Many people make far less than six figures per year. In fact, the average salary in the U.S. is just $60,575 per year. Most people will not win the lottery or inherit a vast amount of wealth.

Can you save your way to wealth? While saving more than you spend is a crucial part of finding financial success, consider the average interest rate on a savings account. It’s a paltry 0.53%. If you put $100,000 in a savings account and let it grow for 20 years, you would end up with about $111,065. Your money earned just over $11,000 in two decades.

So how can the average person create wealth for themselves and their families? Through investing. But investing can be intimidating for newcomers. There are so many things to consider and so many different strategies to choose from. How do you know where to start?

This article will help. It will explain building an investment strategy for beginners. You’ll learn why investing is so essential, the keys to successful investing, and explore investment strategies for beginners.

Saving Vs. Investing

You will sometimes see the terms “saving” and “investing” used interchangeably in the world of personal finance, but they are not the same. As we saw above, the average interest rate on a savings account is well under 1%, and even with a considerable amount of cash in savings for two decades, the money only grew by $11,000.

Now consider the impact of inflation on money. Inflation is defined as “an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.”

We put our $100,000 in the savings account in our example in 2003 and made no additional contributions. For our $100,000 to have the same buying power in twenty years, it would have to be $165,820.11. The cumulative rate of inflation over those 20 years was 65.8%. But our money was only earning 0.53% and only gained about $11,000. Inflation ate away at our money, leaving us nearly $55,000 short.

Now, if we had invested that $100,000 with a conservative average rate of return of 7%, factored in taxes and inflation, and made no additional contributions to the initial $100,000 at the end of 20 years, we would have $179,354.27. A much better result! That is the difference between saving and investing and why investing is so essential.

Keys to Successful Investing

Successful investors, even the legendary ones like Warren Buffett and Ray Dalio, don’t have some secret, magical knowledge they’re keeping from the rest of us. But they do share some key traits that anyone can adopt.

- Patience

Successful investors are in it for the long haul. They are not day trading or frequently jumping in and out of the market. They have the patience to ride out the market fluctuations that are a natural part of investing.

- Discipline

Once a successful investor has created an investment strategy, they let it play out. They don’t deviate based on emotions, headlines, or other outside influences. All investment plans will need tweaking over time as circumstances change (marriage, divorce, children, etc.), but a solid financial plan takes those things into account and doesn’t have to be completely overhauled.

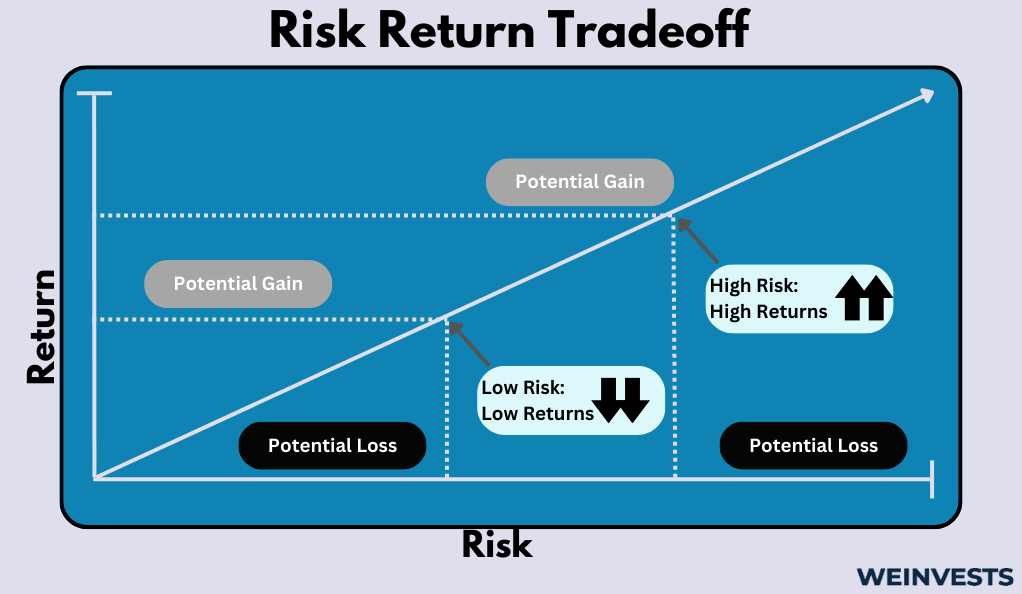

Managing Risk

There is some level of risk in every investment. Successful investors understand this and take steps to manage and mitigate that risk by diversifying their portfolios across different types of assets and asset classes. They also understand the danger of taking too little risk. Too little risk in an investment strategy can mean falling short of reaching a financial goal.

Seeking Knowledge

You don’t need an MBA from Wharton to become a successful investor, but you do have to understand some investing fundamentals, economic trends, and market dynamics. Seeking knowledge can also include working with a financial professional.

Setting Clear Goals

Depending on what a sum of money is intended for, its investment strategies will be different. Short-term money, money needed for things like a wedding or a vacation, is invested very differently than long-term money, money needed for things like educational expenses for children and retirement.

Consistency

If you remember our investing example above, our $100,000 grew considerably over 20 years, but we didn’t double our money. That’s because we didn’t make additional contributions over that period, just the initial $100,000. But what if he had contributed an additional $1,000 per month using all the same metrics in our example?

At the end of the 20 years, our money more than quadrupled (taking into account taxes and inflation) to $435,127! The two true secrets to growing wealth through investing are time (starting early and holding investments long-term, decades in some cases) and consistency, regularly investing.

Seeking Quality Investments

Every investor would love to find the next big thing before anyone else and scoop up tons of shares at rock-bottom prices. Successful investors know that this happens infrequently over an investing career, if it ever happens at all.

Rather than taking a big gamble on an unknown entity, they primarily invest in companies with healthy fundamentals and a long history of success.

Investment Strategies for Beginners

Investing doesn’t have to be complicated. These are some tried and tested investment strategies for beginners that can help set you up for a lifetime of financial security.

Buy and Hold

Think of buy-and-hold investing like a dish that cooks low and slow. You assemble the components, turn on the heat, and let time do its thing with your only input, the occasional stir.

Buy-and-hold simply means buying an investment and holding it long-term, for decades in some cases but typically for at least five years. You don’t have to check the numbers daily or even monthly. You don’t have to make any decisions. If the market is up, you do nothing. If the market is down, you do nothing. This can be easier said than done when the market is plunging, and the headlines are scary.

The market has always had ups and downs, sometimes major ups and downs. But even in the worst bear markets, it has always come back. Buy-and-hold investments also minimize capital gains taxes as the rate on long-term capital gains is lower than those of short-term gains.

Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that seek to replicate the performance of a specific financial market index like the S&P 500, Dow Jones Industrial Average, or Nasdaq Composite.

The funds mimic the investment holdings and overall returns of their chosen index. Index funds are a great tool for those who prefer impact investing, a sustainable investing strategy for those who only want to invest in companies that are socially and environmentally responsible, as there are index funds and ETFs that specialize in that kind of investing.

Index funds are passively managed; they aren’t trying to beat the market, just match its performance. Index funds offer diversification as they hold a wide range of assets that are a part of the target index. This helps insulate investors from risk; their eggs are in many baskets. Because of this passive management, index funds’ operating expenses are lower than actively managed investments, meaning lower fees for investors.

An index fund or ETF investment strategy is a great way to include the buy-and-hold investing strategy because they are meant to be held long-term (although an investor can sell any time they wish, of course).

Index Funds and Individual Stocks

Once you choose the best index fund for your financial goals, the rest of the work is done for you. The funds consist of stocks from every company listed on its chosen index; you don’t have to research individual stocks and compose a portfolio.

But it can be fun and possibly lucrative to hold some individual stocks as well. While the vast majority of your money might be in an index fund, you also research and buy shares in a few companies. A good way for new investors to choose individual stocks is to start with what you know. What companies goods, and services do you use and like every day? You still need to perform your due diligence, but companies you know well are a good place to start.

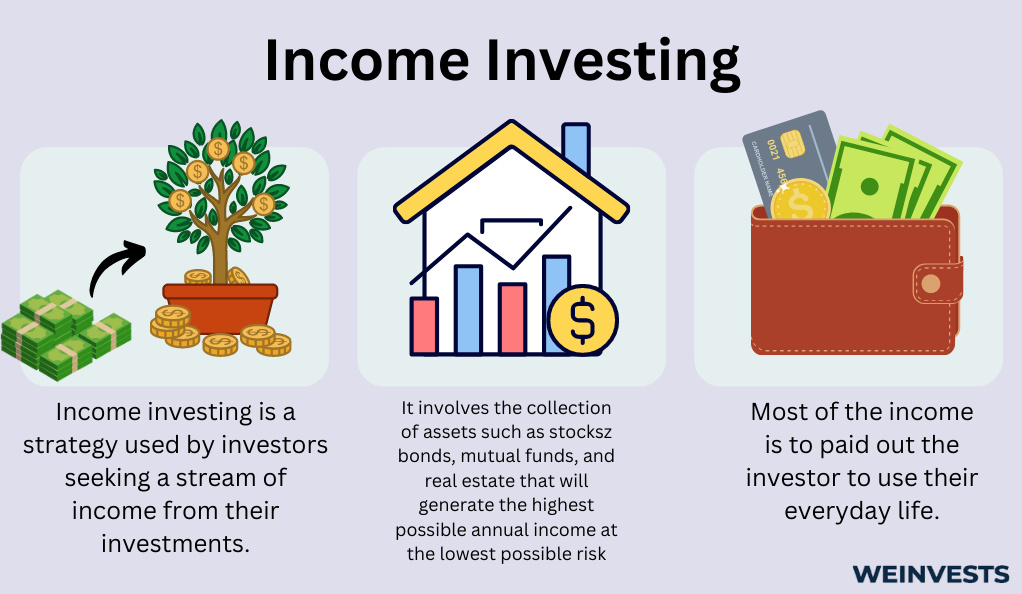

Income Investing

An income investment strategy means choosing investments that generate income and payout on a regular schedule to provide cash flow. Income investing is a strategy often used by those who prioritize stability and regular income over the potential for high returns that are associated with growth-oriented investments.

There are several types of income investments:

- Dividend Paying Stocks: Shares of companies that pay out a portion of their profits to shareholders in the form of dividends.

- Bonds: Bonds are debt securities issued by governments, municipalities, or companies to raise capital. Bondholders receive regular interest payments, and the principal is returned once the bonds mature.

- Real Estate Investment Trusts (REITs); REITS are companies that own or finance income-producing real estate across different sectors, including residential, commercial, and industrial. REITs must distribute a significant portion of their earnings to shareholders in the form of dividends.

- Rental Property: Rental property can provide monthly income in the form of rental payments. For investors who prefer a hands-off approach, there are property management companies that take care of things like finding and vetting tenants, collecting rent, maintenance, and repairs.

Dollar-Cost Averaging

Remember, one of the traits of a successful investor is consistency, regular investing. Regular investing is an investment strategy of its own; it’s known as dollar-cost averaging (DCA). Investors regularly invest a fixed amount into a financial asset regardless of its current price or current market conditions. These equal investments can be made monthly or quarterly, for example, rather than investing a lump sum all at once.

The idea behind DCA is that by investing a fixed amount at regular intervals, an investor can buy more shares of an asset when the price is lower and fewer shares when the price is higher. DCA helps smooth out the impact of short-term volatility in the market and reduces the risk of trying to time the market.

Conclusion

Merely saving money, even large sums of money, is not enough to grow your wealth and help you reach your financial goals. In order to grow and maintain wealth, you need to start investing, and the sooner, the better. Without investing, inflation will erode the buying power of your money over time. While any investment comes with some risk, the real risk to your money is not investing.

Successful investing is possible for anyone. Successful investors share some common traits, patience, discipline, managing risk, educating themselves, having clear goals, being consistent, and looking for quality investments.

There are some simple investing strategies that can help beginning investors find success, including buy-and-hold, index funds alone or with a few individual stocks, income investing, and dollar-cost averaging. None of these strategies are overly or needlessly complicated and can be implemented by anyone.

FAQ

What is the difference between saving and investing?

Saving means holding money in a savings account, while investing means using money to buy an asset with the hope that the asset will generate income or grow in value.

What are the keys to becoming a successful investor?

Successful investing requires patience, discipline, managing risk, learning, having clear goals, being consistent, and seeking out quality investments that have a proven track record of success.

What are some investment strategies that beginners can implement?

Buy-and-hold, index funds, index funds mixed with a few well-researched individual stocks, income investing, and dollar-cost averaging are some simple but effective investing strategies that are suitable for new investors and investors with more experience alike.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More