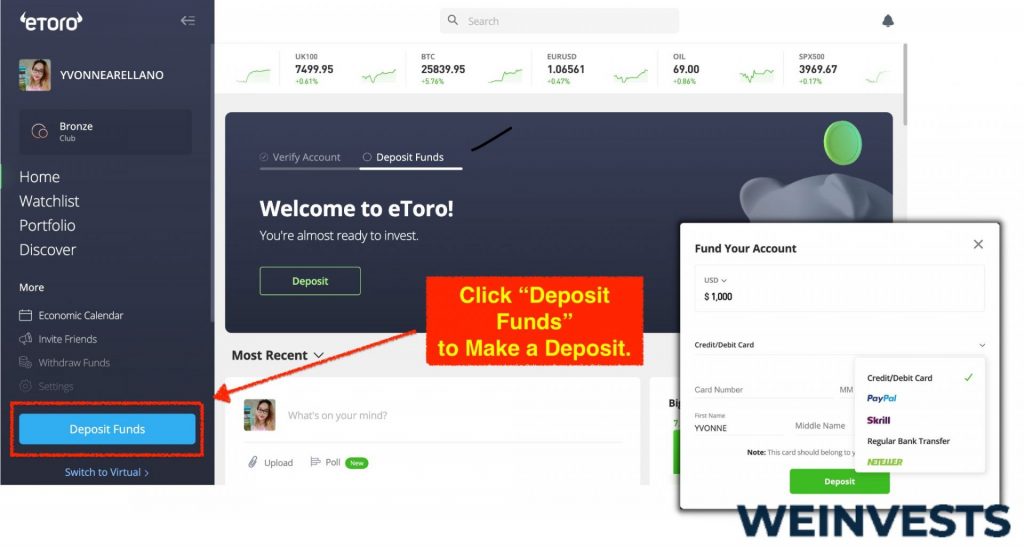

Step 3: Make a Deposit

Before you can start investing, you will need to deposit funds into your eToro account. To do this, click on the “Deposit Funds” button, which is typically located at the bottom left corner of the platform. You will then be prompted to choose your preferred deposit methods, such as credit/debit card, bank transfer, or e-wallet (e.g., PayPal, Skrill, or Neteller). Enter the amount you wish to deposit, and follow the on-screen instructions to complete the transaction.

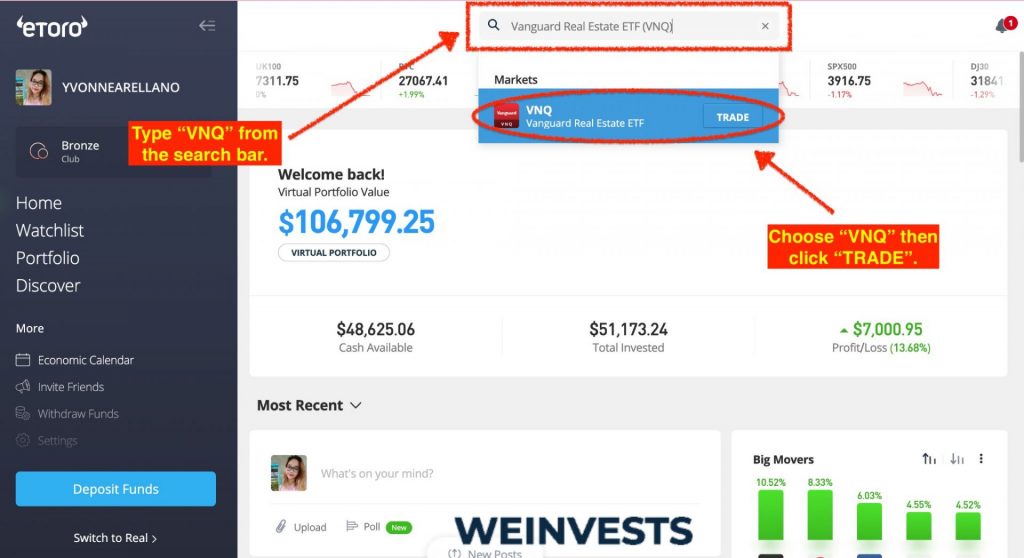

Step 4: Search for VNQ

Once your account is funded, you can search for the Vanguard Real Estate ETF (VNQ) on the eToro platform. Use the search bar at the top of the page and type in “VNQ” or “Vanguard Real Estate ETF.” The platform will display the relevant results, and you can click on the VNQ to access its dedicated page.

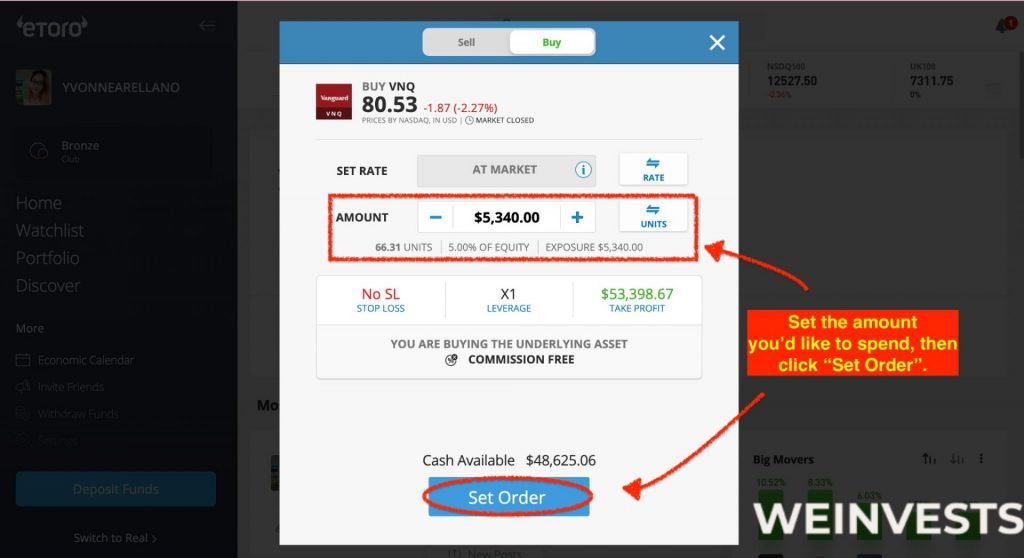

Step 5: Trade VNQ

To invest in VNQ, navigate to the VNQ page and click on the “Trade” button. A new window will appear, allowing you to enter the amount you wish to invest, set stop loss and take profit levels, and choose between a market or limit order. Review your order details and click on “Open Trade” to complete the transaction. Congratulations! You have successfully invested in Vanguard Real Estate ETF (VNQ) on eToro.

Note: eToro doesn’t offer direct ownership of the ETF, but a CFD (Contract for Difference) that will replicate the fund’s performance due to European regulations restricting the broker from offering non-EU ETFs directly. CFDs will perform almost exactly like the underlying ETFs, with a small deviation because of the eToro’s spread.

Risks and Considerations

All investment vehicles, ETFs included, carry risks that you should be aware of. Before you invest in VNQ, make sure that you understand the following risks. We’ll also give a rule of thumb regarding how much you should allocate to this ETF.

Stock Market Risk

Stock market risk is the possibility of a general decrease in the prices of equities. The stock market prices move in cycles with bull and bear periods. This risk can become more pronounced with ETFs like VNQ because it’s very common for REITs to use leverage and can be managed by investing in physical assets like gold as well.

Interest Rate Risk

Interest rate risk is related to the chance that borrowing costs for REITs will increase. This can negatively affect the prices of REITs as investors seek more attractive yields in bonds.

Volatility Risk

Volatility can be the worst enemy for investors who need to make withdrawals from their funds. Withdrawing money from your investments at unfavorable periods can realize losses that the less volatile the overall portfolio is, the more severe such losses will be. Real estate ETF investing, unlike direct ownership of real estate assets, will be more volatile because of the public’s speculation on REIT stocks.

Liquidity Risk

Liquidity is vital for the effective replication of an index. Even though the MSCI US Investable Market Real Estate 25/50 Index has liquidity criteria when selecting stocks, historical trading volume cannot guarantee future volume. And inadequate volatility can make trading the stocks for the ETF challenging to be done at favorable prices.

Sector Risk

This risk is related to the chance that the real estate sector as a market may suffer a decline in demand.

Last, let us consider how much you should allocate to VNQ.

A rule of thumb is provided by research made by Morningstar Associates and sponsored by Nareit. Their analysis suggests that the optimal allocation to REITs is in the range of 4% to 13%.

But keep in mind that your financial situation may suggest the need for a different allocation size. Consider consulting with a financial advisor to get tailor-made advice.

Conclusion

Real estate is definitely an important asset and a good addition to anyone’s portfolio. But REIT ETFs are the most liquid and passive way to get exposure to the sector.

VNQ is a good choice as its fees are reasonable, it has a long track record with returns very close to those of the index, and its issuer and manager, Vanguard, is a well-established institution.The ETF can provide investors with a decent dividend yield and capital appreciation at the same time, which makes it ideal for those who need some income but are not willing to sacrifice some of their principal in the process.

And as you noticed above, investing in this ETF is straightforward with an online trading platform account. But whichever broker you choose, make sure that you understand the risks associated with investing in this ETF before you buy it.

And it’s best to ask for advice from a professional financial advisor before you take any new investment decision. This article’s nature is informational and shouldn’t replace financial advice.

FAQs

Is VNQ a good ETF?

VNQ is a good ETF for someone looking for exposure to the real estate sector. It’s also a good option for dividend-seeking investors who require capital growth at the same time. Additionally, VNQ’s expense ratio of 0.12% is reasonable and it has a very long track record on which its performance is based.

Does VNQ pay a dividend?

Yes, VNQ pays a dividend as its holdings are mostly REITs which have to distribute at least 90% of their profits back to shareholders. The trailing twelve-month dividend yield of the ETF is 3.62%.

Is VNQ good for the long term?

VNQ is for both short-term and long-term investors. For a buy-and-hold strategy, it’s a good choice as its historical performance is very close to the benchmark’s.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More