This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The iShares Short-Term Corporate Bond ETF (IGSB) is an exchange-traded fund, which is trying to track the investment results of an index composed of USD-denominated investment-grade corporate bonds which have one to five years of remaining maturity. It is a low-cost investment instrument that gives exposure to a short-term and well-diverse portfolio of corporate bonds. The benchmark of this ETF is the ICE BofA US Short-Term Corporate Bond Index, the performance of which IGSB seeks to replicate.

Table of Contents

Characteristics, Performance Analysis, and Expectations

Characteristics

Similar to comparable ETFs, this fund offers exposure to a variety of industries, including but not limited to the below list which is positive in terms of sectorial diversity and concentration balancing:

- Finance

- Healthcare

- Energy

- Others

By holding thousands of bonds, IGSB significantly reduces the risk involved in investing in a single or few issuers. The regular rebalancing to make sure that the bond holdings match the index it follows, as well as the fund’s dividend payments to its investors are both done monthly.

As the fund’s name suggests, iShares Short-Term Corporate Bond ETF is a fixed-income facility, pre-structured as a large collection of short-term debt securities – bonds issued by various U.S. corporations.

Although compared to long-term papers, shorter-maturity bonds offer lower returns these securities are also considered to be less risky, due to their holding periods. Many investors often prefer shorter maturities as a method of keeping their capital in a short-term investment option given their lower-risk characteristics.

As with any other ETF, IGSB shares are traded like normal company stocks, based on their share price which is called net asset value (NAV) for ETFs. It is defined as the difference between the fund’s total assets and liabilities (known as total net assets or TNA), divided by the number of outstanding shares.

Currently, the fund has below key characteristics worth taking into account before investing:

- TNA amounts to around USD 24.1 billion.

- It is distributed through its 3,500+ corporate bond holdings.

- The number of outstanding shares is nearly 476 million pieces.

- IGSB’s closing share price for the last trading day was USD 50.57.

- Its effective duration is currently calculated to be 2.6 years.

- The fund’s expense ratio is merely 0.04% – near the lowest in the ETF universe, which is charged by BlackRock as the fund manager for covering its operating costs.

Performance Analysis

In terms of its overall performance, IGSB has been on a good and mostly bullish run since its inception in early 2007, annually delivering an average of 2.28% in total return for its investors. The cumulative results are thus truly impressive, especially for a fund with short-term nature: a hypothetical USD 10,000 invested at the launch would have grown to over USD 14,300 making a cumulative return of exceeding 43% in total returns before taxes.

The current year 2023 too, started off positively for the fund – bringing a year-to-date (YTD) increase of 1.42% as of 31.01.2023 in its value.

Expectations

The promising start of fiscal 2023, the expected gradual slow-down of inflation rates, along with the general market trends to date, provide a mostly optimistic outlook for the rest of the year. As long as the short-term bonds continue their performance so far and no disappointing events occur in the near future then IGSB should continue its run up the hill, remaining a comparatively safe investment instrument. This concerns particularly the short-term oriented and individual investors, who are eagerly investing in such kinds of ETFs following their capital preservation strategies in turbulent times.

In particular, those seeking a simple and comparatively cheap option of participating in the short-term corporate bond market may consider this ETF.

Lastly, it can be an attractive choice for investors looking to diversify their portfolios, while targeting a shorter investment horizon and aiming to generate an additional income flow all at once.

If you’ll decide to invest in iShares Short-Term Corporate Bond ETF, you first need to check if your country of residence is eligible for trading BlackRock products directly on their website. There you can see the listed geographical areas, then select your continent or region which will drop down the approved country list, where iShare titles can be purchased. If positive, the next step should be to register and open a direct brokerage account with BlackRock. Upon doing so, you will be allowed to start investing through the whole range of their product line, including IGSB among others.

However, if you won’t find your country on the above-mentioned list, there are still two alternative options. First, if you have a different brokerage account with one of the online platforms, such as eToro, Interactive Brokers, or Trading 212, or else, you may try searching for the ticker symbol of this ETF by simply typing IGSB in the search bar. If not successful, then the last resort to apply is your good-old bank, which may help you to acquire the fund’s shares, provided that IGSB is already on their tradable list or can be added to it by your request.

If you’re looking to invest in iShares Short-Term Corporate Bond ETF (IGSB), eToro is an excellent choice. In this mini guide, we will walk you through the process of opening an account on eToro and investing in IGSB.

Step 1: Open your Personal Account

To begin, navigate to the eToro homepage and click on the “Sign Up” button to create a new account. You will be directed to a registration page where you’ll need to provide your personal information, such as your name, email address, and phone number. Once you’ve completed the form, click “Create Account” to proceed. You will receive an email with a link to verify your account.

Step 2: Upload ID

After verifying your account, you’ll need to provide proof of identity to comply with regulatory requirements. You can do this by uploading a clear image of your government-issued ID or passport. Make sure that your document is not expired and that all the necessary information is visible. Once your ID has been uploaded and approved, your account will be fully verified, allowing you to proceed with trading.

Step 3: Make a Deposit

To start investing in IGSB stocks, you’ll first need to fund your eToro account. Navigate to the “Deposit Funds” button on the platform and select your preferred payment method. eToro offers various options, including credit/debit cards, bank transfers, and e-wallets like PayPal, Neteller, and Skrill. Follow the on-screen instructions to complete the deposit process.

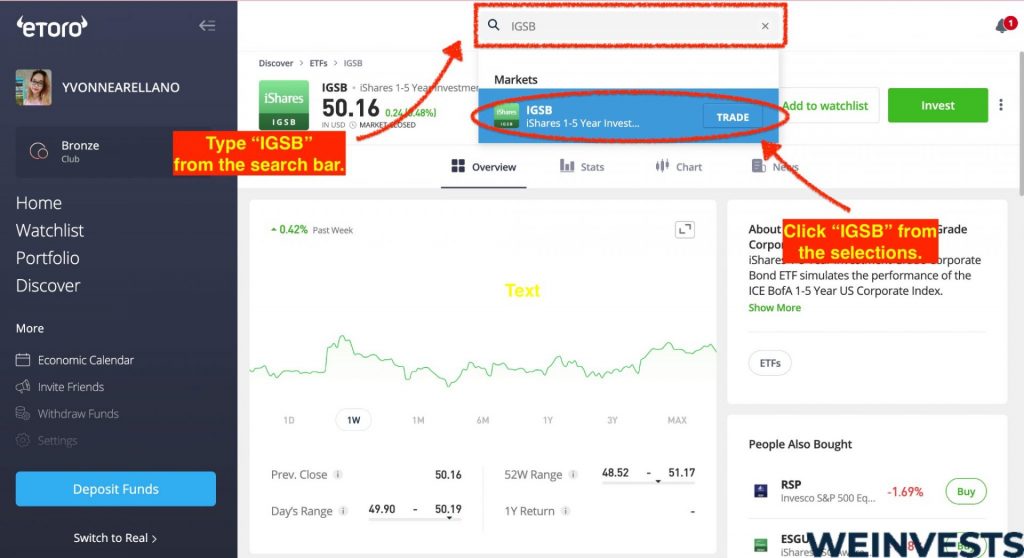

Step 4: Search for IGSB

With funds in your account, you’re now ready to search for IGSB on the eToro platform. Navigate to the main search bar and type in “iShares Short-Term Corporate Bond ETF” or the ticker symbol “IGSB.” The platform will display a list of matching results, and you can select the IGSB ETF from the list.

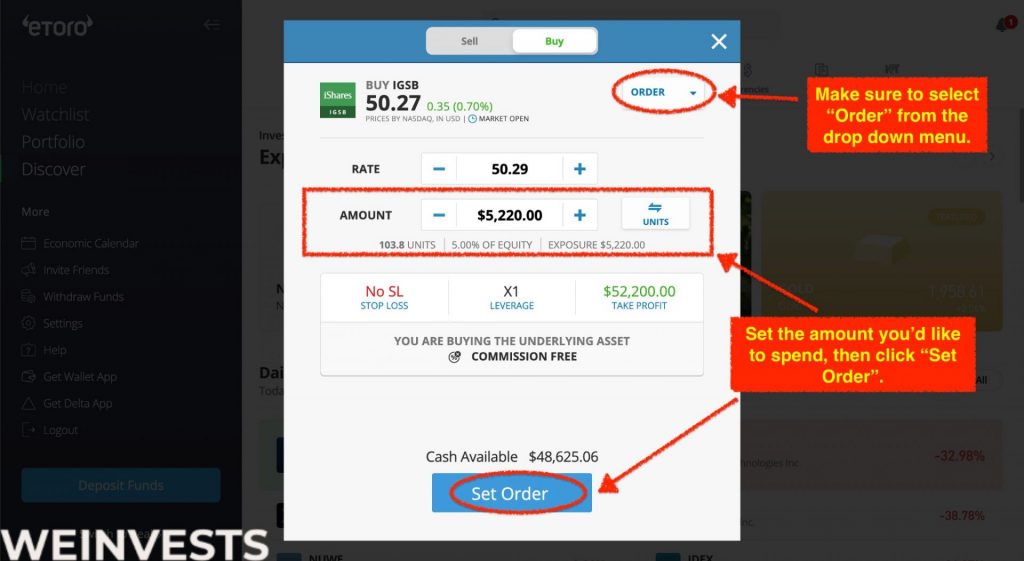

Step 5: Trade IGSB

After finding the IGSB ETF, click on the “Trade” button to initiate the trading process. A new window will appear, allowing you to enter the amount you’d like to invest, set stop-loss or take-profit orders, and choose your leverage (if applicable). Review your order details and click “Set Order” to complete the transaction. Congratulations, you have now invested in iShares Short-Term Corporate Bond ETF (IGSB) on eToro!

Risks associated with IGSB

Market Risk

As a market risk, we classify the risk-containing events which can be triggered by various important factors behind the financial markets. Once occurring, those may have the potential of affecting your portfolio both – positively or negatively. We typically classify factors like interest rate changes, significant fluctuations in the share price of a given instrument driven by supply/demand imbalances, high and lasting inflation, and strong volatility in key currency rates, as well as economic or political events having a big impact on the broader markets.

Since the iShares Short-Term Corporate Bond ETF is holding bonds issued by large companies, it is understandably affected by the financial performance of the issuers, adverse changes in their debt-servicing capacity, level of financial credibility, etc. Negative headlines about those enterprises, such as deterioration in their cash flow, unmatched quarterly earning targets, filed lawsuits, or revision of financial estimates of the company announced earlier will most probably impact IGSB’s share price negatively.

Therefore, prior to undertaking any investment in this or any other ETF, you might be eyeing, it is advisable conducting your own research for digging a bit deeper for understanding the market-related as well as other relevant risks (partially elaborated below), as these may cause a partial or complete loss of your invested capital.

Credit Risk

When talking about credit risk, we outline the risks connected with possible failures of the counterparties in servicing their actual financial liabilities. In the case of IGSB or bond ETFs in general, it would mean a default of one or more of the issuing companies. As a fixed-income facility, holding bonds only, the subject fund is exposed to many thousands of issuing entities, which may potentially fail the fulfillment of its own financial obligations.

Nevertheless, while in the case of IGSB, we are dealing with investment-grade bonds, the probability of default by issuing corporations is quite low. Still, it is important to take a closer look at the ETF’s holdings, trying to understand how high the credit risk could actually be in this case, prior to taking a final investment decision.

Liquidity Risk

Compared to other risk classes, liquidity risk is less complex because it is essentially related to an event or situation, which may create obstacles towards a fast and complete cash-out of the invested capital, provided that you would opt to do so. However, given the fund’s TNA and other key features like its high credibility, degree of diversification, multimillion-share trades daily, etc. liquidity risk related to iShares Short-Term Corporate Bond ETF is considered to be very low.

Valuation Risk

By valuation risk, we refer to such risk factors, which may cause possible discrepancies related to the pricing of a certain financial product. In the case of ETFs like IGSB, this type of risk is relatively low, provided that bond, as well as equity ETFs, are mainly traded via stock exchanges, where the share prices are fixed by the forces of supply and demand at any given moment.

However, there are still some internal as well as external events, which can influence the given ETF’s share price, depending on its underlying holdings. Yet, when focusing on IGSB and its good-quality holdings, the valuation risk is quite limited.

Risk Summary

| Risk | Relatively Low | Average | Relatively High |

| Market Risk | – | – | X |

| Credit Risk | – | – | X |

| Liquidity Risk | X | – | – |

| Valuation Risk | – | X | – |

Conclusion

Launched in January 2007 and managed by BlackRock, IGSB offers a good quality portfolio with a total net asset volume of around USD 24.1 billion. At the same time, it secures an annual dividend yield of 1.9% as of January 2023. Thus, it can be an interesting investment vehicle to be considered by investors looking for short-term index-linked bond portfolios, offering good and frequent dividend payments in parallel.

The iShares Short-Term Corporate Bond ETF is a reasonably priced investment vehicle with an expense ratio of merely 0.04%, which gives the investors exposure to a wide range of short-term USD-denominated corporate fixed-income debt instruments. IGSB holds over 3500 bonds with remaining maturities ranging from one to five years and its monthly dividend pay-outs provide a reliable source of additional income to investors. By owning thousands of bonds issued by well-established companies, IGSB offers good diversification with lower-than-usual interest rate risk, is compared to longer-term bonds.

This fund may prove to be suitable for both – individual as well as institutional investors, looking for a highly-rated (4 stars by Morningstar), broadly diversified, income-generating, and affordable option in the short-term corporate bond ETFs’ universe. Finally, it can serve as a valuable tool for any investor aiming to counterbalance possible over-exposures to the equity side in his portfolio through nowadays stormy markets. Nevertheless, it is important to emphasize that everyone, prior to going to invest large or small, must conduct his own research carefully before making the investment move.

Frequently Asked Questions

What is the usual holding period for short-term bond ETFs?

In general, short-term exchange-traded funds may hold bonds or other debt instruments with a maturity of below five years, however, some of the bond ETFs may go for even shorter maturities, ranging from one to three years.

What are the benefits of investing in short-term vs long-term ETFs?

Compared to their long-term alternatives, the short-term ETFs are characterized by lower levels of risk, more specifically – bearing less market and liquidity risks. Although the offered dividend yields are usually lower, however so are the related costs and their degree of volatility, too.

For which investor groups may IGSB be more suitable?

iShares Short-Term Corporate Bond ETF or its comparable peer funds may be more appropriate for investors, aiming to diversify their equity portfolios, while prioritizing capital preservation and reduction of fund management costs, securing a reliable regular income stream with a low-risk investment option in parallel.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More